444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States electric vegetable choppers market represents a rapidly expanding segment within the broader kitchen appliance industry, driven by increasing consumer demand for convenient food preparation solutions. Electric vegetable choppers have gained significant traction among American households as busy lifestyles and health-conscious eating habits converge to create substantial market opportunities. The market demonstrates robust growth potential with an estimated CAGR of 8.2% projected through the forecast period, reflecting strong consumer adoption across diverse demographic segments.

Market dynamics indicate that technological advancements in motor efficiency, blade design, and safety features are reshaping consumer preferences and driving product innovation. The integration of smart features, improved durability, and enhanced user experience has positioned electric vegetable choppers as essential kitchen appliances rather than luxury items. Consumer behavior analysis reveals that approximately 73% of American households now prioritize time-saving kitchen appliances, with electric vegetable choppers ranking among the top five most desired food preparation tools.

Regional distribution across the United States shows concentrated demand in urban and suburban markets, where busy professionals and health-conscious families represent the primary consumer base. The market benefits from strong retail infrastructure, including both traditional brick-and-mortar stores and rapidly expanding e-commerce platforms that facilitate product accessibility and consumer education.

The United States electric vegetable choppers market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail sale of electrically powered kitchen appliances specifically designed for chopping, dicing, mincing, and processing vegetables and similar food items within the American consumer market. These devices utilize electric motors to power sharp rotating or oscillating blades that efficiently process various vegetables into desired sizes and consistencies.

Electric vegetable choppers distinguish themselves from manual alternatives through their ability to process larger quantities of vegetables quickly and consistently, reducing preparation time and physical effort required for meal preparation. The market encompasses various product categories, including compact personal choppers, mid-size family units, and commercial-grade processors designed for heavy-duty use in residential kitchens.

Market scope includes both corded and cordless models, featuring diverse capacity ranges, multiple speed settings, and specialized attachments for different cutting styles. The definition extends to encompass related accessories, replacement parts, and complementary products that enhance the overall user experience and extend product lifecycle value.

Market performance in the United States electric vegetable choppers sector demonstrates exceptional growth momentum, driven by evolving consumer lifestyles and increasing emphasis on healthy home cooking. The market benefits from strong demographic trends, including rising dual-income households, growing health consciousness, and increasing adoption of meal preparation practices among younger consumers.

Key growth drivers include technological innovations in motor design, blade efficiency, and safety mechanisms that have significantly improved product performance and user satisfaction. The market experiences particularly strong demand during peak cooking seasons and holiday periods, with seasonal sales spikes of up to 45% during traditional cooking-intensive periods.

Competitive landscape features a mix of established kitchen appliance manufacturers and emerging specialty brands, each competing on factors including price point, feature differentiation, brand reputation, and customer service quality. The market demonstrates healthy competition that drives continuous innovation and competitive pricing strategies beneficial to consumers.

Distribution channels have evolved significantly, with e-commerce platforms capturing an increasing share of total sales volume while traditional retail maintains strong presence in demonstration-dependent product categories. The integration of online and offline retail strategies has created comprehensive customer touchpoints that support informed purchasing decisions.

Consumer preferences analysis reveals several critical insights shaping market development and product innovation strategies:

Market segmentation reveals distinct consumer clusters with varying needs, preferences, and purchasing behaviors that require targeted marketing and product development approaches.

Primary market drivers propelling growth in the United States electric vegetable choppers market stem from fundamental shifts in American lifestyle patterns and consumer priorities. The increasing prevalence of dual-income households has created substantial demand for time-saving kitchen appliances that streamline meal preparation without compromising food quality or nutritional value.

Health consciousness trends represent another significant driver, as more Americans embrace home cooking as a means of controlling ingredient quality, reducing processed food consumption, and maintaining healthier dietary habits. The growing popularity of meal preparation practices, particularly among millennials and Gen Z consumers, has created sustained demand for efficient food processing tools that facilitate batch cooking and weekly meal planning.

Technological advancement in motor efficiency, blade design, and safety features has enhanced product appeal and functionality, making electric vegetable choppers more attractive to previously hesitant consumers. Improved noise reduction, enhanced durability, and better performance consistency have addressed historical consumer concerns and expanded market accessibility.

Demographic shifts including aging population segments seeking easier food preparation methods and increasing urbanization creating smaller living spaces with premium kitchen efficiency requirements continue driving market expansion. The rise of cooking shows, social media food content, and celebrity chef influence has also contributed to increased interest in kitchen gadgets and food preparation tools.

