444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States non-dairy milk market represents one of the most dynamic and rapidly evolving segments within the broader beverage industry. This transformative market encompasses plant-based alternatives to traditional dairy milk, including almond, oat, soy, coconut, rice, and emerging protein-rich options. Consumer preferences have shifted dramatically toward these alternatives, driven by health consciousness, environmental concerns, lactose intolerance awareness, and ethical considerations surrounding animal welfare.

Market dynamics indicate unprecedented growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 12.3% over recent years. This expansion reflects changing dietary patterns, increased availability across retail channels, and continuous product innovation. Mainstream adoption has accelerated beyond niche health-conscious consumers to include families, athletes, and individuals seeking diverse nutritional profiles.

Regional distribution shows California, New York, and Texas leading consumption patterns, while demographic analysis reveals millennials and Generation Z driving 65% of purchase decisions. The market’s maturation has brought sophisticated product formulations, improved taste profiles, and enhanced nutritional fortification, positioning non-dairy alternatives as legitimate competitors to conventional dairy products.

The United States non-dairy milk market refers to the comprehensive ecosystem of plant-based beverage alternatives designed to replace traditional cow’s milk in consumer applications. These products derive from various plant sources including nuts, grains, legumes, and seeds, processed to create milk-like consistency and nutritional profiles suitable for direct consumption, cooking, and food preparation.

Product categories encompass multiple varieties, each offering distinct nutritional benefits and flavor characteristics. Almond milk dominates market share through its mild taste and versatility, while oat milk has emerged as the fastest-growing segment due to its creamy texture and sustainability credentials. Soy milk maintains strong positioning as a protein-rich option, particularly among fitness enthusiasts and health-conscious consumers.

Manufacturing processes involve extracting liquid from plant materials through grinding, soaking, and filtration techniques. Modern production methods incorporate fortification with vitamins, minerals, and proteins to match or exceed traditional dairy nutritional profiles. Quality standards ensure consistency, safety, and shelf stability while maintaining authentic plant-based characteristics that appeal to diverse consumer preferences.

Market transformation within the United States non-dairy milk sector reflects fundamental shifts in consumer behavior, technological advancement, and retail accessibility. The industry has evolved from specialty health food stores to mainstream supermarket prominence, with major retailers dedicating expanded shelf space to accommodate growing demand and product variety.

Innovation leadership drives competitive differentiation through enhanced formulations, sustainable packaging, and targeted nutritional profiles. Companies invest heavily in research and development to improve taste, texture, and functional properties while addressing specific dietary requirements such as protein content, vitamin fortification, and allergen-free formulations. Premium positioning strategies have successfully elevated price points beyond commodity levels.

Distribution channels have diversified significantly, encompassing traditional grocery chains, specialty organic retailers, online platforms, and foodservice establishments. E-commerce penetration reached 23% of total sales, accelerated by subscription models and direct-to-consumer strategies. Foodservice adoption in coffee shops, restaurants, and institutional settings has created additional demand drivers, with barista-style formulations specifically designed for professional beverage preparation.

Consumer research reveals multifaceted motivations driving non-dairy milk adoption, extending beyond lactose intolerance to encompass environmental sustainability, animal welfare concerns, and perceived health benefits. Nutritional awareness has increased significantly, with consumers actively comparing protein content, vitamin fortification, and sugar levels across different plant-based options.

Health awareness represents the most significant catalyst propelling non-dairy milk market expansion. Consumers increasingly recognize the connection between dietary choices and long-term health outcomes, driving demand for products perceived as healthier alternatives to traditional dairy. Lactose intolerance affects approximately 36% of the US population, creating a substantial consumer base seeking digestible alternatives without compromising nutritional intake.

Environmental consciousness has emerged as a powerful market driver, particularly among younger demographics. Plant-based milk production typically requires significantly less water, land, and energy compared to dairy farming, appealing to environmentally responsible consumers. Carbon footprint reduction initiatives by corporations and individuals have elevated plant-based alternatives as preferred choices for sustainability-minded purchasers.

