444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States insurance brokerage market represents a dynamic and rapidly evolving sector that serves as a critical intermediary between insurance providers and consumers across diverse industries. Insurance brokerages facilitate risk management solutions, policy placement, and comprehensive coverage strategies for businesses and individuals throughout the nation. The market encompasses traditional commercial lines, personal insurance products, specialty coverage areas, and emerging digital brokerage platforms that are transforming how insurance services are delivered.

Market dynamics indicate robust growth driven by increasing regulatory complexities, evolving risk landscapes, and heightened demand for specialized insurance expertise. The sector is experiencing significant transformation through technological integration, with digital platforms and artificial intelligence reshaping traditional brokerage operations. Commercial insurance brokerage continues to dominate market activities, while personal lines and specialty segments demonstrate strong expansion potential.

Regional distribution shows concentrated activity in major metropolitan areas, with California, New York, and Texas leading market penetration. The industry benefits from a diverse client base spanning healthcare, manufacturing, technology, real estate, and emerging sectors requiring sophisticated risk management solutions. Growth rates consistently outpace traditional insurance sectors, with digital transformation initiatives driving operational efficiency improvements of approximately 25-30% across leading brokerage firms.

The United States insurance brokerage market refers to the comprehensive ecosystem of intermediary firms and independent agents that facilitate insurance transactions between carriers and end-users while providing risk assessment, policy comparison, and claims management services. Insurance brokerages operate as independent entities representing client interests rather than specific insurance companies, offering objective advice and access to multiple carrier options for optimal coverage solutions.

Brokerage services encompass risk evaluation, policy placement, premium negotiation, claims advocacy, and ongoing account management across commercial and personal insurance lines. These firms leverage market relationships, technical expertise, and regulatory knowledge to secure appropriate coverage at competitive rates while ensuring compliance with industry standards and client-specific requirements.

Market participants include large national brokerages, regional specialists, independent agencies, and emerging digital platforms that utilize technology to streamline traditional brokerage processes. The sector serves diverse client segments from individual consumers seeking personal insurance to multinational corporations requiring complex commercial coverage programs.

Strategic analysis reveals the United States insurance brokerage market as a resilient and expanding sector characterized by technological innovation, consolidation trends, and evolving client expectations. The market demonstrates consistent growth momentum driven by increasing insurance awareness, regulatory complexity, and demand for specialized risk management expertise across diverse industry verticals.

Key performance indicators highlight strong revenue growth, with digital adoption rates reaching approximately 40-45% among leading brokerage firms. The sector benefits from favorable regulatory environments, expanding commercial insurance requirements, and growing recognition of professional brokerage value in complex risk scenarios. Market consolidation continues through strategic acquisitions, while independent agencies maintain significant market presence through specialized service offerings.

Competitive dynamics feature established national players, regional specialists, and innovative technology-driven entrants competing across service quality, digital capabilities, and client relationship management. The market shows strong resilience to economic fluctuations, with essential insurance services maintaining demand consistency even during challenging economic periods.

Market intelligence identifies several critical insights shaping the United States insurance brokerage landscape:

Primary growth drivers propelling the United States insurance brokerage market include increasing regulatory complexity that necessitates professional guidance for compliance and risk management. Commercial enterprises increasingly recognize the value of independent brokerage services in navigating complex insurance markets and securing optimal coverage terms.

Technological advancement serves as a significant catalyst, enabling brokerages to offer enhanced service delivery, real-time policy management, and sophisticated risk analytics. Digital platforms facilitate improved client engagement, streamlined operations, and expanded market reach for traditional brokerage firms. Artificial intelligence and machine learning applications enhance underwriting support and claims processing efficiency.

Economic factors including business expansion, new venture formation, and evolving risk landscapes drive sustained demand for professional insurance brokerage services. The growing complexity of modern business operations requires specialized expertise in areas such as cyber liability, environmental risks, and international coverage. Regulatory changes at federal and state levels create ongoing opportunities for brokerages to provide compliance guidance and policy adaptation services.

Market awareness of insurance importance continues expanding, particularly following recent natural disasters, cyber incidents, and economic disruptions that highlight the critical nature of comprehensive coverage strategies.

