444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States pet veterinary supplement market represents a rapidly expanding segment within the broader animal healthcare industry, driven by increasing pet ownership rates and growing awareness of preventive veterinary care. Pet owners across the nation are increasingly investing in nutritional supplements to support their companion animals’ health, longevity, and quality of life. The market encompasses a diverse range of products including vitamins, minerals, probiotics, joint support formulations, and specialized therapeutic supplements designed for dogs, cats, and other companion animals.

Market dynamics indicate robust growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion reflects the humanization trend in pet care, where owners treat their pets as family members and seek premium healthcare solutions. Veterinary professionals play a crucial role in driving market growth through recommendations and prescriptions, while retail channels continue to diversify to meet evolving consumer preferences.

Regional distribution shows concentrated market activity in states with high pet ownership rates, including California, Texas, Florida, and New York. The market benefits from strong regulatory frameworks ensuring product safety and efficacy, while innovation in formulation technologies continues to drive product differentiation and market expansion.

The United States pet veterinary supplement market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and sale of nutritional and therapeutic supplements specifically formulated for companion animals under veterinary guidance or recommendation. These products are designed to support various aspects of pet health, including immune function, joint mobility, digestive health, skin and coat condition, and overall wellness maintenance.

Veterinary supplements differ from general pet supplements through their scientific formulation, clinical backing, and often require professional veterinary oversight for optimal usage. The market includes both prescription-only medicines (POMs) and veterinary-recommended over-the-counter products that meet specific regulatory standards for safety, efficacy, and quality assurance in animal healthcare applications.

Market leadership in the United States pet veterinary supplement sector is characterized by strong growth trajectories and increasing consumer adoption rates. The market demonstrates resilience and expansion potential, driven by demographic shifts toward increased pet ownership and evolving attitudes toward preventive animal healthcare. Key growth drivers include the aging pet population, rising disposable income among pet owners, and growing awareness of the benefits of nutritional supplementation in veterinary medicine.

Product innovation continues to shape market dynamics, with manufacturers developing specialized formulations targeting specific health conditions and age-related concerns in companion animals. The integration of natural and organic ingredients has gained significant traction, with 72% of pet owners expressing preference for natural supplement options. Distribution channels have evolved to include veterinary clinics, specialty pet retailers, e-commerce platforms, and traditional retail outlets, creating multiple touchpoints for consumer engagement.

Competitive positioning within the market emphasizes scientific validation, veterinary endorsement, and brand trust as primary differentiators. Companies investing in clinical research and veterinary education programs demonstrate stronger market performance and customer loyalty rates.

Strategic market insights reveal several critical trends shaping the United States pet veterinary supplement landscape:

Consumer behavior analysis indicates that pet owners prioritize product efficacy, safety, and veterinary endorsement when selecting supplements. The market benefits from high customer retention rates, with satisfied users demonstrating strong brand loyalty and repeat purchase patterns.

Primary market drivers propelling growth in the United States pet veterinary supplement sector include several interconnected factors that create sustained demand momentum. Pet humanization trends represent the most significant driver, as owners increasingly view their companion animals as family members deserving premium healthcare solutions. This cultural shift translates into higher spending on preventive care and nutritional supplementation.

Demographic changes in pet ownership patterns contribute substantially to market expansion. The growing population of senior pets requires specialized nutritional support for age-related health challenges, creating sustained demand for joint support, cognitive health, and immune system supplements. Millennial pet owners demonstrate particularly strong adoption rates for veterinary supplements, driven by their proactive approach to pet healthcare and willingness to invest in premium products.

Veterinary practice evolution toward preventive care models drives professional recommendations for nutritional supplementation. Veterinarians increasingly recognize the value of supplements in maintaining pet health and preventing disease progression, leading to higher prescription and recommendation rates. Educational initiatives by veterinary professionals help pet owners understand the benefits of supplementation, driving informed purchasing decisions.

Scientific advancement in animal nutrition research provides the foundation for innovative product development and market growth. Clinical studies demonstrating supplement efficacy build consumer confidence and support veterinary adoption of these products in practice protocols.

