444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United States oil and gas midstream market stands as a critical infrastructure network that facilitates the efficient transportation, processing, and storage of crude oil and natural gas. It plays an indispensable role in connecting oil and gas producers with end-users, ensuring a steady supply of energy resources to power industries and households. From pipelines that traverse vast distances to processing facilities that extract value from raw resources, the midstream sector is the unsung hero of the energy landscape.

Meaning

The United States oil and gas midstream market encompasses a complex web of pipelines, storage tanks, terminals, processing plants, and distribution networks. It serves as the middle link in the energy value chain, bridging the gap between upstream exploration and downstream distribution. This sector not only ensures the reliable flow of energy resources but also contributes significantly to the nation’s economic growth and energy security.

Executive Summary

The United States oil and gas midstream market is a linchpin of the nation’s energy ecosystem, ensuring the smooth transition of crude oil and natural gas from production sites to refineries and end-users. This report delves into the key insights, market dynamics, technological advancements, and regulatory influences that shape the midstream sector. As the backbone of energy logistics, the midstream market is a cornerstone of sustainable development and energy independence.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the United States Oil and Gas Midstream Market:

Surge in Domestic Oil and Gas Production: The U.S. has become one of the world’s leading oil and gas producers, largely due to advancements in hydraulic fracturing (fracking) and horizontal drilling. The growth in shale oil and gas production is a key driver for the midstream market as more infrastructure is needed to transport and store these resources.

Increased Demand for Natural Gas: Natural gas has become a key source of energy in the U.S. and globally. The shift toward cleaner energy sources, both in power generation and industrial applications, is driving the demand for midstream services, especially natural gas pipelines and LNG terminals.

Growth of LNG Exports: The U.S. has become a major exporter of LNG, with terminals along the Gulf Coast and other regions supporting this growth. Midstream infrastructure plays a crucial role in LNG export facilities, boosting demand for LNG storage and transportation services.

Infrastructure Development: With the growing need for efficient and secure transportation of oil, gas, and refined products, investments in new pipelines, storage terminals, and processing facilities are driving the market. Key areas of investment include pipeline expansion, compressor stations, and liquefaction plants.

Energy Security and Strategic Reserves: The U.S. government’s efforts to enhance energy security through the strategic petroleum reserve and by building more robust transportation infrastructure also support the growth of the midstream market.

Market Restraints

Despite its growth prospects, the U.S. Oil and Gas Midstream Market faces several challenges:

Environmental and Safety Regulations: The midstream industry is subject to stringent environmental regulations related to pipeline safety, emissions, and spill prevention. Compliance with these regulations can be costly and time-consuming for midstream companies.

Fluctuating Oil and Gas Prices: The volatile nature of oil and gas prices can impact investment decisions in the midstream sector. Lower commodity prices may lead to reduced production, which could, in turn, reduce the demand for transportation and storage infrastructure.

Land Acquisition and Permitting Issues: The development of new pipelines and storage facilities can be delayed due to land acquisition challenges and the lengthy permitting process. Local opposition to pipeline construction, particularly in sensitive environmental areas, can further complicate projects.

Competition from Alternative Energy Sources: As renewable energy sources, such as solar and wind, gain traction, there may be a reduced demand for fossil fuel-based energy in the long term, which could impact the growth of midstream infrastructure in the U.S. over time.

Market Opportunities

The U.S. Oil and Gas Midstream Market presents numerous opportunities for growth:

Pipeline Expansion and Upgrades: There is a growing need for pipeline expansion, especially in high-production areas like the Permian Basin. Investments in new pipelines and the upgrade of existing infrastructure will be key to accommodating the increasing demand for transportation services.

LNG Export Infrastructure: As the global demand for LNG continues to rise, particularly from Asian and European markets, there are significant opportunities for U.S. companies to expand LNG export facilities, invest in storage infrastructure, and optimize transportation networks to meet this demand.

Technological Innovations: The adoption of digital technologies, such as automated pipeline monitoring systems, predictive maintenance, and data analytics, can improve efficiency, reduce costs, and enhance safety in the midstream sector. Companies that leverage these technologies stand to benefit from increased operational efficiency.

