444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States probiotic market represents one of the most dynamic and rapidly expanding segments within the broader health and wellness industry. Probiotics, which are live microorganisms that provide health benefits when consumed in adequate amounts, have gained tremendous traction among American consumers seeking natural solutions for digestive health, immune support, and overall wellness. The market encompasses a diverse range of products including dietary supplements, functional foods, beverages, and specialized medical formulations.

Market growth has been particularly robust, with the sector experiencing a compound annual growth rate (CAGR) of 7.2% over recent years. This expansion is driven by increasing consumer awareness of gut health importance, rising healthcare costs prompting preventive care approaches, and growing scientific evidence supporting probiotic efficacy. Consumer demographics show particularly strong adoption among health-conscious millennials and Generation X populations, with 68% of probiotic users reporting regular consumption patterns.

Product innovation continues to drive market evolution, with manufacturers developing targeted formulations for specific health conditions, age groups, and lifestyle needs. The integration of probiotics into mainstream food products has significantly expanded market reach, making these beneficial microorganisms accessible to broader consumer segments beyond traditional supplement users.

The United States probiotic market refers to the comprehensive ecosystem of live microorganisms products designed to confer health benefits when consumed in adequate amounts, encompassing supplements, foods, beverages, and medical applications distributed throughout American retail and healthcare channels.

Probiotic products in the US market primarily consist of beneficial bacteria strains such as Lactobacillus and Bifidobacterium species, along with certain yeasts like Saccharomyces boulardii. These microorganisms are formulated into various delivery systems including capsules, tablets, powders, yogurts, kefir, kombucha, and specialized functional foods. Market definition extends beyond traditional supplements to include any product containing live, viable microorganisms intended to provide health benefits.

Regulatory framework in the United States classifies most probiotic products as dietary supplements under FDA oversight, though some products may fall under food or medical device categories depending on their intended use and claims. This classification system influences product development, marketing approaches, and consumer accessibility across different distribution channels.

Market dynamics in the United States probiotic sector reflect a mature yet rapidly evolving industry characterized by strong consumer demand, continuous innovation, and expanding scientific validation. The market has demonstrated remarkable resilience and growth potential, with annual growth rates consistently outpacing many other supplement categories.

Key market drivers include rising awareness of the gut-brain connection, increasing prevalence of digestive disorders, growing interest in preventive healthcare, and expanding research demonstrating probiotic benefits for immune function, mental health, and chronic disease management. Consumer behavior shows 72% of users prioritize products with clinically studied strains and transparent labeling practices.

Competitive landscape features a mix of established pharmaceutical companies, specialized probiotic manufacturers, and emerging biotechnology firms. Market leaders have invested heavily in research and development, clinical trials, and consumer education initiatives to differentiate their offerings in an increasingly crowded marketplace.

Future prospects remain highly favorable, with anticipated expansion into personalized nutrition, precision probiotics, and integration with digital health platforms. The market is expected to benefit from continued scientific advancement, regulatory clarity improvements, and growing mainstream acceptance of microbiome-based health solutions.

Consumer preferences in the US probiotic market reveal several critical trends shaping product development and marketing strategies:

Market segmentation analysis reveals distinct consumer clusters with varying needs, preferences, and purchasing behaviors. Health enthusiasts represent the largest segment, followed by individuals with specific digestive concerns and those seeking immune support solutions.

Primary growth drivers propelling the United States probiotic market forward encompass both scientific advancement and evolving consumer health consciousness. Microbiome research has fundamentally transformed understanding of gut health’s role in overall wellness, creating strong scientific foundation for probiotic benefits.

Healthcare cost concerns drive increasing consumer interest in preventive health measures, with probiotics positioned as cost-effective alternatives to traditional pharmaceutical interventions. Digestive health awareness has reached unprecedented levels, with 45% of American adults reporting regular digestive discomfort, creating substantial market demand for natural solutions.

Aging population dynamics contribute significantly to market expansion, as older adults seek products supporting healthy aging, immune function, and digestive comfort. Lifestyle factors including stress, poor dietary habits, and antibiotic usage have increased awareness of gut microbiome disruption and the need for probiotic supplementation.

Scientific validation continues strengthening through peer-reviewed research demonstrating probiotic efficacy for various health conditions. Media coverage and healthcare provider recommendations have elevated probiotic awareness among mainstream consumers, expanding the market beyond traditional health enthusiasts.