Market constraints affecting the United States pet veterinary supplement sector present challenges that companies must navigate to maintain growth trajectories. Regulatory complexity represents a significant restraint, as manufacturers must comply with evolving FDA guidelines and state-level regulations governing animal supplement production and marketing. These compliance requirements create barriers to entry for smaller companies and increase operational costs across the industry.

Price sensitivity among certain consumer segments limits market penetration, particularly during economic downturns when discretionary spending on pet products may decrease. Premium pricing of veterinary-grade supplements compared to general pet supplements can deter price-conscious consumers, despite superior quality and efficacy profiles.

Market fragmentation creates challenges in brand recognition and consumer education. The proliferation of supplement brands and products can overwhelm pet owners, making it difficult to differentiate between quality offerings and inferior alternatives. Misinformation about supplement benefits and safety can undermine consumer confidence and slow market adoption rates.

Veterinary adoption barriers include time constraints in clinical practice that limit thorough supplement consultations and varying levels of nutritional training among veterinary professionals. Some practitioners remain skeptical about supplement efficacy, preferring traditional pharmaceutical interventions over nutritional approaches.

Emerging opportunities in the United States pet veterinary supplement market present substantial growth potential for companies positioned to capitalize on evolving trends and consumer demands. Personalized nutrition represents a significant opportunity, with advances in genetic testing and health monitoring enabling customized supplement regimens tailored to individual pet needs and health profiles.

E-commerce expansion offers substantial growth potential, particularly through subscription-based models that ensure consistent product delivery and customer retention. Digital platforms enable direct-to-consumer relationships, improved customer education, and data collection for product optimization. The convenience factor of online purchasing appeals to busy pet owners seeking streamlined healthcare management solutions.

Specialty formulations targeting specific breeds, life stages, and health conditions present opportunities for market differentiation and premium pricing. Functional ingredients such as probiotics, omega fatty acids, and antioxidants continue to gain scientific validation and consumer acceptance, creating opportunities for innovative product development.

International expansion opportunities exist as American companies leverage their expertise and product quality to enter global markets. Partnership opportunities with veterinary clinics, pet insurance companies, and retail chains can accelerate market penetration and brand recognition.

Technology integration through mobile apps, wearable devices, and telemedicine platforms creates opportunities for enhanced customer engagement and product positioning within comprehensive pet healthcare ecosystems.

Market dynamics within the United States pet veterinary supplement sector reflect complex interactions between supply-side innovations, demand-side preferences, and regulatory influences that shape competitive landscapes and growth trajectories. Supply chain optimization has become increasingly important as companies seek to balance quality assurance with cost efficiency while meeting growing demand volumes.

Innovation cycles in the market demonstrate accelerating pace, with companies investing heavily in research and development to create differentiated products that address specific pet health challenges. Clinical validation of supplement efficacy has become a critical competitive factor, with companies conducting proprietary studies to support marketing claims and veterinary adoption.

Distribution channel evolution reflects changing consumer preferences and shopping behaviors. Traditional veterinary clinic sales remain important, but omnichannel strategies incorporating online platforms, specialty retailers, and direct-to-consumer models have gained prominence. Channel conflict management requires careful navigation to maintain relationships with veterinary partners while pursuing direct sales opportunities.

Pricing dynamics show premiumization trends as consumers demonstrate willingness to pay higher prices for scientifically-backed, veterinary-recommended products. Value-based pricing strategies focus on health outcomes and long-term benefits rather than simple cost comparisons with generic alternatives.

Competitive intensity continues to increase as new entrants recognize market opportunities and established players expand product portfolios. Market consolidation through acquisitions and partnerships creates larger, more capable organizations with enhanced research capabilities and distribution reach.

Research methodology employed in analyzing the United States pet veterinary supplement market incorporates comprehensive primary and secondary research approaches to ensure accurate market characterization and trend identification. Primary research includes extensive surveys of pet owners, veterinary professionals, and industry stakeholders to gather firsthand insights into purchasing behaviors, product preferences, and market dynamics.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and academic publications related to animal nutrition and veterinary medicine. Market sizing methodologies utilize multiple data sources and validation techniques to ensure accuracy and reliability of growth projections and market share assessments.

