444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States sensor market represents a dynamic and rapidly evolving technological landscape that serves as the backbone of modern automation, IoT applications, and smart infrastructure development. This comprehensive market encompasses a diverse range of sensing technologies including temperature sensors, pressure sensors, motion sensors, proximity sensors, and advanced smart sensors that enable real-time data collection and analysis across multiple industries.

Market dynamics indicate robust growth driven by increasing demand for automation in manufacturing, rising adoption of IoT devices, and expanding applications in automotive, healthcare, and consumer electronics sectors. The market demonstrates strong momentum with projected growth rates of 8.2% CAGR through the forecast period, reflecting the critical role sensors play in digital transformation initiatives across various industries.

Industrial applications continue to dominate market demand, with manufacturing facilities increasingly implementing sensor-based monitoring systems for predictive maintenance, quality control, and operational efficiency optimization. The automotive sector represents another significant growth driver, with advanced driver assistance systems (ADAS) and autonomous vehicle development requiring sophisticated sensor integration.

Technological advancement in sensor miniaturization, wireless connectivity, and artificial intelligence integration has expanded application possibilities significantly. Smart cities initiatives, environmental monitoring systems, and healthcare digitization programs are creating new market opportunities, with sensor adoption rates reaching 75% penetration in key industrial segments.

The United States sensor market refers to the comprehensive ecosystem of electronic devices and systems designed to detect, measure, and transmit information about physical, chemical, or biological phenomena within the domestic market. These sophisticated devices convert various forms of energy or physical properties into electrical signals that can be processed, analyzed, and utilized for decision-making across diverse applications.

Sensor technology encompasses multiple categories including mechanical sensors for pressure and vibration detection, thermal sensors for temperature monitoring, optical sensors for light and image capture, chemical sensors for gas and liquid analysis, and magnetic sensors for position and motion detection. Each category serves specific industrial and consumer applications with varying degrees of precision and functionality.

Market participants include sensor manufacturers, system integrators, software developers, and end-users across industries such as automotive, aerospace, healthcare, manufacturing, agriculture, and consumer electronics. The interconnected nature of modern sensor systems requires collaboration between hardware manufacturers and software developers to deliver comprehensive sensing solutions.

Strategic analysis of the United States sensor market reveals a highly competitive and innovation-driven industry experiencing significant transformation due to technological advancement and expanding application domains. The market demonstrates strong fundamentals with consistent demand growth across multiple sectors, supported by increasing digitization and automation trends.

Key growth drivers include the proliferation of Internet of Things (IoT) applications, increasing focus on predictive maintenance in industrial settings, and rising demand for smart home and building automation systems. Healthcare digitization initiatives and environmental monitoring requirements are creating additional market opportunities, with sensor integration rates improving by 12% annually in critical applications.

Competitive landscape features established technology companies alongside innovative startups developing specialized sensing solutions. Market consolidation through strategic acquisitions and partnerships is reshaping the industry structure, enabling companies to offer comprehensive sensor ecosystems rather than individual components.

Regional distribution shows concentrated activity in technology hubs including California, Texas, and the Northeast corridor, where major manufacturing facilities and research centers drive innovation and market development. The market benefits from strong domestic demand and established supply chain infrastructure supporting both production and distribution activities.

Market intelligence reveals several critical insights shaping the United States sensor market landscape and future development trajectory:

Primary market drivers propelling United States sensor market growth encompass technological advancement, regulatory requirements, and evolving consumer expectations across multiple industry sectors.

Industrial automation represents the most significant growth driver, with manufacturing companies implementing comprehensive sensor networks to optimize production processes, reduce downtime, and improve product quality. Predictive maintenance applications alone account for 35% of industrial sensor demand, reflecting the critical importance of real-time monitoring in modern manufacturing environments.

Internet of Things expansion continues driving sensor adoption across residential, commercial, and industrial applications. Smart building systems, connected vehicles, and wearable devices require sophisticated sensor integration to deliver enhanced functionality and user experiences. The proliferation of edge computing capabilities further amplifies sensor utility by enabling local data processing and real-time decision-making.

Regulatory compliance in industries such as automotive, aerospace, and healthcare mandates specific sensor implementations for safety, environmental, and quality assurance purposes. Emissions monitoring, safety system requirements, and medical device regulations create consistent demand for certified sensor solutions meeting stringent performance standards.

