444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States digital X-ray equipment market represents a transformative segment within the healthcare technology landscape, driven by rapid technological advancement and increasing demand for efficient diagnostic imaging solutions. Digital radiography systems have revolutionized medical imaging by replacing traditional film-based X-ray methods with sophisticated digital sensors and advanced image processing capabilities. The market encompasses a comprehensive range of equipment including computed radiography systems, direct radiography systems, and portable digital X-ray units that serve diverse healthcare settings from large hospital networks to specialized imaging centers.

Market dynamics indicate robust growth potential driven by several key factors including aging population demographics, increasing prevalence of chronic diseases, and growing emphasis on early disease detection. The integration of artificial intelligence and machine learning algorithms into digital X-ray systems has enhanced diagnostic accuracy while reducing examination times by approximately 40-50% compared to traditional methods. Healthcare providers are increasingly adopting these advanced systems to improve patient outcomes and operational efficiency.

Technological innovation continues to shape market evolution with developments in wireless detector technology, cloud-based image storage solutions, and mobile digital radiography systems. The market demonstrates strong growth trajectory with projected expansion at a compound annual growth rate of 6.2% through the forecast period, reflecting sustained investment in healthcare infrastructure modernization and diagnostic imaging capabilities across the United States.

The United States digital X-ray equipment market refers to the comprehensive ecosystem of advanced radiographic imaging systems, software solutions, and related technologies that enable healthcare providers to capture, process, and analyze X-ray images using digital sensors instead of traditional photographic film. This market encompasses the complete value chain from equipment manufacturing and distribution to installation, maintenance, and ongoing technical support services.

Digital X-ray technology fundamentally transforms the radiographic imaging process by converting X-ray photons directly into digital signals through specialized detector systems. These systems include computed radiography which uses photostimulable phosphor plates, and direct radiography which employs flat-panel detectors with either indirect or direct conversion methods. The resulting digital images can be immediately viewed, enhanced, stored, and transmitted electronically, eliminating the time-consuming film development process.

Market scope extends beyond hardware to include sophisticated software platforms for image processing, picture archiving and communication systems, and integrated radiology information systems. The convergence of these technologies creates comprehensive digital imaging solutions that enhance diagnostic capabilities while improving workflow efficiency and patient care delivery across diverse healthcare environments.

Strategic market analysis reveals the United States digital X-ray equipment market as a dynamic and rapidly evolving sector characterized by continuous technological innovation and strong adoption rates across healthcare facilities. The market benefits from favorable regulatory environment, substantial healthcare spending, and increasing focus on value-based care delivery models that emphasize diagnostic accuracy and operational efficiency.

Key market drivers include the growing geriatric population requiring frequent diagnostic imaging, rising incidence of chronic diseases such as cardiovascular conditions and orthopedic disorders, and increasing awareness about early disease detection benefits. Healthcare digitization initiatives have accelerated adoption rates, with digital X-ray systems now representing approximately 85% of new radiographic equipment installations in major healthcare facilities.

Competitive landscape features established medical device manufacturers alongside emerging technology companies developing innovative solutions in artificial intelligence integration, portable imaging systems, and cloud-based image management. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to expand their technological capabilities and market reach. Future growth prospects remain strong with projected market expansion driven by ongoing healthcare infrastructure investments and continued technological advancement in digital imaging capabilities.

Market penetration analysis reveals significant opportunities for continued growth as healthcare facilities upgrade aging radiographic equipment and expand diagnostic imaging capabilities. The following key insights shape market development:

Demographic transformation serves as a primary catalyst for market growth, with the aging United States population requiring increased diagnostic imaging services. The baby boomer generation entering advanced age categories creates sustained demand for radiographic examinations, particularly for orthopedic, cardiovascular, and respiratory conditions. This demographic shift drives healthcare facilities to invest in advanced digital X-ray systems capable of handling increased patient volumes efficiently.

