444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States oil and gas pipeline maintenance, repair, overhaul (MRO) market represents a critical infrastructure sector that ensures the safe, efficient, and continuous operation of the nation’s extensive pipeline network. With over 2.6 million miles of pipelines transporting crude oil, refined petroleum products, and natural gas across the country, the MRO market plays an essential role in maintaining energy security and operational reliability.

Market dynamics indicate robust growth driven by aging infrastructure, stringent regulatory requirements, and increasing demand for energy transportation. The sector encompasses comprehensive maintenance services, emergency repair operations, and scheduled overhaul activities that keep pipeline systems operating at optimal performance levels. Industry analysis reveals that pipeline operators are investing heavily in preventive maintenance programs to minimize unplanned downtime and ensure compliance with federal safety standards.

Technological advancement is reshaping the MRO landscape, with smart inspection technologies, predictive maintenance solutions, and advanced materials driving operational efficiency improvements of approximately 25-30%. The market benefits from the critical nature of pipeline infrastructure, creating consistent demand for specialized MRO services regardless of economic fluctuations.

Regional distribution shows concentrated activity in major oil and gas producing states, including Texas, North Dakota, Pennsylvania, and Oklahoma, where pipeline density and operational intensity drive substantial MRO requirements. The market’s growth trajectory reflects the ongoing need to maintain and upgrade aging pipeline infrastructure while supporting expanding energy production and distribution networks.

The United States oil and gas pipeline MRO market refers to the comprehensive ecosystem of services, technologies, and solutions dedicated to maintaining, repairing, and overhauling pipeline infrastructure used for transporting crude oil, refined petroleum products, and natural gas. This market encompasses preventive maintenance programs, corrective repair services, scheduled overhaul operations, and emergency response capabilities that ensure pipeline systems operate safely and efficiently throughout their operational lifecycle.

MRO activities include routine inspections, corrosion management, valve maintenance, pump servicing, leak detection and repair, pipeline integrity assessments, and major overhaul projects. The market serves pipeline operators, midstream companies, utilities, and energy infrastructure owners who require specialized expertise to maintain compliance with regulatory standards while optimizing operational performance and minimizing environmental risks.

Strategic analysis of the United States oil and gas pipeline MRO market reveals a mature yet dynamic sector characterized by steady demand growth, technological innovation, and evolving regulatory requirements. The market benefits from the critical nature of pipeline infrastructure, which requires continuous maintenance to ensure safe and reliable energy transportation across the nation.

Key market drivers include aging pipeline infrastructure, with approximately 40% of the nation’s pipeline network exceeding 40 years of age, stringent federal safety regulations, and increasing energy production volumes requiring enhanced transportation capacity. The sector demonstrates resilience through economic cycles due to the essential nature of maintenance activities and regulatory compliance requirements.

Technological transformation is driving market evolution, with digital inspection technologies, predictive maintenance solutions, and advanced materials enabling more efficient and effective MRO operations. According to MarkWide Research analysis, the integration of smart technologies is improving maintenance efficiency by 20-25% while reducing operational costs and enhancing safety outcomes.

Market segmentation reveals diverse service categories including preventive maintenance, corrective repairs, emergency response, and major overhaul projects, each serving specific operational needs and regulatory requirements. The competitive landscape features specialized MRO service providers, integrated energy services companies, and technology solution vendors working collaboratively to support pipeline operators.

Market intelligence reveals several critical insights shaping the United States oil and gas pipeline MRO sector:

Infrastructure aging serves as the primary driver for the United States oil and gas pipeline MRO market, with a significant portion of the nation’s pipeline network approaching or exceeding design life expectations. This aging infrastructure requires increasingly frequent maintenance interventions, component replacements, and system upgrades to maintain operational integrity and safety standards.

Regulatory requirements create mandatory demand for MRO services through federal safety standards, environmental protection regulations, and state-level compliance mandates. The Pipeline and Hazardous Materials Safety Administration (PHMSA) regulations require regular inspections, maintenance documentation, and corrective actions that drive consistent market demand regardless of economic conditions.

