444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States haying and forage machinery market represents a critical segment of the agricultural equipment industry, encompassing specialized equipment designed for cutting, conditioning, raking, baling, and harvesting forage crops. This market has experienced steady growth driven by increasing demand for livestock feed, technological advancements in precision agriculture, and the need for efficient hay production systems across American farms.

Market dynamics indicate that the sector is witnessing significant transformation through the integration of smart technologies, GPS guidance systems, and automated features that enhance productivity and reduce labor costs. The market encompasses various equipment types including mowers, tedders, rakes, balers, and forage harvesters, each serving specific functions in the hay production process.

Regional distribution shows strong concentration in the Midwest and Great Plains states, where extensive grasslands and livestock operations drive demand for efficient forage machinery. The market is characterized by seasonal demand patterns that align with hay cutting seasons, typically spanning from late spring through early fall across different geographic regions.

Technological innovation continues to reshape the landscape, with manufacturers introducing precision agriculture features, improved fuel efficiency, and enhanced operator comfort systems. The growing emphasis on sustainable farming practices and environmental stewardship is also influencing equipment design and functionality, creating new opportunities for market expansion.

The United States haying and forage machinery market refers to the comprehensive ecosystem of specialized agricultural equipment designed for the production, processing, and harvesting of hay and forage crops throughout the country. This market encompasses all machinery involved in converting standing grass and legume crops into preserved feed for livestock operations.

Haying machinery includes equipment for cutting grass crops, conditioning them for faster drying, raking them into windrows, and baling them into compact forms for storage and transportation. Forage machinery extends beyond traditional hay production to include equipment for harvesting and processing crops like corn silage, alfalfa, and other feed materials used in livestock nutrition programs.

The market serves diverse agricultural sectors including dairy farming, beef cattle operations, horse breeding facilities, and mixed livestock enterprises. Equipment categories range from compact utility machines suitable for small farms to large-scale commercial systems designed for extensive agricultural operations covering thousands of acres.

Market performance in the United States haying and forage machinery sector demonstrates resilient growth patterns supported by strong agricultural fundamentals and increasing mechanization trends. The industry benefits from consistent demand driven by the nation’s substantial livestock population and the critical role of preserved forage in animal nutrition programs.

Key growth drivers include technological advancement adoption rates reaching 68% among commercial operations, increasing farm consolidation leading to demand for larger, more efficient equipment, and growing emphasis on precision agriculture techniques. The market is experiencing particularly strong growth in GPS-guided systems and automated baling technologies.

Competitive landscape features established manufacturers competing through innovation, service networks, and financing solutions. Market leaders are investing heavily in research and development to introduce smart farming capabilities, improved fuel efficiency, and enhanced operator experience features that differentiate their product offerings.

Regional trends show the strongest growth in traditional agricultural states, with emerging opportunities in areas experiencing agricultural expansion. The market is also benefiting from replacement cycles as aging equipment fleets require modernization to meet current productivity and environmental standards.

Technology integration represents the most significant trend reshaping the haying and forage machinery landscape, with precision agriculture features becoming standard rather than optional on new equipment. MarkWide Research analysis indicates that smart technology adoption is accelerating across all farm sizes, driven by demonstrated productivity improvements and operational cost reductions.

Market segmentation reveals distinct preferences across different agricultural regions, with Great Plains operations favoring large-scale equipment while Northeast farms prefer compact, versatile machinery suitable for smaller fields and varied terrain conditions.

Livestock industry expansion serves as the primary driver for haying and forage machinery demand, with growing cattle herds and dairy operations requiring substantial quantities of preserved feed. The increasing focus on feed quality and nutritional consistency is driving demand for advanced conditioning and preservation equipment that maintains optimal forage characteristics.

Labor shortage challenges across agricultural sectors are accelerating adoption of automated and semi-automated haying equipment. Farmers are investing in machinery that reduces manual labor requirements while maintaining or improving productivity levels, creating strong demand for technologically advanced systems.

