444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States hardware stores retail market represents a cornerstone of American commerce, serving millions of consumers and contractors with essential tools, building materials, and home improvement products. This dynamic sector encompasses traditional neighborhood hardware stores, large-format home improvement retailers, and specialized tool distributors that collectively form a comprehensive ecosystem supporting residential and commercial construction activities.

Market dynamics indicate robust growth driven by sustained home improvement trends, aging housing stock requiring maintenance, and increased DIY enthusiasm among American consumers. The sector demonstrates remarkable resilience, with hardware retailers experiencing consistent demand across economic cycles due to the essential nature of their product offerings. Growth projections suggest the market will expand at a 4.2% CAGR through the forecast period, supported by demographic shifts and evolving consumer preferences.

Regional distribution shows significant concentration in suburban and rural markets, where hardware stores serve as community anchors providing specialized knowledge and personalized service. Urban markets increasingly favor large-format retailers, while rural areas maintain strong loyalty to independent hardware stores that offer unique product mixes and local expertise.

The United States hardware stores retail market refers to the comprehensive network of retail establishments specializing in the sale of tools, building materials, fasteners, electrical supplies, plumbing fixtures, paint, lawn and garden equipment, and related home improvement products to consumers and professional contractors.

This market encompasses various retail formats including traditional neighborhood hardware stores, large home improvement centers, specialty tool retailers, and lumber yards that serve both residential and commercial customers. The sector bridges the gap between manufacturers and end-users, providing essential distribution channels for construction and maintenance supplies while offering value-added services such as key cutting, tool rental, and expert consultation.

Hardware stores traditionally function as problem-solving destinations where customers seek solutions for repair, maintenance, and improvement projects. These establishments differentiate themselves through knowledgeable staff, specialized product assortments, and community-focused service approaches that larger retailers often cannot replicate.

The United States hardware stores retail market demonstrates sustained growth momentum driven by fundamental demographic and economic trends supporting home improvement activities. Consumer spending patterns indicate increased investment in home maintenance and enhancement projects, with 68% of homeowners planning significant improvement projects annually.

Market segmentation reveals distinct customer categories including DIY enthusiasts, professional contractors, and maintenance personnel, each with specific product requirements and shopping preferences. Independent hardware stores maintain competitive advantages in specialized product knowledge and personalized service, while large retailers leverage economies of scale and extensive product assortments.

Technology integration increasingly influences market dynamics, with retailers adopting e-commerce platforms, inventory management systems, and customer relationship tools to enhance operational efficiency and service delivery. Digital transformation initiatives enable smaller retailers to compete more effectively with larger competitors through improved customer engagement and streamlined operations.

Future prospects remain positive, supported by aging housing stock requiring ongoing maintenance, millennial homeownership growth, and sustained interest in home improvement projects. Market participants continue investing in store modernization, expanded service offerings, and technology upgrades to capture emerging opportunities.

Strategic analysis reveals several critical insights shaping the United States hardware stores retail market landscape:

Several key factors propel growth in the United States hardware stores retail market, creating sustained demand for products and services across multiple customer segments.

Home improvement trends represent the primary market driver, with American homeowners increasingly investing in property enhancement projects. Rising home values encourage improvement investments, while aging housing stock requires ongoing maintenance and modernization efforts. The popularity of DIY culture, amplified by social media platforms and home improvement television programming, drives consumer engagement with hardware retailers.

Demographic shifts significantly influence market dynamics, particularly millennial homeownership growth and baby boomer aging-in-place preferences. Younger homeowners demonstrate strong interest in home customization and improvement projects, while older homeowners focus on maintenance and accessibility modifications. Both demographics rely heavily on hardware stores for project supplies and expert guidance.

Economic factors including low interest rates, increased home equity, and disposable income growth support hardware retail market expansion. Consumer confidence in home improvement investments remains strong, driven by property value appreciation and lifestyle enhancement priorities. Additionally, supply chain localization trends benefit regional hardware retailers serving local construction and maintenance markets.

