444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States rental rate for residential real estate market represents a dynamic and complex ecosystem that significantly impacts millions of Americans across diverse geographic regions. This market encompasses the pricing mechanisms, demand-supply dynamics, and regulatory frameworks that govern rental properties throughout the nation. Market fundamentals indicate substantial growth in rental demand, driven by demographic shifts, economic factors, and evolving lifestyle preferences among American consumers.

Current market conditions reflect a landscape characterized by regional variations in rental pricing, with metropolitan areas experiencing different growth trajectories compared to suburban and rural markets. The rental market has demonstrated remarkable resilience, with average rental rates showing consistent upward momentum across most major markets. Supply constraints continue to influence pricing dynamics, while demographic trends such as millennial household formation and changing homeownership patterns contribute to sustained rental demand.

Geographic diversity remains a defining characteristic of the US rental market, with coastal markets typically commanding premium rates while emerging secondary markets gain increasing attention from both tenants and investors. Technology integration has transformed how rental properties are marketed, managed, and priced, creating new efficiencies and market transparency that benefit both landlords and tenants.

The United States rental rate for residential real estate market refers to the comprehensive system of pricing, leasing, and management of residential properties available for rent across all fifty states and the District of Columbia. This market encompasses single-family homes, apartments, condominiums, townhouses, and other residential units that property owners make available to tenants through lease agreements.

Market scope includes the determination of rental prices based on factors such as location, property characteristics, local market conditions, and regulatory environments. The rental rate market operates through various channels including property management companies, real estate agents, online platforms, and direct landlord-tenant relationships. Pricing mechanisms reflect local supply and demand dynamics, economic conditions, and demographic trends that influence both rental availability and affordability.

Regulatory frameworks at federal, state, and local levels significantly impact rental rate structures through rent control policies, tenant protection laws, and housing assistance programs. The market serves diverse tenant populations ranging from young professionals and families to seniors and students, each with distinct housing needs and budget constraints.

Market performance in the United States rental rate for residential real estate sector demonstrates robust growth patterns driven by fundamental demographic and economic shifts. The market continues to evolve in response to changing consumer preferences, technological innovations, and regulatory developments that shape rental housing accessibility and affordability across diverse geographic markets.

Key growth drivers include sustained population growth in major metropolitan areas, delayed homeownership among younger demographics, and increasing mobility preferences among American workers. Supply-demand imbalances in many markets have contributed to rental rate appreciation, with new construction struggling to keep pace with growing demand in high-growth regions.

Technology adoption has revolutionized market operations, with digital platforms facilitating property discovery, application processes, and lease management. Investment activity remains strong, with institutional investors and individual property owners recognizing the long-term potential of rental real estate as an asset class. Regulatory considerations continue to influence market dynamics, particularly in jurisdictions implementing rent stabilization measures or tenant protection policies.

Future prospects indicate continued market expansion, supported by demographic trends and evolving housing preferences that favor rental flexibility over homeownership commitment among significant population segments.

Market analysis reveals several critical insights that define the current state and future trajectory of the US rental rate market:

Demographic transformation serves as the primary catalyst driving rental market expansion across the United States. The millennial generation, now in prime household formation years, demonstrates strong preferences for rental housing due to lifestyle flexibility, career mobility, and delayed homeownership decisions. Population growth in major metropolitan areas continues to fuel demand for rental properties, particularly in technology hubs and emerging business centers.

Economic factors significantly influence rental market dynamics, with employment growth in key sectors driving demand for housing in specific geographic markets. Income growth patterns among professional demographics support rental rate appreciation, while economic uncertainty encourages rental flexibility over homeownership commitments. Interest rate environments affect both tenant decisions and investor capital allocation strategies.

Housing supply constraints represent a fundamental market driver, with limited new construction in high-demand areas creating supply-demand imbalances that support rental rate growth. Regulatory barriers to new development, including zoning restrictions and lengthy approval processes, contribute to supply limitations in many markets.

Lifestyle evolution among American consumers increasingly favors rental living, with preferences for urban locations, walkable neighborhoods, and amenity-rich properties driving demand for professionally managed rental communities. Technology adoption has enhanced the rental experience, making property search, application, and lease management more efficient and attractive to tech-savvy consumers.

