444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States retail reverse logistics market represents a critical component of modern supply chain management, encompassing the systematic process of moving goods from their final destination back through the supply chain for value recovery or proper disposal. This rapidly expanding sector has gained unprecedented momentum as retailers face increasing pressure to manage product returns, refurbishment, recycling, and redistribution efficiently. Market dynamics indicate robust growth driven by the surge in e-commerce activities, evolving consumer expectations, and stringent environmental regulations.

E-commerce expansion has fundamentally transformed the reverse logistics landscape, with online retailers experiencing return rates averaging 20-30% compared to traditional brick-and-mortar stores at 8-10%. This dramatic shift has created substantial opportunities for specialized reverse logistics providers who offer comprehensive solutions including product inspection, refurbishment, repackaging, and resale through various channels. Technology integration plays a pivotal role in optimizing these processes, with advanced analytics, artificial intelligence, and automation systems enabling more efficient handling of returned merchandise.

Sustainability initiatives have emerged as a primary driver, with retailers increasingly recognizing reverse logistics as essential for achieving circular economy objectives. Companies are implementing sophisticated programs to minimize waste, maximize product lifecycle value, and meet growing consumer demands for environmentally responsible practices. The market encompasses diverse sectors including apparel, electronics, automotive parts, pharmaceuticals, and consumer goods, each presenting unique challenges and opportunities for reverse logistics optimization.

The United States retail reverse logistics market refers to the comprehensive ecosystem of services, technologies, and processes designed to manage the backward flow of products from consumers back to retailers, manufacturers, or disposal facilities. This market encompasses all activities involved in handling returned merchandise, including collection, transportation, inspection, sorting, refurbishment, repackaging, resale, recycling, and disposal operations.

Reverse logistics fundamentally differs from traditional forward logistics by focusing on value recovery from products that have already reached end consumers. The process involves multiple stakeholders including retailers, third-party logistics providers, refurbishment specialists, liquidation companies, recycling facilities, and technology solution providers. Value recovery mechanisms include reselling products as new, offering them as open-box items, refurbishing for secondary markets, harvesting components for spare parts, recycling materials, or responsible disposal when no value can be recovered.

Market participants range from large integrated logistics companies offering end-to-end reverse logistics solutions to specialized service providers focusing on specific aspects such as product testing, cosmetic refurbishment, or electronic waste recycling. The market also includes technology vendors providing software solutions for returns management, inventory tracking, and process optimization.

Strategic market positioning reveals the United States retail reverse logistics market as a high-growth sector driven by fundamental shifts in retail operations and consumer behavior. The market demonstrates exceptional resilience and expansion potential, with growth rates significantly outpacing traditional logistics segments. E-commerce proliferation continues to be the primary catalyst, generating unprecedented volumes of product returns that require sophisticated handling and processing capabilities.

Key market characteristics include increasing adoption of technology-driven solutions, growing emphasis on sustainability and circular economy principles, and rising demand for specialized reverse logistics services across diverse retail categories. The market exhibits strong fragmentation with opportunities for both large integrated providers and niche specialists to capture significant market share through differentiated service offerings.

Competitive dynamics favor companies that can demonstrate superior value recovery rates, efficient processing capabilities, and comprehensive technology integration. Market leaders are investing heavily in automation, artificial intelligence, and data analytics to optimize reverse logistics operations and provide enhanced visibility to retail clients. Regulatory compliance requirements, particularly in electronics and pharmaceutical sectors, are creating additional demand for specialized reverse logistics capabilities.

Future market trajectory appears highly favorable, with continued e-commerce growth, increasing environmental consciousness, and evolving consumer expectations driving sustained demand for advanced reverse logistics solutions. The market is expected to witness significant consolidation as larger players acquire specialized capabilities and smaller companies seek partnerships to expand their service offerings.

