444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States private 5G network market represents a transformative segment of the telecommunications infrastructure landscape, experiencing unprecedented growth as enterprises seek dedicated, high-performance connectivity solutions. Private 5G networks are revolutionizing how businesses approach wireless communication, offering enhanced security, reduced latency, and improved control over network operations compared to traditional public networks.

Market dynamics indicate robust expansion driven by increasing demand for industrial automation, smart manufacturing, and mission-critical applications requiring ultra-reliable low-latency communication. The market is witnessing significant adoption across manufacturing, healthcare, logistics, and energy sectors, with organizations recognizing the strategic value of dedicated wireless infrastructure. Growth projections suggest the market will expand at a compound annual growth rate of 47.5% through the forecast period, reflecting strong enterprise confidence in private 5G technology.

Enterprise adoption is accelerating as organizations prioritize digital transformation initiatives and seek competitive advantages through advanced connectivity solutions. The convergence of 5G technology with edge computing, artificial intelligence, and Internet of Things applications is creating new opportunities for businesses to optimize operations and enhance productivity. Manufacturing sector adoption currently represents approximately 35% of total private 5G deployments, highlighting the technology’s particular relevance for industrial applications.

The United States private 5G network market refers to the ecosystem of dedicated fifth-generation wireless networks deployed and operated by individual organizations for their specific operational requirements, offering enhanced control, security, and performance compared to shared public networks.

Private 5G networks utilize licensed, unlicensed, or shared spectrum to create isolated wireless environments tailored to specific enterprise needs. These networks provide organizations with complete control over network configuration, security protocols, and performance parameters while ensuring predictable connectivity for critical applications. Key characteristics include ultra-low latency, high bandwidth capacity, massive device connectivity, and network slicing capabilities that enable customized service levels for different applications.

Technology implementation involves deploying dedicated radio access networks, core network infrastructure, and management systems within enterprise premises or specific geographic areas. Organizations can leverage various deployment models, including on-premises installations, hybrid cloud configurations, and managed service arrangements with telecommunications providers and system integrators.

Strategic market positioning reveals the United States private 5G network market as a critical enabler of next-generation enterprise connectivity, with substantial growth momentum driven by digital transformation imperatives and Industry 4.0 initiatives. The market encompasses diverse deployment scenarios, from small-scale campus networks to large industrial complexes requiring comprehensive wireless coverage.

Technology adoption patterns demonstrate strong preference for private 5G solutions among enterprises seeking enhanced network control, improved security posture, and guaranteed performance levels for mission-critical applications. Manufacturing organizations are leading adoption efforts, with 42% of private 5G implementations focused on industrial automation, predictive maintenance, and smart factory initiatives.

Market segmentation reveals diverse opportunities across spectrum types, deployment models, and industry verticals. Organizations are increasingly recognizing private 5G networks as strategic infrastructure investments rather than tactical connectivity solutions, driving sustained demand for comprehensive network deployments and professional services.

Competitive landscape features established telecommunications equipment vendors, cloud service providers, and specialized system integrators offering end-to-end private 5G solutions. The market is characterized by strategic partnerships between technology providers and industry-specific solution developers, creating comprehensive ecosystems that address unique enterprise requirements.

Market intelligence reveals several critical insights shaping the United States private 5G network landscape:

According to MarkWide Research analysis, these insights reflect fundamental shifts in enterprise networking strategies, with organizations prioritizing dedicated infrastructure investments to support long-term digital transformation objectives.

Primary growth drivers propelling the United States private 5G network market include accelerating digital transformation initiatives across enterprise sectors and increasing demand for ultra-reliable, low-latency connectivity solutions. Organizations are recognizing private 5G networks as essential infrastructure for supporting advanced applications including autonomous systems, real-time analytics, and mission-critical communications.

Industrial automation requirements represent a significant market driver, with manufacturing organizations seeking dedicated wireless infrastructure to support smart factory initiatives, predictive maintenance systems, and autonomous guided vehicles. The need for deterministic network performance and guaranteed service levels is driving enterprises away from shared public networks toward private infrastructure investments.