Affordability challenges represent the most significant constraint facing the US rental market, with rental costs growing faster than median incomes in many metropolitan areas. This affordability gap limits market expansion by reducing the pool of qualified tenants and creating social and political pressure for regulatory intervention.

Regulatory restrictions in various jurisdictions impose constraints on rental rate growth through rent control policies, rent stabilization measures, and tenant protection laws. These regulatory frameworks can limit investor returns and discourage new rental housing development, potentially exacerbating supply shortages over time.

Construction costs and labor shortages in the building industry constrain new supply development, limiting the market’s ability to respond to growing demand through increased inventory. Material costs and skilled labor availability significantly impact development economics and project feasibility.

Economic volatility can impact tenant demand and payment capacity, particularly during economic downturns when unemployment rises and income stability decreases. Credit market conditions affect both tenant qualification rates and investor financing availability, influencing overall market activity levels.

Competition from homeownership markets can limit rental demand when mortgage rates decline and homeownership becomes more accessible to potential renters. Government homeownership incentives and first-time buyer programs may redirect demand away from rental properties.

Emerging markets present significant growth opportunities as population and employment growth spreads beyond traditional coastal metropolitan areas. Secondary cities and suburban markets offer attractive investment prospects with lower entry costs and strong demographic fundamentals supporting rental demand growth.

Technology innovation creates opportunities for market participants to enhance operational efficiency, improve tenant experiences, and develop new service offerings. PropTech solutions including smart home technology, automated property management, and data analytics platforms offer competitive advantages and operational improvements.

Demographic trends including aging baby boomers seeking maintenance-free living and Generation Z entering the rental market create opportunities for specialized housing products and services. Lifestyle-oriented developments that cater to specific demographic needs and preferences can command premium rental rates.

Institutional investment growth provides opportunities for market consolidation and professionalization, potentially improving operational standards and tenant experiences across the rental market. Capital market evolution continues to create new financing and investment structures that support market expansion.

Regulatory evolution in some markets toward more balanced landlord-tenant frameworks creates opportunities for increased investment and development activity. Public-private partnerships for affordable housing development offer opportunities to address housing needs while generating reasonable returns.

Supply-demand fundamentals continue to drive rental market dynamics across the United States, with demand consistently outpacing new supply in most major metropolitan areas. This structural imbalance supports rental rate appreciation and occupancy levels, creating favorable conditions for property owners and investors. Demand drivers remain robust, supported by demographic trends, employment growth, and lifestyle preferences that favor rental housing.

Regional variations in market dynamics reflect local economic conditions, regulatory environments, and demographic patterns. High-growth markets in the Sun Belt and Mountain West demonstrate strong rental demand driven by population migration and job creation, while established coastal markets maintain premium pricing despite supply constraints.

Seasonal patterns influence rental market activity, with peak leasing seasons typically occurring during spring and summer months when tenant mobility is highest. Market cycles reflect broader economic conditions, with rental markets generally demonstrating greater stability than homeownership markets during economic volatility.

Competitive dynamics vary significantly by market segment and geographic location, with professional property management companies competing alongside individual landlords and institutional owners. Service differentiation through amenities, technology, and customer service becomes increasingly important in competitive markets.

Comprehensive analysis of the United States rental rate for residential real estate market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes surveys and interviews with property managers, landlords, tenants, and industry professionals to gather firsthand market intelligence and trend identification.

Secondary research incorporates analysis of government housing data, census information, economic indicators, and industry reports to establish market baselines and historical trends. Data sources include the U.S. Census Bureau, Bureau of Labor Statistics, Department of Housing and Urban Development, and various state and local housing authorities.

Market modeling techniques utilize statistical analysis and econometric methods to identify relationships between rental rates and key variables such as employment levels, population growth, and housing supply. Regression analysis helps quantify the impact of various factors on rental rate determination and market performance.

Geographic analysis examines rental market conditions across different metropolitan statistical areas, states, and regions to identify patterns and variations in market performance. Comparative analysis between markets helps identify best practices and emerging trends that may influence future market development.

Validation processes ensure research accuracy through cross-referencing multiple data sources and expert review of findings and conclusions.

Northeast Region maintains its position as a premium rental market, with major metropolitan areas including New York, Boston, and Washington D.C. commanding some of the highest rental rates nationally. The region benefits from strong employment in finance, technology, and government sectors, supporting robust rental demand. Market characteristics include high population density, limited developable land, and strict regulatory environments that constrain supply growth.