Chronic disease prevalence continues expanding across the United States population, necessitating regular diagnostic monitoring and screening procedures. Conditions such as osteoporosis, arthritis, cardiovascular disease, and respiratory disorders require frequent radiographic assessment, creating consistent demand for digital imaging capabilities. Healthcare providers recognize that early detection through advanced imaging technologies improves patient outcomes while reducing long-term treatment costs.

Technological advancement in digital X-ray systems offers compelling value propositions including improved image quality, reduced examination times, and enhanced diagnostic capabilities. Modern systems provide immediate image availability, eliminating film processing delays and enabling faster clinical decision-making. Image enhancement software allows radiologists to manipulate digital images for optimal visualization, improving diagnostic accuracy and reducing the need for repeat examinations.

Healthcare digitization initiatives accelerate adoption of digital imaging technologies as medical facilities modernize their infrastructure to support electronic health records and integrated care delivery models. Government incentives and regulatory requirements encourage healthcare providers to implement digital systems that improve care coordination and patient safety while reducing administrative burdens.

Capital investment requirements represent a significant barrier for many healthcare facilities considering digital X-ray system upgrades. The substantial upfront costs associated with purchasing advanced digital equipment, installing supporting infrastructure, and training personnel can strain organizational budgets, particularly for smaller healthcare providers and rural facilities with limited financial resources.

Technical complexity of modern digital X-ray systems requires specialized expertise for operation, maintenance, and troubleshooting. Healthcare facilities must invest in comprehensive staff training programs and ongoing technical support, adding to operational costs. The learning curve associated with transitioning from traditional film-based systems to sophisticated digital platforms can temporarily impact productivity during implementation phases.

Cybersecurity concerns increasingly influence purchasing decisions as digital X-ray systems become integrated with hospital networks and cloud-based storage solutions. Healthcare organizations must implement robust data protection measures and comply with stringent HIPAA regulations, requiring additional investments in cybersecurity infrastructure and ongoing monitoring capabilities.

Regulatory compliance complexity creates challenges for both manufacturers and healthcare providers navigating evolving FDA requirements and quality standards. The approval process for new digital X-ray technologies can be lengthy and expensive, potentially delaying market introduction of innovative solutions. Healthcare facilities must ensure their systems maintain compliance with changing regulations, requiring ongoing investments in updates and modifications.

Artificial intelligence integration presents substantial growth opportunities as healthcare providers seek advanced diagnostic capabilities that enhance accuracy while reducing interpretation time. Machine learning algorithms can assist radiologists in identifying abnormalities, prioritizing urgent cases, and improving overall diagnostic workflow efficiency. Companies developing AI-powered digital X-ray solutions are positioned to capture significant market share as these technologies mature and gain regulatory approval.

Portable and mobile systems represent a rapidly expanding market segment driven by increasing demand for point-of-care imaging in emergency departments, intensive care units, and outpatient settings. The development of lightweight, battery-powered digital X-ray units enables healthcare providers to bring diagnostic capabilities directly to patients, improving care delivery efficiency and patient satisfaction.

Telemedicine expansion creates new opportunities for digital X-ray equipment manufacturers to develop systems optimized for remote consultation and teleradiology applications. The growing acceptance of virtual healthcare delivery models, accelerated by recent global health events, drives demand for digital imaging systems that support seamless image sharing and remote interpretation capabilities.

Emerging market segments including veterinary applications, industrial inspection, and security screening offer diversification opportunities for digital X-ray technology providers. These markets benefit from the same technological advantages driving healthcare adoption while providing additional revenue streams and reduced dependence on healthcare market cycles.

Supply chain evolution reflects the increasing sophistication of digital X-ray equipment manufacturing and distribution networks. Global component sourcing enables manufacturers to optimize costs while maintaining quality standards, though recent supply chain disruptions have highlighted the importance of diversified supplier relationships and domestic manufacturing capabilities.

Competitive intensity continues escalating as established medical device companies face competition from innovative technology startups developing specialized solutions for niche applications. This dynamic environment drives continuous innovation and competitive pricing strategies, ultimately benefiting healthcare providers through improved product offerings and value propositions.

