444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States fixed income asset management market represents a cornerstone of the American financial services industry, encompassing the professional management of bonds, treasury securities, corporate debt instruments, and other fixed-income investments. This sophisticated market serves institutional investors, pension funds, insurance companies, and individual investors seeking stable returns and portfolio diversification through professionally managed fixed-income strategies.

Market dynamics in the United States fixed income sector reflect the complex interplay between Federal Reserve monetary policy, interest rate environments, and evolving investor preferences for yield-generating assets. The market has demonstrated remarkable resilience, with asset under management growth rates consistently outpacing traditional equity-focused strategies in recent years, particularly as investors seek stability amid market volatility.

Technological advancement has fundamentally transformed how fixed income assets are managed, with artificial intelligence, machine learning algorithms, and advanced analytics enabling more sophisticated risk assessment and portfolio optimization. The integration of environmental, social, and governance (ESG) criteria into fixed income investment strategies has gained significant traction, with approximately 78% of institutional investors now incorporating ESG factors into their fixed income allocation decisions.

Regulatory frameworks continue to shape market operations, with the Securities and Exchange Commission and other regulatory bodies implementing enhanced oversight measures to ensure market transparency and investor protection. The market’s evolution reflects broader trends in financial services, including the growing demand for customized investment solutions and the increasing importance of risk management in portfolio construction.

The United States fixed income asset management market refers to the comprehensive ecosystem of professional investment management services focused on bonds, treasury securities, municipal bonds, corporate debt, and other interest-bearing financial instruments within the American financial landscape. This market encompasses the activities of asset management companies, investment advisors, and financial institutions that provide specialized expertise in managing fixed income portfolios for various client segments.

Fixed income asset management involves the systematic approach to selecting, purchasing, and managing debt securities with the primary objectives of generating steady income streams, preserving capital, and managing interest rate risk. Professional asset managers in this space utilize sophisticated analytical tools, market research, and risk management techniques to optimize portfolio performance while maintaining appropriate risk levels aligned with client objectives and market conditions.

The market encompasses various investment strategies including active management, where portfolio managers make tactical decisions to outperform benchmarks, and passive management, which focuses on tracking specific fixed income indices. Additionally, the market includes specialized segments such as high-yield bond management, government securities management, and emerging market debt strategies, each requiring distinct expertise and risk management approaches.

Strategic positioning within the United States fixed income asset management market reveals a landscape characterized by increasing sophistication, technological integration, and evolving client demands. The market continues to attract significant investor interest as economic uncertainties drive demand for stable, income-generating investment alternatives to traditional equity investments.

Key market participants include established asset management giants, boutique fixed income specialists, and emerging fintech-enabled investment platforms that leverage technology to deliver enhanced client experiences. The competitive landscape reflects a balance between traditional investment approaches and innovative strategies that incorporate alternative data sources, quantitative modeling, and automated portfolio management capabilities.

Growth trajectories indicate sustained expansion driven by demographic trends, particularly the aging population’s increasing need for income-generating investments, and institutional investors’ growing allocation to fixed income assets as part of diversified portfolio strategies. The market benefits from regulatory support for retirement savings programs and tax-advantaged investment vehicles that favor fixed income allocations.

Innovation drivers include the integration of artificial intelligence in credit analysis, the development of sustainable fixed income products, and the emergence of direct indexing capabilities that allow for greater customization of fixed income portfolios. These technological advancements are reshaping how asset managers deliver value to clients while managing operational efficiency and regulatory compliance requirements.

Market penetration analysis reveals several critical insights that define the current state and future trajectory of the United States fixed income asset management sector:

Demographic transformation serves as a primary catalyst for growth in the United States fixed income asset management market. The aging baby boomer population increasingly seeks stable, income-generating investments to support retirement needs, creating sustained demand for professionally managed fixed income strategies. This demographic shift coincides with longer life expectancies, requiring more sophisticated approaches to retirement income planning and asset preservation.

Monetary policy dynamics significantly influence market growth patterns, with Federal Reserve interest rate decisions creating opportunities for active fixed income management. Periods of rate volatility generate demand for professional expertise in navigating complex interest rate environments, while low-rate periods drive innovation in yield-enhancement strategies and alternative fixed income approaches.