Southeast Region demonstrates exceptional growth in rental markets, with cities like Atlanta, Charlotte, and Nashville experiencing significant population influx and employment expansion. Regional advantages include lower cost structures, business-friendly regulatory environments, and strong demographic trends supporting rental demand. The region captures approximately 28% market share of national rental growth activity.

Midwest Region offers stable rental markets with moderate growth rates and attractive affordability metrics compared to coastal markets. Market stability reflects diversified economic bases and reasonable housing supply relative to demand. Cities like Chicago, Minneapolis, and Columbus provide steady rental market performance with balanced supply-demand dynamics.

Southwest Region leads national rental market growth, with Texas and Arizona markets demonstrating exceptional performance driven by population migration and job creation. Market expansion in cities like Austin, Dallas, and Phoenix reflects favorable business climates and lifestyle attractions that drive rental demand growth.

West Region encompasses both premium coastal markets and emerging inland metropolitan areas, with California markets commanding premium rates while cities like Denver and Salt Lake City offer growth opportunities with improving market fundamentals.

Market structure in the United States rental rate for residential real estate sector encompasses a diverse array of participants ranging from individual property owners to large institutional investors and property management companies. Competition dynamics vary significantly by market segment, property type, and geographic location.

Major market participants include:

Competitive strategies focus on operational excellence, technology adoption, customer service enhancement, and strategic market positioning. Market consolidation continues as institutional investors acquire individual properties and smaller portfolios to achieve operational efficiencies and market scale.

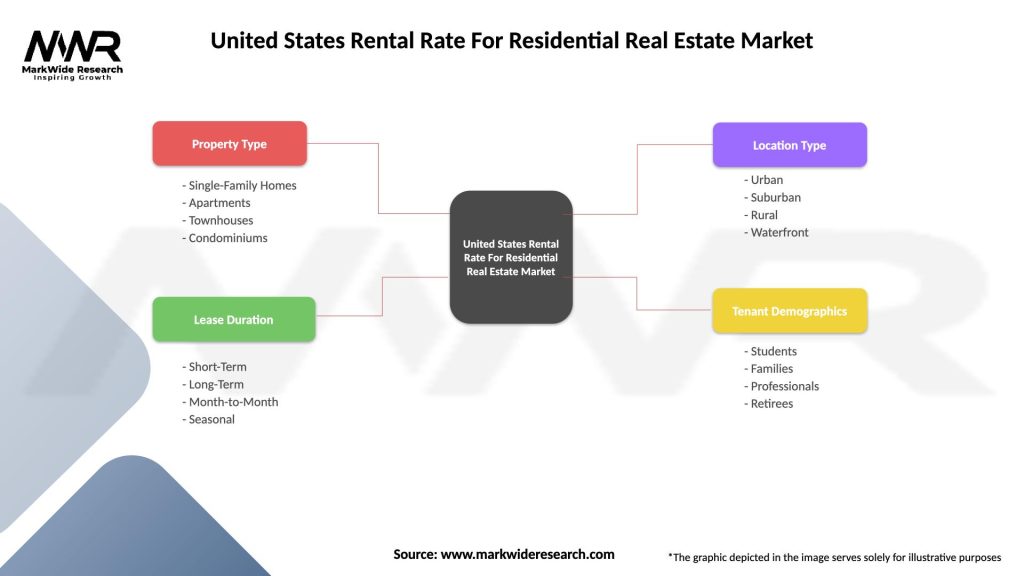

Property Type Segmentation divides the rental market into distinct categories based on housing characteristics and target demographics:

Geographic Segmentation reflects significant variations in rental market characteristics:

Demographic Segmentation addresses diverse tenant populations with varying housing needs and preferences.

Multifamily Apartment Segment represents the largest component of the rental market, with professionally managed properties offering standardized lease terms and amenity packages. This segment benefits from operational efficiencies and institutional investment interest. Market performance demonstrates consistent occupancy levels above 94% nationally, with new supply absorption remaining strong in most markets.

Single-Family Rental Segment has experienced rapid growth and institutionalization, with companies like Invitation Homes and American Homes 4 Rent creating scalable business models. This segment appeals to families seeking more space and privacy while maintaining rental flexibility. Operational challenges include property maintenance and tenant turnover management across dispersed portfolios.

