444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States payment market represents one of the most dynamic and rapidly evolving financial ecosystems globally, characterized by unprecedented innovation and technological advancement. This comprehensive landscape encompasses traditional payment methods alongside cutting-edge digital solutions, creating a complex yet highly efficient infrastructure that processes billions of transactions annually. Digital transformation has fundamentally reshaped consumer behavior and merchant preferences, driving adoption rates that exceed 78% for contactless payments among urban consumers.

Market dynamics indicate substantial growth momentum across multiple payment channels, with mobile payment adoption experiencing remarkable acceleration. The integration of artificial intelligence, blockchain technology, and advanced security protocols has enhanced transaction processing capabilities while maintaining robust fraud prevention measures. Financial institutions and fintech companies continue to collaborate extensively, fostering an environment where traditional banking services merge seamlessly with innovative payment solutions.

Consumer preferences have shifted dramatically toward convenience-driven payment options, with real-time processing and seamless user experiences becoming fundamental expectations rather than premium features. This transformation has created significant opportunities for payment service providers, technology companies, and financial institutions to capture market share through strategic innovation and customer-centric solutions.

The United States payment market refers to the comprehensive ecosystem of financial transaction processing systems, technologies, and services that facilitate the exchange of monetary value between consumers, businesses, and financial institutions across the country. This market encompasses traditional payment methods including cash, checks, and credit cards, alongside modern digital solutions such as mobile wallets, contactless payments, peer-to-peer transfers, and cryptocurrency transactions.

Payment processing infrastructure includes the networks, platforms, and technologies that enable secure transaction authorization, clearing, and settlement processes. The market involves multiple stakeholders including banks, credit unions, payment processors, fintech companies, technology providers, and regulatory bodies that collectively ensure efficient and secure monetary exchanges throughout the economy.

Digital payment solutions have become increasingly sophisticated, incorporating advanced technologies like near-field communication, biometric authentication, and artificial intelligence to enhance security and user experience while reducing transaction friction and processing times.

Strategic analysis reveals that the United States payment market has undergone transformational changes driven by technological innovation, changing consumer behaviors, and regulatory evolution. The market demonstrates robust growth potential with digital payment adoption rates reaching 85% among millennials and continuing to expand across demographic segments.

Key market drivers include the proliferation of smartphone technology, increasing e-commerce penetration, demand for contactless payment solutions, and the growing importance of financial inclusion initiatives. Payment service providers have responded by developing comprehensive solutions that address diverse consumer needs while maintaining stringent security standards and regulatory compliance.

Competitive landscape features established financial institutions competing alongside innovative fintech startups, creating a dynamic environment that fosters continuous innovation and service enhancement. The market benefits from strong regulatory frameworks that promote fair competition while ensuring consumer protection and systemic stability.

Future growth prospects remain exceptionally positive, supported by ongoing digital transformation initiatives, increasing merchant acceptance of alternative payment methods, and the continued evolution of consumer payment preferences toward more convenient and secure solutions.

Market intelligence indicates several critical trends shaping the United States payment landscape:

Technology integration continues to drive market evolution, with artificial intelligence and machine learning enhancing fraud detection capabilities while improving transaction processing efficiency and customer experience across all payment channels.

Primary growth catalysts propelling the United States payment market include technological advancement, changing consumer expectations, and evolving business requirements. The widespread adoption of smartphones and mobile internet connectivity has created unprecedented opportunities for digital payment solution deployment across diverse market segments.

E-commerce expansion continues to drive demand for secure, efficient online payment processing capabilities. Businesses require comprehensive payment solutions that support multiple payment methods while providing seamless integration with existing systems and platforms. This demand has accelerated innovation in payment gateway technologies and merchant services.

Consumer convenience preferences have fundamentally shifted toward frictionless payment experiences that minimize transaction time and complexity. The expectation for instant payment processing, transparent fee structures, and enhanced security features has become standard across all demographic segments, driving continuous innovation in payment technology development.

Regulatory support for financial innovation has created favorable conditions for new payment solution development and deployment. Government initiatives promoting financial inclusion and digital payment adoption have further accelerated market growth while ensuring appropriate consumer protection measures remain in place.

Business efficiency requirements have increased demand for integrated payment solutions that streamline operations, reduce processing costs, and provide comprehensive transaction analytics and reporting capabilities for improved financial management and decision-making processes.