Product innovation continues advancing taste profiles, nutritional content, and functional properties. Manufacturers invest substantially in research and development to create formulations that closely mimic dairy milk characteristics while offering unique benefits. Fortification strategies ensure products meet or exceed traditional milk’s nutritional value, addressing historical concerns about protein content and vitamin availability.

Retail accessibility has expanded dramatically, with non-dairy alternatives now available across virtually all grocery formats. Mainstream distribution has eliminated the specialty store requirement, making products convenient for regular shopping routines. Price competitiveness has improved through economies of scale and manufacturing efficiency, reducing the premium associated with plant-based alternatives.

Price premiums continue challenging widespread adoption, particularly among price-sensitive consumer segments. Non-dairy alternatives typically cost 40-60% more than conventional dairy milk, creating barriers for budget-conscious households and limiting market penetration in certain demographic groups. Economic sensitivity becomes pronounced during inflationary periods when consumers prioritize essential purchases.

Taste preferences remain a significant obstacle despite substantial product improvements. Traditional dairy milk’s familiar flavor profile and creamy texture create comparison standards that some plant-based alternatives struggle to match consistently. Consumer expectations for identical sensory experiences can lead to disappointment and brand switching when products fail to deliver anticipated characteristics.

Nutritional concerns persist among health-conscious consumers who question whether plant-based alternatives provide equivalent nutritional benefits. Protein content varies significantly across different plant sources, with some options offering substantially lower protein levels than dairy milk. Bioavailability of added vitamins and minerals may differ from naturally occurring nutrients in traditional milk.

Regulatory challenges include ongoing debates about labeling requirements and the use of dairy terminology for plant-based products. Industry opposition from traditional dairy producers has resulted in legislative efforts to restrict the use of terms like “milk” for non-dairy alternatives. Compliance costs associated with varying state regulations can burden manufacturers and potentially limit market expansion.

Product diversification presents substantial growth opportunities through innovative plant source exploration and hybrid formulations. Emerging proteins from peas, hemp, and other legumes offer unique nutritional profiles and sustainability advantages. Functional beverages incorporating probiotics, adaptogens, and specialized nutrients can command premium pricing while addressing specific health concerns.

Demographic expansion beyond traditional health-conscious consumers offers significant market potential. Family-oriented marketing targeting parents seeking healthier options for children represents an underexplored segment. Senior consumers with digestive sensitivities and dietary restrictions present another growth opportunity through targeted product development and marketing strategies.

Foodservice penetration continues expanding as restaurants, coffee shops, and institutional facilities incorporate non-dairy alternatives into their offerings. Barista-quality formulations designed specifically for professional beverage preparation have created new market segments with higher margins. Institutional adoption in schools, hospitals, and corporate cafeterias represents substantial volume opportunities.

International expansion through export opportunities and licensing agreements can leverage successful US market strategies in global markets. Technology transfer and brand recognition developed domestically provide competitive advantages in international market entry. Supply chain optimization through vertical integration and strategic partnerships can improve margins while ensuring quality consistency.

Competitive intensity has escalated significantly as traditional dairy companies enter the non-dairy segment alongside established plant-based specialists. Market consolidation through acquisitions and strategic partnerships has reshaped the competitive landscape, with major food corporations acquiring innovative startups to gain market access and technological capabilities.

Supply chain evolution reflects the industry’s maturation, with specialized ingredient suppliers, co-manufacturing facilities, and distribution networks developing to support market growth. Raw material sourcing has become increasingly sophisticated, with companies establishing direct relationships with farmers to ensure quality and sustainability standards while managing cost volatility.

Consumer education efforts by industry participants have successfully addressed misconceptions about plant-based alternatives while highlighting benefits. Marketing investments focus on taste comparisons, nutritional equivalency, and environmental impact messaging. Influencer partnerships and social media campaigns have proven particularly effective in reaching younger demographics.

