444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States dairy market represents one of the most significant agricultural sectors in the American economy, encompassing a diverse range of products from traditional milk and cheese to innovative plant-based alternatives. Market dynamics indicate robust growth driven by evolving consumer preferences, technological advancements in dairy processing, and expanding distribution channels. The sector demonstrates remarkable resilience with annual growth rates consistently outpacing many traditional food categories.

Consumer demand patterns reveal a shift toward premium dairy products, organic offerings, and functional dairy items enriched with probiotics and additional nutrients. The market encompasses traditional dairy products including fluid milk, cheese, butter, yogurt, and ice cream, alongside emerging categories such as dairy-based protein powders and specialty beverages. Regional production remains concentrated in key dairy states including Wisconsin, California, New York, and Pennsylvania, with these regions accounting for approximately 60% of total production capacity.

Technological innovation continues to reshape the industry landscape, with automated milking systems, advanced pasteurization techniques, and sustainable packaging solutions driving operational efficiency. The integration of digital technologies in supply chain management has enhanced product traceability and quality assurance, meeting increasingly stringent consumer expectations for transparency and safety.

The United States dairy market refers to the comprehensive ecosystem of dairy production, processing, distribution, and retail activities within American borders, encompassing all milk-derived products and related services. This market includes traditional dairy operations from farm-level milk production through sophisticated processing facilities that transform raw milk into diverse consumer products.

Market scope extends beyond conventional dairy products to include value-added items such as specialty cheeses, probiotic yogurts, lactose-free alternatives, and premium ice cream varieties. The definition encompasses both large-scale commercial operations and artisanal producers, reflecting the market’s diversity in production methods, product quality, and target consumer segments.

Industry stakeholders include dairy farmers, processing companies, distributors, retailers, equipment manufacturers, and service providers supporting the entire value chain. The market also incorporates regulatory bodies, quality assurance organizations, and research institutions that contribute to industry standards and innovation development.

Strategic analysis of the United States dairy market reveals a mature yet dynamic industry experiencing transformation through consumer preference evolution and technological advancement. The sector maintains strong fundamentals with consistent demand growth across multiple product categories, particularly in premium and organic segments where growth rates exceed 12% annually.

Key market drivers include increasing health consciousness among consumers, rising demand for protein-rich foods, and growing popularity of artisanal and locally-sourced dairy products. The market benefits from established distribution networks, advanced processing capabilities, and strong brand recognition among leading dairy companies.

Competitive landscape features both large multinational corporations and regional specialty producers, creating a diverse market structure that serves various consumer segments. Innovation in product development, particularly in functional dairy products and sustainable packaging, represents a critical success factor for market participants.

Future growth prospects remain positive, supported by demographic trends, export opportunities, and continued product innovation. However, challenges including raw material cost volatility, regulatory compliance requirements, and competition from plant-based alternatives require strategic adaptation from industry participants.

Market intelligence reveals several critical insights shaping the United States dairy industry landscape:

Primary growth drivers propelling the United States dairy market include evolving consumer dietary preferences toward protein-rich, nutritious food options. Health awareness trends significantly influence purchasing decisions, with consumers increasingly recognizing dairy products’ nutritional benefits including calcium, protein, and essential vitamins.

Demographic factors contribute substantially to market expansion, particularly the growing population of health-conscious millennials and Generation Z consumers who prioritize quality and sustainability in food choices. These demographic segments demonstrate willingness to pay premium prices for organic, grass-fed, and locally-sourced dairy products.

Technological advancements in dairy processing enable producers to develop innovative products meeting specific consumer needs, including lactose-free options, probiotic-enhanced items, and extended shelf-life products. Advanced packaging technologies preserve product quality while reducing environmental impact, appealing to sustainability-minded consumers.

Economic prosperity and rising disposable incomes support increased consumption of premium dairy products. The foodservice industry’s recovery and expansion further drive demand for dairy ingredients and specialty products used in restaurants, cafes, and food manufacturing applications.

Significant challenges facing the United States dairy market include increasing competition from plant-based alternatives that appeal to consumers seeking dairy-free options due to dietary restrictions, environmental concerns, or lifestyle choices. Market penetration of alternative products continues expanding, particularly among younger consumer demographics.