Energy production growth in key regions, particularly from shale oil and gas development, increases pipeline utilization rates and accelerates wear patterns, requiring more frequent maintenance interventions. Higher throughput volumes and operating pressures place additional stress on pipeline systems, driving demand for specialized MRO services.

Safety and environmental concerns motivate pipeline operators to invest in comprehensive maintenance programs that prevent incidents, minimize environmental risks, and protect public safety. High-profile pipeline incidents have increased regulatory scrutiny and public awareness, driving investment in preventive maintenance and advanced monitoring technologies.

Technological advancement enables more effective and efficient MRO operations while creating new service opportunities. Smart inspection technologies, predictive maintenance solutions, and advanced materials allow service providers to offer enhanced value propositions that improve operational outcomes while reducing long-term costs.

High operational costs associated with specialized MRO services can limit market growth, particularly for smaller pipeline operators with constrained budgets. Advanced inspection technologies, specialized equipment, and certified personnel require significant investments that may challenge cost-sensitive operators.

Skilled labor shortages in specialized technical fields constrain market expansion, as MRO operations require experienced technicians, certified welders, and specialized engineers. The aging workforce and limited training programs create ongoing challenges for service providers seeking to expand capacity.

Regulatory complexity can create operational challenges and compliance costs that impact market dynamics. Evolving regulations, varying state requirements, and complex permitting processes can delay projects and increase operational complexity for MRO service providers.

Access limitations to pipeline infrastructure in remote or environmentally sensitive areas can complicate maintenance operations and increase service costs. Geographic challenges, weather constraints, and environmental restrictions may limit the timing and scope of maintenance activities.

Technology integration challenges may slow adoption of advanced MRO solutions, particularly among traditional operators with established procedures and legacy systems. Integration complexity, training requirements, and change management considerations can delay technology deployment and limit market growth potential.

Digital transformation presents significant opportunities for MRO service providers to develop innovative solutions that improve operational efficiency, reduce costs, and enhance safety outcomes. Integration of IoT sensors, artificial intelligence, and machine learning technologies creates new service models and value propositions.

Predictive maintenance solutions offer substantial market opportunities by enabling operators to optimize maintenance scheduling, reduce unplanned downtime, and extend asset lifecycles. Advanced analytics and condition monitoring technologies allow service providers to offer outcome-based service contracts and performance guarantees.

Environmental compliance requirements create growing demand for specialized services including leak detection and repair (LDAR) programs, emissions monitoring, and environmental remediation services. Increasing environmental regulations and corporate sustainability commitments drive investment in these specialized service areas.

Infrastructure modernization projects provide opportunities for comprehensive MRO service packages that combine traditional maintenance with system upgrades and technology integration. Pipeline operators seeking to improve efficiency and reliability create demand for integrated service solutions.

Emergency response services represent a high-value market opportunity, as pipeline operators require rapid response capabilities for incident management and system restoration. Specialized emergency response teams and equipment provide premium service opportunities with strong profit margins.

Supply chain dynamics in the United States oil and gas pipeline MRO market reflect the complex interplay between service providers, equipment manufacturers, technology vendors, and pipeline operators. The market operates through established relationships and long-term service contracts that provide stability while enabling innovation and service improvement.

Competitive dynamics feature a mix of large integrated service companies, specialized MRO contractors, and regional service providers competing on technical expertise, service quality, and cost effectiveness. Market consolidation trends are creating larger service organizations with enhanced capabilities and geographic reach.

Pricing dynamics reflect the specialized nature of MRO services, with premium pricing for emergency response, specialized technical expertise, and advanced technology solutions. Long-term service contracts provide pricing stability while spot market services command higher rates during peak demand periods.

