444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States electric vehicle battery anode market represents a critical component of the nation’s rapidly expanding electric mobility ecosystem. As the automotive industry undergoes unprecedented transformation toward electrification, battery anode materials have emerged as fundamental enablers of enhanced energy density, charging speed, and overall vehicle performance. The market encompasses various anode technologies including graphite, silicon-based composites, lithium titanate, and emerging next-generation materials that power electric vehicles across passenger cars, commercial vehicles, and specialty applications.

Market dynamics indicate robust growth driven by federal electrification mandates, state-level zero emission vehicle programs, and substantial investments in domestic battery manufacturing capabilities. The sector benefits from growing consumer acceptance of electric vehicles, with adoption rates reaching 7.6% of total vehicle sales in recent periods. Manufacturing localization initiatives supported by the Inflation Reduction Act have accelerated domestic anode production capacity, reducing supply chain dependencies while creating opportunities for technological innovation and cost optimization.

Technology evolution continues reshaping the competitive landscape as manufacturers pursue advanced anode materials offering superior energy density and faster charging capabilities. Silicon-enhanced graphite anodes are gaining significant traction, delivering capacity improvements of up to 40% compared to conventional graphite solutions. The integration of artificial intelligence and machine learning in anode material development is accelerating innovation cycles while improving manufacturing precision and quality control processes.

The United States electric vehicle battery anode market refers to the domestic industry segment focused on developing, manufacturing, and supplying anode materials specifically designed for electric vehicle battery applications. Anodes serve as the negative electrode in lithium-ion batteries, playing a crucial role in energy storage and release during charging and discharging cycles.

Anode materials primarily include natural and synthetic graphite, silicon-based composites, lithium titanate, and emerging alternatives such as lithium metal and hard carbon. These materials determine key battery characteristics including energy density, charging speed, cycle life, and thermal stability. The market encompasses raw material processing, anode manufacturing, coating technologies, and integration with cathode materials and electrolytes to create complete battery systems for electric vehicles.

Market participants include specialized anode manufacturers, integrated battery producers, automotive original equipment manufacturers, and technology companies developing next-generation materials. The ecosystem extends from mining and refining operations through advanced manufacturing facilities to research institutions driving innovation in anode chemistry and production processes.

Strategic positioning of the United States electric vehicle battery anode market reflects the nation’s commitment to achieving energy independence while building competitive advantages in clean transportation technologies. The sector demonstrates exceptional growth momentum supported by comprehensive policy frameworks, substantial private investments, and accelerating consumer adoption of electric vehicles across multiple market segments.

Technology leadership initiatives focus on developing high-performance anode materials that address critical challenges including energy density limitations, charging speed constraints, and cost competitiveness. Silicon-enhanced graphite anodes represent the dominant near-term technology pathway, while solid-state battery anodes and lithium metal solutions offer longer-term transformation potential. Research and development investments have increased by 85% over recent periods, reflecting industry commitment to innovation excellence.

Manufacturing capacity expansion across multiple states creates domestic supply chain resilience while generating high-value employment opportunities. Major facilities in Georgia, Michigan, North Carolina, and Nevada establish regional manufacturing hubs serving automotive assembly operations and battery gigafactories. The integration of sustainable production practices and circular economy principles positions the market for long-term environmental and economic sustainability.

Competitive dynamics feature both established materials companies and emerging technology specialists pursuing differentiated market positions through proprietary anode chemistries and manufacturing processes. Strategic partnerships between automotive manufacturers and anode suppliers accelerate technology commercialization while ensuring supply chain security for critical battery components.

Technology advancement drives market evolution as manufacturers pursue next-generation anode materials offering superior performance characteristics. Key insights shaping market development include:

Market intelligence indicates growing emphasis on domestic supply chain development as manufacturers seek to reduce dependencies on international suppliers while building technological capabilities. The integration of artificial intelligence and automation in anode production processes enhances quality control while reducing manufacturing costs and improving production efficiency.