Technological advancement continues improving production efficiency, product quality, and shelf stability. Processing innovations enable better texture replication and nutritional optimization while reducing manufacturing costs. Packaging developments extend shelf life and improve sustainability profiles, addressing key consumer concerns about freshness and environmental impact.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes consumer surveys, industry expert interviews, and retail partner discussions to gather firsthand insights about market trends, preferences, and challenges. Sample sizes exceed industry standards to ensure statistical significance across demographic segments and geographic regions.

Secondary research incorporates industry reports, government statistics, trade association data, and academic studies to provide comprehensive market context. Data triangulation validates findings across multiple sources, ensuring consistency and reliability of conclusions. Historical analysis examines market evolution patterns to identify trends and predict future developments.

Quantitative analysis utilizes advanced statistical methods to identify correlations, market drivers, and growth patterns. Regression modeling helps predict market behavior under various scenarios, while time series analysis reveals seasonal patterns and long-term trends. Market sizing employs bottom-up and top-down approaches to ensure accuracy and completeness.

Qualitative research provides deeper insights into consumer motivations, brand perceptions, and purchase decision factors. Focus groups and in-depth interviews reveal nuanced preferences and barriers that quantitative methods might miss. Expert opinions from industry leaders, nutritionists, and retail specialists provide professional perspectives on market dynamics and future opportunities.

West Coast leadership in non-dairy milk adoption reflects the region’s health-conscious culture and environmental awareness. California dominates with approximately 28% of national consumption, driven by diverse demographics, high disposable income, and strong retail presence of specialty and organic products. Innovation hubs in San Francisco and Los Angeles foster startup development and consumer trend adoption.

Northeast markets show strong growth momentum, particularly in urban areas with educated, affluent consumers. New York and Massachusetts lead regional adoption, with metropolitan areas accounting for 75% of regional sales. Premium product acceptance runs higher than national averages, supporting brand differentiation strategies and higher-margin products.

Southeast expansion represents significant growth potential as traditional dairy-consuming regions gradually adopt plant-based alternatives. Florida and Texas show accelerating adoption rates, particularly in urban centers with diverse populations. Retail penetration has improved substantially, with major grocery chains expanding non-dairy sections to meet growing demand.

Midwest markets present both challenges and opportunities, with traditional dairy farming heritage creating consumer loyalty to conventional products. However, health consciousness and dietary restriction awareness drive steady growth in major metropolitan areas. Price sensitivity remains higher than coastal regions, requiring value-oriented product positioning and promotional strategies.

Market leadership reflects a dynamic competitive environment with established players and innovative newcomers competing across multiple dimensions including taste, nutrition, sustainability, and price. Brand differentiation strategies focus on unique selling propositions such as organic certification, protein content, flavor varieties, and environmental impact messaging.

Product type segmentation reveals distinct consumer preferences and growth patterns across different plant-based alternatives. Almond milk maintains the largest market share at approximately 42% of total volume, benefiting from early market entry, mild flavor profile, and extensive retail availability. Taste acceptance and versatility in applications contribute to sustained leadership despite increasing competition.

Oat milk represents the fastest-growing segment, experiencing annual growth rates exceeding 25% due to creamy texture, sustainability credentials, and excellent performance in coffee applications. Barista formulations have driven adoption in foodservice channels, while retail versions appeal to consumers seeking dairy-like consistency and mouthfeel.

Soy milk maintains steady market position as the original dairy alternative, particularly strong among health-conscious consumers seeking high protein content. Nutritional profile closely matches dairy milk, making it preferred for cooking and baking applications. Organic varieties command premium pricing and loyal consumer following.

Coconut milk appeals to consumers preferring tropical flavor profiles and those following ketogenic or paleo diets. Full-fat versions provide richness for cooking applications, while light varieties serve as beverage alternatives. Specialty positioning supports higher margins despite smaller market share.