Technology convergence creates new market dynamics as digital X-ray systems integrate with broader healthcare technology ecosystems including electronic health records, clinical decision support systems, and population health management platforms. This integration trend requires manufacturers to develop comprehensive solutions rather than standalone equipment, influencing product development strategies and partnership arrangements.

Regulatory landscape evolution impacts market dynamics through changing approval processes, quality standards, and safety requirements. FDA modernization initiatives aim to accelerate approval timelines for innovative medical devices while maintaining rigorous safety standards, potentially benefiting companies with strong regulatory expertise and compliance capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United States digital X-ray equipment market. Primary research activities include structured interviews with healthcare administrators, radiologists, and medical equipment procurement specialists across diverse healthcare settings including academic medical centers, community hospitals, and specialized imaging facilities.

Secondary research components encompass analysis of industry publications, regulatory filings, patent databases, and clinical research studies to understand technological trends and market developments. Market sizing methodologies utilize bottom-up approaches analyzing equipment installation data, replacement cycles, and capacity expansion trends across different healthcare facility types.

Data validation processes ensure research accuracy through triangulation of multiple information sources and expert review panels comprising industry professionals with extensive experience in medical imaging markets. Quantitative analysis incorporates statistical modeling to project market trends and growth trajectories based on historical data patterns and identified market drivers.

Market segmentation analysis examines various dimensions including technology type, application area, end-user category, and geographic distribution to provide comprehensive market understanding. This multi-dimensional approach enables identification of specific growth opportunities and market dynamics affecting different segments within the broader digital X-ray equipment market.

Geographic distribution of the United States digital X-ray equipment market reveals significant regional variations driven by healthcare infrastructure density, population demographics, and economic factors. The Northeast region demonstrates strong market presence with approximately 28% market share due to high concentration of major medical centers, academic institutions, and specialty healthcare facilities requiring advanced diagnostic imaging capabilities.

West Coast markets including California, Washington, and Oregon represent approximately 25% of national demand, driven by large population centers, innovative healthcare systems, and strong technology adoption rates. These regions often serve as early adopters of cutting-edge digital X-ray technologies, influencing national market trends and product development priorities.

Southeast regional markets show robust growth potential with expanding healthcare infrastructure and increasing population growth rates. States such as Florida, Texas, and North Carolina demonstrate strong demand for digital X-ray equipment driven by aging populations and healthcare facility expansion projects. This region accounts for approximately 22% of market activity with continued growth expected.

Midwest and Mountain regions collectively represent the remaining market share, characterized by diverse healthcare delivery models ranging from large urban medical centers to rural critical access hospitals. These markets often prioritize cost-effective solutions and systems capable of serving diverse patient populations across geographic distances, creating demand for portable and versatile digital X-ray systems.

Market leadership in the United States digital X-ray equipment sector is characterized by a mix of established medical device manufacturers and innovative technology companies developing specialized solutions. The competitive environment drives continuous innovation and strategic positioning as companies seek to differentiate their offerings through advanced features, superior image quality, and comprehensive service support.

Strategic partnerships and acquisition activities continue shaping the competitive landscape as companies seek to expand their technological capabilities and market reach. Collaboration initiatives between equipment manufacturers and software developers create integrated solutions that address evolving healthcare provider needs for comprehensive digital imaging platforms.

Technology-based segmentation reveals distinct market categories with varying growth trajectories and application requirements. Direct radiography systems represent the largest segment due to superior image quality, immediate image availability, and workflow efficiency advantages. These systems utilize flat-panel detectors that convert X-ray photons directly into digital signals, eliminating intermediate conversion steps.

Computed radiography systems maintain significant market presence, particularly in healthcare facilities transitioning from film-based systems. These systems use photostimulable phosphor plates that can be integrated with existing X-ray equipment, providing cost-effective digitization solutions for budget-conscious healthcare providers.

