444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States freestanding casualty department market represents a rapidly evolving segment of the healthcare delivery system, characterized by independent emergency care facilities operating outside traditional hospital settings. These specialized medical facilities provide comprehensive emergency and urgent care services, addressing the growing demand for accessible, cost-effective healthcare solutions across diverse patient populations.

Market dynamics indicate substantial growth momentum driven by increasing healthcare accessibility needs, rising patient volumes, and evolving consumer preferences for convenient medical care. The sector has experienced remarkable expansion, with freestanding emergency departments demonstrating significant penetration rates of approximately 15-18% in key metropolitan markets across the United States.

Healthcare transformation continues to reshape the emergency care landscape, with freestanding casualty departments emerging as critical components of integrated healthcare networks. These facilities bridge the gap between traditional emergency rooms and urgent care centers, offering advanced diagnostic capabilities and specialized treatment protocols while maintaining operational flexibility and reduced overhead costs.

Geographic distribution patterns reveal concentrated development in suburban and underserved urban areas, where traditional hospital emergency departments face capacity constraints or accessibility challenges. The market demonstrates strong correlation with population density, demographic trends, and regional healthcare infrastructure development initiatives.

The United States freestanding casualty department market refers to the comprehensive ecosystem of independent emergency medical facilities that operate separately from hospital campuses while providing full-service emergency care capabilities. These facilities combine the clinical sophistication of hospital emergency departments with the operational efficiency and accessibility advantages of standalone healthcare delivery models.

Freestanding casualty departments encompass medical facilities equipped with advanced diagnostic imaging, laboratory services, emergency treatment capabilities, and specialized medical staff trained in emergency medicine protocols. Unlike urgent care centers, these facilities maintain the capacity to handle complex medical emergencies, trauma cases, and critical care situations requiring immediate intervention.

Operational characteristics include 24/7 availability, comprehensive emergency medical services, direct hospital transfer capabilities, and integration with regional healthcare networks. These facilities serve as strategic healthcare access points, particularly in communities where traditional hospital emergency departments experience overcrowding or geographic accessibility limitations.

Market expansion in the United States freestanding casualty department sector reflects fundamental shifts in healthcare delivery preferences, demographic trends, and regulatory frameworks supporting alternative emergency care models. The industry demonstrates robust growth trajectories with increasing adoption rates across diverse geographic markets and patient demographics.

Key performance indicators reveal significant operational advantages, including reduced patient wait times by approximately 35-40% compared to traditional hospital emergency departments, enhanced patient satisfaction scores, and improved cost-effectiveness metrics. These facilities have successfully captured market share through strategic positioning and service differentiation strategies.

Investment patterns show substantial capital allocation toward facility development, technology integration, and workforce expansion. Healthcare systems, private equity firms, and specialized healthcare real estate developers have recognized the strategic value proposition of freestanding casualty departments as complementary assets within comprehensive healthcare delivery networks.

Regulatory environment continues to evolve, with state-level licensing requirements, quality assurance standards, and reimbursement frameworks adapting to accommodate the unique operational characteristics of freestanding emergency care facilities. These developments support market stability and long-term growth sustainability.

Strategic positioning within the healthcare continuum reveals several critical insights driving market development and competitive dynamics:

Demographic transformation represents the primary catalyst driving freestanding casualty department market expansion. Aging population demographics, increasing chronic disease prevalence, and growing healthcare utilization rates create sustained demand for accessible emergency medical services across diverse patient populations.

Healthcare accessibility challenges in rural and suburban communities fuel market development as traditional hospital emergency departments face capacity constraints and geographic limitations. Freestanding facilities address these gaps by providing localized emergency care services with reduced travel times and enhanced convenience factors.

Cost containment initiatives within healthcare systems drive adoption of alternative emergency care delivery models. Freestanding casualty departments offer operational cost advantages while maintaining clinical quality standards, supporting healthcare organizations’ financial sustainability objectives and value-based care initiatives.

Consumer preference evolution toward convenient, patient-centered healthcare experiences accelerates market growth. Patients increasingly value shorter wait times, personalized attention, and comfortable facility environments that freestanding casualty departments can provide through optimized operational designs.

Technology advancement enables sophisticated emergency care delivery in standalone facilities. Advanced diagnostic imaging, telemedicine capabilities, electronic health record integration, and point-of-care testing technologies support comprehensive emergency medical services outside traditional hospital settings.

Regulatory complexity presents significant operational challenges for freestanding casualty department development. State-specific licensing requirements, quality assurance standards, and reimbursement frameworks create compliance burdens that may limit market entry and expansion opportunities for some healthcare organizations.

