444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States data center physical security market represents a critical component of the nation’s digital infrastructure protection landscape. As organizations increasingly rely on cloud computing, big data analytics, and digital transformation initiatives, the need for comprehensive physical security measures at data center facilities has reached unprecedented levels. Physical security systems encompass a wide range of technologies including biometric access controls, surveillance cameras, perimeter security, environmental monitoring, and intrusion detection systems designed to protect valuable digital assets and ensure operational continuity.

Market dynamics indicate robust growth driven by escalating cyber threats, regulatory compliance requirements, and the proliferation of edge computing facilities across the United States. The sector is experiencing a compound annual growth rate (CAGR) of 8.2%, reflecting the increasing investment in sophisticated security infrastructure. Enterprise organizations are prioritizing multi-layered security approaches that combine traditional physical barriers with advanced technological solutions to create comprehensive protection frameworks for their critical data center operations.

Regional distribution shows significant concentration in major metropolitan areas, with California, Texas, Virginia, and New York accounting for approximately 62% of total market activity. The growing adoption of hybrid cloud architectures and the expansion of hyperscale data centers are driving demand for integrated security solutions that can scale with evolving infrastructure requirements while maintaining the highest levels of protection against both physical and digital threats.

The United States data center physical security market refers to the comprehensive ecosystem of hardware, software, and services designed to protect data center facilities from unauthorized physical access, environmental threats, and security breaches. This market encompasses all tangible security measures implemented to safeguard critical IT infrastructure, including servers, networking equipment, storage systems, and supporting infrastructure components housed within data center environments.

Physical security solutions in this context include access control systems utilizing biometric authentication, smart card readers, and multi-factor verification protocols. Perimeter security involves fencing, barriers, vehicle access controls, and external surveillance systems that create the first line of defense. Interior security measures encompass video surveillance networks, motion detection systems, environmental monitoring for temperature and humidity control, fire suppression systems, and power monitoring solutions that ensure continuous operational security.

Market participants include security technology manufacturers, system integrators, managed security service providers, and specialized data center security consultants who collaborate to deliver comprehensive protection strategies. The market also encompasses ongoing maintenance, monitoring, and support services that ensure security systems remain effective against evolving threats and maintain compliance with industry standards and regulatory requirements.

Strategic market analysis reveals that the United States data center physical security market is experiencing transformative growth driven by digital transformation initiatives and increasing security awareness among enterprise organizations. Key market drivers include the rapid expansion of cloud computing adoption, which has increased by 34% annually among large enterprises, creating substantial demand for secure data center infrastructure capable of protecting sensitive digital assets and ensuring business continuity.

Technology evolution is reshaping market dynamics as organizations adopt artificial intelligence-powered security systems, advanced biometric authentication methods, and integrated security platforms that provide comprehensive threat detection and response capabilities. Regulatory compliance requirements, particularly in healthcare, financial services, and government sectors, are driving investments in sophisticated security infrastructure that meets stringent industry standards and audit requirements.

Competitive landscape features established security technology providers alongside innovative startups developing next-generation solutions for emerging threats. Market consolidation trends indicate increasing collaboration between traditional security vendors and cloud service providers to deliver integrated security solutions that address both physical and logical security requirements. Investment patterns show organizations allocating approximately 12-15% of their total data center budgets to physical security infrastructure, reflecting the critical importance of comprehensive protection strategies in today’s threat environment.

Market intelligence reveals several critical insights shaping the United States data center physical security landscape. Primary growth drivers include the exponential increase in data generation, edge computing deployment, and regulatory compliance requirements that mandate robust physical security measures for sensitive information protection.

Digital transformation initiatives across industries are creating unprecedented demand for secure data center infrastructure capable of supporting cloud computing, artificial intelligence, and big data analytics applications. Enterprise organizations are investing heavily in data center expansion to support digital business models, driving corresponding investments in comprehensive physical security systems that protect valuable digital assets and ensure operational continuity.

Regulatory compliance requirements represent a significant market driver as organizations in healthcare, financial services, and government sectors must adhere to stringent security standards. HIPAA, SOX, and federal security mandates require robust physical security measures that can withstand rigorous auditing processes and demonstrate effective protection against unauthorized access and data breaches.

Cyber threat evolution is driving increased awareness of physical security vulnerabilities as sophisticated attackers target data center facilities directly. Security professionals recognize that comprehensive protection strategies must address both digital and physical attack vectors, leading to investments in integrated security platforms that provide holistic threat detection and response capabilities.

