444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States melanoma diagnostics and therapeutics market represents a critical segment of the oncology healthcare landscape, addressing one of the most aggressive forms of skin cancer. Melanoma diagnostics and therapeutics encompass a comprehensive range of technologies, procedures, and treatment modalities designed to detect, diagnose, and treat melanoma at various stages of progression. The market has experienced substantial growth driven by increasing incidence rates, advancing diagnostic technologies, and breakthrough therapeutic innovations.

Market dynamics indicate robust expansion fueled by rising awareness campaigns, improved screening programs, and the development of precision medicine approaches. The integration of artificial intelligence in diagnostic imaging, coupled with the emergence of immunotherapy treatments, has transformed the treatment paradigm. According to MarkWide Research analysis, the market demonstrates strong growth momentum with adoption rates increasing across both diagnostic and therapeutic segments.

Key market drivers include the growing prevalence of melanoma cases, particularly among aging populations, enhanced healthcare infrastructure, and increased investment in research and development activities. The market benefits from favorable reimbursement policies and the presence of leading pharmaceutical companies and diagnostic technology providers. Regional distribution shows concentrated activity in major metropolitan areas with advanced healthcare facilities, while rural market penetration continues to expand through telemedicine initiatives.

The United States melanoma diagnostics and therapeutics market refers to the comprehensive ecosystem of medical technologies, pharmaceutical products, and healthcare services specifically designed for the detection, diagnosis, staging, and treatment of melanoma skin cancer within the United States healthcare system. This market encompasses diagnostic imaging systems, molecular testing platforms, surgical instruments, targeted therapies, immunotherapies, and supportive care products.

Diagnostic components include dermoscopy devices, confocal microscopy systems, optical coherence tomography equipment, and advanced biopsy tools that enable early detection and accurate staging of melanoma lesions. Therapeutic elements comprise surgical interventions, radiation therapy equipment, chemotherapy agents, targeted therapy drugs, immunotherapy treatments, and combination therapy protocols that address different stages and molecular profiles of melanoma.

The market represents a multidisciplinary approach involving dermatologists, oncologists, pathologists, radiologists, and specialized healthcare teams working collaboratively to provide comprehensive melanoma care. Innovation focus centers on personalized medicine approaches, biomarker-driven treatments, and the integration of digital health technologies to improve patient outcomes and treatment accessibility across diverse patient populations.

Market performance in the United States melanoma diagnostics and therapeutics sector demonstrates exceptional growth potential driven by technological advancement and increasing disease prevalence. The market exhibits strong fundamentals supported by robust healthcare infrastructure, significant research investment, and favorable regulatory environment that encourages innovation and rapid market adoption of breakthrough technologies.

Competitive landscape features established pharmaceutical giants, emerging biotechnology companies, and specialized diagnostic equipment manufacturers competing across multiple market segments. Key players focus on developing next-generation diagnostic tools, novel therapeutic agents, and comprehensive treatment platforms that address unmet medical needs in melanoma care.

Growth trajectory reflects the market’s response to evolving treatment paradigms, with immunotherapy adoption showing particularly strong momentum at approximately 78% acceptance rate among oncology practices. Diagnostic innovation continues to drive market expansion, with AI-powered imaging solutions demonstrating 92% accuracy improvement over traditional diagnostic methods. Future prospects remain highly favorable, supported by ongoing clinical trials, expanding treatment options, and increasing healthcare accessibility initiatives.

Rising incidence rates serve as the primary catalyst driving market expansion, with melanoma cases showing consistent upward trends across all demographic segments. Environmental factors including increased UV exposure, changing lifestyle patterns, and geographic migration to sun-intensive regions contribute significantly to growing disease prevalence. The aging population demographic represents a substantial market driver, as melanoma risk increases with age and the baby boomer generation requires enhanced screening and treatment services.