Farm consolidation trends are driving demand for larger, more efficient equipment capable of handling extensive acreage with minimal operator intervention. This trend is particularly pronounced in commercial hay production operations that serve multiple livestock facilities across regional markets.

Precision agriculture adoption is creating opportunities for equipment featuring GPS guidance, yield monitoring, and variable rate application capabilities. These technologies enable farmers to optimize field operations, reduce input costs, and improve overall forage quality through precise management techniques.

Environmental stewardship requirements are influencing equipment selection, with farmers seeking machinery that minimizes soil compaction, reduces fuel consumption, and supports sustainable farming practices. This driver is particularly strong in regions with strict environmental regulations and conservation program participation.

High capital investment requirements represent the most significant barrier to market growth, particularly for smaller farming operations with limited financial resources. Modern haying and forage equipment often requires substantial upfront investments that may be challenging for farms operating on tight profit margins.

Seasonal demand patterns create challenges for both manufacturers and dealers, with equipment sales concentrated in specific periods aligned with hay cutting seasons. This seasonality affects inventory management, production planning, and cash flow for industry participants throughout the supply chain.

Weather dependency significantly impacts market performance, as adverse weather conditions can delay hay cutting seasons, reduce crop yields, and affect farmer purchasing decisions. Extended periods of drought or excessive rainfall can substantially influence annual equipment demand patterns.

Maintenance complexity associated with advanced technological features can deter adoption among farmers lacking technical expertise or access to specialized service support. The increasing sophistication of modern equipment requires enhanced training and support infrastructure that may not be readily available in all agricultural regions.

Trade policy uncertainties and tariff implications can affect equipment pricing and availability, particularly for components sourced from international suppliers. These factors create planning challenges for both manufacturers and end users considering equipment investments.

Smart farming integration presents substantial opportunities for equipment manufacturers to differentiate their offerings through advanced technology features. The growing acceptance of precision agriculture techniques creates demand for machinery equipped with sensors, data collection capabilities, and connectivity features that support farm management systems.

Export market expansion offers growth potential for American-manufactured haying and forage equipment, particularly in developing agricultural markets where mechanization is increasing. The reputation for quality and innovation associated with U.S. agricultural equipment creates competitive advantages in international markets.

Renewable energy applications are creating new market segments as biomass production for energy generation requires specialized harvesting and processing equipment. This emerging application extends beyond traditional livestock feed production to include energy crop harvesting systems.

Custom harvesting services represent a growing market segment that requires specialized, high-capacity equipment operated by professional service providers. This trend creates opportunities for manufacturers to develop equipment specifically designed for commercial harvesting operations serving multiple farms.

Retrofit and upgrade markets provide opportunities to enhance existing equipment with modern technology features, extending equipment life while improving performance. This approach offers cost-effective solutions for farmers seeking technological benefits without complete equipment replacement.

Supply chain relationships between manufacturers, dealers, and end users are evolving to provide enhanced service support and financing solutions. The complexity of modern equipment requires stronger partnerships throughout the distribution network to ensure proper installation, training, and ongoing maintenance support.

Technology adoption rates vary significantly across different farm sizes and geographic regions, with larger commercial operations typically leading in advanced feature implementation. This creates a tiered market structure where manufacturers must address diverse technological sophistication levels among their customer base.

Competitive pressures are driving continuous innovation in equipment design, fuel efficiency, and operator comfort features. Manufacturers are investing heavily in research and development to maintain market position while addressing evolving customer requirements and regulatory standards.

Economic cycles significantly influence purchasing patterns, with equipment sales closely correlated to agricultural commodity prices and farm profitability. Strong crop prices typically drive equipment replacement and expansion, while economic downturns lead to delayed purchasing decisions and extended equipment lifecycles.

Regulatory environment changes affecting emission standards, safety requirements, and environmental compliance are shaping equipment design and manufacturing processes. These factors influence development costs and may affect equipment pricing and availability in certain market segments.

Primary research methodology encompasses comprehensive surveys and interviews with key industry participants including equipment manufacturers, dealers, farmers, and custom harvesting operators. This approach provides direct insights into market trends, purchasing behaviors, and technology adoption patterns across diverse agricultural operations.