Product accessibility improvements through expanded retail distribution, online availability, and integration into familiar food products have removed traditional barriers to probiotic consumption, facilitating broader market adoption.

Regulatory challenges present ongoing constraints for the US probiotic market, particularly regarding health claims and product standardization. FDA oversight limitations on structure-function claims restrict manufacturers’ ability to communicate specific health benefits, potentially limiting consumer understanding and adoption.

Quality control issues across the industry have created consumer skepticism regarding product efficacy and reliability. Viability concerns related to probiotic survival during manufacturing, storage, and transit pose technical challenges that some manufacturers struggle to address effectively.

Price sensitivity among certain consumer segments limits market penetration, particularly for premium products featuring specialized strains or advanced delivery systems. Insurance coverage limitations for probiotic products position them as out-of-pocket expenses, potentially restricting access for price-conscious consumers.

Scientific complexity surrounding probiotic mechanisms and strain-specific benefits can overwhelm consumers, leading to confusion and suboptimal product selection. Conflicting research results for certain applications may create uncertainty among both consumers and healthcare providers.

Competition from pharmaceuticals and other health solutions may limit probiotic adoption for specific conditions where alternative treatments are well-established. Cultural barriers in certain demographic segments may resist adoption of fermented or bacteria-based products despite their health benefits.

Personalized nutrition represents the most significant emerging opportunity in the US probiotic market, with advances in microbiome testing enabling customized probiotic recommendations based on individual gut profiles. Precision probiotics tailored to specific genetic markers, health conditions, or lifestyle factors could revolutionize the industry.

Digital health integration offers substantial growth potential through smartphone apps, wearable devices, and telehealth platforms that monitor gut health metrics and recommend appropriate probiotic interventions. Subscription models and direct-to-consumer delivery systems could enhance customer retention and lifetime value.

Functional food expansion presents opportunities to integrate probiotics into mainstream food categories beyond traditional yogurt and fermented products. Beverage innovation including probiotic-enhanced waters, teas, and sports drinks could capture new consumer segments and usage occasions.

Medical applications development for specific therapeutic uses could open new market channels through healthcare provider recommendations and potential insurance coverage. Pediatric formulations addressing children’s unique digestive and immune needs represent an underserved market segment with significant growth potential.

International expansion opportunities exist for US-based companies to leverage domestic market expertise in global markets experiencing similar probiotic adoption trends. Research partnerships with academic institutions could accelerate product development and clinical validation efforts.

Supply chain dynamics in the US probiotic market involve complex relationships between strain suppliers, manufacturers, distributors, and retailers. Raw material sourcing requires specialized facilities capable of maintaining probiotic viability throughout production processes, creating barriers to entry for new manufacturers.

Manufacturing capabilities vary significantly across the industry, with leading companies investing in advanced freeze-drying technologies, controlled atmosphere packaging, and cold-chain distribution systems. Quality assurance protocols have become increasingly sophisticated, with 85% of major manufacturers now implementing third-party testing programs.

Distribution channels continue evolving, with traditional retail outlets facing competition from e-commerce platforms and direct-to-consumer models. Healthcare practitioner channels represent a growing segment, with 38% of probiotics now purchased based on professional recommendations.

Pricing dynamics reflect the premium positioning of many probiotic products, though competitive pressures have led to increased value offerings and private label alternatives. Innovation cycles remain rapid, with new product launches occurring frequently as companies seek differentiation in crowded market segments.

Consumer education efforts by manufacturers, retailers, and healthcare providers continue shaping market dynamics by improving understanding of probiotic benefits and appropriate usage patterns.

Market analysis for the United States probiotic sector employs comprehensive research methodologies combining primary and secondary data sources to provide accurate market insights. Primary research includes consumer surveys, industry expert interviews, and manufacturer consultations to capture current market dynamics and future trends.

Secondary research encompasses analysis of industry reports, scientific literature, regulatory filings, and company financial statements to establish market baselines and growth trajectories. Data validation processes ensure accuracy through cross-referencing multiple sources and expert review panels.

Consumer behavior analysis utilizes survey methodologies targeting diverse demographic groups to understand purchasing patterns, product preferences, and satisfaction levels. Market sizing calculations employ bottom-up and top-down approaches to establish comprehensive market scope and segmentation.

Competitive intelligence gathering includes product analysis, pricing studies, and distribution channel mapping to understand competitive positioning and market share dynamics. Trend identification combines quantitative data analysis with qualitative insights from industry stakeholders.