Federal policy support serves as the primary catalyst driving United States electric vehicle battery anode market expansion. The Inflation Reduction Act provides substantial tax incentives for domestic battery manufacturing while establishing local content requirements that favor domestically produced anode materials. Clean energy initiatives target carbon emission reductions through transportation electrification, creating sustained demand for high-performance battery components.

Automotive industry transformation accelerates anode market growth as major manufacturers commit to comprehensive electrification strategies. General Motors, Ford, and other domestic automakers have announced investments exceeding hundreds of billions in electric vehicle development and production. These commitments create predictable demand for advanced anode materials while driving technology requirements for enhanced energy density and charging performance.

Consumer acceptance of electric vehicles continues expanding as vehicle performance improves and charging infrastructure develops. Range anxiety concerns diminish with advanced anode technologies enabling vehicle ranges exceeding 400 miles on single charges. The growing availability of fast-charging networks supported by federal infrastructure investments further accelerates consumer adoption rates.

Technology innovation drives market expansion through continuous improvements in anode material performance and manufacturing processes. Silicon-enhanced anodes offer significant capacity advantages while maintaining compatibility with existing battery designs. Research breakthroughs in solid-state battery anodes promise revolutionary performance improvements including enhanced safety, faster charging, and extended operational life.

Supply chain security considerations motivate domestic anode production development as manufacturers seek to reduce dependencies on international suppliers. Geopolitical tensions and trade uncertainties emphasize the strategic importance of domestic battery material capabilities for national energy security and economic competitiveness.

High capital requirements present significant barriers to entry for new market participants seeking to establish anode manufacturing capabilities. Advanced production facilities require substantial investments in specialized equipment, quality control systems, and skilled workforce development. The technical complexity of anode manufacturing processes demands extensive expertise and proven operational capabilities.

Technology transition challenges create uncertainties as manufacturers navigate evolving battery chemistries and performance requirements. Silicon-enhanced anodes offer performance advantages but require modified manufacturing processes and quality control procedures. The integration of new materials into existing battery designs necessitates extensive testing and validation programs that extend development timelines.

Raw material availability constraints affect anode production capacity as demand for graphite, silicon, and other critical materials increases rapidly. Natural graphite supplies face geographic concentration risks while synthetic graphite production requires significant energy inputs. Material cost volatility impacts manufacturing economics and pricing strategies across the supply chain.

Skilled workforce limitations challenge market expansion as specialized manufacturing requires expertise in materials science, electrochemistry, and advanced production technologies. The rapid growth of battery manufacturing creates competition for qualified personnel while necessitating comprehensive training programs for new workforce entrants.

Regulatory compliance requirements add complexity and costs to anode manufacturing operations. Environmental regulations governing material handling, waste management, and emissions control require ongoing investments in compliance systems and monitoring capabilities. Safety standards for battery materials demand rigorous testing and documentation procedures.

Next-generation technology development creates substantial opportunities for companies pursuing breakthrough anode materials and manufacturing processes. Solid-state battery anodes offer revolutionary performance potential while lithium metal anodes promise exceptional energy density improvements. Research partnerships with universities and national laboratories accelerate innovation while sharing development risks and costs.

Manufacturing capacity expansion opportunities emerge as domestic demand for anode materials grows rapidly. Strategic facility locations near automotive assembly plants and battery gigafactories optimize logistics while reducing transportation costs. The integration of renewable energy sources in manufacturing operations creates competitive advantages through reduced carbon footprints and operational costs.

Recycling and circular economy initiatives present new business opportunities as electric vehicle batteries reach end-of-life stages. Advanced recycling technologies recover valuable anode materials while reducing waste and environmental impact. Closed-loop systems create sustainable material flows while reducing dependence on virgin raw materials.

Application diversification beyond passenger vehicles opens additional market segments including commercial trucks, buses, marine vessels, and stationary energy storage systems. Each application requires specialized anode formulations optimized for specific performance requirements and operating conditions. Custom solutions command premium pricing while building long-term customer relationships.

