444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States processed pork market represents a cornerstone of American food processing, encompassing an extensive range of value-added pork products that have become integral to consumer diets nationwide. This dynamic sector includes bacon, ham, sausages, deli meats, and various specialty pork products that undergo transformation from raw pork into convenient, shelf-stable, and flavor-enhanced offerings.

Market dynamics indicate robust growth driven by evolving consumer preferences, technological advancements in processing techniques, and expanding distribution channels. The industry has witnessed a 6.2% annual growth rate in premium processed pork segments, reflecting increasing demand for artisanal and specialty products. Consumer behavior patterns show heightened interest in convenient protein options, with processed pork products capturing 34% of total pork consumption in American households.

Regional distribution across the United States reveals concentrated processing facilities in the Midwest, particularly in Iowa, Illinois, and Minnesota, where proximity to hog production creates operational efficiencies. The market encompasses traditional large-scale processors alongside emerging artisanal producers, creating a diverse competitive landscape that serves various consumer segments from budget-conscious families to premium food enthusiasts.

The United States processed pork market refers to the comprehensive industry segment focused on transforming raw pork into value-added products through various processing techniques including curing, smoking, seasoning, and packaging for extended shelf life and enhanced consumer convenience.

Processing methodologies encompass traditional techniques such as salt curing and smoking, alongside modern approaches including vacuum packaging, modified atmosphere packaging, and advanced preservation technologies. These processes not only extend product shelf life but also create distinctive flavors and textures that differentiate products in competitive retail environments.

Product categories within this market span breakfast meats like bacon and breakfast sausage, lunch meats including ham and turkey alternatives, dinner solutions such as bratwurst and Italian sausage, and specialty items like pepperoni and chorizo. Each category serves specific consumer needs while contributing to the overall market ecosystem.

Strategic analysis of the United States processed pork market reveals a mature yet evolving industry characterized by consolidation among major processors while simultaneously experiencing growth in artisanal and specialty segments. The market demonstrates resilience through economic cycles, supported by consistent consumer demand for convenient protein options.

Key performance indicators show that processed pork maintains strong market penetration, with 87% of American households regularly purchasing at least one processed pork product monthly. Innovation drives market expansion, particularly in clean-label products, reduced-sodium formulations, and organic offerings that address health-conscious consumer preferences.

Competitive positioning within the broader protein market remains strong, with processed pork products offering superior convenience and longer shelf life compared to fresh alternatives. The industry benefits from established supply chains, advanced processing technologies, and strong brand recognition among leading manufacturers.

Consumer preference trends reveal significant shifts toward premium and specialty processed pork products, with artisanal bacon and craft sausages experiencing particularly strong growth. MarkWide Research analysis indicates that consumers increasingly prioritize product quality, ingredient transparency, and unique flavor profiles over traditional price-focused purchasing decisions.

Consumer lifestyle changes serve as primary market drivers, with busy schedules increasing demand for convenient, ready-to-consume protein options. The rise of dual-income households and time-constrained meal preparation creates sustained demand for processed pork products that offer quick cooking solutions without sacrificing taste or nutrition.

Technological advancement in processing equipment and preservation techniques enables manufacturers to develop innovative products with extended shelf life, improved flavor profiles, and enhanced nutritional characteristics. Modern processing facilities incorporate automation, quality control systems, and traceability technologies that improve efficiency while maintaining food safety standards.

Foodservice sector expansion significantly drives market growth, with restaurants, cafeterias, and food trucks increasingly incorporating processed pork products into menu offerings. The versatility of processed pork enables creative culinary applications, from gourmet bacon-wrapped entrees to artisanal charcuterie boards that appeal to diverse consumer preferences.

Export opportunities create additional growth drivers as international markets develop appreciation for American-style processed pork products. Trade relationships and regulatory approvals enable domestic processors to access global markets, particularly in Asia and Latin America, where growing middle-class populations seek premium protein products.

Health concerns regarding processed meat consumption present significant market challenges, with medical research linking certain processed meats to health risks. Consumer awareness of sodium content, preservatives, and additives creates demand for reformulated products while potentially limiting overall category growth among health-conscious demographics.