Capital investment requirements for facility development, medical equipment procurement, and technology infrastructure represent substantial financial barriers. The initial investment needed to establish fully equipped freestanding casualty departments may exceed the financial capacity of smaller healthcare providers or independent operators.

Workforce recruitment challenges in emergency medicine specialties create operational constraints. Competition for qualified emergency physicians, nurses, and support staff intensifies as the market expands, potentially leading to increased labor costs and staffing difficulties in certain geographic markets.

Reimbursement uncertainties from insurance providers and government healthcare programs create financial risk factors. Variations in payment rates, coverage policies, and prior authorization requirements may impact revenue predictability and long-term financial sustainability for freestanding facilities.

Community resistance in some markets stems from concerns about healthcare fragmentation and potential impacts on existing hospital emergency departments. Local stakeholders may oppose new facility development if perceived as competitive threats to established healthcare institutions.

Geographic expansion opportunities exist in underserved markets where traditional emergency care access remains limited. Rural communities, growing suburban areas, and regions with aging healthcare infrastructure present significant development potential for new freestanding casualty departments.

Technology integration creates opportunities for service enhancement and operational optimization. Artificial intelligence applications, remote monitoring capabilities, and advanced diagnostic technologies can differentiate freestanding facilities while improving patient outcomes and operational efficiency.

Partnership development with hospital systems, physician groups, and healthcare networks offers strategic growth pathways. Collaborative arrangements can provide referral networks, shared resources, and integrated care coordination while maintaining operational independence.

Specialized service offerings enable market differentiation and revenue diversification. Facilities can develop expertise in specific emergency care areas such as pediatric emergency medicine, behavioral health crisis intervention, or occupational injury treatment to capture targeted patient populations.

Value-based care participation presents opportunities for enhanced reimbursement and strategic positioning within evolving healthcare payment models. Freestanding casualty departments can demonstrate cost-effectiveness and quality outcomes that align with value-based care objectives.

Competitive landscape evolution reflects increasing market maturation with established healthcare systems, private equity-backed operators, and independent physician groups competing for market share. This competition drives innovation in service delivery models, facility design, and patient experience enhancement initiatives.

Regulatory framework development continues to shape market dynamics through evolving state licensing requirements, quality standards, and reimbursement policies. Recent regulatory changes have generally supported market growth by providing clearer operational guidelines and reducing administrative barriers.

Patient utilization patterns demonstrate growing acceptance and preference for freestanding casualty departments among diverse demographic groups. Utilization data indicates approximately 22-25% annual growth in patient volumes across established facilities, reflecting strong market demand and consumer adoption.

Healthcare system integration trends show increasing collaboration between freestanding facilities and hospital networks. These partnerships enhance care coordination, improve patient transfer protocols, and create synergistic operational advantages for both facility types.

Technology adoption rates accelerate as facilities invest in advanced medical equipment, digital health platforms, and operational management systems. These technological enhancements support clinical quality improvements and operational efficiency gains that strengthen competitive positioning.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United States freestanding casualty department market. Primary research activities include structured interviews with healthcare executives, facility operators, and industry experts to gather firsthand perspectives on market trends and operational challenges.

Secondary research components encompass extensive analysis of industry publications, regulatory filings, healthcare databases, and academic research studies. This approach provides comprehensive coverage of market dynamics, competitive landscapes, and regulatory developments affecting the freestanding casualty department sector.

Data validation processes ensure research accuracy through cross-referencing multiple information sources, expert review panels, and statistical verification procedures. MarkWide Research employs rigorous quality assurance protocols to maintain research integrity and reliability standards.

Market segmentation analysis utilizes advanced analytical frameworks to identify key market segments, growth patterns, and competitive dynamics. Geographic, demographic, and operational segmentation approaches provide detailed insights into market structure and development opportunities.

Forecasting methodologies incorporate quantitative modeling techniques, trend analysis, and scenario planning to project future market developments. These analytical approaches consider multiple variables including demographic trends, regulatory changes, and technological advancement impacts on market growth trajectories.

Geographic distribution patterns across the United States reveal significant regional variations in freestanding casualty department development and market penetration. The Southwest region leads market development with approximately 28-30% of total facilities, driven by rapid population growth, suburban expansion, and supportive regulatory environments.

Texas market dynamics demonstrate the most mature freestanding casualty department ecosystem, with established regulatory frameworks and widespread consumer acceptance. The state’s large geographic area, diverse population centers, and healthcare accessibility challenges create optimal conditions for continued market expansion.