Data collection processes include structured interviews with key opinion leaders in veterinary medicine, supplement manufacturers, and distribution channel partners. Quantitative analysis incorporates statistical modeling to identify correlations between market drivers and growth patterns, enabling predictive insights for future market development.

Validation procedures ensure data accuracy through cross-referencing multiple sources and expert review processes. MarkWide Research employs rigorous quality control measures to maintain the integrity and reliability of market analysis and forecasting models used in this comprehensive market assessment.

Regional market distribution across the United States reveals significant variations in pet veterinary supplement adoption rates and spending patterns, influenced by demographic factors, income levels, and cultural attitudes toward pet care. West Coast markets, particularly California, demonstrate the highest penetration rates with 45% of pet owners regularly using veterinary supplements, driven by health-conscious consumer attitudes and higher disposable incomes.

Northeast regions including New York, Massachusetts, and Connecticut show strong market performance with 38% adoption rates, supported by dense veterinary clinic networks and educated consumer bases. Urban markets consistently outperform rural areas in supplement adoption, reflecting differences in veterinary access, income levels, and pet care spending priorities.

Southern states present growing market opportunities with 28% current adoption rates but demonstrate rapid growth potential as pet ownership rates increase and veterinary infrastructure expands. Texas and Florida lead regional growth due to large pet populations and increasing awareness of preventive healthcare benefits.

Midwest markets show steady growth with 32% adoption rates, characterized by strong veterinary relationships and practical approaches to pet healthcare. Rural markets across all regions present untapped opportunities as veterinary education and product accessibility improve.

Regional preferences vary in product categories, with joint support supplements showing higher adoption in colder climates and digestive health products gaining traction in areas with specific environmental challenges affecting pet health.

Competitive dynamics in the United States pet veterinary supplement market feature a diverse mix of established pharmaceutical companies, specialized pet health manufacturers, and emerging innovative brands competing across multiple product categories and distribution channels. Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies.

Competitive strategies emphasize scientific validation, veterinary education, and brand differentiation through quality positioning and clinical evidence. Innovation focus areas include novel delivery systems, combination formulations, and personalized nutrition solutions that address specific pet health challenges.

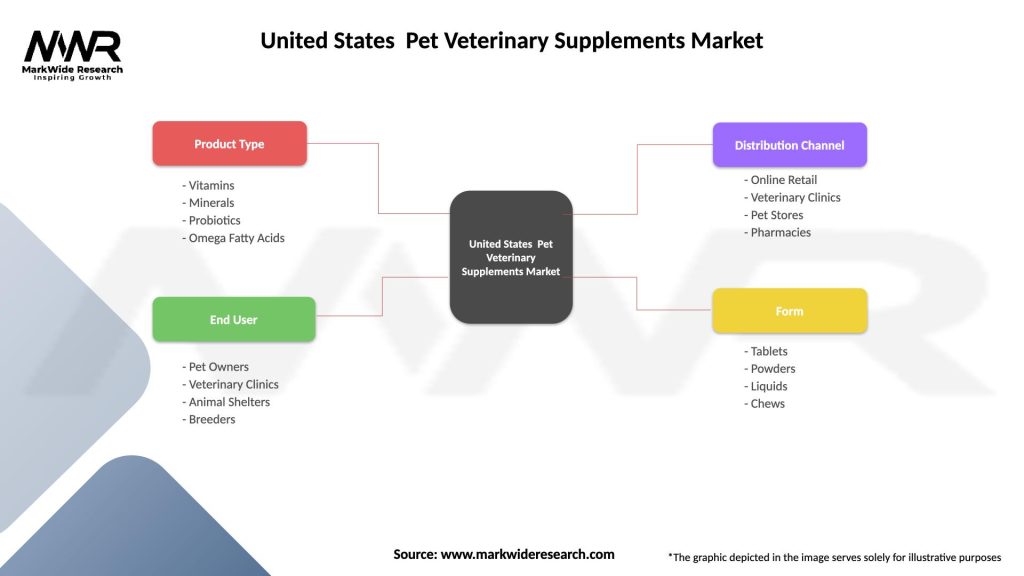

Market segmentation analysis reveals distinct categories within the United States pet veterinary supplement market, each characterized by specific growth patterns, consumer preferences, and competitive dynamics. Product-based segmentation provides insights into category performance and growth opportunities across diverse supplement types.

