444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States marketing agencies market represents a dynamic and rapidly evolving sector that serves as the backbone of modern business communication and brand development. This comprehensive ecosystem encompasses traditional advertising agencies, digital marketing specialists, public relations firms, and integrated marketing communications providers that collectively drive brand awareness and customer engagement across diverse industries.

Market dynamics indicate robust growth driven by digital transformation initiatives, with agencies experiencing a 12.5% annual growth rate in digital service adoption. The landscape has fundamentally shifted from traditional media-focused approaches to data-driven, multi-channel strategies that leverage advanced analytics and artificial intelligence technologies.

Industry consolidation continues to reshape the competitive environment, with major holding companies acquiring specialized boutique agencies to expand their service portfolios. Simultaneously, independent agencies are carving out significant market share by offering personalized services and agile response capabilities that larger organizations often struggle to match.

Regional distribution shows concentrated activity in major metropolitan areas, with 45% of agencies located in New York, Los Angeles, Chicago, and San Francisco. However, emerging markets in Austin, Denver, and Nashville are gaining prominence as technology hubs attract both agencies and their clients seeking innovative marketing solutions.

The United States marketing agencies market refers to the comprehensive network of professional service organizations that provide strategic marketing, advertising, branding, and communication services to businesses across all sectors. These agencies serve as intermediaries between brands and consumers, developing creative campaigns, managing media placements, and executing integrated marketing strategies designed to drive business growth and market penetration.

Service offerings within this market span traditional advertising, digital marketing, social media management, content creation, public relations, brand strategy, market research, and emerging technologies such as influencer marketing and programmatic advertising. Agencies range from full-service integrated providers to specialized boutiques focusing on specific industries or marketing disciplines.

Market participants include multinational agency networks, independent agencies, freelance consultants, and in-house marketing departments that compete for client budgets and market share. The ecosystem supports thousands of businesses while employing hundreds of thousands of marketing professionals across creative, strategic, technical, and account management roles.

Strategic transformation defines the current state of the United States marketing agencies market, as organizations adapt to rapidly changing consumer behaviors, technological innovations, and economic pressures. The industry has demonstrated remarkable resilience while navigating challenges including economic uncertainty, talent shortages, and evolving client expectations for measurable return on investment.

Digital acceleration remains the primary growth driver, with 78% of agencies reporting increased demand for digital marketing services compared to traditional advertising channels. This shift has prompted significant investments in technology infrastructure, data analytics capabilities, and specialized talent acquisition to meet evolving client requirements.

Competitive differentiation increasingly depends on agencies’ ability to demonstrate measurable business impact through advanced attribution modeling, customer journey optimization, and integrated campaign performance metrics. Successful agencies are those that combine creative excellence with data-driven insights to deliver comprehensive marketing solutions.

Future growth prospects appear favorable, supported by continued business investment in marketing technology, expanding e-commerce opportunities, and the ongoing need for professional expertise in navigating complex digital marketing landscapes. However, agencies must continue adapting their service models to remain competitive in an increasingly sophisticated marketplace.

Industry evolution reveals several critical insights that shape the current marketing agencies landscape and influence future development trajectories:

Digital transformation initiatives across all business sectors continue to fuel demand for specialized marketing agency services. Organizations recognize that successful digital marketing requires expertise in multiple disciplines including search engine optimization, social media marketing, content strategy, and marketing automation platforms.

E-commerce expansion has created unprecedented opportunities for marketing agencies, as businesses seek professional guidance in developing omnichannel customer experiences. The complexity of modern consumer journeys requires sophisticated marketing strategies that integrate online and offline touchpoints seamlessly.

Data availability and analytics have transformed marketing from an art to a science, with agencies providing valuable services in customer segmentation, predictive modeling, and performance optimization. According to MarkWide Research analysis, agencies that offer advanced analytics services report 35% higher client retention rates compared to those focusing solely on creative services.

