444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States food truck market represents a dynamic and rapidly evolving segment of the mobile food service industry, characterized by innovative culinary concepts, entrepreneurial spirit, and changing consumer preferences. Food trucks have transformed from simple street vendors to sophisticated mobile restaurants offering gourmet cuisine, ethnic specialties, and artisanal food experiences across urban and suburban landscapes nationwide.

Market dynamics indicate substantial growth driven by increasing consumer demand for convenient, affordable, and diverse dining options. The industry has experienced remarkable expansion, with food truck operations growing at approximately 12.4% annually over recent years. This growth trajectory reflects the sector’s resilience and adaptability to changing market conditions, including economic fluctuations and evolving consumer behaviors.

Geographic distribution shows concentrated activity in major metropolitan areas, with California, Texas, and New York leading in food truck density and revenue generation. Urban centers provide optimal operating environments due to high foot traffic, diverse demographics, and supportive regulatory frameworks. Suburban expansion has also gained momentum, with food trucks increasingly serving corporate campuses, residential neighborhoods, and special events.

Technology integration has revolutionized food truck operations, with 85% of operators now utilizing mobile payment systems, GPS tracking, and social media marketing platforms. This technological adoption has enhanced operational efficiency, customer engagement, and business scalability while reducing traditional barriers to entry for new entrepreneurs.

The United States food truck market refers to the comprehensive ecosystem of mobile food service businesses operating throughout the country, encompassing vehicle-based restaurants, catering services, and specialty food vendors that serve prepared meals and beverages from customized trucks, trailers, and mobile units.

Food truck operations typically involve entrepreneurs or small business owners who have converted commercial vehicles into mobile kitchens, enabling them to serve customers at various locations including street corners, business districts, festivals, and private events. These businesses range from simple snack vendors to sophisticated culinary operations offering restaurant-quality meals with specialized equipment and professional-grade cooking facilities.

Market participants include independent operators, franchise systems, corporate-sponsored trucks, and multi-unit food truck companies. The industry encompasses diverse culinary categories including ethnic cuisine, gourmet burgers, artisanal desserts, healthy food options, and fusion concepts that combine multiple culinary traditions.

The United States food truck market demonstrates robust growth potential driven by evolving consumer preferences, urbanization trends, and entrepreneurial innovation. Market expansion has been fueled by increasing demand for convenient dining options, diverse culinary experiences, and affordable meal alternatives that cater to busy lifestyles and adventurous palates.

Key growth drivers include rising consumer interest in street food culture, social media marketing effectiveness, and supportive municipal policies that have streamlined permitting processes in many jurisdictions. Operational flexibility allows food truck operators to adapt quickly to market demands, seasonal variations, and special events, providing competitive advantages over traditional brick-and-mortar restaurants.

Industry challenges encompass regulatory compliance complexities, seasonal weather impacts, and intense competition within popular operating zones. However, successful operators have demonstrated resilience through strategic location planning, menu innovation, and strong customer relationship building. Technology adoption has emerged as a critical success factor, with 78% of profitable operators leveraging digital platforms for marketing, ordering, and customer engagement.

Future prospects indicate continued market expansion supported by growing acceptance of mobile dining concepts, increasing urban population density, and ongoing innovation in food truck design and operational efficiency. The industry’s ability to adapt to changing consumer preferences and economic conditions positions it favorably for sustained growth.

Consumer behavior analysis reveals significant shifts in dining preferences, with millennials and Generation Z driving demand for authentic, Instagram-worthy food experiences that food trucks uniquely provide. Social media influence has become paramount, with successful food trucks building loyal followings through engaging content and real-time location updates.

Consumer lifestyle changes represent the primary catalyst for food truck market expansion, with increasing numbers of Americans seeking convenient, affordable dining options that fit busy schedules and mobile lifestyles. Urbanization trends have created dense populations of potential customers who value quick service and diverse culinary options within walking distance of workplaces and residential areas.