Regulatory compliance requirements impose substantial costs and operational complexities on processors, particularly smaller manufacturers lacking resources for comprehensive quality assurance programs. USDA inspection protocols, labeling requirements, and food safety regulations require continuous investment in facilities, training, and documentation systems.

Raw material price volatility affects profitability and pricing strategies, with pork commodity prices fluctuating based on feed costs, disease outbreaks, and global trade conditions. Processors must balance cost management with quality maintenance while remaining competitive in price-sensitive market segments.

Competition from alternatives intensifies as plant-based protein products and other meat alternatives gain market acceptance. Innovative companies developing processed alternatives to traditional pork products create competitive pressure while appealing to vegetarian, vegan, and flexitarian consumer segments.

Clean-label product development presents substantial opportunities for manufacturers willing to invest in reformulation and premium positioning. Consumers increasingly seek processed pork products with recognizable ingredients, minimal additives, and transparent sourcing, creating market space for premium-priced offerings.

E-commerce expansion offers direct-to-consumer sales channels that enable processors to build brand relationships, capture higher margins, and access niche markets. Online platforms facilitate subscription services, specialty product sales, and geographic expansion beyond traditional retail distribution networks.

International market penetration provides growth opportunities as global consumers develop preferences for American-style processed pork products. Strategic partnerships, export development, and cultural adaptation of products enable access to emerging markets with growing protein consumption.

Innovation in packaging and preservation technologies creates opportunities for extended shelf life, improved convenience, and enhanced product presentation. Smart packaging, portion control, and sustainable materials appeal to environmentally conscious consumers while improving operational efficiency.

Supply chain integration characterizes the processed pork market, with major players controlling multiple stages from hog production through retail distribution. This vertical integration provides cost control, quality assurance, and supply security while creating barriers for new market entrants lacking similar scale and resources.

Seasonal demand patterns influence production planning and inventory management, with holiday periods driving increased consumption of ham, bacon, and specialty sausages. Summer grilling seasons boost demand for bratwurst and other cooking sausages, while breakfast meat consumption remains relatively stable throughout the year.

Regional taste preferences create market segmentation opportunities, with Southern consumers favoring spicier sausages, Midwest markets preferring traditional bratwurst, and coastal regions showing interest in artisanal and international varieties. Understanding these preferences enables targeted product development and marketing strategies.

Technological disruption continues reshaping the industry through automation, artificial intelligence, and data analytics that optimize production processes, predict maintenance needs, and enhance quality control. These technologies improve efficiency while reducing labor costs and human error risks.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United States processed pork market. Primary research includes surveys of industry participants, consumer focus groups, and interviews with key stakeholders across the value chain from producers to retailers.

Secondary research incorporates analysis of industry publications, government statistics, trade association reports, and company financial statements to establish market baselines and identify trends. USDA data provides authoritative information on production volumes, consumption patterns, and regulatory developments affecting the industry.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to project future market conditions and identify potential growth opportunities. These models incorporate economic indicators, demographic trends, and consumer behavior patterns to enhance forecasting accuracy.

Validation processes ensure research findings accuracy through cross-referencing multiple data sources, expert review panels, and industry feedback sessions. This rigorous approach provides confidence in market insights and recommendations for strategic decision-making.

Midwest dominance in processed pork production reflects the region’s concentration of hog farming operations and established processing infrastructure. States like Iowa, Illinois, and Minnesota host major processing facilities that benefit from proximity to raw materials, skilled labor forces, and transportation networks enabling efficient distribution nationwide.

Southern markets demonstrate strong consumption patterns, particularly for seasoned and spicy processed pork products that align with regional culinary preferences. Texas, North Carolina, and Georgia represent significant consumption centers while also hosting processing facilities serving regional and national markets.

Western states show growing demand for premium and organic processed pork products, with California leading consumption of artisanal and specialty items. The region’s health-conscious consumer base drives demand for clean-label products and innovative formulations that address dietary concerns.

Northeast markets exhibit sophisticated consumer preferences with strong demand for deli meats, artisanal sausages, and imported-style products. Urban centers like New York and Boston support premium pricing for high-quality processed pork products while maintaining substantial volume consumption.