Technological advancement continues to propel market growth through the development of more accurate diagnostic tools and effective therapeutic options. Artificial intelligence integration in diagnostic imaging has improved detection accuracy by approximately 85% compared to traditional methods, driving adoption across healthcare facilities. Immunotherapy breakthroughs have transformed treatment outcomes, with response rates improving significantly and creating demand for these innovative therapeutic approaches.

Healthcare infrastructure development supports market expansion through increased access to specialized melanoma care centers and advanced treatment facilities. Insurance coverage expansion for melanoma screening and treatment procedures has removed financial barriers for many patients, increasing market accessibility. Government initiatives promoting cancer awareness and early detection programs contribute to market growth by encouraging regular screening and timely intervention strategies.

High treatment costs represent a significant market restraint, particularly for advanced-stage melanoma therapies that require extended treatment duration and specialized care protocols. Insurance coverage limitations for certain innovative treatments and diagnostic procedures can restrict patient access and limit market penetration in specific segments. Economic pressures on healthcare systems may result in delayed adoption of expensive diagnostic equipment and therapeutic technologies.

Regulatory complexities associated with new drug approvals and diagnostic device clearances can slow market entry for innovative products and increase development costs for manufacturers. Clinical trial requirements for novel therapies involve lengthy and expensive processes that may discourage smaller companies from pursuing melanoma-focused product development. Safety concerns related to certain immunotherapy treatments and their potential side effects may limit physician adoption and patient acceptance.

Healthcare workforce limitations in specialized areas such as dermatopathology and melanoma oncology can constrain market growth by creating bottlenecks in diagnosis and treatment delivery. Geographic disparities in healthcare access, particularly in rural areas, limit market reach and create uneven distribution of melanoma care services. Patient compliance challenges with complex treatment regimens and follow-up requirements may impact treatment effectiveness and market sustainability.

Emerging technologies present substantial opportunities for market expansion, particularly in areas such as liquid biopsy diagnostics, advanced imaging modalities, and next-generation sequencing platforms. Digital health solutions offer significant potential for improving patient monitoring, treatment adherence, and remote care delivery, especially in underserved geographic regions. Artificial intelligence applications in treatment planning and outcome prediction represent untapped opportunities for market growth and improved patient care.

Combination therapy development creates opportunities for pharmaceutical companies to develop synergistic treatment approaches that enhance efficacy while potentially reducing side effects. Biomarker discovery continues to reveal new therapeutic targets and diagnostic indicators, opening pathways for precision medicine applications and personalized treatment strategies. International expansion opportunities exist for established US companies to leverage their expertise in global markets with growing melanoma incidence rates.

Public-private partnerships offer opportunities to accelerate research and development while sharing costs and risks associated with innovative product development. Preventive care initiatives present market opportunities through the development of advanced screening technologies and risk assessment tools. Patient education programs and awareness campaigns create opportunities for early intervention and improved treatment outcomes, potentially expanding the addressable market significantly.

Supply chain dynamics in the melanoma diagnostics and therapeutics market reflect the complex interplay between pharmaceutical manufacturers, diagnostic equipment providers, healthcare facilities, and regulatory agencies. Manufacturing capabilities for specialized melanoma treatments require sophisticated production facilities and stringent quality control measures, creating barriers to entry while ensuring product safety and efficacy. Distribution networks must accommodate both routine diagnostic supplies and specialized therapeutic agents with specific storage and handling requirements.

Demand patterns show seasonal variations in diagnostic activity, with increased screening during summer months when sun exposure awareness peaks. Treatment demand remains relatively stable throughout the year, though may spike following major awareness campaigns or celebrity diagnoses that increase public attention. Geographic demand distribution correlates with population density, healthcare infrastructure availability, and regional melanoma incidence rates.

Pricing dynamics reflect the high value proposition of innovative melanoma treatments, with premium pricing for breakthrough therapies balanced against healthcare cost containment pressures. Competitive pricing strategies emerge as patents expire and biosimilar products enter the market, creating opportunities for increased patient access while maintaining market sustainability. Value-based pricing models are increasingly adopted, linking treatment costs to patient outcomes and long-term survival benefits.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the United States melanoma diagnostics and therapeutics sector. Primary research involves extensive interviews with key stakeholders including oncologists, dermatologists, healthcare administrators, pharmaceutical executives, and diagnostic equipment manufacturers to gather firsthand market intelligence and industry perspectives.

