444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States electric space heaters market represents a dynamic and rapidly evolving segment within the broader heating, ventilation, and air conditioning (HVAC) industry. This market encompasses a diverse range of portable and fixed electric heating solutions designed to provide supplemental or primary heating for residential, commercial, and industrial spaces. The market has experienced substantial growth driven by increasing energy efficiency awareness, technological advancements, and changing consumer preferences toward convenient heating solutions.

Market dynamics indicate strong momentum with the sector experiencing a 6.2% compound annual growth rate (CAGR) over recent years. This growth trajectory reflects the increasing adoption of electric space heaters as energy-efficient alternatives to traditional heating systems. The market benefits from continuous innovation in heating technologies, including infrared heating, ceramic heating elements, and smart connectivity features that enhance user experience and energy management.

Consumer preferences have shifted significantly toward portable and programmable heating solutions that offer flexibility and cost-effectiveness. The market serves diverse applications ranging from residential supplemental heating to commercial space conditioning and industrial process heating. Regional variations in climate patterns, energy costs, and building infrastructure contribute to differentiated demand patterns across various states and metropolitan areas.

The United States electric space heaters market refers to the comprehensive ecosystem of electric heating devices designed to warm specific areas or spaces using electrical energy as the primary power source. These heating solutions convert electrical energy into thermal energy through various mechanisms including resistance heating, infrared radiation, and convection processes to provide targeted temperature control for indoor environments.

Electric space heaters encompass a broad spectrum of products including portable heaters, wall-mounted units, baseboard heaters, radiant panels, and industrial heating systems. The market includes both consumer-grade residential products and commercial-industrial heating solutions designed for larger spaces and specialized applications. These devices serve as either primary heating sources in smaller spaces or supplemental heating systems to enhance comfort in specific zones while potentially reducing overall energy consumption.

Market performance in the United States electric space heaters sector demonstrates robust expansion driven by multiple converging factors including energy efficiency initiatives, technological innovation, and evolving consumer heating preferences. The market benefits from increasing awareness of zone heating benefits, which allows users to heat specific areas rather than entire buildings, potentially reducing overall energy consumption by 15-25% compared to central heating systems.

Key market segments include residential portable heaters, commercial fixed installations, and industrial heating applications, each exhibiting distinct growth patterns and technological requirements. The residential segment dominates market share due to widespread adoption of portable heating solutions for supplemental warmth and energy cost management. Commercial and industrial segments show strong growth potential driven by facility modernization and energy efficiency mandates.

Technological advancement represents a primary market driver with manufacturers investing heavily in smart heating technologies, improved energy efficiency ratings, and enhanced safety features. The integration of IoT connectivity, programmable thermostats, and mobile app controls has transformed traditional space heaters into sophisticated climate management tools that appeal to tech-savvy consumers seeking convenience and energy optimization.

Strategic market insights reveal several critical trends shaping the United States electric space heaters landscape:

Primary market drivers propelling growth in the United States electric space heaters market include multiple interconnected factors that create sustained demand across various consumer segments. Energy cost management represents a fundamental driver as consumers seek ways to reduce heating expenses through targeted zone heating rather than heating entire buildings or homes.

Technological advancement serves as a significant growth catalyst with manufacturers developing increasingly sophisticated heating solutions that offer improved energy efficiency, enhanced safety features, and smart connectivity options. The integration of programmable thermostats, remote controls, and mobile app connectivity has transformed basic heating appliances into comprehensive climate management systems that appeal to modern consumers.

Climate variability across different regions of the United States creates consistent demand for supplemental heating solutions, particularly in areas experiencing unexpected cold snaps or in buildings with inadequate primary heating systems. The flexibility of electric space heaters to provide immediate, localized warmth makes them attractive solutions for addressing specific heating needs without major infrastructure modifications.

Building infrastructure challenges in older residential and commercial properties drive adoption of electric space heaters as cost-effective alternatives to expensive HVAC system upgrades. Many older buildings lack adequate heating distribution, making portable and fixed electric heaters practical solutions for achieving comfortable temperatures in specific areas.

Market constraints affecting the United States electric space heaters sector include several factors that may limit growth potential or create challenges for market participants. High electricity costs in certain regions can make electric heating less economical compared to natural gas or other heating alternatives, particularly for continuous or large-scale heating applications.