Market constraints affecting the United States electric vegetable choppers market include several factors that may limit growth potential or create challenges for market participants. Price sensitivity among certain consumer segments, particularly in economic uncertainty periods, can restrict premium product adoption and limit market expansion in price-conscious demographics.

Kitchen space limitations in urban apartments and smaller homes create storage challenges that may discourage purchases of additional appliances, especially among consumers with limited counter and cabinet space. The perception of electric vegetable choppers as non-essential luxury items rather than necessary kitchen tools can also limit market penetration in certain consumer segments.

Competition from alternatives including traditional manual choppers, food processors, and multi-functional kitchen appliances creates market share pressure and requires continuous differentiation efforts. Some consumers prefer manual control over food preparation processes, viewing electric alternatives as unnecessary or overly complicated for simple tasks.

Maintenance concerns related to cleaning difficulty, blade replacement costs, and potential mechanical failures can deter some consumers, particularly those who prioritize low-maintenance kitchen tools. Additionally, noise concerns in apartment living situations and energy consumption considerations may influence purchase decisions among environmentally conscious consumers.

Emerging opportunities in the United States electric vegetable choppers market present significant potential for growth and innovation. The increasing adoption of smart home technology creates opportunities for connected appliances featuring app integration, recipe suggestions, and automated settings that enhance user experience and convenience.

Sustainable product development represents a growing opportunity as environmentally conscious consumers seek energy-efficient models, recyclable materials, and durable construction that reduces replacement frequency. The development of cordless models with improved battery technology addresses portability needs and eliminates cord management issues in modern kitchen designs.

Specialty market segments including senior-friendly designs with enhanced safety features, ergonomic handles, and simplified controls present untapped potential. The growing interest in international cuisines creates opportunities for specialized attachments and cutting styles that accommodate diverse cooking traditions and food preparation techniques.

E-commerce expansion continues offering opportunities for direct-to-consumer sales, subscription-based replacement part services, and enhanced customer education through video demonstrations and virtual product trials. The integration of artificial intelligence for personalized product recommendations and usage optimization represents an emerging frontier for market differentiation.

Market dynamics in the United States electric vegetable choppers sector reflect complex interactions between consumer behavior, technological innovation, competitive pressures, and broader economic factors. Supply chain considerations including component sourcing, manufacturing efficiency, and distribution logistics significantly impact product availability, pricing strategies, and market responsiveness to demand fluctuations.

Consumer education plays a crucial role in market development, as many potential buyers lack familiarity with electric vegetable chopper capabilities, benefits, and proper usage techniques. Effective demonstration strategies, both in retail environments and through digital channels, directly influence conversion rates and customer satisfaction levels.

Seasonal demand patterns create predictable market rhythms, with increased sales during holiday cooking seasons, back-to-school periods, and New Year health resolution timeframes. These patterns require strategic inventory management, marketing timing, and promotional planning to maximize revenue opportunities and maintain market share.

Innovation cycles driven by technological advancement and competitive differentiation create continuous pressure for product improvement and feature enhancement. According to MarkWide Research analysis, successful market participants invest approximately 12-15% of revenue in research and development to maintain competitive positioning and meet evolving consumer expectations.

Research approach for analyzing the United States electric vegetable choppers market employs comprehensive methodological frameworks combining quantitative data analysis, qualitative consumer insights, and industry expert perspectives. Primary research components include consumer surveys, focus groups, retailer interviews, and manufacturer consultations that provide direct market intelligence and trend identification.

Secondary research encompasses analysis of industry reports, trade publications, patent filings, and regulatory documentation that offers broader market context and historical trend analysis. Data triangulation methods ensure accuracy and reliability of market insights by cross-referencing multiple information sources and validation techniques.

Market sizing methodologies utilize bottom-up and top-down approaches, incorporating retail sales data, import/export statistics, and manufacturer shipment information to develop comprehensive market understanding. Consumer behavior analysis employs demographic segmentation, psychographic profiling, and purchase pattern analysis to identify market drivers and growth opportunities.

Forecasting models integrate historical performance data, current market indicators, and projected trend analysis to develop realistic growth projections and scenario planning. The methodology incorporates economic indicators, demographic shifts, and technological advancement timelines to ensure forecast accuracy and practical applicability for strategic planning purposes.

Regional market distribution across the United States reveals distinct patterns reflecting demographic characteristics, economic conditions, and cultural preferences that influence electric vegetable chopper adoption and usage patterns. Northeast region demonstrates strong market penetration with approximately 28% market share, driven by high population density, elevated income levels, and busy urban lifestyles that prioritize convenience appliances.