Market intelligence reveals several critical insights shaping the United States retail reverse logistics landscape:

E-commerce expansion serves as the fundamental driver propelling the United States retail reverse logistics market forward. The exponential growth in online shopping has created a corresponding surge in product returns, with digital-native consumers exhibiting different return behaviors compared to traditional shoppers. Consumer expectations for hassle-free returns, free return shipping, and rapid refund processing have elevated reverse logistics from a cost center to a competitive differentiator for retailers.

Regulatory compliance requirements across various industries are driving demand for specialized reverse logistics capabilities. Electronics manufacturers must comply with e-waste regulations, pharmaceutical companies face strict requirements for expired or recalled products, and automotive retailers must manage hazardous materials according to environmental standards. These compliance needs create opportunities for reverse logistics providers with specialized expertise and certifications.

Sustainability initiatives have emerged as a powerful market driver, with retailers increasingly recognizing reverse logistics as essential for achieving circular economy objectives. Corporate sustainability commitments, consumer environmental consciousness, and investor pressure for ESG compliance are motivating companies to implement comprehensive reverse logistics programs that maximize product lifecycle value and minimize waste generation.

Technology advancement continues to drive market growth by enabling more efficient and cost-effective reverse logistics operations. Artificial intelligence, machine learning, robotics, and advanced analytics are transforming traditional reverse logistics processes, making previously uneconomical activities viable and profitable. Data-driven insights allow retailers to optimize return policies, predict return patterns, and implement proactive measures to reduce return rates while improving customer satisfaction.

High operational complexity represents a significant restraint in the United States retail reverse logistics market, as managing returned products requires sophisticated processes, specialized facilities, and skilled workforce capabilities. Unlike forward logistics with standardized processes, reverse logistics involves unpredictable product conditions, varying return reasons, and complex decision-making regarding value recovery options. This complexity increases operational costs and creates barriers for smaller companies seeking to enter the market.

Infrastructure limitations constrain market growth in certain regions, particularly areas lacking adequate reverse logistics facilities, transportation networks, or specialized processing capabilities. The need for strategically located facilities with appropriate equipment for inspection, refurbishment, and repackaging creates significant capital investment requirements that may limit market expansion in underserved geographic areas.

Technology integration challenges pose obstacles for companies seeking to implement advanced reverse logistics solutions. Legacy systems, data integration complexities, and the need for seamless connectivity across multiple stakeholders create technical barriers that require substantial investment and expertise to overcome. Standardization gaps across the industry further complicate technology adoption and interoperability between different reverse logistics providers and retail clients.

Regulatory uncertainties in emerging areas such as data privacy, cross-border returns, and environmental compliance create challenges for reverse logistics providers operating across multiple jurisdictions. Evolving regulations require continuous adaptation of processes and systems, increasing compliance costs and operational complexity for market participants.

Emerging technology adoption presents substantial opportunities for innovation and differentiation in the United States retail reverse logistics market. Advanced technologies including artificial intelligence, blockchain, Internet of Things sensors, and robotic process automation offer potential for significant operational improvements and new service capabilities. Companies that successfully integrate these technologies can achieve competitive advantages through enhanced efficiency, improved accuracy, and superior customer experiences.

Vertical market expansion offers significant growth opportunities as reverse logistics services extend into new retail categories and industry sectors. Emerging opportunities include luxury goods authentication, pharmaceutical returns management, automotive parts refurbishment, and specialized handling of hazardous materials. Each vertical presents unique requirements and value propositions that create opportunities for specialized service providers.

Sustainability services represent a rapidly growing opportunity segment as retailers seek comprehensive solutions for achieving environmental objectives. Services including carbon footprint reduction, circular economy implementation, waste minimization, and sustainable packaging solutions are increasingly in demand. Certification programs and environmental compliance services create additional revenue opportunities for reverse logistics providers with appropriate expertise and credentials.

International expansion opportunities exist for established reverse logistics providers to extend their capabilities into cross-border returns management, global refurbishment networks, and international resale channels. The growth of global e-commerce creates demand for reverse logistics solutions that can efficiently handle returns across multiple countries and regulatory environments.

