444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States precision farming software market represents a transformative segment within the agricultural technology landscape, fundamentally reshaping how farmers approach crop management, resource optimization, and yield enhancement. This dynamic market encompasses sophisticated digital solutions that leverage advanced technologies including GPS guidance systems, variable rate technology, field mapping software, and data analytics platforms to enable precise agricultural practices.

Market dynamics indicate robust expansion driven by increasing adoption of smart farming technologies across diverse agricultural operations. The sector demonstrates remarkable growth potential with 12.8% CAGR projected through the forecast period, reflecting strong demand for precision agriculture solutions among commercial farming enterprises. Technology integration continues accelerating as farmers recognize the substantial benefits of data-driven decision making in optimizing crop yields and reducing operational costs.

Regional distribution shows concentrated adoption in major agricultural states including Iowa, Illinois, Nebraska, and California, where large-scale farming operations increasingly implement precision farming software to enhance productivity. The market encompasses various software categories including farm management systems, crop monitoring applications, soil analysis tools, and yield mapping solutions, each addressing specific aspects of modern agricultural operations.

The United States precision farming software market refers to the comprehensive ecosystem of digital applications and platforms designed to optimize agricultural practices through data-driven insights, automated processes, and precision technology integration. These software solutions enable farmers to make informed decisions regarding crop management, resource allocation, and field operations by leveraging real-time data collection and advanced analytics capabilities.

Precision farming software encompasses various technological components including geographic information systems (GIS), global positioning systems (GPS), remote sensing applications, and machine learning algorithms that collectively enable precise agricultural management. These platforms facilitate variable rate application of fertilizers, pesticides, and seeds based on specific field conditions, soil characteristics, and crop requirements.

Core functionalities include field mapping, crop monitoring, yield prediction, soil analysis, weather integration, and equipment management, providing farmers with comprehensive tools to optimize every aspect of their agricultural operations. The software solutions integrate seamlessly with modern farming equipment, enabling automated guidance systems and precision application technologies that significantly enhance operational efficiency and resource utilization.

Market expansion in the United States precision farming software sector reflects the agricultural industry’s digital transformation, with increasing adoption of smart farming technologies driving substantial growth opportunities. The market demonstrates strong momentum supported by government initiatives promoting sustainable agriculture practices and technological innovation in farming operations.

Key growth drivers include rising demand for food security solutions, increasing focus on sustainable farming practices, and growing awareness of precision agriculture benefits among farming communities. Technology adoption rates show 68% of commercial farms now utilizing some form of precision farming software, representing significant market penetration across diverse agricultural segments.

Competitive landscape features established agricultural technology companies alongside emerging software developers, creating a dynamic ecosystem of innovation and solution development. Investment activity remains robust with venture capital and private equity firms recognizing the substantial growth potential in agricultural technology solutions.

Future prospects indicate continued expansion driven by advancing technologies including artificial intelligence, machine learning, and Internet of Things (IoT) integration, positioning the market for sustained long-term growth and technological evolution.

Market segmentation reveals diverse application areas driving precision farming software adoption across the United States agricultural sector:

Technology trends show increasing integration of artificial intelligence and machine learning capabilities within precision farming software platforms, enabling predictive analytics and automated decision-making processes that enhance agricultural productivity and resource optimization.

Primary growth catalysts propelling the United States precision farming software market include increasing demand for agricultural efficiency and sustainable farming practices. Food security concerns drive farmers to adopt advanced technologies that maximize crop yields while minimizing environmental impact and resource consumption.

Economic pressures within the agricultural sector motivate farmers to seek cost optimization solutions that precision farming software provides through reduced input costs, improved resource allocation, and enhanced operational efficiency. Labor shortage challenges further accelerate adoption of automated and software-driven farming solutions that reduce dependency on manual labor.

Government initiatives supporting digital agriculture transformation provide substantial market momentum through funding programs, tax incentives, and regulatory frameworks encouraging precision farming technology adoption. Environmental regulations increasingly require farmers to demonstrate sustainable practices, driving demand for software solutions that monitor and optimize resource utilization.

Technological advancement in areas including satellite imagery, drone technology, and sensor networks creates new opportunities for precision farming software integration, enabling more sophisticated and accurate agricultural management capabilities that attract farmer adoption.

Implementation challenges present significant barriers to precision farming software adoption, particularly among smaller agricultural operations with limited technical expertise and financial resources. High initial investment costs associated with comprehensive precision farming software systems and supporting hardware infrastructure deter many potential users from market entry.

Technology complexity creates adoption hurdles as many farmers require extensive training and support to effectively utilize advanced software platforms. Data management concerns including privacy, security, and ownership issues generate hesitation among farmers regarding cloud-based precision farming solutions.

