444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United States Health and Medical Insurance Market is a vital component of the country’s healthcare system. With the rising cost of medical treatments and an increasing awareness of the importance of health coverage, the demand for health and medical insurance has grown significantly over the years. Health insurance provides financial protection to individuals and families by covering medical expenses in the event of illness, injury, or hospitalization.

Meaning

Health and medical insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. It can also include coverage for preventive care services, prescription drugs, and other healthcare-related expenses. The purpose of health insurance is to alleviate the financial burden that individuals may face due to medical treatments, making healthcare more accessible and affordable for the general population.

Executive Summary

The United States Health and Medical Insurance Market has witnessed substantial growth in recent years, driven by various factors such as the increasing healthcare needs of an aging population, the implementation of the Affordable Care Act (ACA), and advancements in medical technology. The market has become highly competitive, with insurance companies vying for a larger market share by offering innovative products and services.

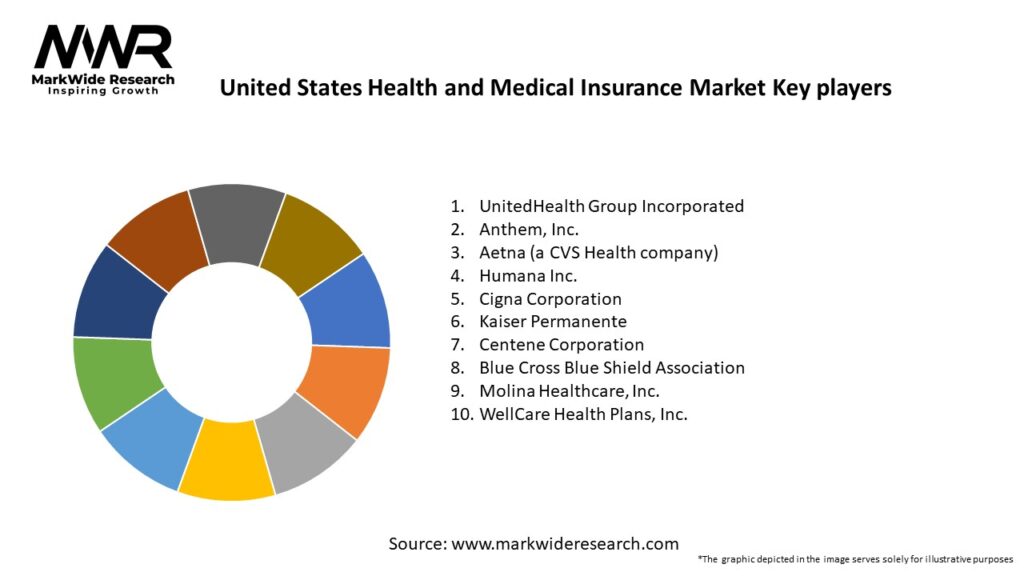

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United States Health and Medical Insurance Market is characterized by intense competition and continuous innovation. Insurance providers are constantly looking for ways to differentiate their products and services from competitors, whether through cost-effective pricing, enhanced coverage options, or improved customer service. Additionally, changes in government policies and regulations can significantly impact the market dynamics, shaping insurance offerings and market strategies.

Regional Analysis

The health and medical insurance market in the United States is not uniform across all regions. Different states may have varying levels of insurance penetration and preferences for specific insurance products. Factors such as the local healthcare infrastructure, demographics, and state-specific regulations play a crucial role in shaping the regional health insurance landscape.

Competitive Landscape

Leading Companies in the United States Health and Medical Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