Entrepreneurial opportunities attract aspiring restaurateurs who face significant barriers to entry in traditional restaurant markets due to high real estate costs, extensive buildout requirements, and substantial initial capital investments. Food trucks offer a more accessible pathway to restaurant ownership, with lower startup costs and greater operational flexibility.

Social media marketing has revolutionized food truck promotion, enabling operators to build brand awareness, communicate location information, and engage customers at minimal cost. Digital platforms allow food trucks to compete effectively with larger restaurant chains by creating authentic connections with customers and generating viral marketing opportunities through shareable content.

Municipal support in many cities has improved through streamlined permitting processes, designated food truck zones, and recognition of mobile food vendors as legitimate contributors to local economic development. Policy improvements have reduced regulatory barriers while maintaining food safety standards, encouraging market growth and innovation.

Regulatory complexity remains a significant challenge for food truck operators, with varying requirements across different municipalities, counties, and states creating compliance burdens that can limit operational flexibility and increase administrative costs. Permitting processes often involve multiple agencies, lengthy approval timelines, and ongoing renewal requirements that strain small business resources.

Weather dependency significantly impacts food truck operations, particularly in regions with harsh winters or extreme weather conditions that limit outdoor dining and reduce customer foot traffic. Seasonal fluctuations create revenue volatility that challenges business planning and cash flow management for operators without diversified income streams.

Competition intensity has increased substantially as market growth attracts new entrants, creating oversaturation in popular operating locations and putting pressure on profit margins. Location competition for prime spots near office buildings, universities, and high-traffic areas has intensified, sometimes leading to territorial disputes and increased permit costs.

Infrastructure limitations in some areas lack adequate parking spaces, electrical hookups, and waste disposal facilities necessary for food truck operations. Operational constraints related to limited storage space, water capacity, and cooking equipment restrict menu complexity and service capacity compared to traditional restaurants.

Suburban expansion presents significant growth opportunities as food trucks explore underserved markets in residential neighborhoods, office parks, and suburban commercial centers where traditional restaurants may be limited. Corporate catering services offer recurring revenue streams through partnerships with businesses seeking convenient employee meal options.

Technology integration continues to create opportunities for operational efficiency improvements, customer engagement enhancement, and new revenue streams through delivery partnerships, pre-ordering systems, and loyalty programs. Digital innovation enables food trucks to compete more effectively with established restaurant chains while maintaining their unique mobile advantages.

Franchise development opportunities allow successful food truck concepts to scale rapidly through proven business models, standardized operations, and shared marketing resources. Brand expansion through franchising enables entrepreneurs to enter markets with reduced risk while providing franchisors with accelerated growth potential.

Sustainability initiatives create differentiation opportunities for food trucks that adopt eco-friendly practices, locally sourced ingredients, and environmentally conscious operations. Green practices appeal to environmentally aware consumers and can justify premium pricing while building brand loyalty among sustainability-focused customer segments.

Supply chain evolution has adapted to support food truck operations through specialized distributors, mobile-friendly packaging solutions, and flexible delivery schedules that accommodate the unique needs of mobile food service businesses. Vendor relationships have become increasingly sophisticated, with suppliers offering customized products and services designed specifically for food truck operations.

Customer expectations continue to evolve, with diners seeking not only quality food but also unique experiences, social media-worthy presentations, and authentic cultural connections. Experience economy trends favor food trucks that can provide memorable interactions, storytelling elements, and community engagement beyond simple food service transactions.

Competitive landscape dynamics show increasing collaboration between food trucks and traditional restaurants, with some establishments operating both fixed and mobile locations to maximize market reach. Hybrid models allow businesses to test new markets, extend brand presence, and provide catering services while maintaining core restaurant operations.

Economic factors influence food truck performance through consumer spending patterns, fuel costs, food commodity prices, and labor market conditions. Market resilience has been demonstrated during economic downturns when consumers seek affordable dining alternatives, positioning food trucks favorably during challenging economic periods.