Regulatory compliance requirements in areas such as data privacy, accessibility, and advertising standards create ongoing demand for agency expertise. Businesses rely on agencies to navigate complex regulatory landscapes while maintaining effective marketing communications.

Competitive market pressures drive businesses to seek professional marketing support to differentiate their brands and capture market share. Agencies provide strategic guidance and execution capabilities that many organizations cannot develop internally due to resource constraints or expertise gaps.

Economic uncertainty periodically impacts marketing budgets, as businesses often reduce advertising and marketing expenditures during economic downturns. This cyclical nature of demand creates revenue volatility for agencies and requires careful financial management and diversified client portfolios.

In-house marketing trends present ongoing challenges as some organizations choose to build internal marketing capabilities rather than outsourcing to agencies. Large corporations particularly are investing in internal teams and technology platforms to reduce dependency on external service providers.

Talent acquisition difficulties constrain agency growth, with skilled marketing professionals in high demand across multiple industries. The competition for qualified staff drives up labor costs and can limit agencies’ ability to scale operations effectively.

Technology disruption requires continuous investment in new platforms, tools, and training to remain competitive. Agencies must balance the costs of staying current with emerging technologies against the need to maintain profitability and competitive pricing.

Client budget pressures often result in fee compression and demands for increased value delivery. Agencies must continuously demonstrate return on investment while managing cost structures to maintain healthy profit margins.

Artificial intelligence integration presents significant opportunities for agencies to enhance service delivery through automated campaign optimization, predictive analytics, and personalized content creation. Early adopters of AI technologies are positioning themselves as innovation leaders in the marketplace.

Emerging market segments including healthcare technology, fintech, and sustainable products require specialized marketing expertise that creates new revenue opportunities for agencies willing to develop industry-specific capabilities and knowledge.

International expansion opportunities exist as U.S. businesses increasingly seek global market entry support. Agencies with international capabilities or partnership networks can capture additional revenue by supporting client expansion initiatives.

Marketing technology consulting represents a growing opportunity as businesses struggle to integrate and optimize complex technology stacks. Agencies can expand their service offerings to include technology selection, implementation, and optimization consulting.

Performance marketing specialization offers opportunities for agencies to develop expertise in measurable, results-driven marketing approaches that align with client demands for accountability and return on investment demonstration.

Competitive intensity continues to increase as new entrants join the market and existing players expand their service offerings. This dynamic environment rewards agencies that can differentiate themselves through specialized expertise, superior results, or innovative service delivery models.

Client expectations have evolved significantly, with businesses demanding integrated marketing solutions that span multiple channels and touchpoints. Agencies must develop comprehensive capabilities or establish strategic partnerships to meet these complex requirements effectively.

Technology evolution drives continuous adaptation, with agencies investing in new platforms and tools to remain competitive. The pace of technological change requires ongoing education and training investments to maintain staff competency and service quality.

Pricing pressures from clients seeking cost efficiencies challenge agencies to optimize their operations while maintaining service quality. Successful agencies are those that can demonstrate clear value propositions and measurable business impact to justify their fees.

Talent mobility within the industry creates both opportunities and challenges, as skilled professionals move between agencies and clients. This dynamic requires agencies to focus on employee retention strategies and knowledge management systems.

Comprehensive analysis of the United States marketing agencies market employs multiple research methodologies to ensure accurate and actionable insights. Primary research includes extensive interviews with agency executives, client-side marketing leaders, and industry experts to understand current trends and future projections.

Secondary research incorporates analysis of industry reports, financial statements, regulatory filings, and trade publication data to validate primary findings and provide quantitative context. This multi-source approach ensures comprehensive market understanding and reduces potential bias in findings.

Market segmentation analysis examines the industry across multiple dimensions including service type, client industry, agency size, and geographic distribution. This detailed segmentation provides insights into growth opportunities and competitive dynamics within specific market niches.