Safety concerns associated with electric heating devices, including fire risks and electrical hazards, create regulatory compliance requirements and consumer hesitation that may impact market adoption. Historical incidents involving space heater-related fires have led to increased safety regulations and consumer awareness campaigns that emphasize proper usage and safety precautions.

Energy grid limitations in some regions may restrict the widespread adoption of electric heating solutions, particularly during peak demand periods when electrical infrastructure faces capacity constraints. This challenge becomes more pronounced during extreme weather events when heating demand peaks coincide with overall electrical system stress.

Competition from alternative heating technologies, including natural gas heaters, heat pumps, and renewable heating solutions, creates market pressure and may limit growth in certain segments. The availability and cost-effectiveness of alternative heating options vary by region, influencing consumer preferences and market dynamics.

Emerging opportunities in the United States electric space heaters market present significant potential for growth and innovation across multiple dimensions. The increasing focus on energy efficiency and environmental sustainability creates opportunities for manufacturers to develop advanced heating technologies that minimize energy consumption while maximizing heating effectiveness.

Smart home integration represents a substantial opportunity as consumers increasingly adopt connected home technologies. Electric space heaters equipped with IoT capabilities, voice control compatibility, and integration with home automation systems can capture growing demand from tech-savvy consumers seeking comprehensive climate management solutions.

Commercial market expansion offers significant growth potential as businesses seek energy-efficient heating solutions for office spaces, retail environments, and industrial facilities. The trend toward flexible workspace design and zone-based climate control creates demand for sophisticated electric heating systems that can adapt to changing space utilization patterns.

Renewable energy integration presents opportunities for electric space heaters to benefit from the growing adoption of solar power and other renewable energy sources. As more consumers install solar panels and battery storage systems, electric heating becomes increasingly attractive as a way to utilize clean, self-generated electricity for heating needs.

Market dynamics in the United States electric space heaters sector reflect complex interactions between technological innovation, consumer behavior, regulatory requirements, and competitive pressures. The market demonstrates strong seasonal patterns with peak demand occurring during colder months, creating cyclical sales patterns that influence manufacturing, inventory management, and marketing strategies.

Consumer behavior patterns show increasing sophistication in heating product selection, with buyers considering factors beyond basic heating capacity including energy efficiency ratings, safety certifications, smart features, and design aesthetics. This evolution in consumer preferences drives manufacturers to invest in product differentiation and value-added features that justify premium pricing.

Regulatory influences play a significant role in shaping market dynamics through energy efficiency standards, safety requirements, and environmental regulations. The implementation of stricter efficiency standards has led to improved product performance across the market while potentially increasing manufacturing costs and product prices.

Supply chain considerations affect market dynamics through component availability, manufacturing costs, and distribution efficiency. The market has experienced supply chain disruptions that impact product availability and pricing, leading manufacturers to develop more resilient sourcing strategies and inventory management approaches.

Comprehensive research methodology employed in analyzing the United States electric space heaters market incorporates multiple data collection and analysis techniques to ensure accurate and reliable market insights. The research approach combines quantitative analysis of market data with qualitative assessment of industry trends, consumer behavior, and competitive dynamics.

Primary research activities include structured interviews with industry executives, manufacturers, distributors, and end-users to gather firsthand insights into market conditions, growth drivers, and emerging trends. These interviews provide valuable perspectives on market challenges, opportunities, and strategic priorities that shape industry direction.

Secondary research sources encompass industry reports, government statistics, trade association data, and company financial information to establish comprehensive market baselines and validate primary research findings. This multi-source approach ensures data accuracy and provides broader market context for analysis and projections.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market trends and identify growth opportunities. The research methodology incorporates scenario analysis to assess potential market outcomes under different economic and regulatory conditions, providing stakeholders with robust planning insights.

Regional market dynamics across the United States reveal significant variations in electric space heater adoption patterns, driven by climate differences, energy costs, building infrastructure, and local regulations. The Northeast region demonstrates strong market demand due to harsh winter conditions and high heating costs, with consumers seeking efficient supplemental heating solutions to reduce overall energy expenses.