Market consolidation characterizes the competitive environment, with several major corporations controlling significant market share through extensive processing capabilities, distribution networks, and brand portfolios. These industry leaders benefit from economies of scale, research and development resources, and established retailer relationships.

Product-based segmentation reveals distinct market categories with unique characteristics, consumer bases, and growth trajectories. Each segment requires tailored marketing approaches, distribution strategies, and product development initiatives to maximize market penetration and profitability.

By Product Type:

By Distribution Channel:

Bacon category maintains premium positioning within processed pork markets, with consumers willing to pay higher prices for quality, flavor, and convenience. Thick-cut, applewood-smoked, and uncured varieties command premium pricing while traditional bacon remains a household staple with consistent purchase frequency.

Sausage segments demonstrate significant innovation potential, with manufacturers developing ethnic varieties, organic formulations, and unique flavor combinations that appeal to adventurous consumers. Breakfast sausage benefits from morning meal trends while dinner sausages capitalize on grilling and cooking occasions.

Deli meat categories face competitive pressure from fresh alternatives while maintaining advantages in convenience and shelf life. Premium positioning through artisanal preparation methods, unique flavor profiles, and clean-label formulations creates differentiation opportunities in crowded market segments.

Specialty products including pepperoni, chorizo, and international varieties serve niche markets with higher margins and loyal consumer bases. These products often benefit from foodservice applications in pizza, Mexican cuisine, and ethnic restaurants that drive both retail and commercial demand.

Manufacturers benefit from established consumer demand, proven processing technologies, and diverse product portfolio opportunities that enable market segmentation and premium positioning. The industry’s maturity provides predictable cash flows while innovation creates growth opportunities in emerging segments.

Retailers gain from processed pork products’ high turnover rates, strong profit margins, and consumer loyalty that drives repeat purchases. These products serve as traffic drivers while offering cross-merchandising opportunities with complementary items like bread, cheese, and condiments.

Consumers enjoy convenient protein options with extended shelf life, consistent quality, and diverse flavor profiles that enhance meal preparation efficiency. Processed pork products provide familiar tastes while offering premium options for special occasions and everyday convenience.

Foodservice operators benefit from processed pork products’ operational advantages including portion control, consistent quality, and menu versatility. These products enable creative culinary applications while maintaining food safety standards and cost predictability essential for profitable operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean-label movement drives significant product reformulation efforts as consumers increasingly scrutinize ingredient lists and seek products with recognizable, natural components. Manufacturers respond by developing nitrate-free, reduced-sodium, and organic formulations that maintain taste and safety while addressing health concerns.

Artisanal positioning creates premium market segments where traditional processing methods, unique flavor profiles, and small-batch production appeal to consumers seeking authentic, high-quality experiences. These products command higher prices while building brand differentiation in competitive markets.

Convenience innovation focuses on packaging solutions, portion control, and ready-to-eat formats that align with busy lifestyles and changing meal patterns. Resealable packaging, single-serve portions, and microwaveable options enhance consumer convenience while maintaining product quality.

Sustainability initiatives encompass environmental responsibility throughout the supply chain, from sustainable farming practices to eco-friendly packaging materials. MWR analysis indicates that 73% of consumers consider environmental impact when making processed pork purchasing decisions, driving industry adoption of sustainable practices.

Technology integration revolutionizes processing operations through automation, artificial intelligence, and Internet of Things applications that optimize production efficiency, enhance quality control, and reduce labor costs. Smart sensors monitor temperature, humidity, and other critical parameters ensuring consistent product quality.

Merger and acquisition activity continues reshaping the competitive landscape as companies seek scale advantages, market access, and technological capabilities. Strategic acquisitions enable rapid market entry, brand portfolio expansion, and operational synergies that strengthen competitive positions.

Regulatory evolution includes updated food safety protocols, labeling requirements, and inspection procedures that ensure consumer protection while imposing compliance costs on manufacturers. Industry adaptation to these changes requires ongoing investment in facilities, training, and quality assurance systems.

Innovation partnerships between processors and technology companies accelerate development of new products, processing methods, and packaging solutions. These collaborations leverage external expertise while reducing development costs and time-to-market for innovative offerings.

