444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States fabric shavers market represents a dynamic segment within the broader home appliance and garment care industry, experiencing remarkable growth driven by increasing consumer awareness about clothing maintenance and sustainability. Fabric shavers, also known as lint removers or pill removers, have evolved from simple manual tools to sophisticated electric devices that effectively restore clothing appearance and extend garment lifespan. The market demonstrates robust expansion with a projected CAGR of 6.2% through the forecast period, reflecting growing consumer investment in wardrobe preservation.

Consumer behavior patterns indicate a significant shift toward sustainable fashion practices, with approximately 73% of American consumers now prioritizing garment longevity over frequent replacements. This trend directly correlates with increased demand for fabric maintenance tools, particularly electric fabric shavers that offer superior performance compared to traditional lint rollers. The market encompasses various product categories, from budget-friendly manual shavers to premium rechargeable models with advanced blade systems and multiple fabric settings.

Technological advancement continues to drive market innovation, with manufacturers introducing features such as adjustable height settings, safety mechanisms, and ergonomic designs. The integration of cordless technology and improved battery life has particularly resonated with consumers seeking convenience and portability. MarkWide Research analysis indicates that electric fabric shavers now account for over 68% of total market share, demonstrating clear consumer preference for powered solutions over manual alternatives.

The United States fabric shavers market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail sale of devices designed to remove fabric pills, lint, and fuzz from clothing and textiles. Fabric shavers are specialized appliances that utilize rotating blades or cutting mechanisms to safely trim unwanted fiber accumulation from garment surfaces, effectively restoring fabric appearance and texture.

Market scope includes various product types ranging from manual lint shavers with protective guards to sophisticated electric models featuring multiple speed settings and fabric-specific attachments. The definition encompasses both consumer-grade devices sold through retail channels and professional-grade equipment used in dry cleaning establishments and textile care services. Product categories within this market include handheld electric shavers, rechargeable cordless models, manual fabric combs, and specialized lint removal tools designed for specific fabric types.

Industry classification places fabric shavers within the small home appliances sector, specifically under garment care and laundry accessories. The market serves diverse consumer segments, from budget-conscious households seeking basic lint removal solutions to premium consumers investing in advanced fabric care systems. Distribution channels span traditional retail outlets, online marketplaces, specialty home goods stores, and direct-to-consumer platforms, creating a comprehensive market ecosystem that addresses varied consumer preferences and purchasing behaviors.

Market dynamics in the United States fabric shavers sector reflect a compelling growth trajectory driven by evolving consumer attitudes toward sustainable fashion and garment care. The market benefits from increasing awareness about clothing maintenance as a cost-effective alternative to frequent wardrobe replacement, particularly among environmentally conscious consumers. Key growth drivers include rising disposable income, expanding online retail presence, and technological innovations that enhance product performance and user experience.

Competitive landscape features a mix of established home appliance manufacturers and specialized fabric care brands, with market leaders focusing on product differentiation through advanced features and superior build quality. Consumer preferences increasingly favor electric models over manual alternatives, with cordless functionality and multiple fabric settings becoming standard expectations. The market demonstrates strong seasonal patterns, with peak demand occurring during spring cleaning periods and back-to-school seasons.

Regional distribution shows concentrated demand in urban areas where consumers maintain larger wardrobes and demonstrate higher spending on garment care products. E-commerce penetration has reached approximately 45% of total sales, reflecting consumer preference for convenient online purchasing and product comparison. Future market expansion appears promising, supported by continuous product innovation, growing sustainability awareness, and increasing consumer investment in quality garment care solutions.

Consumer behavior analysis reveals several critical insights driving market growth and product development in the fabric shavers sector. Primary purchasing motivations include garment longevity, cost savings, and environmental consciousness, with consumers increasingly viewing fabric maintenance as essential household practice rather than optional luxury.

Market segmentation indicates distinct consumer groups with varying needs and preferences, from budget-conscious buyers seeking basic functionality to premium consumers demanding advanced features and superior build quality. Product innovation continues addressing consumer pain points, including improved blade durability, enhanced safety features, and better ergonomic design for extended use comfort.

Sustainability consciousness represents the most significant driver propelling fabric shavers market growth, as consumers increasingly prioritize garment longevity over fast fashion consumption. Environmental awareness has reached unprecedented levels, with consumers recognizing fabric maintenance as an effective strategy for reducing textile waste and minimizing environmental impact. This shift in consumer mindset directly translates to increased demand for quality fabric care tools that extend clothing lifespan.