International expansion opportunities develop as United States manufacturers build technological capabilities and production scale. Export markets in allied nations seeking supply chain diversification create additional revenue streams while leveraging domestic manufacturing investments. Technology licensing agreements provide alternative monetization strategies for proprietary anode innovations.

Supply chain evolution fundamentally reshapes market dynamics as manufacturers pursue vertical integration and strategic partnerships. Automotive companies increasingly invest directly in battery and anode production capabilities to ensure supply security and technology control. Vertical integration strategies reduce supply chain risks while enabling closer coordination between battery design and vehicle requirements.

Technology competition intensifies as multiple anode chemistries compete for market adoption. Graphite-based solutions maintain cost advantages while silicon-enhanced alternatives offer superior performance characteristics. Performance benchmarking focuses on energy density, charging speed, cycle life, and safety parameters that directly impact vehicle competitiveness.

Investment flows accelerate market development as venture capital, private equity, and strategic investors support anode technology companies. Government funding through the Department of Energy and other agencies provides additional capital for research and commercialization activities. Public-private partnerships leverage combined resources for large-scale manufacturing facility development.

Regulatory frameworks continue evolving to support domestic battery manufacturing while ensuring environmental protection and worker safety. Tax incentives and grants encourage domestic production while local content requirements favor domestically produced materials. Standards development creates consistent quality and performance benchmarks across the industry.

Market consolidation trends emerge as successful companies acquire complementary technologies and manufacturing capabilities. Strategic acquisitions accelerate technology development while building comprehensive product portfolios. Partnership networks enable smaller companies to access markets and manufacturing capabilities while maintaining technology independence.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United States electric vehicle battery anode market. Primary research activities include extensive interviews with industry executives, technology developers, manufacturing specialists, and automotive engineers across the electric vehicle ecosystem. Survey methodologies capture quantitative data on market trends, technology preferences, and investment priorities from key stakeholders.

Secondary research encompasses detailed analysis of industry reports, patent filings, regulatory documents, and financial disclosures from public companies. Academic research papers and conference proceedings provide insights into emerging technologies and scientific breakthroughs affecting anode material development. Government databases offer statistical information on production capacity, trade flows, and policy initiatives supporting market growth.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Industry consultants and technical specialists review findings to confirm market dynamics and technology assessments. Statistical analysis employs advanced modeling techniques to identify trends and project future market developments.

Market segmentation analysis examines anode materials by chemistry type, application segment, and geographic distribution. Manufacturing cost analysis evaluates production economics and competitive positioning across different technology approaches. Technology roadmapping assesses development timelines and commercialization prospects for emerging anode materials.

Geographic distribution of United States electric vehicle battery anode market activities reflects strategic clustering around automotive manufacturing centers and battery production facilities. The Southeast region leads market development with major investments in Georgia, North Carolina, and Tennessee creating integrated battery manufacturing ecosystems. Regional market share indicates the Southeast capturing approximately 35% of domestic anode production capacity.

Midwest manufacturing centers in Michigan, Ohio, and Indiana leverage automotive industry expertise and infrastructure to support anode production development. The region benefits from established supply chains, skilled workforce availability, and proximity to major automotive assembly operations. Great Lakes states account for roughly 28% of national anode manufacturing capacity through both new facilities and converted existing operations.

Western states including California, Nevada, and Arizona focus on technology innovation and advanced manufacturing processes. Silicon Valley companies drive research and development activities while Nevada hosts major battery gigafactories requiring substantial anode material supplies. West Coast operations represent approximately 22% of domestic production capacity with emphasis on high-performance specialty applications.

Northeast corridor states contribute through research institutions, technology development, and specialized manufacturing capabilities. Universities and national laboratories in the region advance fundamental research while companies focus on next-generation anode materials and production processes. Regional specialization in advanced materials and manufacturing technologies supports the broader national market development.

Texas operations emerge as significant contributors through large-scale manufacturing facilities and raw material processing capabilities. The state’s energy resources and industrial infrastructure support cost-effective anode production while serving growing regional demand from automotive and energy storage applications.