Strategic focus on premium product development enables manufacturers to capture higher margins while addressing consumer demands for quality and innovation. Investment in clean-label formulations, artisanal processing methods, and unique flavor profiles creates competitive differentiation in mature market segments.

Digital transformation initiatives should encompass e-commerce capabilities, direct-to-consumer marketing, and data analytics that enhance customer relationships and operational efficiency. Online sales channels provide valuable consumer insights while enabling targeted marketing and product customization.

Sustainability integration throughout operations addresses growing consumer environmental concerns while potentially reducing costs through efficiency improvements. Renewable energy adoption, waste reduction programs, and sustainable packaging initiatives enhance brand reputation while supporting long-term profitability.

International expansion strategies should prioritize markets with growing middle-class populations and developing appreciation for American-style processed pork products. Strategic partnerships, cultural adaptation, and regulatory compliance enable successful market entry while diversifying revenue sources.

Market evolution toward premium and specialty products continues driving industry transformation, with traditional commodity-focused strategies giving way to brand-building and innovation initiatives. MarkWide Research projects that premium processed pork segments will experience sustained growth rates of 8-10% annually over the next five years.

Technology adoption accelerates across all industry segments, from automated processing lines to blockchain traceability systems that enhance food safety and consumer confidence. These investments improve operational efficiency while enabling new product development and quality assurance capabilities.

Consumer preferences continue evolving toward health-conscious, convenient, and sustainable options that align with changing lifestyles and values. Successful companies will balance these demands while maintaining the taste, quality, and affordability that define processed pork market appeal.

Competitive dynamics intensify as plant-based alternatives gain market acceptance and new entrants challenge established players with innovative products and business models. Market leaders must continuously innovate while leveraging scale advantages and brand recognition to maintain competitive positions.

The United States processed pork market represents a mature yet dynamic industry segment characterized by strong consumer demand, established distribution channels, and continuous innovation opportunities. While facing challenges from health concerns and alternative proteins, the market demonstrates resilience through premium product development, technological advancement, and strategic adaptation to changing consumer preferences.

Strategic success in this market requires balancing traditional strengths in taste, convenience, and value with emerging demands for clean-label ingredients, sustainability, and health-conscious formulations. Companies that successfully navigate these requirements while maintaining operational efficiency and brand recognition will capture the greatest opportunities for growth and profitability.

Future market development depends on continued innovation in product formulations, processing technologies, and distribution strategies that address evolving consumer needs while maintaining the fundamental appeal of processed pork products. The industry’s ability to adapt to changing market conditions while preserving core value propositions will determine long-term success in this competitive and essential food sector.

What is Processed Pork?

Processed pork refers to pork products that have been preserved or enhanced through methods such as curing, smoking, or cooking. Common examples include bacon, ham, and sausages, which are widely consumed in various culinary applications.

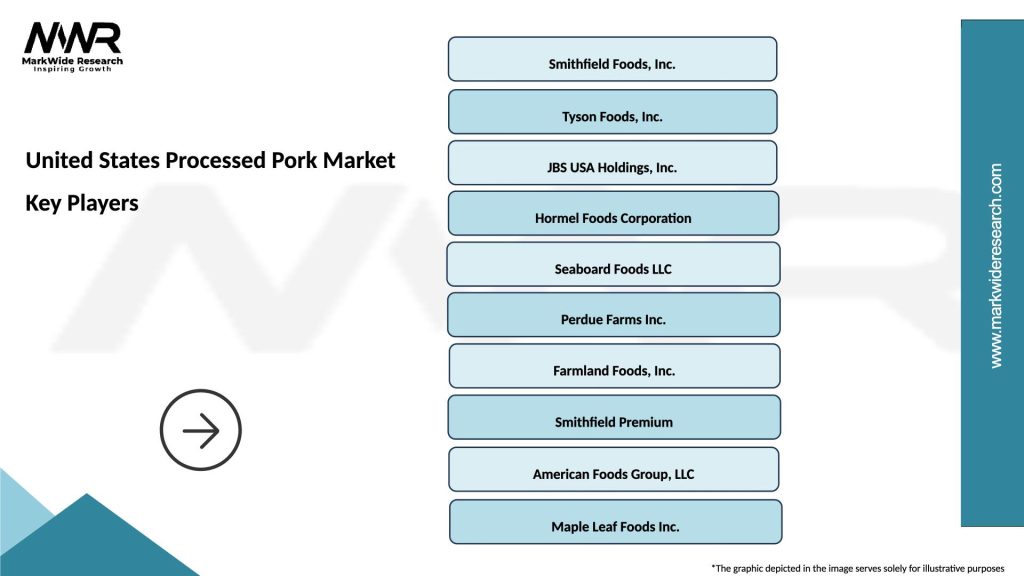

What are the key players in the United States Processed Pork Market?