Innovation dynamics drive continuous improvement in service delivery methods, inspection technologies, and maintenance techniques. Collaboration between service providers, technology vendors, and pipeline operators accelerates innovation adoption and market evolution, with efficiency improvements reaching 15-20% annually in leading organizations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United States oil and gas pipeline MRO market. Primary research includes extensive interviews with industry executives, service providers, technology vendors, and pipeline operators to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, regulatory filings, company financial statements, and technical publications to validate primary findings and provide comprehensive market context. Government data sources, including PHMSA statistics and energy production data, provide authoritative baseline information for market sizing and trend analysis.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. Quantitative analysis focuses on market trends, growth patterns, and segment performance while qualitative analysis explores market dynamics, competitive positioning, and strategic implications.

Market modeling techniques incorporate historical data, current market conditions, and forward-looking indicators to develop reliable market projections and trend analysis. The methodology emphasizes practical insights that support strategic decision-making for market participants and stakeholders.

Texas region dominates the United States oil and gas pipeline MRO market, accounting for approximately 30% of national activity due to extensive pipeline infrastructure, major refining centers, and significant energy production volumes. The state’s complex pipeline network, including major interstate systems and gathering networks, creates substantial demand for comprehensive MRO services.

Gulf Coast region represents another major market concentration, with Louisiana, Mississippi, and Alabama hosting critical pipeline infrastructure connecting offshore production, refining centers, and distribution networks. The region’s petrochemical industry and export facilities drive demand for specialized MRO services and emergency response capabilities.

Midwest region shows strong MRO activity centered on major pipeline hubs in Oklahoma, Kansas, and Illinois, where extensive pipeline networks converge to transport crude oil and refined products to major markets. The region’s aging infrastructure and high utilization rates create consistent demand for maintenance and upgrade services.

Northeast region demonstrates growing MRO demand driven by natural gas pipeline expansion, aging infrastructure, and stringent environmental regulations. Pennsylvania, New York, and surrounding states require specialized services for both traditional pipeline systems and new infrastructure supporting shale gas development.

Western region shows concentrated activity in California and Colorado, where environmental regulations, seismic considerations, and challenging terrain create demand for specialized MRO expertise and advanced technology solutions.

Market leadership in the United States oil and gas pipeline MRO sector features several categories of service providers, each offering distinct capabilities and market positioning:

Competitive differentiation focuses on technical expertise, service quality, response capabilities, safety performance, and technology integration. Leading companies invest in advanced equipment, certified personnel, and innovative service delivery methods to maintain competitive advantages in this specialized market.

By Service Type:

By Pipeline Type:

By Technology:

Preventive Maintenance Services represent the largest market segment, driven by regulatory requirements and operator preferences for proactive maintenance approaches. This category benefits from predictable demand patterns and long-term service contracts, with growth rates of approximately 6-8% annually as operators expand preventive programs.

Emergency Response Services command premium pricing due to the critical nature of rapid incident response and specialized expertise requirements. This high-value segment serves pipeline operators requiring immediate response capabilities for system failures, leaks, and other critical incidents.

Integrity Management Services show strong growth driven by regulatory requirements and operator focus on system reliability. Advanced inspection technologies and data analytics enable service providers to offer comprehensive integrity assessment and management programs that optimize maintenance scheduling and extend asset lifecycles.

Technology-Enabled Services represent the fastest-growing segment, with digital solutions and smart technologies transforming traditional MRO approaches. Predictive maintenance, condition monitoring, and data analytics create new service opportunities and improve operational outcomes for pipeline operators.

Specialized Repair Services address complex technical challenges requiring specialized expertise, equipment, and materials. This segment includes hot tapping, composite repairs, and other advanced repair techniques that enable operators to maintain system integrity while minimizing operational disruptions.

Pipeline Operators benefit from comprehensive MRO services that ensure system reliability, regulatory compliance, and operational efficiency. Professional MRO services reduce operational risks, extend asset lifecycles, and optimize maintenance costs while maintaining safety standards and environmental compliance.