Technology adoption enables hardware retailers to enhance customer service, streamline operations, and expand market reach through digital channels. Point-of-sale systems, inventory management software, and e-commerce platforms improve operational efficiency while providing customers with enhanced shopping experiences and product accessibility.

Despite positive growth trends, the United States hardware stores retail market faces several significant challenges that may constrain expansion and profitability.

Competitive pressure from large-format home improvement retailers creates ongoing challenges for independent hardware stores. These major retailers leverage economies of scale, extensive product assortments, and aggressive pricing strategies that smaller competitors struggle to match. Market consolidation trends further intensify competitive dynamics, potentially reducing market share for traditional hardware stores.

Supply chain disruptions and inventory management complexities pose operational challenges for hardware retailers. Product availability issues, transportation delays, and cost fluctuations impact customer satisfaction and profit margins. Smaller retailers particularly struggle with supply chain optimization due to limited purchasing power and distribution network access.

Labor shortages and skilled workforce challenges affect hardware retail operations, particularly in technical product categories requiring specialized knowledge. Finding and retaining knowledgeable staff becomes increasingly difficult as experienced personnel retire and younger workers seek opportunities in other sectors. Training costs and turnover rates impact operational efficiency and customer service quality.

E-commerce competition from online retailers and direct-to-consumer manufacturers creates pricing pressure and customer acquisition challenges. Digital-native competitors offer convenience and competitive pricing that traditional hardware stores must address through enhanced service offerings and value propositions. Omnichannel integration requirements demand significant technology investments that strain smaller retailers’ resources.

Emerging opportunities within the United States hardware stores retail market present significant potential for growth and differentiation among market participants.

Service expansion represents a major opportunity for hardware retailers to increase revenue and customer loyalty. Installation services, equipment rental, and maintenance contracts provide recurring revenue streams while differentiating stores from product-only competitors. Professional services targeting both residential and commercial customers offer higher profit margins and stronger customer relationships.

Niche market specialization enables hardware stores to develop competitive advantages in specific product categories or customer segments. Specialty areas such as restoration hardware, sustainable building materials, or smart home technology allow retailers to command premium pricing while serving underserved market segments. Expert positioning in specialized categories builds customer loyalty and reduces price-based competition.

Digital transformation opportunities include e-commerce platform development, mobile applications, and digital marketing initiatives that expand customer reach and engagement. Online ordering with in-store pickup, virtual consultation services, and digital inventory management systems enhance customer convenience while improving operational efficiency. Social media marketing and content creation establish thought leadership and community engagement.

Partnership development with contractors, property managers, and maintenance companies creates stable revenue streams and market expansion opportunities. Commercial account programs, bulk purchasing arrangements, and exclusive supplier relationships provide competitive advantages while ensuring consistent sales volumes. Strategic alliances with complementary service providers expand customer value propositions.

Complex interactions between various market forces shape the competitive landscape and growth trajectory of the United States hardware stores retail market.

Consumer behavior evolution significantly influences market dynamics, with customers increasingly seeking convenience, expertise, and value-added services. Shopping patterns demonstrate preference for retailers offering comprehensive solutions rather than simple product transactions. Customer expectations for knowledgeable staff, product availability, and service quality continue rising, requiring retailers to invest in training and operational improvements.

Competitive positioning strategies vary significantly across market participants, with independent stores emphasizing personalized service and specialized knowledge while large retailers focus on product variety and competitive pricing. Market differentiation increasingly depends on service quality, customer relationships, and unique value propositions rather than product availability alone.

Supply chain optimization becomes increasingly critical as retailers seek to balance inventory costs with product availability. Advanced forecasting systems, vendor partnerships, and distribution efficiency improvements enable better customer service while managing working capital requirements. MarkWide Research analysis indicates that retailers implementing advanced inventory management systems achieve 18% improvements in stock turnover rates.

Technology integration accelerates across the market, with retailers adopting point-of-sale systems, customer relationship management tools, and e-commerce platforms to enhance competitiveness. Digital transformation initiatives enable smaller retailers to compete more effectively while providing customers with enhanced shopping experiences and service accessibility.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United States hardware stores retail market dynamics and trends.

