444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States office furniture market represents a dynamic and evolving sector that continues to adapt to changing workplace environments and employee expectations. This comprehensive market encompasses a wide range of products including desks, chairs, storage solutions, conference tables, and modular workstation systems designed to enhance productivity and comfort in professional settings.

Market dynamics indicate robust growth driven by the ongoing transformation of traditional office spaces into more flexible, collaborative environments. The market has experienced significant expansion with a projected CAGR of 5.2% through the forecast period, reflecting strong demand for innovative furniture solutions that support hybrid work models and employee wellness initiatives.

Key market segments include ergonomic seating solutions, height-adjustable desks, collaborative furniture systems, and technology-integrated workstations. The increasing emphasis on workplace wellness and productivity optimization has created substantial opportunities for manufacturers to develop furniture solutions that address evolving corporate needs and employee preferences.

Regional distribution shows concentrated demand in major metropolitan areas, with approximately 35% of market activity centered in the Northeast corridor, followed by strong performance in the West Coast and Southeast regions. This geographic concentration reflects the density of corporate headquarters and commercial real estate development in these areas.

The United States office furniture market refers to the comprehensive ecosystem of manufacturers, distributors, and retailers involved in designing, producing, and selling furniture specifically engineered for professional workplace environments across commercial, institutional, and home office settings.

This market encompasses traditional office furniture categories including executive desks, task chairs, filing cabinets, conference room furniture, and reception area seating, as well as contemporary solutions such as collaborative workstations, flexible seating arrangements, and technology-enabled furniture systems that support modern work practices.

The scope extends beyond basic furniture provision to include comprehensive workplace solutions that integrate ergonomic design principles, sustainability considerations, and technological connectivity to create environments that enhance employee productivity, comfort, and overall workplace satisfaction.

The United States office furniture market demonstrates remarkable resilience and adaptability in response to fundamental shifts in workplace design and employee expectations. The market has successfully navigated challenges posed by remote work trends while capitalizing on opportunities created by office redesign initiatives and return-to-office strategies.

Key growth drivers include the increasing adoption of hybrid work models, which has prompted organizations to redesign office spaces to maximize collaboration and flexibility. Approximately 68% of companies have implemented or plan to implement flexible workspace designs, creating substantial demand for modular and adaptable furniture solutions.

Market segmentation reveals strong performance across multiple categories, with ergonomic seating solutions leading growth due to heightened awareness of employee health and wellness. The integration of technology into furniture design has emerged as a significant trend, with smart desks and connected furniture systems gaining traction among forward-thinking organizations.

Competitive dynamics show established manufacturers maintaining market leadership while innovative startups introduce disruptive solutions focused on sustainability, customization, and user experience. This competitive environment has accelerated product innovation and improved value propositions for end customers.

Market analysis reveals several critical insights that define the current landscape and future trajectory of the United States office furniture sector:

The United States office furniture market benefits from multiple powerful drivers that continue to fuel growth and innovation across the sector. These fundamental forces are reshaping how organizations approach workplace design and furniture procurement strategies.

Workplace transformation initiatives represent the primary growth catalyst, as organizations redesign office environments to support hybrid work models and enhance employee engagement. The shift toward activity-based working has created demand for diverse furniture solutions that accommodate different work styles and collaborative needs.

Employee wellness programs have emerged as a significant driver, with organizations investing in ergonomic furniture solutions to reduce workplace injuries and improve employee satisfaction. Studies indicate that proper ergonomic furniture can improve productivity by 12-15% while reducing health-related absenteeism.

Technology integration requirements continue to drive innovation in office furniture design, as organizations seek solutions that seamlessly incorporate power management, connectivity, and device integration capabilities. This trend has created opportunities for furniture manufacturers to develop value-added products that command premium pricing.

Corporate real estate optimization strategies are influencing furniture purchasing decisions, as organizations seek to maximize space utilization and create more efficient work environments. The emphasis on space efficiency has driven demand for modular and multi-functional furniture solutions.

Despite strong growth prospects, the United States office furniture market faces several significant restraints that could impact future expansion and profitability across the sector.

