444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States pharmaceutical logistics services market represents a critical component of the nation’s healthcare infrastructure, encompassing the complex network of storage, transportation, and distribution services that ensure medications reach patients safely and efficiently. This specialized sector has experienced remarkable transformation driven by evolving regulatory requirements, technological innovations, and the increasing complexity of pharmaceutical supply chains.

Market dynamics indicate robust growth potential, with the sector expanding at a compound annual growth rate (CAGR) of 8.2% over the forecast period. The market encompasses various service categories including cold chain logistics, specialty drug distribution, clinical trial logistics, and reverse logistics for pharmaceutical returns and waste management.

Key market characteristics include stringent regulatory compliance requirements, temperature-sensitive product handling, and the need for real-time tracking and monitoring capabilities. The sector serves diverse stakeholders including pharmaceutical manufacturers, biotechnology companies, hospitals, retail pharmacies, and clinical research organizations.

Geographic distribution shows concentration in major metropolitan areas and pharmaceutical manufacturing hubs, with California, New Jersey, and North Carolina representing significant market shares. The market’s evolution reflects broader healthcare trends including personalized medicine, biologics growth, and direct-to-patient delivery models.

The United States pharmaceutical logistics services market refers to the comprehensive ecosystem of specialized supply chain services designed to handle the storage, transportation, and distribution of pharmaceutical products throughout the country. This market encompasses all activities from manufacturer to end-user, ensuring product integrity, regulatory compliance, and patient safety.

Core components include warehousing and storage facilities with controlled environments, transportation services with temperature monitoring, inventory management systems, and regulatory compliance services. The market also covers specialized services such as clinical trial logistics, direct-to-patient delivery, and reverse logistics for product recalls and returns.

Service providers range from large integrated logistics companies to specialized pharmaceutical logistics firms, each offering unique capabilities tailored to specific pharmaceutical product categories and distribution requirements. The market’s complexity stems from the need to maintain product efficacy while navigating complex regulatory frameworks.

Market performance demonstrates strong growth momentum driven by increasing pharmaceutical consumption, expanding specialty drug categories, and evolving distribution models. The sector benefits from technological advancements in tracking, monitoring, and automation that enhance operational efficiency and regulatory compliance.

Key growth drivers include the aging population’s increased medication needs, growing prevalence of chronic diseases requiring specialty treatments, and the expansion of biologics and biosimilar markets. Additionally, direct-to-patient delivery models have gained 45% adoption rate among specialty pharmacies, creating new service opportunities.

Competitive landscape features established logistics giants alongside specialized pharmaceutical logistics providers, with market consolidation trends evident through strategic acquisitions and partnerships. Technology integration remains a critical differentiator, with companies investing heavily in IoT sensors, blockchain tracking, and artificial intelligence for predictive analytics.

Future outlook suggests continued expansion driven by pharmaceutical innovation, regulatory evolution, and changing patient expectations for convenient, reliable medication access. The market’s resilience was demonstrated during recent global disruptions, highlighting the essential nature of pharmaceutical logistics services.

Strategic insights reveal several critical factors shaping market development and competitive positioning:

Primary growth drivers propelling market expansion include demographic shifts, technological advancement, and evolving healthcare delivery models. The aging U.S. population creates sustained demand for pharmaceutical products, with seniors representing the highest per-capita medication consumers.

Specialty drug proliferation serves as a major catalyst, with these high-value medications requiring sophisticated handling and distribution capabilities. The biologics segment shows particular strength, demanding specialized cold chain logistics and enhanced security measures throughout the supply chain.

Regulatory requirements continue driving market growth as compliance costs create barriers to entry while benefiting established service providers with proven track records. The Drug Supply Chain Security Act (DSCSA) implementation has accelerated adoption of serialization and track-and-trace technologies.

E-commerce expansion in pharmaceutical retail has created new distribution channels and service requirements. Online pharmacy growth has increased by 35% annually, necessitating specialized last-mile delivery capabilities and patient verification systems.

Clinical trial complexity drives demand for specialized logistics services, with personalized medicine and gene therapy trials requiring unprecedented levels of coordination and temperature control. The decentralized clinical trial model has further expanded service requirements.