By Application: Direct consumption represents the largest category, accounting for approximately 68% of total usage. Consumers primarily use non-dairy milk for cereal, coffee, and drinking applications. Cooking and baking applications show steady growth as product formulations improve heat stability and flavor neutrality. Specialty beverages including smoothies and protein shakes drive premium product demand.

By Packaging: Shelf-stable cartons dominate the market with 78% share due to convenience, longer shelf life, and cost efficiency. Refrigerated options appeal to consumers preferring fresh taste profiles and premium positioning. Sustainable packaging initiatives including recyclable materials and reduced plastic usage influence purchasing decisions among environmentally conscious consumers.

By Distribution Channel: Supermarkets and hypermarkets account for 65% of sales volume, providing broad consumer access and competitive pricing. Natural and organic stores maintain strong positions for premium and specialty products. Online channels show rapid growth, particularly for subscription services and bulk purchasing options.

By Price Point: Premium products priced above conventional dairy milk capture 35% of market value despite lower volume share. Value positioning focuses on cost-per-serving comparisons and nutritional benefits. Private label alternatives gain market share by offering competitive pricing with acceptable quality standards.

Manufacturers benefit from higher profit margins compared to traditional dairy processing, with plant-based alternatives typically generating 15-25% higher margins. Innovation opportunities allow for product differentiation and premium positioning through unique formulations, flavors, and nutritional profiles. Sustainability messaging resonates with environmentally conscious consumers, supporting brand loyalty and market expansion.

Retailers experience increased category growth and customer traffic through expanded non-dairy sections. Cross-merchandising opportunities with organic, health, and specialty food categories enhance overall basket size and customer engagement. Private label development provides margin improvement opportunities while meeting price-conscious consumer needs.

Suppliers of plant-based ingredients benefit from growing demand for almonds, oats, soybeans, and other raw materials. Value-added processing capabilities command premium pricing compared to commodity ingredient sales. Sustainable sourcing practices align with brand requirements and consumer expectations, creating competitive advantages.

Consumers gain access to diverse nutritional profiles, allergen-free options, and environmentally sustainable choices. Health benefits include reduced cholesterol intake, lower saturated fat consumption, and improved digestibility for lactose-intolerant individuals. Variety expansion provides options for different taste preferences and dietary requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Functional enhancement represents a dominant trend as manufacturers incorporate probiotics, protein boosters, and specialized nutrients to create products addressing specific health concerns. Adaptogenic ingredients and superfood additions appeal to wellness-focused consumers seeking additional benefits beyond basic nutrition. Personalized nutrition concepts drive development of products targeting specific dietary needs and health goals.

Sustainability focus intensifies across all aspects of production, from regenerative agriculture practices to carbon-neutral manufacturing and recyclable packaging. Water usage reduction and biodiversity protection become key messaging points for environmentally conscious consumers. Circular economy principles influence ingredient sourcing and waste reduction strategies throughout the supply chain.

Premiumization continues driving market value growth through artisanal products, organic certification, and specialty formulations. Small-batch production and local sourcing appeal to consumers seeking authentic, high-quality alternatives. Limited edition flavors and seasonal varieties create excitement and encourage trial among existing consumers.

Technology integration enhances production efficiency and product quality through advanced processing techniques and quality control systems. Precision fermentation and cellular agriculture represent emerging technologies that could revolutionize plant-based milk production. Smart packaging incorporating freshness indicators and sustainability tracking appeals to tech-savvy consumers.

Strategic acquisitions have reshaped the competitive landscape as major food corporations acquire innovative plant-based companies to gain market access and technological capabilities. Danone’s acquisition of WhiteWave Foods and Unilever’s purchase of various plant-based brands demonstrate the strategic importance of this market segment to multinational corporations.

Manufacturing capacity expansion reflects industry confidence in long-term growth prospects, with companies investing in dedicated production facilities and co-manufacturing partnerships. Regional production strategies reduce transportation costs and environmental impact while improving supply chain resilience and product freshness.