Economic uncertainty remains a primary concern, as organizations may defer furniture investments during periods of financial constraint or market volatility. Corporate budget pressures can lead to extended replacement cycles and reduced spending on non-essential furniture upgrades.

Remote work adoption continues to present challenges, as some organizations reduce office footprints and furniture requirements in response to permanent remote work policies. This trend has created uncertainty in demand forecasting and long-term market planning.

Supply chain disruptions have impacted manufacturing costs and delivery timelines, creating challenges for both manufacturers and customers. Raw material price volatility and transportation constraints have pressured profit margins and customer satisfaction levels.

Intense price competition from low-cost manufacturers and direct-to-consumer brands has created pressure on traditional distribution channels and pricing strategies. This competitive dynamic has compressed margins and required increased investment in differentiation strategies.

The United States office furniture market presents numerous compelling opportunities for growth and expansion, driven by evolving workplace trends and emerging customer needs.

Sustainable furniture solutions represent a significant growth opportunity, as organizations increasingly prioritize environmental responsibility in procurement decisions. The market for eco-friendly office furniture is expanding rapidly, with 42% of organizations indicating sustainability as a key purchasing criterion.

Smart furniture integration offers substantial potential for innovation and premium positioning, as organizations seek furniture solutions that incorporate IoT capabilities, health monitoring, and productivity optimization features. This emerging segment commands higher margins and creates opportunities for recurring revenue through service offerings.

Home office market expansion continues to present growth opportunities, as hybrid work models create demand for professional-grade furniture in residential settings. This segment has shown remarkable resilience and growth potential beyond traditional commercial applications.

Healthcare and education sectors offer diversification opportunities, as these markets require specialized furniture solutions that address unique functional and regulatory requirements. The aging population and educational infrastructure investments create sustained demand in these segments.

The United States office furniture market operates within a complex ecosystem of interconnected factors that influence supply, demand, and competitive positioning across the sector.

Demand dynamics are increasingly influenced by generational workforce changes, with millennials and Gen Z employees driving preferences for collaborative, flexible, and technology-enabled work environments. These demographic shifts are reshaping product development priorities and marketing strategies across the industry.

Supply chain evolution has become a critical competitive factor, with successful companies investing in supply chain resilience, domestic manufacturing capabilities, and direct-to-customer distribution models. These investments have improved delivery times and customer satisfaction while reducing dependency on international suppliers.

Innovation cycles have accelerated significantly, with manufacturers introducing new products and features at an unprecedented pace to address rapidly evolving customer needs. This dynamic environment rewards companies that can quickly adapt to market changes and customer feedback.

Pricing strategies have become more sophisticated, with companies implementing value-based pricing models that reflect the total cost of ownership and productivity benefits rather than simple cost-plus approaches. This evolution has improved profitability for innovative manufacturers while providing better value propositions for customers.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines quantitative data collection with qualitative insights from industry stakeholders and market participants.

Primary research activities included structured interviews with key industry executives, furniture dealers, corporate facility managers, and end-user organizations to gather firsthand insights into market trends, purchasing behaviors, and future requirements. This primary research provided critical validation of market dynamics and emerging opportunities.

Secondary research encompassed analysis of industry publications, trade association reports, government statistics, and corporate financial disclosures to establish market baselines and identify growth patterns. This comprehensive data collection approach ensured robust analytical foundations for market projections and strategic recommendations.

Data validation processes included cross-referencing multiple sources, conducting expert interviews, and applying statistical analysis techniques to ensure accuracy and reliability of findings. The research methodology adhered to industry best practices for market research and analysis.

The United States office furniture market exhibits distinct regional characteristics that reflect local economic conditions, industry concentrations, and demographic factors across different geographic areas.

Northeast region maintains the largest market share at approximately 35% of total demand, driven by high concentrations of corporate headquarters, financial services firms, and professional services organizations in major metropolitan areas including New York, Boston, and Philadelphia. This region demonstrates strong preference for premium furniture solutions and innovative workplace designs.