Regulatory compliance costs impose substantial financial burdens on dairy producers, particularly smaller operations struggling to meet evolving food safety standards, environmental regulations, and animal welfare requirements. These compliance costs can limit market entry for new participants and strain existing operations’ profitability.

Raw material price volatility affects production costs and profit margins, with feed costs, energy prices, and labor expenses subject to significant fluctuations. Climate-related challenges including extreme weather events can disrupt milk production and increase operational costs for dairy farmers.

Consumer health concerns regarding saturated fat content, lactose intolerance, and perceived links between dairy consumption and certain health conditions create market headwinds. Negative publicity surrounding industrial dairy farming practices also influences consumer perceptions and purchasing decisions.

Emerging opportunities in the United States dairy market center on product innovation and market segment expansion. Functional dairy products incorporating probiotics, omega-3 fatty acids, and other health-enhancing ingredients represent high-growth potential areas with premium pricing opportunities.

Export market development offers substantial growth prospects, particularly in Asian markets where rising middle-class populations demonstrate increasing demand for high-quality American dairy products. Trade agreements and diplomatic relationships create favorable conditions for international market expansion.

Sustainable production practices present opportunities for market differentiation and premium positioning. Consumers increasingly value environmentally responsible production methods, creating demand for carbon-neutral, regenerative agriculture, and animal welfare-certified dairy products.

Direct-to-consumer channels enable dairy producers to capture higher margins while building stronger customer relationships. E-commerce platforms, subscription services, and farm-direct sales channels provide alternative distribution methods that bypass traditional retail markups.

Value-added processing opportunities include artisanal cheese production, specialty butter varieties, and premium ice cream formulations that command higher prices and stronger brand loyalty among discerning consumers.

Complex interactions between supply and demand factors create dynamic market conditions in the United States dairy sector. Supply chain efficiency improvements through technology adoption and logistics optimization enhance market responsiveness while reducing operational costs.

Seasonal demand patterns influence market dynamics, with ice cream consumption peaking during summer months while hot beverage-related dairy products experience higher demand during colder seasons. These patterns require sophisticated inventory management and production planning strategies.

Price elasticity varies significantly across dairy product categories, with premium and specialty products demonstrating lower price sensitivity compared to commodity dairy items. This dynamic enables producers to maintain margins through product differentiation and value-added offerings.

Competitive pressures from both traditional dairy companies and alternative product manufacturers drive continuous innovation and efficiency improvements. Market participants must balance cost management with quality maintenance and brand building investments.

Regulatory environment changes impact market dynamics through food safety requirements, labeling standards, and environmental regulations. Industry adaptation to regulatory changes often creates temporary market disruptions but ultimately strengthens consumer confidence and market stability.

Comprehensive research approach utilized multiple data sources and analytical methods to ensure accurate market assessment and reliable insights. Primary research included extensive interviews with industry executives, dairy farmers, distributors, and retail partners across major dairy-producing regions.

Secondary research incorporated analysis of industry reports, government agricultural statistics, trade association data, and academic studies related to dairy market trends and consumer behavior patterns. MarkWide Research analysts conducted thorough examination of historical market data to identify long-term trends and cyclical patterns.

Data validation processes included cross-referencing multiple sources, statistical analysis of market trends, and expert panel reviews to ensure information accuracy and reliability. Quantitative analysis focused on production volumes, consumption patterns, and market share distributions across different product categories and geographic regions.

Market modeling techniques incorporated econometric analysis, trend extrapolation, and scenario planning to develop realistic market projections and identify potential risk factors. Consumer survey data and focus group insights provided qualitative context for quantitative market analysis.

Geographic distribution of dairy production and consumption reveals distinct regional characteristics across the United States. Midwest region dominates milk production with Wisconsin leading in cheese manufacturing and maintaining approximately 28% of national cheese production.

California represents the largest dairy-producing state by volume, contributing significant portions of fluid milk, butter, and specialty dairy products to national supply. The state’s favorable climate and advanced agricultural infrastructure support year-round production capabilities.

Northeast corridor demonstrates strong demand for premium and organic dairy products, with consumers in metropolitan areas showing willingness to pay higher prices for quality and sustainability attributes. New York and Vermont maintain strong reputations for artisanal cheese and specialty dairy production.