Business continuity requirements are compelling organizations to implement redundant security systems that ensure continuous operation even during security incidents or system failures. Disaster recovery planning increasingly incorporates physical security considerations, driving demand for resilient security infrastructure that can maintain protection during emergency situations and support rapid recovery operations.

High implementation costs represent a significant barrier to market growth, particularly for small and medium-sized organizations with limited capital budgets. Comprehensive security systems require substantial upfront investments in hardware, software, installation, and ongoing maintenance, creating financial challenges for organizations seeking to upgrade legacy security infrastructure or implement new protection measures.

Technical complexity associated with modern security systems can create implementation challenges for organizations lacking specialized expertise. Integration requirements between different security technologies, existing IT infrastructure, and operational systems often require extensive customization and professional services, increasing project timelines and costs while potentially creating compatibility issues.

Skills shortage in cybersecurity and physical security domains limits organizational ability to effectively implement and manage sophisticated security systems. Qualified security professionals are in high demand, creating recruitment challenges and increasing labor costs for organizations seeking to build internal security capabilities or maintain complex security infrastructure.

Legacy system constraints can limit adoption of advanced security technologies in organizations with existing infrastructure investments. Retrofit challenges associated with upgrading older data center facilities to accommodate modern security systems may require significant facility modifications, creating additional costs and operational disruptions that delay security enhancement projects.

Edge computing expansion presents substantial growth opportunities as organizations deploy distributed data center architectures to support low-latency applications and improve user experiences. Edge facilities require scalable security solutions that can be rapidly deployed across multiple locations while maintaining centralized management and monitoring capabilities, creating demand for innovative security technologies and services.

Artificial intelligence integration offers significant opportunities for security technology providers to develop intelligent systems that can automatically detect threats, predict security incidents, and optimize security operations. Machine learning algorithms can enhance video surveillance, access control, and environmental monitoring systems, providing more effective protection while reducing operational overhead and false alarm rates.

Cloud security convergence creates opportunities for integrated solutions that address both physical and logical security requirements within unified platforms. Hybrid cloud architectures require security solutions that can seamlessly protect on-premises data centers while integrating with cloud-based security services, driving demand for innovative technologies that bridge traditional physical security and modern cloud security paradigms.

Managed security services represent a growing opportunity as organizations seek to outsource security operations to specialized providers. Security-as-a-Service models can provide cost-effective access to advanced security technologies and expertise while reducing internal resource requirements, creating opportunities for service providers to develop comprehensive managed security offerings tailored to data center environments.

Technological advancement is fundamentally reshaping market dynamics as traditional security approaches evolve to incorporate artificial intelligence, machine learning, and advanced analytics capabilities. Security systems are becoming increasingly intelligent, capable of autonomous threat detection, predictive analysis, and automated response actions that enhance protection effectiveness while reducing operational overhead and human intervention requirements.

Vendor ecosystem evolution shows increasing collaboration between traditional security manufacturers, cloud service providers, and technology integrators to deliver comprehensive solutions that address complex customer requirements. Strategic partnerships are enabling the development of integrated platforms that combine multiple security technologies into cohesive systems, improving user experience and operational efficiency while reducing total cost of ownership.

Customer expectations are driving demand for security solutions that provide real-time visibility, predictive analytics, and seamless integration with existing IT infrastructure. Organizations require security systems that can adapt to changing threat landscapes, scale with business growth, and provide comprehensive reporting capabilities that support compliance requirements and risk management initiatives.

Market maturation is leading to increased standardization of security protocols, interoperability requirements, and best practice frameworks that guide implementation decisions. Industry standards are evolving to address emerging threats and technology capabilities, creating opportunities for vendors that can demonstrate compliance with recognized security frameworks and deliver solutions that meet evolving customer expectations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United States data center physical security market landscape. Primary research includes extensive interviews with industry executives, security professionals, technology vendors, and end-user organizations to gather firsthand insights into market trends, challenges, and opportunities that shape purchasing decisions and technology adoption patterns.

Secondary research encompasses analysis of industry reports, regulatory filings, patent databases, and technology documentation to understand market structure, competitive dynamics, and innovation trends. Data validation processes ensure information accuracy through cross-referencing multiple sources and verification with industry experts who possess deep domain knowledge and market experience.

Quantitative analysis utilizes statistical modeling techniques to identify market trends, growth patterns, and correlation relationships between different market variables. Market sizing methodologies incorporate bottom-up and top-down approaches that consider technology adoption rates, customer spending patterns, and regional market characteristics to develop accurate growth projections and market opportunity assessments.