Significant challenges facing the United States payment market include cybersecurity concerns, regulatory compliance complexity, and infrastructure limitations that can impede rapid innovation deployment. Security breaches and fraud incidents continue to create consumer hesitancy regarding new payment technologies, particularly among older demographic segments.

Regulatory compliance requirements impose substantial costs and operational complexity on payment service providers, particularly smaller fintech companies that may lack extensive compliance infrastructure. The need to navigate multiple regulatory frameworks while maintaining innovation momentum creates ongoing challenges for market participants.

Technology integration difficulties can limit the adoption of new payment solutions, especially among traditional merchants and financial institutions with legacy systems. The cost and complexity of system upgrades often delay the implementation of advanced payment technologies, creating market fragmentation and inconsistent user experiences.

Consumer education needs remain significant, as many potential users lack understanding of new payment technologies and their benefits. This knowledge gap can slow adoption rates and limit market penetration for innovative payment solutions, particularly in underserved communities and among older consumers.

Interoperability challenges between different payment systems and platforms can create friction in the user experience and limit the effectiveness of payment solutions. The lack of standardization across payment networks can complicate merchant adoption and consumer usage patterns.

Emerging opportunities within the United States payment market present substantial growth potential for innovative companies and established financial institutions. The increasing demand for personalized financial services creates opportunities for payment providers to develop customized solutions that address specific consumer and business needs.

Financial inclusion initiatives offer significant market expansion possibilities, particularly in underserved communities where traditional banking services may be limited. Payment companies can develop solutions that provide essential financial services to unbanked and underbanked populations, creating new revenue streams while addressing social needs.

Small business market penetration represents a substantial opportunity as entrepreneurs and small merchants increasingly seek affordable, comprehensive payment processing solutions. The development of tailored payment packages for small businesses can drive market growth while supporting economic development across diverse communities.

Integration with emerging technologies such as Internet of Things devices, artificial intelligence, and blockchain presents opportunities for creating next-generation payment solutions that offer enhanced functionality, security, and user experience. These technological convergences can create entirely new payment use cases and market segments.

Cross-industry partnerships enable payment companies to expand their reach and capabilities by collaborating with retailers, healthcare providers, transportation companies, and other service sectors to create integrated payment experiences that add value for both businesses and consumers.

Complex market forces shape the United States payment landscape through the interaction of technological innovation, regulatory evolution, competitive pressures, and changing consumer behaviors. These dynamics create both challenges and opportunities for market participants across all segments of the payment ecosystem.

Technological disruption continues to accelerate market evolution, with new payment technologies emerging regularly and existing solutions undergoing continuous enhancement. The pace of innovation requires market participants to maintain agility and adaptability while investing in research and development to remain competitive.

Competitive intensity has increased significantly as traditional financial institutions face competition from fintech startups, technology companies, and alternative payment providers. This competition drives innovation and service improvement while potentially compressing profit margins and requiring strategic differentiation.

Consumer behavior evolution influences market dynamics through changing preferences for payment methods, security expectations, and service requirements. Payment providers must continuously adapt their offerings to meet evolving consumer needs while anticipating future trends and preferences.

Regulatory landscape changes impact market dynamics by introducing new compliance requirements, enabling new business models, and affecting competitive positioning. Market participants must navigate regulatory complexity while leveraging regulatory opportunities to enhance their market position and service capabilities.

Comprehensive research approach employed for analyzing the United States payment market incorporates multiple data collection and analysis methodologies to ensure accuracy, reliability, and depth of insights. Primary research activities include extensive interviews with industry executives, payment service providers, financial institutions, and technology companies to gather firsthand market intelligence.

Secondary research components involve detailed analysis of industry reports, regulatory filings, company financial statements, and market data from authoritative sources. This approach provides comprehensive market understanding while validating primary research findings through multiple data sources and analytical perspectives.

Quantitative analysis techniques include statistical modeling, trend analysis, and market sizing methodologies that provide precise insights into market dynamics, growth patterns, and competitive positioning. These analytical approaches ensure that market assessments are based on robust data foundations and sound analytical principles.

Qualitative research methods incorporate focus groups, expert interviews, and case study analysis to understand market nuances, consumer preferences, and industry trends that quantitative data alone cannot capture. This mixed-method approach provides comprehensive market understanding and strategic insights.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review, and analytical consistency checks. These quality assurance measures maintain high standards of research reliability and support confident decision-making by market participants and stakeholders.

