444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States electric vehicle battery manufacturing market represents a transformative sector driving America’s transition toward sustainable transportation. This rapidly expanding industry encompasses the production of lithium-ion batteries, solid-state batteries, and emerging battery technologies specifically designed for electric vehicles. Market dynamics indicate unprecedented growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 24.7% as domestic manufacturing capabilities expand to meet surging demand.

Manufacturing infrastructure across the United States has undergone substantial expansion, with major automotive manufacturers and battery specialists establishing production facilities throughout key regions. The market encompasses various battery chemistries, including lithium iron phosphate (LFP), nickel manganese cobalt (NMC), and next-generation solid-state technologies. Regional distribution shows concentrated activity in the Southeast, Midwest, and Southwest, where favorable policies and proximity to automotive assembly plants create optimal manufacturing conditions.

Technology advancement remains a critical driver, with manufacturers investing heavily in research and development to improve energy density, reduce charging times, and enhance battery longevity. The market benefits from significant federal and state incentives, including the Inflation Reduction Act provisions that encourage domestic battery production. Supply chain localization efforts have accelerated, with companies establishing integrated operations spanning raw material processing to finished battery pack assembly.

The United States electric vehicle battery manufacturing market refers to the comprehensive ecosystem of companies, facilities, and technologies involved in producing battery systems specifically designed for electric vehicles within American borders. This market encompasses the entire value chain from raw material processing and cell production to battery pack assembly and quality testing.

Manufacturing scope includes various battery technologies such as lithium-ion cells, battery management systems, thermal management components, and structural battery packs. The market serves multiple vehicle segments including passenger cars, commercial vehicles, buses, and specialty electric vehicles. Domestic production capabilities have expanded significantly to reduce dependence on foreign battery suppliers and strengthen national energy security.

Market participants range from established automotive manufacturers like General Motors and Ford to specialized battery companies such as Tesla’s Gigafactory operations and emerging players focused on next-generation technologies. The sector includes both original equipment manufacturers (OEMs) and tier-one suppliers providing batteries to multiple automotive brands.

Strategic positioning of the United States electric vehicle battery manufacturing market reflects a critical inflection point in American industrial policy and clean energy transition. The sector has emerged as a national priority, supported by substantial government investments and private sector commitments totaling hundreds of billions in planned manufacturing capacity expansion.

Market transformation is evident through the establishment of multiple gigafactory-scale facilities across strategic locations, creating a domestic supply chain capable of supporting millions of electric vehicles annually. Key manufacturers have announced production targets that position the United States as a global leader in battery manufacturing capacity by the end of the decade. Technology leadership initiatives focus on advancing battery performance while reducing costs through economies of scale and manufacturing innovation.

Competitive landscape features intense rivalry among established players and new entrants, driving rapid innovation in battery chemistry, manufacturing processes, and recycling technologies. The market benefits from policy support including tax credits for domestic production, research grants for advanced technologies, and regulatory frameworks promoting supply chain resilience. Investment momentum continues accelerating with 73% of announced battery manufacturing projects expected to begin production within the next three years.

Manufacturing capacity expansion represents the most significant development in the United States electric vehicle battery market, with planned facilities expected to transform domestic production capabilities. MarkWide Research analysis indicates that current and announced projects will establish the foundation for long-term market leadership in North America.

Government policy support serves as the primary catalyst driving United States electric vehicle battery manufacturing expansion. The Inflation Reduction Act provides substantial tax incentives for domestic battery production, creating favorable economics for manufacturers establishing operations within American borders. Federal initiatives include research grants, loan guarantees, and procurement commitments that reduce investment risks and accelerate market development.

Automotive industry transformation creates unprecedented demand for domestic battery supply as major manufacturers commit to electric vehicle production targets. Traditional automakers have announced plans to electrify their entire vehicle lineups within the next decade, requiring secure access to high-quality battery systems. Supply chain resilience concerns following global disruptions have motivated companies to establish domestic manufacturing capabilities rather than relying solely on international suppliers.