Consumer technology evolution drives continuous innovation in sensor miniaturization, power efficiency, and functionality enhancement. Smartphone manufacturers, wearable device companies, and smart home product developers require increasingly sophisticated sensor capabilities to differentiate their offerings and meet consumer expectations for advanced features.

Market challenges facing the United States sensor market include technical limitations, cost considerations, and implementation complexities that may impact growth trajectory and adoption rates across certain applications.

High development costs associated with advanced sensor technology development can limit market entry for smaller companies and restrict innovation in specialized applications. Research and development investments required for next-generation sensor capabilities often exceed available resources for many market participants, potentially slowing overall market advancement.

Technical complexity in sensor integration and system optimization presents challenges for end-users lacking specialized expertise. Many potential applications require sophisticated understanding of sensor characteristics, data processing requirements, and system integration considerations that may discourage adoption in certain market segments.

Cybersecurity concerns related to connected sensor networks and data transmission create hesitation among potential users, particularly in critical infrastructure and sensitive applications. Security vulnerabilities in sensor systems can expose organizations to data breaches, operational disruptions, and compliance violations.

Supply chain dependencies on specialized materials and components can create vulnerability to disruptions and price volatility. Semiconductor shortages and raw material availability issues have historically impacted sensor production and pricing, affecting market stability and growth predictability.

Emerging opportunities within the United States sensor market present significant potential for growth and innovation across established and developing application areas.

Smart cities development creates substantial opportunities for sensor deployment in traffic management, environmental monitoring, infrastructure maintenance, and public safety applications. Municipal governments increasingly recognize the value of sensor-based data collection for improving city services and operational efficiency, with smart city sensor adoption growing at 15% annually.

Healthcare digitization offers expanding opportunities for medical sensors, remote monitoring devices, and diagnostic equipment. Aging population demographics and increasing focus on preventive healthcare drive demand for continuous monitoring solutions and point-of-care diagnostic devices incorporating advanced sensor technology.

Agricultural technology advancement presents opportunities for precision farming applications utilizing soil sensors, weather monitoring systems, and crop health assessment tools. Sustainable agriculture practices and food security concerns drive adoption of sensor-based farming solutions that optimize resource utilization and improve crop yields.

Energy sector transformation toward renewable energy sources and smart grid implementation creates opportunities for sensor applications in power generation monitoring, grid optimization, and energy efficiency management. The transition to sustainable energy systems requires sophisticated sensor networks for performance monitoring and predictive maintenance.

Market dynamics within the United States sensor market reflect complex interactions between technological innovation, competitive pressures, and evolving customer requirements across diverse application domains.

Innovation cycles in sensor technology continue accelerating, with new sensing principles, materials, and manufacturing processes enabling enhanced performance characteristics and expanded application possibilities. According to MarkWide Research analysis, sensor performance improvements of 20% annually in key metrics such as sensitivity, accuracy, and power efficiency drive continuous market evolution.

Competitive intensity varies significantly across sensor categories, with established players maintaining strong positions in traditional applications while emerging companies focus on specialized or next-generation technologies. Market consolidation through acquisitions and strategic partnerships reshapes competitive dynamics and enables comprehensive solution offerings.

Customer expectations continue evolving toward integrated solutions combining sensors, connectivity, data processing, and analytics capabilities. End-users increasingly prefer turnkey systems rather than individual components, driving market participants to develop comprehensive platforms and ecosystem partnerships.

Technology convergence between sensors, artificial intelligence, and edge computing creates new market dynamics and application possibilities. The integration of multiple technologies enables sophisticated sensing solutions with enhanced functionality and autonomous operation capabilities.

Research approach for analyzing the United States sensor market employs comprehensive methodologies combining primary research, secondary data analysis, and industry expert insights to develop accurate market assessments and projections.

Primary research activities include structured interviews with industry executives, technology developers, and end-users across key market segments. Survey methodologies capture quantitative data regarding adoption patterns, purchasing decisions, and technology preferences among various customer categories.

Secondary research encompasses analysis of industry publications, government databases, patent filings, and corporate financial reports to understand market trends, competitive positioning, and technological development trajectories. Regulatory documentation and standards development activities provide insights into compliance requirements and market evolution drivers.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review, and statistical analysis techniques. Market sizing methodologies utilize bottom-up and top-down approaches to develop comprehensive market assessments across different sensor categories and application segments.