Competitive intensity in the United States retail reverse logistics market continues to escalate as traditional logistics companies, specialized reverse logistics providers, and technology-enabled startups compete for market share. This competition drives innovation, service quality improvements, and pricing optimization, ultimately benefiting retail clients through enhanced service offerings and competitive pricing structures.

Customer expectations are evolving rapidly, with retailers demanding more sophisticated reverse logistics capabilities including real-time visibility, predictive analytics, and integrated reporting systems. These expectations drive continuous service enhancement and technology investment among reverse logistics providers seeking to maintain competitive positioning and client satisfaction.

Supply chain integration trends are reshaping market dynamics as retailers seek seamless integration between forward and reverse logistics operations. This integration requires reverse logistics providers to develop capabilities that complement traditional supply chain functions and provide holistic solutions that optimize overall supply chain performance.

Economic factors including labor costs, transportation expenses, and facility costs influence market dynamics and pricing structures. Reverse logistics providers must continuously optimize operations to maintain profitability while delivering value to retail clients facing their own cost pressures and margin constraints.

Comprehensive market analysis for the United States retail reverse logistics market employs a multi-faceted research approach combining primary and secondary research methodologies. Primary research includes extensive interviews with industry executives, reverse logistics service providers, retail decision-makers, and technology vendors to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, trade publications, and academic research to establish market foundations and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and provides historical context for current market developments.

Data collection methods include structured surveys, in-depth interviews, focus groups, and observational studies conducted across diverse market segments and geographic regions. The research methodology emphasizes both quantitative metrics and qualitative insights to provide a balanced perspective on market conditions and future prospects.

Analytical frameworks employed include market sizing models, competitive analysis matrices, trend analysis, and scenario planning to develop comprehensive market intelligence. The research approach ensures accuracy, reliability, and actionability of market insights for stakeholders across the reverse logistics ecosystem.

Geographic distribution across the United States reveals significant regional variations in reverse logistics market development and opportunities. The West Coast region, led by California, commands approximately 35% of market activity, driven by high e-commerce penetration, technology company concentration, and progressive environmental regulations. Major metropolitan areas including Los Angeles, San Francisco, and Seattle serve as primary hubs for reverse logistics operations.

East Coast markets account for roughly 30% of reverse logistics activity, with the Northeast corridor from Boston to Washington D.C. representing a mature market characterized by established retail presence, dense population centers, and sophisticated logistics infrastructure. New York, Philadelphia, and Boston serve as key processing centers for returned merchandise from major retail operations.

Midwest regions contribute approximately 20% of market volume, with Chicago serving as a central hub for reverse logistics operations due to its strategic location and transportation connectivity. The region benefits from lower operational costs and proximity to major manufacturing centers, making it attractive for refurbishment and remanufacturing operations.

Southern states represent about 15% of market activity, with Texas, Florida, and Georgia emerging as growth markets driven by population expansion, increasing e-commerce adoption, and favorable business environments. These regions offer opportunities for reverse logistics facility development and service expansion to support growing retail operations.