Qualitative research focuses on understanding customer motivations, decision-making processes, and technology evaluation criteria that influence purchasing decisions. Expert interviews with security consultants, system integrators, and technology analysts provide insights into emerging trends, competitive positioning, and future market evolution that quantitative data alone cannot capture.

Geographic distribution of the United States data center physical security market shows significant concentration in major metropolitan areas that serve as technology and business hubs. California leads market activity with approximately 24% market share, driven by Silicon Valley technology companies, cloud service providers, and the state’s robust digital economy that requires extensive data center infrastructure and corresponding security investments.

Texas represents the second-largest regional market with 18% market share, benefiting from favorable business climate, lower operational costs, and strategic location advantages that attract data center development. Major cities including Dallas, Austin, and Houston host significant data center concentrations serving both regional and national customers, driving demand for comprehensive physical security solutions.

Virginia’s Northern region accounts for 16% of market activity, primarily due to proximity to Washington D.C. and concentration of government contractors, federal agencies, and cloud service providers. Data Center Alley in Loudoun County represents one of the world’s largest data center markets, creating substantial demand for advanced security technologies that meet government and enterprise security requirements.

New York metropolitan area contributes 12% of market share, driven by financial services industry requirements, media companies, and enterprise headquarters that require secure data center infrastructure. Regional growth patterns indicate expanding activity in secondary markets including North Carolina, Georgia, and Arizona as organizations seek geographic diversification and cost optimization opportunities while maintaining robust security standards.

Market leadership is distributed among established security technology providers, specialized data center security vendors, and emerging technology companies developing innovative solutions for evolving threat landscapes. Competitive dynamics reflect increasing emphasis on integrated platforms, artificial intelligence capabilities, and comprehensive service offerings that address complex customer requirements.

Innovation focus among leading vendors emphasizes artificial intelligence integration, cloud-based management platforms, and mobile accessibility that enhance security effectiveness while improving user experience and operational efficiency.

Technology segmentation reveals diverse categories of physical security solutions deployed in data center environments, each addressing specific security requirements and operational challenges. Access control systems represent the largest segment, encompassing biometric authentication, smart card readers, and multi-factor verification technologies that regulate facility access and maintain detailed audit trails.

By Technology:

By Application:

Access control systems dominate market activity due to fundamental security requirements for regulating facility access and maintaining comprehensive audit capabilities. Biometric authentication is experiencing particularly strong growth with adoption rates increasing 31% annually as organizations seek to eliminate traditional key-based access methods and enhance security through unique biological identifiers that cannot be easily compromised or shared.

Video surveillance technologies are evolving rapidly with artificial intelligence integration enabling automated threat detection, behavioral analysis, and predictive security capabilities. Intelligent cameras equipped with advanced analytics can identify suspicious activities, unauthorized access attempts, and environmental anomalies while reducing false alarm rates and improving security team efficiency through automated alert prioritization.

Environmental monitoring systems are gaining importance as organizations recognize the critical relationship between physical security and operational continuity. Advanced sensors that monitor temperature, humidity, air quality, and power conditions provide early warning of potential equipment failures, environmental threats, and security breaches that could compromise data center operations and data integrity.

Integrated security platforms represent the fastest-growing category as organizations seek unified solutions that combine multiple security technologies into cohesive systems. Platform integration enables centralized management, coordinated response capabilities, and comprehensive reporting that improves security effectiveness while reducing operational complexity and total cost of ownership for comprehensive security programs.

Technology vendors benefit from expanding market opportunities driven by digital transformation initiatives and increasing security awareness among enterprise organizations. Revenue growth potential is substantial as organizations invest in comprehensive security infrastructure to protect valuable digital assets and ensure compliance with evolving regulatory requirements that mandate robust physical security measures.

System integrators gain opportunities to develop specialized expertise in data center security implementations while building long-term customer relationships through ongoing support and maintenance services. Professional services demand is increasing as organizations require customized security solutions that integrate with existing infrastructure and address specific operational requirements and compliance mandates.

End-user organizations achieve enhanced security posture through comprehensive protection strategies that address both traditional and emerging threats. Operational benefits include improved business continuity, regulatory compliance, risk mitigation, and competitive advantages through secure digital infrastructure that enables innovation and growth while protecting sensitive information and critical business operations.

Service providers can develop managed security offerings that provide cost-effective access to advanced security technologies and expertise while generating recurring revenue streams. Managed services enable organizations to focus on core business activities while ensuring continuous security monitoring and threat response capabilities that maintain protection effectiveness and compliance requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming data center physical security through intelligent systems capable of autonomous threat detection, predictive analysis, and automated response actions. Machine learning algorithms enable security systems to learn normal operational patterns and identify anomalies that may indicate security threats, reducing false alarms while improving detection accuracy and response effectiveness.