Service Providers gain access to a stable market with consistent demand driven by regulatory requirements and infrastructure needs. The specialized nature of pipeline MRO creates barriers to entry and enables premium pricing for technical expertise and specialized capabilities.

Technology Vendors find opportunities to develop and deploy innovative solutions that improve MRO effectiveness and efficiency. The market’s focus on safety, reliability, and cost optimization drives demand for advanced inspection technologies, predictive maintenance solutions, and digital platforms.

Regulatory Agencies benefit from improved pipeline safety and environmental protection through professional MRO services that ensure compliance with federal and state regulations. Comprehensive maintenance programs reduce incident risks and support regulatory objectives for pipeline safety.

Communities and Environment gain protection through professional MRO services that prevent pipeline incidents, minimize environmental risks, and ensure safe energy transportation. Proper maintenance reduces the likelihood of leaks, spills, and other incidents that could impact local communities and ecosystems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Integration represents a transformative trend reshaping the United States oil and gas pipeline MRO market, with operators and service providers adopting IoT sensors, artificial intelligence, and machine learning technologies to optimize maintenance operations. This digital transformation enables predictive maintenance approaches that reduce costs and improve reliability.

Predictive Maintenance adoption accelerates as operators recognize the benefits of condition-based maintenance over traditional scheduled approaches. Advanced analytics and monitoring technologies enable service providers to predict equipment failures and optimize maintenance timing, reducing unplanned downtime by approximately 25-30%.

Environmental Compliance requirements drive demand for specialized services including leak detection and repair programs, emissions monitoring, and environmental remediation capabilities. Increasing regulatory focus on environmental protection creates new service opportunities and drives investment in advanced monitoring technologies.

Workforce Development initiatives address skilled labor shortages through training programs, apprenticeships, and technology solutions that augment human capabilities. Service providers invest in workforce development to ensure adequate technical expertise for complex MRO operations.

Service Integration trends show operators preferring comprehensive service packages that combine multiple MRO capabilities under single contracts. This integration reduces complexity, improves coordination, and enables service providers to offer enhanced value propositions through coordinated service delivery.

Technology Advancement continues driving industry evolution, with new inspection technologies, robotic systems, and advanced materials improving MRO effectiveness and efficiency. Recent developments include drone-based inspection systems, AI-powered defect detection, and composite repair materials that extend asset lifecycles.

Regulatory Evolution shapes market dynamics through updated safety standards, environmental requirements, and compliance mandates. Recent regulatory developments emphasize pipeline integrity management, environmental protection, and incident prevention, driving demand for specialized MRO services.

Market Consolidation trends show larger service companies acquiring specialized providers to expand capabilities and geographic reach. This consolidation creates more comprehensive service organizations while maintaining specialized expertise in critical technical areas.

Partnership Development between service providers, technology vendors, and pipeline operators accelerates innovation adoption and service improvement. Collaborative relationships enable faster deployment of new technologies and more effective service delivery models.

Investment Growth in MRO capabilities reflects operator recognition of maintenance importance for system reliability and regulatory compliance. MWR analysis indicates that MRO investment levels are increasing by 8-10% annually as operators prioritize infrastructure maintenance and upgrade programs.

Technology Investment recommendations emphasize the importance of adopting digital solutions and predictive maintenance technologies to remain competitive in the evolving MRO market. Service providers should invest in IoT platforms, data analytics capabilities, and mobile technologies that improve service delivery and customer value.

Workforce Development strategies should focus on training and retaining skilled technical personnel while leveraging technology to augment human capabilities. Companies should invest in apprenticeship programs, continuing education, and technology training to address skilled labor shortages.

Service Diversification opportunities exist in environmental compliance, emergency response, and specialized technical services that command premium pricing. Service providers should evaluate expansion into high-value service segments that leverage existing capabilities and customer relationships.

Geographic Expansion strategies should target regions with growing pipeline infrastructure and increasing MRO demand. Companies should consider strategic partnerships, acquisitions, or organic expansion to access new markets and customer bases.