Significant challenges facing the United States insurance brokerage market include intense competition from direct insurance sales channels and emerging insurtech platforms that bypass traditional brokerage models. Price pressure from clients seeking cost reductions can impact commission structures and profitability margins for established brokerage firms.

Regulatory constraints vary significantly across states, creating compliance complexities and operational challenges for brokerages operating in multiple jurisdictions. Licensing requirements, continuing education mandates, and fiduciary responsibilities impose ongoing administrative burdens and costs. Technology investment requirements strain smaller independent agencies lacking resources for comprehensive digital transformation initiatives.

Talent acquisition challenges persist as the industry competes for qualified professionals with insurance expertise, sales capabilities, and technological proficiency. Client retention becomes increasingly challenging as digital platforms offer simplified insurance purchasing processes that appeal to cost-conscious consumers.

Market saturation in certain geographic regions and industry segments intensifies competition and limits growth opportunities for new entrants. Economic downturns can reduce client insurance spending and delay coverage expansion decisions, impacting brokerage revenue streams.

Emerging opportunities within the United States insurance brokerage market include expanding into underserved market segments such as small businesses, emerging industries, and specialized risk categories. Digital transformation initiatives create opportunities for enhanced service delivery, operational efficiency, and expanded client reach through innovative technology platforms.

Specialty insurance lines present significant growth potential, particularly in areas such as cyber liability, environmental coverage, and emerging technology risks. The increasing complexity of modern business operations creates demand for specialized expertise and customized insurance solutions that traditional carriers may not adequately address.

Geographic expansion opportunities exist through digital platforms that enable brokerages to serve clients beyond traditional territorial boundaries. Strategic partnerships with technology providers, industry associations, and complementary service firms can enhance value propositions and market penetration capabilities.

Acquisition opportunities allow established brokerages to expand market presence, acquire specialized expertise, and achieve operational synergies. The retirement of aging agency owners creates succession opportunities for growth-oriented firms. International expansion potential exists for brokerages serving multinational clients requiring global coverage coordination.

Competitive dynamics within the United States insurance brokerage market reflect a complex interplay between traditional relationship-based service models and emerging technology-driven approaches. Market forces include client demand for transparency, efficiency, and comprehensive risk management solutions that drive continuous innovation and service enhancement initiatives.

Supply chain relationships between brokerages and insurance carriers continue evolving, with technology platforms enabling more efficient policy placement and claims management processes. Digital disruption creates both challenges and opportunities as traditional brokerages adapt to changing client expectations while maintaining competitive advantages through personal relationships and specialized expertise.

Pricing dynamics reflect market competition, regulatory influences, and client cost sensitivity, with successful brokerages demonstrating value through risk management expertise rather than competing solely on price. Service differentiation becomes increasingly important as clients seek comprehensive solutions beyond basic policy placement.

Market consolidation trends continue reshaping the competitive landscape, with larger firms acquiring specialized agencies to expand capabilities and market presence. Innovation cycles accelerate as technology adoption drives operational improvements and new service delivery models throughout the industry.

Comprehensive analysis of the United States insurance brokerage market employs multiple research methodologies to ensure accurate and actionable insights. Primary research includes extensive interviews with industry executives, brokerage professionals, and key stakeholders across various market segments and geographic regions.

Secondary research encompasses analysis of industry publications, regulatory filings, financial reports, and market studies from authoritative sources. Quantitative analysis utilizes statistical modeling, trend analysis, and comparative assessments to identify market patterns and growth trajectories.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert verification, and consistency checks across different research methodologies. Market segmentation analysis provides detailed insights into specific industry verticals, geographic regions, and service categories.

Qualitative research explores market dynamics, competitive strategies, and emerging trends through structured interviews and focus group discussions with industry participants. Technological assessment evaluates digital transformation impacts and innovation trends affecting traditional brokerage operations.

Geographic distribution across the United States insurance brokerage market reveals significant concentration in major metropolitan areas, with California leading market activity at approximately 18-20% of national brokerage revenues. The state’s diverse economy, large population, and complex regulatory environment create substantial demand for professional insurance brokerage services across commercial and personal lines.