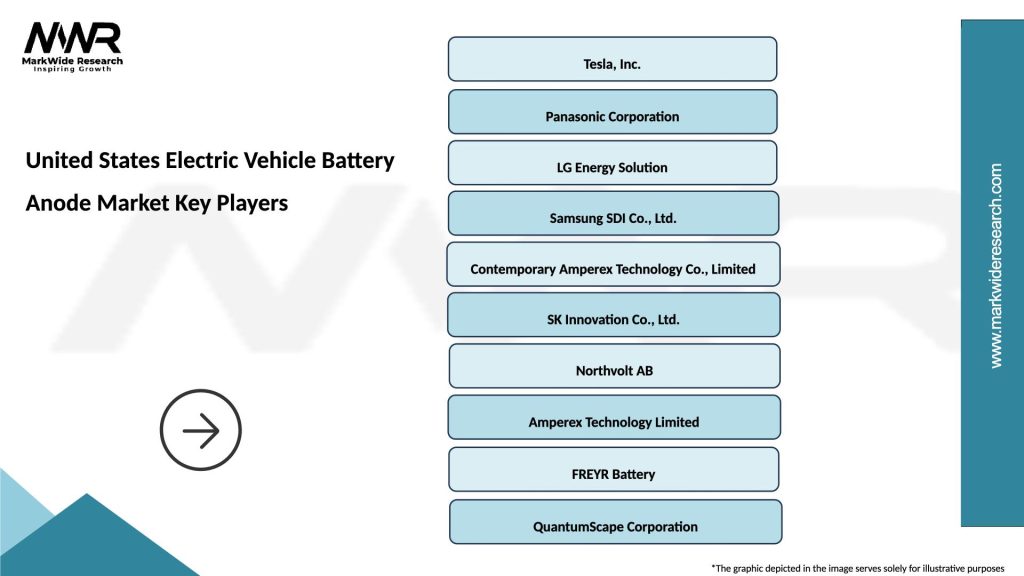

Market leadership in the United States electric vehicle battery anode sector features a diverse ecosystem of established materials companies, emerging technology specialists, and integrated battery manufacturers. The competitive landscape continues evolving as companies pursue differentiated positioning through proprietary technologies and strategic partnerships.

Strategic partnerships between anode manufacturers and automotive companies accelerate technology commercialization while ensuring supply chain security. Joint ventures and licensing agreements enable technology sharing while reducing development risks and capital requirements. The competitive dynamics emphasize innovation excellence, manufacturing scalability, and customer relationship development as key success factors.

Technology differentiation strategies focus on performance advantages including energy density improvements, fast charging capabilities, and extended cycle life. Companies pursue intellectual property development through patent portfolios while building manufacturing expertise and quality control capabilities.

