444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States OOH and DOOH market represents a dynamic and rapidly evolving segment of the advertising industry, encompassing both traditional out-of-home advertising and cutting-edge digital out-of-home solutions. Market dynamics indicate substantial growth potential as advertisers increasingly recognize the effectiveness of location-based advertising in reaching consumers during their daily journeys. The integration of digital technologies has transformed traditional billboard advertising into sophisticated, data-driven marketing platforms capable of delivering targeted, contextually relevant content.

Digital transformation continues to reshape the landscape, with digital out-of-home advertising experiencing remarkable adoption rates of 78% among major advertisers seeking enhanced engagement capabilities. The convergence of programmatic advertising, real-time data analytics, and advanced display technologies has created unprecedented opportunities for brands to connect with consumers in high-traffic locations across urban and suburban markets.

Geographic distribution shows concentrated activity in major metropolitan areas, with 65% of advertising inventory located in the top 25 markets. This concentration reflects the strategic importance of population density and consumer traffic patterns in determining advertising effectiveness and return on investment for brands across various industry sectors.

The United States OOH and DOOH market refers to the comprehensive ecosystem of advertising platforms and technologies that deliver promotional content to consumers outside their homes through both traditional static displays and advanced digital installations. This market encompasses billboard advertising, transit advertising, street furniture displays, digital signage networks, and interactive advertising platforms strategically positioned in high-visibility locations.

Out-of-home advertising traditionally includes static billboards, posters, and transit advertisements, while digital out-of-home (DOOH) represents the technological evolution featuring LED displays, LCD screens, interactive kiosks, and programmatically enabled advertising networks. The integration of these platforms creates a unified advertising ecosystem capable of delivering measurable, targeted campaigns across diverse consumer touchpoints.

Technology integration enables real-time content updates, audience measurement, and programmatic buying capabilities that distinguish modern DOOH from traditional advertising formats. This technological foundation supports data-driven decision making and enhanced campaign optimization for advertisers seeking maximum impact and engagement.

Market evolution demonstrates the transformation of traditional outdoor advertising into a sophisticated, technology-enabled industry segment characterized by increasing digitization and programmatic capabilities. The convergence of location-based targeting, real-time analytics, and creative flexibility has positioned OOH and DOOH as essential components of integrated marketing strategies for brands across multiple industry verticals.

Growth trajectories indicate robust expansion driven by urbanization trends, increased consumer mobility, and advertiser demand for measurable, contextually relevant advertising solutions. Digital adoption rates continue accelerating, with 82% of new installations featuring digital capabilities and programmatic integration. This shift reflects advertiser preferences for flexible, data-driven campaigns capable of delivering personalized content based on location, time, and audience demographics.

Investment patterns show sustained capital allocation toward infrastructure development, technology upgrades, and network expansion across key metropolitan markets. The industry’s focus on measurement capabilities, audience verification, and programmatic integration has attracted significant advertiser interest and budget reallocation from traditional media channels toward location-based advertising solutions.

Strategic positioning reveals several critical factors driving market development and advertiser adoption across the United States OOH and DOOH landscape:

Urbanization trends continue driving demand for strategic advertising placements in high-density metropolitan areas where consumer traffic patterns create optimal exposure opportunities. The concentration of population growth in major cities has increased the value of premium advertising locations, particularly those featuring advanced digital capabilities and programmatic integration.

Consumer mobility patterns have evolved significantly, with increased commuting times and diverse transportation options creating extended exposure windows for out-of-home advertising. The average consumer spends 4.2 hours daily outside their home environment, representing substantial opportunities for brand engagement through strategically positioned advertising displays.

Technology advancement enables sophisticated targeting capabilities previously unavailable in traditional outdoor advertising. Real-time data integration, weather-responsive content, and audience measurement technologies have transformed static displays into dynamic, responsive advertising platforms capable of delivering personalized experiences based on contextual factors.

Advertiser demand for measurable, accountable advertising solutions has accelerated adoption of digital out-of-home platforms offering comprehensive analytics and attribution modeling. Brands increasingly require detailed performance metrics and audience verification to justify advertising investments and optimize campaign effectiveness across multiple touchpoints.