Institutional investment trends continue to favor fixed income allocations as pension funds, endowments, and insurance companies seek to match long-term liabilities with appropriate duration assets. The growing recognition of fixed income’s role in portfolio diversification and risk management has led to increased allocations across institutional investor categories, supporting sustained market growth.

Regulatory support through tax-advantaged retirement accounts, 401(k) plans, and other savings vehicles creates structural demand for fixed income investments. Government policies encouraging retirement savings and long-term investment planning provide a stable foundation for market expansion, while regulatory frameworks ensure investor protection and market integrity.

Technology advancement enables asset managers to deliver enhanced value propositions through improved risk management, more efficient operations, and better client experiences. The integration of artificial intelligence, machine learning, and big data analytics allows for more sophisticated investment strategies and personalized portfolio management approaches that attract both institutional and individual investors.

Interest rate sensitivity represents a fundamental challenge for the fixed income asset management market, as rising interest rate environments can negatively impact bond values and create headwinds for portfolio performance. Duration risk management becomes increasingly complex during periods of rate volatility, requiring sophisticated hedging strategies that may reduce overall returns and complicate investment decision-making processes.

Fee pressure from the growth of passive investment strategies and exchange-traded funds continues to compress management fees across the industry. The commoditization of basic fixed income exposure through low-cost index funds challenges traditional active management approaches, forcing asset managers to demonstrate clear value-add through alpha generation or specialized services to justify higher fee structures.

Regulatory complexity creates operational challenges and compliance costs that can limit market accessibility for smaller asset managers. The evolving regulatory landscape requires continuous investment in compliance systems, reporting capabilities, and risk management infrastructure, creating barriers to entry and ongoing operational expenses that impact profitability and competitive positioning.

Credit risk concerns in certain fixed income sectors, particularly high-yield and emerging market debt, can create periods of reduced investor appetite and asset outflows. Economic uncertainties, corporate defaults, and geopolitical tensions can trigger risk-off sentiment that negatively impacts fixed income strategies focused on credit-sensitive securities.

Technology infrastructure requirements demand significant capital investment and ongoing maintenance costs that can strain resources, particularly for mid-sized asset managers. The need to compete with larger firms’ technological capabilities while maintaining cost-effective operations creates challenges in delivering competitive investment performance and client service levels.

ESG integration presents substantial growth opportunities as investors increasingly demand sustainable and responsible investment options within their fixed income allocations. The development of green bonds, social impact bonds, and sustainability-linked debt instruments creates new product categories that can command premium fees while addressing growing client demand for values-aligned investment strategies.

Private credit expansion offers significant opportunities for asset managers to diversify revenue streams and capture higher fee margins through direct lending, private debt, and alternative credit strategies. The growing demand from institutional investors for yield enhancement and portfolio diversification beyond traditional public fixed income markets creates substantial market potential for specialized expertise in private credit markets.

Technology-enabled customization allows asset managers to develop personalized fixed income solutions that address specific client needs, risk tolerances, and investment objectives. Direct indexing, tax-loss harvesting, and customized ESG screening capabilities enable differentiated service offerings that can justify premium pricing and strengthen client relationships.

International expansion opportunities exist for established US asset managers to leverage their expertise in global fixed income markets, particularly in emerging market debt and international corporate bonds. Cross-border investment capabilities and multi-currency hedging expertise can attract institutional clients seeking global diversification within their fixed income allocations.

Fintech partnerships and digital distribution channels create opportunities to reach new client segments, particularly younger investors and smaller institutions that value technology-enabled investment solutions. Robo-advisory platforms, digital wealth management tools, and automated portfolio management systems can expand market reach while improving operational efficiency and client engagement.

Competitive intensity within the United States fixed income asset management market reflects the ongoing tension between traditional active management approaches and the growing influence of passive investment strategies. This dynamic creates pressure for active managers to demonstrate consistent alpha generation while passive providers compete primarily on cost efficiency and tracking accuracy.