Secondary research incorporates analysis of industry publications, government agricultural statistics, trade association reports, and manufacturer financial disclosures. This data provides quantitative foundation for market sizing, trend analysis, and competitive landscape assessment throughout the research process.

Market segmentation analysis examines equipment categories, geographic regions, farm sizes, and application types to identify specific growth opportunities and market dynamics. This segmentation approach enables detailed understanding of diverse market requirements and purchasing patterns across different agricultural sectors.

Technology assessment evaluates emerging innovations, patent filings, and research and development investments to identify future market directions and competitive advantages. This analysis includes examination of precision agriculture integration, automation capabilities, and environmental compliance features.

Competitive intelligence gathering includes analysis of manufacturer strategies, product launches, market positioning, and distribution network developments. This research component provides insights into industry dynamics and strategic directions among leading market participants.

Midwest region dominates the United States haying and forage machinery market, accounting for approximately 42% of total equipment sales due to extensive corn and soybean production requiring substantial forage harvesting capabilities. States including Iowa, Illinois, Indiana, and Ohio represent core markets with strong dealer networks and established agricultural infrastructure supporting equipment sales and service.

Great Plains states including Kansas, Nebraska, Oklahoma, and Texas contribute significant market share through large-scale cattle operations and extensive grassland management requirements. This region shows particular strength in large square baler and high-capacity mowing equipment segments, with 35% regional market concentration in commercial hay production equipment.

Western states present unique market characteristics driven by diverse agricultural operations ranging from large-scale dairy farms in California to extensive ranching operations across Montana, Wyoming, and Colorado. The region demonstrates strong demand for specialized equipment designed for varied terrain and crop conditions.

Southeastern region shows growing market potential driven by expanding livestock operations and increasing mechanization adoption. States including Georgia, Alabama, Tennessee, and North Carolina are experiencing growth in dairy and beef cattle operations requiring modern forage production equipment.

Northeastern states represent a specialized market segment characterized by smaller farm operations requiring compact, versatile equipment suitable for varied terrain and field conditions. This region shows particular strength in utility-class equipment and multi-purpose machinery designed for diversified agricultural operations.

Market leadership is characterized by established manufacturers with comprehensive product lines, extensive dealer networks, and strong brand recognition among agricultural customers. The competitive environment emphasizes innovation, service support, and financing solutions to differentiate offerings in a mature market.

Competitive strategies focus on technology differentiation, service network expansion, and customer relationship management. Leading manufacturers are investing in precision agriculture capabilities, automated features, and connectivity solutions that provide operational advantages for end users.

By Equipment Type:

By Farm Size:

By Application:

Mowing equipment represents the largest segment by volume, with disc mowers gaining market share due to superior cutting quality and reduced maintenance requirements compared to traditional sickle bar systems. Technology integration in this category includes GPS guidance systems and automatic header height control that optimize cutting performance across varying field conditions.

Baling equipment shows strong growth in large square baler segments, driven by commercial hay operations seeking to maximize storage density and transportation efficiency. Round balers maintain popularity among smaller operations due to versatility and lower labor requirements, while featuring enhanced net wrap systems and improved bale density control.

Forage harvesters demonstrate increasing sophistication with kernel processing capabilities, crop flow sensors, and automated adjustment systems that optimize silage quality. The segment benefits from growing interest in high-moisture forage preservation techniques that improve nutritional value and reduce weather dependency.

Conditioning equipment is experiencing innovation in conditioning roll design and adjustment systems that accommodate diverse crop types while minimizing leaf loss. Advanced conditioning systems feature variable conditioning intensity and automated adjustment based on crop moisture content and species characteristics.

Precision agriculture integration across all categories is driving demand for equipment featuring yield monitoring, GPS guidance, and data collection capabilities. These features enable farmers to optimize field operations, track productivity, and make informed management decisions based on detailed operational data.

Farmers benefit from increased operational efficiency through advanced equipment features that reduce labor requirements, improve forage quality, and optimize field productivity. Modern machinery enables precise timing of harvest operations, resulting in better nutritional value and reduced weather-related losses.