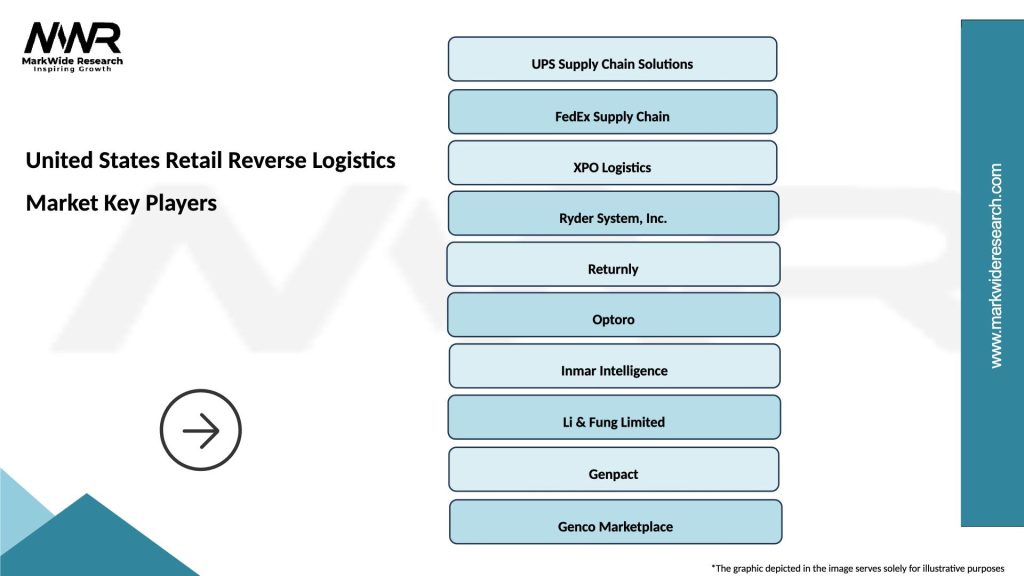

Market leadership in the United States retail reverse logistics sector is characterized by a diverse ecosystem of established logistics companies, specialized reverse logistics providers, and innovative technology-enabled service providers. The competitive landscape demonstrates significant fragmentation with opportunities for companies of various sizes to capture market share through differentiated service offerings and specialized capabilities.

Major market participants include:

Competitive strategies focus on technology differentiation, service quality enhancement, geographic expansion, and vertical market specialization. Leading companies invest heavily in automation, artificial intelligence, and data analytics to provide superior value recovery rates and operational efficiency for retail clients.

Service type segmentation reveals diverse reverse logistics offerings tailored to specific retail requirements and product categories:

Industry vertical segmentation demonstrates varying reverse logistics requirements across retail categories:

Geographic segmentation reflects regional market characteristics and infrastructure development across major metropolitan areas and emerging markets throughout the United States.

Apparel and fashion represents the largest category in the United States retail reverse logistics market, driven by exceptionally high return rates in online fashion retail. This category requires specialized handling for size exchanges, seasonal inventory management, and quality assessment of returned garments. Value recovery strategies include primary resale, outlet channel distribution, donation programs, and textile recycling initiatives.

Electronics and technology products present unique reverse logistics challenges due to rapid product obsolescence, complex refurbishment requirements, and strict regulatory compliance needs. This category offers high value recovery potential through certified refurbishment programs, component harvesting, and responsible e-waste recycling. Specialized capabilities including data wiping, functionality testing, and cosmetic restoration are essential for maximizing value recovery.

Automotive parts and accessories require specialized reverse logistics handling due to core exchange programs, warranty processing, and hazardous materials management. This category benefits from established remanufacturing infrastructure and strong aftermarket demand for refurbished components. Regulatory compliance requirements for automotive fluids, batteries, and other hazardous materials create opportunities for specialized service providers.

Home goods and furniture present logistical challenges due to size, weight, and damage susceptibility during transportation. This category requires specialized facilities and handling equipment for inspection, refurbishment, and repackaging operations. Value recovery often involves cosmetic restoration, component replacement, and alternative sales channel utilization.

Retailers benefit significantly from professional reverse logistics services through improved customer satisfaction, reduced operational complexity, and enhanced sustainability credentials. Outsourcing reverse logistics operations allows retailers to focus on core competencies while accessing specialized expertise and infrastructure for handling returned merchandise efficiently.

Cost optimization represents a primary benefit as professional reverse logistics providers achieve economies of scale, operational efficiency, and higher value recovery rates compared to in-house operations. Retailers can convert reverse logistics from a cost center into a value-generating activity through strategic partnerships with specialized service providers.

