444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States HR Professional Service Market represents a dynamic and rapidly evolving sector that encompasses comprehensive human resources solutions for businesses across all industries. This market includes talent acquisition, employee management, payroll processing, benefits administration, compliance management, and strategic HR consulting services. Market dynamics indicate sustained growth driven by increasing regulatory complexity, digital transformation initiatives, and the evolving nature of work arrangements.

Current market conditions reflect a significant shift toward technology-enabled HR solutions, with organizations increasingly outsourcing specialized HR functions to professional service providers. The market demonstrates robust expansion at a compound annual growth rate (CAGR) of 8.2%, fueled by small and medium enterprises seeking cost-effective HR solutions and large corporations requiring specialized expertise for complex workforce management challenges.

Service diversification has become a hallmark of the market, with providers expanding beyond traditional HR functions to include employee experience optimization, diversity and inclusion consulting, remote workforce management, and data analytics services. The integration of artificial intelligence and machine learning technologies has enhanced service delivery efficiency by approximately 35% across major market segments.

The United States HR Professional Service Market refers to the comprehensive ecosystem of external service providers that deliver specialized human resources functions, consulting, and strategic support to organizations across various industries. This market encompasses both traditional HR outsourcing services and innovative technology-driven solutions that help businesses manage their workforce effectively while maintaining compliance with evolving employment regulations.

Professional HR services include talent acquisition and recruitment, employee onboarding and training, performance management systems, compensation and benefits administration, HR compliance consulting, and strategic workforce planning. These services enable organizations to focus on core business activities while ensuring optimal human capital management through specialized expertise and advanced technological platforms.

Market participants range from large multinational HR service providers offering comprehensive solutions to specialized boutique firms focusing on specific industry verticals or functional areas. The market serves diverse client segments, from startups requiring basic HR support to Fortune 500 companies seeking complex workforce transformation strategies.

Market leadership in the United States HR Professional Service Market is characterized by intense competition among established players and emerging technology-focused providers. The market has experienced accelerated growth following the COVID-19 pandemic, with remote work adoption driving demand for digital HR solutions and virtual employee engagement services.

Key growth drivers include increasing regulatory complexity requiring specialized compliance expertise, rising labor costs prompting outsourcing decisions, and the need for advanced analytics to optimize workforce performance. Approximately 72% of organizations now utilize some form of professional HR services, representing substantial market penetration across business segments.

Technology integration has transformed service delivery models, with cloud-based platforms, artificial intelligence, and predictive analytics becoming standard offerings. The shift toward employee-centric HR approaches has created new service categories focused on employee experience, wellness programs, and personalized career development pathways.

Market consolidation continues as larger providers acquire specialized firms to expand service portfolios and geographic reach. This trend has enhanced service quality while creating comprehensive solutions that address the full spectrum of HR challenges facing modern organizations.

Strategic market insights reveal several critical trends shaping the United States HR Professional Service Market landscape:

Market maturation is evident in the sophistication of service offerings and the integration of multiple HR functions into comprehensive platforms. Service providers are increasingly focusing on outcome-based pricing models and measurable business impact rather than traditional transaction-based approaches.

Primary market drivers propelling growth in the United States HR Professional Service Market include the increasing complexity of employment regulations and compliance requirements. Organizations face mounting pressure to navigate federal, state, and local employment laws while maintaining operational efficiency, creating substantial demand for specialized HR expertise.

Technological advancement serves as a significant growth catalyst, with artificial intelligence, machine learning, and automation technologies enabling more sophisticated HR service delivery. These technologies have improved service efficiency by approximately 40% while reducing operational costs for both service providers and clients.

Workforce demographics are driving demand for innovative HR solutions, particularly as millennials and Generation Z employees expect personalized, technology-enabled workplace experiences. The multi-generational workforce requires diverse engagement strategies and flexible benefit programs that professional HR services are uniquely positioned to provide.

Cost optimization pressures continue to motivate organizations to outsource HR functions, particularly among small and medium enterprises that lack internal HR expertise. Professional HR services offer economies of scale and specialized knowledge that enable cost-effective workforce management while maintaining service quality.

Business agility requirements have increased demand for flexible HR solutions that can rapidly adapt to changing market conditions, regulatory updates, and organizational restructuring needs. Professional HR services provide the scalability and expertise necessary to support dynamic business environments.

Significant market restraints include concerns about data security and privacy, particularly as HR services involve sensitive employee information and personal data. Organizations remain cautious about outsourcing critical HR functions due to potential security vulnerabilities and compliance risks associated with third-party data handling.