Primary research includes extensive interviews with hardware store owners, managers, and industry executives to gather firsthand insights into market conditions, challenges, and opportunities. Customer surveys and focus groups provide valuable perspectives on shopping preferences, service expectations, and satisfaction levels across different market segments.

Secondary research encompasses analysis of industry reports, trade publications, government statistics, and financial data from publicly traded companies. Market data compilation includes sales figures, store counts, geographic distribution patterns, and competitive positioning analysis across various retail formats and market segments.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, statistical analysis, and expert review. Market sizing methodologies incorporate bottom-up and top-down approaches to provide comprehensive market perspective and validate findings across different analytical frameworks.

Trend analysis utilizes historical data patterns, current market indicators, and forward-looking projections to identify emerging opportunities and potential challenges. Quantitative and qualitative analysis techniques provide balanced perspectives on market dynamics and future growth prospects.

Geographic distribution of the United States hardware stores retail market reveals distinct regional characteristics and growth patterns influenced by local economic conditions, demographics, and competitive landscapes.

Northeast Region demonstrates mature market characteristics with high store density in urban and suburban areas. This region shows 22% market share of total hardware retail activity, driven by aging housing stock requiring maintenance and renovation. Independent hardware stores maintain strong positions in smaller communities, while large retailers dominate metropolitan markets. Seasonal variations significantly impact sales patterns, with spring and summer months generating peak activity.

Southeast Region exhibits robust growth driven by population migration, new construction activity, and favorable business climates. Representing 28% of national market activity, this region benefits from year-round construction seasons and strong DIY culture. Hardware retailers experience consistent demand across residential and commercial segments, with particular strength in lawn and garden categories.

Midwest Region maintains traditional hardware store culture with strong independent retailer presence serving rural and small-town markets. This region accounts for 25% of market share, characterized by customer loyalty to local businesses and emphasis on agricultural and industrial supplies. Seasonal fluctuations affect outdoor product categories, while indoor maintenance products provide steady year-round demand.

Western Region shows dynamic growth patterns influenced by technology adoption, environmental consciousness, and diverse geographic conditions. Comprising 25% of market activity, this region demonstrates strong demand for sustainable products, water conservation supplies, and earthquake preparedness items. Urban markets favor large retailers, while rural areas support specialized hardware stores serving agricultural and recreational markets.

The competitive environment within the United States hardware stores retail market encompasses diverse participants ranging from large national chains to independent neighborhood stores, each employing distinct strategies to capture market share and customer loyalty.

Major market participants include:

Competitive strategies vary significantly across market segments, with large retailers emphasizing scale advantages, product variety, and competitive pricing, while independent stores focus on personalized service, specialized expertise, and community relationships. Market differentiation increasingly depends on service quality, customer experience, and unique value propositions rather than product availability alone.

Market segmentation analysis reveals distinct categories within the United States hardware stores retail market, each characterized by specific customer needs, product requirements, and service expectations.

By Store Format:

By Customer Type:

By Product Category:

Detailed category analysis provides comprehensive understanding of product performance and growth opportunities within the United States hardware stores retail market.

Tools and Hardware Category represents the traditional core of hardware retail, encompassing hand tools, power tools, fasteners, and basic hardware items. This segment demonstrates steady growth driven by DIY enthusiasm and professional contractor demand. Premium tool brands command higher margins, while commodity hardware items face pricing pressure from online competitors. Innovation in cordless technology and smart tools creates opportunities for retailers emphasizing cutting-edge products.

Building Materials Segment shows strong correlation with construction activity and home improvement trends. Lumber, drywall, insulation, and related products generate significant revenue but require substantial inventory investment and storage space. Professional contractors represent the primary customer base, with relationships and service quality determining competitive success. Supply chain efficiency becomes critical due to product bulk and transportation costs.