Zero trust security models are driving adoption of comprehensive authentication and authorization systems that verify every access request regardless of user location or credentials. Multi-factor authentication combining biometrics, smart cards, and behavioral analysis provides layered security that significantly reduces unauthorized access risks while maintaining user convenience and operational efficiency.

Cloud-based security management is enabling centralized monitoring and control of distributed data center facilities through unified platforms that provide real-time visibility and coordinated response capabilities. Remote management capabilities allow security teams to monitor multiple locations from centralized operations centers while maintaining consistent security policies and response procedures across all facilities.

Environmental security integration is expanding beyond traditional access control to include comprehensive monitoring of temperature, humidity, air quality, and power conditions that affect both security and operational continuity. Predictive maintenance capabilities enabled by environmental monitoring help prevent equipment failures that could create security vulnerabilities or operational disruptions.

Strategic partnerships between security technology vendors and cloud service providers are creating integrated solutions that address both physical and logical security requirements within unified platforms. Collaboration initiatives enable the development of comprehensive security ecosystems that provide seamless protection across hybrid cloud environments while simplifying management and reducing operational complexity.

Regulatory framework evolution is driving standardization of security requirements and best practices across different industry sectors. Compliance mandates in healthcare, financial services, and government sectors are becoming more stringent, requiring advanced security technologies and comprehensive audit capabilities that demonstrate effective protection against evolving threats and unauthorized access attempts.

Technology convergence trends show increasing integration between traditional physical security systems and modern IT infrastructure, enabling security solutions that leverage existing network capabilities while providing enhanced functionality. IP-based security systems offer improved scalability, remote management capabilities, and integration opportunities that reduce total cost of ownership while enhancing security effectiveness.

Market consolidation activities include strategic acquisitions and mergers that enable vendors to expand technology portfolios and geographic reach while building comprehensive solution capabilities. Industry consolidation is creating larger, more capable vendors that can address complex customer requirements and provide integrated solutions spanning multiple security domains and technology categories.

MarkWide Research recommends that organizations prioritize comprehensive security strategies that address both current threats and future requirements through scalable, integrated platforms. Investment planning should focus on technologies that provide long-term value through artificial intelligence capabilities, cloud integration, and comprehensive management platforms that can evolve with changing security landscapes and business requirements.

Technology selection should emphasize interoperability and integration capabilities that enable seamless operation with existing infrastructure while providing flexibility for future expansion and technology upgrades. Vendor evaluation criteria should include proven track record, comprehensive support capabilities, and commitment to ongoing innovation that ensures security systems remain effective against evolving threats and compliance requirements.

Implementation strategies should incorporate phased deployment approaches that minimize operational disruption while enabling rapid realization of security benefits. Change management processes should address user training, operational procedure updates, and ongoing maintenance requirements that ensure security systems achieve intended effectiveness and provide sustained protection value.

Budget allocation should balance immediate security needs with long-term strategic objectives, ensuring adequate resources for both technology acquisition and ongoing operational requirements. Total cost of ownership considerations should include hardware, software, implementation services, training, and ongoing maintenance costs that affect overall investment returns and security program sustainability.

Market evolution indicates continued strong growth driven by expanding digital infrastructure requirements and increasing security awareness among organizations across all industry sectors. Growth projections suggest the market will maintain robust expansion with projected CAGR of 8.5% through the next five years, reflecting sustained investment in comprehensive security infrastructure that addresses both traditional and emerging threats.

Technology advancement will continue to reshape market dynamics as artificial intelligence, machine learning, and advanced analytics become standard components of comprehensive security platforms. Innovation trends indicate increasing emphasis on predictive security capabilities, automated threat response, and integrated platforms that provide unified management of multiple security technologies and operational systems.

Market expansion opportunities will emerge from edge computing deployment, 5G network infrastructure development, and increasing adoption of hybrid cloud architectures that require distributed security solutions. MWR analysis indicates that edge computing security requirements will drive significant market growth of 15-20% in specialized security solutions designed for distributed data center environments.

Industry maturation will lead to increased standardization, improved interoperability, and comprehensive service offerings that address complete security lifecycle requirements. Future market structure will likely feature fewer, larger vendors providing comprehensive platforms alongside specialized providers focusing on specific technology domains or vertical market requirements, creating diverse opportunities for market participants and customers seeking tailored security solutions.