Competitive intelligence gathering includes analysis of agency capabilities, client portfolios, pricing strategies, and market positioning to understand competitive dynamics and identify success factors. This analysis helps stakeholders understand best practices and market opportunities.

Trend analysis incorporates historical data review and forward-looking projections to identify emerging opportunities and potential challenges. This temporal perspective provides context for current market conditions and supports strategic planning initiatives.

Northeast region maintains its position as the largest marketing agencies market, with 38% market concentration driven by New York City’s status as a global advertising hub. Major agency holding companies maintain headquarters and significant operations in the region, supported by proximity to Fortune 500 clients and media companies.

West Coast markets demonstrate strong growth, particularly in technology-focused marketing services. Los Angeles and San Francisco represent major agency centers, with 28% regional market share supported by entertainment industry clients and technology companies requiring specialized digital marketing expertise.

Southeast expansion has accelerated as businesses relocate to markets offering favorable business climates and lower operating costs. Atlanta, Miami, and Charlotte have emerged as significant agency markets, attracting both clients and agencies seeking growth opportunities outside traditional major markets.

Midwest stability continues with Chicago serving as a major agency center supporting manufacturing, financial services, and consumer goods clients. The region’s central location and diverse client base provide steady demand for marketing services across multiple industries.

Southwest growth reflects broader economic development trends, with Austin, Dallas, and Denver attracting technology companies and supporting agency ecosystems. These markets offer opportunities for agencies seeking expansion outside saturated coastal markets.

Market leadership remains concentrated among major agency holding companies that offer integrated marketing services across multiple disciplines and geographic markets:

Independent agencies continue to gain market share by offering specialized expertise, agile service delivery, and personalized client relationships. These organizations often focus on specific industries or marketing disciplines to differentiate themselves from larger competitors.

By Service Type:

By Client Industry:

By Agency Size:

Digital marketing services continue to dominate growth within the agencies market, with 85% of agencies reporting increased client demand for digital capabilities. Search engine marketing, social media advertising, and marketing automation represent the highest-growth service categories as businesses prioritize measurable, data-driven marketing approaches.

Creative services remain essential despite digital transformation, with successful agencies integrating creative excellence with data-driven insights. Video content creation, interactive experiences, and personalized creative campaigns represent areas of particular growth and client investment.

Strategy consulting has emerged as a high-value service category, with agencies positioning themselves as strategic business partners rather than tactical service providers. This evolution requires agencies to develop deeper business acumen and industry expertise beyond traditional marketing knowledge.

Technology services represent a rapidly expanding category as agencies help clients navigate complex marketing technology landscapes. Services include platform selection, implementation support, integration consulting, and ongoing optimization to maximize technology investments.

Performance marketing continues gaining importance as clients demand accountability and measurable results. Agencies specializing in performance-based pricing models and attribution analysis are experiencing strong growth and client retention rates.

For Marketing Agencies:

For Client Organizations:

For Industry Suppliers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Data-driven marketing has become the industry standard, with agencies investing heavily in analytics platforms and data science capabilities. MWR research indicates that 92% of successful agencies now offer advanced data analytics services as core competencies rather than optional add-ons.

Personalization at scale represents a major trend as agencies help clients deliver individualized marketing experiences across large customer bases. This requires sophisticated technology integration and creative production capabilities that can adapt content for multiple audience segments simultaneously.

Omnichannel integration continues evolving as agencies develop capabilities to create seamless customer experiences across online and offline touchpoints. This trend requires agencies to understand complex customer journey mapping and attribution modeling across multiple channels.

Sustainability marketing has emerged as a significant trend, with agencies developing expertise in environmental, social, and governance (ESG) communications. Clients increasingly require support in communicating sustainability initiatives and corporate responsibility programs effectively.

Influencer marketing maturation shows the evolution from experimental campaigns to strategic, long-term partnership programs. Agencies are developing sophisticated influencer relationship management capabilities and measurement frameworks to demonstrate campaign effectiveness.

