444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Luxury residential real estate in the United States represents a thriving segment of the housing market, catering to high-net-worth individuals seeking exclusive properties with premium amenities and superior locations. These luxury properties are characterized by their opulent designs, spacious interiors, and top-notch features, setting them apart from traditional residential options. The market for luxury residential real estate has been on an upward trajectory, driven by several factors that contribute to its growth and sustained demand.

Meaning

Luxury residential real estate refers to high-end properties with a price significantly above the median home value in a given area. These properties are characterized by their exclusivity, prime locations, premium construction, and extensive amenities that cater to the discerning tastes of affluent buyers. Luxury homes often feature state-of-the-art technology, panoramic views, lavish interiors, and ample space, offering a lifestyle that goes beyond the ordinary.

Executive Summary

The United States luxury residential real estate market has experienced robust growth over the past few years, fueled by a combination of economic prosperity, low-interest rates, and strong demand from domestic and international buyers. The market’s performance has been marked by consistent appreciation in property values, making it an attractive investment option for many wealthy individuals. Despite challenges posed by the COVID-19 pandemic, the luxury real estate sector has displayed resilience, adapting to changing circumstances and embracing innovative marketing strategies.

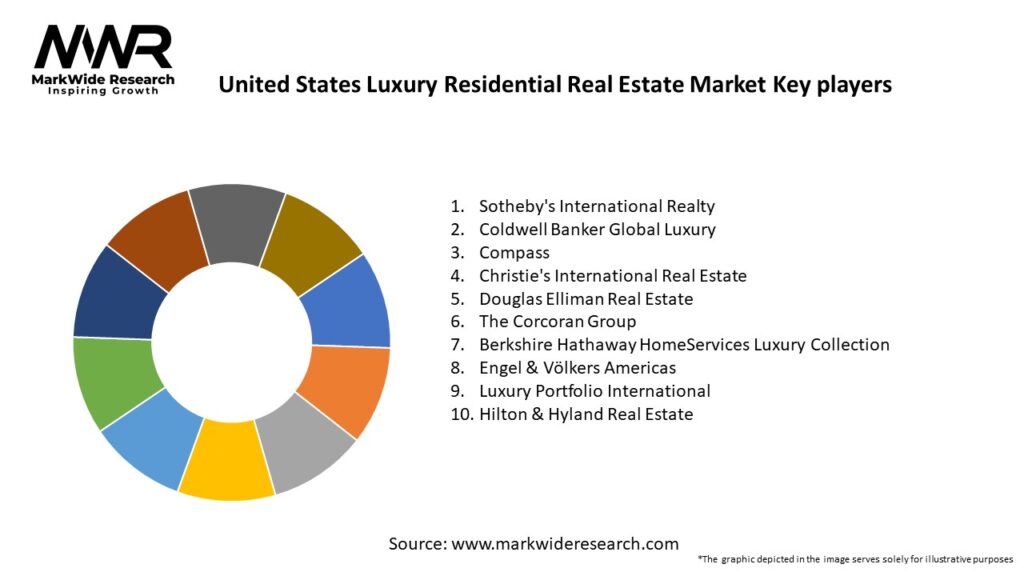

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United States luxury residential real estate market is characterized by its dynamic nature, influenced by various internal and external factors. Economic conditions, buyer preferences, technological advancements, and global events continuously shape the market landscape. Staying attuned to these dynamics is crucial for industry participants and stakeholders to make informed decisions and adapt to changing market trends.

Regional Analysis

The luxury residential real estate market in the United States exhibits regional variations, with certain cities and states serving as hotspots for high-end properties. Key cities such as New York City, Los Angeles, Miami, and San Francisco attract a significant number of luxury homebuyers due to their economic vibrancy, cultural offerings, and exclusive neighborhoods. Other metropolitan areas and affluent suburbs also contribute to the regional dynamics of the luxury real estate market.

Competitive Landscape

Leading Companies in the United States Luxury Residential Real Estate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The luxury residential real estate market can be segmented based on property type, location, amenities, and price range. Property types may include luxury condos, penthouses, townhouses, and sprawling estates. Location segmentation involves categorizing properties based on urban, suburban, or rural settings, while amenities may range from private pools and spas to home theaters and smart home technology.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the luxury residential real estate market, initially causing disruptions due to lockdowns and travel restrictions. However, the market showed resilience as remote work and the desire for more spacious and secure homes drove demand for luxury properties in suburban and rural areas. Virtual property tours and online transactions also became common practices, catering to safety concerns and travel limitations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the United States luxury residential real estate market remains optimistic. As economic conditions stabilize and travel restrictions ease, demand from domestic and international buyers is expected to rebound. The industry will continue to evolve, embracing technological advancements and sustainable practices to cater to the changing preferences of affluent buyers.

Conclusion

The United States luxury residential real estate market presents a world of opulence and exclusivity, attracting affluent buyers seeking high-end properties with premium amenities. Despite challenges posed by economic fluctuations and global events, the luxury market has displayed resilience and adaptability. Industry players must continually innovate, stay attuned to market dynamics, and leverage technology to meet the demands of discerning luxury homebuyers. With a promising future outlook, the luxury real estate sector remains a compelling investment opportunity for developers, investors, and stakeholders alike.

United States Luxury Residential Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Single-Family Homes, Condominiums, Townhouses, Luxury Estates |

| Buyer Profile | High-Net-Worth Individuals, Investors, Foreign Buyers, Retirees |

| Price Tier | Entry-Level Luxury, Mid-Tier Luxury, High-End Luxury, Ultra-Luxury |

| Sales Channel | Direct Sales, Real Estate Agents, Online Platforms, Auctions |

Leading Companies in the United States Luxury Residential Real Estate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at