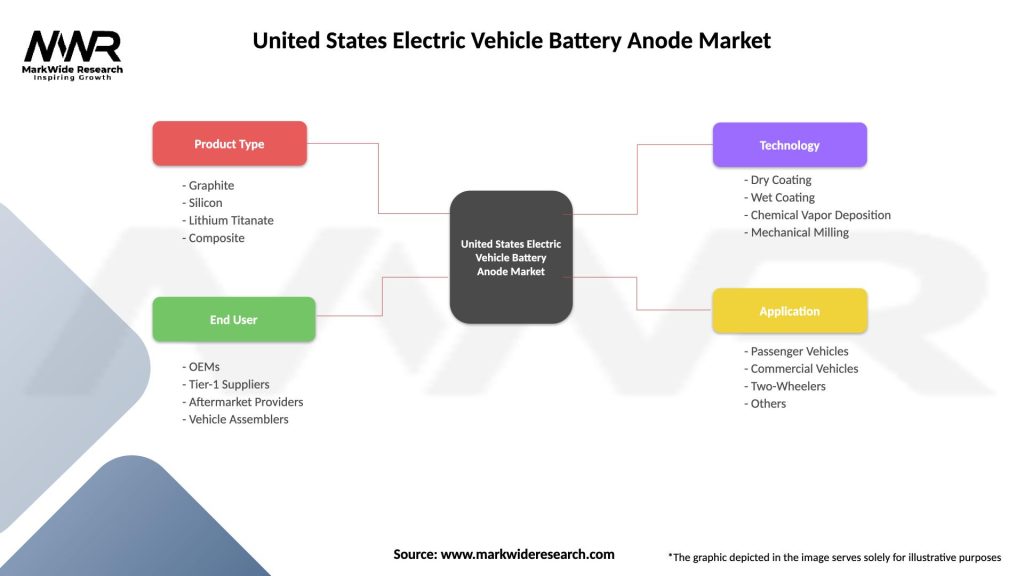

Material type segmentation divides the United States electric vehicle battery anode market into distinct categories based on chemical composition and performance characteristics. Each segment addresses specific application requirements and cost considerations across the electric vehicle ecosystem.

By Material Type:

By Application Segment:

By Manufacturing Process:

Natural graphite anodes maintain significant market presence due to cost advantages and established supply chains. These materials offer reliable performance for mainstream electric vehicle applications while supporting manufacturing scale economies. Supply chain optimization focuses on reducing geographic concentration risks while maintaining cost competitiveness against synthetic alternatives.

Synthetic graphite solutions command premium positioning through superior consistency and customizable properties. Manufacturing processes enable precise control over material characteristics including particle size, surface area, and electrochemical performance. Quality advantages justify higher costs for applications requiring consistent performance and extended operational life.

Silicon-enhanced graphite represents the fastest-growing category as manufacturers pursue energy density improvements without compromising manufacturing scalability. These composite materials deliver capacity improvements of 20-40% compared to conventional graphite while maintaining compatibility with existing battery designs. Technology development focuses on optimizing silicon content and distribution for maximum performance benefits.

Lithium titanate anodes serve specialized applications requiring exceptional fast-charging capabilities and extended cycle life. These materials enable charging times under 10 minutes while maintaining performance over thousands of charge cycles. Market applications include commercial vehicles, buses, and energy storage systems where rapid charging and durability are critical requirements.

Next-generation materials including silicon nanowires and solid-state anodes offer revolutionary performance potential for future electric vehicle applications. Development timelines extend 3-5 years for commercial availability while requiring substantial investments in manufacturing process development and scale-up activities.

Automotive manufacturers benefit from domestic anode production through enhanced supply chain security and reduced logistics costs. Local sourcing eliminates international shipping delays while enabling closer collaboration on technology development and customization. Quality control improvements result from direct supplier relationships and reduced supply chain complexity.

Battery manufacturers gain competitive advantages through access to advanced anode materials and manufacturing expertise. Domestic suppliers offer faster response times for technical support and product modifications while reducing currency exchange risks. Innovation partnerships accelerate technology development while sharing research and development costs.

Technology companies monetize intellectual property through licensing agreements and joint ventures with established manufacturers. Market access opportunities expand through partnerships while reducing capital requirements for manufacturing facility development. Revenue diversification across multiple market segments reduces business risks while building sustainable competitive positions.

Investors participate in high-growth market opportunities while supporting domestic manufacturing development and energy independence objectives. Government incentives enhance investment returns through tax credits and grants while reducing project risks. Portfolio diversification across the electric vehicle value chain creates multiple value creation opportunities.

Regional economies benefit from high-value manufacturing job creation and economic development activities. Workforce development programs create career opportunities in advanced manufacturing while building technical capabilities for future industry growth. Tax revenue generation supports community development while attracting additional investments in supporting industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Silicon integration acceleration dominates current market trends as manufacturers pursue enhanced energy density while maintaining manufacturing scalability. Silicon-enhanced graphite anodes deliver significant performance improvements with capacity increases reaching 35% compared to conventional materials. Technology refinement focuses on optimizing silicon particle size and distribution while addressing expansion-related challenges during charge cycles.

Manufacturing automation advancement transforms anode production processes through artificial intelligence and machine learning integration. Automated quality control systems ensure consistent material properties while reducing production costs and improving manufacturing efficiency. Process optimization algorithms continuously refine production parameters based on real-time performance data and quality measurements.