Technology advancement in battery chemistry and manufacturing processes enables cost reductions and performance improvements that make domestic production increasingly competitive. Energy density improvements of 15-20% annually combined with manufacturing scale economies create compelling value propositions for American-made batteries. Consumer adoption of electric vehicles continues accelerating, driven by expanding model availability, improving charging infrastructure, and growing environmental awareness among buyers.

Capital intensity requirements for battery manufacturing facilities represent significant barriers to market entry, with gigafactory-scale operations requiring multi-billion dollar investments. Technology risks associated with rapidly evolving battery chemistries create uncertainty for manufacturers making long-term production commitments. Companies must balance current market demands with emerging technologies that could potentially obsolete existing manufacturing infrastructure.

Raw material supply constraints pose ongoing challenges for domestic battery manufacturing, particularly for critical minerals like lithium, cobalt, and nickel. Skilled workforce shortages in specialized manufacturing roles limit production ramp-up capabilities, requiring substantial investments in training and recruitment programs. Regulatory complexity across federal, state, and local jurisdictions creates compliance challenges for manufacturers establishing new facilities.

International competition from established battery manufacturers in Asia presents ongoing competitive pressure through aggressive pricing and advanced manufacturing capabilities. Quality standards in automotive applications require extensive testing and certification processes that can delay product launches and increase development costs. Recycling infrastructure limitations create potential long-term sustainability challenges as battery volumes increase substantially.

Next-generation technologies present substantial opportunities for United States manufacturers to establish leadership positions in emerging battery segments. Solid-state batteries offer potential advantages in energy density, safety, and charging speed, creating opportunities for companies investing in advanced research and development. Silicon nanowire anodes and other breakthrough technologies could provide competitive advantages for early adopters.

Commercial vehicle electrification represents a rapidly expanding market segment with unique battery requirements for heavy-duty applications. Energy storage integration opportunities allow battery manufacturers to serve both transportation and grid storage markets, improving facility utilization and revenue diversification. Export potential to neighboring countries and global markets creates additional growth opportunities for efficient domestic manufacturers.

Recycling and circular economy initiatives offer opportunities to establish closed-loop manufacturing systems that reduce raw material dependence while creating new revenue streams. Partnership opportunities with automotive manufacturers, technology companies, and research institutions enable shared risk and accelerated innovation. Government contracts for military and public transportation applications provide stable demand foundations for manufacturing capacity expansion.

Competitive intensity within the United States electric vehicle battery manufacturing market continues escalating as established players and new entrants compete for market share and strategic partnerships. Technology differentiation has become increasingly important, with manufacturers investing heavily in proprietary battery chemistries, manufacturing processes, and performance optimization systems.

Supply chain dynamics reflect ongoing efforts to establish domestic sources for critical raw materials and components. Vertical integration strategies include partnerships with mining companies, chemical processors, and recycling facilities to ensure material security and cost control. Manufacturing efficiency improvements through automation and process optimization enable cost reductions of 12-18% annually for leading producers.

Market consolidation trends indicate potential partnerships and acquisitions as companies seek to achieve scale economies and technology access. Innovation cycles are accelerating, with new battery technologies moving from laboratory to commercial production in increasingly shorter timeframes. Customer relationships with automotive manufacturers are becoming more strategic and long-term, involving joint development programs and capacity commitments.

Comprehensive analysis of the United States electric vehicle battery manufacturing market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, manufacturing engineers, policy makers, and technology specialists across the battery value chain.

Secondary research encompasses analysis of company financial reports, government publications, industry associations, and technical literature to validate market trends and projections. Data triangulation methods compare information from multiple sources to ensure reliability and identify potential discrepancies in market assessments.

Market modeling techniques incorporate production capacity data, demand forecasts, and technology adoption curves to project future market development scenarios. Expert validation processes involve review by industry specialists and academic researchers to ensure analytical rigor and practical relevance. Continuous monitoring of market developments enables regular updates to research findings and projections.

Southeast region has emerged as the dominant hub for United States electric vehicle battery manufacturing, accounting for approximately 45% of planned production capacity. States including Georgia, North Carolina, Tennessee, and Kentucky offer favorable business climates, skilled workforces, and proximity to automotive assembly operations. Infrastructure advantages include established transportation networks, reliable power supply, and supportive state-level incentive programs.