New York maintains strong market presence, accounting for roughly 15-17% of national activity, driven by financial services concentration, international business operations, and sophisticated risk management requirements. Texas demonstrates robust growth with approximately 12-14% market share, supported by energy sector expansion, population growth, and diverse industrial base.

Florida represents a significant regional market due to hurricane exposure, tourism industry, and growing population requiring specialized property and casualty coverage. Illinois benefits from Chicago’s role as a major commercial center and transportation hub, while Pennsylvania maintains steady market presence through manufacturing and healthcare sector concentration.

Emerging markets in the Southeast and Southwest regions show accelerating growth as business relocations and population shifts create new opportunities for brokerage expansion. Rural markets present untapped potential for digital brokerage platforms capable of serving dispersed client bases efficiently.

Market leadership within the United States insurance brokerage sector features a diverse competitive environment spanning large national firms, regional specialists, and independent agencies. Major players maintain competitive advantages through comprehensive service offerings, technology investments, and established carrier relationships.

Competitive strategies focus on technology integration, specialized expertise development, and strategic acquisitions to enhance market position and service capabilities.

Market segmentation within the United States insurance brokerage industry reflects diverse client needs, coverage types, and service delivery models. Primary segmentation occurs across commercial lines, personal lines, and specialty coverage areas, each requiring distinct expertise and market approaches.

By Service Type:

By Client Size:

By Industry Vertical:

Commercial lines brokerage represents the largest segment, driven by complex business insurance requirements and regulatory compliance needs. This category benefits from strong client relationships, recurring revenue streams, and opportunities for cross-selling additional services. Growth rates remain steady with increasing demand for specialized coverage in emerging risk areas.

Personal lines services face competitive pressure from direct insurance sales and digital platforms, yet maintain relevance through personalized service and complex coverage scenarios. High-net-worth individuals represent a particularly attractive segment requiring sophisticated coverage strategies and risk management expertise.

Specialty lines coverage demonstrates the strongest growth potential, with cyber liability insurance experiencing particularly robust demand as businesses recognize digital risk exposure. Environmental coverage, professional indemnity, and emerging technology risks create opportunities for brokerages with specialized expertise.

Employee benefits brokerage remains stable with consistent demand from employers seeking comprehensive workforce protection programs. Healthcare cost management and regulatory compliance drive ongoing opportunities for specialized consulting services within this segment.

Digital brokerage platforms represent an emerging category combining traditional expertise with technology-enabled service delivery, appealing to cost-conscious clients seeking efficient insurance solutions.

Insurance brokerages benefit from recurring revenue streams, strong client relationships, and opportunities for business expansion through acquisition and organic growth strategies. The industry offers professional fulfillment through helping clients manage risks and protect assets while building sustainable business enterprises.

Client advantages include access to multiple insurance carriers, objective advice, and professional advocacy during claims processes. Businesses benefit from comprehensive risk assessment, policy optimization, and ongoing account management that reduces administrative burdens while ensuring adequate coverage.

Insurance carriers gain efficient distribution channels, reduced acquisition costs, and access to specialized market segments through brokerage partnerships. Regulatory compliance becomes more manageable with professional guidance and expertise.

Economic benefits extend to local communities through job creation, professional services, and risk mitigation that supports business continuity and economic stability. Innovation drivers include technology adoption, service enhancement, and market expansion initiatives that benefit all stakeholders.

Investment opportunities attract capital through stable cash flows, growth potential, and defensive characteristics that perform well across economic cycles. Career development prospects offer advancement opportunities in sales, account management, and specialized expertise areas.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the United States insurance brokerage market, with firms investing heavily in technology platforms that enhance client experience and operational efficiency. Artificial intelligence applications streamline underwriting support, risk assessment, and policy management processes while reducing administrative costs.

Consolidation acceleration continues as larger brokerages acquire specialized agencies to expand capabilities and market presence. This trend creates opportunities for succession planning while enabling smaller firms to access resources and technology investments. Market concentration increases among leading players while maintaining space for specialized independent agencies.

Specialization focus intensifies as brokerages develop expertise in specific industries, coverage types, or client segments to differentiate from competitors. Cyber liability, environmental risks, and emerging technology coverage represent particularly active specialization areas with strong growth potential.