West Coast markets including California, Oregon, and Washington show robust demand patterns influenced by health-conscious consumer bases, innovative technology adoption, and strong e-commerce infrastructure. The region’s emphasis on organic foods, meal preparation trends, and kitchen innovation creates favorable conditions for premium product segments and feature-rich models.

Southern states represent emerging growth opportunities with increasing urbanization, rising disposable incomes, and evolving cooking traditions that incorporate modern convenience appliances. Traditional cooking cultures in the region create unique market dynamics requiring culturally sensitive marketing approaches and product positioning strategies.

Midwest region demonstrates steady market growth supported by family-oriented demographics, value-conscious purchasing behaviors, and strong retail infrastructure. The region’s emphasis on practical functionality over premium features creates opportunities for mid-range product segments that balance performance with affordability.

Competitive environment in the United States electric vegetable choppers market features diverse participants ranging from established kitchen appliance manufacturers to specialized food preparation equipment companies. Market leaders leverage brand recognition, distribution networks, and product innovation capabilities to maintain competitive advantages and market share positions.

Competitive strategies emphasize product differentiation through feature innovation, safety enhancements, and user experience improvements that create sustainable competitive advantages and customer loyalty.

Market segmentation analysis reveals multiple classification approaches that provide strategic insights for product development, marketing positioning, and distribution strategies. By capacity, the market divides into personal/small (1-2 cups), family/medium (3-4 cups), and large/commercial (5+ cups) segments, with medium capacity units representing the largest market share at approximately 52% of total sales.

By price range, segmentation includes budget ($15-30), mid-range ($31-60), and premium ($61+) categories, with mid-range products capturing the majority of consumer purchases due to balanced feature sets and perceived value propositions. By power source, the market segments into corded and cordless models, with corded units maintaining dominance due to consistent power delivery and lower costs.

By distribution channel, segmentation encompasses online retail, specialty kitchen stores, department stores, warehouse clubs, and direct-to-consumer sales. Online channels demonstrate rapid growth with e-commerce representing 38% of total market volume, reflecting changing consumer shopping preferences and convenience priorities.

By consumer demographics, key segments include young professionals (25-35), established families (35-50), and mature households (50+), each demonstrating distinct preferences for features, pricing, and brand positioning that require targeted marketing approaches.

Product category analysis reveals distinct performance patterns and consumer preferences across different electric vegetable chopper types and configurations. Compact personal choppers appeal primarily to single-person households, small families, and consumers with limited kitchen space, emphasizing portability, easy storage, and basic functionality at accessible price points.

Multi-function processors combining chopping, mincing, and blending capabilities represent the fastest-growing category, driven by consumer preferences for versatile appliances that maximize kitchen efficiency and minimize appliance proliferation. These units typically command premium pricing but deliver enhanced value through expanded functionality.

Safety-enhanced models featuring advanced blade guards, non-slip bases, and automatic shut-off mechanisms appeal particularly to households with children or elderly users, creating specialized market niches with specific design requirements and marketing messages.

Smart-enabled choppers with app connectivity, preset programs, and digital controls represent emerging premium segments targeting tech-savvy consumers willing to invest in connected kitchen ecosystems. While currently representing a small market share, this category demonstrates strong growth potential as smart home adoption accelerates.

Manufacturers in the United States electric vegetable choppers market benefit from growing consumer demand, technological innovation opportunities, and expanding distribution channels that support revenue growth and market expansion. The market’s relatively low barriers to entry for specialized features create opportunities for differentiation and premium positioning strategies.

Retailers gain advantages through strong product margins, consistent consumer demand, and cross-selling opportunities with complementary kitchen products and accessories. The demonstration-friendly nature of electric vegetable choppers supports in-store sales strategies and customer engagement initiatives that drive conversion rates.

Consumers benefit from increased product variety, competitive pricing, enhanced safety features, and improved performance capabilities that deliver superior value propositions compared to manual alternatives. Time savings, consistency improvements, and reduced physical effort represent primary consumer value drivers.

Supply chain partners including component suppliers, logistics providers, and service organizations benefit from stable demand patterns, growth opportunities, and long-term business relationships with established manufacturers. The market’s seasonal predictability supports inventory planning and resource allocation optimization.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological integration represents the most significant trend shaping the United States electric vegetable choppers market, with manufacturers increasingly incorporating smart features, app connectivity, and automated settings that enhance user experience and convenience. Voice control compatibility and integration with popular smart home ecosystems create new value propositions for tech-savvy consumers.