Analytical frameworks incorporate quantitative modeling techniques, trend analysis, and scenario planning to develop market projections and identify key growth opportunities. Industry expert validation ensures research findings align with practical market realities and emerging trends.

Regional distribution within the United States sensor market demonstrates concentrated activity in key technology and manufacturing hubs, with distinct characteristics and growth patterns across different geographic areas.

West Coast dominance led by California accounts for approximately 40% of market activity, driven by strong presence of technology companies, automotive manufacturers, and aerospace industry participants. Silicon Valley continues serving as a primary innovation center for sensor technology development, while Los Angeles area aerospace and defense contractors drive demand for specialized sensing solutions.

Texas emergence as a significant market region reflects growing manufacturing activity, energy sector presence, and technology company expansion. The state’s diverse industrial base including oil and gas, manufacturing, and technology sectors creates demand for various sensor applications, representing 18% of national market share.

Northeast corridor maintains strong market presence through established manufacturing centers, research institutions, and healthcare industry concentration. States including Massachusetts, New York, and Pennsylvania contribute significantly to medical device sensor development and industrial automation applications.

Midwest manufacturing regions continue representing important market segments for industrial sensors, automotive applications, and agricultural technology. Michigan’s automotive industry concentration and Illinois manufacturing base drive consistent demand for sensor solutions supporting production optimization and quality control initiatives.

Competitive environment within the United States sensor market features diverse participants ranging from large multinational corporations to specialized technology companies and innovative startups developing next-generation sensing solutions.

Market positioning strategies vary significantly among competitors, with some focusing on broad product portfolios while others specialize in specific sensor technologies or application markets. Innovation capabilities, manufacturing scale, and customer relationships serve as key competitive differentiators.

Market segmentation within the United States sensor market encompasses multiple classification approaches based on technology type, application area, end-user industry, and performance characteristics.

By Technology Type:

By Application Area:

Industrial sensors represent the largest market category, driven by manufacturing automation, process optimization, and predictive maintenance applications. This segment demonstrates consistent growth with adoption rates of 65% penetration in major manufacturing facilities, reflecting the critical importance of real-time monitoring in modern production environments.

Automotive sensors constitute a rapidly growing category fueled by vehicle electrification, advanced driver assistance systems, and autonomous driving development. Engine management sensors, safety system components, and environmental monitoring devices drive consistent demand growth, with electric vehicle sensor content increasing by 45% compared to traditional vehicles.

Consumer electronics sensors continue expanding through smartphone innovation, wearable device development, and smart home product proliferation. Miniaturization requirements and power efficiency demands drive continuous technology advancement in this highly competitive segment.

Healthcare sensors represent an emerging high-growth category supported by medical device innovation, remote patient monitoring, and diagnostic equipment advancement. Regulatory compliance requirements and performance standards create barriers to entry while ensuring product quality and reliability.

Environmental sensors gain importance through increasing focus on air quality monitoring, climate change assessment, and regulatory compliance requirements. Smart cities initiatives and industrial environmental monitoring drive consistent demand growth in this specialized market segment.

Sensor manufacturers benefit from expanding market opportunities across multiple industries, enabling diversified revenue streams and reduced dependence on single market segments. Technology advancement and innovation capabilities provide competitive advantages and premium pricing opportunities for advanced sensor solutions.

System integrators gain opportunities to develop comprehensive sensing solutions combining hardware, software, and analytics capabilities. The trend toward integrated systems creates value-added service opportunities and stronger customer relationships through ongoing support and optimization services.

End-user industries realize significant operational benefits including improved efficiency, reduced maintenance costs, enhanced safety, and better decision-making capabilities through real-time data collection and analysis. MWR studies indicate operational efficiency improvements of 25% on average following comprehensive sensor system implementation.

Technology investors find attractive opportunities in sensor technology companies developing next-generation solutions for emerging applications. Market growth prospects and technology advancement potential create favorable investment conditions for both established companies and innovative startups.

Research institutions benefit from collaboration opportunities with industry participants, enabling practical application of research developments and access to funding for advanced sensor technology projects. Academic-industry partnerships accelerate innovation and technology transfer processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend enabling sensors to perform local data processing, pattern recognition, and predictive analytics. Edge computing capabilities reduce data transmission requirements while improving response times and system reliability.