Infrastructure limitations present significant challenges for market expansion, particularly in secondary and tertiary markets where installation costs and regulatory complexities may limit deployment opportunities. The substantial capital requirements for digital display installation and ongoing maintenance can create barriers for smaller operators and limit network density in emerging markets.

Regulatory complexities vary significantly across municipal jurisdictions, creating compliance challenges for operators seeking to expand their networks. Zoning restrictions, permit requirements, and aesthetic guidelines can substantially impact installation timelines and operational flexibility, particularly for digital displays in historic or residential areas.

Competition intensity from digital advertising platforms and streaming services has increased pressure on traditional advertising budgets. Advertisers face numerous channel options for reaching target audiences, requiring OOH and DOOH providers to demonstrate clear value propositions and measurable performance advantages over alternative media investments.

Economic sensitivity affects advertising spending patterns during economic uncertainty, with outdoor advertising often experiencing budget reductions during recessionary periods. The cyclical nature of advertising expenditure can impact long-term infrastructure investments and network expansion plans across various market segments.

Programmatic advertising represents substantial growth potential as automated buying platforms become more sophisticated and widely adopted. The integration of real-time bidding, audience data, and creative optimization technologies creates opportunities for increased advertiser participation and campaign efficiency improvements across digital out-of-home networks.

Smart city initiatives offer collaborative opportunities for infrastructure development and technology integration. Municipal partnerships for digital signage, information displays, and interactive kiosks can create revenue-sharing models while providing valuable public services and enhancing urban communication capabilities.

Retail integration presents expanding opportunities for location-based advertising within shopping centers, retail environments, and point-of-sale locations. The convergence of digital signage and retail technology enables sophisticated targeting based on purchase behavior, demographic profiles, and real-time inventory considerations.

Transportation networks continue expanding across major metropolitan areas, creating new advertising inventory opportunities within transit systems, airports, and mobility hubs. The captive audience environment and extended exposure times in transportation settings provide premium advertising opportunities for brands seeking engaged consumer attention.

Technology convergence drives fundamental changes in how outdoor advertising operates and delivers value to advertisers. The integration of artificial intelligence, machine learning, and real-time data analytics enables sophisticated campaign optimization and audience targeting previously impossible with traditional static displays. These technological capabilities have increased advertiser confidence and budget allocation toward digital out-of-home platforms.

Competitive landscape evolution shows consolidation among major operators while creating opportunities for specialized technology providers and niche market participants. The industry structure balances large-scale network operators with innovative technology companies developing advanced display solutions, measurement platforms, and programmatic capabilities.

Consumer behavior shifts toward mobile integration and digital engagement have created expectations for interactive, responsive advertising experiences. Modern consumers expect seamless connectivity between outdoor advertising and their mobile devices, driving demand for QR codes, NFC technology, and augmented reality integration within DOOH campaigns.

Measurement standardization efforts across the industry have improved advertiser confidence through consistent metrics and verification processes. Industry organizations continue developing comprehensive measurement frameworks that provide comparable data across different operators and geographic markets, facilitating more informed advertising investment decisions.

Comprehensive analysis of the United States OOH and DOOH market incorporates multiple research approaches including primary industry interviews, secondary data analysis, and market observation studies. The methodology encompasses quantitative assessment of market trends, competitive positioning, and technology adoption patterns across diverse geographic and demographic segments.

Primary research includes structured interviews with industry executives, advertising agency professionals, technology providers, and municipal officials involved in outdoor advertising regulation and planning. These interviews provide qualitative insights into market dynamics, competitive strategies, and future development priorities across the ecosystem.

Secondary research encompasses analysis of industry reports, regulatory filings, technology patents, and academic studies related to outdoor advertising effectiveness and consumer behavior patterns. This research foundation supports quantitative analysis and trend identification across multiple market dimensions and time periods.

Market observation includes systematic monitoring of advertising installations, technology deployments, and campaign implementations across major metropolitan markets. This observational research provides real-world validation of reported trends and identifies emerging patterns in advertiser behavior and technology adoption.