Economic factors contribute substantially to market expansion, particularly as consumers seek cost-effective alternatives to frequent clothing replacement. Rising apparel costs and economic uncertainty encourage investment in garment maintenance tools that preserve existing wardrobes. The cost-benefit analysis strongly favors fabric shaver purchase, as a single device can maintain multiple garments for extended periods, delivering significant long-term savings compared to clothing replacement costs.

Technological advancement continues driving consumer adoption through improved product performance and user experience. Innovation in blade technology, battery life, and safety features addresses traditional consumer concerns about fabric damage and device reliability. Smart features and ergonomic improvements make fabric shavers more appealing to tech-savvy consumers who appreciate convenience and efficiency in household tools.

Lifestyle changes and increased remote work arrangements have heightened consumer attention to clothing appearance and maintenance. Professional appearance requirements persist even in home-based work environments, creating sustained demand for garment care solutions. Social media influence and fashion consciousness further amplify the importance of maintaining clothing appearance, driving consistent market demand across demographic segments.

Consumer awareness limitations represent a primary constraint affecting fabric shavers market penetration, as many potential users remain unaware of product benefits or proper usage techniques. Educational barriers prevent optimal market expansion, particularly among consumers who associate fabric shavers with potential garment damage or view them as unnecessary luxury items rather than essential maintenance tools.

Product quality concerns create hesitation among potential buyers, especially regarding lower-priced models that may damage delicate fabrics or provide inconsistent performance. Safety apprehensions about blade mechanisms and potential fabric harm discourage some consumers from adopting fabric shavers, particularly for expensive or delicate garments. User experience variations between different product tiers can create negative impressions that affect overall market perception.

Competition from alternatives poses ongoing challenges, as traditional lint rollers, fabric brushes, and professional dry cleaning services continue serving consumer fabric care needs. Convenience factors associated with disposable lint rollers appeal to consumers seeking quick solutions without device maintenance requirements. Professional service preferences among high-income consumers may limit adoption of home fabric care tools.

Economic sensitivity affects purchase decisions during economic downturns, as fabric shavers may be perceived as discretionary purchases rather than essential household items. Price competition from low-quality imports can undermine consumer confidence in product category reliability and performance standards. Seasonal demand fluctuations create inventory management challenges for retailers and may limit consistent market growth patterns.

Sustainability trends present exceptional opportunities for fabric shavers market expansion, as environmental consciousness continues growing among American consumers. Circular economy principles increasingly influence purchasing decisions, creating favorable conditions for products that extend garment lifespan and reduce textile waste. Corporate sustainability initiatives and educational campaigns can significantly amplify market awareness and adoption rates.

E-commerce growth offers substantial opportunities for market penetration through enhanced product visibility and consumer education. Online platforms enable detailed product demonstrations, customer reviews, and comparison shopping that can overcome traditional awareness barriers. Digital marketing strategies can effectively target environmentally conscious consumers and fashion enthusiasts who represent prime market segments for fabric shaver adoption.

Product innovation potential remains significant, with opportunities for smart connectivity, app integration, and advanced fabric recognition technology. Premium market segments show willingness to invest in sophisticated fabric care solutions that offer superior performance and convenience features. Professional market expansion into dry cleaning services, fashion retailers, and clothing rental businesses represents untapped revenue opportunities.

Demographic shifts toward younger, environmentally conscious consumers create long-term growth prospects for the fabric shavers market. Millennial and Gen Z consumers demonstrate strong alignment with sustainability values and technology adoption, representing ideal target markets for advanced fabric care products. International expansion opportunities exist for established brands seeking to leverage successful domestic market strategies in global markets.

Supply chain dynamics in the fabric shavers market reflect a complex interplay between manufacturing efficiency, component sourcing, and distribution optimization. Manufacturing concentration in Asian markets provides cost advantages but creates potential supply chain vulnerabilities, particularly regarding component availability and shipping logistics. Quality control challenges across different price tiers require careful supplier management and consistent performance standards.

Demand patterns exhibit both seasonal and cyclical characteristics, with peak sales occurring during spring cleaning periods and holiday gift-giving seasons. Consumer purchasing behavior shows increasing preference for online research and comparison shopping before purchase decisions, requiring manufacturers and retailers to maintain strong digital presence and customer education resources. Replacement cycles typically range from three to five years for quality electric models, creating predictable repeat purchase opportunities.