Significant challenges impact market growth and operational efficiency, creating obstacles for both established players and new entrants. Regulatory complexity represents the most substantial constraint, with overlapping federal and state requirements creating compliance burdens and operational inefficiencies.

High capital requirements for specialized infrastructure, including temperature-controlled facilities and monitoring systems, create barriers to market entry and expansion. The need for continuous technology upgrades to meet evolving regulatory and customer requirements strains operational budgets.

Skilled workforce shortages plague the industry, particularly for specialized roles requiring pharmaceutical handling expertise and regulatory knowledge. Driver shortages affect 68% of logistics companies, impacting service reliability and operational costs.

Cybersecurity threats pose increasing risks as digitalization expands, with pharmaceutical supply chains becoming attractive targets for malicious actors. Data breach incidents can result in significant financial penalties and reputational damage.

Cost pressures from pharmaceutical manufacturers and healthcare systems limit pricing flexibility while operational costs continue rising. The need to balance cost efficiency with service quality and regulatory compliance creates ongoing operational challenges.

Emerging opportunities present significant growth potential across multiple market segments and service categories. The personalized medicine revolution creates demand for highly specialized logistics services capable of handling individualized treatments and small-batch productions.

Technology integration opportunities include artificial intelligence for predictive analytics, blockchain for supply chain transparency, and IoT sensors for real-time monitoring. These technologies offer competitive advantages and operational efficiencies while addressing regulatory requirements.

Geographic expansion opportunities exist in underserved rural markets where specialized pharmaceutical logistics services remain limited. The development of hub-and-spoke distribution models can efficiently serve these markets while maintaining cost effectiveness.

Value-added services represent growth opportunities including patient support programs, medication adherence monitoring, and clinical trial logistics. MarkWide Research analysis indicates that companies offering comprehensive service portfolios achieve 25% higher profit margins compared to basic logistics providers.

Sustainability initiatives create opportunities for differentiation through eco-friendly packaging, carbon-neutral transportation, and waste reduction programs. Environmental consciousness among healthcare stakeholders drives demand for sustainable logistics solutions.

Complex market dynamics shape competitive positioning and strategic decision-making across the pharmaceutical logistics ecosystem. Supply chain digitization continues accelerating, with companies investing heavily in technology platforms that provide end-to-end visibility and control.

Consolidation trends reflect economies of scale benefits and the need for comprehensive service capabilities. Large logistics providers acquire specialized pharmaceutical logistics companies to expand their service portfolios and geographic reach.

Customer expectations continue evolving toward greater transparency, faster delivery times, and enhanced service reliability. The Amazon effect has influenced pharmaceutical logistics, with patients expecting similar convenience and tracking capabilities for their medications.

Regulatory evolution creates both challenges and opportunities, with new guidelines often requiring significant operational adjustments while potentially creating competitive advantages for compliant providers. The FDA’s focus on supply chain integrity has intensified scrutiny of logistics operations.

Technology disruption continues reshaping operational models, with automation, artificial intelligence, and advanced analytics becoming standard requirements rather than competitive differentiators. Companies failing to adapt risk losing market share to more technologically advanced competitors.

Comprehensive research methodology employed multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research included extensive interviews with industry executives, logistics managers, and regulatory experts across the pharmaceutical supply chain.

Secondary research encompassed analysis of industry reports, regulatory filings, company financial statements, and trade association publications. Government databases provided statistical information on pharmaceutical production, distribution patterns, and regulatory compliance metrics.

Quantitative analysis utilized statistical modeling techniques to project market trends, growth rates, and competitive dynamics. Market sizing methodologies incorporated bottom-up and top-down approaches to validate findings and ensure consistency across different data sources.

Qualitative assessment included expert opinion surveys, focus groups with industry stakeholders, and case study analysis of successful logistics implementations. This approach provided insights into market dynamics that quantitative data alone cannot capture.

Data validation processes included cross-referencing multiple sources, expert review panels, and statistical significance testing to ensure research reliability and accuracy. Continuous monitoring of market developments ensures ongoing relevance of research findings.