West Coast markets account for roughly 28% of market activity, with California leading demand due to technology sector growth and progressive workplace design trends. The region shows strong adoption of sustainable furniture solutions and technology-integrated products, reflecting the values and preferences of the dominant technology industry.

Southeast region represents approximately 22% of market share, benefiting from corporate relocations, manufacturing growth, and expanding service sectors. This region demonstrates balanced demand across furniture categories with increasing emphasis on value-oriented solutions and flexible workspace designs.

Midwest and other regions comprise the remaining 15% of market demand, with steady growth driven by manufacturing sector recovery, healthcare expansion, and educational institution investments. These markets show preference for durable, functional furniture solutions that support traditional work environments.

The United States office furniture market features a diverse competitive landscape with established industry leaders, innovative mid-market players, and emerging direct-to-consumer brands competing across multiple segments and price points.

Market leaders maintain competitive advantages through comprehensive product portfolios, extensive distribution networks, and strong brand recognition among corporate customers:

Emerging competitors are disrupting traditional business models through direct-to-consumer sales, subscription services, and technology-enabled solutions that appeal to modern organizations seeking flexibility and innovation.

Regional manufacturers maintain competitive positions through specialized products, local service capabilities, and customization offerings that address specific market needs and customer preferences.

The United States office furniture market can be analyzed across multiple segmentation dimensions that reveal distinct customer needs, growth opportunities, and competitive dynamics.

By Product Category:

By End-User Segment:

By Distribution Channel:

Seating solutions dominate market demand with approximately 45% of total market share, driven by ergonomic requirements and employee wellness initiatives. Task chairs represent the largest sub-segment, with increasing demand for adjustable features, lumbar support, and sustainable materials. Premium ergonomic chairs command higher margins while volume segments focus on value and durability.

Desk and workstation systems account for roughly 30% of market activity, with height-adjustable desks experiencing exceptional growth due to health and wellness trends. Collaborative table solutions are gaining traction as organizations redesign spaces to support teamwork and flexible work arrangements. Technology integration features such as built-in power and connectivity are becoming standard expectations.

Storage solutions represent approximately 15% of market demand, with traditional filing cabinets declining as organizations adopt digital document management. However, personal storage and mobile solutions are growing as workspaces become more flexible and employees require secure storage for personal items and technology devices.

Architectural and systems furniture comprise the remaining 10% of market share, with modular wall systems and space dividers gaining popularity as organizations seek to create flexible, reconfigurable work environments. These products offer opportunities for higher margins and ongoing reconfiguration services.

Manufacturers benefit from sustained demand growth driven by workplace transformation trends and increasing emphasis on employee wellness. The market offers opportunities for premium positioning through innovative design, sustainable materials, and technology integration. Successful manufacturers can achieve strong margins through value-added services and comprehensive solution offerings.

Dealers and distributors provide essential local market expertise, space planning services, and installation capabilities that create value for end customers. The evolving market creates opportunities for dealers to expand service offerings and develop recurring revenue streams through maintenance, reconfiguration, and consulting services.

End-user organizations gain access to furniture solutions that enhance employee productivity, support wellness initiatives, and create attractive work environments that aid in talent recruitment and retention. Modern office furniture solutions can improve space utilization efficiency and reduce long-term operational costs.

Employees benefit from improved ergonomics, enhanced comfort, and work environments that support collaboration and individual productivity. Quality office furniture contributes to job satisfaction and can reduce health-related issues associated with prolonged desk work.

Investors find attractive opportunities in a market that demonstrates resilience, innovation potential, and alignment with major workplace trends. The sector offers exposure to both traditional commercial markets and emerging segments such as home office and smart furniture solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid workspace design has emerged as the dominant trend shaping office furniture requirements, with organizations creating spaces that support both in-person collaboration and individual focused work. This trend drives demand for flexible, reconfigurable furniture solutions that can adapt to changing space utilization patterns throughout the day.

Wellness-centric furniture continues gaining momentum as organizations recognize the connection between employee health and productivity. Ergonomic features, sit-stand desks, and furniture that promotes movement and proper posture are becoming standard requirements rather than premium options.