Southeast regional growth accelerates through Florida, Georgia, and North Carolina markets, where aging demographics and tourism-related healthcare demands drive facility development. These states show strong adoption rates and favorable regulatory environments supporting market growth.

Western states including California, Arizona, and Colorado present mixed market conditions with varying regulatory approaches and competitive dynamics. Urban markets show strong development potential, while rural areas face infrastructure and workforce challenges that may limit near-term expansion.

Northeast corridor markets experience slower development due to established hospital networks, regulatory complexity, and higher real estate costs. However, suburban markets in states like Pennsylvania and New Jersey show emerging opportunities for strategic facility placement.

Midwest regional patterns reflect selective market development concentrated in growing metropolitan areas and underserved rural communities. States with supportive regulatory frameworks and healthcare workforce availability demonstrate stronger market development potential.

Market leadership encompasses diverse organizational structures including hospital health systems, private equity-backed operators, and independent physician-owned facilities. This competitive diversity creates dynamic market conditions with varying strategic approaches and operational models.

Strategic positioning varies among competitors, with some focusing on hospital system partnerships while others emphasize independent operations and community-based care delivery. These different approaches create diverse competitive dynamics and market opportunities.

Operational model segmentation reveals distinct categories of freestanding casualty departments based on ownership structure, service scope, and strategic positioning within local healthcare markets.

By Ownership Structure:

By Service Scope:

By Geographic Market:

Hospital-affiliated facilities demonstrate superior patient transfer capabilities and integrated care coordination, resulting in approximately 18-20% higher patient satisfaction scores compared to independent operations. These facilities benefit from established referral networks and comprehensive support services.

Independent physician-owned facilities show greater operational flexibility and faster decision-making processes, enabling rapid adaptation to local market conditions and patient preferences. These facilities often achieve superior physician recruitment and retention rates through ownership participation opportunities.

Private equity-backed operations excel in standardized operational protocols, technology implementation, and scalable growth strategies. These facilities typically demonstrate consistent quality metrics and operational efficiency improvements through professional management systems.

Hybrid emergency-urgent care models capture broader patient populations and achieve higher facility utilization rates by serving both emergency and non-emergency medical needs. This approach optimizes revenue potential while providing comprehensive community healthcare access.

Specialized pediatric emergency centers address specific market needs in communities with limited pediatric emergency care access. These facilities require specialized equipment, training, and facility design considerations but can achieve strong market differentiation and patient loyalty.

Rural community facilities face unique operational challenges including workforce recruitment, patient volume variability, and transportation logistics. However, these facilities provide essential healthcare access and often receive community support and regulatory advantages.

Healthcare systems benefit from freestanding casualty departments through expanded market reach, improved patient access, and enhanced competitive positioning. These facilities enable health systems to serve broader geographic areas while optimizing resource allocation and operational efficiency.

Patients gain access to high-quality emergency care with reduced wait times, convenient locations, and enhanced service experiences. Freestanding facilities typically provide more personalized attention and comfortable environments compared to traditional hospital emergency departments.

Physicians and healthcare professionals find attractive practice opportunities with greater autonomy, flexible scheduling, and potentially higher compensation structures. These facilities often offer more manageable patient volumes and reduced administrative burdens compared to hospital-based positions.

Communities benefit from improved healthcare access, reduced emergency medical service transport times, and enhanced local economic development. Freestanding casualty departments contribute to community health infrastructure while creating local employment opportunities.

Insurance providers can achieve cost savings through reduced emergency care costs and improved care coordination. Freestanding facilities often provide more cost-effective emergency care compared to traditional hospital emergency departments while maintaining quality standards.

Real estate developers and investors benefit from stable, long-term healthcare tenants with predictable cash flows and community-essential services. Healthcare real estate represents a growing investment category with defensive characteristics and inflation protection potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration acceleration drives significant improvements in diagnostic capabilities, patient monitoring, and care coordination. Freestanding casualty departments increasingly adopt artificial intelligence applications, advanced imaging technologies, and integrated electronic health record systems to enhance clinical outcomes and operational efficiency.

Patient experience optimization becomes a primary competitive differentiator as facilities invest in comfort amenities, streamlined registration processes, and personalized care delivery models. These enhancements result in measurably higher patient satisfaction scores and stronger community loyalty.

Workforce model innovation includes flexible staffing arrangements, telemedicine support, and specialized training programs designed to attract and retain qualified emergency medicine professionals. These approaches address workforce shortages while maintaining clinical quality standards.

Partnership strategy evolution shows increasing collaboration between freestanding facilities and hospital systems, creating integrated care networks that optimize patient outcomes and resource utilization. These partnerships enhance care coordination while maintaining operational independence.