Wireless sensor networks continue expanding through improved battery technology, energy harvesting capabilities, and low-power communication protocols. Wireless deployment reduces installation costs and enables flexible sensor placement in challenging environments.

Miniaturization advancement through MEMS technology development enables smaller, more efficient sensor designs suitable for space-constrained applications. Micro-sensors with enhanced performance characteristics expand application possibilities in consumer electronics and medical devices.

Multi-sensor fusion techniques combine data from multiple sensor types to improve accuracy, reliability, and functionality. Sensor fusion applications in autonomous vehicles, robotics, and industrial automation demonstrate significant performance advantages over single-sensor systems.

Sustainability focus drives development of environmentally friendly sensor materials, energy-efficient designs, and recyclable components. Green sensor technology addresses environmental concerns while meeting performance requirements for various applications.

Recent industry developments within the United States sensor market demonstrate accelerating innovation and expanding application opportunities across multiple technology and market segments.

Automotive sensor advancement includes development of high-resolution LiDAR systems, advanced radar sensors, and multi-spectral imaging devices supporting autonomous vehicle development. Major automotive suppliers are investing heavily in next-generation sensor technology to meet evolving safety and performance requirements.

Healthcare sensor innovation encompasses wearable monitoring devices, implantable sensors, and point-of-care diagnostic systems. Recent developments include continuous glucose monitoring improvements, cardiac monitoring advancement, and respiratory health assessment devices.

Industrial IoT expansion drives development of ruggedized wireless sensors, predictive maintenance solutions, and comprehensive monitoring systems. Manufacturing companies increasingly adopt sensor-based digital transformation initiatives to improve operational efficiency and competitiveness.

Environmental monitoring enhancement includes air quality sensor networks, water quality monitoring systems, and climate assessment devices. Government initiatives and regulatory requirements drive deployment of comprehensive environmental sensing infrastructure.

Strategic recommendations for United States sensor market participants focus on technology development, market positioning, and operational optimization to capitalize on growth opportunities and address market challenges.

Investment prioritization should emphasize artificial intelligence integration, wireless connectivity, and miniaturization capabilities that enable next-generation sensor applications. Companies developing comprehensive sensing solutions rather than individual components are better positioned for long-term success.

Market expansion strategies should target emerging applications in healthcare, environmental monitoring, and smart infrastructure while maintaining strong positions in established industrial and automotive markets. Diversification across multiple application areas reduces market risk and provides growth stability.

Partnership development with software companies, system integrators, and end-user industries enables comprehensive solution offerings and stronger customer relationships. Collaborative approaches accelerate technology development and market penetration while sharing development costs and risks.

Talent acquisition and retention strategies should focus on specialized engineering capabilities, particularly in areas such as artificial intelligence, wireless communications, and advanced materials. Skills development programs and university partnerships can address talent shortage challenges.

Long-term prospects for the United States sensor market remain highly positive, supported by continuing digitization trends, expanding IoT applications, and emerging technology opportunities across multiple industry sectors.

Technology evolution will continue driving market growth through enhanced sensor capabilities, improved integration possibilities, and expanded application opportunities. MarkWide Research projections indicate sensor performance improvements will accelerate, with accuracy enhancements of 30% expected over the next five years while power consumption decreases significantly.

Market expansion into new application areas including smart cities, precision agriculture, and advanced healthcare will create substantial growth opportunities. The convergence of sensors with artificial intelligence, 5G connectivity, and edge computing will enable sophisticated applications previously considered impractical.

Industry transformation toward comprehensive sensing ecosystems will reshape competitive dynamics and customer relationships. Companies successfully developing integrated platforms combining sensors, connectivity, data processing, and analytics will capture disproportionate market value.

Regulatory evolution will continue influencing market development through safety requirements, environmental standards, and data privacy regulations. Proactive compliance strategies and participation in standards development will provide competitive advantages for forward-thinking companies.

The United States sensor market represents a dynamic and rapidly evolving industry positioned for sustained growth driven by technological advancement, expanding applications, and increasing digitization across multiple sectors. Market fundamentals remain strong with consistent demand growth, innovation opportunities, and favorable industry trends supporting long-term development prospects.