Environmental benefits include reduced waste generation, increased product lifecycle extension, and improved sustainability metrics that support corporate environmental objectives and regulatory compliance requirements. Professional reverse logistics services enable retailers to achieve circular economy goals while maintaining operational efficiency.

Customer experience enhancement through streamlined returns processes, faster refund processing, and improved communication creates competitive advantages for retailers in increasingly competitive markets. Superior reverse logistics capabilities can differentiate retailers and build customer loyalty through positive returns experiences.

Risk mitigation benefits include regulatory compliance assurance, proper handling of hazardous materials, secure data destruction, and professional liability coverage that protects retailers from potential legal and financial risks associated with reverse logistics operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend reshaping the United States retail reverse logistics market. AI-powered solutions enable predictive analytics for return forecasting, automated decision-making for product disposition, and optimization of value recovery processes. Machine learning algorithms analyze historical return patterns, product conditions, and market demand to make intelligent routing and processing decisions that maximize value recovery while minimizing costs.

Sustainability-focused operations have emerged as a dominant trend, with reverse logistics providers implementing comprehensive environmental programs including carbon footprint reduction, waste minimization, and circular economy initiatives. Companies are developing specialized capabilities for product lifecycle extension, material recovery, and environmentally responsible disposal methods that align with corporate sustainability objectives.

Omnichannel integration continues to evolve as retailers seek seamless reverse logistics solutions that support multiple sales channels and return methods. This trend requires reverse logistics providers to develop capabilities for handling returns from online purchases, in-store returns, buy-online-return-in-store scenarios, and various other omnichannel configurations.

Real-time visibility and transparency have become essential requirements, with retailers demanding comprehensive tracking, reporting, and analytics capabilities throughout the reverse logistics process. Advanced dashboard solutions, mobile applications, and API integrations provide stakeholders with immediate access to return status, processing updates, and performance metrics.

Strategic partnerships between major retailers and specialized reverse logistics providers have accelerated, with companies forming long-term alliances to develop customized solutions and achieve operational synergies. These partnerships often involve shared investments in technology, facilities, and process development to create competitive advantages for both parties.

Facility expansion and modernization initiatives are transforming the reverse logistics infrastructure landscape, with companies investing in automated processing centers, strategically located facilities, and specialized equipment for handling diverse product categories. Geographic expansion focuses on underserved markets and emerging e-commerce growth regions.

Technology acquisitions and investments have intensified as reverse logistics companies seek to enhance their capabilities through advanced software solutions, automation technologies, and data analytics platforms. These investments enable service differentiation and operational efficiency improvements that create competitive advantages in the market.

Regulatory compliance enhancements continue to drive industry development as companies adapt to evolving requirements for data privacy, environmental protection, and product safety. Specialized compliance capabilities create opportunities for differentiation and premium pricing in regulated industry sectors.

MarkWide Research analysis suggests that companies seeking success in the United States retail reverse logistics market should prioritize technology investment, operational excellence, and strategic partnerships. The research indicates that market leaders consistently demonstrate superior value recovery rates, customer satisfaction scores, and operational efficiency metrics compared to competitors relying on traditional approaches.

Investment priorities should focus on automation technologies, data analytics capabilities, and facility modernization to achieve competitive positioning in an increasingly sophisticated market. Companies that successfully integrate artificial intelligence, robotics, and advanced software solutions will capture disproportionate market share and profitability growth.

Service differentiation strategies should emphasize specialized capabilities, vertical market expertise, and sustainability solutions that address evolving client requirements and regulatory compliance needs. Companies developing unique value propositions in emerging areas such as luxury goods authentication or pharmaceutical returns management will achieve premium pricing and client loyalty.

Geographic expansion opportunities exist in underserved markets and emerging e-commerce regions where reverse logistics infrastructure development lags behind market demand. Strategic facility placement and regional partnerships can create competitive advantages and market leadership positions in growth markets.

