444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United States Non-Woven Fabric market is a thriving sector within the textile industry, characterized by the production and utilization of non-woven fabrics in various applications. Non-woven fabrics are engineered fabrics made by bonding or interlocking fibers mechanically, thermally, or chemically. These fabrics offer unique characteristics such as high strength, breathability, absorbency, and cost-effectiveness, making them highly versatile and widely used in sectors like healthcare, hygiene, automotive, construction, and agriculture. The market’s growth is driven by factors such as the increasing demand for disposable hygiene products, rising healthcare awareness, and advancements in non-woven fabric technology.

Meaning

The United States Non-Woven Fabric market refers to the sector involved in the manufacturing, distribution, and utilization of non-woven fabrics. Non-woven fabrics are made from fibers that are mechanically or chemically bonded together, rather than being woven like traditional fabrics. They find extensive use in various industries due to their unique properties and cost-effectiveness.

Executive Summary

This comprehensive report provides valuable insights into the United States Non-Woven Fabric market, presenting key market drivers, restraints, opportunities, and trends. Industry participants and stakeholders can leverage this information to make informed decisions and stay competitive in the dynamic non-woven fabric market.

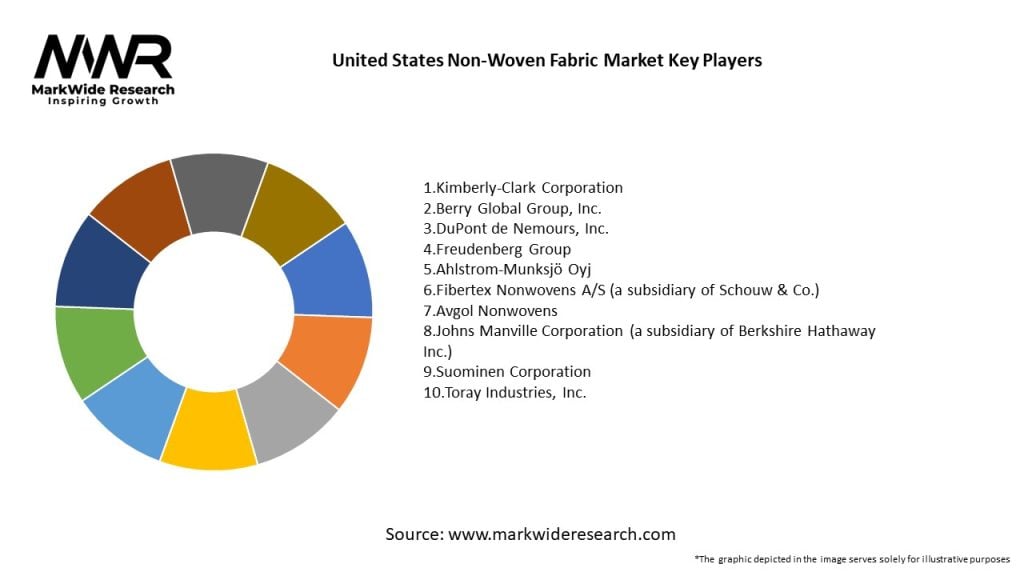

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Expanding Healthcare and Hygiene Segments:

The COVID-19 pandemic has significantly accelerated the demand for disposable medical products, including surgical masks, gowns, and wipes made from non-woven fabrics. The healthcare industry’s ongoing focus on infection control and patient safety is further driving market demand.

Growth in Packaging and Filtration Applications:

Non-woven fabrics are increasingly used in packaging applications for food and consumer goods due to their lightweight and durable properties. Additionally, the filtration market benefits from non-wovens that can effectively capture particulates and contaminants, particularly in automotive and industrial applications.

Technological Innovations in Production:

Advancements in production technologies such as spunbond, meltblown, and hydroentanglement processes are enhancing the performance and cost-efficiency of non-woven fabrics. These technological breakthroughs are enabling manufacturers to produce materials that meet the specific needs of diverse applications.

Sustainability Initiatives:

Rising environmental awareness and regulatory pressures are pushing companies to develop eco-friendly non-woven fabrics. The integration of recycled fibers and bio-based materials is becoming a significant market driver, appealing to both environmentally conscious consumers and regulatory bodies.

Growing Consumer Awareness and Demand:

Changing consumer lifestyles, with an increased emphasis on hygiene and convenience, are driving demand for disposable products such as wipes, diapers, and sanitary products. This shift is supported by marketing campaigns and enhanced product performance.

Infrastructure and Industrial Development:

Ongoing investments in industrial infrastructure, particularly in sectors like automotive manufacturing and construction, are propelling the demand for non-woven materials used in insulation, composites, and protective gear.

Market Restraints

Raw Material Price Volatility:

Fluctuations in the prices of polymers such as polypropylene, polyester, and other synthetic fibers can significantly impact production costs. This volatility can affect profit margins and market pricing strategies.