Sustainable design practices are increasingly influencing purchasing decisions, with organizations seeking furniture made from recycled materials, renewable resources, and designed for circular economy principles. MarkWide Research indicates that sustainability considerations influence 58% of corporate furniture purchases.

Technology integration has evolved from optional features to essential requirements, with furniture incorporating wireless charging, USB connectivity, and smart sensors that monitor usage patterns and environmental conditions. This trend creates opportunities for recurring revenue through software and service offerings.

Biophilic design elements are being incorporated into office furniture to create connections with nature and improve employee well-being. This includes natural materials, organic shapes, and furniture that supports the integration of plants and natural lighting.

Recent industry developments demonstrate the dynamic nature of the United States office furniture market and the rapid pace of innovation across the sector.

Merger and acquisition activity has intensified as companies seek to expand capabilities, enter new markets, and achieve operational synergies. Notable consolidation has occurred in both manufacturing and distribution segments, creating larger, more comprehensive solution providers.

Sustainability initiatives have accelerated across the industry, with major manufacturers committing to carbon neutrality goals, circular economy principles, and sustainable material sourcing. These initiatives are reshaping product development processes and supply chain strategies.

Digital transformation efforts are revolutionizing how companies interact with customers, manage operations, and deliver services. Virtual reality showrooms, AI-powered space planning tools, and digital configuration platforms are becoming competitive differentiators.

Direct-to-consumer expansion has gained momentum as manufacturers seek to capture more value and improve customer relationships. This trend is particularly pronounced in the home office segment, where traditional dealer networks have less presence.

International expansion continues as US manufacturers seek growth opportunities in emerging markets while also diversifying supply chain risks through global manufacturing strategies.

Market participants should focus on developing comprehensive solutions that address the full spectrum of modern workplace needs rather than competing solely on individual product features or pricing. The most successful companies will be those that can integrate furniture, technology, and services into cohesive workplace solutions.

Investment in sustainability should be prioritized as a core business strategy rather than a marketing initiative. Organizations that can demonstrate genuine environmental leadership will capture increasing market share as corporate sustainability commitments intensify.

Technology integration capabilities must be developed either internally or through strategic partnerships to remain competitive in evolving market segments. The convergence of furniture and technology creates opportunities for differentiation and premium positioning.

Distribution strategy evolution is essential to address changing customer preferences and market dynamics. Companies should develop omnichannel approaches that combine traditional dealer relationships with direct-to-customer capabilities and digital platforms.

Data analytics investments will become increasingly important for understanding customer behavior, optimizing operations, and developing predictive capabilities that support strategic decision-making and customer service excellence.

The United States office furniture market is positioned for continued growth and transformation as workplace evolution accelerates and new customer needs emerge. MWR analysis projects sustained expansion driven by hybrid work adoption, wellness initiatives, and technology integration requirements.

Growth projections indicate the market will maintain a healthy CAGR of 5.2% through the forecast period, with particular strength in ergonomic seating, height-adjustable desks, and collaborative furniture solutions. The home office segment is expected to maintain elevated demand levels as hybrid work models become permanent fixtures of corporate culture.

Innovation acceleration will continue reshaping product offerings, with smart furniture, sustainable materials, and wellness-focused designs becoming mainstream rather than niche segments. Companies that successfully integrate these trends into comprehensive solutions will capture disproportionate market share.

Market consolidation is likely to continue as companies seek scale advantages, expanded capabilities, and improved competitive positioning. This consolidation will create opportunities for specialized players while challenging traditional mid-market competitors.

International expansion will become increasingly important as domestic market growth moderates and companies seek new revenue sources. Successful expansion will require adaptation to local preferences while leveraging core competencies developed in the US market.

The United States office furniture market stands at a pivotal moment in its evolution, driven by fundamental changes in how and where people work. The convergence of hybrid work models, employee wellness priorities, sustainability requirements, and technology integration is creating unprecedented opportunities for innovation and growth.