Midwest markets show robust growth driven by extreme temperature variations and aging building infrastructure that benefits from supplemental heating solutions. This region accounts for approximately 28% of national market share due to consistent cold weather patterns and consumer preference for reliable backup heating options.

Western states present diverse market conditions with mountain regions showing strong demand for portable heating solutions while coastal areas demonstrate more moderate adoption patterns. The region’s focus on energy efficiency and environmental sustainability drives demand for high-efficiency electric heating products that align with local environmental priorities.

Southern markets exhibit growing adoption of electric space heaters despite generally warmer climates, driven by occasional cold weather events and the need for supplemental heating in poorly insulated buildings. The region shows 18% market share with growth potential as climate patterns become more variable and consumers seek flexible heating solutions.

Competitive dynamics in the United States electric space heaters market feature a diverse mix of established manufacturers, emerging technology companies, and specialized heating solution providers. The market structure includes both large multinational corporations and smaller niche players that focus on specific product categories or market segments.

Leading market participants include:

Market segmentation analysis reveals distinct categories within the United States electric space heaters market, each characterized by specific product features, target applications, and consumer preferences. Understanding these segments enables manufacturers and stakeholders to develop targeted strategies and optimize product offerings for specific market needs.

By Product Type:

By Technology:

Residential portable heaters represent the largest market category, driven by consumer demand for flexible, cost-effective heating solutions that can be moved between rooms as needed. This segment benefits from continuous innovation in safety features, energy efficiency, and smart connectivity options that enhance user experience and provide better value propositions.

Commercial fixed installations show strong growth potential as businesses invest in energy-efficient heating solutions for office spaces, retail environments, and hospitality facilities. This category emphasizes reliability, energy efficiency, and integration with building management systems to optimize operational costs and maintain comfortable environments.

Industrial heating applications require specialized solutions capable of handling demanding operational conditions while maintaining energy efficiency and safety standards. This segment focuses on high-capacity heating systems that can operate continuously in challenging environments while meeting strict regulatory requirements.

Smart heating solutions represent an emerging category that combines traditional heating functionality with advanced connectivity and control features. These products appeal to tech-savvy consumers seeking integration with home automation systems and remote monitoring capabilities that enable optimized energy management.

Industry participants in the United States electric space heaters market benefit from multiple value creation opportunities across the entire value chain. Manufacturers gain access to a large and growing market with diverse application segments that enable product portfolio diversification and revenue optimization strategies.

Technology innovation benefits include opportunities to develop differentiated products that command premium pricing while meeting evolving consumer demands for energy efficiency, safety, and convenience. The integration of smart technologies creates new revenue streams through value-added services and enhanced customer engagement.

Distribution partners benefit from strong seasonal demand patterns that create predictable sales cycles and inventory management opportunities. The market’s diverse product range enables retailers to serve multiple customer segments while optimizing shelf space and inventory investment.

End-user benefits include access to cost-effective heating solutions that provide flexibility, energy efficiency, and comfort enhancement. Consumers can achieve 20-30% energy savings through strategic zone heating while maintaining comfortable living and working environments.

Stakeholder advantages extend to energy utilities that benefit from load diversification and peak demand management opportunities. Electric space heaters can provide grid stability benefits when integrated with demand response programs and smart grid technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological convergence represents a dominant trend in the United States electric space heaters market, with manufacturers integrating smart connectivity, advanced sensors, and artificial intelligence capabilities into traditional heating products. This trend transforms basic heating appliances into sophisticated climate management systems that can learn user preferences and optimize energy consumption automatically.

Energy efficiency optimization continues as a primary market trend driven by consumer cost consciousness and environmental awareness. Manufacturers are developing heating solutions that achieve 95%+ energy conversion efficiency while incorporating features like programmable timers, occupancy sensors, and adaptive heating algorithms that minimize energy waste.

Design aesthetics evolution reflects changing consumer preferences for heating products that complement modern interior design trends. Manufacturers are investing in sleek, minimalist designs that blend seamlessly with contemporary home and office environments while maintaining superior heating performance.

Safety enhancement focus drives continuous improvement in product safety features including advanced tip-over protection, overheat sensors, cool-touch surfaces, and automatic shut-off mechanisms. According to MarkWide Research analysis, safety-certified products show 35% higher adoption rates compared to basic models.