Application-based segmentation encompasses diverse medical specialties and diagnostic requirements:

End-user segmentation reflects diverse healthcare delivery environments with varying equipment requirements and purchasing patterns. Hospitals represent the largest end-user segment, requiring comprehensive digital X-ray solutions capable of handling high patient volumes and diverse clinical applications.

Stationary digital X-ray systems dominate the market due to their comprehensive capabilities and integration with existing healthcare infrastructure. These systems offer superior image quality, advanced processing capabilities, and seamless connectivity with hospital information systems. Installation flexibility allows healthcare facilities to configure systems according to specific workflow requirements and space constraints.

Portable digital X-ray systems demonstrate exceptional growth potential driven by increasing demand for bedside imaging and emergency department applications. These systems provide diagnostic capabilities in situations where patient transport is challenging or inadvisable, improving care delivery efficiency and patient satisfaction. Battery technology improvements and weight reduction initiatives enhance system portability and usability.

Retrofit digital X-ray solutions serve healthcare facilities seeking to upgrade existing analog systems without complete equipment replacement. These solutions typically involve installing digital detectors and processing systems that work with existing X-ray generators, providing cost-effective digitization pathways for budget-conscious organizations.

Specialized imaging systems address specific clinical requirements including chest imaging, extremity imaging, and pediatric applications. These systems incorporate specialized features such as automatic exposure control, pediatric dose reduction protocols, and ergonomic design elements that enhance clinical workflow and patient comfort.

Healthcare providers realize substantial operational benefits from digital X-ray system adoption including improved workflow efficiency, reduced examination times, and enhanced diagnostic capabilities. Immediate image availability eliminates film processing delays, enabling faster clinical decision-making and improved patient throughput. Image quality enhancements through digital processing reduce the need for repeat examinations, improving patient satisfaction while reducing radiation exposure.

Radiologists and imaging professionals benefit from advanced image manipulation capabilities, computer-aided detection tools, and seamless integration with picture archiving and communication systems. Digital systems enable remote image interpretation, supporting teleradiology applications and flexible work arrangements. Workflow optimization features reduce administrative tasks and improve diagnostic productivity.

Patients experience improved care delivery through reduced waiting times, lower radiation exposure, and enhanced diagnostic accuracy. Digital image sharing capabilities facilitate care coordination between multiple healthcare providers, reducing the need for repeat examinations and improving treatment continuity. Portable imaging options minimize patient transport requirements, particularly beneficial for critically ill or mobility-impaired individuals.

Healthcare administrators achieve operational improvements through reduced film and processing costs, improved space utilization, and enhanced regulatory compliance capabilities. Digital archiving eliminates physical storage requirements while providing secure, searchable image databases. Integration capabilities with existing healthcare information systems support comprehensive electronic health record implementation and meaningful use requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the digital X-ray equipment market. Machine learning algorithms are increasingly incorporated into imaging systems to assist with image analysis, abnormality detection, and diagnostic workflow optimization. These AI-powered capabilities can reduce interpretation time by approximately 30-40% while improving diagnostic accuracy and consistency.

Cloud-based image management solutions are gaining traction as healthcare providers seek scalable, cost-effective alternatives to traditional on-premise picture archiving and communication systems. Cloud storage offers advantages including reduced infrastructure costs, improved accessibility, and enhanced disaster recovery capabilities. Hybrid cloud models provide flexibility while addressing security and compliance concerns.

Mobile and portable system advancement continues driven by demand for point-of-care imaging capabilities. Modern portable systems offer image quality approaching stationary systems while providing unprecedented mobility and ease of use. Wireless connectivity and battery technology improvements enhance system functionality and clinical utility.

Dose reduction initiatives focus on minimizing patient radiation exposure while maintaining diagnostic image quality. Advanced image processing algorithms and detector technology improvements enable significant dose reductions compared to traditional systems. Pediatric imaging protocols receive particular attention due to increased radiation sensitivity in younger patients.