Electrical and Plumbing Categories benefit from code compliance requirements and ongoing maintenance needs in residential and commercial properties. These technical product areas require knowledgeable staff and specialized inventory management. Smart home technology integration creates growth opportunities, while traditional products provide steady demand. Professional installation services offer additional revenue potential and customer relationship strengthening.

Paint and Supplies Division demonstrates seasonal patterns with peak activity during spring and summer months. Color matching technology and custom mixing capabilities provide competitive advantages for hardware retailers. Environmental regulations drive demand for low-VOC and sustainable paint products. Professional painter relationships and contractor programs generate consistent commercial sales volumes.

Multiple stakeholder groups derive significant benefits from the robust United States hardware stores retail market ecosystem, creating value across the supply chain and supporting local communities.

For Retailers:

For Consumers:

For Manufacturers:

For Communities:

Comprehensive SWOT analysis reveals the strategic position and future prospects of the United States hardware stores retail market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Several significant trends shape the evolution of the United States hardware stores retail market, influencing customer behavior, competitive dynamics, and growth opportunities.

Digital Transformation Acceleration represents a fundamental shift in hardware retail operations, with stores implementing e-commerce platforms, mobile applications, and digital marketing strategies. MWR analysis indicates that retailers adopting omnichannel approaches experience 27% higher customer retention rates compared to traditional brick-and-mortar only operations. Point-of-sale integration, inventory management systems, and customer relationship platforms enhance operational efficiency while improving customer experiences.

Service-Centric Business Models emerge as hardware retailers expand beyond product sales to include installation, repair, and maintenance services. This trend enables differentiation from online competitors while generating higher-margin revenue streams. Tool rental programs, equipment servicing, and project consultation services create recurring customer relationships and increase transaction values.

Sustainability Focus influences product selection and customer preferences, with increasing demand for environmentally friendly building materials, energy-efficient tools, and sustainable landscaping supplies. Retailers emphasizing green products and eco-conscious practices attract environmentally aware consumers while supporting regulatory compliance initiatives.

Smart Home Integration creates opportunities for hardware retailers to serve customers implementing connected home technologies. Smart locks, automated irrigation systems, and energy management devices require installation expertise and ongoing support that traditional hardware stores can provide through specialized training and service programs.

Professional Contractor Focus drives retailers to develop specialized programs serving commercial customers with bulk purchasing, delivery services, and account management. Professional-grade tools, commercial-quantity supplies, and contractor-specific services generate higher transaction values and more predictable revenue streams.

Recent industry developments demonstrate the dynamic nature of the United States hardware stores retail market and highlight emerging trends shaping future growth.

Technology Integration Initiatives accelerate across the market, with retailers implementing advanced point-of-sale systems, inventory management software, and customer relationship platforms. Mobile applications enabling product lookup, inventory checking, and online ordering enhance customer convenience while improving operational efficiency. Augmented reality tools help customers visualize projects and select appropriate products.

Acquisition and Consolidation Activity continues reshaping the competitive landscape, with larger retailers acquiring regional chains and independent stores to expand geographic coverage. Cooperative buying groups strengthen independent retailers’ purchasing power and operational capabilities through shared resources and best practices.

Service Expansion Programs gain momentum as retailers recognize the competitive advantages of installation and repair services. Professional certification programs, equipment investments, and staff training initiatives enable stores to offer comprehensive project solutions rather than simple product sales.

Sustainability Initiatives influence product sourcing, store operations, and customer education programs. Retailers increasingly emphasize environmentally responsible products, energy-efficient operations, and waste reduction programs to appeal to environmentally conscious consumers and comply with regulatory requirements.

Supply Chain Optimization becomes critical as retailers seek to balance inventory costs with product availability. Advanced forecasting systems, vendor partnerships, and distribution efficiency improvements enable better customer service while managing working capital requirements.

Strategic recommendations for hardware retail market participants focus on adapting to evolving customer expectations, competitive pressures, and technological opportunities.