Geographic distribution reveals significant regional variations in market concentration, service capabilities, and growth potential across the United States. Northeast region maintains the largest market share at 32%, driven by high pharmaceutical manufacturing concentration and major population centers.

California represents the largest single-state market, benefiting from biotechnology industry concentration, large population base, and proximity to Pacific Rim pharmaceutical imports. The state’s specialty drug distribution accounts for 28% of national volume.

Southeast region shows rapid growth driven by pharmaceutical manufacturing expansion, favorable business climates, and strategic geographic positioning for national distribution. North Carolina, South Carolina, and Georgia have emerged as major pharmaceutical logistics hubs.

Midwest region benefits from central geographic location and established transportation infrastructure, making it ideal for national distribution centers. Chicago, Indianapolis, and Memphis serve as major pharmaceutical logistics gateways.

Southwest region demonstrates strong growth potential driven by population expansion, cross-border pharmaceutical trade, and increasing healthcare infrastructure development. Texas has become a major pharmaceutical distribution center serving both domestic and international markets.

Market competition features diverse players ranging from global logistics giants to specialized pharmaceutical service providers, each offering unique capabilities and market positioning strategies.

Competitive strategies focus on technology differentiation, geographic expansion, and value-added service development. Companies invest heavily in automation, data analytics, and customer-facing technologies to maintain competitive advantages.

Market consolidation continues through strategic acquisitions and partnerships, with larger players acquiring specialized capabilities and smaller companies seeking scale advantages through collaboration.

Market segmentation reveals distinct categories based on service type, product category, and end-user requirements, each with unique characteristics and growth dynamics.

By Service Type:

By Product Category:

By End User:

Cold chain logistics represents the fastest-growing segment, driven by increasing biologics adoption and vaccine distribution requirements. This category demands sophisticated temperature monitoring, specialized equipment, and enhanced security protocols throughout the supply chain.

Specialty drug logistics commands premium pricing due to high-value products and complex handling requirements. These medications often require patient-specific delivery, enhanced security, and specialized storage conditions, creating opportunities for differentiated service providers.

Clinical trial logistics shows strong growth potential as pharmaceutical research expands and trials become more complex. Decentralized trial models have increased logistics complexity while creating new service opportunities for specialized providers.

Direct-to-patient services have experienced rapid expansion, particularly accelerated by recent healthcare delivery changes. This segment requires specialized capabilities including patient verification, medication adherence support, and flexible delivery options.

Reverse logistics gains importance as pharmaceutical waste management and product recall requirements intensify. MWR data indicates that reverse logistics services have grown by 22% annually as regulatory requirements expand.

Pharmaceutical manufacturers benefit from specialized logistics services through reduced operational complexity, enhanced regulatory compliance, and improved market reach. Outsourcing logistics allows companies to focus on core competencies while ensuring product integrity and patient safety.

Healthcare providers gain advantages through reliable supply chain management, reduced inventory carrying costs, and improved patient care capabilities. Specialized logistics services ensure medication availability while minimizing waste and expiration losses.

Patients benefit from improved medication access, enhanced convenience through home delivery options, and better adherence support programs. Specialized logistics services contribute to medication affordability through efficient distribution and reduced waste.

Logistics service providers capture value through specialized expertise, technology investments, and comprehensive service portfolios. The pharmaceutical logistics market offers higher margins compared to general logistics due to specialized requirements and regulatory compliance needs.

Regulatory agencies benefit from improved supply chain transparency, enhanced product tracking capabilities, and better compliance monitoring. Advanced logistics systems provide data and visibility that support regulatory oversight and public health protection.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping pharmaceutical logistics through automation, artificial intelligence, and advanced analytics. Companies invest heavily in technology platforms that provide real-time visibility, predictive capabilities, and enhanced customer experiences.

Sustainability initiatives gain prominence as environmental consciousness increases among healthcare stakeholders. Green logistics practices including electric vehicles, sustainable packaging, and carbon-neutral operations become competitive differentiators.