Connectivity limitations in rural agricultural areas restrict the effectiveness of precision farming software that relies on consistent internet access for real-time data synchronization and cloud-based functionality. Integration challenges with existing farm equipment and legacy systems create additional complexity and costs for software implementation.

Market fragmentation with numerous software providers offering incompatible solutions creates confusion and integration difficulties for farmers seeking comprehensive precision farming platforms. Return on investment uncertainty particularly affects smaller farming operations that struggle to quantify the financial benefits of precision farming software adoption.

Emerging technologies present substantial growth opportunities within the United States precision farming software market, particularly through integration of artificial intelligence, machine learning, and predictive analytics capabilities that enhance decision-making accuracy and operational efficiency.

Vertical integration opportunities enable precision farming software providers to expand their offerings through partnerships with equipment manufacturers, seed companies, and agricultural input suppliers, creating comprehensive ecosystem solutions that address multiple aspects of farm management.

Subscription-based models offer accessible entry points for smaller farming operations, enabling market expansion beyond large commercial farms to include mid-size agricultural enterprises and specialty crop producers who previously found precision farming software cost-prohibitive.

Data monetization strategies create additional revenue streams for precision farming software companies through agricultural data analytics services, market intelligence platforms, and research partnerships with academic institutions and agricultural organizations. International expansion opportunities enable successful United States precision farming software companies to leverage their technological expertise in global agricultural markets.

Supply chain evolution within the precision farming software market reflects increasing consolidation among technology providers and growing partnerships between software companies and traditional agricultural equipment manufacturers. Market maturation drives standardization efforts that improve interoperability between different precision farming software platforms and hardware systems.

Customer expectations continue evolving toward more integrated and user-friendly solutions that provide comprehensive farm management capabilities within single platforms. Competitive pressures intensify as established agricultural technology companies compete with innovative startups offering specialized precision farming software solutions.

Technology convergence accelerates integration between precision farming software and complementary technologies including autonomous vehicles, robotics systems, and advanced sensor networks, creating more sophisticated and capable agricultural management platforms.

Regulatory landscape evolution influences market dynamics through changing requirements for environmental compliance, data privacy protection, and agricultural reporting standards that precision farming software must accommodate. Investment patterns show increasing focus on sustainable agriculture technologies and climate-smart farming solutions that address environmental challenges while maintaining agricultural productivity.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the United States precision farming software market. Primary research activities included extensive interviews with industry stakeholders including farmers, software developers, agricultural consultants, and technology integrators to gather firsthand market perspectives.

Secondary research encompassed analysis of industry reports, government publications, academic studies, and company financial statements to establish market context and validate primary research findings. Data triangulation methods ensured research accuracy through cross-verification of information from multiple independent sources.

Market sizing methodologies utilized bottom-up and top-down approaches to establish comprehensive market scope and growth projections. Quantitative analysis incorporated statistical modeling and trend analysis to identify market patterns and forecast future developments.

Qualitative research provided deeper insights into market dynamics, competitive positioning, and customer behavior patterns through structured interviews and focus group discussions with key market participants. Technology assessment evaluated current and emerging precision farming software capabilities to understand innovation trends and future market directions.

Geographic distribution of the United States precision farming software market shows concentrated adoption in major agricultural regions, with the Midwest accounting for 42% market share due to extensive corn and soybean production operations that benefit significantly from precision farming technologies.

California represents the second-largest regional market with 18% market share, driven by diverse specialty crop production and advanced agricultural practices in the Central Valley region. Great Plains states including Nebraska, Kansas, and Oklahoma collectively contribute 22% market share through large-scale wheat and cattle operations increasingly adopting precision farming software solutions.

Southeastern states demonstrate growing market penetration with 12% market share, particularly in cotton, peanut, and specialty crop production areas where precision farming software provides significant yield optimization benefits. Technology adoption rates vary significantly by region, with more technologically advanced farming areas showing higher precision farming software utilization.

Regional preferences reflect local agricultural practices and crop types, with grain production areas favoring yield mapping and variable rate application software, while specialty crop regions prioritize crop monitoring and irrigation management solutions. Infrastructure development including broadband internet access significantly influences regional adoption patterns and software functionality utilization.

Market leadership within the United States precision farming software sector features a diverse ecosystem of established agricultural technology companies and innovative software developers:

Competitive strategies focus on technology innovation, strategic partnerships, and comprehensive solution development that address multiple aspects of farm management within integrated platforms. Market differentiation occurs through specialized functionality, user interface design, and integration capabilities with existing farm equipment and systems.

Technology-based segmentation reveals distinct categories within the United States precision farming software market:

By Technology:

By Application:

By Farm Size:

Crop management software represents the largest market segment, driven by increasing demand for real-time crop monitoring and health assessment capabilities. These platforms integrate satellite imagery, weather data, and sensor information to provide comprehensive crop management insights that optimize yield potential and resource utilization.