Recent technological breakthroughs have significantly enhanced digital X-ray system capabilities and market prospects. MarkWide Research analysis indicates that major manufacturers are investing heavily in artificial intelligence development and workflow optimization solutions to differentiate their product offerings and capture market share in competitive segments.

Regulatory approvals for innovative digital X-ray technologies continue accelerating market development. The FDA’s breakthrough device designation program has expedited approval processes for several advanced imaging systems incorporating AI capabilities and novel detector technologies. These approvals enable faster market introduction of innovative solutions addressing unmet clinical needs.

Strategic partnerships between equipment manufacturers and healthcare technology companies are creating comprehensive digital imaging ecosystems. These collaborations combine hardware expertise with software innovation to develop integrated solutions addressing evolving healthcare provider requirements for efficiency, accuracy, and connectivity.

Investment activities in digital X-ray technology development remain robust with venture capital funding supporting innovative startups developing specialized solutions for niche applications. Acquisition strategies by major medical device companies focus on acquiring AI capabilities, software expertise, and emerging technology platforms that complement existing product portfolios.

Strategic recommendations for market participants emphasize the importance of continuous innovation and customer-focused solution development. Healthcare providers should prioritize digital X-ray systems offering comprehensive integration capabilities, advanced AI features, and strong vendor support to maximize return on investment and clinical outcomes.

Technology development priorities should focus on artificial intelligence integration, workflow optimization, and cybersecurity enhancement to address evolving healthcare provider needs. Companies investing in these areas are positioned to capture significant market share as healthcare digitization accelerates and quality requirements increase.

Market entry strategies for new participants should emphasize specialized applications or underserved market segments where established competitors may have limited presence. Niche applications such as veterinary imaging, urgent care facilities, or mobile healthcare delivery offer opportunities for innovative companies to establish market presence.

Partnership development represents a critical success factor for companies seeking to expand their market reach and technological capabilities. Strategic alliances with healthcare IT companies, AI developers, and service providers can create comprehensive solutions addressing diverse customer requirements while leveraging complementary expertise and resources.

Long-term market prospects for the United States digital X-ray equipment market remain highly favorable driven by sustained healthcare infrastructure investment, technological innovation, and demographic trends supporting increased diagnostic imaging demand. MWR projections indicate continued market expansion with growth rates maintaining momentum through the forecast period as healthcare providers prioritize diagnostic accuracy and operational efficiency.

Technological evolution will continue transforming market dynamics with artificial intelligence capabilities becoming standard features rather than premium options. Next-generation systems will incorporate advanced AI algorithms for automated image analysis, predictive maintenance, and personalized imaging protocols optimized for individual patient characteristics and clinical requirements.

Market consolidation trends are expected to continue as larger companies acquire innovative technologies and smaller competitors to strengthen their market positions. This consolidation may result in more comprehensive product portfolios and integrated solutions while potentially reducing the number of independent equipment manufacturers in the market.

Emerging applications including point-of-care imaging, home healthcare delivery, and telemedicine integration will create new growth opportunities and market segments. These applications require specialized equipment characteristics including enhanced portability, simplified operation, and robust connectivity capabilities that may drive development of new product categories within the broader digital X-ray equipment market.

Market analysis reveals the United States digital X-ray equipment market as a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, demographic trends, and healthcare modernization initiatives. The transition from traditional film-based systems to sophisticated digital platforms represents a fundamental transformation in diagnostic imaging capabilities, offering significant benefits for healthcare providers, patients, and the broader healthcare system.

Key success factors for market participants include continuous innovation in artificial intelligence integration, workflow optimization, and cybersecurity capabilities while maintaining focus on cost-effectiveness and clinical utility. Companies that successfully balance technological advancement with practical healthcare provider needs are positioned to capture significant market share in this competitive environment.

Future market development will be shaped by evolving healthcare delivery models, regulatory requirements, and technological capabilities that continue expanding the potential applications and benefits of digital X-ray systems. The convergence of imaging technology with broader healthcare digitization trends creates opportunities for innovative solutions that address complex clinical challenges while improving operational efficiency and patient outcomes across diverse healthcare settings.