Sustainability integration emerges as manufacturers develop heating solutions compatible with renewable energy sources and implement eco-friendly manufacturing processes. This trend aligns with broader environmental consciousness and regulatory initiatives promoting sustainable heating technologies.

Recent industry developments highlight the dynamic nature of the United States electric space heaters market with significant innovations, strategic partnerships, and market expansion initiatives shaping the competitive landscape. Major manufacturers are investing heavily in research and development to create next-generation heating solutions that address evolving consumer needs.

Product innovation breakthroughs include the development of hybrid heating systems that combine multiple heating technologies for optimal performance and efficiency. These advanced systems can automatically switch between convection, radiant, and infrared heating modes based on environmental conditions and user preferences.

Strategic partnerships between heating manufacturers and smart home technology companies are creating integrated solutions that seamlessly connect with popular home automation platforms. These collaborations enable voice control compatibility, smartphone app integration, and coordination with other smart home devices for comprehensive climate management.

Manufacturing expansion initiatives by leading companies include new production facilities and capacity increases to meet growing market demand. Several manufacturers have announced significant investments in domestic manufacturing capabilities to reduce supply chain dependencies and improve customer service.

Regulatory compliance advancements reflect industry efforts to exceed safety and efficiency standards through voluntary certification programs and enhanced testing protocols. These initiatives demonstrate manufacturer commitment to product quality and consumer safety while building market confidence.

Strategic recommendations for market participants in the United States electric space heaters sector emphasize the importance of innovation, differentiation, and customer-centric approaches to capture growth opportunities and maintain competitive advantages in an evolving market landscape.

Product development priorities should focus on integrating smart technologies, enhancing energy efficiency, and improving safety features while maintaining cost-effectiveness. Manufacturers should invest in modular design approaches that enable customization for different market segments and applications.

Market expansion strategies should target underserved segments including commercial applications, industrial heating, and specialty markets that offer higher margins and growth potential. Companies should develop specialized product lines tailored to specific industry requirements and regulatory standards.

Distribution optimization recommendations include strengthening online sales channels, expanding retail partnerships, and developing direct-to-consumer capabilities that provide better customer engagement and margin improvement opportunities. Digital marketing investments should emphasize product education and value proposition communication.

Technology investment priorities should focus on IoT connectivity, artificial intelligence integration, and energy management capabilities that differentiate products and create competitive advantages. Partnerships with technology companies can accelerate development timelines and reduce investment requirements.

Future market prospects for the United States electric space heaters industry appear highly favorable, with multiple growth drivers supporting sustained expansion across various market segments. The market is projected to maintain a strong growth trajectory of 6.5% CAGR over the next five years, driven by technological innovation, energy efficiency focus, and expanding application areas.

Technology evolution will continue transforming the market with advanced heating solutions incorporating artificial intelligence, machine learning, and predictive analytics to optimize energy consumption and user comfort. These innovations will create new value propositions and enable premium pricing strategies for manufacturers investing in advanced technologies.

Market expansion opportunities include growing adoption in commercial and industrial applications as businesses prioritize energy efficiency and flexible heating solutions. The integration of electric space heaters with renewable energy systems will create new market segments and growth opportunities aligned with sustainability trends.

Consumer behavior evolution toward smart home adoption and energy consciousness will drive demand for connected heating solutions that provide remote control, energy monitoring, and integration with home automation systems. MWR projects that smart-enabled heaters will represent 45% of market share by 2028.

Regulatory developments will likely emphasize higher efficiency standards and enhanced safety requirements, creating opportunities for manufacturers with advanced technologies while potentially challenging companies with basic product offerings. Proactive compliance and innovation will be essential for long-term market success.

The United States electric space heaters market represents a dynamic and growing sector with substantial opportunities for manufacturers, distributors, and stakeholders across the heating industry value chain. The market benefits from strong fundamental drivers including energy efficiency awareness, technological innovation, and diverse application requirements that support sustained growth and development.

Market evolution toward smart, connected heating solutions creates significant opportunities for companies investing in advanced technologies and customer-centric innovation. The integration of IoT capabilities, energy management features, and safety enhancements positions electric space heaters as essential components of modern climate control systems rather than simple heating appliances.

