444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States real estate brokerage market represents a cornerstone of the American economy, facilitating property transactions across residential, commercial, and industrial sectors. This dynamic marketplace has experienced significant transformation in recent years, driven by technological innovation, changing consumer preferences, and evolving regulatory frameworks. Digital platforms and PropTech solutions have revolutionized traditional brokerage operations, creating new opportunities for market participants while challenging established business models.

Market growth in the real estate brokerage sector has been robust, with the industry demonstrating remarkable resilience despite economic fluctuations. The sector is experiencing a compound annual growth rate (CAGR) of 6.2%, reflecting strong demand for professional real estate services across diverse market segments. Residential brokerage services continue to dominate market activity, accounting for approximately 78% of total brokerage transactions, while commercial and industrial segments contribute significantly to overall revenue generation.

Technological adoption has accelerated dramatically, with 85% of brokerages now utilizing some form of digital platform or customer relationship management system. This technological integration has enhanced operational efficiency, improved client experiences, and enabled brokerages to expand their service offerings beyond traditional transaction facilitation.

The United States real estate brokerage market refers to the comprehensive ecosystem of licensed professionals, firms, and organizations that facilitate property transactions between buyers and sellers across all real estate categories. This market encompasses traditional full-service brokerages, discount brokerages, online platforms, and hybrid service models that provide varying levels of support throughout the property transaction process.

Real estate brokerages serve as intermediaries in property transactions, offering expertise in market analysis, property valuation, negotiation, legal compliance, and transaction management. The market includes both large national franchises and independent local firms, each serving distinct client segments with specialized service offerings tailored to specific market needs and consumer preferences.

Market dynamics in the United States real estate brokerage sector reflect a period of significant transformation and opportunity. The industry is experiencing unprecedented change driven by technological innovation, shifting consumer expectations, and evolving competitive landscapes. Digital disruption has created new business models while traditional brokerages adapt their service offerings to remain competitive in an increasingly dynamic marketplace.

Key market drivers include sustained housing demand, low interest rate environments, demographic shifts, and increasing adoption of digital real estate platforms. The market benefits from strong consumer confidence in real estate as an investment vehicle, supported by favorable economic conditions and government policies that encourage homeownership and property investment.

Competitive intensity has increased significantly, with new entrants challenging traditional brokerage models through innovative service delivery, reduced commission structures, and enhanced digital experiences. This competition has driven industry-wide improvements in service quality, operational efficiency, and customer satisfaction metrics across all market segments.

Strategic market insights reveal several critical trends shaping the future of real estate brokerage services. The industry is witnessing a fundamental shift toward technology-enabled service delivery, with clients increasingly expecting seamless digital experiences throughout their property transactions.

Primary market drivers propelling growth in the United States real estate brokerage sector encompass both macroeconomic factors and industry-specific trends. Demographic shifts continue to generate sustained demand for real estate services, with millennial homebuyers entering the market in significant numbers and baby boomers engaging in downsizing and relocation activities.

Economic conditions have remained favorable for real estate activity, with low interest rates supporting affordability and encouraging property investment. Government policies promoting homeownership through various incentive programs have further stimulated market activity, creating opportunities for brokerage service providers across diverse market segments.

Market challenges facing the United States real estate brokerage industry include regulatory complexities, competitive pressures, and economic uncertainties that can impact transaction volumes and revenue generation. Regulatory compliance requirements continue to increase operational costs and complexity for brokerage firms across all market segments.

Economic volatility can significantly impact real estate transaction activity, with market downturns leading to reduced commission revenues and operational challenges for brokerage firms. Interest rate fluctuations directly influence buyer demand and market activity levels, creating uncertainty in revenue projections and business planning processes.

Emerging opportunities in the United States real estate brokerage market reflect evolving consumer preferences, technological capabilities, and market dynamics. Digital transformation continues to create new service delivery models and operational efficiencies that can enhance competitive positioning and client satisfaction.

Market expansion opportunities exist in underserved geographic regions and specialized property segments where traditional brokerage services may be limited. Technology integration enables brokerages to serve broader markets while maintaining personalized service levels that differentiate their offerings from purely digital competitors.

Market dynamics in the United States real estate brokerage sector reflect the complex interplay of economic conditions, technological innovation, regulatory changes, and competitive forces. Supply and demand fundamentals continue to drive market activity, with regional variations creating diverse opportunities and challenges for brokerage service providers.

Competitive dynamics have intensified significantly, with traditional full-service brokerages facing pressure from discount brokerages, online platforms, and hybrid service models. This competition has led to innovation in service delivery, pricing models, and client experience enhancement across the industry. Market consolidation trends are evident as larger firms acquire smaller competitors to expand their geographic reach and service capabilities.

Technology adoption rates have accelerated, with 92% of brokerages now utilizing digital marketing platforms and customer relationship management systems. This technological integration has improved operational efficiency by approximately 35% while enhancing client communication and transaction management capabilities.