Geographic market distribution across the United States reveals significant variations in payment adoption patterns, technology preferences, and growth opportunities. The Northeast region demonstrates high adoption rates for advanced payment technologies, with urban centers leading in mobile payment usage and contactless transaction volumes.

Western states show strong innovation adoption, particularly in California where technology companies drive payment solution development and consumer acceptance. The region accounts for approximately 32% of digital payment transaction volume nationally, reflecting high technology penetration and consumer sophistication.

Southern markets present substantial growth opportunities as traditional payment preferences gradually shift toward digital solutions. Rural areas within this region show increasing adoption of mobile payment technologies, driven by improved internet infrastructure and smartphone penetration rates.

Midwest regions demonstrate steady growth in payment technology adoption, with particular strength in business-to-business payment solutions and agricultural sector applications. The region shows 18% annual growth in digital payment adoption among small and medium-sized businesses.

Urban versus rural dynamics create distinct market segments with different needs, preferences, and growth patterns. Urban areas typically lead in adoption of new payment technologies, while rural markets often require different solution approaches that address connectivity and infrastructure considerations.

Market competition in the United States payment sector features diverse participants ranging from established financial institutions to innovative fintech startups. The competitive environment fosters continuous innovation while creating opportunities for strategic partnerships and market consolidation.

Leading market participants include:

Competitive strategies focus on technology innovation, customer experience enhancement, security improvement, and market expansion through strategic partnerships and acquisitions. Companies differentiate through specialized service offerings, pricing models, and integration capabilities.

Market segmentation analysis reveals distinct categories based on payment method, end-user type, transaction value, and technology platform. Each segment demonstrates unique characteristics, growth patterns, and competitive dynamics that influence overall market development.

By Payment Method:

By End-User Type:

Digital payment categories demonstrate varying growth trajectories and adoption patterns across different market segments. Mobile payment solutions show the strongest growth momentum, driven by smartphone penetration and consumer preference for convenient payment options.

Contactless payment adoption has accelerated significantly, particularly following health and safety concerns that increased demand for touch-free transaction methods. This category shows 45% year-over-year growth in transaction volume across retail and food service sectors.

Peer-to-peer payment services have gained substantial market traction among younger consumers who value instant money transfer capabilities and social payment features. These solutions have become essential tools for personal financial management and social commerce activities.

Business payment solutions continue evolving to address complex enterprise requirements including multi-currency support, automated reconciliation, and integrated accounting capabilities. According to MarkWide Research analysis, business payment adoption rates have increased 28% annually as companies seek operational efficiency improvements.

Cryptocurrency payment integration represents an emerging category with growing merchant acceptance and consumer interest. While still representing a small market share, this category shows potential for significant expansion as regulatory clarity improves and technology matures.

Financial institutions benefit from payment market participation through diversified revenue streams, enhanced customer relationships, and improved operational efficiency. Digital payment solutions enable banks and credit unions to reduce processing costs while offering competitive services that attract and retain customers.

Merchants and retailers gain significant advantages through advanced payment processing capabilities including faster transaction settlement, reduced cash handling costs, improved security, and enhanced customer experience. Payment technology integration can increase sales conversion rates and customer satisfaction levels.

Technology companies find substantial opportunities in payment market participation through platform development, security solution provision, and integration services. The growing demand for payment innovation creates continuous opportunities for technology advancement and market expansion.

Consumers benefit from payment market evolution through increased convenience, enhanced security, improved transaction speed, and expanded payment options. Digital payment solutions provide better financial management tools and more flexible payment timing and methods.

Regulatory bodies benefit from market development through improved transaction transparency, enhanced fraud detection capabilities, and better financial system oversight. Digital payment systems provide more comprehensive data for regulatory monitoring and economic analysis.

Strengths:

Weaknesses:

Opportunities:

Threats:

Dominant market trends shaping the United States payment landscape include the acceleration of contactless payment adoption, integration of artificial intelligence in fraud detection, and the emergence of embedded finance solutions. These trends reflect fundamental shifts in consumer behavior and technology capabilities.

Real-time payment systems are gaining significant momentum as consumers and businesses demand instant transaction processing capabilities. The Federal Reserve’s FedNow service and similar initiatives are driving market-wide adoption of immediate payment settlement, transforming expectations for transaction speed and efficiency.