Strategic success factors include continuous innovation, market diversification, and strong customer relationships that enable companies to capture growth opportunities while navigating competitive challenges. The market rewards companies that can balance technological advancement with cost-effectiveness while maintaining high safety and reliability standards.

Long-term prospects remain highly positive as the market continues expanding through new applications, technological capabilities, and consumer adoption patterns. Companies positioned with innovative products, strong distribution networks, and customer-focused strategies are well-positioned to capitalize on the substantial growth opportunities within the United States electric space heaters market over the coming years.

What is Electric Space Heaters?

Electric space heaters are portable heating devices that use electricity to generate heat for small spaces. They are commonly used in residential and commercial settings to provide supplemental warmth during colder months.

What are the key players in the United States Electric Space Heaters Market?

Key players in the United States Electric Space Heaters Market include companies like De’Longhi, Lasko, and Honeywell, which offer a variety of electric space heating solutions for consumers, among others.

What are the main drivers of the United States Electric Space Heaters Market?

The main drivers of the United States Electric Space Heaters Market include the increasing demand for energy-efficient heating solutions, the rise in residential construction, and the growing trend of remote work leading to higher home heating needs.

What challenges does the United States Electric Space Heaters Market face?

Challenges in the United States Electric Space Heaters Market include regulatory compliance regarding energy efficiency standards, competition from alternative heating solutions, and consumer concerns about safety and energy costs.

What opportunities exist in the United States Electric Space Heaters Market?

Opportunities in the United States Electric Space Heaters Market include the development of smart heaters with IoT capabilities, increasing consumer awareness of energy-efficient products, and the potential for growth in the commercial sector.

What trends are shaping the United States Electric Space Heaters Market?

Trends shaping the United States Electric Space Heaters Market include the integration of advanced technologies such as smart thermostats, a focus on eco-friendly materials, and the growing popularity of compact and stylish designs that cater to modern consumer preferences.

United States Electric Space Heaters Market

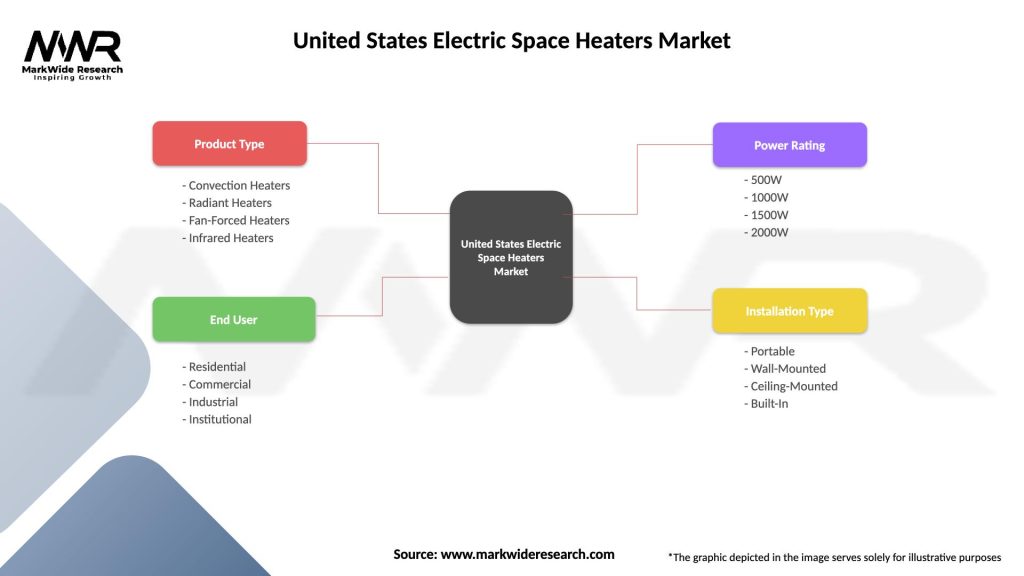

| Segmentation Details | Description |

|---|---|

| Product Type | Convection Heaters, Radiant Heaters, Fan-Forced Heaters, Infrared Heaters |

| End User | Residential, Commercial, Industrial, Institutional |

| Power Rating | 500W, 1000W, 1500W, 2000W |

| Installation Type | Portable, Wall-Mounted, Ceiling-Mounted, Built-In |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Electric Space Heaters Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at