Midwest manufacturing corridor maintains significant importance, representing 28% of domestic battery production capacity through facilities in Michigan, Ohio, and Indiana. The region benefits from deep automotive industry expertise, established supply chains, and research institutions focused on advanced manufacturing technologies. Great Lakes region offers additional advantages through access to Canadian raw materials and established trade relationships.

Southwest markets including Texas and Nevada contribute 18% of national production capacity, leveraging abundant renewable energy resources and favorable regulatory environments. Western states account for the remaining 9% of capacity, with California leading in research and development activities while other states focus on specialized applications. Regional specialization is emerging, with different areas developing expertise in specific battery technologies and applications.

Market leadership in the United States electric vehicle battery manufacturing sector reflects a dynamic competitive environment with both established automotive companies and specialized battery manufacturers competing for market position.

Strategic partnerships between automotive manufacturers and battery specialists have become increasingly common, enabling shared investment risks and accelerated technology development. Technology differentiation strategies focus on battery chemistry optimization, manufacturing efficiency, and integration with vehicle systems.

By Battery Type: The market segments into multiple battery technologies serving different vehicle applications and performance requirements. Lithium-ion batteries dominate current production, representing over 85% of manufacturing capacity, with subcategories including NMC, LFP, and NCA chemistries. Solid-state batteries represent emerging technology with significant growth potential, while lithium-metal and silicon-anode technologies address specific performance requirements.

By Vehicle Application: Market segmentation reflects diverse electric vehicle categories with distinct battery requirements. Passenger vehicles account for the largest segment, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Commercial vehicles represent rapidly growing segment including delivery trucks, buses, and heavy-duty applications. Specialty vehicles encompass military, agricultural, and industrial applications with unique performance specifications.

By Manufacturing Scale: Production facilities range from pilot-scale operations focused on research and development to gigafactory-scale facilities capable of producing batteries for millions of vehicles annually. Integrated manufacturers combine cell production, pack assembly, and battery management system integration, while specialized suppliers focus on specific components or technologies.

Lithium-ion Technology: Current market leader with established manufacturing processes and proven automotive applications. NMC batteries offer high energy density suitable for long-range vehicles, while LFP batteries provide cost advantages and enhanced safety characteristics. Manufacturing optimization focuses on improving energy density while reducing production costs through economies of scale.

Solid-state Batteries: Emerging technology category with potential to revolutionize electric vehicle performance through higher energy density, faster charging, and improved safety characteristics. Development challenges include manufacturing scalability and cost reduction, with several companies targeting commercial production within the next five years. Investment levels in solid-state technology research have increased 340% over the past three years.

Battery Management Systems: Critical component category ensuring safe and efficient battery operation through monitoring, thermal management, and charge optimization. Advanced BMS technology incorporates artificial intelligence and machine learning to optimize battery performance and longevity. Integration complexity requires close collaboration between battery manufacturers and automotive OEMs.

Automotive Manufacturers benefit from domestic battery supply chain security, reduced transportation costs, and closer collaboration with battery suppliers for integrated product development. Supply chain resilience improvements reduce risks associated with international shipping disruptions and geopolitical tensions. Customization opportunities enable optimized battery solutions for specific vehicle platforms and performance requirements.

Battery Manufacturers gain access to the world’s largest automotive market while benefiting from supportive government policies and incentives. Proximity advantages to automotive assembly plants reduce logistics costs and enable just-in-time delivery systems. Technology partnerships with research institutions and automotive companies accelerate innovation and commercialization timelines.

Regional Communities benefit from substantial job creation, economic development, and tax revenue generation from battery manufacturing facilities. Workforce development programs create career opportunities in advanced manufacturing and clean energy technologies. Supply chain development attracts additional businesses and creates multiplier effects throughout regional economies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Gigafactory Proliferation: Establishment of large-scale integrated manufacturing facilities represents the dominant trend in domestic battery production. Facility planning emphasizes co-location with automotive assembly plants and integration of supply chain operations. Production scaling targets indicate capacity utilization rates of 78% expected within three years of facility startup.