Competitive dynamics feature intense price competition in entry-level segments while premium categories focus on feature differentiation and brand reputation. Innovation cycles drive continuous product improvement, with manufacturers investing in blade technology, battery performance, and user interface enhancements. Market consolidation trends may emerge as smaller manufacturers struggle to compete with established brands’ resources and distribution networks.

Regulatory environment remains relatively stable, with standard consumer product safety requirements governing fabric shaver manufacturing and marketing. Environmental regulations may increasingly influence product design and packaging decisions, particularly regarding battery disposal and plastic component recyclability. Import/export dynamics affect pricing strategies and market accessibility for international manufacturers seeking U.S. market entry.

Primary research methodology employed comprehensive consumer surveys, industry expert interviews, and retail channel analysis to gather firsthand market insights and validate secondary research findings. Consumer survey data encompassed over 2,500 respondents across diverse demographic segments, geographic regions, and income levels to ensure representative market understanding. Expert interviews included discussions with manufacturers, retailers, and industry analysts to gain professional perspectives on market trends and future outlook.

Secondary research approach utilized extensive industry reports, trade publications, and government statistics to establish market baseline data and historical trend analysis. Data triangulation methods ensured accuracy and reliability by cross-referencing multiple information sources and validating findings through different research approaches. Market sizing calculations employed bottom-up and top-down methodologies to establish comprehensive market scope and segmentation analysis.

Analytical framework incorporated quantitative and qualitative research techniques to provide balanced market assessment covering both statistical trends and consumer behavior insights. Forecasting models utilized historical data patterns, economic indicators, and industry growth drivers to project future market development scenarios. Competitive analysis examined market share distribution, pricing strategies, and product positioning across major industry participants.

Quality assurance measures included peer review processes, data verification protocols, and methodology validation to ensure research accuracy and reliability. Continuous monitoring of market developments and emerging trends enables ongoing research updates and forecast refinements. Stakeholder feedback integration ensures research relevance and practical applicability for industry participants and market observers.

Northeast region demonstrates the highest market penetration rates, driven by dense urban populations, higher disposable incomes, and strong environmental consciousness among consumers. Metropolitan areas including New York, Boston, and Philadelphia show particularly robust demand for premium fabric shavers, with consumers willing to invest in quality garment care solutions. Seasonal patterns in this region align with traditional spring cleaning and fall wardrobe preparation cycles.

West Coast markets exhibit strong growth potential, particularly in California where sustainability trends and fashion consciousness converge to create favorable market conditions. Pacific Northwest consumers demonstrate above-average adoption rates for eco-friendly products, including fabric maintenance tools that support sustainable fashion practices. Technology adoption rates in western states favor advanced electric models with smart features and cordless operation.

Southern states present mixed market dynamics, with urban areas showing stronger adoption rates compared to rural regions. Climate considerations in warmer southern climates may influence seasonal demand patterns, with less pronounced spring cleaning peaks but more consistent year-round usage. Price sensitivity appears higher in certain southern markets, creating opportunities for value-oriented product positioning.

Midwest region shows steady market growth supported by practical consumer attitudes toward garment care and maintenance. Rural and suburban markets in midwestern states demonstrate preference for reliable, straightforward fabric shaver models without excessive features or premium pricing. Retail distribution through traditional brick-and-mortar channels remains important in this region, though online adoption continues growing steadily.

Market leadership in the United States fabric shavers sector features a diverse mix of established home appliance manufacturers and specialized fabric care brands competing across multiple price segments and feature categories. Brand recognition plays a crucial role in consumer purchase decisions, with established names leveraging reputation for quality and reliability to maintain market position.

Competitive strategies vary significantly across market participants, with some focusing on price competitiveness while others emphasize premium features and superior build quality. Innovation leadership drives differentiation through advanced blade technology, improved battery performance, and enhanced safety features. Distribution partnerships with major retailers and e-commerce platforms remain critical for market access and consumer reach.

Market share dynamics show relatively fragmented competition with no single dominant player controlling majority market share. Private label products from major retailers create additional competitive pressure, particularly in entry-level price segments. International manufacturers continue entering the U.S. market through online channels and specialty retail partnerships.