By Product Type:

By Animal Type:

By Distribution Channel:

Joint and mobility supplements maintain market leadership through consistent demand from aging pet populations and preventive care adoption. Glucosamine-based formulations dominate this category, with innovative combinations including hyaluronic acid and natural anti-inflammatory ingredients gaining market traction. Clinical evidence supporting efficacy drives veterinary recommendations and consumer confidence in these products.

Digestive health supplements represent the fastest-growing category, driven by increased understanding of the gut-health connection and rising incidence of digestive issues in pets. Probiotic formulations lead category growth with 15.2% annual growth rates, while prebiotic and enzyme products provide complementary benefits for comprehensive digestive support.

Skin and coat supplements benefit from visible results that reinforce consumer satisfaction and repeat purchases. Omega-3 fatty acid products dominate this category, with fish oil and algae-based alternatives addressing diverse consumer preferences for sustainable and allergen-free options.

Immune system supplements gained significant momentum following increased health awareness trends, with antioxidant-rich formulations and vitamin combinations supporting overall pet wellness. Natural ingredient preferences drive product development in this category, with botanical extracts and organic formulations commanding premium pricing.

Cognitive and behavioral supplements address growing concerns about senior pet care and anxiety management, representing a specialized but rapidly expanding market segment with significant growth potential as pet populations age.

Industry participants in the United States pet veterinary supplement market realize substantial benefits through participation in this growing sector, including revenue diversification, customer loyalty development, and professional service enhancement opportunities. Veterinary practitioners benefit from expanded service offerings that support preventive care models and strengthen client relationships through comprehensive pet health management.

Manufacturers enjoy several key advantages:

Retailers and distributors benefit from high-margin product categories with strong consumer demand and low return rates. Customer loyalty in the supplement category translates to increased basket sizes and repeat visits, supporting overall business performance.

Pet owners realize significant value through improved pet health outcomes, potentially reduced veterinary costs through preventive care, and enhanced quality of life for their companion animals. Long-term benefits include extended pet lifespans and reduced age-related health complications.

Stakeholder alignment creates positive feedback loops where veterinary recommendations drive consumer adoption, leading to improved pet health outcomes that reinforce professional confidence in supplement efficacy and continued market growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the United States pet veterinary supplement market reflect evolving consumer preferences, technological advancement, and scientific understanding of animal nutrition. Natural and organic ingredients have gained substantial momentum, with pet owners increasingly seeking clean-label products free from artificial additives and synthetic compounds.

Personalization trends are revolutionizing product development and marketing approaches, with companies leveraging genetic testing, health monitoring data, and individual pet profiles to create customized supplement regimens. Precision nutrition represents the next frontier in pet supplementation, offering targeted solutions based on breed-specific needs, life stage requirements, and health condition management.

Sustainability considerations influence purchasing decisions, with environmentally conscious pet owners preferring products with sustainable sourcing, eco-friendly packaging, and minimal environmental impact. Plant-based alternatives to traditional animal-derived ingredients address both sustainability concerns and dietary restrictions.

Technology integration enhances product delivery and customer engagement through smart packaging, mobile apps, and connected devices that monitor pet health and supplement compliance. Telemedicine platforms create new opportunities for veterinary consultation and supplement recommendation services.

Functional food concepts blur the lines between nutrition and supplementation, with treats and foods incorporating therapeutic ingredients for convenient daily administration. Combination products addressing multiple health concerns simultaneously gain popularity among consumers seeking simplified supplement regimens.

Recent industry developments demonstrate the dynamic nature of the United States pet veterinary supplement market, with significant investments in research, technology, and market expansion initiatives driving sector evolution. Merger and acquisition activity has intensified as companies seek to expand product portfolios, enhance distribution capabilities, and achieve economies of scale in competitive markets.

Regulatory developments include updated FDA guidance on supplement manufacturing standards and labeling requirements, creating more stringent quality control expectations while providing clearer compliance pathways for manufacturers. State-level regulations continue to evolve, with some jurisdictions implementing additional oversight measures for pet supplement safety and efficacy claims.