Renewable Energy Integration: With the growing push for cleaner energy, midstream companies that can integrate renewable energy projects, such as biogas production and hydrogen infrastructure, may have a competitive advantage in the long term.

Market Dynamics

The U.S. Oil and Gas Midstream Market is shaped by several dynamics:

Technological Advancements: The integration of advanced technologies in pipeline monitoring, safety, and predictive analytics is transforming the midstream industry. Technologies such as drone surveillance, AI, and real-time data analytics are improving the safety and efficiency of oil and gas transportation and storage.

Geopolitical Factors: Geopolitical instability, both domestically and internationally, can impact the supply and demand for oil and gas. Trade policies and global energy trends can significantly affect midstream investments, especially in the context of LNG exports.

Environmental Concerns: The growing focus on reducing carbon emissions and mitigating climate change has led to stricter regulations for the oil and gas industry. Midstream companies must adapt to these evolving environmental standards by adopting cleaner, safer technologies.

Private Sector Investments: Private equity firms and institutional investors are increasingly funding midstream infrastructure projects due to the stable, long-term returns they offer. This growing private sector interest is helping to accelerate the development of new pipelines, storage terminals, and other key infrastructure.

Regional Analysis

The U.S. Oil and Gas Midstream Market is dominated by several key regions:

Gulf Coast: The Gulf Coast region is a critical hub for oil and gas production, refining, and transportation. With numerous LNG terminals, refineries, and oil pipelines, the Gulf Coast remains a central player in the U.S. midstream market.

Permian Basin: As one of the largest oil and gas-producing regions in the U.S., the Permian Basin has become a focal point for midstream investments. The increasing demand for pipelines and transportation services in this region is fueling growth.

Appalachian Basin: This region, primarily known for its natural gas production, is seeing increased investments in midstream infrastructure to facilitate the transportation and processing of natural gas.

Midwest: The Midwest is home to several key pipelines, storage facilities, and processing plants, with growing demand for crude oil and refined products being transported to markets in the U.S. and abroad.

Competitive Landscape

Leading Companies in the United States Oil and Gas Midstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

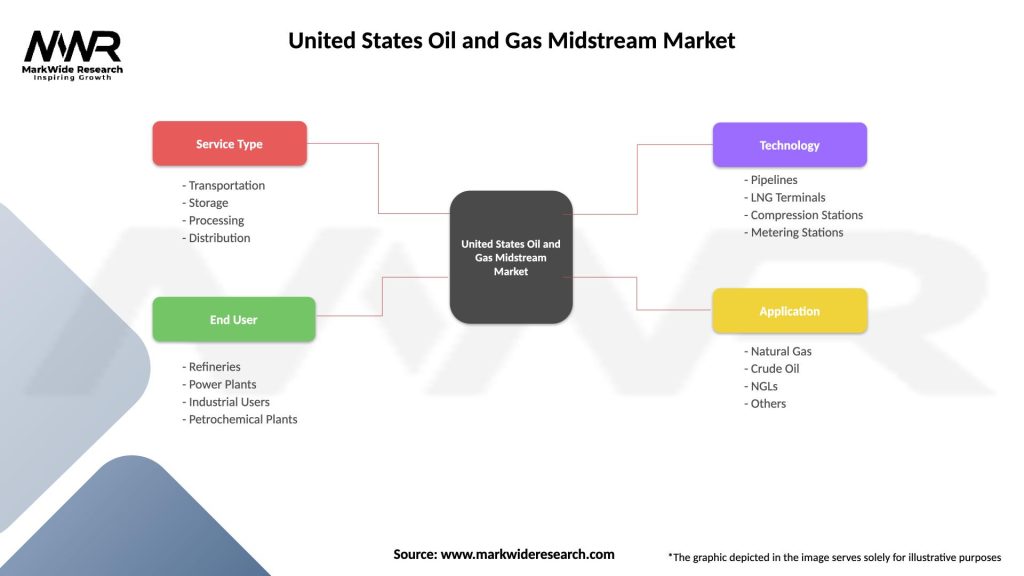

Segmentation

The U.S. Oil and Gas Midstream Market can be segmented based on the following:

By Service Type: Transportation, Storage, Processing, and Others.

By Product Type: Crude Oil, Natural Gas, Refined Products, LNG.