Equipment manufacturers gain competitive advantages through innovation leadership, expanded market reach, and enhanced customer relationships. Investment in advanced technology development creates differentiation opportunities and supports premium pricing strategies in competitive markets.

Dealers and distributors benefit from growing service revenue opportunities associated with sophisticated equipment requiring specialized maintenance and support. The complexity of modern machinery creates ongoing revenue streams through parts sales, service contracts, and training programs.

Livestock producers receive improved feed quality and consistency through advanced forage production techniques enabled by modern equipment. Better preservation methods and timing control result in higher nutritional value and reduced feed costs for dairy and beef operations.

Custom operators can expand service offerings and improve profitability through high-capacity equipment that enables efficient coverage of multiple farms. Advanced features reduce operator fatigue and improve service quality, supporting business growth and customer satisfaction.

Financial institutions benefit from stable lending opportunities in agricultural equipment financing, supported by strong collateral values and established customer relationships. The essential nature of forage production equipment provides security for financing arrangements across diverse agricultural markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation advancement represents the most significant trend reshaping the haying and forage machinery landscape, with manufacturers introducing semi-autonomous systems that reduce operator intervention while maintaining precise control over cutting, conditioning, and baling operations. These systems incorporate advanced sensors and control algorithms that adapt to varying field conditions automatically.

Connectivity integration is transforming equipment into data collection platforms that provide valuable insights into field productivity, equipment performance, and operational efficiency. MWR analysis indicates that connected equipment adoption is accelerating, with 58% of new equipment featuring some form of connectivity capability.

Sustainability focus is driving development of equipment designed to minimize environmental impact through reduced fuel consumption, lower emissions, and improved soil health protection. Manufacturers are incorporating features that reduce soil compaction, optimize fuel efficiency, and support conservation tillage practices.

Customization capabilities are expanding as manufacturers recognize diverse customer requirements across different agricultural regions and operation types. Modular equipment designs enable farmers to configure machinery specifically for their crops, field conditions, and operational preferences.

Service digitization is revolutionizing equipment support through remote diagnostics, predictive maintenance, and mobile service applications. These technologies reduce downtime, improve service efficiency, and provide proactive maintenance scheduling that prevents costly equipment failures during critical harvest periods.

Technology partnerships between equipment manufacturers and precision agriculture companies are accelerating innovation in smart farming capabilities. These collaborations are producing integrated systems that combine machinery control with farm management software, creating comprehensive solutions for modern agricultural operations.

Manufacturing investments in domestic production facilities are strengthening supply chain resilience and reducing dependency on international components. Several major manufacturers have announced facility expansions and new production lines dedicated to advanced forage equipment manufacturing.

Acquisition activities within the industry are consolidating technology capabilities and expanding product portfolios. Strategic acquisitions are enabling established manufacturers to integrate specialized technologies and enter new market segments more rapidly than through internal development.

Research initiatives focusing on artificial intelligence and machine learning applications are advancing autonomous operation capabilities. These developments promise to revolutionize field operations through intelligent systems that can adapt to changing conditions and optimize performance without operator intervention.

Sustainability programs launched by major manufacturers are addressing environmental concerns through improved fuel efficiency, reduced emissions, and enhanced recyclability of equipment components. These initiatives respond to growing environmental awareness among agricultural customers and regulatory requirements.

Technology investment should remain a priority for manufacturers seeking to maintain competitive position in an increasingly sophisticated market. Companies should focus on developing integrated systems that provide comprehensive solutions rather than individual equipment pieces, creating greater customer value and loyalty.

Service network expansion represents a critical success factor as equipment complexity increases and customer expectations for support grow. Manufacturers should invest in mobile service capabilities, remote diagnostics, and technician training programs to ensure adequate support coverage across rural markets.

Market segmentation strategies should recognize the diverse requirements of different customer groups, from small family farms to large commercial operations. Developing targeted product lines and marketing approaches for specific segments can improve market penetration and customer satisfaction.