What is Digital X Ray Equipment?

Digital X Ray Equipment refers to advanced imaging technology that captures and processes X-ray images digitally, allowing for enhanced image quality, faster processing times, and improved diagnostic capabilities in various medical applications.

What are the key players in the United States Digital X Ray Equipment Market?

Key players in the United States Digital X Ray Equipment Market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems, among others.

What are the main drivers of growth in the United States Digital X Ray Equipment Market?

The growth of the United States Digital X Ray Equipment Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in imaging technology, and the rising demand for early diagnosis and preventive healthcare.

What challenges does the United States Digital X Ray Equipment Market face?

Challenges in the United States Digital X Ray Equipment Market include high initial costs of equipment, the need for skilled professionals to operate advanced systems, and regulatory hurdles that can delay product approvals.

What opportunities exist in the United States Digital X Ray Equipment Market?

Opportunities in the United States Digital X Ray Equipment Market include the growing adoption of telemedicine, the integration of artificial intelligence in imaging processes, and the expansion of outpatient care facilities that require advanced diagnostic tools.

What trends are shaping the United States Digital X Ray Equipment Market?

Trends in the United States Digital X Ray Equipment Market include the shift towards portable and mobile X-ray systems, the increasing use of cloud-based storage for imaging data, and the development of hybrid imaging technologies that combine X-ray with other modalities.

United States Digital X Ray Equipment Market

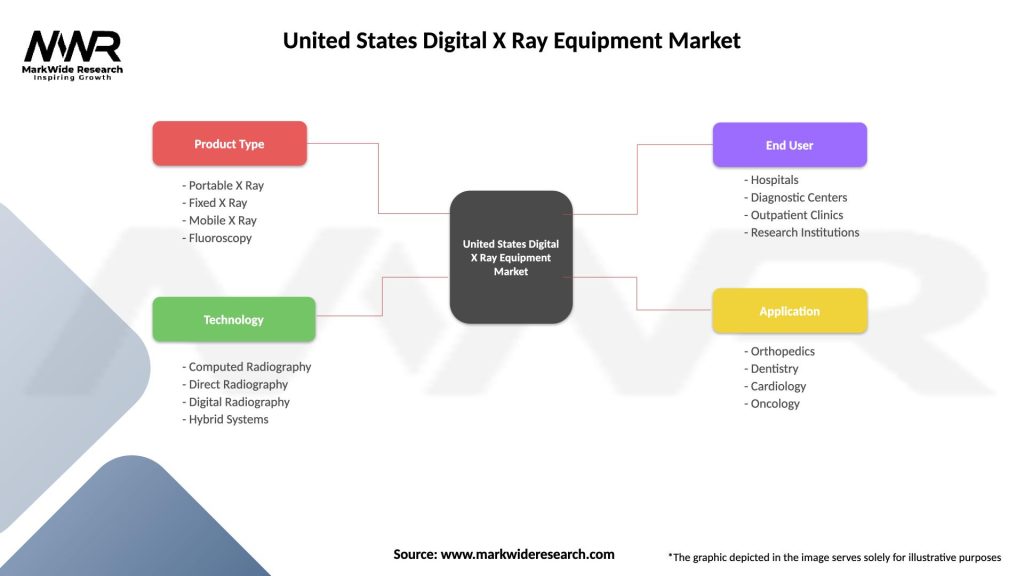

| Segmentation Details | Description |

|---|---|

| Product Type | Portable X Ray, Fixed X Ray, Mobile X Ray, Fluoroscopy |

| Technology | Computed Radiography, Direct Radiography, Digital Radiography, Hybrid Systems |

| End User | Hospitals, Diagnostic Centers, Outpatient Clinics, Research Institutions |

| Application | Orthopedics, Dentistry, Cardiology, Oncology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Digital X Ray Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at