Client expectations continue to evolve toward greater transparency, lower fees, and enhanced digital experiences, forcing asset managers to invest in technology infrastructure and client service capabilities. The demand for real-time reporting, detailed risk analytics, and customized investment solutions requires significant operational enhancements that impact both costs and competitive positioning.

Regulatory evolution shapes market dynamics through enhanced oversight requirements, fiduciary standards, and transparency mandates that influence how asset managers operate and compete. According to MarkWide Research analysis, regulatory compliance costs have increased substantially, creating advantages for larger firms with greater resources to invest in compliance infrastructure.

Interest rate cycles create varying market conditions that favor different investment strategies and management approaches. Rising rate environments may benefit active managers who can navigate duration risk and identify relative value opportunities, while stable rate periods may favor passive strategies that provide consistent exposure at lower costs.

Innovation pressure drives continuous product development and service enhancement as asset managers seek to differentiate their offerings in an increasingly competitive marketplace. The integration of alternative data sources, quantitative modeling techniques, and sustainable investing criteria represents ongoing efforts to create unique value propositions that attract and retain client assets.

Comprehensive market analysis for the United States fixed income asset management sector employs multiple research methodologies to ensure accurate and actionable insights. Primary research involves direct engagement with industry participants, including asset managers, institutional investors, consultants, and regulatory officials, through structured interviews and surveys designed to capture current market conditions and future expectations.

Secondary research incorporates analysis of regulatory filings, industry reports, academic studies, and market data from established financial information providers. This approach ensures comprehensive coverage of market trends, competitive dynamics, and regulatory developments that influence market structure and participant behavior.

Quantitative analysis utilizes statistical modeling techniques to identify market patterns, growth trends, and correlation relationships between various market factors. Data sources include asset flow information, performance metrics, fee structures, and client allocation patterns across different fixed income strategies and market segments.

Qualitative assessment focuses on understanding market participant perspectives, strategic priorities, and operational challenges through in-depth interviews and focus group discussions. This methodology provides insights into decision-making processes, competitive strategies, and market outlook that complement quantitative findings.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review panels, and statistical verification techniques. The methodology incorporates feedback from industry practitioners and academic experts to validate findings and ensure practical relevance for market participants and stakeholders.

Northeast region dominates the United States fixed income asset management landscape, with New York serving as the primary hub for major asset management companies and institutional investors. The concentration of financial services infrastructure, regulatory oversight, and capital markets expertise creates significant competitive advantages for firms operating in this region, accounting for approximately 45% of total industry assets under management.

West Coast markets, particularly California, represent the second-largest regional concentration of fixed income asset management activity, driven by the presence of large pension funds, technology company treasury operations, and innovative fintech companies. The region’s focus on sustainable investing and technology integration has positioned it as a leader in ESG-focused fixed income strategies and digital investment platforms.

Southeast expansion reflects the growing importance of states like Florida, North Carolina, and Georgia as alternative locations for asset management operations. Lower operating costs, favorable regulatory environments, and proximity to growing institutional investor bases have attracted both established firms and emerging managers to establish significant operations in these markets.

Midwest presence centers around Chicago’s derivatives markets and the region’s concentration of pension funds and insurance companies. The area’s expertise in risk management and quantitative strategies has created specialization in structured products and alternative fixed income approaches that serve institutional client needs.

Regional diversification trends indicate increasing geographic distribution of asset management operations as firms seek cost efficiencies and access to diverse talent pools. Remote work capabilities and digital client service models have reduced the importance of traditional financial centers while creating opportunities for expansion into previously underserved markets.

Market leadership in the United States fixed income asset management sector is characterized by a combination of large, diversified asset managers and specialized boutique firms that focus exclusively on fixed income strategies. The competitive environment reflects varying approaches to client service, investment philosophy, and operational scale.

Competitive differentiation strategies focus on investment performance, risk management capabilities, client service quality, and fee competitiveness. Firms compete through specialized expertise in particular fixed income sectors, innovative product development, and technology-enhanced investment processes that deliver superior client outcomes.

By Investment Strategy:

By Client Type:

By Fixed Income Sector:

Government Securities Management represents the most stable and predictable segment of the fixed income asset management market, characterized by lower fees but consistent asset flows from risk-averse investors. This category benefits from its role as a portfolio anchor and safe-haven asset during market volatility, though returns are typically lower than other fixed income sectors.