Environmental Concerns and Waste Management:

The disposable nature of many non-woven products raises concerns about environmental pollution and waste management. Regulatory pressures and consumer advocacy for sustainable practices are forcing companies to invest in recycling and waste reduction technologies.

High Initial Investment and Production Costs:

Advanced production technologies and state-of-the-art machinery require significant capital investment. This can be a barrier to entry for smaller players and may limit the scalability of operations.

Stringent Regulatory Compliance:

Compliance with regulatory standards, particularly in sectors such as healthcare and automotive, can be both time-consuming and costly. Navigating these requirements is essential for market entry and continued operation.

Competition from Alternative Materials:

The market faces competition from traditional woven and knitted fabrics, as well as from emerging materials that may offer superior performance or sustainability benefits. This competition can erode market share and put downward pressure on prices.

Supply Chain Disruptions:

Global supply chain challenges, including logistics and transportation issues, can disrupt production schedules and affect timely delivery of raw materials and finished products.

Market Opportunities

Development of Eco-Friendly Non-Wovens:

Investment in the research and development of biodegradable and recyclable non-woven fabrics offers significant growth potential. This can open up new markets in eco-conscious consumer segments and help companies comply with evolving environmental regulations.

Expansion in the Medical and Hygiene Sectors:

The ongoing demand for high-quality medical supplies and hygiene products presents ample opportunities. The development of non-wovens with enhanced antimicrobial properties or improved comfort can further drive adoption in these critical sectors.

Technological Integration and Digitalization:

Integrating digital monitoring systems into production processes can improve quality control, optimize manufacturing efficiency, and reduce operational costs. This technological advancement can also lead to the creation of smart non-woven products that provide additional value to end users.

Strategic Collaborations and Partnerships:

Forming alliances with research institutions, raw material suppliers, and end-use product manufacturers can facilitate innovation and market expansion. Collaborative research initiatives can lead to breakthrough technologies that differentiate products in the marketplace.

Growth in Automotive and Construction Applications:

Non-woven fabrics are increasingly used in automotive interiors, insulation, and composite materials, as well as in construction applications such as geotextiles and roofing materials. Expansion in these sectors offers significant revenue opportunities.

Customization and Niche Markets:

Tailoring non-woven fabric solutions for specific applications—such as high-performance filtration media, specialized packaging, or premium hygiene products—can capture niche markets and provide higher margins.

Market Dynamics

The dynamics of the United States non-woven fabric market are influenced by a mix of supply-side innovations, demand-side trends, and broader economic factors:

Supply Side Factors:

Demand Side Factors:

Economic and Regulatory Influences:

Regional Analysis

Within the United States, the non-woven fabric market exhibits varied regional characteristics based on industrial activity, consumer demand, and manufacturing capabilities:

Northeast:

The Northeast region, with its dense population and concentration of healthcare and pharmaceutical companies, is a key market for non-woven medical and hygiene products. Proximity to major research institutions also drives innovation in high-performance non-woven applications.

Midwest:

The Midwest is known for its strong manufacturing base, particularly in the automotive and industrial sectors. Non-woven fabrics used in automotive interiors, filtration systems, and construction materials find significant application in this region.

South:

The Southern United States is experiencing rapid industrial growth, with a focus on expanding healthcare infrastructure and consumer goods production. The region’s favorable business environment and lower operational costs make it a growing hub for non-woven fabric manufacturing and consumption.

West:

The West Coast, with its progressive regulatory environment and emphasis on sustainability, is a leader in developing eco-friendly non-woven materials. High-tech manufacturing and strong consumer markets in states like California drive demand for innovative non-woven products across various applications.

Competitive Landscape

Leading Companies in the United States Non-Woven Fabric Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

