444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United States End-of-line Packaging Tape market is a thriving segment within the packaging industry. End-of-line packaging tape is used to seal cartons and packages during the final stage of the packaging process. It provides secure and tamper-evident sealing, ensuring the protection and integrity of packaged goods during storage, transportation, and distribution. The market is driven by the increasing demand for efficient and reliable packaging solutions, advancements in tape technology, and the growth of e-commerce.

Meaning

End-of-line packaging tape refers to the tape used to seal cartons and packages at the final stage of the packaging process. It provides a secure and tamper-evident closure, ensuring the integrity of the packaged goods. The tape is designed to adhere to various surfaces, including cardboard, paper, plastic, and other packaging materials. The United States End-of-line Packaging Tape market focuses on the manufacturing, distribution, and sale of such tapes within the country.

Executive Summary

The United States End-of-line Packaging Tape market has experienced substantial growth in recent years, driven by the increasing demand for efficient packaging solutions and the rise of e-commerce. The market is characterized by the presence of both local and international tape manufacturers, offering a wide range of tape types, sizes, and adhesive formulations.

The United States End-of-line Packaging Tape Market is projected to grow steadily, valued at USD 1.2 billion in 2023. With a projected CAGR of 5% from 2024 to 2030, the market is driven by the growing e-commerce sector and the increasing need for secure and efficient packaging solutions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United States End-of-line Packaging Tape market is influenced by factors such as the growth of the packaging industry, technological advancements, regulatory requirements, and consumer preferences. The market is characterized by intense competition, product innovation, and the need for efficient and reliable sealing solutions.

Regional Analysis

A regional analysis of the United States End-of-line Packaging Tape market can provide insights into regional variations in packaging trends, consumer preferences, and industry-specific requirements. Different regions within the United States may exhibit varying levels of market maturity, growth potential, and demand for specific tape types and sizes.

Competitive Landscape

Leading Companies in the United States End-of-line Packaging Tape Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

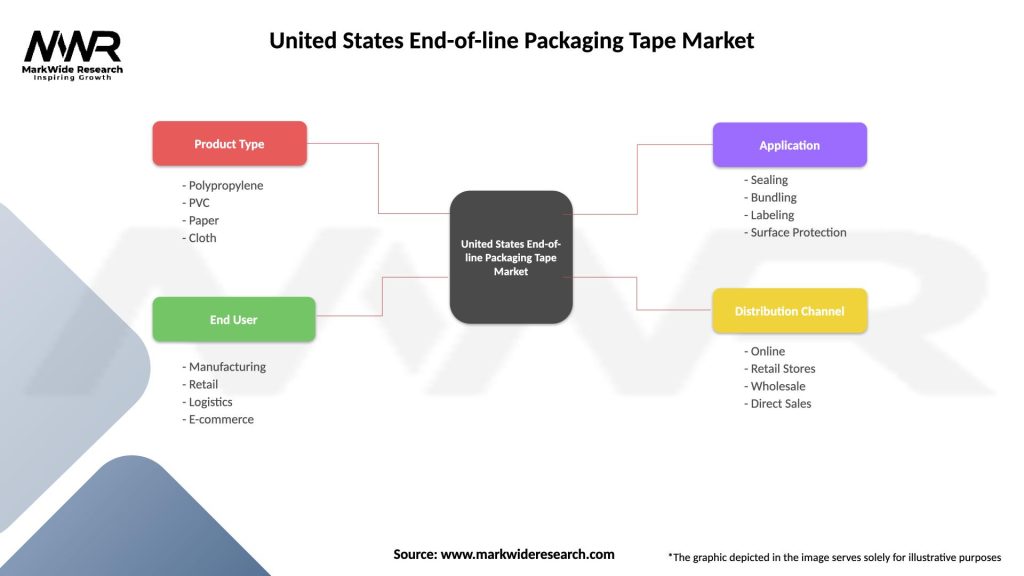

Segmentation

The United States End-of-line Packaging Tape market can be segmented based on factors such as tape type, adhesive formulation, application, and end-use industry. Common segments include:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the United States End-of-line Packaging Tape market. The increase in e-commerce activities and the need for secure packaging solutions during the pandemic have driven the demand for end-of-line packaging tapes. However, supply chain disruptions, raw material shortages, and logistical challenges have posed hurdles for tape manufacturers.

Key Industry Developments

Analyst Suggestions

Future Outlook

The United States End-of-line Packaging Tape market is expected to experience steady growth in the coming years, driven by the continued expansion of e-commerce, the need for reliable packaging solutions, and the emphasis on sustainable packaging practices. Tape manufacturers that prioritize innovation, customization, and sustainability will be well-positioned to capitalize on the evolving market trends and meet the diverse needs of industries and consumers.

Conclusion

The United States End-of-line Packaging Tape market plays a crucial role in ensuring the secure and efficient sealing of cartons and packages. The market is driven by factors such as the growth of e-commerce, advancements in tape technology, and the emphasis on product safety and security. While challenges exist in terms of environmental concerns and competition from alternative closure methods, opportunities arise from the demand for sustainable packaging solutions and customized tape offerings. The future outlook for the market is promising, with manufacturers focusing on innovation, differentiation, and strategic partnerships to meet the evolving needs of the packaging industry.

What is End-of-line Packaging Tape?

End-of-line packaging tape refers to adhesive tape used in the final stages of packaging processes to seal boxes and secure products for shipping. It is essential for ensuring that packages remain intact during transit and storage.

What are the key players in the United States End-of-line Packaging Tape Market?

Key players in the United States End-of-line packaging tape market include 3M, Intertape Polymer Group, and Shurtape Technologies, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the United States End-of-line Packaging Tape Market?

The growth of the United States End-of-line packaging tape market is driven by the increasing demand for e-commerce packaging, the rise in consumer goods production, and the need for efficient logistics solutions. Additionally, sustainability trends are pushing for eco-friendly tape options.

What challenges does the United States End-of-line Packaging Tape Market face?

Challenges in the United States End-of-line packaging tape market include fluctuations in raw material prices, competition from alternative sealing methods, and the need for compliance with environmental regulations. These factors can impact production costs and market dynamics.

What opportunities exist in the United States End-of-line Packaging Tape Market?

Opportunities in the United States End-of-line packaging tape market include the development of biodegradable and recyclable tape products, advancements in adhesive technology, and the expansion of automated packaging solutions. These trends can enhance product offerings and market reach.

What trends are shaping the United States End-of-line Packaging Tape Market?

Trends shaping the United States End-of-line packaging tape market include the increasing adoption of smart packaging technologies, the shift towards sustainable materials, and the growth of customized packaging solutions. These trends reflect changing consumer preferences and industry standards.

United States End-of-line Packaging Tape Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polypropylene, PVC, Paper, Cloth |

| End User | Manufacturing, Retail, Logistics, E-commerce |

| Application | Sealing, Bundling, Labeling, Surface Protection |

| Distribution Channel | Online, Retail Stores, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States End-of-line Packaging Tape Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at