Key players in the United States Processed Pork Market include Smithfield Foods, Tyson Foods, and Hormel Foods, which are known for their extensive product lines and market presence. These companies focus on innovation and quality to meet consumer demands, among others.

What are the growth factors driving the United States Processed Pork Market?

The growth of the United States Processed Pork Market is driven by increasing consumer demand for convenient and ready-to-eat meat products, as well as the rising popularity of pork in various cuisines. Additionally, health trends promoting protein-rich diets contribute to market expansion.

What challenges does the United States Processed Pork Market face?

The United States Processed Pork Market faces challenges such as fluctuating raw material prices and increasing competition from alternative protein sources. Additionally, concerns regarding health and sustainability may impact consumer preferences.

What opportunities exist in the United States Processed Pork Market?

Opportunities in the United States Processed Pork Market include the development of healthier product options and the expansion of online retail channels. Innovations in packaging and flavor profiles can also attract new consumer segments.

What trends are shaping the United States Processed Pork Market?

Trends shaping the United States Processed Pork Market include a growing interest in artisanal and specialty pork products, as well as an emphasis on transparency in sourcing and production. Additionally, the rise of plant-based alternatives is influencing product development strategies.

United States Processed Pork Market

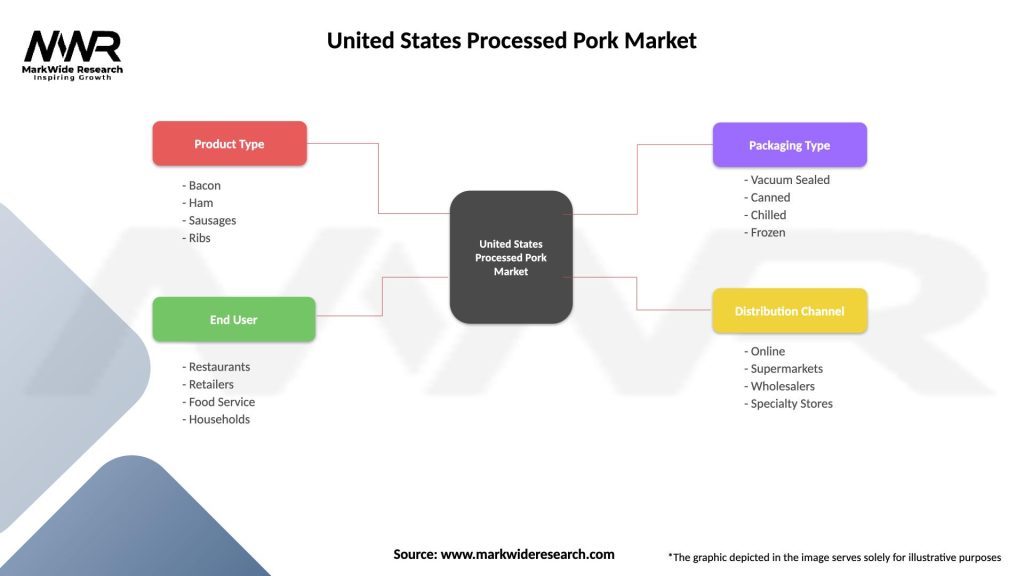

| Segmentation Details | Description |

|---|---|

| Product Type | Bacon, Ham, Sausages, Ribs |

| End User | Restaurants, Retailers, Food Service, Households |

| Packaging Type | Vacuum Sealed, Canned, Chilled, Frozen |

| Distribution Channel | Online, Supermarkets, Wholesalers, Specialty Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Processed Pork Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at