Client experience enhancement drives investment in digital platforms, mobile applications, and self-service capabilities that meet evolving expectations for convenience and transparency. Data analytics applications provide insights for risk management, pricing optimization, and client relationship management.

Regulatory evolution creates ongoing adaptation requirements while generating opportunities for compliance consulting and specialized advisory services. Sustainability considerations influence coverage decisions and risk assessment methodologies across various industry sectors.

Recent developments within the United States insurance brokerage market include significant merger and acquisition activity as firms pursue growth strategies and market consolidation opportunities. Technology partnerships between traditional brokerages and insurtech companies create innovative service delivery models combining personal expertise with digital efficiency.

Regulatory updates at state and federal levels impact licensing requirements, fiduciary responsibilities, and disclosure obligations, requiring ongoing adaptation and compliance investments. Professional development initiatives address workforce challenges through enhanced training programs and certification requirements.

Market expansion activities include geographic growth through digital platforms and strategic partnerships that extend service territories beyond traditional boundaries. Product innovation focuses on emerging risk categories and specialized coverage areas that address evolving client needs.

Industry associations promote professional standards, continuing education, and advocacy efforts that support market development and regulatory engagement. Research initiatives by organizations such as MarkWide Research provide market intelligence and trend analysis that inform strategic decision-making across the industry.

Investment activity includes private equity and venture capital funding for innovative brokerage models and technology platforms that enhance traditional service delivery approaches.

Strategic recommendations for United States insurance brokerage market participants emphasize technology investment as a critical success factor for long-term competitiveness. Digital transformation initiatives should focus on client experience enhancement, operational efficiency, and data analytics capabilities that provide competitive advantages.

Specialization strategies offer opportunities for differentiation and premium pricing in specific industry verticals or coverage areas. Cyber liability, environmental risks, and emerging technology sectors represent particularly attractive specialization opportunities with strong growth potential and limited competition.

Acquisition considerations should evaluate cultural fit, client retention rates, and technology compatibility alongside financial metrics. Succession planning creates opportunities for growth-oriented firms to acquire established client relationships and specialized expertise.

Talent development investments are essential for addressing workforce challenges and building capabilities for future growth. Professional development programs should emphasize technology proficiency, industry expertise, and client relationship management skills.

Market expansion through digital platforms enables geographic growth while maintaining cost efficiency. Partnership strategies with complementary service providers can enhance value propositions and client retention rates.

Regulatory compliance should be viewed as a competitive advantage rather than merely a cost center, with expertise in complex requirements providing differentiation opportunities.

Long-term prospects for the United States insurance brokerage market remain positive, supported by increasing insurance awareness, regulatory complexity, and demand for professional risk management expertise. Growth projections indicate continued expansion at rates of approximately 5-7% annually over the next five years, driven by economic growth, business formation, and evolving risk landscapes.

Technology integration will continue reshaping service delivery models, with successful brokerages combining digital efficiency with personal expertise to meet diverse client needs. Artificial intelligence and machine learning applications will enhance risk assessment, policy placement, and claims management capabilities while reducing operational costs.

Market consolidation trends are expected to continue, with larger firms acquiring specialized agencies and independent brokerages seeking succession solutions. Geographic expansion through digital platforms will enable broader market reach while maintaining local market expertise and relationships.

Emerging risk categories including cyber liability, climate change, and pandemic-related coverage will drive demand for specialized expertise and innovative coverage solutions. Regulatory evolution will create ongoing opportunities for compliance consulting and advisory services.

Competitive dynamics will favor brokerages that successfully integrate technology capabilities with traditional relationship-based service models. Client expectations for transparency, efficiency, and comprehensive risk management solutions will continue driving innovation and service enhancement initiatives throughout the industry.

The United States insurance brokerage market represents a dynamic and resilient sector positioned for continued growth and evolution in response to changing client needs, technological advancement, and regulatory developments. Market fundamentals remain strong, supported by essential service provision, recurring revenue streams, and defensive characteristics that perform well across economic cycles.

Strategic success factors include technology adoption, specialization development, and client relationship management that differentiate professional brokerage services from direct sales alternatives. The industry’s ability to adapt to digital transformation while maintaining personal expertise and local market knowledge creates sustainable competitive advantages.