Partnership development with precision agriculture companies, software providers, and service organizations can accelerate innovation and expand market reach. Strategic alliances enable companies to leverage complementary capabilities while sharing development costs and risks.

International expansion should be considered as domestic markets mature and global agricultural mechanization increases. American equipment manufacturers have competitive advantages in technology and quality that can be leveraged in developing agricultural markets worldwide.

Market growth prospects remain positive driven by ongoing agricultural modernization, livestock industry expansion, and increasing emphasis on operational efficiency. The sector is expected to benefit from continued technology adoption and replacement of aging equipment fleets across American farms.

Technology evolution will continue transforming the industry through artificial intelligence integration, enhanced automation capabilities, and improved connectivity features. MarkWide Research projects that autonomous operation capabilities will reach 25% market penetration within the next decade, fundamentally changing field operation approaches.

Sustainability requirements will increasingly influence equipment design and customer purchasing decisions. Manufacturers investing in environmental performance improvements and sustainable manufacturing practices will gain competitive advantages as regulatory requirements and customer awareness continue growing.

Market consolidation may continue as smaller manufacturers struggle to compete with the investment requirements for advanced technology development. This trend could result in fewer but more capable competitors offering comprehensive product portfolios and support services.

Global opportunities will expand as international agricultural markets develop and mechanization adoption increases worldwide. American equipment manufacturers are well-positioned to capitalize on these opportunities through their technology leadership and established reputation for quality and innovation.

The United States haying and forage machinery market demonstrates strong fundamentals supported by essential agricultural requirements, technological innovation, and evolving customer needs. The industry’s ability to adapt to changing agricultural practices while maintaining focus on productivity and efficiency positions it well for continued growth and development.

Technology integration will remain the primary driver of market evolution, with precision agriculture capabilities, automation features, and connectivity solutions becoming standard rather than optional equipment features. Manufacturers successfully navigating this technological transformation while maintaining cost competitiveness will capture the greatest market opportunities.

Market participants should focus on comprehensive solutions that address diverse customer requirements across different farm sizes and operational approaches. The industry’s future success depends on continued innovation, service excellence, and adaptation to evolving agricultural practices that support sustainable and profitable farming operations throughout the United States.

What is Haying & Forage Machinery?

Haying & Forage Machinery refers to the equipment used in the production and harvesting of hay and forage crops. This includes machinery such as mowers, rakes, tedders, and balers that are essential for efficient crop management and livestock feeding.

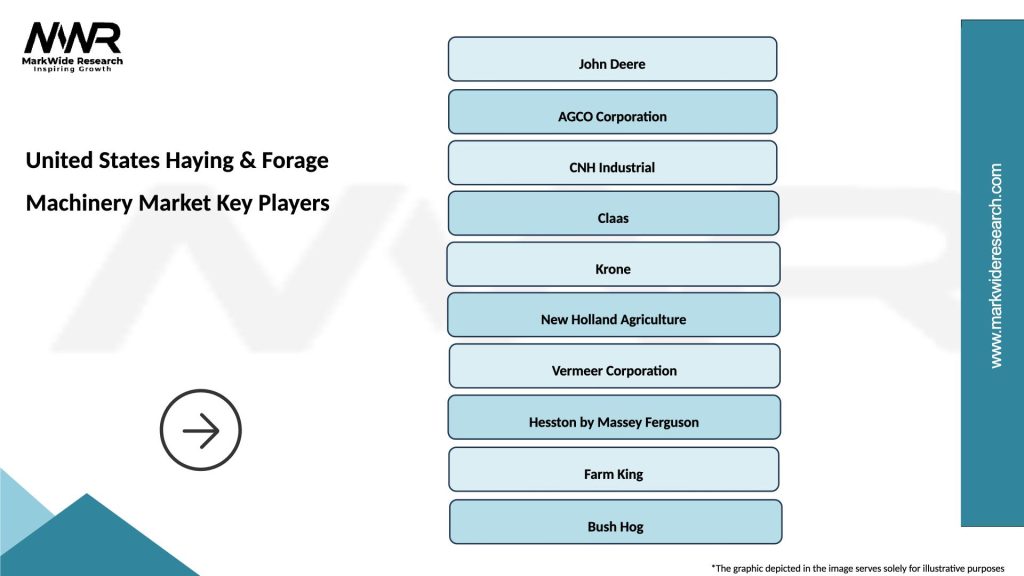

What are the key players in the United States Haying & Forage Machinery Market?