Customer Partnership development should focus on long-term relationships and integrated service delivery that provides enhanced value to pipeline operators. Service providers should develop outcome-based contracts and performance guarantees that align interests and demonstrate value creation.

Market growth projections for the United States oil and gas pipeline MRO market indicate continued expansion driven by aging infrastructure, regulatory requirements, and technology advancement. The market is expected to maintain steady growth rates of 5-7% annually over the next decade as infrastructure maintenance needs increase and service capabilities expand.

Technology transformation will continue reshaping the market, with digital solutions, artificial intelligence, and advanced materials becoming standard components of MRO service delivery. According to MarkWide Research projections, technology-enabled services will represent 40-45% of market activity within the next five years.

Regulatory evolution will drive continued demand for specialized MRO services, with increasing focus on environmental protection, safety performance, and system integrity. New regulations and updated standards will create additional service requirements and drive investment in advanced capabilities.

Market consolidation trends are expected to continue, creating larger, more capable service organizations while maintaining specialized expertise in critical technical areas. This consolidation will improve service quality and expand geographic coverage while creating economies of scale.

Innovation acceleration will drive continuous improvement in service delivery methods, inspection technologies, and maintenance techniques. Collaboration between service providers, technology vendors, and operators will accelerate innovation adoption and market evolution, creating new opportunities for growth and differentiation.

The United States oil and gas pipeline MRO market represents a critical and resilient sector that ensures the safe, reliable operation of the nation’s energy transportation infrastructure. With aging pipeline networks, stringent regulatory requirements, and advancing technology solutions, the market demonstrates strong fundamentals and consistent growth potential.

Key success factors include technical expertise, service quality, technology integration, and strong customer relationships that enable service providers to deliver value while maintaining competitive positioning. The market’s essential nature creates stability while innovation opportunities drive continued evolution and improvement.

Strategic opportunities exist in digital transformation, predictive maintenance, environmental compliance, and integrated service delivery that address evolving customer needs and market requirements. Companies that invest in technology, workforce development, and customer partnerships will be best positioned for long-term success in this dynamic market.

The future outlook remains positive, with steady demand growth, technology advancement, and expanding service opportunities creating a favorable environment for market participants and stakeholders committed to supporting America’s critical energy infrastructure through professional MRO services.

What is Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO)?

Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) refers to the processes and activities involved in ensuring the operational efficiency and safety of oil and gas pipelines. This includes routine maintenance, emergency repairs, and upgrades to pipeline systems to prevent leaks and failures.

