444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United States private banking market caters to the financial needs of high net worth individuals (HNWIs), providing personalized and exclusive banking services. Private banking institutions offer a wide range of services, including wealth management, investment advisory, estate planning, and specialized lending solutions. This comprehensive report provides valuable insights into the market dynamics, key trends, competitive landscape, and future outlook of the United States private banking market.

Meaning

Private banking refers to personalized banking and financial services offered to individuals with high levels of wealth and assets. Private banks provide customized solutions tailored to the unique needs of HNWIs, focusing on wealth preservation, growth, and comprehensive financial management.

Executive Summary

The United States private banking market serves as a trusted advisor and financial partner for HNWIs, offering exclusive services to manage their wealth and achieve their financial goals. This report provides an overview of the market, highlighting key insights, trends, and opportunities for industry participants to meet the evolving needs of their affluent clientele.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United States private banking market operates in a dynamic landscape influenced by factors such as economic conditions, regulatory changes, technological advancements, and evolving client preferences. Private banks need to adapt to these dynamics by leveraging innovative strategies, embracing digital transformation, and focusing on client-centric services.

Regional Analysis

The private banking market in the United States exhibits regional variations based on factors such as population demographics, concentration of HNWIs, economic hubs, and industry presence. Major financial centers, such as New York City, Los Angeles, and San Francisco, attract a significant share of private banking activities.

Competitive Landscape

Leading Companies in the United States Private Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

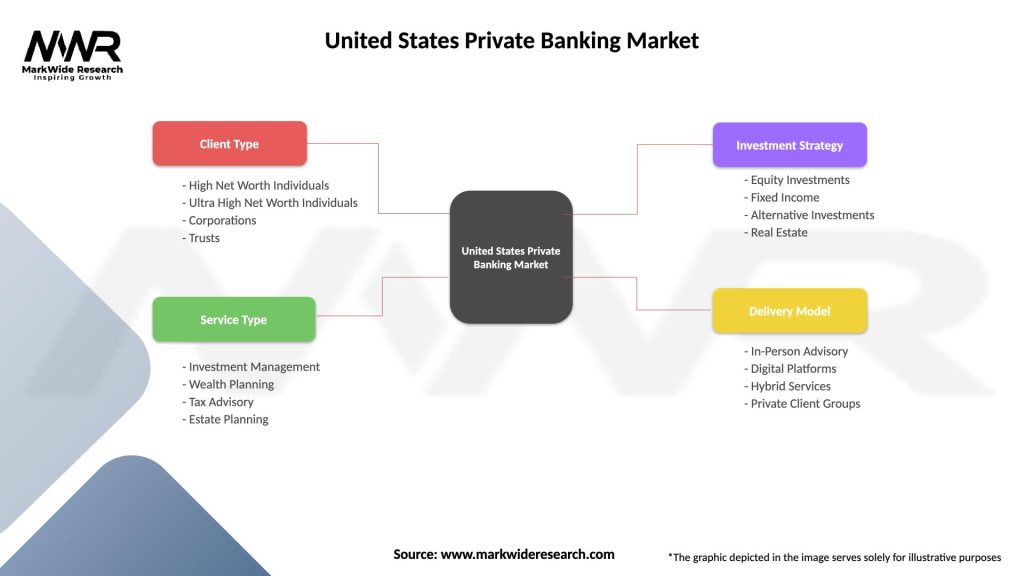

Segmentation

The private banking market can be segmented based on various factors, including client wealth levels, services offered, investment focus, and geographical coverage. Wealth level segments include ultra-high net worth individuals (UHNWIs) and high net worth individuals (HNWIs). Services offered encompass wealth management, investment advisory, estate planning, family office services, and specialized lending. Investment focus may include traditional asset classes, alternative investments, or a combination of both.

Category-wise Insights

The private banking market comprises various categories, each with its unique characteristics and client requirements. Category-wise insights may include specialized services for entrepreneurs and business owners, customized investment solutions for HNWIs in specific industries, or tailored offerings for family offices and multi-generational wealth management.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the private banking market, affecting client sentiment, investment strategies, and operational dynamics. The pandemic highlighted the need for remote access to financial services, accelerated digital transformation initiatives, and increased the focus on risk management and portfolio diversification.

Key Industry Developments

Analyst Suggestions

Future Outlook

The United States private banking market is expected to witness steady growth, driven by the increasing wealth of HNWIs, demand for specialized financial services, and the integration of technology-driven solutions. Private banking institutions that embrace digital transformation, prioritize client-centric services, and adapt to evolving client needs will be well-positioned for future success.

Conclusion

The United States private banking market serves as a trusted financial partner for HNWIs, offering personalized services, comprehensive wealth management, and specialized expertise. Private banking institutions play a vital role in preserving and growing clients’ wealth, providing tailored solutions, and addressing the complex financial needs of affluent individuals. The market presents opportunities for revenue growth, client loyalty, and brand differentiation. By embracing digital transformation, focusing on sustainability, and nurturing client relationships, private banking institutions can navigate the evolving landscape and meet the evolving expectations of their discerning clientele.

What is Private Banking?

Private Banking refers to personalized financial services and investment management offered to high-net-worth individuals. It typically includes wealth management, estate planning, and tax advisory services tailored to the unique needs of affluent clients.

What are the key players in the United States Private Banking Market?

Key players in the United States Private Banking Market include JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup, among others. These institutions provide a range of services from investment management to personalized financial planning.

What are the growth factors driving the United States Private Banking Market?

The growth of the United States Private Banking Market is driven by increasing wealth among high-net-worth individuals, a rising demand for personalized financial services, and the expansion of investment opportunities in diverse asset classes.

What challenges does the United States Private Banking Market face?

The United States Private Banking Market faces challenges such as regulatory compliance, competition from fintech companies, and the need to adapt to changing client expectations regarding digital services and transparency.

What opportunities exist in the United States Private Banking Market?

Opportunities in the United States Private Banking Market include the integration of technology for enhanced client experiences, the growing interest in sustainable investing, and the potential for expanding services to younger affluent clients.

What trends are shaping the United States Private Banking Market?

Trends shaping the United States Private Banking Market include the increasing use of digital platforms for client engagement, a focus on holistic wealth management, and the rise of impact investing as clients seek to align their investments with personal values.

United States Private Banking Market

| Segmentation Details | Description |

|---|---|

| Client Type | High Net Worth Individuals, Ultra High Net Worth Individuals, Corporations, Trusts |

| Service Type | Investment Management, Wealth Planning, Tax Advisory, Estate Planning |

| Investment Strategy | Equity Investments, Fixed Income, Alternative Investments, Real Estate |

| Delivery Model | In-Person Advisory, Digital Platforms, Hybrid Services, Private Client Groups |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Private Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at