Key players in the United States Haying & Forage Machinery Market include companies like John Deere, AGCO Corporation, and Kuhn Group. These companies are known for their innovative machinery and technology that enhance productivity in hay and forage operations, among others.

What are the growth factors driving the United States Haying & Forage Machinery Market?

The growth of the United States Haying & Forage Machinery Market is driven by increasing demand for high-quality forage, advancements in machinery technology, and the rising number of livestock farms. Additionally, the focus on improving operational efficiency in agriculture contributes to market expansion.

What challenges does the United States Haying & Forage Machinery Market face?

The United States Haying & Forage Machinery Market faces challenges such as high initial investment costs and the need for regular maintenance of machinery. Additionally, fluctuating weather conditions can impact forage production, affecting machinery demand.

What opportunities exist in the United States Haying & Forage Machinery Market?

Opportunities in the United States Haying & Forage Machinery Market include the development of smart farming technologies and automation in machinery. There is also potential for growth in organic farming practices, which require specialized equipment for hay and forage production.

What trends are shaping the United States Haying & Forage Machinery Market?

Trends in the United States Haying & Forage Machinery Market include the increasing adoption of precision agriculture techniques and the integration of IoT technology in machinery. Additionally, sustainability practices are influencing the design and functionality of new equipment.

United States Haying & Forage Machinery Market

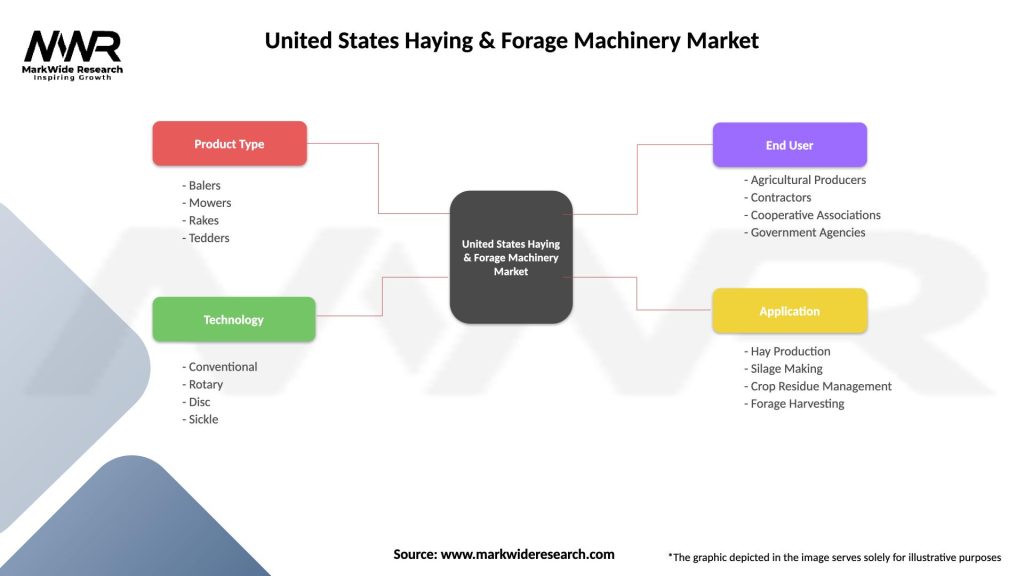

| Segmentation Details | Description |

|---|---|

| Product Type | Balers, Mowers, Rakes, Tedders |

| Technology | Conventional, Rotary, Disc, Sickle |

| End User | Agricultural Producers, Contractors, Cooperative Associations, Government Agencies |

| Application | Hay Production, Silage Making, Crop Residue Management, Forage Harvesting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Haying & Forage Machinery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at