Technology Convergence: Integration of artificial intelligence, automation, and advanced materials science is transforming battery manufacturing processes. Digital twin technology enables optimization of production parameters and quality control systems. Predictive maintenance systems reduce downtime and improve manufacturing efficiency through data-driven insights.

Sustainability Integration: Environmental responsibility has become central to manufacturing strategy, with companies implementing renewable energy systems and waste reduction programs. Circular economy principles guide facility design and operation, emphasizing material recovery and recycling capabilities. Carbon footprint reduction initiatives target net-zero manufacturing operations within the next decade.

Manufacturing Announcements: Major automotive and battery companies have announced substantial investments in domestic manufacturing capacity, with combined commitments exceeding previous projections. Facility construction timelines have accelerated, with several gigafactory projects advancing ahead of original schedules. Technology partnerships between automotive manufacturers and battery specialists continue expanding.

Policy Developments: Implementation of Inflation Reduction Act provisions has created clear incentive structures for domestic battery manufacturing. State-level initiatives complement federal programs with additional tax incentives, workforce development funding, and infrastructure support. Regulatory frameworks for battery recycling and material recovery are being established to support circular economy objectives.

Technology Breakthroughs: MWR analysis indicates significant advancement in solid-state battery development, with multiple companies announcing pilot production capabilities. Manufacturing process innovations have achieved cost reductions while improving battery performance characteristics. Quality control systems incorporating machine learning have reduced defect rates by 65% compared to traditional methods.

Strategic Positioning: Companies should focus on establishing clear technology differentiation and strategic partnerships with automotive manufacturers to secure long-term market position. Investment timing remains critical, with early movers likely to capture market share advantages and benefit from learning curve effects. Geographic diversification across multiple regions can reduce regulatory and operational risks.

Technology Investment: Balanced portfolios combining current lithium-ion production with next-generation technology development offer optimal risk-return profiles. Manufacturing flexibility to accommodate multiple battery chemistries and form factors will become increasingly important as market requirements evolve. Automation integration should prioritize quality control and process optimization over pure cost reduction.

Supply Chain Strategy: Vertical integration of critical materials and components can provide competitive advantages and supply security. Partnership development with mining companies, recycling facilities, and research institutions creates strategic value beyond immediate cost benefits. Risk management systems should address raw material price volatility and geopolitical supply disruptions.

Market trajectory for United States electric vehicle battery manufacturing indicates sustained growth driven by automotive industry electrification and supportive government policies. Production capacity expansion will continue accelerating, with domestic manufacturing expected to meet majority of national demand by 2030. Technology evolution toward solid-state and advanced lithium-ion systems will drive next-generation manufacturing investments.

Competitive dynamics will intensify as market matures, with success increasingly dependent on manufacturing efficiency, technology innovation, and strategic partnerships. Consolidation trends may emerge as companies seek scale economies and technology access through mergers and acquisitions. Export opportunities will develop as domestic manufacturers achieve cost competitiveness and establish quality reputations.

Innovation acceleration in battery chemistry, manufacturing processes, and recycling technologies will continue reshaping market dynamics. Sustainability requirements will become increasingly important, driving investments in renewable energy integration and circular economy systems. Market maturation is expected to result in standardization of manufacturing processes and improved industry-wide efficiency metrics.

The United States electric vehicle battery manufacturing market represents a transformative opportunity that positions America at the forefront of the global clean energy transition. Strategic investments by government and private sector participants have created unprecedented momentum for domestic battery production capabilities that will serve both transportation and energy storage applications.

Market fundamentals remain exceptionally strong, supported by automotive industry electrification commitments, favorable policy environments, and advancing battery technologies. Manufacturing capacity expansion continues exceeding projections, with integrated supply chains developing to support long-term market growth and competitiveness.

Future success will depend on continued innovation in battery technology, manufacturing efficiency, and supply chain integration. Companies that establish early market positions while maintaining flexibility for technology evolution are positioned to capture substantial value creation opportunities in this rapidly expanding sector. The United States electric vehicle battery manufacturing market stands ready to become a cornerstone of American industrial leadership in the clean energy economy.

What is Electric Vehicle Battery Manufacturing?