Sustainability focus drives product development toward energy-efficient motors, recyclable materials, and durable construction that extends product lifecycles and reduces environmental impact. Consumers increasingly consider environmental factors in purchasing decisions, creating competitive advantages for eco-friendly product designs.

Customization trends emphasize modular designs, interchangeable components, and specialized attachments that allow users to adapt products to specific needs and preferences. This trend supports premium pricing strategies while addressing diverse consumer requirements within single product platforms.

Health and safety enhancement continues driving innovation in blade guards, automatic shut-off mechanisms, and ergonomic designs that reduce injury risks and improve user confidence. MWR data indicates that safety-enhanced models demonstrate 23% higher customer satisfaction ratings compared to basic alternatives, supporting premium positioning strategies.

Recent industry developments highlight significant innovations and strategic initiatives that shape market evolution and competitive dynamics. Motor technology advancement has produced more powerful yet quieter units that address historical consumer concerns about noise levels while improving processing efficiency and speed.

Battery technology improvements in cordless models have extended operating times and reduced charging requirements, making portable units more practical for regular use. Advanced lithium-ion batteries now provide sufficient power for most household chopping tasks while maintaining compact form factors.

Safety innovation includes development of advanced blade guard systems, pressure-sensitive activation mechanisms, and automatic blade stopping technology that prevents accidents and increases user confidence. These developments particularly appeal to households with children or elderly users.

Design evolution emphasizes aesthetic integration with modern kitchen designs, featuring sleek profiles, premium materials, and color options that complement contemporary home décor. Manufacturers increasingly recognize that visual appeal significantly influences purchase decisions in competitive market segments.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing persistent challenges that limit market potential. Product differentiation through innovative features, superior performance, and enhanced user experience represents the most effective approach for maintaining competitive advantages in increasingly crowded market segments.

Distribution strategy optimization should emphasize omnichannel approaches that integrate online and offline retail experiences, providing consumers with comprehensive product information, demonstration opportunities, and convenient purchase options. Investment in e-commerce capabilities and digital marketing becomes increasingly critical for market success.

Consumer education initiatives can significantly impact market penetration by addressing knowledge gaps, demonstrating product benefits, and building confidence in electric vegetable chopper capabilities. Video content, social media engagement, and influencer partnerships provide effective channels for consumer education and brand building.

Market expansion strategies should target underserved demographic segments, including seniors seeking easier food preparation methods and busy professionals prioritizing meal preparation efficiency. Tailored product features and targeted marketing messages can unlock significant growth potential in these segments.

Market projections for the United States electric vegetable choppers market indicate sustained growth driven by demographic trends, technological innovation, and evolving consumer preferences. Long-term growth prospects remain positive with projected CAGR of 7.5-9.2% through the next five years, supported by increasing health consciousness, convenience priorities, and kitchen technology adoption.

Technology evolution will likely focus on artificial intelligence integration, predictive maintenance capabilities, and enhanced connectivity features that create more intelligent and user-friendly appliances. Smart features including automatic ingredient recognition, portion control assistance, and recipe integration represent emerging development areas.

Market maturation in established segments will drive innovation toward specialized applications, premium materials, and enhanced durability that justify higher price points and improve profit margins. Manufacturers will increasingly focus on value-added features rather than basic functionality improvements.

Demographic shifts including aging population growth and increasing urbanization will create new market opportunities requiring specialized product designs and targeted marketing approaches. According to MarkWide Research projections, the senior consumer segment alone could represent 25-30% of market growth over the next decade, driven by accessibility needs and convenience preferences.

The United States electric vegetable choppers market demonstrates robust growth potential supported by favorable demographic trends, technological innovation opportunities, and evolving consumer lifestyle preferences that prioritize convenience and health-conscious food preparation. Market dynamics indicate sustained expansion driven by increasing dual-income households, growing health awareness, and continuous product innovation that addresses consumer needs and preferences.

Competitive landscape evolution favors manufacturers that successfully balance innovation with affordability, safety with performance, and functionality with aesthetic appeal. The market rewards companies that invest in consumer education, distribution optimization, and strategic differentiation while maintaining competitive pricing strategies that appeal to diverse consumer segments.

Future success in this market will depend on manufacturers’ ability to anticipate and respond to changing consumer preferences, technological advancement opportunities, and emerging market segments that represent untapped growth potential. The integration of smart technology, sustainability considerations, and specialized design features will likely determine competitive positioning and market share distribution in coming years.