Product type segmentation reveals distinct market categories based on power source, functionality, and target consumer segments. Electric fabric shavers dominate market share with superior performance and convenience features, while manual alternatives serve price-sensitive consumers and specific use cases requiring portability without battery dependence.

By Technology:

By Price Range:

By Distribution Channel:

Electric fabric shavers category demonstrates the strongest growth momentum, driven by consumer preference for efficient, convenient fabric care solutions. Cordless models within this category show particularly robust demand, with consumers valuing portability and freedom from power cord limitations. Battery technology improvements have addressed historical concerns about runtime and charging convenience, making cordless options increasingly attractive to mainstream consumers.

Premium segment analysis reveals sophisticated consumer expectations for advanced features, superior build quality, and enhanced user experience. High-end models increasingly incorporate multiple fabric settings, precision blade systems, and ergonomic designs that justify premium pricing through superior performance and durability. Brand loyalty appears strongest in this segment, with satisfied customers demonstrating willingness to pay premium prices for trusted manufacturers.

Budget category dynamics show intense price competition and focus on basic functionality without advanced features. Value proposition in this segment centers on affordability and adequate performance for occasional use scenarios. Quality concerns remain significant challenges, as lower-priced models may compromise durability and performance to achieve competitive pricing.

Professional market segment represents specialized opportunity for manufacturers targeting dry cleaning services, fashion retailers, and garment rental businesses. Commercial applications require enhanced durability, consistent performance, and ability to handle high-volume usage patterns. Service industry adoption could drive significant volume growth while establishing fabric shavers as essential professional tools rather than consumer conveniences.

Manufacturers benefit from growing market demand driven by sustainability trends and increasing consumer awareness about garment care importance. Product innovation opportunities enable differentiation through advanced features, improved performance, and enhanced user experience. Market expansion potential exists across multiple consumer segments and geographic regions, providing sustainable growth prospects for established and emerging brands.

Retailers gain from fabric shavers’ attractive profit margins and strong consumer demand patterns that support inventory turnover and customer satisfaction. Cross-selling opportunities with related garment care products and seasonal demand patterns create predictable revenue streams. Online retail advantages include detailed product demonstration capabilities and customer review systems that support informed purchase decisions.

Consumers receive significant value through extended garment lifespan, improved clothing appearance, and cost savings compared to frequent wardrobe replacement. Environmental benefits align with growing sustainability consciousness, enabling consumers to reduce textile waste while maintaining clothing quality. Convenience factors associated with modern fabric shavers make garment maintenance accessible and efficient for busy lifestyles.

Supply chain partners benefit from stable demand patterns and opportunities for component innovation and manufacturing efficiency improvements. Distribution networks gain from product categories that appeal to diverse consumer segments and support both online and traditional retail channels. Service providers including repair and maintenance services may find opportunities in supporting premium fabric shaver categories requiring professional servicing.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping fabric shavers market development, with consumers increasingly viewing garment maintenance as essential environmental responsibility. Circular economy principles influence purchasing decisions, creating preference for products that extend clothing lifespan and reduce textile waste. Eco-friendly packaging and recyclable components become important product features for environmentally conscious consumers.

Technology advancement continues driving product innovation through improved blade systems, enhanced battery performance, and smart connectivity features. Cordless operation has become standard expectation rather than premium feature, with manufacturers focusing on battery life optimization and charging convenience. Safety enhancements including protective guards and automatic shutoff features address consumer concerns about fabric damage and user safety.

Design evolution emphasizes ergonomic improvements, aesthetic appeal, and user-friendly interfaces that make fabric shavers more attractive to style-conscious consumers. Compact form factors and travel-friendly designs cater to mobile lifestyles and storage constraints in smaller living spaces. Color options and modern styling help fabric shavers integrate seamlessly with contemporary home aesthetics.

Market premiumization shows consumers increasingly willing to invest in higher-quality fabric shavers that offer superior performance and durability. Feature differentiation through adjustable settings, multiple attachments, and specialized fabric modes creates value propositions that justify premium pricing. Brand positioning shifts toward lifestyle and fashion categories rather than purely functional appliance classification.

Product innovation acceleration has intensified across the fabric shavers industry, with manufacturers investing heavily in research and development to create differentiated offerings. Blade technology improvements focus on precision cutting systems that effectively remove pills while protecting fabric integrity. Battery advancement enables longer runtime and faster charging capabilities that address traditional cordless model limitations.