Research methodology for analyzing the United States real estate brokerage market incorporates comprehensive primary and secondary research approaches to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, real estate professionals, technology providers, and regulatory officials to gather firsthand perspectives on market trends and dynamics.

Secondary research encompasses analysis of industry reports, regulatory filings, financial statements, and market data from authoritative sources. Data validation processes ensure accuracy and reliability of all market information and statistical analysis presented in this comprehensive market assessment.

Regional market analysis reveals significant variations in real estate brokerage activity across different geographic areas of the United States. West Coast markets continue to demonstrate strong activity levels, accounting for approximately 32% of national brokerage revenues, driven by high property values and active investment markets in California, Washington, and Oregon.

East Coast markets represent approximately 28% of market activity, with particular strength in the Northeast corridor and Florida markets. Texas and Southeast regions contribute 25% of national activity, benefiting from population growth, economic development, and favorable business environments that attract both residential and commercial real estate investment.

Midwest markets account for the remaining 15% of brokerage activity, with steady demand driven by affordable housing markets and stable economic conditions. Rural and secondary markets are experiencing increased attention as remote work trends and lifestyle changes drive population shifts away from major metropolitan areas.

Competitive landscape analysis reveals a diverse ecosystem of market participants ranging from large national franchises to specialized local brokerages. Market leadership is distributed among several major players, each with distinct competitive advantages and market positioning strategies.

Market segmentation in the United States real estate brokerage sector reflects diverse service models, property types, and client categories. Service model segmentation includes traditional full-service brokerages, discount brokerages, online platforms, and hybrid models that combine digital efficiency with personalized service delivery.

Property type segmentation encompasses residential, commercial, industrial, and land brokerage services, each requiring specialized expertise and market knowledge. Client segmentation includes first-time homebuyers, move-up buyers, investors, commercial clients, and institutional investors, each with distinct service requirements and value propositions.

Residential brokerage services continue to dominate market activity, driven by sustained homebuying demand and demographic trends supporting household formation. Luxury residential markets have shown particular strength, with high-net-worth clients seeking specialized services and expertise in premium property segments.

Commercial brokerage services have demonstrated resilience despite economic uncertainties, with investment activity supporting demand for professional advisory services. Industrial real estate brokerage has experienced significant growth driven by e-commerce expansion and supply chain optimization requirements.

Technology-enabled services are becoming increasingly important across all categories, with clients expecting digital tools, virtual tours, and online transaction management capabilities. MarkWide Research analysis indicates that brokerages investing in technology platforms are achieving higher client satisfaction rates and improved operational efficiency metrics.

Industry participants benefit from multiple value creation opportunities within the evolving real estate brokerage market. Technology adoption enables improved operational efficiency, enhanced client experiences, and expanded market reach capabilities that drive competitive advantages and revenue growth.

Stakeholder benefits extend beyond immediate transaction facilitation to include market expertise, regulatory compliance support, and ongoing advisory services that add value throughout the property ownership lifecycle. Professional development opportunities within the brokerage industry continue to attract talented individuals seeking entrepreneurial opportunities and flexible career paths.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the United States real estate brokerage industry reflect fundamental changes in consumer behavior, technology capabilities, and competitive dynamics. Digital transformation continues to accelerate, with brokerages investing heavily in customer relationship management systems, mobile applications, and virtual tour capabilities.

Personalization trends are driving demand for customized service offerings tailored to specific client needs and preferences. Data analytics and artificial intelligence are being utilized to enhance market insights, improve client matching, and optimize transaction processes across all brokerage segments.

Recent industry developments highlight the dynamic nature of the United States real estate brokerage market and the ongoing evolution of service delivery models. Technology partnerships between traditional brokerages and PropTech companies are creating innovative solutions that enhance client experiences while improving operational efficiency.

Regulatory developments continue to influence market dynamics, with various states implementing new disclosure requirements and consumer protection measures. Market consolidation activities have accelerated, with strategic acquisitions and partnerships reshaping competitive landscapes across regional markets.

Industry analysts recommend that real estate brokerages focus on technology integration, service differentiation, and operational efficiency to maintain competitive positioning in the evolving market landscape. Investment in digital platforms and customer experience enhancement should be prioritized to meet changing consumer expectations and competitive pressures.

Strategic recommendations include developing specialized expertise in high-growth market segments, expanding geographic reach through technology-enabled service delivery, and creating strategic partnerships that enhance service capabilities. MWR analysis suggests that brokerages implementing comprehensive technology strategies are achieving superior performance metrics compared to traditional service providers.

Future market outlook for the United States real estate brokerage industry remains positive, supported by favorable demographic trends, continued technology adoption, and evolving service delivery models. Market growth is expected to continue at a steady pace, with technology-enabled brokerages likely to capture increasing market share through enhanced service capabilities and operational efficiency.