Innovation breakthroughs in delivery systems include time-release formulations, improved palatability solutions, and novel ingredient combinations that enhance bioavailability and therapeutic effectiveness. Clinical research initiatives by leading manufacturers provide scientific validation for product claims and support veterinary adoption of evidence-based supplementation protocols.

Partnership developments between supplement manufacturers and veterinary clinic chains create integrated healthcare solutions that combine professional services with nutritional support products. Technology partnerships with pet health monitoring companies enable data-driven supplement recommendations and personalized nutrition solutions.

Market expansion initiatives include new product launches targeting underserved pet health categories and geographic expansion into previously untapped regional markets with growing pet populations and increasing healthcare awareness.

Strategic recommendations for stakeholders in the United States pet veterinary supplement market emphasize the importance of scientific validation, veterinary partnership development, and consumer education initiatives to maintain competitive positioning and drive sustainable growth. MWR analysis indicates that companies investing in clinical research and evidence-based product development demonstrate superior market performance and customer retention rates.

Product development strategies should focus on addressing unmet needs in specific pet health categories while leveraging natural ingredients and sustainable sourcing practices that align with consumer preferences. Innovation priorities include personalized nutrition solutions, improved delivery systems, and combination products that simplify supplement regimens for pet owners.

Distribution strategy optimization requires balanced approaches that maintain strong veterinary relationships while expanding direct-to-consumer and e-commerce capabilities. Omnichannel integration enables companies to reach diverse consumer segments while providing consistent brand experiences across multiple touchpoints.

Marketing investments should prioritize veterinary education programs, consumer awareness campaigns, and digital engagement strategies that build brand trust and product understanding. Content marketing focusing on pet health education and supplement benefits creates value for consumers while supporting purchase decisions.

Quality assurance and regulatory compliance must remain top priorities as market oversight continues to evolve and consumer expectations for product safety and efficacy increase. Transparency initiatives including ingredient sourcing disclosure and manufacturing process information build consumer confidence and brand differentiation.

Future market projections for the United States pet veterinary supplement sector indicate continued robust growth driven by demographic trends, technological advancement, and evolving consumer attitudes toward preventive pet healthcare. Long-term growth prospects remain highly favorable, with market expansion expected to maintain strong double-digit growth rates over the next decade as pet ownership continues to increase and supplement adoption becomes more mainstream.

Technological integration will reshape market dynamics through personalized nutrition platforms, artificial intelligence-driven health monitoring, and precision supplementation protocols tailored to individual pet needs. Digital transformation of veterinary practices will create new opportunities for supplement integration and professional recommendation systems.

Product innovation will focus on advanced delivery systems, novel ingredient combinations, and therapeutic formulations that address emerging pet health challenges. Functional ingredients with proven clinical benefits will drive premium product development and market differentiation strategies.

Market consolidation is expected to continue as larger companies acquire specialized manufacturers and innovative brands to expand product portfolios and market reach. Strategic partnerships between supplement companies, veterinary organizations, and technology platforms will create integrated healthcare ecosystems for comprehensive pet wellness management.

Regulatory evolution will likely result in more standardized quality requirements and efficacy standards, potentially creating barriers for smaller manufacturers while strengthening consumer confidence in established brands. International expansion opportunities will grow as American companies leverage their expertise and quality reputation to enter global markets with increasing pet healthcare awareness.

The United States pet veterinary supplement market represents a dynamic and rapidly expanding sector within the broader animal healthcare industry, characterized by strong growth fundamentals, increasing consumer adoption, and continuous innovation in product development and delivery systems. Market evolution reflects the deepening bond between pet owners and their companion animals, driving demand for premium healthcare solutions that support longevity, quality of life, and preventive wellness management.

Key success factors in this market include scientific validation of product efficacy, strong veterinary partnerships, and consumer education initiatives that build trust and understanding of supplement benefits. Companies positioned for long-term success demonstrate commitment to quality, innovation, and evidence-based product development while maintaining flexibility to adapt to evolving consumer preferences and regulatory requirements.