Embrace Digital Transformation: Hardware retailers must invest in e-commerce platforms, mobile applications, and digital marketing to remain competitive. Omnichannel integration enabling online ordering with in-store pickup, virtual consultation services, and social media engagement expands customer reach while enhancing service delivery. Technology investments should focus on improving customer experience and operational efficiency rather than simply matching competitor capabilities.

Develop Service Differentiation: Expanding beyond product sales to include installation, repair, and maintenance services creates competitive advantages and higher-margin revenue streams. Professional certification programs, equipment investments, and staff training enable comprehensive project solutions that online retailers cannot replicate. Service offerings should align with local market needs and customer preferences.

Strengthen Customer Relationships: Personalized service, expert guidance, and community connections provide sustainable competitive advantages. Customer relationship management systems, loyalty programs, and regular communication initiatives build long-term relationships that resist price-based competition. Focus on becoming trusted advisors rather than simple product vendors.

Optimize Product Mix: Regular analysis of sales data, customer feedback, and market trends should guide inventory decisions and product category emphasis. Specialty items, premium brands, and unique products command higher margins while differentiating stores from mass-market competitors. Seasonal adjustments and local market customization improve inventory turnover and customer satisfaction.

Pursue Strategic Partnerships: Relationships with contractors, property managers, and complementary service providers create stable revenue streams and market expansion opportunities. Commercial account programs, bulk purchasing arrangements, and exclusive supplier relationships provide competitive advantages while ensuring consistent sales volumes.

The future trajectory of the United States hardware stores retail market appears positive, supported by fundamental demographic trends, technological advancement opportunities, and evolving customer expectations that favor service-oriented retailers.

Growth projections indicate continued market expansion driven by aging housing stock requiring maintenance, millennial homeownership growth, and sustained interest in home improvement projects. MarkWide Research forecasts suggest the market will maintain steady growth rates of 4-5% annually through the next decade, with service-oriented retailers experiencing above-average performance.

Technology integration will accelerate, with successful retailers implementing comprehensive digital strategies including e-commerce platforms, mobile applications, and advanced inventory management systems. Artificial intelligence and machine learning applications will enhance customer service, optimize inventory management, and improve operational efficiency. Virtual and augmented reality tools will revolutionize customer engagement and project planning processes.

Market consolidation trends will continue, with larger retailers acquiring regional chains and independent stores to expand geographic coverage and achieve operational efficiencies. However, successful independent retailers focusing on specialized service, niche markets, and strong customer relationships will maintain competitive positions through differentiation strategies.

Service evolution will transform hardware retail from product-focused to solution-oriented business models. Installation services, equipment rental, project consultation, and maintenance contracts will become standard offerings rather than optional add-ons. Retailers emphasizing comprehensive project solutions will capture larger shares of customer spending while building stronger relationships.

Sustainability considerations will increasingly influence product selection, store operations, and customer preferences. Environmental consciousness, energy efficiency, and sustainable building practices will drive demand for eco-friendly products and services. Retailers positioning themselves as sustainability leaders will attract environmentally aware customers and comply with evolving regulatory requirements.

The United States hardware stores retail market demonstrates remarkable resilience and growth potential, supported by fundamental consumer needs, demographic trends, and evolving service expectations. Despite competitive pressures from large retailers and online competitors, the market offers significant opportunities for participants willing to adapt to changing customer preferences and technological advancement.

Success factors increasingly emphasize service quality, customer relationships, and technological integration rather than simple product availability and pricing. Hardware retailers that embrace digital transformation, expand service offerings, and strengthen customer connections will thrive in the evolving marketplace. The essential nature of hardware products, combined with the value of expert guidance and immediate availability, provides sustainable competitive advantages for well-positioned retailers.

Future growth prospects remain positive, driven by aging housing stock, millennial homeownership trends, and sustained interest in home improvement projects. Market participants that invest in technology, develop comprehensive service capabilities, and maintain strong customer relationships will capture the greatest share of emerging opportunities while building resilient, profitable businesses serving their communities’ essential needs.

What is Hardware Stores Retail?