Innovation trends will continue to drive market evolution, with artificial intelligence, virtual reality, and blockchain technologies creating new opportunities for service enhancement and operational improvement. Consumer preferences will increasingly favor brokerages that combine professional expertise with digital convenience and personalized service delivery.

Long-term projections indicate sustained growth in brokerage services, with the industry expected to maintain a growth trajectory of 5-7% annually over the next five years. MarkWide Research forecasts that technology-focused brokerages will achieve market share gains of 15-20% as they capitalize on changing consumer preferences and operational advantages.

The United States real estate brokerage market represents a dynamic and evolving industry characterized by technological innovation, competitive intensity, and changing consumer expectations. Market participants that successfully adapt to these changing dynamics through technology adoption, service innovation, and operational excellence will be well-positioned to capitalize on future growth opportunities.

Strategic success in this market requires a balanced approach combining traditional real estate expertise with modern technology capabilities and enhanced customer service delivery. The industry’s future will be shaped by continued digital transformation, evolving consumer preferences, and the ability of market participants to create value through innovative service models and operational efficiency improvements.

What is Real Estate Brokerage?

Real Estate Brokerage refers to the business of helping clients buy, sell, or rent properties. This includes various services such as property listings, market analysis, and negotiation support.

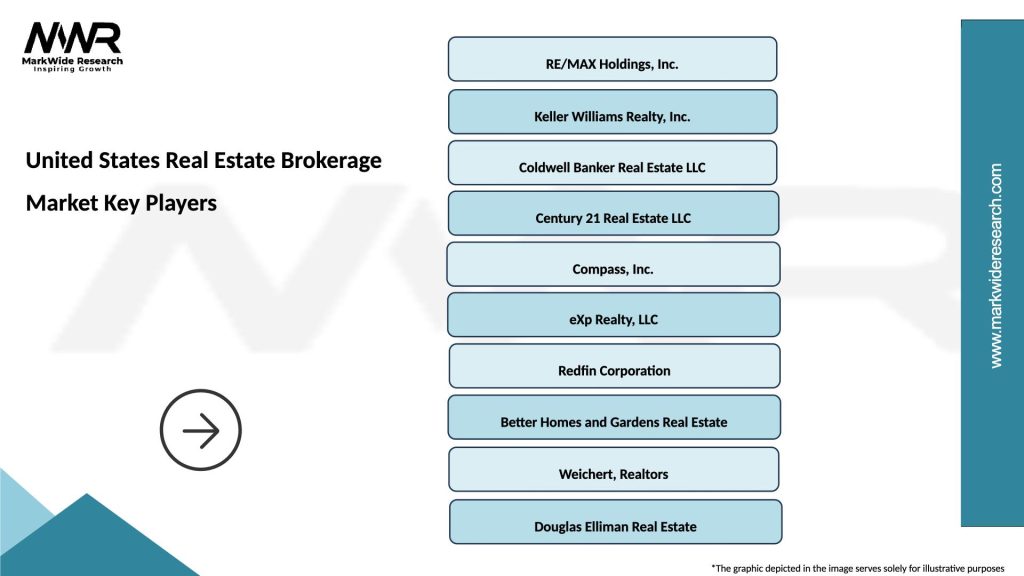

What are the key players in the United States Real Estate Brokerage Market?

Key players in the United States Real Estate Brokerage Market include companies like Keller Williams Realty, RE/MAX, and Coldwell Banker, among others. These firms provide a range of services from residential to commercial real estate transactions.

What are the main drivers of growth in the United States Real Estate Brokerage Market?

The main drivers of growth in the United States Real Estate Brokerage Market include increasing urbanization, rising disposable incomes, and a growing demand for housing. Additionally, technological advancements in property listings and virtual tours are enhancing consumer engagement.

What challenges does the United States Real Estate Brokerage Market face?

Challenges in the United States Real Estate Brokerage Market include regulatory changes, market volatility, and competition from online platforms. These factors can impact traditional brokerage models and require adaptation to maintain market share.

What opportunities exist in the United States Real Estate Brokerage Market?

Opportunities in the United States Real Estate Brokerage Market include the expansion of digital services, increased focus on sustainability in property development, and the potential for growth in underserved markets. These trends can lead to innovative business models and enhanced customer experiences.

What trends are shaping the United States Real Estate Brokerage Market?

Trends shaping the United States Real Estate Brokerage Market include the rise of remote work influencing housing preferences, the integration of artificial intelligence in property management, and a shift towards eco-friendly properties. These trends are redefining how real estate transactions are conducted.

United States Real Estate Brokerage Market

| Segmentation Details | Description |

|---|---|

| Service Type | Residential Brokerage, Commercial Brokerage, Property Management, Investment Sales |

| Customer Type | First-Time Buyers, Real Estate Investors, Corporations, Luxury Buyers |

| Technology | CRM Systems, Virtual Tours, Listing Platforms, Market Analytics |

| Distribution Channel | Online Platforms, Traditional Agencies, Auctions, Referral Networks |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Real Estate Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at