Sustainability initiatives gain prominence as manufacturers pursue environmental responsibility and circular economy principles. Recycling programs recover valuable materials from end-of-life batteries while reducing waste and environmental impact. Carbon footprint reduction efforts focus on renewable energy integration and process efficiency improvements throughout the manufacturing value chain.

Solid-state battery preparation drives research and development activities as companies position for next-generation battery technology adoption. Solid-state anodes promise enhanced safety, faster charging, and improved energy density compared to conventional liquid electrolyte systems. Technology development timelines target commercial availability within 3-5 years for automotive applications.

Supply chain localization accelerates as manufacturers seek to reduce international dependencies and improve supply security. Domestic raw material processing capabilities expand while strategic partnerships ensure reliable material supplies. Vertical integration strategies enable greater control over quality and costs while reducing supply chain complexity.

Manufacturing capacity expansion continues across multiple states as companies respond to growing market demand and policy incentives. Major facility announcements in Georgia, Michigan, and North Carolina create substantial production capabilities while generating employment opportunities. Investment commitments exceed billions of dollars in aggregate, demonstrating industry confidence in market growth prospects.

Technology partnerships between automotive manufacturers and anode suppliers accelerate innovation while ensuring supply chain security. Joint development programs focus on customized anode solutions optimized for specific vehicle platforms and performance requirements. Strategic alliances enable risk sharing while accelerating time-to-market for advanced technologies.

Regulatory framework development provides clarity and support for domestic manufacturing investments. The Department of Energy announces funding programs supporting anode technology development while establishing performance standards and safety requirements. Policy coordination between federal and state agencies ensures consistent support for industry development.

Research breakthrough announcements from universities and national laboratories advance fundamental understanding of anode materials and manufacturing processes. MarkWide Research analysis indicates accelerating innovation cycles with patent filings increasing substantially across silicon-based and solid-state anode technologies. Technology transfer programs facilitate commercialization of laboratory discoveries through industry partnerships.

International collaboration initiatives establish technology sharing agreements with allied nations while maintaining domestic manufacturing priorities. Research partnerships with European and Asian institutions accelerate technology development while building global market access opportunities.

Strategic positioning recommendations emphasize technology differentiation and manufacturing excellence as key success factors in the competitive United States electric vehicle battery anode market. Companies should focus on developing proprietary anode formulations while building scalable production capabilities that support long-term market growth. Investment priorities should balance near-term silicon-enhanced graphite opportunities with longer-term solid-state anode development.

Partnership development strategies should prioritize relationships with automotive manufacturers and battery producers to ensure market access and technology validation. Supply chain integration initiatives should focus on securing reliable raw material supplies while building domestic processing capabilities. Strategic alliances with research institutions accelerate innovation while sharing development costs and risks.

Manufacturing optimization efforts should emphasize automation and quality control systems that ensure consistent product performance while reducing production costs. Sustainability integration should include recycling capabilities and renewable energy utilization to meet environmental requirements and customer expectations. Workforce development programs ensure adequate skilled personnel for manufacturing operations and technology development activities.

Market diversification strategies should explore applications beyond passenger vehicles including commercial trucks, energy storage systems, and specialty applications. Technology roadmapping should align development activities with automotive industry electrification timelines while maintaining flexibility for emerging opportunities. International expansion planning should leverage domestic technology advantages while building global market presence.

Risk management approaches should address supply chain vulnerabilities, technology transition uncertainties, and competitive pressures through diversified strategies and contingency planning. Financial planning should account for substantial capital requirements while leveraging available government incentives and private investment opportunities.

Market trajectory for the United States electric vehicle battery anode sector indicates sustained growth driven by accelerating electric vehicle adoption and domestic manufacturing development. MarkWide Research projections suggest the market will experience robust expansion with compound annual growth rates exceeding 25% through the next decade. Technology evolution toward silicon-enhanced and solid-state anodes will drive performance improvements while supporting premium market positioning.