Northeast region maintains the highest concentration of premium advertising inventory, with 28% of total market share concentrated in major metropolitan areas including New York, Boston, and Philadelphia. The region’s dense urban environment, extensive public transportation networks, and high consumer traffic volumes create optimal conditions for both traditional and digital out-of-home advertising deployment.

West Coast markets demonstrate the highest adoption rates for advanced digital technologies and programmatic advertising capabilities. California, Washington, and Oregon lead in innovative display technologies and interactive advertising experiences, with 85% of new installations featuring advanced digital capabilities and real-time content management systems.

Southeast expansion shows robust growth potential driven by population migration, urban development, and increased transportation infrastructure investment. Markets including Atlanta, Miami, and Charlotte are experiencing accelerated network expansion and technology upgrades as operators respond to growing advertiser demand and consumer traffic patterns.

Midwest markets present balanced opportunities combining traditional outdoor advertising strength with emerging digital adoption. Cities like Chicago, Detroit, and Minneapolis maintain substantial traditional billboard networks while gradually incorporating digital technologies and programmatic capabilities to meet evolving advertiser requirements.

Market leadership is distributed among several major operators with distinct geographic strengths and technology capabilities:

Technology providers play increasingly important roles in market development through advanced display solutions, content management platforms, and programmatic advertising technologies. Companies specializing in LED displays, interactive technologies, and audience measurement systems contribute essential capabilities supporting industry digitization and advertiser adoption.

Competitive differentiation focuses on location quality, technology capabilities, measurement accuracy, and programmatic integration. Operators compete through premium inventory acquisition, advanced display technologies, comprehensive analytics platforms, and strategic partnerships with advertising agencies and technology providers.

By Format:

By Technology:

By Application:

Digital billboard segment demonstrates the strongest growth trajectory with 92% of major advertisers incorporating digital displays into their outdoor advertising strategies. The flexibility of real-time content updates, dayparting capabilities, and creative rotation options provide substantial advantages over traditional static displays, driving continued investment and network expansion.

Transit advertising benefits from increasing public transportation usage and extended consumer exposure times in captive environments. Airport advertising particularly shows premium pricing power and advertiser demand due to affluent audience demographics and extended dwell times during travel experiences.

Interactive technologies represent the fastest-growing segment as advertisers seek engagement beyond traditional display advertising. Augmented reality integration, mobile connectivity, and touch-screen capabilities create immersive brand experiences that generate measurable consumer interaction and enhanced campaign effectiveness.

Programmatic buying continues expanding across all format categories, with 67% of digital inventory now available through automated purchasing platforms. This capability enables more efficient campaign management, real-time optimization, and improved targeting accuracy for advertisers seeking data-driven outdoor advertising solutions.

Advertisers benefit from enhanced targeting capabilities, measurable campaign performance, and flexible content management options that traditional advertising channels cannot provide. The combination of location-based targeting and real-time analytics enables sophisticated campaign optimization and improved return on advertising investment across diverse market segments.

Media operators gain revenue optimization opportunities through programmatic selling, premium inventory positioning, and technology-enabled operational efficiencies. Digital displays command higher advertising rates while reducing production and installation costs associated with traditional static advertising campaigns.

Technology providers find expanding market opportunities as operators invest in advanced display systems, content management platforms, and audience measurement technologies. The industry’s digital transformation creates sustained demand for innovative solutions supporting campaign effectiveness and operational efficiency.

Consumers experience more relevant, timely advertising content that provides useful information and entertainment value. Interactive technologies and location-based messaging create positive brand interactions while reducing advertising clutter through targeted, contextually appropriate content delivery.

Strengths:

Weaknesses:

Opportunities:

Threats:

Programmatic automation continues transforming how outdoor advertising is bought, sold, and optimized. Real-time bidding platforms enable advertisers to purchase specific time slots, locations, and audience segments with unprecedented precision and efficiency. This trend reduces transaction costs while improving campaign targeting and performance measurement capabilities.