Biometric authentication integration represents a critical trend toward enhanced security and user experience. Payment providers are incorporating fingerprint, facial recognition, and voice authentication technologies to reduce fraud while simplifying the payment process for consumers.

Buy Now, Pay Later services have experienced explosive growth, particularly among younger consumers seeking flexible payment options. This trend has created new market segments and competitive dynamics while raising questions about credit risk management and regulatory oversight.

Cryptocurrency mainstream adoption continues advancing as major payment processors and financial institutions integrate digital currency capabilities. This trend reflects growing consumer interest and merchant acceptance of alternative payment methods beyond traditional fiat currencies.

Recent industry developments demonstrate the rapid pace of innovation and market evolution within the United States payment sector. Major financial institutions have announced significant investments in payment technology infrastructure, reflecting the strategic importance of maintaining competitive payment capabilities.

Regulatory developments include updated guidance on digital payment security standards, cryptocurrency regulation clarification, and enhanced consumer protection measures. These regulatory changes provide greater certainty for market participants while ensuring appropriate safeguards for consumers and the financial system.

Technology partnerships between traditional financial institutions and fintech companies have accelerated, creating hybrid solutions that combine established infrastructure with innovative capabilities. These collaborations enable rapid deployment of new payment features while leveraging existing customer relationships and regulatory compliance.

Merchant acceptance expansion for alternative payment methods has reached new milestones, with major retailers and service providers implementing comprehensive payment option suites. This development reflects growing consumer demand for payment flexibility and merchant recognition of competitive advantages from payment innovation.

International payment corridor improvements have enhanced cross-border transaction efficiency and reduced costs for both consumers and businesses. These developments support global commerce growth while addressing long-standing pain points in international money transfers.

Strategic recommendations for payment market participants emphasize the importance of customer-centric innovation, security investment, and strategic partnership development. Companies should prioritize user experience enhancement while maintaining robust security standards and regulatory compliance.

Technology investment priorities should focus on artificial intelligence integration, real-time processing capabilities, and advanced security measures. MWR analysis suggests that companies investing in these areas demonstrate superior market performance and customer satisfaction rates.

Market expansion strategies should consider underserved segments including small businesses, rural communities, and specific demographic groups that may benefit from tailored payment solutions. These market segments offer substantial growth opportunities while supporting broader financial inclusion objectives.

Partnership development remains crucial for market success, particularly collaborations that combine complementary capabilities and market access. Strategic alliances can accelerate innovation deployment while reducing development costs and market entry barriers.

Regulatory engagement should be proactive and collaborative, helping shape policy development while ensuring compliance with evolving requirements. Companies that effectively navigate regulatory complexity while contributing to policy discussions often achieve competitive advantages and market leadership positions.

Long-term market prospects for the United States payment sector remain exceptionally positive, driven by continued technological advancement, evolving consumer preferences, and expanding digital commerce. The market is expected to maintain robust growth momentum with digital payment adoption rates projected to reach 92% of adult consumers within the next five years.

Technology evolution will continue driving market transformation through artificial intelligence integration, quantum computing applications, and advanced biometric authentication systems. These technological advances will enhance security, improve user experience, and create new payment use cases across various industries and applications.

Regulatory landscape development is expected to provide greater clarity and standardization while maintaining innovation-friendly policies. Future regulations will likely focus on consumer protection, financial stability, and fair competition while enabling continued market growth and technological advancement.

Market consolidation trends may accelerate as companies seek scale advantages and comprehensive service capabilities. Strategic mergers and acquisitions will likely reshape competitive dynamics while creating opportunities for specialized service providers and innovative technology companies.

Global integration opportunities will expand as international payment corridors become more efficient and cost-effective. United States payment companies are well-positioned to capitalize on global market opportunities while serving domestic market needs through advanced technology platforms and service capabilities.

The United States payment market represents a dynamic and rapidly evolving ecosystem that continues to transform through technological innovation, changing consumer behaviors, and regulatory development. Market participants benefit from strong growth momentum, diverse opportunities, and a competitive environment that fosters continuous improvement and innovation.

Strategic success factors include customer-centric innovation, robust security implementation, regulatory compliance excellence, and strategic partnership development. Companies that effectively balance these priorities while maintaining operational efficiency and market responsiveness are positioned for sustained growth and market leadership.