Overall market outlook remains optimistic, with strong fundamentals supporting continued growth and innovation that benefits consumers, manufacturers, and industry stakeholders. The United States electric vegetable choppers market is well-positioned to capitalize on emerging opportunities while addressing existing challenges through strategic innovation and market development initiatives.

What is Electric Vegetable Choppers?

Electric Vegetable Choppers are kitchen appliances designed to automate the chopping, slicing, and dicing of vegetables, making food preparation faster and more efficient. They are popular among home cooks and professional chefs for their convenience and time-saving capabilities.

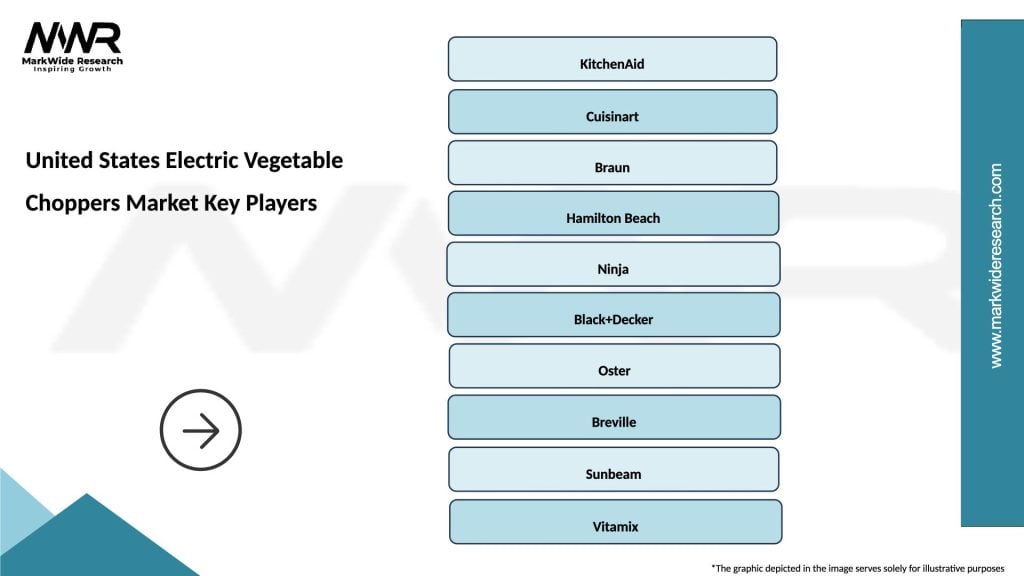

What are the key players in the United States Electric Vegetable Choppers Market?

Key players in the United States Electric Vegetable Choppers Market include companies like Cuisinart, Hamilton Beach, and KitchenAid, which offer a variety of models catering to different consumer needs. These companies focus on innovation and quality to maintain their competitive edge, among others.

What are the growth factors driving the United States Electric Vegetable Choppers Market?

The growth of the United States Electric Vegetable Choppers Market is driven by increasing consumer demand for convenience in food preparation, the rise of home cooking trends, and the growing popularity of healthy eating. Additionally, advancements in technology are enhancing the functionality of these appliances.

What challenges does the United States Electric Vegetable Choppers Market face?

Challenges in the United States Electric Vegetable Choppers Market include competition from manual chopping tools, consumer concerns about product durability, and the need for continuous innovation to meet changing consumer preferences. These factors can impact market growth and brand loyalty.

What opportunities exist in the United States Electric Vegetable Choppers Market?

Opportunities in the United States Electric Vegetable Choppers Market include the potential for product diversification, such as introducing multifunctional appliances that combine chopping with other cooking tasks. Additionally, targeting health-conscious consumers with features that promote healthy meal preparation can drive growth.

What trends are shaping the United States Electric Vegetable Choppers Market?

Trends in the United States Electric Vegetable Choppers Market include the increasing integration of smart technology, such as app connectivity and voice control, as well as a focus on sustainable materials in product design. These innovations are appealing to tech-savvy consumers and environmentally conscious buyers.

United States Electric Vegetable Choppers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Countertop Choppers, Handheld Choppers, Multi-functional Choppers, Commercial Choppers |

| Technology | Pulse Technology, Smart Technology, Manual Control, Automatic Control |

| End User | Households, Restaurants, Catering Services, Food Processing Units |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Wholesale Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Electric Vegetable Choppers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at