Luxury Rental Segment commands premium rates through high-end amenities, concierge services, and prime locations. Target demographics include high-income professionals and empty nesters seeking maintenance-free living with luxury features. This segment demonstrates resilience during economic downturns due to tenant income stability.

Affordable Housing Segment serves essential workforce populations through various subsidy programs and naturally occurring affordable housing. Market dynamics include regulatory oversight, income restrictions, and long-term affordability requirements that influence investment and operational strategies.

Student Housing Segment provides specialized rental housing near colleges and universities, with lease terms and amenity packages designed for student populations. Market characteristics include seasonal demand patterns and parental guarantee requirements.

Property Owners and Investors benefit from stable cash flow generation, potential appreciation, and portfolio diversification through rental real estate investments. Market advantages include inflation protection, tax benefits, and the ability to leverage investment capital for enhanced returns. Professional management services enable passive investment approaches while maintaining property performance.

Tenants and Residents gain housing flexibility, reduced maintenance responsibilities, and access to amenities that might be unaffordable in homeownership scenarios. Rental benefits include mobility for career advancement, predictable monthly housing costs, and professional property management services. Lifestyle advantages encompass access to urban locations and community amenities.

Property Management Companies create value through operational expertise, technology platforms, and economies of scale in property operations. Business benefits include recurring revenue streams, growth opportunities through portfolio expansion, and technology-enabled operational efficiencies.

Local Communities benefit from well-maintained rental housing that provides workforce housing options and supports local economic development. Community advantages include property tax revenue generation, neighborhood stability, and housing diversity that supports various income levels.

Financial Institutions participate through lending, investment, and service provision to rental market participants. Market opportunities include mortgage lending, construction financing, and investment banking services for real estate transactions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology transformation continues reshaping the rental market through digital platforms, smart home integration, and automated property management systems. PropTech adoption accelerates across all market segments, with virtual touring, online leasing, and mobile property management becoming standard practices. Data analytics enable more sophisticated pricing strategies and operational optimization.

Demographic evolution drives demand for specialized housing products and services, with millennials prioritizing amenity-rich properties in walkable neighborhoods while baby boomers seek maintenance-free living options. Generational preferences influence property design, amenity packages, and service delivery models across the rental market.

Sustainability focus gains importance as tenants and investors prioritize environmentally responsible properties. Green building features including energy efficiency, renewable energy, and sustainable materials become competitive differentiators in many markets. ESG considerations influence institutional investment decisions and property development strategies.

Flexible living arrangements emerge as tenants seek shorter-term leases, furnished options, and co-living arrangements that accommodate changing lifestyle needs. Market innovation includes flexible lease terms, furnished rental options, and shared living spaces that appeal to mobile professionals and cost-conscious renters.

Suburban migration accelerated by remote work trends creates new rental demand patterns, with suburban and secondary markets experiencing increased interest from tenants seeking more space and affordability. According to MarkWide Research analysis, suburban rental markets show accelerating growth rates compared to traditional urban cores.

Institutional investment expansion continues transforming the rental market landscape, with private equity firms, pension funds, and REITs increasing allocation to residential rental properties. Market consolidation accelerates as institutional investors acquire portfolios and develop operational platforms for scalable property management.

Single-family rental institutionalization represents a significant market development, with companies creating sophisticated acquisition, renovation, and management processes for detached rental homes. Technology platforms enable efficient operations across geographically dispersed portfolios.

Build-to-rent development emerges as a specialized real estate product, with developers creating single-family and multifamily communities specifically designed for rental rather than homeownership. Design innovations optimize properties for rental operations while providing attractive living environments for tenants.

Regulatory evolution includes both tenant protection measures and market-friendly policies, with jurisdictions balancing housing affordability concerns against investment incentives. Policy developments significantly impact market dynamics and investment strategies across different geographic markets.

Technology integration advances through artificial intelligence, Internet of Things devices, and blockchain applications that enhance property operations, tenant services, and investment management. Innovation adoption creates competitive advantages and operational efficiencies for early adopters.

Market participants should focus on technology adoption and operational excellence to maintain competitive positioning in an increasingly sophisticated rental market. Investment strategies should emphasize geographic diversification and property type specialization to optimize risk-adjusted returns while serving diverse tenant demographics.

Property owners should prioritize tenant experience enhancement through amenity improvements, responsive management, and technology integration that meets evolving renter expectations. Operational efficiency gains through professional management and technology platforms can improve profitability and tenant satisfaction simultaneously.