Regulatory support through spectrum allocation policies, particularly the Citizens Broadband Radio Service (CBRS) framework, has created favorable conditions for private 5G deployment. Spectrum availability has increased by 28% over the past two years, providing organizations with greater flexibility in network design and implementation strategies.

Security considerations continue driving market growth as organizations prioritize data protection and network isolation for sensitive operations. Private 5G networks offer enhanced security through dedicated infrastructure, customizable encryption protocols, and complete control over data routing and storage policies.

Implementation complexity represents a primary market restraint, with organizations facing significant technical challenges in designing, deploying, and managing private 5G networks. The requirement for specialized expertise in radio frequency engineering, network optimization, and system integration creates barriers for many enterprises considering private 5G adoption.

Capital investment requirements pose substantial challenges for smaller organizations, as private 5G network deployment involves significant upfront costs for equipment, infrastructure, and professional services. The total cost of ownership considerations, including ongoing maintenance and upgrade expenses, can deter organizations from pursuing private network strategies.

Spectrum management complexity creates operational challenges, particularly for organizations utilizing shared spectrum resources that require coordination with other users and compliance with regulatory requirements. The technical expertise required for spectrum planning and interference mitigation represents an ongoing operational burden.

Technology maturity concerns persist among some enterprises, particularly regarding the stability and reliability of private 5G solutions compared to established networking technologies. Organizations may delay adoption pending further technology validation and the availability of proven use cases within their specific industry sectors.

Emerging application opportunities in augmented reality, virtual reality, and mixed reality applications present significant growth potential for private 5G networks. These immersive technologies require ultra-low latency and high bandwidth capabilities that private networks can uniquely provide, creating new market segments for specialized deployment scenarios.

Edge computing convergence offers substantial opportunities for integrated solutions that combine private 5G connectivity with distributed computing capabilities. Organizations seeking to process data closer to operational endpoints are driving demand for comprehensive edge infrastructure that includes dedicated wireless networks.

Vertical market expansion presents opportunities beyond traditional manufacturing applications, with healthcare, education, transportation, and public safety sectors showing increasing interest in private 5G solutions. Healthcare adoption is projected to grow at 52% annually, driven by telemedicine, remote patient monitoring, and surgical robotics applications.

Managed service opportunities are expanding as organizations seek to outsource private 5G network operations while retaining the benefits of dedicated infrastructure. Service providers are developing comprehensive managed offerings that reduce operational complexity while maintaining network control and security benefits.

Technology evolution continues reshaping market dynamics, with ongoing improvements in 5G standards, equipment capabilities, and software-defined networking features enhancing private network value propositions. The integration of artificial intelligence and machine learning capabilities into network management systems is improving operational efficiency and reducing complexity.

Competitive pressures are intensifying as traditional telecommunications equipment vendors compete with cloud service providers and specialized technology companies for private 5G market share. This competition is driving innovation in deployment models, pricing strategies, and service offerings while accelerating technology development cycles.

Ecosystem development is creating new partnership opportunities between technology vendors, system integrators, and industry-specific solution providers. These collaborative relationships are essential for delivering comprehensive private 5G solutions that address unique enterprise requirements across different vertical markets.

Regulatory evolution continues influencing market dynamics through spectrum policy changes, security requirements, and industry-specific compliance standards. Organizations must navigate evolving regulatory landscapes while planning private 5G investments and deployment strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United States private 5G network market. Primary research activities include extensive interviews with industry executives, technology vendors, system integrators, and end-user organizations across diverse vertical markets.

Data collection processes incorporate both quantitative and qualitative research approaches, including structured surveys, in-depth interviews, and focus group discussions with key market participants. Secondary research activities encompass analysis of industry reports, regulatory filings, patent databases, and technology vendor announcements to validate primary research findings.

Market modeling techniques utilize advanced statistical methods and forecasting algorithms to project market trends, growth patterns, and competitive dynamics. The research framework incorporates multiple scenario analyses to account for various market development possibilities and external factors that may influence growth trajectories.

Validation procedures ensure research accuracy through triangulation of data sources, expert review processes, and continuous monitoring of market developments. The methodology emphasizes real-world market conditions and practical implementation considerations that influence enterprise decision-making processes.