Future market development will be shaped by emerging technologies, evolving consumer expectations, and continued regulatory evolution. The integration of artificial intelligence, blockchain technology, and advanced security measures will create new opportunities while addressing existing market challenges and limitations.

Market participants should maintain focus on innovation, security, and customer experience while preparing for continued market evolution and competitive intensity. The United States payment market offers substantial opportunities for companies that can effectively navigate complexity while delivering value to consumers, merchants, and financial institutions across the comprehensive payment ecosystem.

What is Payment?

Payment refers to the transfer of money or value from one party to another, often facilitated through various methods such as cash, credit cards, digital wallets, and bank transfers. In the context of the United States Payment Market, it encompasses a wide range of financial transactions and technologies.

What are the key players in the United States Payment Market?

Key players in the United States Payment Market include companies like PayPal, Square, Visa, and Mastercard, which provide various payment processing solutions and technologies. These companies are instrumental in shaping the payment landscape through innovations and partnerships, among others.

What are the growth factors driving the United States Payment Market?

The United States Payment Market is driven by factors such as the increasing adoption of digital payment solutions, the rise of e-commerce, and consumer demand for convenience and speed in transactions. Additionally, advancements in technology, such as contactless payments and mobile wallets, are contributing to market growth.

What challenges does the United States Payment Market face?

Challenges in the United States Payment Market include concerns over cybersecurity and fraud, regulatory compliance issues, and the need for interoperability among different payment systems. These factors can hinder the seamless experience that consumers and businesses expect.

What opportunities exist in the United States Payment Market?

Opportunities in the United States Payment Market include the expansion of fintech solutions, the integration of blockchain technology for secure transactions, and the growing demand for personalized payment experiences. These trends present avenues for innovation and growth in the sector.

What trends are shaping the United States Payment Market?

Trends shaping the United States Payment Market include the increasing use of mobile payments, the rise of subscription-based services, and the growing emphasis on contactless transactions. Additionally, the integration of artificial intelligence in fraud detection and customer service is becoming more prevalent.

United States Payment Market

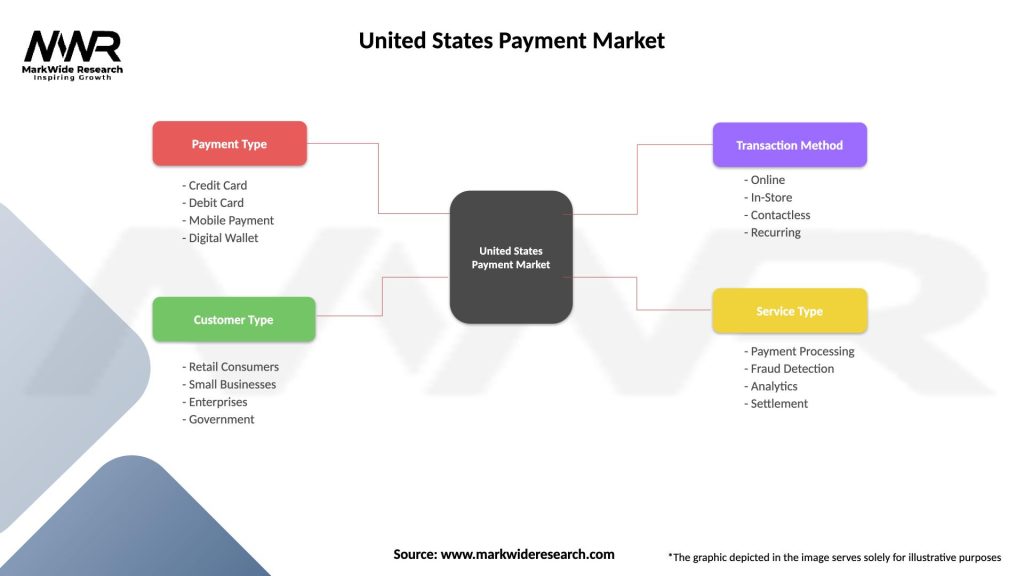

| Segmentation Details | Description |

|---|---|

| Payment Type | Credit Card, Debit Card, Mobile Payment, Digital Wallet |

| Customer Type | Retail Consumers, Small Businesses, Enterprises, Government |

| Transaction Method | Online, In-Store, Contactless, Recurring |

| Service Type | Payment Processing, Fraud Detection, Analytics, Settlement |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Payment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at