Soil analysis solutions demonstrate strong growth momentum as farmers recognize the critical importance of soil health optimization for sustainable agricultural practices. Advanced soil mapping technologies enable precise fertilizer application and nutrient management strategies that improve crop yields while reducing environmental impact.

Equipment management platforms gain increasing adoption among large-scale farming operations seeking to optimize machinery utilization and maintenance scheduling. These solutions provide fleet management capabilities and operational efficiency metrics that reduce equipment costs and improve productivity.

Financial management tools within precision farming software platforms address growing demand for profitability analysis and cost optimization capabilities. According to MarkWide Research analysis, integrated financial management features show 35% adoption growth among commercial farming operations seeking comprehensive business management solutions.

Farmers benefit from precision farming software through enhanced operational efficiency, reduced input costs, and improved crop yields that directly impact profitability and sustainability. Data-driven decision making enables more accurate resource allocation and timing of agricultural activities, resulting in optimized farming outcomes.

Agricultural input suppliers leverage precision farming software data to provide targeted product recommendations and customized service offerings that better meet farmer needs. Supply chain optimization through precision farming software integration improves inventory management and distribution efficiency.

Equipment manufacturers benefit from precision farming software integration through enhanced product differentiation and increased customer value proposition. Service revenue opportunities expand through software-based offerings and ongoing customer engagement models.

Financial institutions utilize precision farming software data for improved risk assessment and agricultural lending decisions. Insurance companies benefit from enhanced risk modeling capabilities and claims verification processes through precision farming software data integration.

Research institutions access valuable agricultural data through precision farming software platforms, enabling advanced research initiatives and innovation development that benefit the broader agricultural community.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a dominant trend within precision farming software, with machine learning algorithms increasingly incorporated into platforms for predictive analytics and automated decision-making capabilities. Computer vision technology enables advanced crop monitoring and pest detection through drone and satellite imagery analysis.

Cloud-based platforms gain widespread adoption as farmers recognize the benefits of scalable computing resources and remote data access capabilities. Mobile-first design becomes standard as farmers increasingly rely on smartphone applications and tablet interfaces for field-based software interaction.

Sustainability metrics integration reflects growing emphasis on environmental stewardship and carbon footprint reduction within agricultural operations. Blockchain technology adoption enables supply chain traceability and food safety verification through precision farming software platforms.

Subscription-based pricing models replace traditional software licensing approaches, providing farmers with flexible payment options and continuous software updates. API-first architecture enables seamless integration between different precision farming software solutions and third-party agricultural services.

Strategic partnerships between precision farming software companies and agricultural equipment manufacturers accelerate market integration and solution development. Acquisition activity intensifies as larger agricultural technology companies seek to expand their precision farming software capabilities through targeted acquisitions.

Government initiatives including the USDA Digital Agriculture Strategy provide substantial support for precision farming software adoption through funding programs and research partnerships. University collaborations advance precision farming software research and development through academic-industry partnerships.

International expansion efforts by United States precision farming software companies create global market opportunities and technology transfer initiatives. Venture capital investment in agricultural technology startups reaches record levels, supporting innovation in precision farming software development.

Regulatory developments including data privacy legislation and environmental compliance requirements influence precision farming software design and functionality. Industry standardization efforts promote interoperability between different precision farming software platforms and hardware systems.

Market participants should prioritize user experience optimization and interface simplification to accelerate adoption among farmers with limited technical expertise. Investment in training programs and customer support services will prove critical for successful precision farming software implementation and customer retention.

Technology integration strategies should focus on seamless connectivity between precision farming software platforms and existing farm equipment to maximize value proposition and minimize implementation complexity. Data security measures require continuous enhancement to address growing cybersecurity concerns and regulatory requirements.

Pricing strategy optimization through flexible subscription models and tiered service offerings will enable market expansion beyond large commercial farms to include mid-size and smaller agricultural operations. Partnership development with agricultural input suppliers and service providers creates opportunities for integrated solution offerings.

MWR analysis suggests that companies focusing on sustainability metrics and environmental compliance features will gain competitive advantages as regulatory requirements and consumer demand for sustainable agriculture continue expanding. International market exploration presents significant growth opportunities for established United States precision farming software companies.

Long-term growth prospects for the United States precision farming software market remain exceptionally positive, driven by accelerating digital transformation within the agricultural sector and increasing recognition of precision farming benefits among farming communities. Technology advancement in areas including artificial intelligence, satellite imagery, and sensor networks will continue expanding precision farming software capabilities and market opportunities.

Market evolution toward more integrated and comprehensive platforms will consolidate fragmented solutions into unified farm management systems that address multiple aspects of agricultural operations. Adoption rates are projected to reach 78% among commercial farms within the next five years, representing substantial market expansion from current penetration levels.