Corporate Bond Strategies offer higher return potential through credit risk premiums but require sophisticated credit analysis and risk management capabilities. Active management in this category can add significant value through security selection and sector allocation decisions, justifying higher management fees compared to government securities strategies.

Municipal Bond Management serves a specialized client base seeking tax-advantaged income, particularly high-net-worth individuals and tax-sensitive institutions. This category requires expertise in tax law, municipal credit analysis, and state-specific market dynamics, creating barriers to entry that support higher fee structures for specialized managers.

High-Yield and Alternative Credit strategies represent the highest-growth segment within fixed income asset management, driven by institutional investors’ search for yield enhancement. These strategies command premium fees due to their complexity and specialized expertise requirements, though they also carry higher risk profiles that require sophisticated risk management capabilities.

ESG-Focused Fixed Income has emerged as a rapidly growing category, with MarkWide Research indicating substantial asset flow increases as investors integrate sustainability criteria into their fixed income allocations. This category allows managers to differentiate their offerings while addressing growing client demand for responsible investing options.

Asset Managers benefit from the fixed income market’s stability and predictable fee streams, which provide revenue diversification and reduced earnings volatility compared to equity-focused strategies. The market’s size and growth potential offer substantial opportunities for scale building and operational leverage, while specialized expertise in fixed income can command premium pricing and strengthen client relationships.

Institutional Investors gain access to professional expertise in complex fixed income markets, enabling more effective liability matching, risk management, and return optimization. Professional management provides operational efficiency, regulatory compliance support, and access to specialized market segments that would be difficult to manage internally.

Individual Investors benefit from professional portfolio management, diversification across multiple fixed income sectors, and access to institutional-quality investment strategies through mutual funds and ETFs. Professional management provides expertise in credit analysis, duration management, and tax optimization that individual investors typically cannot replicate independently.

Financial Advisors can offer clients comprehensive fixed income solutions without requiring specialized expertise in bond markets, enabling them to focus on client relationship management and overall portfolio construction. Access to professional fixed income management enhances their value proposition and supports client retention through superior investment outcomes.

Regulatory Bodies benefit from professional asset management through enhanced market stability, improved investor protection, and more effective oversight of fixed income markets. Professional managers provide transparency, compliance expertise, and risk management capabilities that support overall market integrity and investor confidence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Investing Integration has become a dominant trend as institutional and individual investors increasingly incorporate ESG criteria into their fixed income allocation decisions. Green bonds, social impact bonds, and sustainability-linked debt instruments represent the fastest-growing segments within the fixed income universe, with asset managers developing specialized expertise and dedicated product offerings to capture this demand.

Technology-Driven Innovation continues to reshape how fixed income portfolios are managed, with artificial intelligence and machine learning algorithms enhancing credit analysis, risk assessment, and portfolio optimization capabilities. Advanced analytics enable more sophisticated approaches to relative value identification and systematic trading strategies that can generate alpha while managing risk more effectively.

Direct Indexing Adoption allows institutional and high-net-worth clients to own individual securities rather than fund shares, enabling greater customization, tax optimization, and ESG screening at the security level. This trend challenges traditional mutual fund structures while creating opportunities for asset managers to provide more personalized investment solutions.

Alternative Credit Growth reflects institutional investors’ search for yield enhancement beyond traditional public fixed income markets. Private credit, direct lending, and structured credit strategies have gained significant traction as investors seek to capture illiquidity premiums and access credit opportunities not available in public markets.

Fee Structure Evolution includes the development of outcome-based pricing models, performance-linked fees, and tiered pricing structures that align manager compensation with client results. These innovations address fee pressure while maintaining profitability for asset managers who can demonstrate consistent value creation.

Regulatory Framework Updates have enhanced transparency requirements and fiduciary standards for fixed income asset managers, leading to improved client disclosure and risk management practices. The Securities and Exchange Commission has implemented new rules regarding liquidity risk management and derivatives usage that impact how fixed income portfolios are constructed and managed.