Interactive experiences are becoming standard expectations as consumers seek engagement beyond passive advertising exposure. Touch screens, augmented reality integration, and mobile connectivity create immersive brand interactions that generate measurable engagement metrics and enhanced consumer recall compared to traditional display advertising.

Sustainability initiatives drive adoption of energy-efficient display technologies and environmentally conscious installation practices. Solar-powered displays, LED technology upgrades, and recyclable materials address environmental concerns while reducing operational costs and supporting corporate sustainability objectives.

Data integration enables sophisticated audience analysis combining location intelligence, demographic profiling, and behavioral insights. According to MarkWide Research analysis, this trend supports more effective campaign targeting and provides advertisers with comprehensive performance attribution across multiple touchpoints and consumer journey stages.

Technology partnerships between traditional outdoor advertising operators and digital platform providers are accelerating innovation and capability development. These collaborations combine location-based inventory with advanced targeting technologies, creating comprehensive advertising solutions that compete effectively with digital-only platforms.

Measurement standardization efforts across the industry have produced consistent metrics and verification processes that improve advertiser confidence and facilitate campaign comparison across different operators and markets. Industry organizations continue developing comprehensive frameworks supporting transparent, accountable advertising investment decisions.

Regulatory evolution in major metropolitan areas has created more favorable environments for digital display deployment while maintaining aesthetic and safety standards. Updated zoning regulations and streamlined permit processes support network expansion and technology upgrades across key advertising markets.

Investment activity shows sustained capital allocation toward infrastructure modernization, technology integration, and strategic market expansion. Private equity and strategic investors continue supporting industry consolidation and capability development as operators position for long-term growth and competitive advantage.

Strategic positioning recommendations emphasize the importance of technology investment and programmatic capability development for operators seeking sustainable competitive advantages. Companies should prioritize digital infrastructure upgrades, measurement platform integration, and automated buying system compatibility to meet evolving advertiser requirements and market expectations.

Market expansion strategies should focus on high-growth metropolitan areas with favorable regulatory environments and strong advertiser demand. Secondary market opportunities exist for operators willing to invest in digital technology and programmatic capabilities that differentiate their offerings from traditional outdoor advertising alternatives.

Partnership development with technology providers, advertising agencies, and municipal authorities can create synergistic opportunities for network expansion, capability enhancement, and revenue optimization. Collaborative approaches enable resource sharing and risk mitigation while accelerating market development and competitive positioning.

Innovation investment in interactive technologies, audience measurement systems, and creative capabilities will determine long-term market success as advertisers increasingly demand engagement beyond traditional display advertising. Companies should allocate resources toward emerging technologies that enhance consumer interaction and campaign effectiveness measurement.

Growth projections indicate continued expansion driven by urbanization trends, technology advancement, and advertiser demand for measurable, location-based advertising solutions. MWR data suggests the industry will experience sustained development as digital adoption accelerates and programmatic capabilities become standard across major metropolitan markets.

Technology evolution will continue transforming outdoor advertising through artificial intelligence integration, advanced analytics, and enhanced interactive capabilities. The convergence of 5G connectivity, edge computing, and real-time data processing will enable more sophisticated targeting and personalization than currently possible with existing technology platforms.

Market consolidation trends suggest continued industry structure evolution as operators seek scale advantages and technology capabilities through strategic acquisitions and partnerships. This consolidation will likely create more efficient operations while maintaining competitive dynamics that benefit advertisers through innovation and service improvement.

Regulatory development will continue adapting to digital advertising realities while balancing community aesthetic concerns, privacy protection, and commercial interests. Future regulations will likely provide clearer frameworks for digital display deployment while addressing emerging issues related to data collection and consumer privacy protection.

Market transformation of the United States OOH and DOOH industry reflects broader advertising industry evolution toward data-driven, measurable, and technologically sophisticated marketing solutions. The successful integration of digital technologies, programmatic capabilities, and advanced measurement systems has positioned outdoor advertising as a competitive alternative to traditional and digital media channels.

Strategic opportunities exist for industry participants willing to invest in technology infrastructure, measurement capabilities, and innovative advertising formats that meet evolving advertiser requirements. The combination of location-based targeting, real-time optimization, and interactive engagement creates unique value propositions that differentiate outdoor advertising from alternative media investments.