Primary research methodologies employed comprehensive surveys of food truck operators, customer interviews, and direct observation of market activities across diverse geographic regions and demographic segments. Data collection involved structured questionnaires, focus group discussions, and in-depth interviews with industry stakeholders including operators, suppliers, regulators, and customers.

Secondary research incorporated analysis of industry reports, government statistics, trade association data, and academic studies related to mobile food service operations and consumer behavior patterns. Market intelligence was gathered from multiple sources including business registrations, permit databases, and social media analytics to ensure comprehensive market coverage.

Analytical frameworks utilized statistical modeling, trend analysis, and comparative studies to identify market patterns, growth drivers, and competitive dynamics. Quantitative analysis examined operational metrics, financial performance indicators, and customer satisfaction measurements to validate qualitative findings and support market projections.

Validation processes included cross-referencing data sources, expert consultations, and market testing of key findings to ensure accuracy and reliability of research conclusions. Quality assurance measures incorporated peer review, data verification, and sensitivity analysis to maintain research integrity and credibility.

West Coast markets lead the United States food truck industry, with California accounting for approximately 28% of national food truck operations. Los Angeles and San Francisco serve as innovation hubs where gourmet food truck concepts originate and gain national recognition. The region benefits from year-round operating weather, diverse culinary traditions, and supportive municipal policies that encourage mobile food entrepreneurship.

Texas markets demonstrate robust growth with Austin, Houston, and Dallas emerging as major food truck destinations. Texas operations represent approximately 18% of national market activity, driven by favorable business regulations, strong local food cultures, and growing urban populations that support diverse mobile dining options.

Northeast corridor markets including New York, Philadelphia, and Boston show concentrated activity despite challenging winter weather conditions. Urban density and high foot traffic volumes compensate for seasonal limitations, with many operators adapting through indoor market participation and catering services during adverse weather periods.

Southeast expansion has accelerated in markets like Atlanta, Miami, and Nashville, where favorable climate conditions and growing metropolitan populations create opportunities for year-round operations. Regional growth has been supported by increasing acceptance of street food culture and municipal policy improvements that facilitate food truck operations.

Midwest markets face seasonal challenges but demonstrate strong summer performance in cities like Chicago, Detroit, and Minneapolis. Seasonal adaptation strategies include winter catering focus, indoor market participation, and temporary relocation to warmer climates during peak cold weather periods.

Market structure consists primarily of independent operators alongside growing franchise systems and corporate-sponsored food truck initiatives. Independent operators maintain the largest market share through local market knowledge, operational flexibility, and authentic brand positioning that resonates with consumers seeking unique dining experiences.

Competitive strategies focus on menu differentiation, location optimization, social media engagement, and customer loyalty building. Successful operators typically combine culinary excellence with strong marketing capabilities and operational efficiency to build sustainable competitive advantages in crowded markets.

By Cuisine Type: The market segments into diverse culinary categories reflecting America’s multicultural food landscape and evolving consumer preferences for authentic, innovative dining experiences.

By Operating Model: Different business approaches cater to varying market opportunities and operator capabilities.

Ethnic cuisine trucks demonstrate the strongest customer loyalty and repeat business rates, with Mexican food trucks leading in both number of operations and customer frequency. Asian fusion concepts show particular innovation in menu development and social media marketing, often achieving viral success through unique flavor combinations and visually appealing presentations.

Gourmet food trucks command premium pricing and attract affluent customer segments seeking restaurant-quality experiences in casual settings. Chef-driven concepts leverage culinary expertise and professional reputations to build strong brand recognition and customer following, often serving as stepping stones to brick-and-mortar restaurant development.

Dessert and specialty trucks benefit from high profit margins and strong social media appeal, with artisanal ice cream and gourmet donut concepts particularly successful in urban markets. Coffee trucks serve growing demand for specialty beverages and provide consistent morning revenue streams that complement lunch-focused operations.

Health-focused trucks address increasing consumer demand for nutritious, dietary-specific options while often commanding premium pricing. Organic and locally-sourced concepts appeal to environmentally conscious consumers and support sustainable food system initiatives that resonate with socially aware customer segments.