Geographic distribution of private 5G network deployments across the United States reveals distinct regional patterns influenced by industrial concentration, regulatory environments, and technology infrastructure availability. Manufacturing-intensive regions including the Midwest and Southeast demonstrate higher adoption rates, accounting for approximately 38% of total deployments.

West Coast markets lead in technology innovation and early adoption, with California organizations pioneering advanced private 5G applications in entertainment, healthcare, and logistics sectors. The region benefits from proximity to technology vendors, research institutions, and venture capital funding that accelerates deployment initiatives.

Northeast corridor shows strong adoption in financial services, healthcare, and education sectors, with organizations leveraging private 5G networks for mission-critical applications requiring enhanced security and reliability. The region’s dense urban environment creates unique deployment challenges and opportunities for innovative network architectures.

Southern states demonstrate growing momentum in energy, petrochemical, and aerospace industries, with large industrial facilities implementing comprehensive private 5G networks to support automation and safety initiatives. Energy sector adoption in this region represents 23% of total private 5G investments.

Market leadership is distributed among established telecommunications equipment vendors, cloud service providers, and specialized private network solution developers. The competitive environment is characterized by rapid innovation, strategic partnerships, and comprehensive solution portfolios addressing diverse enterprise requirements.

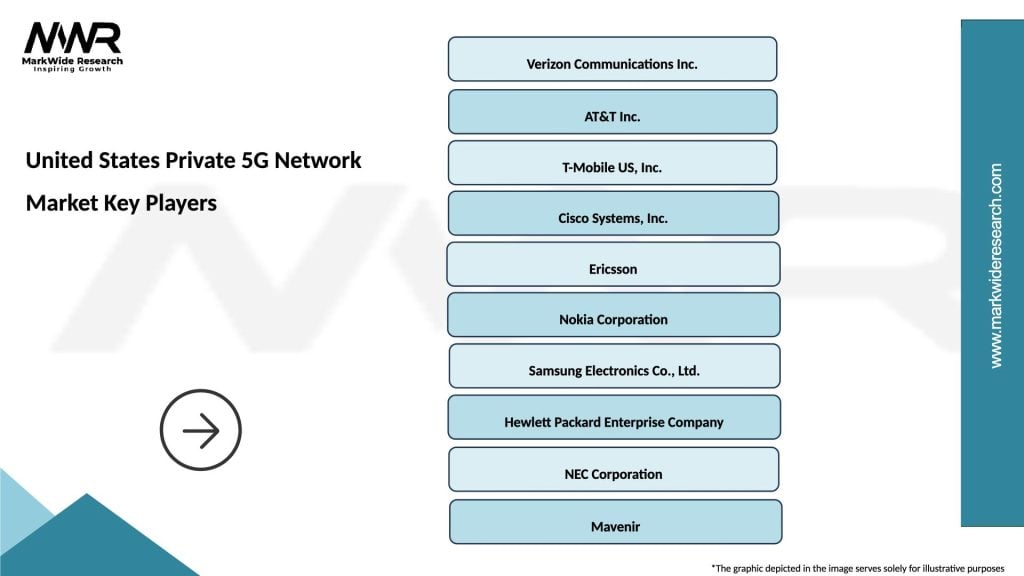

Key market participants include:

Competitive strategies focus on vertical market specialization, comprehensive service offerings, and strategic partnerships with system integrators and industry solution providers. Companies are investing heavily in research and development to enhance network performance, reduce deployment complexity, and expand application capabilities.

Market segmentation analysis reveals diverse opportunities across multiple dimensions including spectrum type, deployment model, industry vertical, and organization size. Each segment presents unique requirements, growth patterns, and competitive dynamics that influence market development strategies.

By Spectrum Type:

By Deployment Model:

By Industry Vertical:

Manufacturing category dominates private 5G adoption with comprehensive smart factory implementations requiring ultra-reliable connectivity for automated production systems, quality control processes, and predictive maintenance applications. Organizations in this sector prioritize network determinism and real-time communication capabilities to support mission-critical operations.