Retail partnership evolution includes exclusive product launches, private label development, and category management collaborations. Amazon’s investment in plant-based brands and Walmart’s expansion of organic and natural product sections demonstrate retail commitment to market growth. Direct-to-consumer channels gain importance through subscription services and online-exclusive products.

Regulatory developments include ongoing discussions about labeling standards, nutritional requirements, and marketing claims for plant-based alternatives. FDA guidance on fortification standards and state-level legislation regarding dairy terminology usage continue shaping industry practices and competitive dynamics.

MarkWide Research recommends that industry participants focus on product differentiation through unique nutritional profiles, sustainable sourcing practices, and superior taste formulations. Innovation investment should prioritize addressing remaining barriers such as protein content optimization and cost reduction strategies. Brand building efforts must emphasize authentic messaging about health benefits and environmental impact.

Market expansion strategies should target underserved demographic segments and geographic regions with tailored product offerings and marketing approaches. Price optimization through manufacturing efficiency improvements and supply chain integration can enhance accessibility while maintaining profitability. Partnership development with foodservice operators and retail chains provides volume growth opportunities.

Supply chain resilience requires diversified ingredient sourcing and strategic inventory management to mitigate raw material price volatility. Vertical integration opportunities in key ingredient categories can provide cost advantages and quality control benefits. Sustainability initiatives should encompass entire value chains from farming practices to packaging materials.

Technology adoption in production processes, quality control, and consumer engagement can provide competitive advantages and operational efficiency improvements. Data analytics capabilities enable better demand forecasting, inventory optimization, and personalized marketing strategies. Digital marketing investments should focus on social media engagement and influencer partnerships to reach younger demographics effectively.

Market maturation will continue over the next five years, with sustained growth rates expected to moderate from current levels as the market reaches broader consumer adoption. MWR projections indicate continued expansion driven by demographic shifts, health awareness, and environmental consciousness. Product innovation will focus on addressing remaining taste and nutritional gaps while exploring new plant sources and processing technologies.

Competitive dynamics will intensify as traditional dairy companies expand their plant-based portfolios and new entrants introduce innovative products. Market consolidation through acquisitions and strategic partnerships will likely continue, creating larger, more efficient operations. Price competition may increase as manufacturing scales improve and raw material costs stabilize.

Regulatory environment will evolve to provide clearer guidelines for labeling, nutritional claims, and marketing practices. Industry standards for sustainability reporting and environmental impact measurement will become more standardized. International trade opportunities may expand as global markets develop appreciation for US innovation and quality standards.

Consumer preferences will continue evolving toward more sophisticated products offering multiple benefits beyond basic dairy replacement. Functional beverages incorporating health-promoting ingredients will gain market share, while personalized nutrition concepts may drive product customization. Sustainability requirements will become increasingly important in purchase decisions, influencing packaging, sourcing, and production practices throughout the industry.

The United States non-dairy milk market represents a transformative force within the broader beverage industry, demonstrating remarkable growth momentum and mainstream consumer acceptance. Market dynamics reflect fundamental shifts in consumer preferences toward healthier, more sustainable alternatives to traditional dairy products. Innovation leadership by industry participants has successfully addressed historical barriers related to taste, nutrition, and accessibility.

Growth prospects remain robust despite market maturation, supported by expanding demographic adoption, continued product innovation, and increasing retail support. Competitive intensity will drive further improvements in product quality and cost efficiency while creating opportunities for differentiation through specialized formulations and sustainable practices. Strategic positioning around health benefits, environmental impact, and taste excellence will determine long-term market success.

Industry evolution toward premiumization and functional enhancement reflects sophisticated consumer demands and willingness to pay for superior products. Supply chain development and manufacturing efficiency improvements will support continued market expansion while addressing price sensitivity concerns. The United States non-dairy milk market is positioned for sustained growth as it becomes an integral component of the modern American diet, driven by health consciousness, environmental awareness, and continuous innovation in plant-based alternatives.

What is Non-Dairy Milk?