Hardware Stores Retail refers to the business of selling tools, building materials, and home improvement products to consumers and contractors. This sector includes a variety of products such as hand tools, power tools, plumbing supplies, and paint.

What are the key players in the United States Hardware Stores Retail Market?

Key players in the United States Hardware Stores Retail Market include The Home Depot, Lowe’s, Ace Hardware, and True Value, among others. These companies dominate the market by offering a wide range of products and services to meet consumer needs.

What are the growth factors driving the United States Hardware Stores Retail Market?

The growth of the United States Hardware Stores Retail Market is driven by increasing home improvement projects, a rise in DIY culture, and the expansion of e-commerce platforms. Additionally, the demand for sustainable and energy-efficient products is also contributing to market growth.

What challenges does the United States Hardware Stores Retail Market face?

The United States Hardware Stores Retail Market faces challenges such as intense competition from online retailers, fluctuating raw material prices, and supply chain disruptions. These factors can impact pricing strategies and inventory management for brick-and-mortar stores.

What opportunities exist in the United States Hardware Stores Retail Market?

Opportunities in the United States Hardware Stores Retail Market include the growing trend of smart home technology, increased consumer interest in home renovation, and the potential for expanding product lines to include eco-friendly options. These trends can help retailers attract a broader customer base.

What trends are shaping the United States Hardware Stores Retail Market?

Trends shaping the United States Hardware Stores Retail Market include the rise of omnichannel retailing, where consumers shop both online and in-store, and the increasing popularity of DIY home improvement projects. Additionally, the focus on sustainability is influencing product offerings and consumer preferences.

United States Hardware Stores Retail Market

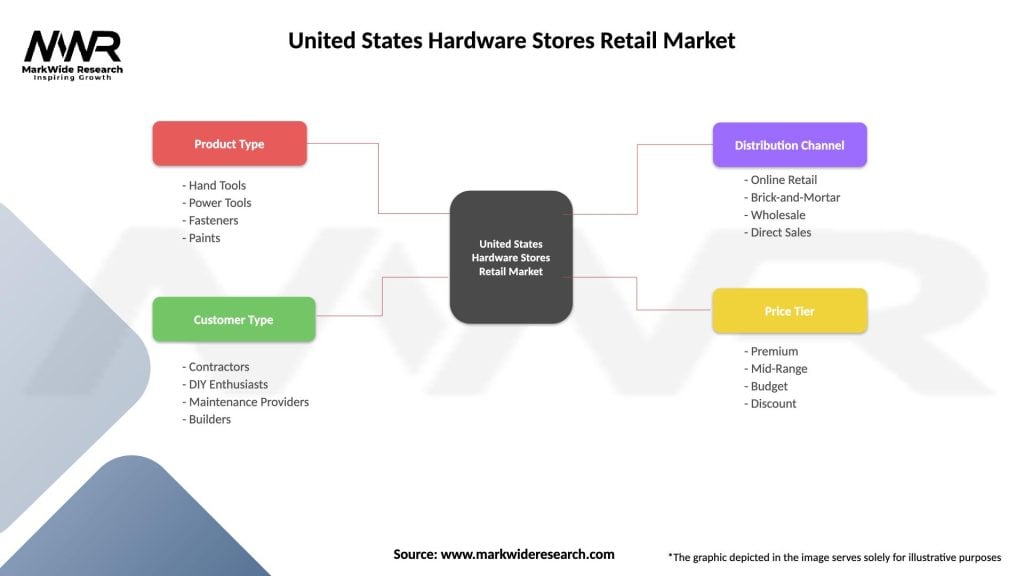

| Segmentation Details | Description |

|---|---|

| Product Type | Hand Tools, Power Tools, Fasteners, Paints |

| Customer Type | Contractors, DIY Enthusiasts, Maintenance Providers, Builders |

| Distribution Channel | Online Retail, Brick-and-Mortar, Wholesale, Direct Sales |

| Price Tier | Premium, Mid-Range, Budget, Discount |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Hardware Stores Retail Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at