Integration challenges pose substantial barriers, as many organizations struggle to seamlessly integrate external HR services with existing internal systems and processes. Legacy technology infrastructure and complex organizational structures can complicate service implementation and reduce overall effectiveness.

Cost considerations continue to limit market adoption, particularly among smaller organizations with limited budgets for professional services. While HR outsourcing can provide long-term cost benefits, the initial investment and ongoing service fees may exceed internal HR operation costs for some businesses.

Cultural resistance within organizations can impede adoption of external HR services, as employees and management may prefer maintaining direct control over HR functions. This resistance is particularly pronounced in organizations with strong internal HR capabilities or unique cultural requirements.

Service standardization limitations restrict the ability of HR service providers to address highly specialized or industry-specific requirements. Organizations with unique HR needs may find that standardized service offerings do not adequately address their specific challenges or regulatory requirements.

Emerging opportunities in the United States HR Professional Service Market include the growing demand for artificial intelligence-powered HR analytics and predictive workforce modeling. Organizations are increasingly seeking data-driven insights to optimize talent acquisition, retention strategies, and performance management, creating substantial growth potential for technology-enabled service providers.

Remote work transformation presents significant opportunities for HR service providers to develop specialized solutions for distributed workforce management. The permanent shift toward hybrid and remote work arrangements has created demand for virtual onboarding, remote employee engagement, and digital performance management services.

Diversity, equity, and inclusion (DEI) initiatives represent a rapidly expanding market segment, with organizations requiring specialized consulting and implementation support. Approximately 85% of companies have established formal DEI programs, creating substantial demand for expert guidance and measurement services.

Gig economy integration offers opportunities for HR service providers to develop solutions for managing contingent workers, freelancers, and project-based employees. The growing reliance on flexible workforce arrangements requires specialized HR services that traditional internal departments may not be equipped to handle.

Industry-specific solutions present opportunities for specialized service providers to develop deep expertise in particular sectors such as healthcare, technology, manufacturing, or financial services. These vertical-focused approaches can command premium pricing while delivering superior value through specialized knowledge and compliance expertise.

Market dynamics in the United States HR Professional Service Market are characterized by rapid technological evolution and changing client expectations. The integration of artificial intelligence and machine learning technologies has fundamentally altered service delivery models, enabling more personalized and efficient HR solutions.

Competitive pressures have intensified as traditional HR service providers compete with technology-focused startups and consulting firms expanding into HR services. This competition has accelerated innovation and improved service quality while putting downward pressure on pricing for standardized services.

Client sophistication has increased significantly, with organizations demanding measurable outcomes, transparent pricing, and seamless technology integration. Service providers must demonstrate clear return on investment and business impact to maintain competitive positioning in the evolving market landscape.

Regulatory evolution continues to shape market dynamics, with changing employment laws, privacy regulations, and compliance requirements creating both challenges and opportunities for service providers. Organizations increasingly rely on professional HR services to navigate complex regulatory environments and maintain compliance.

Technology convergence is creating new service categories and delivery models, with HR services increasingly integrated with broader business process outsourcing and technology solutions. This convergence has improved efficiency by approximately 30% while expanding the scope of available services.

Comprehensive research methodology employed in analyzing the United States HR Professional Service Market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, service providers, and client organizations across various business segments and geographic regions.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and market intelligence databases. This approach provides comprehensive coverage of market trends, competitive dynamics, and technological developments affecting the HR professional services sector.

Quantitative analysis utilizes statistical modeling and trend analysis to identify growth patterns, market share distributions, and performance metrics. Data validation processes ensure accuracy and consistency across all research findings and market projections.

Qualitative assessment includes expert interviews, focus groups, and case study analysis to understand market nuances, client preferences, and emerging trends. This approach provides deeper insights into market dynamics and future development opportunities.

Market segmentation analysis examines service categories, client segments, geographic regions, and technology platforms to identify specific growth opportunities and competitive positioning strategies. The methodology ensures comprehensive coverage of all relevant market dimensions and stakeholder perspectives.

Regional market distribution across the United States reveals significant concentration in major metropolitan areas, with Northeast and West Coast regions accounting for approximately 55% of market activity. These regions benefit from high concentrations of large corporations, technology companies, and financial services firms that drive demand for sophisticated HR professional services.

California market leadership is particularly pronounced in technology-enabled HR services and innovative workforce solutions, reflecting the state’s concentration of technology companies and startups. The region demonstrates the highest adoption rates for artificial intelligence-powered HR analytics and employee experience optimization services.