Market dynamics favor companies that can adapt quickly to changing customer needs while maintaining operational excellence and financial discipline. The most successful participants will be those that view furniture not as standalone products but as components of comprehensive workplace solutions that enhance productivity, support wellness, and create engaging work environments.

Future success will depend on the ability to balance traditional strengths in manufacturing and distribution with new capabilities in technology integration, sustainability, and customer experience. Organizations that can navigate this transition while maintaining focus on core customer needs will be well-positioned to capture the significant opportunities ahead in this dynamic and evolving market.

What is Office Furniture?

Office furniture refers to the various types of furniture used in an office setting, including desks, chairs, cabinets, and conference tables. These items are designed to enhance productivity and comfort in the workplace.

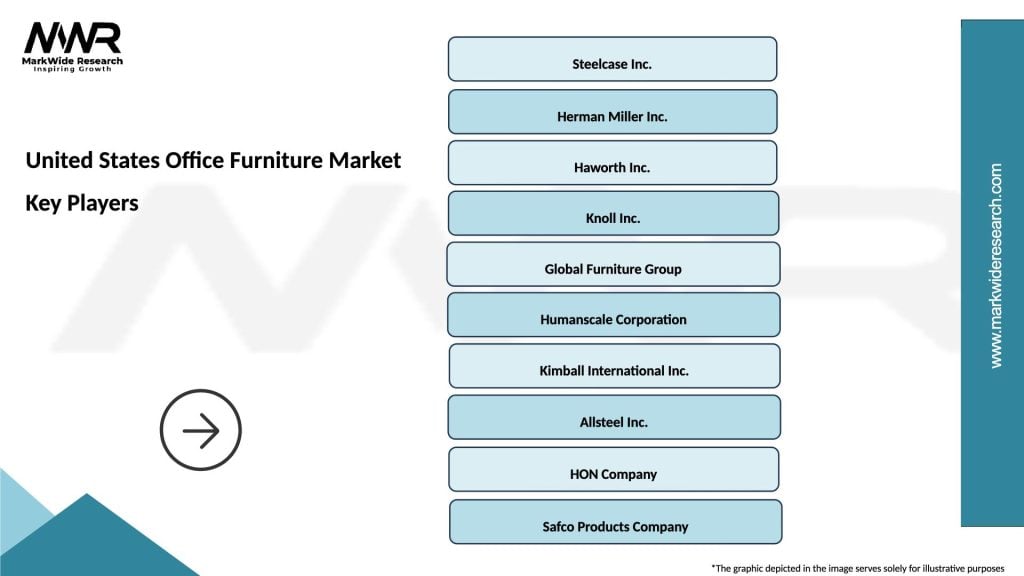

What are the key players in the United States Office Furniture Market?

Key players in the United States Office Furniture Market include Steelcase, Herman Miller, and Haworth. These companies are known for their innovative designs and extensive product ranges, catering to various office environments and needs.

What are the main drivers of growth in the United States Office Furniture Market?

The main drivers of growth in the United States Office Furniture Market include the increasing demand for ergonomic furniture, the rise of remote work leading to home office setups, and the ongoing trend of office space redesigns to promote collaboration.

What challenges does the United States Office Furniture Market face?

Challenges in the United States Office Furniture Market include fluctuating raw material prices, supply chain disruptions, and the need to adapt to changing workplace dynamics and employee preferences.

What opportunities exist in the United States Office Furniture Market?

Opportunities in the United States Office Furniture Market include the growing focus on sustainable materials, the integration of technology in furniture design, and the increasing demand for customizable office solutions.

What trends are shaping the United States Office Furniture Market?

Trends shaping the United States Office Furniture Market include the rise of flexible workspaces, the incorporation of biophilic design elements, and the emphasis on wellness-focused furniture that promotes health and productivity.

United States Office Furniture Market

| Segmentation Details | Description |

|---|---|

| Product Type | Desks, Chairs, Cubicles, Conference Tables |

| Material | Wood, Metal, Plastic, Fabric |

| End User | Corporations, Educational Institutions, Government, Healthcare Facilities |

| Distribution Channel | Online Retail, Direct Sales, Showrooms, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Office Furniture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at