Future success will depend on continued innovation, strategic partnerships, and operational excellence as the industry navigates technological advancement, regulatory evolution, and competitive pressures. Companies that successfully balance traditional outdoor advertising strengths with emerging digital capabilities will capture the greatest opportunities in this dynamic and evolving market landscape.

What is OOH and DOOH?

OOH, or Out-Of-Home advertising, refers to any advertising that reaches the consumer while they are outside their home. DOOH, or Digital Out-Of-Home, incorporates digital screens and technology to deliver dynamic advertising content in public spaces.

What are the key players in the United States OOH And DOOH Market?

Key players in the United States OOH And DOOH Market include companies like Clear Channel Outdoor, Lamar Advertising, and Outfront Media, which dominate the traditional and digital advertising landscapes, among others.

What are the growth factors driving the United States OOH And DOOH Market?

The growth of the United States OOH And DOOH Market is driven by increased urbanization, the rise of mobile technology, and the effectiveness of targeted advertising strategies that engage consumers in real-time.

What challenges does the United States OOH And DOOH Market face?

The United States OOH And DOOH Market faces challenges such as regulatory restrictions, competition from digital media, and the need for continuous technological advancements to keep pace with consumer expectations.

What opportunities exist in the United States OOH And DOOH Market?

Opportunities in the United States OOH And DOOH Market include the integration of augmented reality, the expansion of programmatic advertising, and the potential for enhanced audience measurement techniques to improve campaign effectiveness.

What trends are shaping the United States OOH And DOOH Market?

Trends shaping the United States OOH And DOOH Market include the increasing use of data analytics for targeted advertising, the growth of interactive and immersive advertising experiences, and the shift towards sustainable advertising practices.

United States OOH And DOOH Market

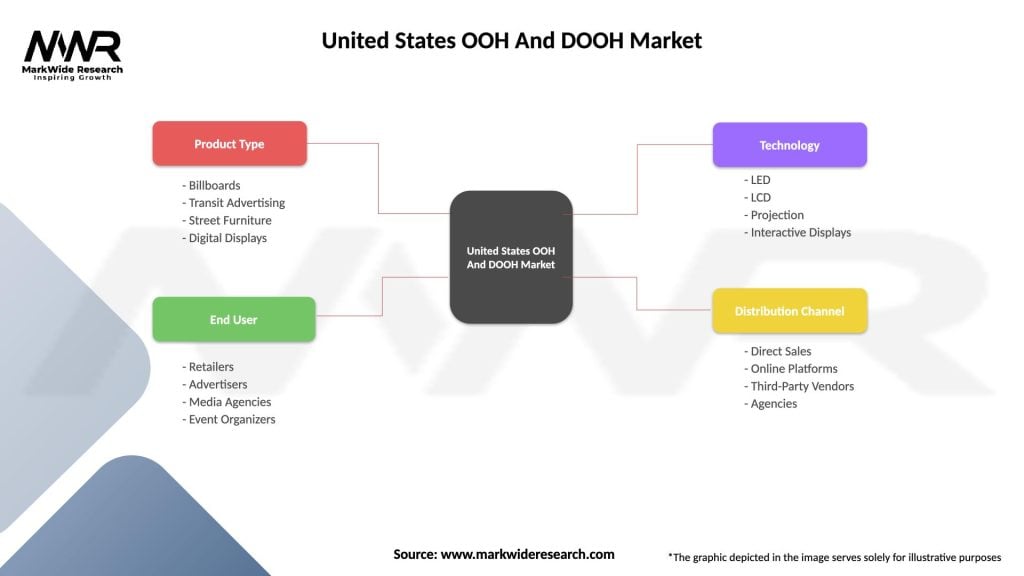

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Advertising, Street Furniture, Digital Displays |

| End User | Retailers, Advertisers, Media Agencies, Event Organizers |

| Technology | LED, LCD, Projection, Interactive Displays |

| Distribution Channel | Direct Sales, Online Platforms, Third-Party Vendors, Agencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States OOH And DOOH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at