Manufacturing capacity development will continue expanding across multiple regions as companies respond to growing demand and policy incentives. Domestic production capabilities will achieve substantial scale by 2030, reducing import dependencies while building technological leadership in advanced anode materials. Investment flows will maintain momentum through both private capital and government funding programs supporting technology development and manufacturing expansion.

Technology advancement will accelerate through continued research and development investments in next-generation anode materials. Silicon-based solutions will achieve mainstream adoption while solid-state anodes begin commercial deployment in premium applications. Performance improvements will enable electric vehicles with ranges exceeding 500 miles and charging times under 10 minutes for practical applications.

Application expansion beyond passenger vehicles will create additional market opportunities in commercial transportation, marine vessels, and stationary energy storage systems. Each segment will require specialized anode formulations optimized for specific performance requirements and operating conditions. Market diversification will reduce dependence on automotive applications while building sustainable revenue streams.

Sustainability integration will become increasingly important as manufacturers pursue circular economy principles and environmental responsibility. Recycling capabilities will mature to recover substantial portions of anode materials while renewable energy integration reduces manufacturing carbon footprints. Regulatory frameworks will continue supporting domestic manufacturing while ensuring environmental protection and worker safety standards.

The United States electric vehicle battery anode market represents a critical component of the nation’s transition toward sustainable transportation and energy independence. Market dynamics demonstrate exceptional growth potential driven by comprehensive policy support, substantial private investments, and accelerating consumer adoption of electric vehicles across multiple segments. Technology innovation continues advancing through silicon-enhanced graphite solutions and emerging solid-state anode materials that promise revolutionary performance improvements.

Manufacturing localization initiatives create domestic supply chain resilience while building competitive advantages in advanced materials and production processes. The integration of sustainability principles and circular economy approaches positions the market for long-term environmental and economic success. Strategic partnerships between automotive manufacturers, battery producers, and anode suppliers accelerate technology commercialization while ensuring supply chain security for critical battery components.

Future prospects indicate sustained market expansion as electric vehicle adoption accelerates and technology capabilities continue advancing. The successful development of domestic anode manufacturing capabilities will support national energy security objectives while creating high-value employment opportunities and economic development benefits across multiple regions. Investment opportunities remain substantial for companies pursuing technology leadership and manufacturing excellence in this rapidly evolving market sector.

What is Electric Vehicle Battery Anode?

Electric Vehicle Battery Anode refers to the component in a battery that allows the flow of lithium ions during the charging and discharging process. It plays a crucial role in the performance and efficiency of electric vehicle batteries.

What are the key players in the United States Electric Vehicle Battery Anode Market?

Key players in the United States Electric Vehicle Battery Anode Market include companies like Tesla, Panasonic, and LG Chem, which are known for their advancements in battery technology and production capabilities, among others.

What are the growth factors driving the United States Electric Vehicle Battery Anode Market?

The growth of the United States Electric Vehicle Battery Anode Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government incentives promoting sustainable transportation.

What challenges does the United States Electric Vehicle Battery Anode Market face?

Challenges in the United States Electric Vehicle Battery Anode Market include the high cost of raw materials, supply chain disruptions, and the need for improved recycling methods for battery components.

What opportunities exist in the United States Electric Vehicle Battery Anode Market?

Opportunities in the United States Electric Vehicle Battery Anode Market include the development of new materials for anodes, such as silicon-based compounds, and the expansion of charging infrastructure to support electric vehicle adoption.

What trends are shaping the United States Electric Vehicle Battery Anode Market?

Trends in the United States Electric Vehicle Battery Anode Market include the shift towards sustainable materials, innovations in battery chemistry, and the increasing integration of artificial intelligence in battery management systems.

United States Electric Vehicle Battery Anode Market

| Segmentation Details | Description |

|---|---|

| Product Type | Graphite, Silicon, Lithium Titanate, Composite |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Technology | Dry Coating, Wet Coating, Chemical Vapor Deposition, Mechanical Milling |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Electric Vehicle Battery Anode Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at