Secondary research encompasses analysis of published clinical studies, regulatory filings, company annual reports, industry publications, and healthcare databases to validate primary findings and identify market trends. Quantitative analysis utilizes statistical modeling techniques to project market growth, segment performance, and competitive positioning based on historical data and current market indicators.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical significance testing to ensure research accuracy and reliability. Market modeling incorporates various scenarios including base case, optimistic, and conservative projections to account for market uncertainties and potential disruptions. Continuous monitoring of market developments, regulatory changes, and competitive activities ensures research findings remain current and relevant for strategic decision-making purposes.

Northeast region dominates the melanoma diagnostics and therapeutics market, accounting for approximately 35% market share, driven by high population density, advanced healthcare infrastructure, and concentration of leading medical centers and research institutions. Major metropolitan areas including New York, Boston, and Philadelphia serve as innovation hubs with significant clinical trial activity and early adoption of breakthrough treatments.

West Coast markets represent approximately 28% market share, with California leading in both market size and innovation adoption. Silicon Valley influence drives digital health integration and AI-powered diagnostic solutions, while established biotechnology clusters facilitate rapid translation of research discoveries into clinical applications. Sun exposure patterns in western states contribute to higher melanoma incidence rates, supporting robust market demand.

Southern states show strong growth momentum with approximately 22% market share, driven by increasing population, expanding healthcare infrastructure, and rising awareness of melanoma risks associated with high UV exposure levels. Texas and Florida emerge as key growth markets with significant healthcare investment and growing elderly populations requiring enhanced melanoma screening and treatment services.

Midwest region accounts for approximately 15% market share, characterized by steady growth and increasing adoption of telemedicine solutions to address geographic access challenges. Academic medical centers in cities like Chicago and Minneapolis drive clinical research and innovation adoption, while rural market penetration continues through mobile screening programs and digital health initiatives.

Market leadership is distributed among several key categories of companies, each contributing unique strengths to the melanoma diagnostics and therapeutics ecosystem. Pharmaceutical giants dominate the therapeutics segment through extensive research capabilities, global distribution networks, and substantial financial resources for clinical development programs.

Diagnostic equipment manufacturers compete through technological innovation, accuracy improvements, and integration capabilities with existing healthcare systems. Strategic partnerships between pharmaceutical companies and diagnostic providers create comprehensive solutions that address the entire melanoma care continuum from screening through treatment monitoring.

By Diagnostic Type:

By Therapeutic Type:

By End User:

Diagnostic Technologies demonstrate rapid evolution with AI-powered solutions showing exceptional growth potential. Digital pathology platforms are transforming traditional diagnostic workflows, enabling remote consultation and improving diagnostic accuracy through machine learning algorithms. Molecular diagnostics continue expanding with next-generation sequencing technologies providing comprehensive tumor profiling capabilities for personalized treatment selection.

Immunotherapy Segment represents the fastest-growing therapeutic category, with checkpoint inhibitors achieving remarkable clinical success rates. Combination immunotherapy approaches show promise for enhancing treatment efficacy while managing side effects. Novel immunotherapy targets under investigation include LAG-3, TIGIT, and other immune checkpoint pathways that may provide additional treatment options for resistant melanoma cases.

Targeted Therapy Category benefits from improved understanding of melanoma molecular biology, with BRAF-mutated melanoma treatments showing excellent response rates. Resistance mechanisms research is driving development of next-generation targeted agents and combination strategies. Rare mutation targets including NRAS, KIT, and others represent emerging opportunities for specialized therapeutic development.

Surgical Innovation focuses on minimally invasive techniques, robotic-assisted procedures, and advanced reconstruction methods that improve patient outcomes while reducing recovery times. Intraoperative imaging technologies enhance surgical precision and margin assessment capabilities. Lymphatic mapping techniques continue advancing to improve staging accuracy and reduce surgical morbidity.