Southeast region experiences rapid market growth driven by population expansion and increasing consumer awareness of dairy product benefits. Florida and Georgia emerge as significant growth markets with expanding distribution networks and retail presence.

Western states including Idaho, Utah, and Colorado contribute substantially to national dairy production while serving growing regional markets. These states benefit from efficient transportation networks enabling product distribution to major population centers.

Market leadership in the United States dairy sector includes several major corporations alongside numerous regional and specialty producers. The competitive environment features both horizontal integration among large processors and vertical integration from farm to retail operations.

Competitive strategies focus on product innovation, brand building, operational efficiency, and strategic acquisitions to expand market presence and capabilities.

Product-based segmentation reveals diverse market categories with distinct growth patterns and consumer preferences:

By Product Type:

By Distribution Channel:

Fluid milk category maintains stable demand despite declining per-capita consumption trends, with organic and specialty milk varieties experiencing growth rates of approximately 8% annually. Consumer preferences shift toward higher-quality options including grass-fed, A2 protein, and locally-sourced milk products.

Cheese segment demonstrates robust growth across multiple subcategories, with artisanal and specialty cheeses commanding premium prices and strong consumer loyalty. Natural cheese consumption continues expanding while processed cheese faces competitive pressure from healthier alternatives.

Yogurt market experiences dynamic growth driven by health-conscious consumers seeking probiotic benefits and protein content. Greek yogurt maintains market leadership while plant-based alternatives gain market share among specific consumer segments.

Ice cream category shows resilience with premium and super-premium segments outperforming traditional varieties. Innovation in flavors, textures, and health-conscious formulations drives category expansion and consumer engagement.

Butter market benefits from cooking trends and artisanal food preparation, with European-style and grass-fed varieties experiencing strong demand growth. Foodservice applications contribute significantly to overall butter consumption patterns.

Dairy farmers benefit from stable demand patterns, technological advancements that improve operational efficiency, and premium pricing opportunities for high-quality milk production. Cooperative membership provides access to processing facilities, marketing support, and risk management tools.

Processing companies gain advantages through economies of scale, product diversification opportunities, and strong brand development potential. Advanced processing technologies enable value-added product creation and extended shelf-life capabilities.

Retailers benefit from consistent consumer demand, attractive profit margins on premium dairy products, and strong category performance that drives store traffic. Private label opportunities provide additional revenue streams and customer loyalty building.

Consumers receive nutritional benefits from high-quality protein sources, calcium, and essential vitamins while enjoying diverse product options meeting various dietary preferences and lifestyle needs. Improved product safety and quality assurance enhance consumer confidence.

Equipment manufacturers and service providers benefit from ongoing modernization needs, sustainability initiatives, and capacity expansion projects throughout the dairy industry supply chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives emerge as dominant trends shaping industry practices and consumer preferences. Carbon-neutral production goals drive investment in renewable energy, methane capture systems, and regenerative agriculture practices among leading dairy producers.

Functional dairy products gain momentum with consumers seeking added health benefits beyond basic nutrition. Probiotic-enhanced products, protein-fortified items, and vitamin-enriched dairy products experience accelerated adoption rates exceeding 18% annually.

Direct-to-consumer sales expand rapidly through online platforms, subscription services, and farm-direct channels. These distribution methods enable producers to capture higher margins while building stronger customer relationships and brand loyalty.

Artisanal and craft dairy products continue gaining popularity among consumers seeking unique flavors, traditional production methods, and local sourcing. Small-batch cheese makers, specialty butter producers, and premium ice cream manufacturers benefit from this trend.

Technology adoption accelerates across all industry segments, from automated milking systems on farms to artificial intelligence applications in quality control and supply chain management. MWR analysis indicates technology integration improves operational efficiency by approximately 22% on average.

Strategic acquisitions reshape the competitive landscape as major dairy companies expand capabilities and market reach through targeted purchases of regional producers and specialty brands. These transactions enable access to new product categories and distribution channels.

Sustainability investments accelerate across the industry with major producers committing substantial resources to environmental improvement initiatives. Solar installations, methane digesters, and water conservation systems become standard features at modern dairy facilities.

Product launch activity intensifies with companies introducing innovative formulations addressing specific consumer needs including lactose-free options, high-protein varieties, and organic certifications. New product success rates improve through enhanced market research and consumer testing.