Texas and Florida represent rapidly growing regional markets, driven by business relocations, population growth, and expanding industrial sectors. These states show increasing demand for comprehensive HR outsourcing services and compliance management solutions.

Midwest regions demonstrate strong demand for traditional HR services and manufacturing-focused workforce solutions. The region’s industrial base creates specific requirements for safety compliance, union relations, and skilled workforce development services.

Southeast markets are experiencing accelerated growth in HR professional services, particularly in healthcare, logistics, and emerging technology sectors. Regional growth rates exceed the national average by approximately 15%, driven by business expansion and workforce development initiatives.

Market leadership in the United States HR Professional Service Market is distributed among several categories of providers, each with distinct competitive advantages and market positioning strategies.

Competitive differentiation increasingly focuses on technology capabilities, industry specialization, and measurable business outcomes. Service providers are investing heavily in artificial intelligence, predictive analytics, and automation technologies to enhance service delivery and client value.

Market consolidation continues as larger providers acquire specialized firms to expand service portfolios and geographic coverage. This trend has created more comprehensive service offerings while maintaining competitive pricing through operational efficiencies.

Service-based segmentation reveals distinct market categories with varying growth rates and competitive dynamics:

Client size segmentation demonstrates different service requirements and adoption patterns:

Industry vertical segmentation shows specialized service requirements across different sectors, with healthcare, technology, and financial services demonstrating the highest service utilization rates at approximately 78% adoption among organizations in these industries.

Talent Acquisition Services represent the fastest-growing segment, driven by competitive labor markets and the need for specialized recruiting expertise. Technology-enabled sourcing, candidate assessment, and onboarding services have transformed traditional recruitment approaches, improving hiring efficiency by approximately 45%.

HR Technology Implementation services have experienced substantial growth as organizations modernize legacy systems and adopt cloud-based HR platforms. Integration complexity and change management requirements create significant demand for specialized implementation and support services.

Compliance and Risk Management services maintain steady growth driven by evolving employment regulations and increased enforcement activity. Organizations increasingly rely on professional services to navigate complex compliance requirements and mitigate employment-related risks.

Employee Experience Optimization has emerged as a high-growth category, with organizations investing in services that improve employee engagement, retention, and productivity. These services include workplace culture assessment, employee journey mapping, and personalized development programs.

Data Analytics and Workforce Intelligence services are experiencing rapid adoption as organizations seek data-driven insights for strategic decision-making. Predictive analytics, performance measurement, and workforce planning services enable more effective human capital management strategies.

Client organizations benefit from access to specialized expertise, advanced technology platforms, and cost-effective HR solutions that enable focus on core business activities. Professional HR services provide scalability, compliance assurance, and improved employee experiences while reducing operational complexity.

Service providers benefit from recurring revenue models, expanding market opportunities, and the ability to leverage technology investments across multiple clients. The market offers opportunities for specialization, premium pricing for expertise, and scalable business models.

Employees benefit from improved HR service quality, enhanced technology platforms, and more personalized workplace experiences. Professional HR services often provide better benefits administration, career development opportunities, and employee support services.

Technology vendors benefit from increased demand for HR technology platforms, integration services, and ongoing support. The market creates opportunities for software providers, system integrators, and technology consultants.

Investors benefit from stable, growing market opportunities with recurring revenue characteristics and expanding service categories. The market demonstrates resilience and consistent growth potential across economic cycles.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues to reshape the United States HR Professional Service Market, with artificial intelligence and machine learning technologies becoming standard components of service offerings. Organizations are increasingly demanding intelligent automation, predictive analytics, and personalized employee experiences.

Employee experience focus has emerged as a dominant trend, with service providers developing comprehensive solutions that address the entire employee lifecycle. This includes personalized onboarding, continuous feedback systems, career development pathways, and wellness program integration.

Data-driven decision making is transforming HR service delivery, with advanced analytics enabling more strategic workforce planning and performance optimization. Approximately 68% of organizations now utilize HR analytics services to support strategic decision-making processes.

Compliance automation has become essential as regulatory complexity increases and enforcement intensifies. Service providers are developing automated compliance monitoring, reporting, and risk assessment capabilities to help clients maintain regulatory adherence.

Flexible service models are gaining popularity, with clients seeking customizable solutions that can adapt to changing business needs. This trend has led to the development of modular service offerings and outcome-based pricing models.

Strategic acquisitions have accelerated as major service providers seek to expand capabilities and market reach. Recent consolidation activity has focused on technology companies, specialized consulting firms, and regional service providers with strong client relationships.