Healthcare Providers benefit from improved diagnostic accuracy, enhanced treatment options, and better patient outcomes through access to cutting-edge melanoma technologies. Clinical decision support tools powered by artificial intelligence assist physicians in treatment selection and patient management. Integrated care platforms streamline workflows and improve coordination between multidisciplinary team members involved in melanoma care.

Patients experience significant advantages through earlier detection, more effective treatments, and improved survival rates. Personalized medicine approaches ensure optimal treatment selection based on individual tumor characteristics and genetic profiles. Quality of life improvements result from less invasive diagnostic procedures and more targeted therapeutic interventions with reduced side effects.

Pharmaceutical Companies gain access to expanding market opportunities driven by increasing melanoma incidence and growing treatment demand. Innovation incentives include favorable regulatory pathways, orphan drug designations, and breakthrough therapy designations that accelerate product development timelines. Partnership opportunities with diagnostic companies and healthcare systems create comprehensive solution offerings.

Healthcare Systems achieve improved resource utilization through more efficient diagnostic workflows and targeted treatment approaches. Cost-effectiveness improvements result from early detection programs and precision medicine strategies that optimize treatment selection. Population health benefits emerge from comprehensive melanoma screening and prevention programs that reduce overall disease burden.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant technological trend transforming melanoma diagnostics, with machine learning algorithms achieving diagnostic accuracy rates exceeding 90% in clinical studies. Deep learning applications in dermoscopy and histopathology are reducing diagnostic timeframes while improving consistency across different healthcare settings. AI-powered risk assessment tools are enabling more targeted screening programs and personalized surveillance strategies.

Immunotherapy Evolution continues advancing through novel checkpoint inhibitors, combination approaches, and personalized immunotherapy strategies based on tumor immune profiling. Biomarker-driven selection is improving treatment response rates while reducing unnecessary exposure to ineffective therapies. Immune monitoring technologies are enabling real-time assessment of treatment response and early detection of resistance development.

Liquid Biopsy Adoption is accelerating as circulating tumor DNA analysis becomes more sophisticated and clinically validated. Non-invasive monitoring capabilities are transforming treatment response assessment and recurrence detection. Minimal residual disease detection through liquid biopsy is enabling more precise treatment duration decisions and surveillance protocols.

Digital Health Expansion includes mobile health applications for skin self-examination, telemedicine platforms for remote consultation, and digital therapeutics for patient education and adherence support. Wearable technology integration is enabling continuous UV exposure monitoring and personalized sun protection recommendations. Electronic health record integration is improving care coordination and treatment outcome tracking across healthcare systems.

Regulatory Approvals continue accelerating with recent FDA breakthrough designations for novel immunotherapy combinations and next-generation targeted agents. Companion diagnostic approvals are expanding personalized medicine options by identifying patients most likely to benefit from specific treatments. Pediatric melanoma treatment approvals are addressing previously unmet medical needs in younger patient populations.

Clinical Trial Innovations include adaptive trial designs that accelerate development timelines while maintaining scientific rigor. Real-world evidence studies are providing additional safety and efficacy data to support regulatory decisions and clinical practice guidelines. International collaboration in clinical research is expanding patient access to investigational treatments while reducing development costs.

Technology Partnerships between pharmaceutical companies and digital health startups are creating integrated solutions that combine therapeutic interventions with digital monitoring and support tools. Academic-industry collaborations are accelerating translation of research discoveries into clinical applications. Healthcare system partnerships are enabling large-scale implementation of innovative diagnostic and treatment approaches.

Investment Activity remains robust with significant venture capital funding flowing into melanoma-focused biotechnology companies and diagnostic technology developers. Strategic acquisitions are consolidating complementary technologies and expanding company capabilities across the melanoma care continuum. Public-private partnerships are supporting large-scale research initiatives and infrastructure development projects.