The United States data center physical security market represents a dynamic and rapidly evolving sector driven by digital transformation initiatives, regulatory compliance requirements, and increasing awareness of security threats targeting critical infrastructure. Market fundamentals remain strong with robust growth projections supported by sustained investment in comprehensive security solutions that protect valuable digital assets and ensure operational continuity across diverse industry sectors.

Technology innovation continues to reshape market opportunities as artificial intelligence, advanced analytics, and integrated platforms enable more effective threat detection and response capabilities while reducing operational complexity and total cost of ownership. Competitive dynamics favor vendors that can deliver comprehensive solutions addressing both current security requirements and future scalability needs through flexible, interoperable platforms that integrate seamlessly with existing infrastructure.

Strategic success in this market requires understanding of complex customer requirements, regulatory compliance mandates, and evolving threat landscapes that influence purchasing decisions and technology adoption patterns. Organizations that invest in comprehensive physical security infrastructure while maintaining focus on operational efficiency and cost optimization will be best positioned to capitalize on expanding market opportunities and achieve sustained competitive advantages in the evolving digital economy.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access controls, and environmental monitoring.

What are the key players in the United States Data Center Physical Security Market?

Key players in the United States Data Center Physical Security Market include companies like Johnson Controls, Cisco Systems, and Honeywell, which provide various security solutions and technologies for data centers, among others.

What are the main drivers of the United States Data Center Physical Security Market?

The main drivers of the United States Data Center Physical Security Market include the increasing frequency of cyber threats, the growing need for compliance with data protection regulations, and the rising demand for cloud services that necessitate robust physical security measures.

What challenges does the United States Data Center Physical Security Market face?

Challenges in the United States Data Center Physical Security Market include the high costs associated with implementing advanced security technologies, the complexity of integrating various security systems, and the evolving nature of security threats that require constant updates and adaptations.

What opportunities exist in the United States Data Center Physical Security Market?

Opportunities in the United States Data Center Physical Security Market include the adoption of AI and machine learning for enhanced security analytics, the growth of edge computing requiring localized security solutions, and the increasing focus on sustainability in security practices.

What trends are shaping the United States Data Center Physical Security Market?

Trends shaping the United States Data Center Physical Security Market include the integration of IoT devices for real-time monitoring, the shift towards remote management of security systems, and the emphasis on holistic security approaches that combine physical and cybersecurity measures.

United States Data Center Physical Security Market

| Segmentation Details | Description |

|---|---|

| Product Type | Access Control Systems, Surveillance Cameras, Intrusion Detection Systems, Fire Safety Equipment |

| Technology | Biometric Authentication, RFID, Video Analytics, Cloud-Based Security |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Installation | On-Premises, Remote Monitoring, Integrated Systems, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

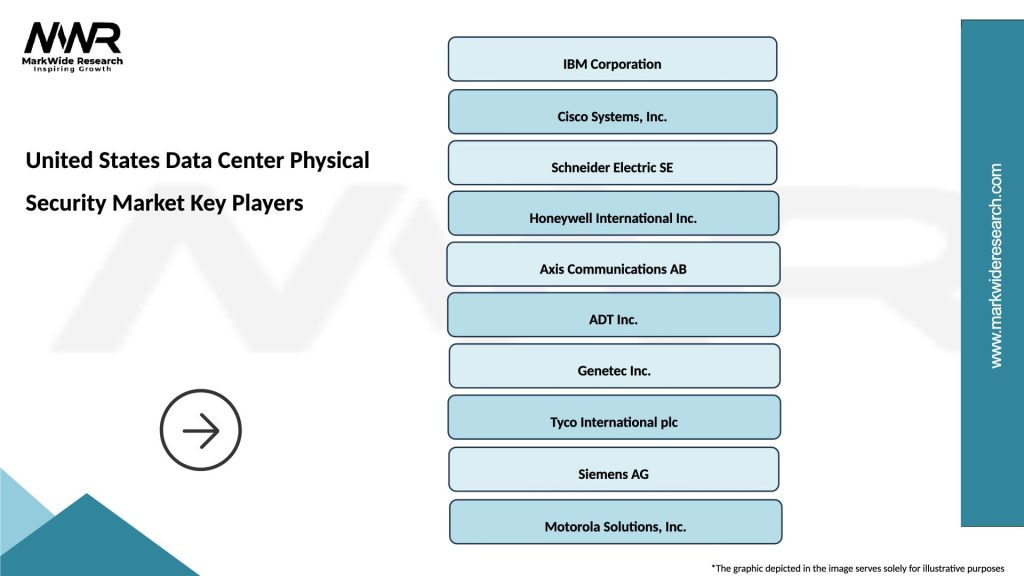

Leading companies in the United States Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at