Investors should carefully evaluate regulatory environments and demographic trends when selecting markets and property types for rental real estate investment. Due diligence should include analysis of local housing policies, economic fundamentals, and competitive dynamics that influence long-term investment performance.

Developers should consider build-to-rent strategies that optimize properties for rental operations while meeting tenant preferences for modern amenities and sustainable features. Market research should inform product development decisions based on demographic trends and competitive positioning.

Policy makers should balance housing affordability objectives with market incentives that encourage rental housing investment and development. Regulatory frameworks should promote housing supply growth while protecting tenant rights and maintaining market stability.

Long-term prospects for the United States rental rate for residential real estate market remain positive, supported by fundamental demographic trends and evolving housing preferences that favor rental flexibility. Market growth is projected to continue at a steady pace of 4-6% annually across most metropolitan areas, with regional variations reflecting local economic conditions and supply-demand dynamics.

Demographic drivers including millennial household formation, Gen Z market entry, and baby boomer downsizing will sustain rental demand across diverse property types and price points. MWR projections indicate that rental households will represent an increasing share of total housing demand over the next decade.

Technology evolution will continue transforming rental market operations, with artificial intelligence, automation, and data analytics creating new efficiencies and service capabilities. Innovation adoption will differentiate successful market participants and enhance tenant experiences across all property segments.

Supply development is expected to gradually improve as regulatory barriers decrease and construction capacity expands, though supply-demand imbalances will persist in high-growth markets. Development trends favor build-to-rent products and mixed-use communities that integrate rental housing with retail and office components.

Investment activity will remain robust as institutional investors recognize rental real estate as a core asset class offering inflation protection and steady cash flows. Capital allocation is expected to increase across all property types, with particular focus on emerging markets and specialized housing products.

The United States rental rate for residential real estate market represents a dynamic and essential component of the American housing ecosystem, serving millions of households while providing investment opportunities across diverse property types and geographic markets. Market fundamentals remain strong, supported by demographic trends, lifestyle preferences, and economic factors that sustain rental demand growth.

Future success in this market will depend on participants’ ability to adapt to evolving tenant expectations, regulatory environments, and technological innovations that continue reshaping rental housing delivery. Strategic positioning through operational excellence, technology adoption, and market specialization will differentiate successful participants in an increasingly competitive landscape.

Investment opportunities abound across various market segments and geographic regions, with emerging markets and specialized housing products offering attractive growth potential. Market evolution toward greater professionalization and technology integration creates efficiencies that benefit both property owners and tenants while supporting continued market expansion and maturation.

What is Rental Rate For Residential Real Estate?

The Rental Rate For Residential Real Estate refers to the price tenants pay to occupy residential properties, which can vary based on location, property type, and market demand.

What are the current trends in the United States Rental Rate For Residential Real Estate Market?

Current trends in the United States Rental Rate For Residential Real Estate Market include rising rental prices in urban areas, increased demand for single-family homes, and a shift towards longer lease terms as tenants seek stability.

Who are the major companies in the United States Rental Rate For Residential Real Estate Market?

Major companies in the United States Rental Rate For Residential Real Estate Market include Zillow, Redfin, and Apartment List, among others.

What factors are driving the United States Rental Rate For Residential Real Estate Market?

Factors driving the United States Rental Rate For Residential Real Estate Market include population growth in metropolitan areas, limited housing supply, and increased interest in rental properties as an investment.

What challenges does the United States Rental Rate For Residential Real Estate Market face?

Challenges in the United States Rental Rate For Residential Real Estate Market include rising construction costs, regulatory hurdles, and the impact of economic fluctuations on tenant affordability.

What opportunities exist in the United States Rental Rate For Residential Real Estate Market?

Opportunities in the United States Rental Rate For Residential Real Estate Market include the potential for growth in suburban rental markets, the rise of co-living spaces, and increased demand for eco-friendly rental properties.

United States Rental Rate For Residential Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Single-Family Homes, Apartments, Townhouses, Condominiums |

| Lease Duration | Short-Term, Long-Term, Month-to-Month, Seasonal |

| Location Type | Urban, Suburban, Rural, Waterfront |

| Tenant Demographics | Students, Families, Professionals, Retirees |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Rental Rate For Residential Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at