Entrepreneurs benefit from lower barriers to entry compared to traditional restaurants, with reduced initial capital requirements, operational flexibility, and ability to test market concepts before committing to permanent locations. Business ownership opportunities enable individuals to pursue culinary passions while building scalable enterprises that can evolve into multi-unit operations or franchise systems.

Consumers gain access to diverse, affordable dining options with convenient locations and unique culinary experiences that traditional restaurants may not provide. Food variety and cultural authenticity offered by food trucks enhance local dining scenes while providing value-conscious meal alternatives for budget-minded diners.

Communities benefit from increased economic activity, job creation, and cultural vibrancy that food trucks bring to neighborhoods, business districts, and special events. Local economic impact includes tax revenue generation, supplier relationships, and tourism attraction that supports broader community development goals.

Suppliers and vendors find new market opportunities through specialized products and services designed for mobile food operations, including equipment manufacturers, food distributors, and technology providers. Industry ecosystem development creates interconnected business relationships that support sustained market growth and innovation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology adoption continues accelerating with food trucks implementing advanced POS systems, mobile ordering apps, and GPS tracking capabilities that enhance customer experience and operational efficiency. Digital integration enables real-time menu updates, location sharing, and customer communication that builds stronger brand relationships and increases sales conversion rates.

Sustainability focus has emerged as a significant trend with operators adopting eco-friendly practices including biodegradable packaging, locally sourced ingredients, and energy-efficient equipment. Environmental consciousness appeals to younger consumers while supporting broader corporate social responsibility initiatives that differentiate brands in competitive markets.

Fusion cuisine innovation drives menu creativity as operators combine diverse culinary traditions to create unique flavor profiles and Instagram-worthy presentations. Cultural fusion reflects America’s multicultural demographics while providing differentiation opportunities in crowded market segments.

Ghost kitchen partnerships enable food trucks to expand delivery capabilities and reach customers beyond traditional operating locations through third-party delivery platforms. Delivery integration creates additional revenue streams while maximizing kitchen utilization during slower periods or adverse weather conditions.

Municipal policy improvements across major cities have streamlined permitting processes, created designated food truck zones, and established clear operating guidelines that reduce regulatory uncertainty. Policy modernization reflects growing recognition of food trucks as legitimate businesses that contribute to local economic development and cultural vibrancy.

Franchise system expansion has accelerated with successful food truck concepts developing standardized operations, training programs, and support systems that enable rapid geographic expansion. Franchising growth provides proven business models for new entrepreneurs while allowing successful operators to scale without direct capital investment.

Technology platform development has produced specialized software solutions for food truck operations including route optimization, inventory management, and customer relationship management systems. Industry-specific technology addresses unique operational challenges while improving efficiency and profitability for operators of all sizes.

Corporate partnerships between food trucks and established restaurant chains, retail companies, and event organizers have created new revenue opportunities and market access channels. Strategic alliances enable food trucks to leverage established brand recognition while providing partners with flexible market testing and customer engagement capabilities.

MarkWide Research recommends that food truck operators prioritize technology adoption to remain competitive in evolving markets, particularly focusing on mobile ordering systems, social media marketing, and customer data analytics. Digital transformation enables smaller operators to compete effectively with larger restaurant chains while building sustainable customer relationships.

Market diversification strategies should include corporate catering services, private event partnerships, and suburban market expansion to reduce dependency on traditional street-side operations. Revenue stream diversification provides stability during seasonal fluctuations and economic uncertainties while maximizing asset utilization throughout the year.

Operational efficiency improvements through standardized processes, inventory management systems, and staff training programs can significantly impact profitability and customer satisfaction. Process optimization becomes increasingly important as competition intensifies and profit margins face pressure from rising operational costs.

Brand building through consistent quality, unique positioning, and community engagement creates sustainable competitive advantages that transcend price competition. Brand differentiation enables premium pricing while building customer loyalty that supports long-term business success and expansion opportunities.