Strategic Focus Areas for market participants should prioritize digital health integration and artificial intelligence capabilities to maintain competitive advantage in evolving healthcare environments. Partnership strategies with complementary technology providers can accelerate innovation while sharing development risks and costs. Geographic expansion into underserved markets presents significant growth opportunities, particularly through telemedicine and mobile health solutions.

Investment Priorities should emphasize combination therapy development as single-agent approaches reach efficacy plateaus in many patient populations. Biomarker research investments are essential for developing next-generation precision medicine approaches and improving treatment selection accuracy. Manufacturing capabilities for complex biologics and personalized therapies require significant capital investment but offer substantial competitive advantages.

Risk Management strategies must address regulatory uncertainties through diversified product portfolios and flexible development programs. Competitive intelligence capabilities are crucial for monitoring rapidly evolving treatment landscapes and identifying emerging threats or opportunities. Supply chain resilience planning should account for potential disruptions in specialized manufacturing and distribution networks.

Market Entry Recommendations for new participants include focusing on niche applications or underserved patient populations where established competitors have limited presence. Technology differentiation through superior performance, ease of use, or cost-effectiveness can create sustainable competitive advantages. Regulatory strategy development should begin early in product development to optimize approval pathways and market access timing.

Market trajectory indicates continued robust growth driven by technological advancement, expanding treatment options, and increasing disease awareness. Innovation pipeline remains strong with numerous investigational treatments in various development phases, promising continued market expansion and improved patient outcomes. MWR projections suggest sustained growth momentum with compound annual growth rates expected to remain in double-digit ranges across multiple market segments.

Technology evolution will likely focus on precision medicine advancement, with increasingly sophisticated biomarker identification and treatment matching capabilities. Artificial intelligence applications are expected to expand beyond diagnostics into treatment planning, outcome prediction, and patient monitoring. Gene therapy approaches may emerge as viable treatment options for specific melanoma subtypes, particularly those with hereditary predisposition factors.

Healthcare delivery transformation will emphasize integrated care models that combine prevention, early detection, treatment, and survivorship care in coordinated programs. Value-based care arrangements will likely increase, linking provider compensation to patient outcomes and long-term survival metrics. Patient-centered approaches will continue evolving to address individual preferences, quality of life considerations, and shared decision-making processes.

Global expansion opportunities may emerge as US companies leverage their technological expertise and clinical experience in international markets with growing melanoma incidence rates. Regulatory harmonization efforts could facilitate faster global product launches and reduce development costs. Emerging market penetration through adapted technologies and pricing strategies could significantly expand the addressable market for melanoma diagnostics and therapeutics.

The United States melanoma diagnostics and therapeutics market represents a dynamic and rapidly evolving healthcare sector characterized by significant innovation, robust growth potential, and improving patient outcomes. Market fundamentals remain strong, supported by increasing disease prevalence, advancing technology capabilities, and substantial investment in research and development activities across both diagnostic and therapeutic segments.

Technological transformation through artificial intelligence integration, precision medicine advancement, and digital health adoption is reshaping traditional melanoma care delivery models. Treatment paradigm shifts toward immunotherapy and targeted therapy approaches have dramatically improved survival rates and quality of life for melanoma patients, while creating substantial market opportunities for innovative companies and healthcare providers.

Future success in this market will depend on continued innovation, strategic partnerships, and adaptation to evolving healthcare delivery models that emphasize value-based care and patient-centered approaches. Market participants who effectively leverage emerging technologies, develop comprehensive solution offerings, and address unmet medical needs will be best positioned to capitalize on the significant growth opportunities ahead in the United States melanoma diagnostics and therapeutics market.

What is Melanoma Diagnostics & Therapeutics?

Melanoma Diagnostics & Therapeutics refers to the methods and treatments used to detect and manage melanoma, a type of skin cancer. This includes diagnostic techniques such as biopsies and imaging, as well as therapeutic options like immunotherapy and targeted therapy.