Technology partnerships between HR service providers and software vendors have created more integrated solutions and improved service delivery capabilities. These collaborations enable comprehensive platforms that address multiple HR functions through unified interfaces.

Regulatory compliance enhancements have driven significant investment in automated monitoring and reporting capabilities. Service providers are developing sophisticated systems to track regulatory changes and ensure client compliance across multiple jurisdictions.

Remote work adaptation has required substantial service model modifications to support distributed workforces effectively. Providers have developed virtual onboarding, remote employee engagement, and digital performance management capabilities.

Industry specialization has increased as service providers develop deep expertise in specific sectors such as healthcare, technology, and financial services. This specialization enables premium pricing and stronger client relationships through industry-specific knowledge and solutions.

MarkWide Research analysis suggests that organizations should prioritize technology-enabled HR service providers that demonstrate strong data security capabilities and proven integration expertise. The selection process should emphasize measurable outcomes, scalability, and alignment with organizational culture and values.

Service provider evaluation should focus on industry expertise, technology capabilities, and track record of successful implementations. Organizations should seek providers that offer comprehensive solutions while maintaining flexibility to adapt to changing business requirements.

Investment priorities should emphasize artificial intelligence, predictive analytics, and employee experience optimization capabilities. These areas represent the highest growth potential and competitive differentiation opportunities in the evolving market landscape.

Risk management strategies should address data security, vendor dependency, and service continuity concerns. Organizations should establish clear governance frameworks and maintain some internal HR capabilities to ensure business continuity.

Long-term planning should consider the evolving nature of work, demographic changes, and technological advancement. Service provider partnerships should be structured to support organizational transformation and future workforce requirements.

Market growth projections indicate continued expansion at a compound annual growth rate of 8.5% through the next five years, driven by increasing demand for specialized HR expertise and technology-enabled solutions. The market is expected to benefit from ongoing digital transformation initiatives and evolving workforce management requirements.

Technology evolution will continue to reshape service delivery models, with artificial intelligence, machine learning, and automation becoming increasingly sophisticated. These technologies will enable more personalized, efficient, and strategic HR services while reducing operational costs.

Service innovation will focus on employee experience optimization, predictive workforce analytics, and industry-specific solutions. Providers that successfully integrate advanced technologies with deep human resources expertise will achieve competitive advantages and premium market positioning.

Market consolidation is expected to continue as larger providers acquire specialized firms and technology companies. This trend will create more comprehensive service offerings while maintaining competitive pricing through operational efficiencies and scale advantages.

Regulatory complexity will continue to drive demand for specialized compliance services and automated monitoring capabilities. Service providers that develop sophisticated regulatory management solutions will benefit from sustained growth opportunities and client dependency.

The United States HR Professional Service Market represents a dynamic and rapidly evolving sector that continues to demonstrate strong growth potential and innovation opportunities. Market expansion is driven by increasing regulatory complexity, technological advancement, and evolving workforce management requirements that create sustained demand for specialized HR expertise.

Technology integration has fundamentally transformed service delivery models, enabling more efficient, personalized, and strategic HR solutions. The successful integration of artificial intelligence, predictive analytics, and automation technologies has improved service quality while reducing operational costs for both providers and clients.

Future success in this market will depend on the ability to combine advanced technology capabilities with deep human resources expertise and industry-specific knowledge. Organizations that prioritize employee experience, data-driven decision making, and flexible service models will achieve sustainable competitive advantages in the evolving marketplace. According to MWR projections, the market will continue expanding as organizations increasingly recognize the strategic value of professional HR services in achieving business objectives and maintaining competitive positioning.

What is HR Professional Service?

HR Professional Service refers to a range of services that assist organizations in managing their human resources effectively. This includes recruitment, training, compliance, and employee relations, among other functions.