Market consolidation trends show larger home appliance manufacturers acquiring specialized fabric care brands to expand product portfolios and market reach. Strategic partnerships between manufacturers and major retailers create exclusive product lines and enhanced market positioning. International expansion efforts by successful domestic brands seek to leverage proven market strategies in global markets.

Digital transformation initiatives include enhanced e-commerce presence, social media marketing campaigns, and influencer partnerships that target younger, tech-savvy consumer segments. Customer education programs through online content and video demonstrations help overcome awareness barriers and demonstrate proper product usage. Review management systems enable manufacturers to gather consumer feedback and improve product development processes.

Sustainability initiatives encompass eco-friendly packaging, recyclable components, and energy-efficient manufacturing processes that align with environmental consciousness trends. Corporate responsibility programs highlight fabric shavers’ role in reducing textile waste and supporting sustainable fashion practices. Certification programs for environmental standards and product safety provide additional consumer confidence and market differentiation opportunities.

Market expansion strategies should prioritize consumer education initiatives that demonstrate fabric shavers’ value proposition and proper usage techniques. Educational content marketing through social media, video demonstrations, and partnership with fashion influencers can effectively address awareness barriers and drive adoption among target demographics. Seasonal marketing campaigns aligned with spring cleaning and wardrobe maintenance periods can maximize promotional impact and sales conversion.

Product development focus should emphasize cordless technology optimization, safety feature enhancement, and user experience improvements that address current market gaps. Premium segment opportunities exist for manufacturers willing to invest in advanced features and superior build quality that justify higher price points. Smart technology integration could create next-generation products that appeal to tech-savvy consumers and enable new service models.

Distribution strategy optimization requires balanced approach between online and traditional retail channels, with emphasis on platforms that enable effective product demonstration and customer education. E-commerce investment should include detailed product information, customer reviews, and comparison tools that support informed purchase decisions. Retail partnership development with home goods and department stores can provide essential hands-on evaluation opportunities for consumers.

Competitive positioning should leverage sustainability messaging, quality differentiation, and customer service excellence to build brand loyalty and market share. MWR analysis suggests that manufacturers focusing on consistent quality and customer satisfaction will outperform competitors relying solely on price competition. International expansion opportunities exist for established brands with proven domestic success and scalable business models.

Long-term market prospects appear highly favorable, supported by growing sustainability consciousness, increasing consumer investment in garment care, and continuous technological innovation. Market growth projections indicate sustained expansion at approximately 6.5% CAGR through the next five years, driven by demographic shifts toward environmentally conscious consumers and premium product adoption. Category maturation will likely result in more sophisticated consumer expectations and increased competition based on performance rather than price alone.

Technology evolution will continue driving product advancement through smart connectivity, improved battery systems, and enhanced safety features that address current market limitations. IoT integration may enable fabric shavers to connect with smartphone apps for usage tracking, maintenance reminders, and personalized fabric care recommendations. Artificial intelligence applications could optimize cutting patterns and fabric recognition for superior performance across diverse textile types.

Market segmentation will likely become more sophisticated, with specialized products targeting specific consumer needs and fabric types. Professional market expansion into commercial applications represents significant growth opportunity for manufacturers willing to develop specialized solutions for dry cleaning services and fashion retailers. Subscription service models for replacement parts and accessories could create recurring revenue streams and enhanced customer relationships.

Sustainability trends will continue influencing product design, manufacturing processes, and marketing strategies as environmental consciousness becomes increasingly important to consumers. Circular economy principles may drive development of repairable, upgradeable fabric shavers that align with long-term sustainability goals. MarkWide Research forecasts that environmental considerations will become primary purchase drivers for approximately 80% of consumers within the next decade, fundamentally reshaping market dynamics and competitive strategies.

The United States fabric shavers market demonstrates compelling growth potential driven by sustainability consciousness, technological innovation, and evolving consumer attitudes toward garment care. Market dynamics favor manufacturers and retailers who can effectively communicate product value propositions while addressing consumer education needs and quality concerns. Competitive landscape remains fragmented but shows signs of consolidation as larger players recognize market opportunities and invest in category expansion.

Future success factors include continuous product innovation, effective consumer education, and strategic distribution partnerships that maximize market reach and customer satisfaction. Sustainability positioning will become increasingly important as environmental consciousness drives purchase decisions across demographic segments. Technology integration and premium product development offer significant opportunities for differentiation and margin improvement in competitive market conditions.