Market expansion is projected to continue at a robust pace, driven by increasing consumer acceptance of mobile dining concepts and ongoing urbanization trends that create dense customer populations. Growth projections indicate sustained expansion at approximately 11.8% annually over the next five years, supported by favorable demographic trends and continued innovation in food truck operations.

Technology integration will accelerate with artificial intelligence, predictive analytics, and autonomous vehicle technologies potentially transforming food truck operations and customer experiences. Innovation adoption will likely separate successful operators from those unable to adapt to rapidly evolving market conditions and customer expectations.

Regulatory environment improvements are expected to continue as municipalities recognize the economic and cultural benefits of food truck operations. Policy evolution should reduce operational barriers while maintaining food safety standards, creating more favorable operating conditions for current and prospective operators.

Market maturation will likely result in increased consolidation, franchise development, and corporate participation as the industry evolves from entrepreneurial startup phase to established business sector. Industry evolution presents both opportunities for scaling successful concepts and challenges for operators unable to adapt to changing competitive dynamics.

The United States food truck market represents a dynamic and resilient industry segment that has successfully adapted to changing consumer preferences, economic conditions, and technological innovations. Market fundamentals remain strong with continued growth driven by urbanization trends, entrepreneurial opportunities, and evolving dining preferences that favor convenient, diverse, and authentic food experiences.

Industry maturation has brought increased professionalism, technology adoption, and operational sophistication while maintaining the entrepreneurial spirit and innovation that originally defined the food truck movement. Successful operators have demonstrated the ability to build sustainable businesses that compete effectively with traditional restaurants while offering unique value propositions to customers and communities.

Future success in the food truck market will depend on operators’ ability to embrace technology, diversify revenue streams, and build strong brands that resonate with evolving consumer preferences. Market opportunities remain substantial for operators who can navigate regulatory requirements, manage operational challenges, and deliver consistent quality experiences that build customer loyalty and community support.

What is Food Truck?

Food trucks are mobile kitchens that serve a variety of food items, often specializing in specific cuisines or unique dishes. They have gained popularity for their convenience and ability to reach diverse locations, catering to different consumer preferences.

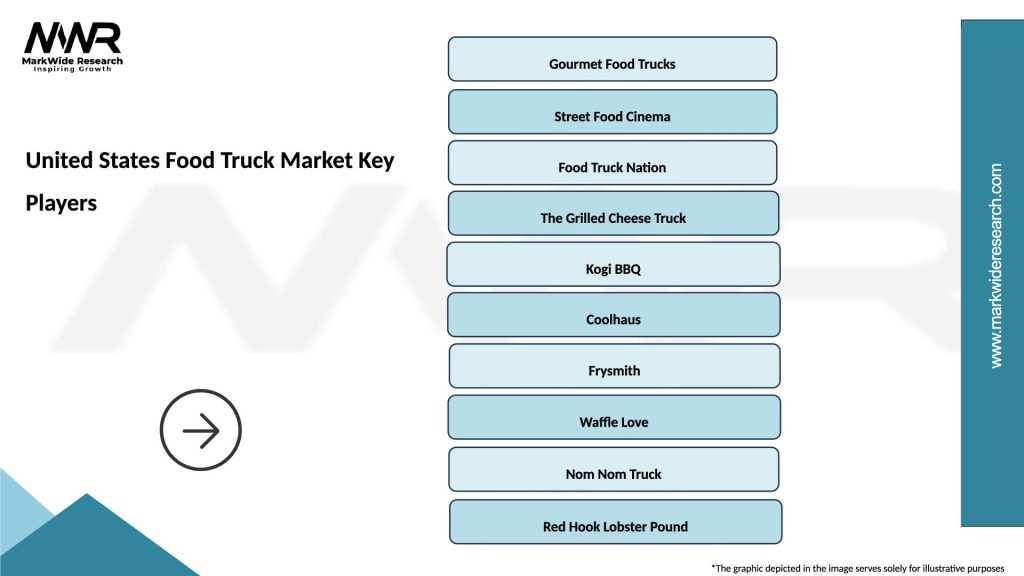

What are the key players in the United States Food Truck Market?