Forecasting models incorporate historical data, current market conditions, and identified growth drivers to project future market development. Quality assurance protocols ensure research reliability through peer review and methodology validation processes.

Geographic distribution of the US probiotic market reveals significant regional variations in consumer adoption, product preferences, and growth rates. West Coast markets including California, Oregon, and Washington demonstrate the highest per-capita consumption rates, with 42% market share attributed to health-conscious consumer demographics and early adoption of wellness trends.

Northeast regions including New York, Massachusetts, and Connecticut show strong growth in premium probiotic segments, driven by higher disposable incomes and healthcare awareness. Urban markets consistently outperform rural areas in probiotic adoption, with metropolitan areas accounting for 78% of total consumption.

Southern states represent emerging growth opportunities, with increasing health consciousness and expanding retail distribution driving market development. Midwest regions show steady growth patterns, particularly in functional food categories that align with traditional dietary preferences.

Distribution channel preferences vary regionally, with West Coast consumers favoring natural product retailers and online purchases, while Midwest and Southern consumers rely more heavily on traditional grocery and pharmacy channels. Price sensitivity also varies geographically, with coastal markets accepting premium pricing more readily than inland regions.

Healthcare provider influence on probiotic recommendations shows regional variation, with integrated healthcare systems in certain markets more actively promoting probiotic use than traditional fee-for-service environments.

Market leadership in the US probiotic sector is distributed among several key categories of companies, each bringing distinct competitive advantages and market positioning strategies.

Competitive strategies vary significantly across market participants, with some companies emphasizing clinical research and healthcare provider relationships, while others focus on consumer marketing and retail distribution excellence. Innovation investments remain high across the industry, with companies developing new strains, delivery systems, and targeted formulations.

Market consolidation trends include acquisitions of smaller specialized companies by larger consumer goods manufacturers seeking to expand their probiotic portfolios and capabilities.

Product type segmentation reveals distinct market categories with varying growth rates and consumer preferences:

By Product Type:

By Consumer Demographics:

By Distribution Channel:

Dietary supplement category maintains market leadership through consistent innovation and strong healthcare provider relationships. Capsule formulations dominate this segment due to convenience, standardized dosing, and extended shelf life. Multi-strain products show particularly strong growth, with consumers seeking comprehensive gut health support.

Functional food category benefits from mainstream consumer acceptance and integration into daily dietary routines. Yogurt products remain the foundation of this segment, though innovation in cheese, ice cream, and baked goods creates new opportunities. Organic and natural positioning drives premium pricing and brand differentiation.

Beverage category demonstrates the highest growth rates, driven by kombucha popularity and probiotic water innovations. Ready-to-drink formats appeal to younger demographics seeking convenient health solutions. Flavor innovation and functional ingredient combinations drive category expansion.

Medical food category represents the smallest but fastest-growing segment, with specialized formulations for specific health conditions. Clinical validation requirements create higher barriers to entry but enable premium pricing and healthcare provider recommendations.

Private label products gain market share across all categories, offering value-conscious consumers affordable alternatives to branded products while maintaining quality standards.

Manufacturers benefit from the US probiotic market through multiple value creation opportunities including premium pricing potential, brand loyalty development, and expansion into adjacent health categories. Research and development investments yield competitive advantages through proprietary strains and delivery technologies.

Retailers gain from probiotic products through higher margin opportunities compared to traditional supplements and foods. Category management benefits include increased customer traffic, basket size expansion, and positioning as health-focused destinations.

Healthcare providers benefit from probiotic recommendations through improved patient outcomes, reduced pharmaceutical dependency, and enhanced preventive care offerings. Patient satisfaction increases when natural solutions effectively address health concerns.

Consumers receive significant value through improved digestive health, immune support, and potential reduction in healthcare costs. Quality of life improvements from probiotic use often justify premium pricing and encourage continued usage.

Investors benefit from market growth potential, recurring revenue models, and expansion opportunities in personalized nutrition and digital health integration. Market resilience during economic downturns provides portfolio stability.

Research institutions gain funding opportunities and commercial partnerships for microbiome research, advancing scientific understanding while creating practical applications for consumer benefit.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization trend dominates current market development, with companies investing in microbiome testing and customized probiotic formulations. Direct-to-consumer models enable personalized recommendations based on individual health profiles and lifestyle factors.

Strain specificity becomes increasingly important as consumers seek targeted solutions for specific health concerns. Clinical research supporting individual strains drives product differentiation and premium positioning strategies.