Healthcare segment demonstrates rapid growth driven by telemedicine expansion, remote patient monitoring, and advanced medical device connectivity requirements. Private 5G networks enable healthcare organizations to maintain strict data privacy compliance while supporting bandwidth-intensive applications including medical imaging and surgical robotics.

Logistics and warehousing category shows strong adoption momentum as organizations implement automated guided vehicles, robotic picking systems, and real-time inventory tracking solutions. The need for seamless connectivity across large warehouse facilities drives demand for comprehensive private 5G coverage and capacity.

Energy sector applications focus on smart grid infrastructure, remote asset monitoring, and safety-critical communications in challenging industrial environments. Private 5G networks provide the reliability and security required for energy operations while supporting digital transformation initiatives across generation, transmission, and distribution systems.

Enterprise organizations realize significant operational benefits through private 5G network deployment, including enhanced productivity, improved safety, and competitive advantages through advanced connectivity capabilities. The technology enables new business models and revenue opportunities while reducing operational costs through automation and optimization.

Technology vendors benefit from expanding market opportunities and recurring revenue streams through equipment sales, software licensing, and professional services. The private 5G market creates demand for specialized solutions and expertise that command premium pricing compared to traditional networking products.

System integrators gain access to high-value project opportunities requiring specialized expertise in network design, deployment, and optimization. The complexity of private 5G implementations creates sustainable competitive advantages for organizations with proven capabilities and industry experience.

Service providers develop new revenue streams through managed private 5G services while leveraging existing infrastructure investments and operational expertise. The market enables telecommunications companies to expand beyond traditional connectivity services into comprehensive digital transformation partnerships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Network slicing adoption is emerging as a critical trend enabling organizations to create multiple virtual networks within a single private 5G infrastructure. This capability allows enterprises to optimize network resources for different applications while maintaining isolation and security requirements across diverse use cases.

Edge computing integration represents a fundamental trend reshaping private 5G deployments, with organizations seeking to process data closer to operational endpoints for reduced latency and improved performance. MWR data indicates that 67% of new private 5G deployments incorporate edge computing capabilities from initial implementation.

Artificial intelligence integration is transforming network management and optimization, with AI-powered systems providing automated network configuration, predictive maintenance, and performance optimization. These capabilities reduce operational complexity while improving network reliability and efficiency.

Sustainability focus is driving demand for energy-efficient private 5G solutions that support corporate environmental objectives while reducing operational costs. Organizations are prioritizing green technology solutions that minimize power consumption and environmental impact.

Standards evolution continues advancing private 5G capabilities through ongoing 3GPP releases and industry collaboration initiatives. Recent developments include enhanced network slicing features, improved security protocols, and expanded support for industrial automation applications requiring ultra-reliable low-latency communication.

Spectrum policy developments are creating new opportunities for private 5G deployment through expanded CBRS availability and additional shared spectrum allocations. Regulatory agencies are working to balance spectrum efficiency with enterprise access requirements while maintaining interference protection for incumbent users.

Vendor partnerships are accelerating solution development through strategic alliances between technology providers, system integrators, and industry specialists. These collaborations are creating comprehensive ecosystems that address specific vertical market requirements while reducing deployment complexity and time-to-market.

Technology convergence initiatives are integrating private 5G with complementary technologies including Wi-Fi 6, edge computing platforms, and industrial IoT solutions. These integrated approaches provide enterprises with comprehensive connectivity and computing platforms that support diverse application requirements.

Strategic planning recommendations emphasize the importance of comprehensive needs assessment and phased deployment approaches for organizations considering private 5G investments. Enterprises should evaluate current and future connectivity requirements while considering integration with existing infrastructure and operational processes.

Vendor selection criteria should prioritize proven experience, comprehensive solution portfolios, and long-term support capabilities rather than focusing solely on initial costs. Organizations benefit from partnerships with vendors offering end-to-end solutions including equipment, software, professional services, and ongoing support.

Implementation strategies should incorporate pilot projects and proof-of-concept deployments to validate technology performance and business benefits before committing to large-scale implementations. This approach reduces risk while building internal expertise and stakeholder confidence.