Specialized service development targets specific patient populations and medical conditions, enabling facilities to differentiate their offerings and capture targeted market segments. Pediatric emergency care, behavioral health crisis intervention, and occupational medicine represent growing specialization areas.

Sustainability initiatives gain prominence as facilities implement environmentally responsible practices, energy-efficient technologies, and sustainable operational procedures. These efforts support community environmental goals while potentially reducing operational costs.

Regulatory framework evolution continues across multiple states with updated licensing requirements, quality standards, and reimbursement policies specifically addressing freestanding casualty departments. Recent developments generally support market growth by providing clearer operational guidelines and reducing administrative barriers.

Technology advancement integration accelerates with facilities implementing advanced diagnostic imaging, point-of-care testing, and telemedicine capabilities. These technological enhancements enable comprehensive emergency care delivery while maintaining cost-effectiveness and operational efficiency.

Market consolidation activities include strategic acquisitions, partnership formations, and operational collaborations among industry participants. These developments create larger, more efficient operating networks while maintaining local market presence and community connections.

Quality improvement initiatives focus on standardized clinical protocols, outcome measurement systems, and patient safety enhancements. Industry participants increasingly adopt evidence-based practices and quality assurance programs to demonstrate clinical excellence and regulatory compliance.

Workforce development programs address staffing challenges through specialized training initiatives, competitive compensation packages, and professional development opportunities. These programs support industry growth by ensuring adequate qualified personnel availability.

Community engagement strategies emphasize local partnerships, health education programs, and community outreach initiatives. These efforts build community support and demonstrate the value proposition of freestanding casualty departments as essential healthcare infrastructure components.

Strategic market entry requires comprehensive feasibility analysis including demographic assessment, competitive landscape evaluation, and regulatory compliance planning. MarkWide Research analysis indicates that successful market entry depends on thorough understanding of local healthcare needs and competitive dynamics.

Operational excellence focus should prioritize patient experience optimization, clinical quality improvement, and operational efficiency enhancement. Facilities achieving superior performance in these areas demonstrate stronger financial performance and market positioning advantages.

Technology investment strategies should emphasize solutions that enhance clinical capabilities while improving operational efficiency. Advanced diagnostic equipment, integrated information systems, and telemedicine platforms represent high-value investment priorities for competitive differentiation.

Partnership development offers significant strategic advantages through hospital system collaboration, physician group alliances, and healthcare network integration. These relationships enhance referral patterns, care coordination, and operational support while maintaining facility independence.

Market differentiation through specialized services, exceptional patient experiences, and community engagement creates sustainable competitive advantages. Facilities that successfully differentiate their offerings achieve stronger patient loyalty and market positioning.

Financial management requires careful attention to reimbursement optimization, cost control, and revenue diversification. Successful facilities implement comprehensive financial management systems and maintain strong relationships with payers and regulatory bodies.

Market expansion trajectory indicates continued robust growth with projected annual expansion rates of approximately 12-15% over the next five years. This growth reflects sustained demand for accessible emergency care, demographic trends supporting healthcare utilization, and continued market acceptance of freestanding casualty departments.

Geographic development patterns will likely concentrate in growing suburban markets, underserved rural communities, and metropolitan areas with healthcare access challenges. MWR projections suggest that approximately 60-65% of future facility development will occur in these target markets.

Technology integration advancement will accelerate with artificial intelligence applications, advanced diagnostic capabilities, and integrated healthcare platforms becoming standard operational components. These technological enhancements will support clinical quality improvements and operational efficiency gains.

Regulatory environment evolution is expected to continue supporting market development through refined licensing frameworks, quality standards, and reimbursement policies. Federal and state regulatory bodies increasingly recognize the value proposition of freestanding casualty departments within comprehensive healthcare delivery systems.

Competitive landscape maturation will likely result in market consolidation, strategic partnerships, and operational standardization across the industry. Larger, more efficient operating networks will emerge while maintaining local market responsiveness and community connections.

Service model innovation will expand beyond traditional emergency care to include preventive services, chronic disease management, and specialized treatment programs. This evolution will enhance facility utilization and revenue diversification while supporting comprehensive community healthcare needs.

The United States freestanding casualty department market represents a dynamic and rapidly expanding segment of the healthcare industry, driven by fundamental shifts in patient preferences, demographic trends, and healthcare delivery optimization needs. Market participants have successfully demonstrated the viability and value proposition of independent emergency care facilities that combine clinical excellence with operational efficiency and enhanced patient experiences.