Technology Platform Consolidation has accelerated as asset managers seek to improve operational efficiency and client service capabilities through integrated technology solutions. Major investments in portfolio management systems, risk analytics platforms, and client reporting tools have become essential for competitive positioning in the market.

ESG Product Innovation has expanded beyond traditional green bonds to include transition bonds, sustainability-linked securities, and social impact investments that address specific environmental and social objectives. Asset managers are developing specialized research capabilities and investment processes to evaluate ESG factors in fixed income security selection.

Cross-Border Expansion initiatives have increased as US asset managers seek growth opportunities in international fixed income markets while foreign managers establish US operations to access American institutional investors. These developments have enhanced global investment capabilities and competitive dynamics within the domestic market.

Partnership Strategies between traditional asset managers and fintech companies have accelerated, combining investment expertise with technology innovation to create enhanced client experiences and operational efficiencies. These collaborations enable faster product development and broader market reach while maintaining investment performance standards.

Strategic Focus recommendations for fixed income asset managers emphasize the importance of developing specialized expertise in high-growth segments such as ESG investing, private credit, and technology-enhanced investment processes. MWR analysis suggests that managers who can demonstrate clear value-add through alpha generation or unique capabilities will be best positioned for long-term success.

Technology Investment should prioritize client-facing capabilities and operational efficiency improvements that can differentiate service offerings while reducing costs. Asset managers should focus on platforms that enable greater customization, real-time reporting, and enhanced risk management capabilities that address evolving client expectations.

Product Development efforts should concentrate on areas where traditional fixed income strategies can be enhanced through innovation, such as direct indexing, outcome-oriented investing, and sustainable investment approaches. Managers should consider partnerships or acquisitions to accelerate capability development in specialized areas.

Client Relationship Management requires enhanced focus on transparency, communication, and service quality as clients become more sophisticated and demanding. Asset managers should invest in relationship management technology and dedicated client service resources to strengthen retention and attract new assets.

Risk Management Enhancement becomes increasingly critical as fixed income markets face potential volatility from interest rate changes, credit concerns, and geopolitical developments. Managers should strengthen stress testing capabilities, scenario analysis, and hedging strategies to protect client assets and maintain performance consistency.

Growth projections for the United States fixed income asset management market indicate continued expansion driven by demographic trends, regulatory support for retirement savings, and institutional investors’ ongoing need for liability matching and portfolio diversification. The market is expected to benefit from increasing sophistication in investment approaches and growing demand for specialized fixed income strategies.

Technology integration will accelerate across all aspects of fixed income asset management, from investment research and portfolio construction to client service and operational management. Artificial intelligence, machine learning, and advanced analytics will become standard tools for competitive asset managers seeking to deliver superior risk-adjusted returns.

Sustainable investing will continue its rapid growth trajectory, with ESG-focused fixed income strategies expected to capture an increasing share of new asset flows. The development of standardized ESG metrics and reporting frameworks will facilitate broader adoption while creating opportunities for managers with specialized sustainable investing expertise.

Market consolidation trends may accelerate as smaller managers face challenges competing with larger firms’ technology capabilities and cost advantages. However, opportunities will remain for boutique managers with specialized expertise or unique investment approaches that can demonstrate consistent value creation for clients.

Regulatory evolution will continue to shape market structure and competitive dynamics, with potential changes in fiduciary standards, fee disclosure requirements, and risk management mandates. Asset managers must maintain flexibility to adapt to regulatory changes while continuing to deliver competitive investment performance and client service.

The United States fixed income asset management market represents a dynamic and evolving sector that continues to play a crucial role in the American financial services landscape. Despite challenges from fee compression and passive competition, the market demonstrates resilience through innovation, specialization, and adaptation to changing client needs and market conditions.

Strategic opportunities abound for asset managers who can successfully navigate the balance between traditional investment expertise and technological innovation. The growing importance of ESG investing, alternative credit strategies, and customized investment solutions creates multiple avenues for differentiation and growth in an increasingly competitive environment.