Operational considerations require careful attention to network management, security protocols, and performance monitoring capabilities. Organizations should invest in training and expertise development to ensure successful long-term operation of private 5G infrastructure.

Market trajectory indicates continued strong growth for the United States private 5G network market, with expanding adoption across diverse industry sectors and evolving deployment models. Technology maturation will reduce implementation complexity while improving performance capabilities and cost-effectiveness.

Application evolution will drive demand for more sophisticated private 5G solutions supporting advanced use cases including autonomous systems, immersive technologies, and real-time artificial intelligence applications. These emerging applications will require enhanced network capabilities and specialized optimization features.

Ecosystem development will continue expanding through strategic partnerships, technology integration, and vertical market specialization. The market will benefit from improved standardization, reduced costs, and enhanced interoperability between different vendor solutions.

Long-term projections suggest the private 5G market will achieve mainstream adoption across enterprise sectors, with penetration rates expected to reach 45% among large enterprises by the end of the forecast period. This growth will be supported by continued technology advancement, favorable regulatory policies, and proven business value demonstrations.

The United States private 5G network market represents a transformative opportunity for enterprises seeking advanced connectivity solutions that support digital transformation initiatives and competitive differentiation. The market demonstrates strong growth momentum driven by increasing demand for dedicated, high-performance wireless infrastructure across diverse industry sectors.

Technology advancement continues improving private 5G capabilities while reducing implementation complexity and operational costs. The convergence of 5G technology with edge computing, artificial intelligence, and industrial IoT creates comprehensive platforms that enable new business models and operational efficiencies.

Market maturation will benefit from continued standards development, expanded vendor ecosystems, and proven use case demonstrations that validate business value propositions. Organizations that strategically invest in private 5G infrastructure will gain significant competitive advantages through enhanced operational capabilities and innovation potential.

Future success in the private 5G market will depend on comprehensive planning, strategic vendor partnerships, and phased implementation approaches that maximize business value while minimizing risk. The technology represents a fundamental shift in enterprise networking that will reshape how organizations approach connectivity, automation, and digital transformation initiatives.

What is Private 5G Network?

A Private 5G Network is a dedicated mobile network that uses 5G technology to provide connectivity for specific organizations or enterprises. These networks are designed to enhance security, control, and performance for applications such as IoT, automation, and real-time data processing.

What are the key players in the United States Private 5G Network Market?

Key players in the United States Private 5G Network Market include companies like Verizon, AT&T, and Nokia, which are actively developing and deploying private 5G solutions for various industries. Other notable companies include Ericsson and Cisco, among others.

What are the growth factors driving the United States Private 5G Network Market?

The growth of the United States Private 5G Network Market is driven by the increasing demand for high-speed connectivity, the rise of IoT applications, and the need for enhanced security in data transmission. Additionally, industries such as manufacturing and healthcare are adopting private 5G networks to improve operational efficiency.

What challenges does the United States Private 5G Network Market face?

Challenges in the United States Private 5G Network Market include high deployment costs, regulatory hurdles, and the complexity of integrating new technologies with existing infrastructure. Additionally, concerns about cybersecurity and data privacy can hinder adoption.

What opportunities exist in the United States Private 5G Network Market?

The United States Private 5G Network Market presents opportunities for innovation in sectors like smart manufacturing, autonomous vehicles, and remote healthcare services. As organizations seek to leverage advanced technologies, the demand for tailored private networks is expected to grow.

What trends are shaping the United States Private 5G Network Market?

Trends in the United States Private 5G Network Market include the increasing adoption of edge computing, the integration of AI and machine learning for network management, and the expansion of partnerships between telecom providers and enterprises. These trends are enhancing the capabilities and applications of private 5G networks.

United States Private 5G Network Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Hybrid, Cloud-Based, Edge Computing |

| End User | Manufacturing, Healthcare, Education, Transportation |

| Technology | Millimeter Wave, Sub-6 GHz, Small Cells, Massive MIMO |

| Service Type | Network Slicing, Private Network Management, Security Solutions, Consulting Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Private 5G Network Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at