Emerging technologies including autonomous vehicles, robotics systems, and advanced analytics will create new categories of precision farming software applications and market segments. Sustainability focus will drive development of software solutions that optimize resource utilization and environmental impact while maintaining agricultural productivity.

Global expansion opportunities will enable successful United States precision farming software companies to leverage their technological expertise in international markets experiencing agricultural modernization. Investment activity will continue supporting innovation and market development as investors recognize the substantial growth potential within agricultural technology sectors.

The United States precision farming software market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by technological innovation, agricultural modernization, and increasing demand for sustainable farming practices. Market fundamentals remain strong with robust adoption rates, expanding application areas, and continuous technology advancement supporting long-term expansion prospects.

Strategic opportunities abound for companies that successfully navigate the complex landscape of farmer needs, technology integration challenges, and competitive pressures while delivering value-driven solutions that enhance agricultural productivity and sustainability. Future success will depend on companies’ ability to balance technological sophistication with user-friendly interfaces and practical implementation approaches that resonate with diverse farming operations across the United States agricultural sector.

What is Precision Farming Software?

Precision Farming Software refers to technology solutions that assist farmers in managing their agricultural practices more efficiently. This includes tools for data analysis, crop monitoring, and resource management to optimize yields and reduce waste.

What are the key players in the United States Precision Farming Software Market?

Key players in the United States Precision Farming Software Market include companies like Trimble, AG Leader Technology, and Climate Corporation, among others. These companies provide various software solutions that enhance farm productivity and decision-making.

What are the growth factors driving the United States Precision Farming Software Market?

The growth of the United States Precision Farming Software Market is driven by increasing demand for food production, advancements in IoT and data analytics, and the need for sustainable farming practices. These factors encourage farmers to adopt precision agriculture technologies.

What challenges does the United States Precision Farming Software Market face?

Challenges in the United States Precision Farming Software Market include high initial investment costs, the complexity of technology integration, and data privacy concerns. These factors can hinder the adoption of precision farming solutions among some farmers.

What opportunities exist in the United States Precision Farming Software Market?

Opportunities in the United States Precision Farming Software Market include the development of AI-driven analytics tools, expansion into smallholder farming, and partnerships with agricultural equipment manufacturers. These trends can enhance the accessibility and effectiveness of precision farming solutions.

What trends are shaping the United States Precision Farming Software Market?

Trends shaping the United States Precision Farming Software Market include the increasing use of drones for crop monitoring, the integration of machine learning for predictive analytics, and the rise of mobile applications for on-the-go farm management. These innovations are transforming how farmers operate.

United States Precision Farming Software Market

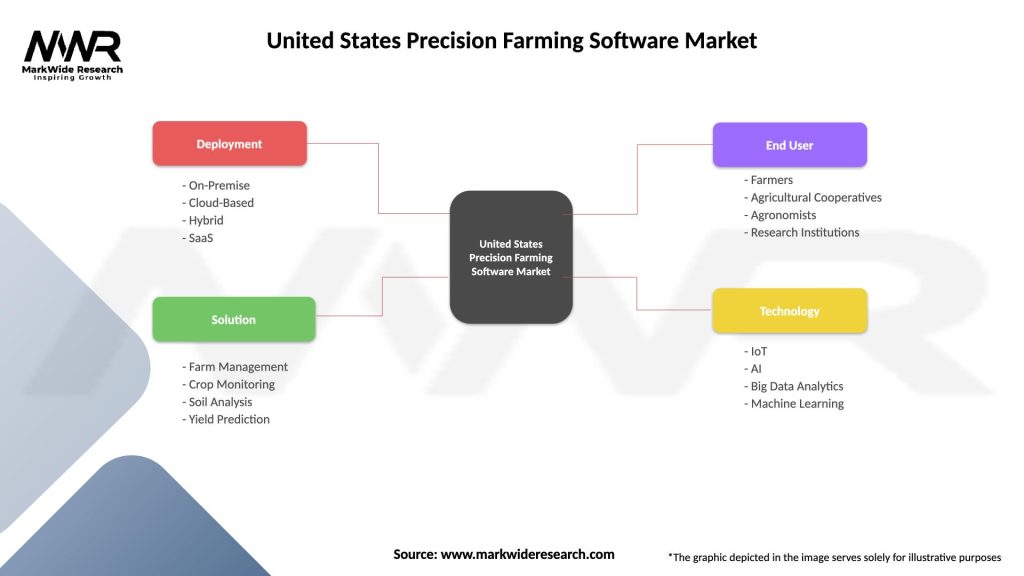

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| Solution | Farm Management, Crop Monitoring, Soil Analysis, Yield Prediction |

| End User | Farmers, Agricultural Cooperatives, Agronomists, Research Institutions |

| Technology | IoT, AI, Big Data Analytics, Machine Learning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Precision Farming Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at