Long-term market prospects for the United States retail reverse logistics market appear exceptionally favorable, with continued e-commerce growth, increasing environmental consciousness, and evolving consumer expectations driving sustained demand for advanced reverse logistics solutions. MWR projections indicate the market will experience accelerated growth as retailers increasingly recognize reverse logistics as a strategic capability rather than a necessary cost.

Technology evolution will continue transforming market dynamics, with artificial intelligence, robotics, and automation becoming standard capabilities rather than competitive differentiators. Companies that successfully integrate these technologies while maintaining service quality and cost competitiveness will achieve market leadership positions in the evolving landscape.

Sustainability requirements will intensify, creating opportunities for reverse logistics providers that can demonstrate measurable environmental benefits and regulatory compliance capabilities. The transition toward circular economy principles will generate new service categories and revenue opportunities for innovative market participants.

Market consolidation is expected to accelerate as larger companies acquire specialized capabilities and smaller providers seek partnerships to expand their service offerings and geographic reach. This consolidation will create more comprehensive service providers capable of handling complex, multi-category reverse logistics requirements for major retail clients.

The United States retail reverse logistics market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by fundamental shifts in retail operations, consumer behavior, and environmental consciousness. The market demonstrates strong fundamentals including increasing demand from e-commerce expansion, growing emphasis on sustainability, and continuous technology innovation that enhances operational efficiency and value recovery capabilities.

Market participants that successfully navigate the complex landscape through strategic technology investments, operational excellence, and specialized service development will capture significant opportunities in this expanding market. The combination of favorable market dynamics, regulatory support for environmental initiatives, and continuous innovation in reverse logistics solutions creates a compelling investment and growth environment for industry stakeholders.

Future success in the United States retail reverse logistics market will depend on companies’ ability to adapt to evolving client requirements, integrate advanced technologies, and develop sustainable solutions that align with corporate environmental objectives. The market’s trajectory toward increased sophistication, automation, and sustainability focus presents substantial opportunities for companies positioned to meet these evolving demands while maintaining operational efficiency and competitive pricing structures.

What is Retail Reverse Logistics?

Retail reverse logistics refers to the processes involved in managing the return of goods from consumers back to retailers or manufacturers. This includes handling returns, refurbishing products, recycling, and managing excess inventory.

What are the key players in the United States Retail Reverse Logistics Market?

Key players in the United States Retail Reverse Logistics Market include companies like UPS, FedEx, and XPO Logistics, which provide logistics and supply chain solutions. Other notable companies include Inmar and Optoro, among others.

What are the main drivers of growth in the United States Retail Reverse Logistics Market?

The growth of the United States Retail Reverse Logistics Market is driven by the increasing e-commerce sales, rising consumer expectations for hassle-free returns, and the need for sustainable practices in waste management.

What challenges does the United States Retail Reverse Logistics Market face?

Challenges in the United States Retail Reverse Logistics Market include high operational costs associated with returns processing, managing reverse supply chains efficiently, and the complexities of handling returned goods in a sustainable manner.

What opportunities exist in the United States Retail Reverse Logistics Market?

Opportunities in the United States Retail Reverse Logistics Market include the adoption of advanced technologies like AI and automation to streamline return processes, as well as the growing emphasis on sustainability and circular economy practices.

What trends are shaping the United States Retail Reverse Logistics Market?

Trends in the United States Retail Reverse Logistics Market include the increasing integration of technology for tracking returns, the rise of omnichannel retailing, and a focus on improving customer experience through efficient return policies.

United States Retail Reverse Logistics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Returns Management, Inventory Liquidation, Repair Services, Recycling Solutions |

| Distribution Channel | Online Retailers, Brick-and-Mortar Stores, Wholesalers, Third-Party Logistics |

| Customer Type | Consumers, Businesses, E-commerce Platforms, Retail Chains |

| Service Type | Reverse Logistics Consulting, Transportation Services, Warehousing Solutions, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Retail Reverse Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at