Non-Dairy Milk refers to plant-based beverages that serve as alternatives to traditional dairy milk. Common types include almond milk, soy milk, oat milk, and coconut milk, which are popular among consumers seeking lactose-free or vegan options.

What are the key players in the United States Non-Dairy Milk Market?

Key players in the United States Non-Dairy Milk Market include Almond Breeze, Silk, Oatly, and Califia Farms, among others. These companies are known for their diverse product offerings and innovative flavors that cater to a growing consumer base.

What are the main drivers of growth in the United States Non-Dairy Milk Market?

The main drivers of growth in the United States Non-Dairy Milk Market include increasing health consciousness among consumers, the rise in lactose intolerance, and the growing popularity of vegan diets. Additionally, the expansion of retail channels has made these products more accessible.

What challenges does the United States Non-Dairy Milk Market face?

The United States Non-Dairy Milk Market faces challenges such as competition from traditional dairy products and potential supply chain disruptions. Additionally, consumer skepticism regarding the nutritional value of non-dairy alternatives can hinder market growth.

What opportunities exist in the United States Non-Dairy Milk Market?

Opportunities in the United States Non-Dairy Milk Market include the development of new flavors and formulations to attract a broader audience. There is also potential for growth in the food service sector, where non-dairy milk can be used in coffee shops and restaurants.

What trends are shaping the United States Non-Dairy Milk Market?

Trends shaping the United States Non-Dairy Milk Market include the rise of organic and fortified non-dairy options, as well as increased consumer interest in sustainability. Innovations in packaging and marketing strategies are also becoming more prominent as brands seek to differentiate themselves.

United States Non-Dairy Milk Market

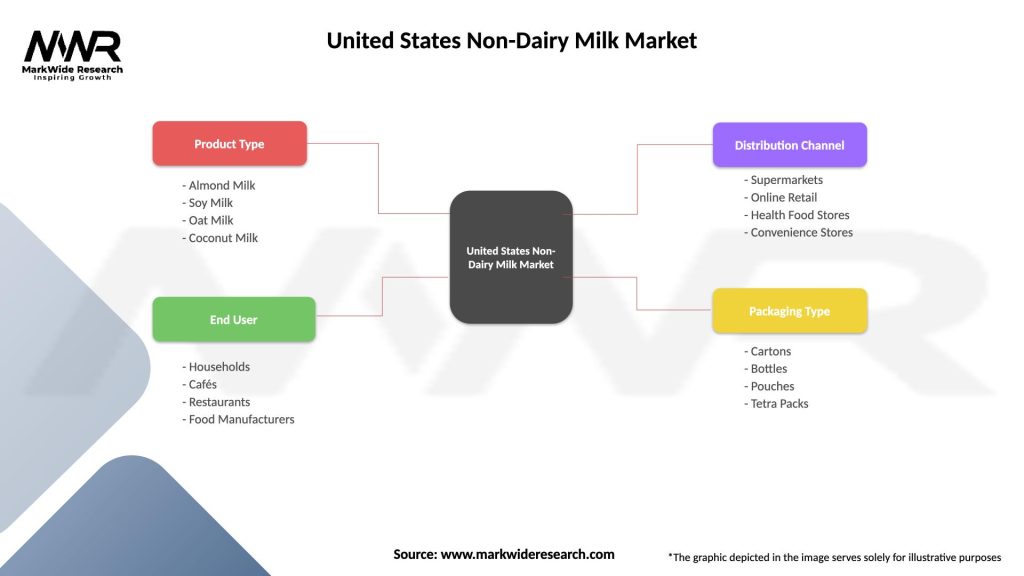

| Segmentation Details | Description |

|---|---|

| Product Type | Almond Milk, Soy Milk, Oat Milk, Coconut Milk |

| End User | Households, Cafés, Restaurants, Food Manufacturers |

| Distribution Channel | Supermarkets, Online Retail, Health Food Stores, Convenience Stores |

| Packaging Type | Cartons, Bottles, Pouches, Tetra Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Non-Dairy Milk Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at