Functional food integration expands beyond traditional dairy products into snacks, beverages, and everyday food items. Mainstream adoption accelerates as probiotics become standard ingredients rather than specialized supplements.

Sustainability focus influences packaging choices, ingredient sourcing, and manufacturing processes. Environmental consciousness among consumers drives demand for eco-friendly probiotic products and corporate responsibility initiatives.

Digital health connectivity enables real-time monitoring of gut health metrics and probiotic effectiveness. Wearable technology integration provides data-driven insights for optimizing probiotic regimens.

Immune health emphasis has intensified following recent global health events, positioning probiotics as essential immune support supplements. Preventive healthcare focus drives increased consumer investment in proactive health measures.

Recent industry developments demonstrate the dynamic nature of the US probiotic market and ongoing innovation efforts by leading companies. Merger and acquisition activity has increased as larger consumer goods companies seek to expand their probiotic capabilities through strategic acquisitions.

Regulatory developments include ongoing discussions regarding probiotic health claims and quality standards, with industry associations working to establish clearer guidelines for manufacturers and consumers. FDA guidance updates continue shaping product development and marketing approaches.

Technology advancement in probiotic manufacturing includes improved encapsulation techniques, enhanced stability formulations, and novel delivery systems. Microencapsulation technology enables better probiotic survival through digestive processes and extended shelf life.

Research breakthroughs in microbiome science continue expanding understanding of probiotic mechanisms and potential applications. Clinical trials for specific health conditions provide evidence supporting targeted probiotic interventions.

Partnership developments between probiotic companies and healthcare systems create new distribution channels and professional endorsement opportunities. Academic collaborations accelerate research and development while providing credibility for commercial applications.

International expansion by US companies and foreign market entry by international players increase competitive dynamics and consumer choice options.

Strategic recommendations for market participants focus on differentiation through clinical research, quality assurance, and consumer education initiatives. MarkWide Research analysis suggests companies should prioritize strain-specific research and transparent labeling to build consumer trust and market share.

Investment priorities should emphasize manufacturing quality improvements, cold-chain distribution capabilities, and digital marketing platforms to reach younger consumer demographics. Technology integration opportunities include microbiome testing services and personalized nutrition platforms.

Market positioning strategies should focus on specific health benefits rather than general wellness claims, enabling more targeted marketing and higher conversion rates. Healthcare provider relationship development remains crucial for credibility and professional recommendations.

Product development should prioritize convenience, taste, and integration into daily routines while maintaining probiotic viability and efficacy. Innovation focus areas include shelf-stable formulations, functional food integration, and condition-specific targeting.

Distribution strategy optimization should balance traditional retail relationships with direct-to-consumer opportunities and emerging channel partnerships. E-commerce capabilities require continued investment to meet evolving consumer shopping preferences.

Regulatory compliance preparation for potential industry changes ensures continued market access and reduces operational risks associated with regulatory uncertainty.

Long-term prospects for the US probiotic market remain exceptionally positive, with continued growth expected across all major product categories and consumer segments. Market maturation will likely lead to increased consolidation and specialization among manufacturers.

Technology integration will transform the industry through personalized nutrition platforms, real-time health monitoring, and precision probiotic formulations. Artificial intelligence applications may enable more sophisticated matching of probiotic strains to individual consumer needs.

Regulatory evolution is expected to provide greater clarity on health claims while potentially establishing higher quality standards for the industry. Professional acceptance by healthcare providers will continue expanding as clinical evidence accumulates.

Market expansion into new demographic segments, particularly pediatric and geriatric populations, offers significant growth opportunities. Therapeutic applications may gain regulatory approval for specific medical conditions, creating new market categories.

Global market integration will increase as US companies expand internationally and foreign competitors enter domestic markets. Innovation cycles are expected to accelerate with increased research funding and commercial investment.

Consumer sophistication will continue growing, demanding higher quality products, better scientific validation, and more personalized solutions. MWR projections indicate sustained growth rates above 6% annually for the foreseeable future, driven by these fundamental market dynamics.

The United States probiotic market represents a compelling intersection of scientific advancement, consumer health consciousness, and commercial opportunity. Market fundamentals remain strong, supported by growing awareness of gut health importance, expanding research validation, and continuous product innovation.

Industry evolution toward personalized nutrition and precision probiotics positions the market for sustained long-term growth beyond traditional supplement categories. Technology integration and digital health connectivity will likely transform how consumers discover, purchase, and monitor probiotic effectiveness.