Electric Vehicle Battery Manufacturing refers to the process of producing batteries specifically designed for electric vehicles, which includes various technologies such as lithium-ion, solid-state, and nickel-metal hydride batteries. These batteries are crucial for powering electric vehicles and are a key component in the transition to sustainable transportation.

What are the key players in the United States Electric Vehicle Battery Manufacturing Market?

Key players in the United States Electric Vehicle Battery Manufacturing Market include Tesla, LG Energy Solution, Panasonic, and CATL, among others. These companies are involved in the development and production of advanced battery technologies to support the growing electric vehicle industry.

What are the main drivers of the United States Electric Vehicle Battery Manufacturing Market?

The main drivers of the United States Electric Vehicle Battery Manufacturing Market include the increasing demand for electric vehicles, advancements in battery technology, and government incentives promoting clean energy. Additionally, the push for reduced carbon emissions is fueling growth in this sector.

What challenges does the United States Electric Vehicle Battery Manufacturing Market face?

The United States Electric Vehicle Battery Manufacturing Market faces challenges such as supply chain disruptions, high raw material costs, and competition from international manufacturers. These factors can impact production efficiency and pricing strategies.

What opportunities exist in the United States Electric Vehicle Battery Manufacturing Market?

Opportunities in the United States Electric Vehicle Battery Manufacturing Market include the potential for innovation in battery technologies, expansion of production facilities, and partnerships with automotive manufacturers. The growing focus on renewable energy sources also presents avenues for development.

What trends are shaping the United States Electric Vehicle Battery Manufacturing Market?

Trends shaping the United States Electric Vehicle Battery Manufacturing Market include the shift towards solid-state batteries, increased recycling efforts for battery materials, and the integration of artificial intelligence in manufacturing processes. These trends aim to enhance efficiency and sustainability in battery production.

United States Electric Vehicle Battery Manufacturing Market

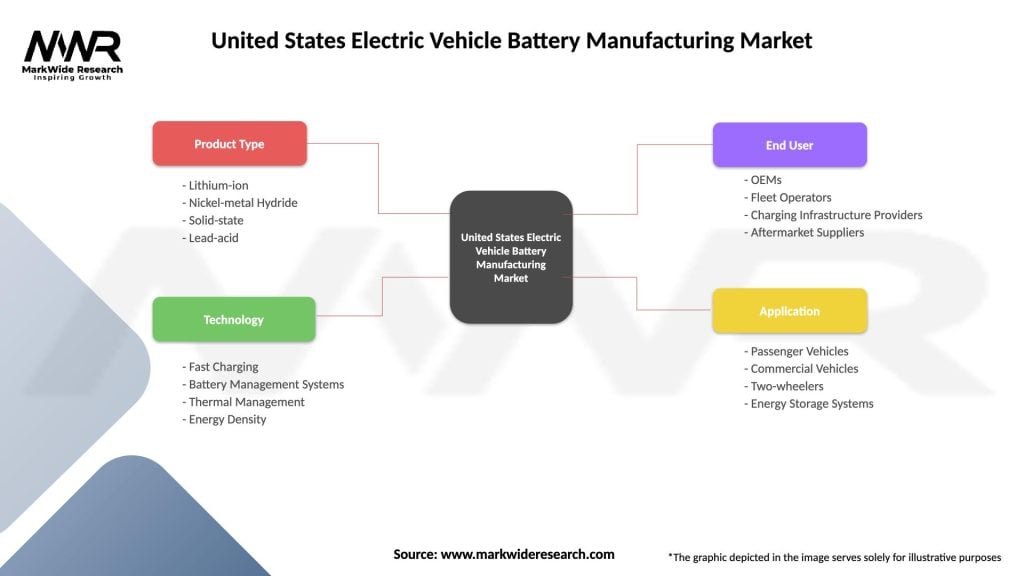

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Solid-state, Lead-acid |

| Technology | Fast Charging, Battery Management Systems, Thermal Management, Energy Density |

| End User | OEMs, Fleet Operators, Charging Infrastructure Providers, Aftermarket Suppliers |

| Application | Passenger Vehicles, Commercial Vehicles, Two-wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Electric Vehicle Battery Manufacturing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at