Industry participants who invest in quality, innovation, and customer education while maintaining competitive pricing will be best positioned to capitalize on market growth opportunities. Long-term outlook remains positive, supported by demographic trends, environmental awareness, and continuous technological advancement that enhances product performance and consumer appeal. Market expansion into professional applications and international markets provides additional growth avenues for established brands with proven success in the domestic market.

What is Fabric Shavers?

Fabric shavers are devices designed to remove lint, fuzz, and pilling from fabrics, enhancing the appearance and longevity of clothing and upholstery. They are commonly used on garments, blankets, and furniture to maintain a clean look.

What are the key players in the United States Fabric Shavers Market?

Key players in the United States Fabric Shavers Market include Conair, Philips, and Panasonic, which offer a range of fabric shavers with various features and designs. These companies focus on innovation and quality to meet consumer demands, among others.

What are the growth factors for the United States Fabric Shavers Market?

The growth of the United States Fabric Shavers Market is driven by increasing consumer awareness about fabric care and the rising demand for home care products. Additionally, the trend towards sustainable fashion encourages consumers to maintain their clothing for longer periods.

What challenges does the United States Fabric Shavers Market face?

The United States Fabric Shavers Market faces challenges such as competition from alternative fabric care solutions and the potential for product quality issues. Additionally, consumer preferences for multifunctional devices can impact the demand for standalone fabric shavers.

What opportunities exist in the United States Fabric Shavers Market?

Opportunities in the United States Fabric Shavers Market include the development of advanced fabric shavers with smart technology and eco-friendly materials. There is also potential for growth in online retail channels as consumers increasingly shop online for home care products.

What trends are shaping the United States Fabric Shavers Market?

Trends shaping the United States Fabric Shavers Market include the rise of portable and rechargeable fabric shavers, as well as an emphasis on ergonomic designs. Additionally, there is a growing interest in products that are easy to clean and maintain, reflecting consumer preferences for convenience.

United States Fabric Shavers Market

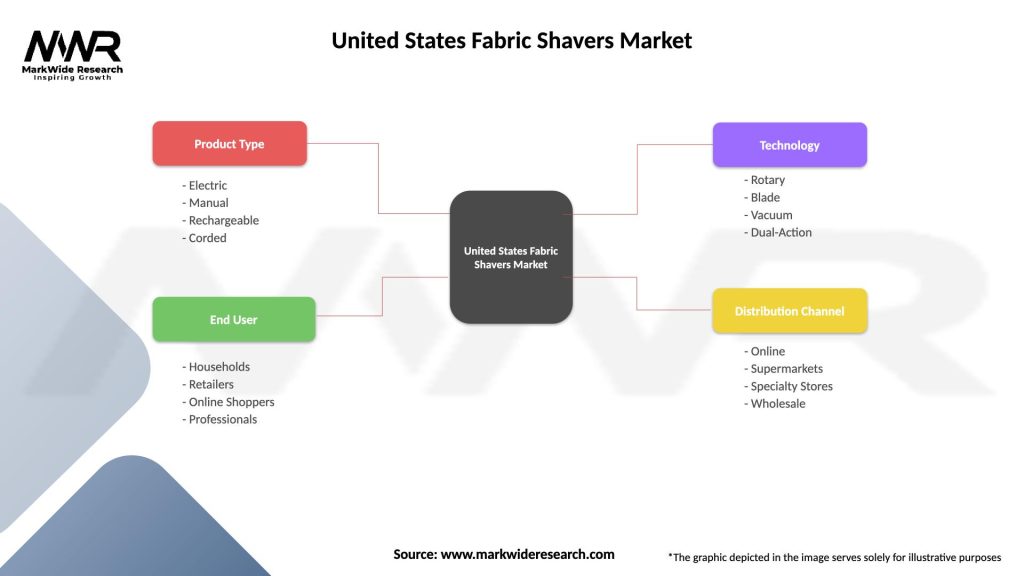

| Segmentation Details | Description |

|---|---|

| Product Type | Electric, Manual, Rechargeable, Corded |

| End User | Households, Retailers, Online Shoppers, Professionals |

| Technology | Rotary, Blade, Vacuum, Dual-Action |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Fabric Shavers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at