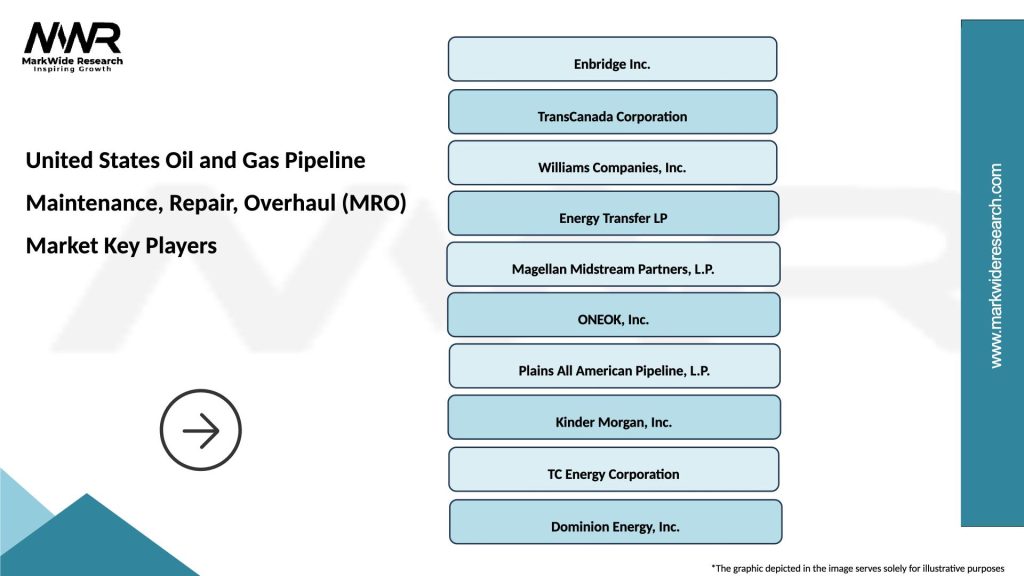

Who are the key players in the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market?

Key players in the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market include companies like Enbridge, Kinder Morgan, and TransCanada, which provide various MRO services for pipeline infrastructure, among others.

What are the main drivers of the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market?

The main drivers of the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market include the increasing demand for energy, the aging infrastructure of existing pipelines, and regulatory requirements for safety and environmental protection.

What challenges does the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market face?

Challenges in the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market include the high costs associated with maintenance activities, the complexity of regulatory compliance, and the potential for environmental impacts during repair operations.

What opportunities exist in the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market?

Opportunities in the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market include advancements in technology for pipeline monitoring and inspection, increased investment in infrastructure upgrades, and the growing focus on sustainability practices.

What trends are shaping the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market?

Trends shaping the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market include the adoption of digital technologies for predictive maintenance, the integration of automation in repair processes, and a heightened emphasis on safety and environmental stewardship.

United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market

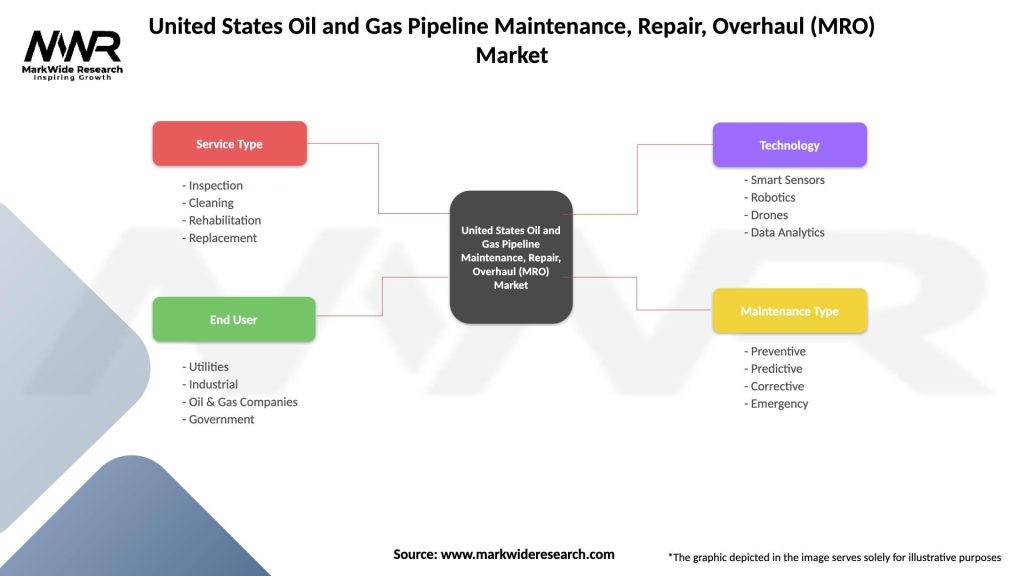

| Segmentation Details | Description |

|---|---|

| Service Type | Inspection, Cleaning, Rehabilitation, Replacement |

| End User | Utilities, Industrial, Oil & Gas Companies, Government |

| Technology | Smart Sensors, Robotics, Drones, Data Analytics |

| Maintenance Type | Preventive, Predictive, Corrective, Emergency |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Oil and Gas Pipeline Maintenance, Repair, Overhaul (MRO) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at