Competitive dynamics favor companies that invest in clinical research, quality assurance, and consumer education while building strong healthcare provider relationships. Market opportunities in functional foods, medical applications, and international expansion provide multiple growth vectors for industry participants.

Consumer trends toward preventive healthcare, natural solutions, and personalized wellness create favorable conditions for continued probiotic market expansion. Regulatory clarity and quality standardization improvements will likely enhance consumer confidence and market stability.

Future success in the US probiotic market will depend on companies’ ability to balance scientific rigor with consumer accessibility, premium positioning with mainstream adoption, and innovation with regulatory compliance. The market’s trajectory suggests continued robust growth and evolution toward more sophisticated, personalized probiotic solutions that address specific health needs and consumer preferences.

What is Probiotic?

Probiotics are live microorganisms that provide health benefits when consumed in adequate amounts. They are often referred to as ‘good’ or ‘friendly’ bacteria and are commonly found in fermented foods, dietary supplements, and certain dairy products.

What are the key players in the United States Probiotic Market?

Key players in the United States Probiotic Market include companies like Danone, Nestlé, and ProbioFerm, which offer a range of probiotic products such as yogurts, supplements, and functional foods, among others.

What are the growth factors driving the United States Probiotic Market?

The growth of the United States Probiotic Market is driven by increasing consumer awareness of gut health, rising demand for functional foods, and the growing popularity of dietary supplements that promote digestive health.

What challenges does the United States Probiotic Market face?

The United States Probiotic Market faces challenges such as regulatory hurdles, varying consumer perceptions about the efficacy of probiotics, and competition from alternative health products that may affect market growth.

What opportunities exist in the United States Probiotic Market?

Opportunities in the United States Probiotic Market include the development of innovative probiotic formulations, expansion into new distribution channels, and increasing interest in personalized nutrition that caters to individual health needs.

What trends are shaping the United States Probiotic Market?

Trends in the United States Probiotic Market include the rise of plant-based probiotics, the integration of probiotics into non-dairy products, and a growing focus on mental health benefits associated with gut microbiome health.

United States Probiotic Market

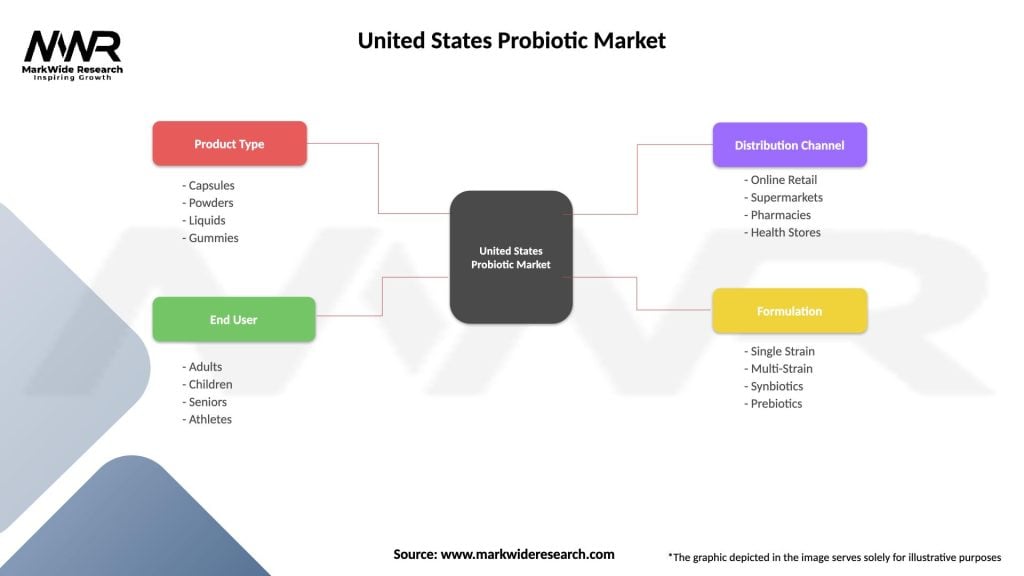

| Segmentation Details | Description |

|---|---|

| Product Type | Capsules, Powders, Liquids, Gummies |

| End User | Adults, Children, Seniors, Athletes |

| Distribution Channel | Online Retail, Supermarkets, Pharmacies, Health Stores |

| Formulation | Single Strain, Multi-Strain, Synbiotics, Prebiotics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Probiotic Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at