Future opportunities span emerging risk categories, geographic expansion, and innovative service delivery models that combine traditional expertise with modern technology capabilities. Market participants that invest in talent development, technology integration, and specialized expertise are well-positioned to capitalize on growth opportunities while navigating competitive challenges.

Industry outlook remains optimistic, with continued demand for professional insurance brokerage services driven by increasing risk complexity, regulatory requirements, and client recognition of value-added expertise. The United States insurance brokerage market will continue serving as a critical component of the broader insurance ecosystem, facilitating risk management solutions and protecting economic interests across diverse industry sectors and client segments.

What is Insurance Brokerage?

Insurance brokerage refers to the business of helping clients find and purchase insurance policies from various insurers. Brokers act as intermediaries, providing advice and facilitating the purchase process for individuals and businesses seeking coverage.

What are the key players in the United States Insurance Brokerage Market?

Key players in the United States Insurance Brokerage Market include Marsh & McLennan Companies, Aon plc, and Willis Towers Watson. These companies provide a range of services, including risk management, employee benefits, and commercial insurance solutions, among others.

What are the growth factors driving the United States Insurance Brokerage Market?

The growth of the United States Insurance Brokerage Market is driven by increasing demand for personalized insurance solutions, the rise of digital platforms for policy management, and the growing complexity of risk management in various industries.

What challenges does the United States Insurance Brokerage Market face?

Challenges in the United States Insurance Brokerage Market include regulatory compliance issues, intense competition among brokers, and the need to adapt to rapidly changing technology and consumer expectations.

What opportunities exist in the United States Insurance Brokerage Market?

Opportunities in the United States Insurance Brokerage Market include the expansion of insurtech solutions, the potential for increased market penetration in underserved sectors, and the growing importance of cybersecurity insurance as businesses face evolving threats.

What trends are shaping the United States Insurance Brokerage Market?

Trends shaping the United States Insurance Brokerage Market include the integration of artificial intelligence in underwriting processes, the shift towards more sustainable insurance practices, and the increasing focus on customer experience through digital engagement strategies.

United States Insurance Brokerage Market

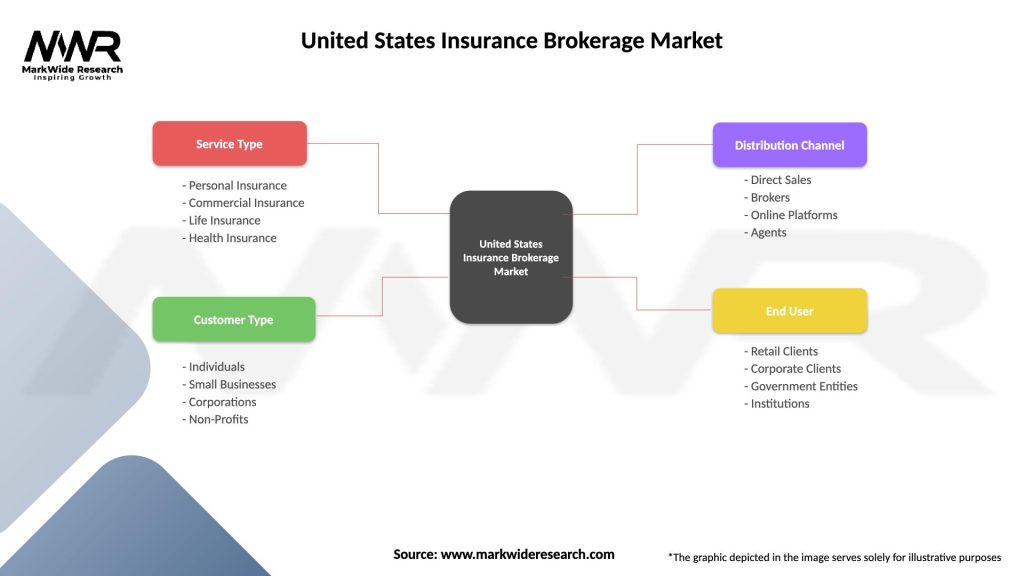

| Segmentation Details | Description |

|---|---|

| Service Type | Personal Insurance, Commercial Insurance, Life Insurance, Health Insurance |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| End User | Retail Clients, Corporate Clients, Government Entities, Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Insurance Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at