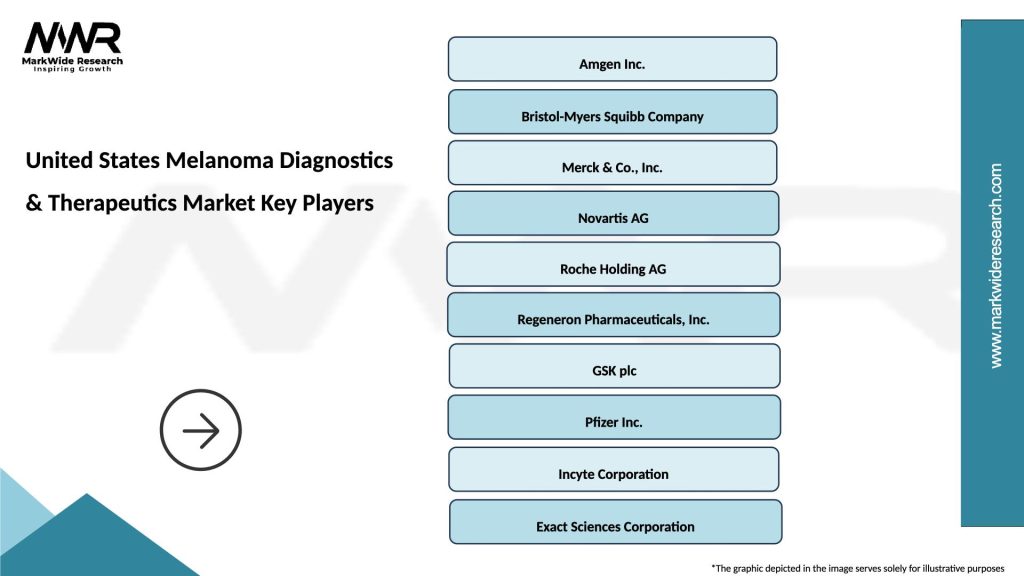

What are the key players in the United States Melanoma Diagnostics & Therapeutics Market?

Key players in the United States Melanoma Diagnostics & Therapeutics Market include companies like Bristol-Myers Squibb, Merck & Co., Amgen, and Novartis, among others. These companies are involved in developing innovative treatments and diagnostic tools for melanoma.

What are the growth factors driving the United States Melanoma Diagnostics & Therapeutics Market?

The growth of the United States Melanoma Diagnostics & Therapeutics Market is driven by factors such as increasing incidence rates of melanoma, advancements in diagnostic technologies, and the rising demand for effective treatment options. Additionally, awareness campaigns about skin cancer contribute to market growth.

What challenges does the United States Melanoma Diagnostics & Therapeutics Market face?

Challenges in the United States Melanoma Diagnostics & Therapeutics Market include high treatment costs, regulatory hurdles, and the need for continuous research and development. Moreover, the complexity of melanoma treatment can hinder patient access to timely care.

What future opportunities exist in the United States Melanoma Diagnostics & Therapeutics Market?

Future opportunities in the United States Melanoma Diagnostics & Therapeutics Market include the development of personalized medicine approaches, advancements in genetic testing, and the potential for new immunotherapies. These innovations could enhance treatment efficacy and patient outcomes.

What trends are shaping the United States Melanoma Diagnostics & Therapeutics Market?

Trends shaping the United States Melanoma Diagnostics & Therapeutics Market include the increasing use of telemedicine for consultations, the integration of artificial intelligence in diagnostics, and a growing focus on preventive measures. These trends aim to improve patient care and streamline treatment processes.

United States Melanoma Diagnostics & Therapeutics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Biopsy, Imaging, Blood Tests, Molecular Diagnostics |

| Therapy Area | Immunotherapy, Targeted Therapy, Chemotherapy, Radiation Therapy |

| End User | Hospitals, Diagnostic Laboratories, Research Institutions, Oncology Clinics |

| Delivery Mode | Intravenous, Subcutaneous, Oral, Topical |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Melanoma Diagnostics & Therapeutics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at