Strategic opportunities continue to emerge across diverse geographic markets, particularly in underserved communities and growing suburban areas where traditional healthcare access remains limited. The industry’s ability to adapt to local market conditions while maintaining standardized quality and operational protocols positions freestanding casualty departments as essential components of comprehensive healthcare delivery networks.

Future market development will likely be characterized by continued expansion, technological advancement, and strategic collaboration among industry participants. The sector’s demonstrated resilience, growth potential, and community value proposition support optimistic long-term prospects for sustained market development and healthcare system integration. Success in this evolving market will depend on operational excellence, strategic positioning, and continued focus on patient-centered care delivery that addresses the diverse healthcare needs of American communities.

What is Freestanding Casualty Department?

Freestanding Casualty Departments are healthcare facilities that provide emergency care services outside of traditional hospital settings. They are designed to treat a variety of urgent medical conditions and injuries, offering a convenient alternative for patients seeking immediate care.

What are the key players in the United States Freestanding Casualty Department Market?

Key players in the United States Freestanding Casualty Department Market include companies like Envision Healthcare, American Family Care, and MedExpress, among others. These organizations are known for their extensive networks and commitment to providing accessible emergency care.

What are the growth factors driving the United States Freestanding Casualty Department Market?

The growth of the United States Freestanding Casualty Department Market is driven by factors such as the increasing demand for convenient healthcare services, a rise in the number of urgent care visits, and the expansion of insurance coverage for emergency services.

What challenges does the United States Freestanding Casualty Department Market face?

Challenges in the United States Freestanding Casualty Department Market include regulatory compliance issues, competition from traditional hospitals, and the need for high-quality staffing and resources to meet patient expectations.

What opportunities exist in the United States Freestanding Casualty Department Market?

Opportunities in the United States Freestanding Casualty Department Market include the potential for technological advancements in telemedicine, the expansion of services to include primary care, and partnerships with local hospitals to enhance patient care.

What trends are shaping the United States Freestanding Casualty Department Market?

Trends in the United States Freestanding Casualty Department Market include the increasing adoption of digital health solutions, a focus on patient-centered care, and the integration of advanced diagnostic technologies to improve treatment outcomes.

United States Freestanding Casualty Department Market

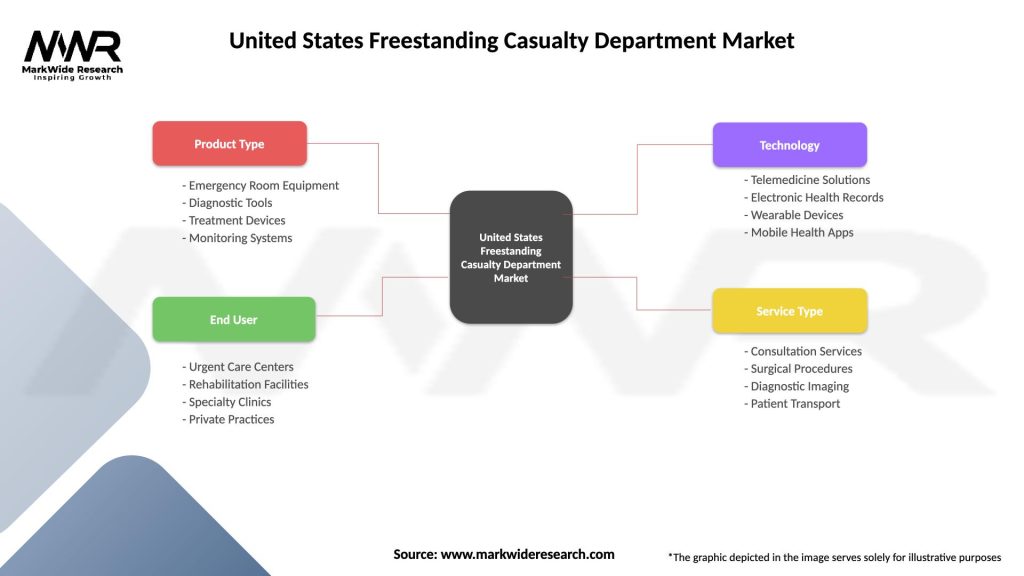

| Segmentation Details | Description |

|---|---|

| Product Type | Emergency Room Equipment, Diagnostic Tools, Treatment Devices, Monitoring Systems |

| End User | Urgent Care Centers, Rehabilitation Facilities, Specialty Clinics, Private Practices |

| Technology | Telemedicine Solutions, Electronic Health Records, Wearable Devices, Mobile Health Apps |

| Service Type | Consultation Services, Surgical Procedures, Diagnostic Imaging, Patient Transport |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Freestanding Casualty Department Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at