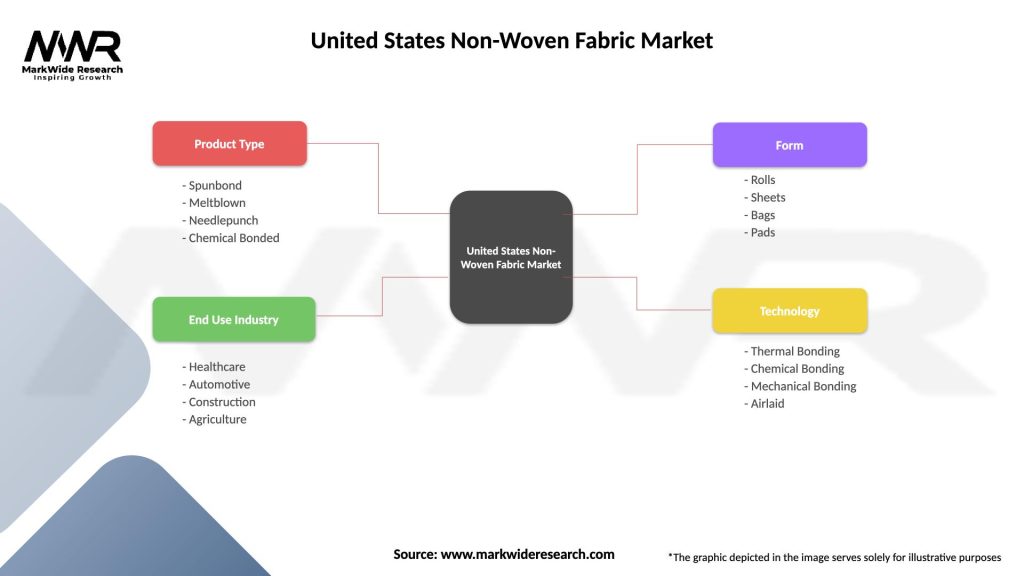

Segmentation

The United States non-woven fabric market can be segmented based on material type, production process, and application, providing a comprehensive view of its structure:

By Material Type:

By Production Process:

By Application:

Category-wise Insights

Medical and Hygiene Applications:

Non-woven fabrics in this segment are critical for ensuring product safety, absorbency, and barrier protection. Products such as surgical masks and disposable gowns must meet rigorous regulatory standards, driving continuous innovation in material properties.

Filtration Media:

The unique fiber structure of non-wovens makes them ideal for capturing particulates and contaminants, making them indispensable in air and liquid filtration applications. The demand for high-efficiency filters is particularly strong in automotive and industrial sectors.

Packaging and Construction:

Lightweight, durable non-wovens are increasingly favored in packaging applications due to their cost-effectiveness and protective qualities. In construction, non-wovens are used for geotextiles and insulation, where their stability and resistance to environmental degradation are key advantages.

Key Benefits for Industry Participants and Stakeholders

Adoption of non-woven fabrics offers significant advantages, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Focus on Sustainability:

There is a notable shift towards developing eco-friendly non-woven fabrics. Companies are investing in recycled materials and bio-based polymers to meet environmental regulations and consumer demand for sustainable products.

Technological Innovation in Production:

Advancements in manufacturing processes such as meltblown, spunbond, and hydroentanglement continue to drive improvements in product quality and cost efficiency.

Integration of Digital Manufacturing:

The adoption of Industry 4.0 principles, including automation and real-time monitoring systems, is transforming production processes, enhancing quality control, and reducing waste.

Growing Demand from Healthcare and Hygiene:

The ongoing emphasis on personal hygiene, particularly highlighted by the COVID-19 pandemic, has boosted the demand for disposable non-woven fabrics in medical and hygiene applications.

Expansion in High-Performance Applications:

Increasing usage of non-woven fabrics in advanced filtration, automotive, and construction applications is driving the need for materials with superior performance characteristics.

Covid-19 Impact

The COVID-19 pandemic has had a significant and multifaceted impact on the United States non-woven fabric market:

Surge in Demand for PPE:

The pandemic led to unprecedented demand for personal protective equipment (PPE) such as surgical masks, gowns, and face shields—all predominantly made from non-woven materials. This surge accelerated production capacities and spurred technological innovations in non-woven manufacturing.

Increased Emphasis on Hygiene Products:

Consumer demand for disposable hygiene products, including wipes and sanitary items, experienced robust growth, driving up production and investment in non-woven technologies.

Supply Chain Disruptions:

The pandemic exposed vulnerabilities in global supply chains, leading to temporary shortages of raw materials and production delays. Manufacturers responded by diversifying supply sources and increasing domestic production capacities.

Accelerated Digital Transformation:

To cope with increased demand and remote working conditions, companies enhanced their digital infrastructure for process monitoring and quality control, leading to more efficient production lines.

Long-Term Strategic Shifts:

Post-pandemic, healthcare and hygiene sectors continue to prioritize the use of non-woven materials, ensuring that the increased demand is sustained and integrated into long-term growth strategies.

Key Industry Developments

Recent industry developments in the United States non-woven fabric market include:

Innovative Product Launches:

Major companies have introduced next-generation non-woven fabrics with improved breathability, higher filtration efficiency, and enhanced sustainability profiles.

Strategic Mergers and Acquisitions:

Consolidation within the market has been observed, with larger companies acquiring smaller, innovative players to expand their product portfolios and enhance market presence.

Investment in Sustainable Technologies:

Research and development initiatives are increasingly focused on creating eco-friendly non-woven fabrics using recycled and bio-based fibers, driven by both regulatory pressures and consumer demand for green products.

Expansion of Production Capacities:

In response to the surge in demand for medical and hygiene products, several manufacturers have expanded their production facilities and upgraded their technologies to meet higher volumes.