International expansion efforts increase as American dairy companies seek growth opportunities in emerging markets. Strategic partnerships with local distributors and joint venture arrangements facilitate market entry and brand establishment.

Regulatory developments include updated food safety standards, labeling requirements, and environmental regulations affecting industry operations. Companies invest in compliance systems and quality assurance programs to meet evolving regulatory expectations.

Strategic recommendations for industry participants focus on embracing sustainability initiatives as competitive differentiators while investing in technology solutions that improve operational efficiency and product quality. MarkWide Research analysis suggests companies prioritizing environmental responsibility achieve stronger brand positioning and customer loyalty.

Product development strategies should emphasize functional benefits and health-enhancing attributes that justify premium pricing while addressing specific consumer dietary needs and preferences. Innovation in packaging solutions that extend shelf life and reduce environmental impact provides additional competitive advantages.

Market expansion opportunities exist in both domestic premium segments and international markets, requiring tailored approaches for different consumer demographics and regulatory environments. Direct-to-consumer channels offer margin improvement potential while strengthening customer relationships.

Operational excellence through technology adoption, supply chain optimization, and quality management systems becomes increasingly critical for maintaining competitiveness in evolving market conditions. Investment in employee training and development supports successful technology implementation and operational improvements.

Partnership strategies including cooperative arrangements, strategic alliances, and vertical integration opportunities can provide access to new capabilities, markets, and resources while sharing risks and costs associated with market expansion initiatives.

Long-term projections for the United States dairy market indicate continued growth driven by population expansion, health awareness trends, and product innovation. Market evolution toward premium and functional products supports margin improvement opportunities for industry participants.

Technology integration will accelerate across all industry segments, from precision agriculture applications in dairy farming to artificial intelligence systems in processing and quality control. These technological advances promise significant efficiency improvements and cost reductions.

Sustainability requirements will become increasingly important for market access and consumer acceptance, driving continued investment in environmental improvement initiatives and renewable energy adoption. Companies demonstrating environmental leadership will gain competitive advantages.

Export market development offers substantial growth potential as international demand for high-quality American dairy products continues expanding. Trade relationships and diplomatic initiatives will influence market access and growth opportunities.

Consumer preferences will continue evolving toward health-conscious, environmentally responsible, and locally-sourced products, creating opportunities for companies that successfully adapt their offerings and marketing strategies to meet these changing demands.

The United States dairy market demonstrates remarkable resilience and adaptability in responding to evolving consumer preferences, technological advancements, and competitive challenges. Industry fundamentals remain strong with consistent demand growth, established distribution networks, and continuous innovation driving market expansion.

Strategic opportunities exist across multiple market segments, from premium and organic products to functional dairy items and international expansion initiatives. Companies that successfully balance operational efficiency with product innovation and sustainability initiatives will achieve the strongest market positions.

Future success in the dairy market requires embracing technological solutions, developing sustainable production practices, and maintaining focus on consumer needs and preferences. The industry’s ability to adapt to changing market conditions while preserving product quality and safety standards will determine long-term growth prospects and competitive positioning in the evolving food and beverage landscape.

What is Dairy?

Dairy refers to products made from the milk of mammals, primarily cows, goats, and sheep. This includes a variety of items such as milk, cheese, yogurt, and butter, which are integral to many diets and cuisines.