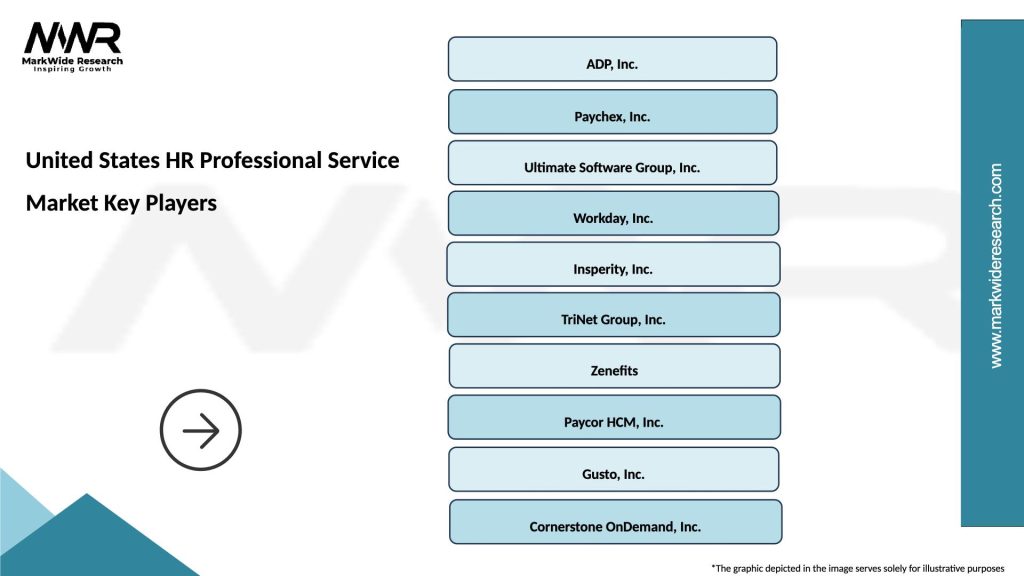

What are the key players in the United States HR Professional Service Market?

Key players in the United States HR Professional Service Market include companies like ADP, Paychex, and Randstad, which provide various HR solutions and services to businesses of all sizes, among others.

What are the growth factors driving the United States HR Professional Service Market?

The growth of the United States HR Professional Service Market is driven by factors such as the increasing need for compliance with labor laws, the rise of remote work, and the demand for talent management solutions.

What challenges does the United States HR Professional Service Market face?

Challenges in the United States HR Professional Service Market include the rapid pace of technological change, the need for data security in HR processes, and the difficulty in attracting skilled HR professionals.

What opportunities exist in the United States HR Professional Service Market?

Opportunities in the United States HR Professional Service Market include the expansion of HR technology solutions, the growing emphasis on employee wellness programs, and the increasing adoption of artificial intelligence in recruitment processes.

What trends are shaping the United States HR Professional Service Market?

Trends shaping the United States HR Professional Service Market include the rise of remote and hybrid work models, the integration of advanced analytics in HR decision-making, and a focus on diversity and inclusion initiatives.

United States HR Professional Service Market

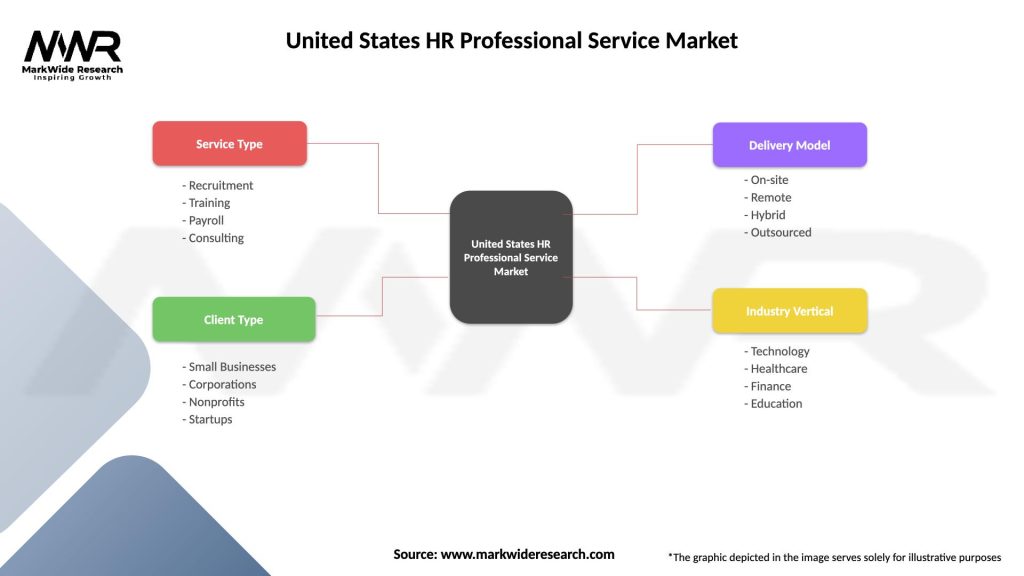

| Segmentation Details | Description |

|---|---|

| Service Type | Recruitment, Training, Payroll, Consulting |

| Client Type | Small Businesses, Corporations, Nonprofits, Startups |

| Delivery Model | On-site, Remote, Hybrid, Outsourced |

| Industry Vertical | Technology, Healthcare, Finance, Education |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States HR Professional Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at