Collaborative Research Projects:

Partnerships between academic institutions, research organizations, and industry players are fostering innovation in non-woven material technologies, resulting in breakthroughs that improve product performance and reduce environmental impact.

Analyst Suggestions

Industry analysts recommend the following strategies for stakeholders to capitalize on emerging opportunities:

Invest in R&D and Sustainable Innovations:

Prioritize research in eco-friendly materials and advanced production processes to develop high-performance non-woven fabrics that meet evolving market demands.

Enhance Supply Chain Resilience:

Diversify raw material sources and invest in domestic production capacities to mitigate the impact of global supply chain disruptions.

Strengthen Strategic Partnerships:

Form collaborations with technology providers, research institutions, and end-user companies to accelerate product innovation and expand market reach.

Focus on Digital Transformation:

Leverage digital manufacturing technologies to optimize production processes, enhance quality control, and reduce operational costs.

Expand into Niche and High-Value Markets:

Identify and target niche applications—such as high-efficiency filtration, advanced automotive components, and specialized construction materials—to secure higher margins and diversify revenue streams.

Optimize Cost Structures:

Streamline production processes and invest in automation to reduce costs and improve competitiveness, particularly in a price-sensitive market environment.

Future Outlook

The future of the United States non-woven fabric market is highly promising, driven by continuous technological innovation, expanding end-use applications, and a growing emphasis on sustainability. Key trends that will shape the market include:

Continued Demand in Healthcare and Hygiene:

The persistent need for high-quality medical and hygiene products will drive sustained demand for non-woven fabrics, particularly in light of global health challenges and evolving consumer preferences.

Technological Breakthroughs:

Advancements in production processes and material science will lead to the development of non-woven fabrics with superior performance, lower costs, and enhanced sustainability attributes.

Expansion of Sustainable Product Lines:

As regulatory and consumer pressures for eco-friendly products intensify, companies that innovate in recycled and bio-based non-woven fabrics will likely capture significant market share.

Digital and Automation Integration:

The adoption of Industry 4.0 practices in manufacturing will improve production efficiency and quality, supporting higher output and reduced lead times.

Emerging Applications:

New market opportunities in sectors such as automotive, filtration, and construction will further diversify revenue streams and drive market growth.

Regulatory and Policy Support:

Favorable government policies and incentives for domestic manufacturing and sustainable production practices will bolster market expansion in the coming years.

Despite challenges such as raw material volatility and environmental concerns, companies that invest in innovation, sustainability, and digital transformation are well-positioned to capitalize on the growth potential of the non-woven fabric market.

Conclusion

The United States Non-Woven Fabric Market is set to play a pivotal role in shaping the future of various industries, from healthcare and hygiene to automotive and construction. Driven by technological advancements, increasing demand for high-performance and sustainable materials, and the integration of digital manufacturing processes, the market is experiencing significant growth and transformation.

What is Non-Woven Fabric?

Non-woven fabric refers to a type of textile that is made from fibers bonded together through various processes such as heat, chemical, or mechanical means. It is widely used in applications like hygiene products, medical supplies, and geotextiles.

What are the key players in the United States Non-Woven Fabric Market?

Key players in the United States Non-Woven Fabric Market include companies like DuPont, Freudenberg, and Ahlstrom-Munksjö, which are known for their innovative products and extensive market reach. These companies focus on various applications such as automotive, healthcare, and filtration, among others.

What are the growth factors driving the United States Non-Woven Fabric Market?

The growth of the United States Non-Woven Fabric Market is driven by increasing demand in the healthcare sector for surgical gowns and masks, rising consumer awareness regarding hygiene products, and the expanding automotive industry requiring lightweight materials.

What challenges does the United States Non-Woven Fabric Market face?

Challenges in the United States Non-Woven Fabric Market include fluctuating raw material prices, environmental concerns regarding waste management, and competition from alternative materials that may offer similar benefits.

What opportunities exist in the United States Non-Woven Fabric Market?

Opportunities in the United States Non-Woven Fabric Market include the development of biodegradable non-woven materials, increasing applications in the construction industry, and the potential for growth in the e-commerce sector for packaging solutions.

What trends are shaping the United States Non-Woven Fabric Market?

Trends in the United States Non-Woven Fabric Market include the rise of sustainable and eco-friendly materials, advancements in manufacturing technologies, and the growing use of non-woven fabrics in personal protective equipment and filtration applications.

United States Non-Woven Fabric Market

| Segmentation Details | Description |

|---|---|

| Product Type | Spunbond, Meltblown, Needlepunch, Chemical Bonded |

| End Use Industry | Healthcare, Automotive, Construction, Agriculture |

| Form | Rolls, Sheets, Bags, Pads |

| Technology | Thermal Bonding, Chemical Bonding, Mechanical Bonding, Airlaid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Non-Woven Fabric Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at