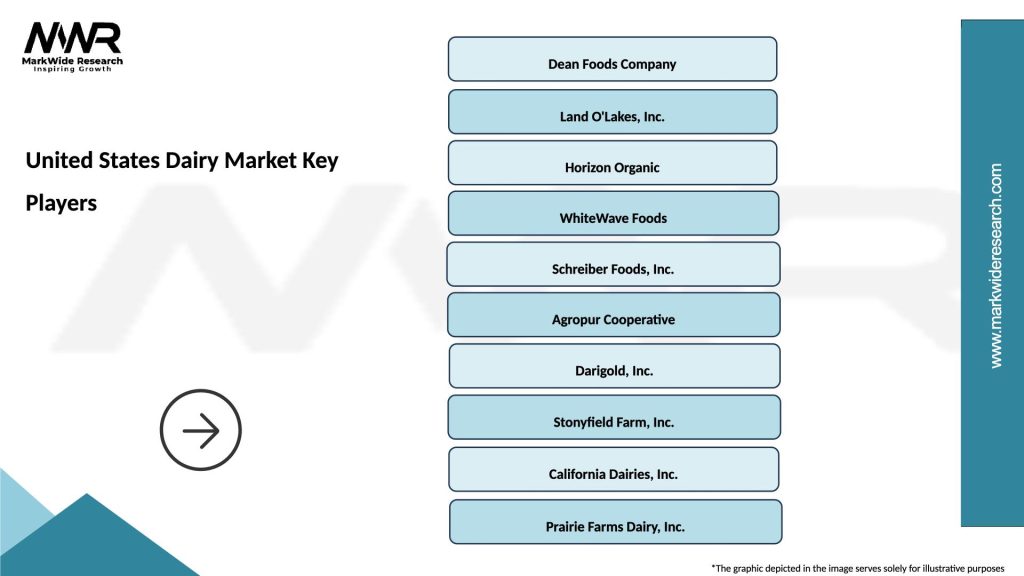

What are the key companies in the United States Dairy Market?

Key companies in the United States Dairy Market include Dairy Farmers of America, Land O’Lakes, and Dean Foods, among others.

What are the main drivers of growth in the United States Dairy Market?

The main drivers of growth in the United States Dairy Market include increasing consumer demand for dairy products, the rise of health-conscious eating habits, and innovations in dairy processing technologies.

What challenges does the United States Dairy Market face?

The United States Dairy Market faces challenges such as fluctuating milk prices, competition from plant-based alternatives, and regulatory pressures regarding animal welfare and environmental sustainability.

What opportunities exist in the United States Dairy Market?

Opportunities in the United States Dairy Market include the expansion of organic and specialty dairy products, growth in export markets, and the development of new dairy-based health products.

What trends are shaping the United States Dairy Market?

Trends shaping the United States Dairy Market include the increasing popularity of lactose-free and plant-based dairy alternatives, the focus on sustainable farming practices, and the rise of functional dairy products that offer health benefits.

United States Dairy Market

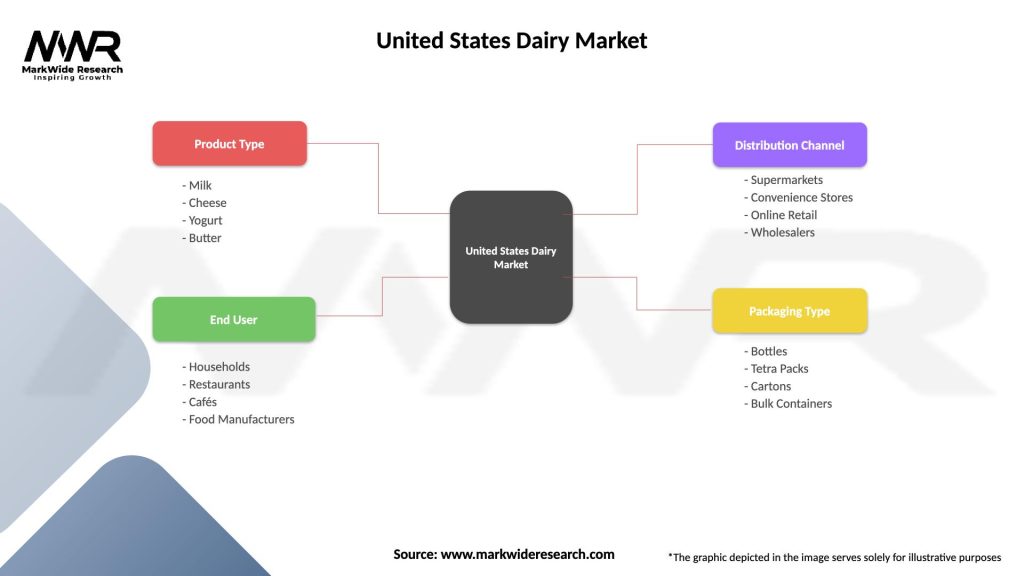

| Segmentation Details | Description |

|---|---|

| Product Type | Milk, Cheese, Yogurt, Butter |

| End User | Households, Restaurants, Cafés, Food Manufacturers |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Wholesalers |

| Packaging Type | Bottles, Tetra Packs, Cartons, Bulk Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Dairy Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at