Personalized medicine growth creates demand for specialized logistics services capable of handling individualized treatments and small-batch productions. This trend requires flexible operational models and enhanced tracking capabilities.

Direct-to-patient delivery expansion accelerates, driven by patient convenience expectations and healthcare cost reduction initiatives. This model requires specialized capabilities including patient verification, medication adherence support, and flexible delivery options.

Supply chain resilience becomes a strategic priority following recent global disruptions. Companies invest in diversified distribution networks, contingency planning, and risk management capabilities to ensure operational continuity.

Recent industry developments reflect ongoing evolution in pharmaceutical logistics capabilities, regulatory requirements, and market dynamics. Technology acquisitions have accelerated as companies seek to enhance their digital capabilities and competitive positioning.

Regulatory updates including enhanced serialization requirements and supply chain security measures have driven significant operational changes across the industry. The Drug Supply Chain Security Act implementation continues influencing logistics operations and technology investments.

Strategic partnerships between pharmaceutical manufacturers and logistics providers have expanded, creating integrated service models that enhance efficiency and reduce costs. These collaborations often involve long-term contracts and shared technology investments.

Infrastructure investments in specialized facilities and equipment have increased, particularly for cold chain capabilities and automated systems. Companies recognize that advanced infrastructure provides competitive advantages and operational efficiencies.

Workforce development initiatives address skilled labor shortages through training programs, technology adoption, and improved compensation packages. The industry recognizes that human capital represents a critical success factor.

Strategic recommendations for market participants focus on technology investment, service differentiation, and operational excellence. Companies should prioritize digital transformation initiatives that enhance visibility, efficiency, and customer experience while ensuring regulatory compliance.

Technology integration represents the highest priority, with artificial intelligence, blockchain, and IoT sensors becoming essential capabilities rather than competitive advantages. MarkWide Research analysis suggests that companies investing in comprehensive technology platforms achieve 15% higher customer retention rates.

Service portfolio expansion through value-added offerings creates opportunities for revenue growth and customer loyalty. Companies should consider patient support programs, clinical trial logistics, and sustainability services as differentiation strategies.

Geographic diversification reduces risk while capturing growth opportunities in underserved markets. Strategic expansion should focus on regions with growing pharmaceutical manufacturing or population centers with limited specialized logistics services.

Partnership strategies with pharmaceutical manufacturers, technology providers, and healthcare systems can create competitive advantages through shared resources, enhanced capabilities, and improved market access.

Market prospects remain highly favorable driven by demographic trends, pharmaceutical innovation, and evolving healthcare delivery models. The aging population ensures sustained demand growth while specialty drug expansion creates opportunities for premium service providers.

Technology evolution will continue reshaping operational models, with artificial intelligence, automation, and advanced analytics becoming standard capabilities. Companies that successfully integrate these technologies will achieve significant competitive advantages.

Regulatory environment evolution will likely increase complexity while creating opportunities for compliant service providers. Enhanced supply chain security requirements and patient safety initiatives will drive demand for specialized logistics capabilities.

Market consolidation is expected to continue as companies seek scale advantages and comprehensive service capabilities. Strategic acquisitions and partnerships will reshape competitive dynamics while creating opportunities for specialized providers.

Growth projections indicate continued market expansion at robust rates exceeding 8% annually, driven by pharmaceutical consumption growth, specialty drug proliferation, and direct-to-patient delivery adoption. The market’s essential nature ensures resilience against economic fluctuations.

The United States pharmaceutical logistics services market represents a dynamic and essential component of the healthcare ecosystem, characterized by strong growth prospects, technological innovation, and evolving service requirements. Market participants benefit from sustained demand driven by demographic trends, pharmaceutical innovation, and regulatory requirements that create barriers to entry while rewarding specialized expertise.

Strategic success factors include technology integration, regulatory compliance excellence, and comprehensive service portfolios that address evolving customer needs. Companies that invest in digital transformation, operational excellence, and customer-centric service models are positioned to capture disproportionate market growth and profitability.