Voice and conversational marketing represent emerging trends as smart speakers and chatbots become more prevalent in consumer interactions. Agencies are developing new creative approaches and technical capabilities to support these emerging channels.

Artificial intelligence adoption has accelerated across the industry, with major agencies investing in AI-powered campaign optimization, content creation, and customer insights platforms. These investments are reshaping service delivery models and creating new competitive advantages for early adopters.

Privacy regulation compliance has become a critical focus area as agencies help clients navigate CCPA, GDPR, and other data privacy requirements. This has led to significant investments in compliance systems and processes that affect campaign targeting and measurement capabilities.

Remote work transformation has permanently altered agency operations, with many organizations adopting hybrid work models that combine remote flexibility with in-person collaboration. This shift has impacted talent acquisition strategies and office space requirements across the industry.

Acquisition activity continues as major holding companies acquire specialized agencies to expand their capabilities in areas such as e-commerce marketing, customer experience design, and marketing technology consulting. These acquisitions reshape competitive dynamics and service offerings.

Client-agency relationship evolution shows a trend toward longer-term partnerships and integrated service models rather than project-based engagements. This shift requires agencies to develop deeper business understanding and strategic consulting capabilities beyond traditional marketing services.

Technology investment priorities should focus on platforms that enhance data analytics, campaign automation, and client reporting capabilities. Agencies that can demonstrate clear return on investment from technology investments will be better positioned to justify pricing and win competitive pitches.

Talent development strategies must address the growing skills gap in digital marketing, data analysis, and technology integration. Successful agencies are investing in continuous education programs and partnerships with educational institutions to develop required capabilities.

Service portfolio expansion should be strategic rather than opportunistic, focusing on areas where agencies can develop genuine expertise and competitive advantages. Specialization in specific industries or marketing disciplines often provides better growth prospects than broad generalization.

Client relationship management requires increased focus on business outcomes rather than marketing metrics alone. Agencies should develop capabilities to demonstrate how marketing activities contribute to client business objectives and financial performance.

Operational efficiency improvements through process automation and technology integration can help agencies maintain profitability while managing cost pressures. Investment in project management systems and workflow optimization can provide significant competitive advantages.

Growth projections for the United States marketing agencies market remain positive, supported by continued business investment in marketing technology and digital transformation initiatives. MarkWide Research analysis suggests the industry will experience sustained growth rates of 8-10% annually over the next five years, driven primarily by digital service demand.

Technology integration will continue reshaping service delivery models, with successful agencies being those that can effectively combine human creativity with artificial intelligence and automation capabilities. This hybrid approach will become the industry standard for competitive differentiation.

Industry consolidation is expected to continue, with mid-size agencies facing pressure to either scale up through acquisitions or specialize in niche markets. The polarization between large integrated agencies and specialized boutiques will likely intensify.

Client expectations will continue evolving toward greater accountability, transparency, and business impact demonstration. Agencies must develop sophisticated measurement and attribution capabilities to meet these increasing demands for performance validation.

Emerging opportunities in areas such as artificial intelligence marketing, sustainability communications, and international expansion will create new revenue streams for agencies willing to invest in developing these capabilities early.

The United States marketing agencies market stands at a pivotal transformation point, balancing traditional creative excellence with data-driven performance marketing demands. Industry participants who successfully navigate this evolution by investing in technology capabilities, developing specialized expertise, and demonstrating measurable business impact will be well-positioned for sustained growth and competitive success.

Strategic adaptation remains essential as agencies face ongoing challenges including talent competition, technology disruption, and evolving client expectations. However, the fundamental need for professional marketing expertise continues growing as businesses recognize the complexity of modern marketing landscapes and the value of specialized knowledge and capabilities.

Future success will depend on agencies’ ability to combine creative innovation with analytical rigor, providing clients with integrated marketing solutions that drive measurable business results. Organizations that can effectively balance these requirements while maintaining operational efficiency and client satisfaction will capture the greatest opportunities in this dynamic and evolving marketplace.