Key players in the United States Food Truck Market include companies like Gourmet Food Trucks, The Grilled Cheese Truck, and Kogi BBQ, which have established strong brand identities and loyal customer bases. These companies often innovate their menus and marketing strategies to stand out in a competitive landscape, among others.

What are the main drivers of growth in the United States Food Truck Market?

The main drivers of growth in the United States Food Truck Market include the increasing demand for diverse and gourmet food options, the rise of food tourism, and the lower startup costs compared to traditional restaurants. Additionally, the flexibility of food trucks allows them to adapt to changing consumer preferences and trends.

What challenges does the United States Food Truck Market face?

The United States Food Truck Market faces challenges such as regulatory hurdles, competition from established restaurants, and fluctuating food costs. Additionally, food trucks must navigate local zoning laws and health regulations, which can vary significantly by location.

What opportunities exist in the United States Food Truck Market?

Opportunities in the United States Food Truck Market include expanding into underserved areas, offering catering services for events, and leveraging social media for marketing. The growing trend of food festivals and events also presents a chance for food trucks to reach larger audiences.

What trends are shaping the United States Food Truck Market?

Trends shaping the United States Food Truck Market include the increasing popularity of plant-based and health-conscious menu options, the integration of technology for ordering and payment, and collaborations with local breweries and farms. These trends reflect a shift towards sustainability and community engagement.

United States Food Truck Market

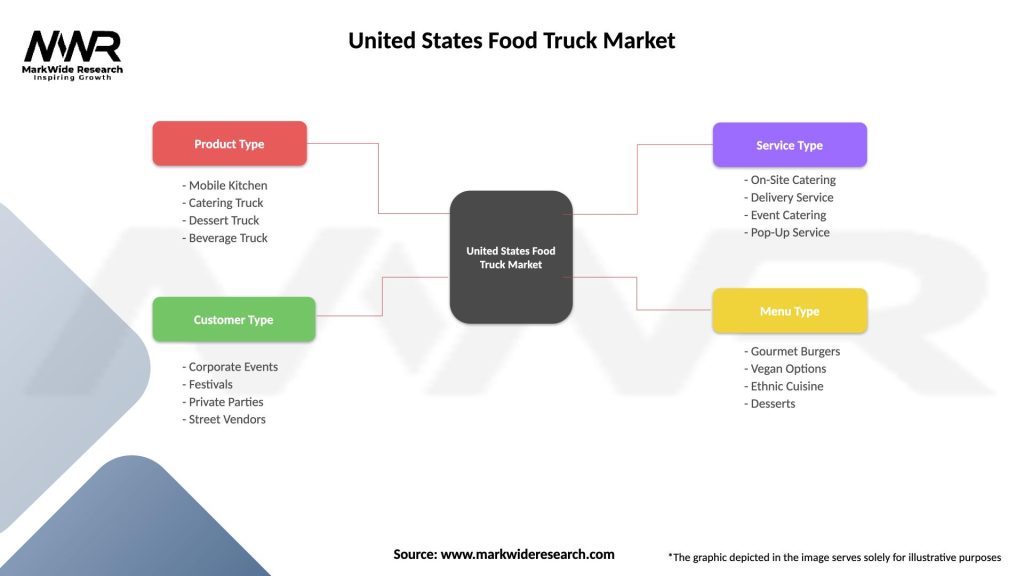

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile Kitchen, Catering Truck, Dessert Truck, Beverage Truck |

| Customer Type | Corporate Events, Festivals, Private Parties, Street Vendors |

| Service Type | On-Site Catering, Delivery Service, Event Catering, Pop-Up Service |

| Menu Type | Gourmet Burgers, Vegan Options, Ethnic Cuisine, Desserts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Food Truck Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at