Future opportunities in personalized nutrition, technology integration, and specialized therapeutic formulations present significant growth potential for industry participants willing to invest in research, development, and market education. MarkWide Research projects continued market expansion driven by demographic trends, increasing pet healthcare awareness, and advancing nutritional science that validates the role of supplementation in comprehensive veterinary care protocols.

The market outlook remains highly favorable for stakeholders across the value chain, from manufacturers and distributors to veterinary professionals and pet owners, as the industry continues to mature and expand its role in supporting the health and wellness of America’s beloved companion animals.

What is Pet Veterinary Supplement?

Pet veterinary supplements are products designed to support the health and well-being of pets, including vitamins, minerals, and herbal remedies that address various health issues and enhance overall vitality.

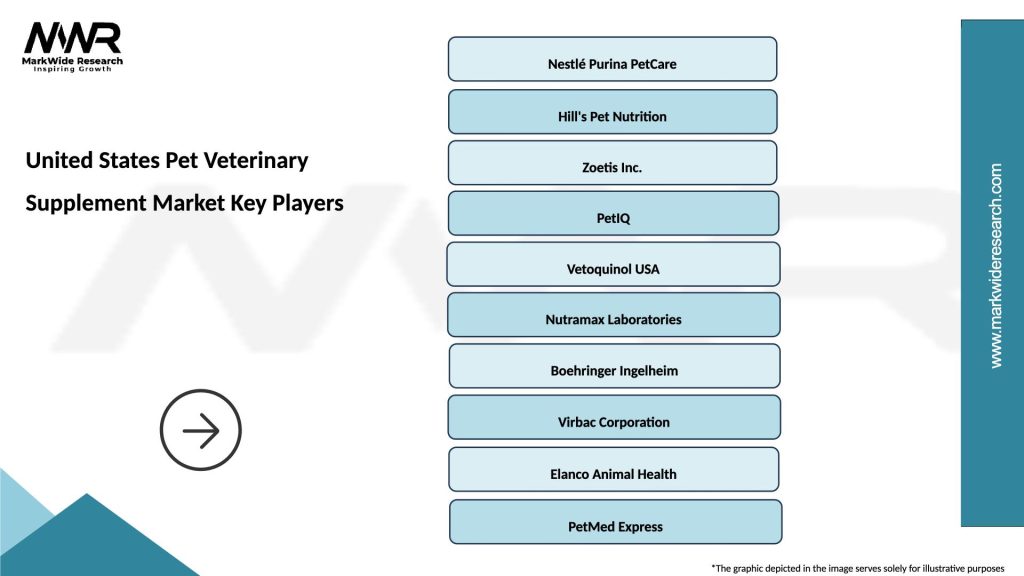

What are the key players in the United States Pet Veterinary Supplement Market?

Key players in the United States Pet Veterinary Supplement Market include companies like Nutramax Laboratories, Vetoquinol, and Pet Naturals of Vermont, among others.

What are the main drivers of growth in the United States Pet Veterinary Supplement Market?

The growth of the United States Pet Veterinary Supplement Market is driven by increasing pet ownership, rising awareness of pet health, and a growing trend towards preventive healthcare for pets.

What challenges does the United States Pet Veterinary Supplement Market face?

Challenges in the United States Pet Veterinary Supplement Market include regulatory hurdles, competition from unregulated products, and the need for scientific validation of supplement efficacy.

What opportunities exist in the United States Pet Veterinary Supplement Market?

Opportunities in the United States Pet Veterinary Supplement Market include the development of innovative formulations, expansion into e-commerce channels, and increasing demand for natural and organic supplements.

What trends are shaping the United States Pet Veterinary Supplement Market?

Trends in the United States Pet Veterinary Supplement Market include a rise in personalized pet nutrition, the use of technology for product development, and a growing focus on holistic pet care solutions.

United States Pet Veterinary Supplement Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Probiotics, Omega Fatty Acids |

| Delivery Mode | Chewable Tablets, Powders, Liquids, Capsules |

| End User | Pet Owners, Veterinary Clinics, Animal Shelters, Pet Retailers |

| Packaging Type | Bottles, Pouches, Tubs, Sachets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Pet Veterinary Supplement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at