What is Marketing Agencies?

Marketing agencies are firms that provide a range of services to help businesses promote their products and services. These services can include advertising, public relations, digital marketing, and market research, among others.

Who are the key players in the United States Marketing Agencies Market?

Key players in the United States Marketing Agencies Market include WPP, Omnicom Group, Publicis Groupe, and Interpublic Group, among others. These companies offer diverse marketing solutions across various sectors, including digital marketing, branding, and media planning.

What are the main drivers of growth in the United States Marketing Agencies Market?

The main drivers of growth in the United States Marketing Agencies Market include the increasing demand for digital marketing services, the rise of social media platforms, and the growing importance of data analytics in marketing strategies. Businesses are increasingly seeking innovative ways to engage consumers.

What challenges do marketing agencies face in the United States?

Marketing agencies in the United States face challenges such as intense competition, rapidly changing technology, and the need to adapt to evolving consumer preferences. Additionally, agencies must navigate regulatory changes that impact advertising practices.

What opportunities exist for growth in the United States Marketing Agencies Market?

Opportunities for growth in the United States Marketing Agencies Market include the expansion of influencer marketing, the integration of artificial intelligence in marketing strategies, and the increasing focus on personalized customer experiences. Agencies can leverage these trends to enhance their service offerings.

What trends are shaping the United States Marketing Agencies Market?

Trends shaping the United States Marketing Agencies Market include the rise of content marketing, the growing importance of sustainability in branding, and the shift towards omnichannel marketing strategies. Agencies are adapting to these trends to meet client demands.

United States Marketing Agencies Market

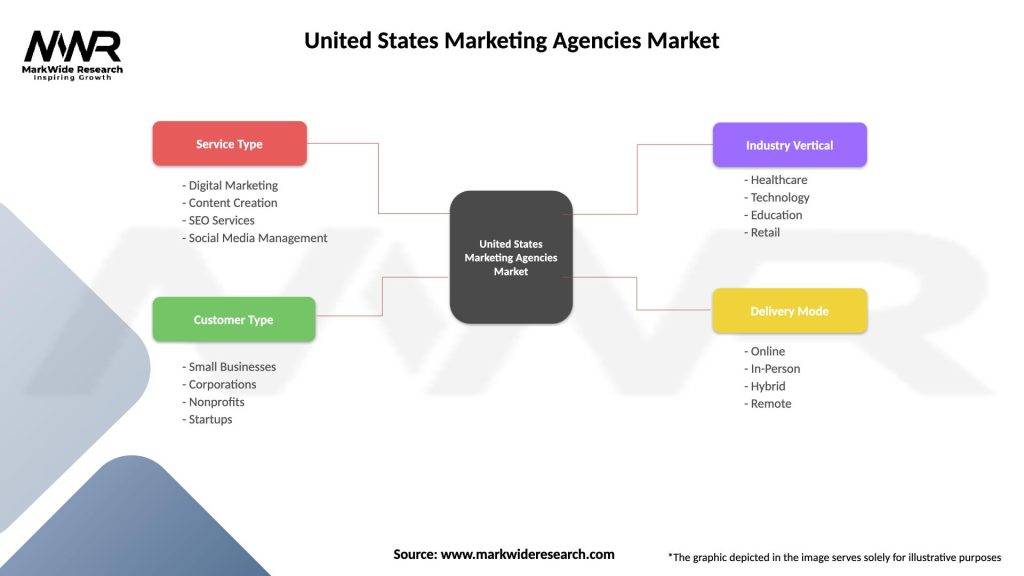

| Segmentation Details | Description |

|---|---|

| Service Type | Digital Marketing, Content Creation, SEO Services, Social Media Management |

| Customer Type | Small Businesses, Corporations, Nonprofits, Startups |

| Industry Vertical | Healthcare, Technology, Education, Retail |

| Delivery Mode | Online, In-Person, Hybrid, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Marketing Agencies Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at