By Region: Gulf Coast, Permian Basin, Appalachian Basin, Midwest, Others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The U.S. Oil and Gas Midstream Market offers several benefits:

Revenue Stability: Midstream infrastructure investments provide stable, long-term returns, making it an attractive sector for investors.

Infrastructure Development: Expanding pipeline and storage infrastructure supports the continued growth of the U.S. oil and gas sector, ensuring the efficient movement of resources to markets.

Technological Advancements: The integration of smart technologies in midstream operations enhances safety, reliability, and operational efficiency.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic sent shockwaves through global energy markets, leading to fluctuations in demand and supply. Lockdowns and travel restrictions temporarily reduced energy consumption, affecting demand for oil and gas. The midstream sector faced operational challenges due to workforce limitations and supply chain disruptions. However, the pandemic underscored the resilience of midstream infrastructure as an essential service, ensuring energy supply continuity even during crises.

Key Industry Developments

The United States oil and gas midstream market has witnessed notable developments, including the expansion of export infrastructure to meet growing global demand for liquefied natural gas. Technological advancements such as real-time monitoring and data analytics have improved operational efficiency and safety. Moreover, the industry’s increasing focus on environmental sustainability has led to investments in methane leak detection and emissions reduction technologies.

Analyst Suggestions

Analysts recommend that participants in the United States oil and gas midstream market continue to prioritize safety and environmental stewardship. Embracing digitalization and automation can enhance operational efficiency and reduce maintenance costs. Collaborating with renewable energy partners and diversifying portfolios can position companies for sustainable growth amid energy transition challenges.

Future Outlook

The future of the United States oil and gas midstream market hinges on its adaptability to changing energy landscapes. As the world moves toward cleaner energy sources, midstream companies that embrace innovation and invest in renewable integration will flourish. While challenges such as regulatory uncertainties and geopolitical dynamics persist, the market’s role in ensuring energy security and facilitating economic growth remains vital.

Conclusion

The United States oil and gas midstream market is the unsung hero of the nation’s energy sector, ensuring the smooth flow of resources from extraction sites to refineries and beyond. As the energy landscape evolves, the midstream market must navigate shifting demand patterns, regulatory landscapes, and technological advancements. By embracing sustainability, innovation, and collaboration, the market can continue to play a pivotal role in shaping the nation’s energy future.

What is Oil and Gas Midstream?

Oil and Gas Midstream refers to the segment of the oil and gas industry that involves the transportation, storage, and processing of crude oil and natural gas. This includes pipelines, storage facilities, and processing plants that connect upstream production with downstream refining and distribution.

What are the key players in the United States Oil and Gas Midstream Market?

Key players in the United States Oil and Gas Midstream Market include companies like Kinder Morgan, Williams Companies, and Enbridge. These companies are involved in various aspects of midstream operations, such as pipeline transportation and storage solutions, among others.

What are the growth factors driving the United States Oil and Gas Midstream Market?

The growth of the United States Oil and Gas Midstream Market is driven by increasing domestic oil and gas production, rising energy demand, and the expansion of pipeline infrastructure. Additionally, the shift towards cleaner energy sources is influencing investments in midstream technologies.

What challenges does the United States Oil and Gas Midstream Market face?

The United States Oil and Gas Midstream Market faces challenges such as regulatory hurdles, environmental concerns, and fluctuating commodity prices. These factors can impact project viability and investment decisions in the midstream sector.

What opportunities exist in the United States Oil and Gas Midstream Market?

Opportunities in the United States Oil and Gas Midstream Market include the development of new pipeline projects, advancements in technology for efficient transportation, and the integration of renewable energy sources. These factors can enhance operational efficiency and sustainability.

What trends are shaping the United States Oil and Gas Midstream Market?

Trends shaping the United States Oil and Gas Midstream Market include increased investment in digital technologies, a focus on sustainability practices, and the rise of decentralized energy systems. These trends are influencing how midstream companies operate and adapt to changing market dynamics.

United States Oil and Gas Midstream Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Storage, Processing, Distribution |

| End User | Refineries, Power Plants, Industrial Users, Petrochemical Plants |

| Technology | Pipelines, LNG Terminals, Compression Stations, Metering Stations |

| Application | Natural Gas, Crude Oil, NGLs, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Oil and Gas Midstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at