Future market evolution will be shaped by continued pharmaceutical innovation, regulatory evolution, and changing patient expectations for convenient, reliable medication access. The market’s critical role in healthcare delivery ensures continued investment and growth opportunities for well-positioned service providers who can navigate complexity while delivering exceptional value to all stakeholders in the pharmaceutical supply chain.

What is Pharmaceutical Logistic Services?

Pharmaceutical Logistic Services refer to the specialized transportation, storage, and distribution of pharmaceutical products, ensuring compliance with regulatory standards and maintaining product integrity throughout the supply chain.

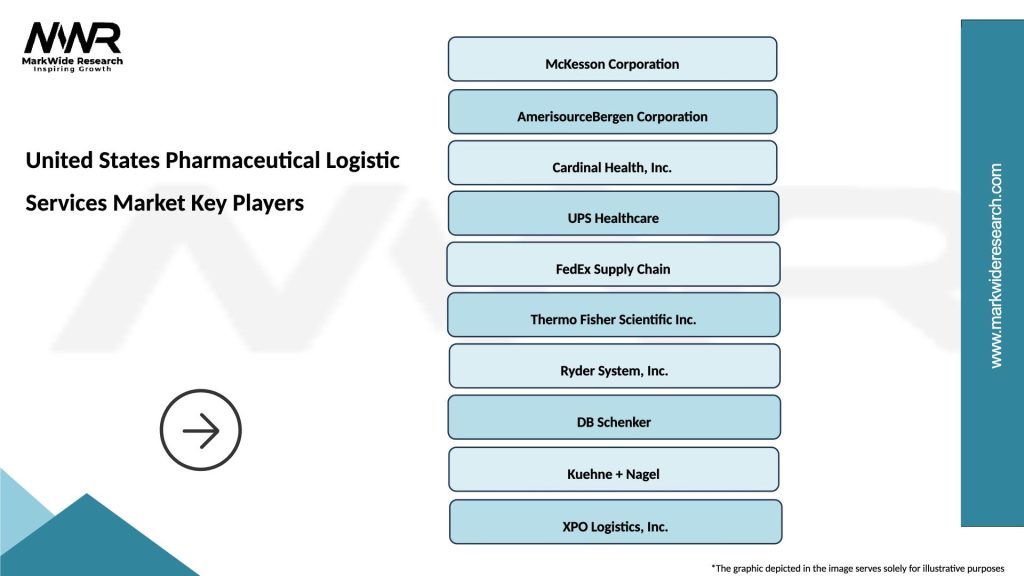

What are the key players in the United States Pharmaceutical Logistic Services Market?

Key players in the United States Pharmaceutical Logistic Services Market include McKesson Corporation, Cardinal Health, and AmerisourceBergen, among others.

What are the main drivers of growth in the United States Pharmaceutical Logistic Services Market?

The main drivers of growth in the United States Pharmaceutical Logistic Services Market include the increasing demand for temperature-sensitive medications, the rise in e-commerce for pharmaceuticals, and the need for efficient supply chain management.

What challenges does the United States Pharmaceutical Logistic Services Market face?

Challenges in the United States Pharmaceutical Logistic Services Market include stringent regulatory requirements, the complexity of managing cold chain logistics, and the risk of supply chain disruptions.

What opportunities exist in the United States Pharmaceutical Logistic Services Market?

Opportunities in the United States Pharmaceutical Logistic Services Market include advancements in technology for tracking and monitoring shipments, the growth of personalized medicine, and the expansion of telehealth services.

What trends are shaping the United States Pharmaceutical Logistic Services Market?

Trends shaping the United States Pharmaceutical Logistic Services Market include the increasing adoption of automation and robotics in warehousing, the integration of artificial intelligence for logistics optimization, and a focus on sustainability in packaging and transportation.

United States Pharmaceutical Logistic Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Warehousing, Transportation, Distribution, Inventory Management |

| End User | Pharmaceutical Manufacturers, Wholesalers, Retail Pharmacies, Hospitals |

| Delivery Mode | Cold Chain, Ambient, Express, Standard |

| Technology | Track & Trace, RFID, IoT Solutions, Automated Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Pharmaceutical Logistic Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at