Market fundamentals remain strong, supported by demographic trends, regulatory frameworks, and the essential role of fixed income investments in portfolio construction and risk management. The sector’s ability to evolve and adapt to changing market conditions while maintaining focus on client outcomes positions it well for continued growth and development in the years ahead.

What is Fixed Income Asset Management?

Fixed Income Asset Management refers to the investment strategy focused on fixed income securities, such as bonds and treasury bills, which provide regular income through interest payments. This approach is essential for managing risk and ensuring stable returns in investment portfolios.

What are the key players in the United States Fixed Income Asset Management Market?

Key players in the United States Fixed Income Asset Management Market include firms like BlackRock, Vanguard, and PIMCO, which specialize in managing fixed income portfolios for various clients, including institutions and individual investors, among others.

What are the growth factors driving the United States Fixed Income Asset Management Market?

The growth of the United States Fixed Income Asset Management Market is driven by factors such as increasing demand for income-generating investments, the need for portfolio diversification, and the rising interest in sustainable investing practices.

What challenges does the United States Fixed Income Asset Management Market face?

Challenges in the United States Fixed Income Asset Management Market include low interest rates, which can compress margins, regulatory changes that affect investment strategies, and the need to adapt to evolving market conditions.

What opportunities exist in the United States Fixed Income Asset Management Market?

Opportunities in the United States Fixed Income Asset Management Market include the growing interest in ESG (Environmental, Social, and Governance) investments, the potential for innovative financial products, and the increasing use of technology in asset management.

What trends are shaping the United States Fixed Income Asset Management Market?

Trends shaping the United States Fixed Income Asset Management Market include the rise of passive investment strategies, the integration of advanced analytics and AI in portfolio management, and a shift towards more flexible investment approaches to meet changing investor needs.

United States Fixed Income Asset Management Market

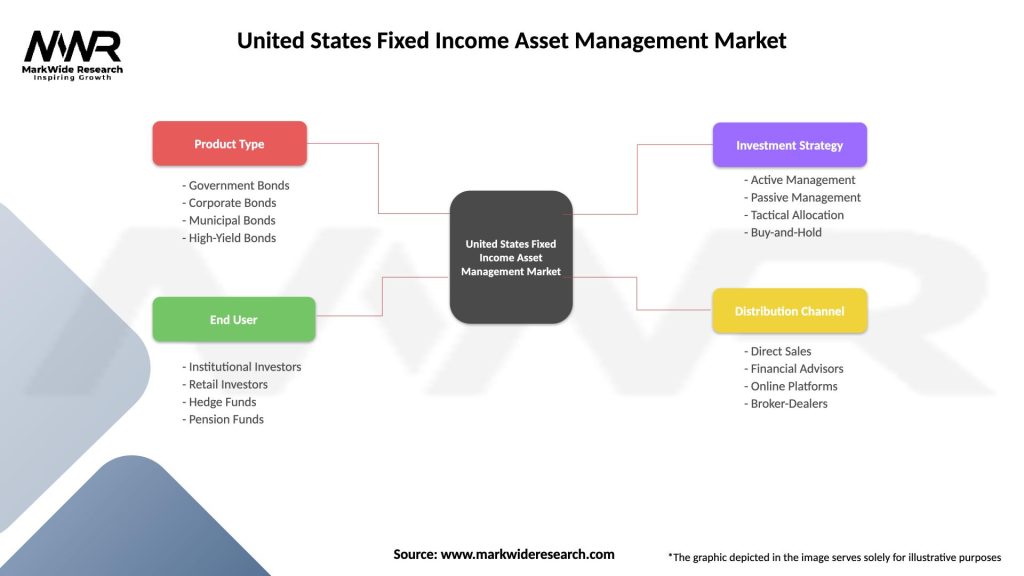

| Segmentation Details | Description |

|---|---|

| Product Type | Government Bonds, Corporate Bonds, Municipal Bonds, High-Yield Bonds |

| End User | Institutional Investors, Retail Investors, Hedge Funds, Pension Funds |

| Investment Strategy | Active Management, Passive Management, Tactical Allocation, Buy-and-Hold |

| Distribution Channel | Direct Sales, Financial Advisors, Online Platforms, Broker-Dealers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Fixed Income Asset Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at