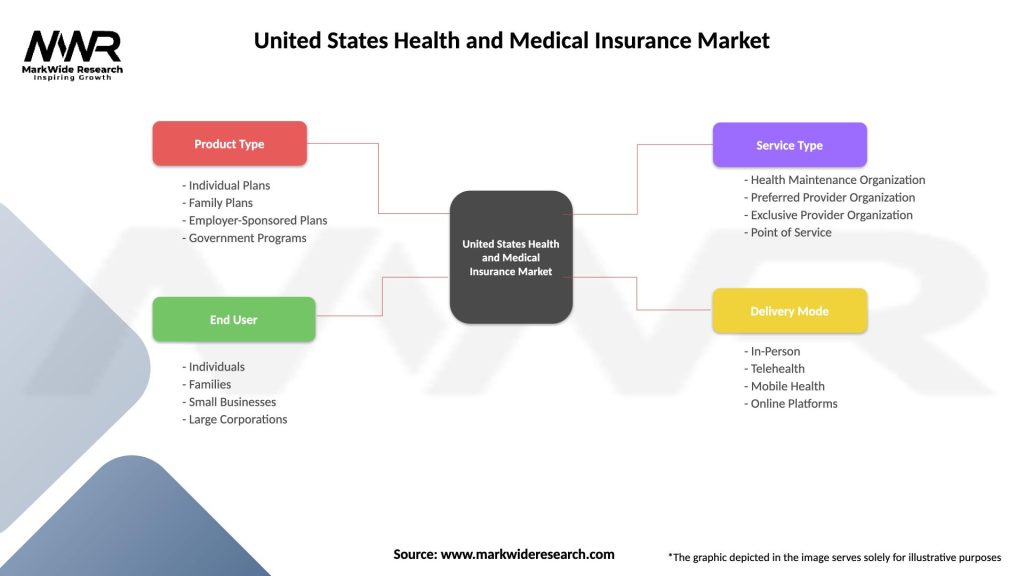

Segmentation

The health and medical insurance market can be segmented based on various factors, including the type of insurance product (individual insurance, group insurance, government-sponsored insurance), coverage type (medical insurance, dental insurance, vision insurance), and customer demographics (age, gender, income).

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a profound impact on the health and medical insurance market. The pandemic highlighted the importance of health insurance, leading to increased demand for coverage. It also prompted insurance providers to offer specific COVID-19 related coverage and expand telehealth services to cater to policyholders’ needs during lockdowns and social distancing measures.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the United States Health and Medical Insurance Market looks promising. With the increasing focus on healthcare and the shift towards preventive care, the demand for health insurance is expected to rise. Advancements in technology, such as AI and data analytics, will further drive innovation in the insurance industry, leading to personalized insurance offerings and improved customer experience.

Conclusion

The United States Health and Medical Insurance Market plays a crucial role in providing financial security and access to healthcare services for individuals and families. With a growing emphasis on preventive care, digital transformation, and customer-centric solutions, the health insurance industry is poised for significant growth. To remain competitive, insurance providers must continuously innovate and adapt to the changing needs and preferences of consumers, while also navigating the challenges posed by regulatory changes and market dynamics. By doing so, they can capitalize on the numerous opportunities and contribute to improving the overall healthcare landscape in the United States.

What is Health and Medical Insurance?

Health and Medical Insurance refers to coverage that pays for medical and surgical expenses incurred by the insured. It can also provide additional benefits such as preventive care, mental health services, and prescription drug coverage.

What are the key players in the United States Health and Medical Insurance Market?

Key players in the United States Health and Medical Insurance Market include UnitedHealth Group, Anthem, Aetna, and Cigna, among others. These companies offer a variety of plans catering to individuals, families, and businesses.

What are the main drivers of growth in the United States Health and Medical Insurance Market?

The main drivers of growth in the United States Health and Medical Insurance Market include the increasing prevalence of chronic diseases, rising healthcare costs, and a growing aging population. Additionally, advancements in medical technology and increased awareness of health insurance benefits contribute to market expansion.

What challenges does the United States Health and Medical Insurance Market face?

Challenges in the United States Health and Medical Insurance Market include regulatory changes, high competition among insurers, and the complexity of healthcare policies. Additionally, issues related to affordability and access to care can hinder market growth.

What opportunities exist in the United States Health and Medical Insurance Market?

Opportunities in the United States Health and Medical Insurance Market include the expansion of telehealth services, the integration of technology in health management, and the growing demand for personalized insurance plans. These trends can enhance customer engagement and improve service delivery.

What trends are shaping the United States Health and Medical Insurance Market?

Trends shaping the United States Health and Medical Insurance Market include the rise of value-based care, increased focus on mental health coverage, and the adoption of digital health solutions. These trends reflect a shift towards more comprehensive and accessible healthcare services.

United States Health and Medical Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Individual Plans, Family Plans, Employer-Sponsored Plans, Government Programs |

| End User | Individuals, Families, Small Businesses, Large Corporations |

| Service Type | Health Maintenance Organization, Preferred Provider Organization, Exclusive Provider Organization, Point of Service |

| Delivery Mode | In-Person, Telehealth, Mobile Health, Online Platforms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Health and Medical Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at