Key success factors for market participants include continuous technology innovation, comprehensive solution development, strategic partnerships, and proactive adaptation to evolving customer requirements. Companies that successfully integrate sensors with advanced technologies such as artificial intelligence and wireless connectivity will capture the greatest market opportunities.

Future market development will be characterized by increasing sophistication, expanded applications, and growing importance of sensor systems in enabling digital transformation across industries. The convergence of multiple technologies and expanding ecosystem partnerships will create new value propositions and competitive dynamics, ensuring continued market evolution and growth opportunities for innovative participants.

What is a sensor?

A sensor is a device that detects and responds to physical stimuli, such as light, heat, motion, moisture, or pressure. In the context of the United States Sensor Market, sensors are widely used in various applications including automotive, healthcare, and industrial automation.

What are the key companies in the United States Sensor Market?

Key companies in the United States Sensor Market include Texas Instruments, Honeywell, Analog Devices, and Bosch Sensortec, among others.

What are the growth factors driving the United States Sensor Market?

The growth of the United States Sensor Market is driven by the increasing demand for automation in industries, the rise of the Internet of Things (IoT), and advancements in sensor technology that enhance accuracy and efficiency in applications such as smart homes and healthcare monitoring.

What challenges does the United States Sensor Market face?

The United States Sensor Market faces challenges such as high manufacturing costs, the complexity of sensor integration into existing systems, and concerns regarding data privacy and security in connected devices.

What opportunities exist in the United States Sensor Market?

Opportunities in the United States Sensor Market include the growing adoption of smart city initiatives, advancements in automotive sensors for autonomous vehicles, and the increasing use of sensors in wearable technology for health monitoring.

What trends are shaping the United States Sensor Market?

Trends shaping the United States Sensor Market include the miniaturization of sensors, the integration of artificial intelligence for data analysis, and the development of multi-sensor systems that provide comprehensive data for various applications.

United States Sensor Market

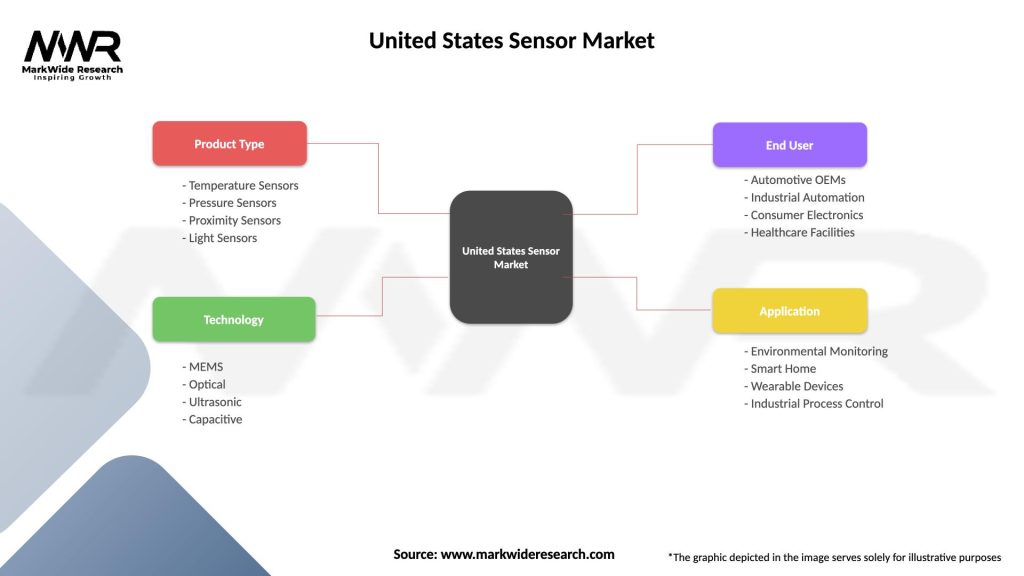

| Segmentation Details | Description |

|---|---|

| Product Type | Temperature Sensors, Pressure Sensors, Proximity Sensors, Light Sensors |

| Technology | MEMS, Optical, Ultrasonic, Capacitive |

| End User | Automotive OEMs, Industrial Automation, Consumer Electronics, Healthcare Facilities |

| Application | Environmental Monitoring, Smart Home, Wearable Devices, Industrial Process Control |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Sensor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at