444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States dairy desserts market represents a dynamic and rapidly evolving segment of the broader food and beverage industry, characterized by continuous innovation and changing consumer preferences. This market encompasses a diverse range of products including ice cream, frozen yogurt, puddings, custards, mousse, and specialty dairy-based desserts that have become integral to American culinary culture. Market dynamics indicate robust growth driven by premiumization trends, health-conscious formulations, and innovative flavor profiles that cater to sophisticated consumer palates.

Consumer behavior patterns reveal a significant shift toward artisanal and premium dairy desserts, with 65% of consumers willing to pay premium prices for high-quality ingredients and unique flavor experiences. The market demonstrates remarkable resilience and adaptability, with manufacturers continuously introducing plant-based alternatives, reduced-sugar options, and functional ingredients to meet diverse dietary requirements and lifestyle preferences.

Regional distribution shows concentrated market activity across major metropolitan areas, with the Northeast and West Coast regions leading consumption patterns. The market benefits from strong retail infrastructure, established cold chain logistics, and sophisticated distribution networks that ensure product availability across diverse retail channels including supermarkets, convenience stores, specialty retailers, and foodservice establishments.

The United States dairy desserts market refers to the comprehensive ecosystem of frozen and refrigerated dessert products primarily made from dairy ingredients including milk, cream, yogurt, and cheese, designed for consumer enjoyment and satisfaction. This market encompasses traditional favorites such as ice cream and frozen yogurt alongside innovative products like Greek yogurt desserts, dairy-based parfaits, and premium artisanal creations that blend traditional dairy processing with modern culinary techniques.

Product categories within this market span from mass-market offerings available in standard retail channels to premium artisanal products found in specialty stores and high-end restaurants. The market includes both ready-to-eat desserts and products requiring minimal preparation, catering to convenience-oriented consumers while maintaining focus on taste, texture, and nutritional value.

Market participants range from large multinational corporations with extensive manufacturing capabilities to small artisanal producers focusing on local and regional markets. This diversity creates a competitive landscape that fosters innovation while providing consumers with extensive choice across price points, quality levels, and flavor profiles.

Strategic analysis of the United States dairy desserts market reveals a mature yet dynamic industry experiencing transformation through health-conscious innovations, premium positioning, and technological advancement in manufacturing processes. The market demonstrates consistent growth momentum supported by strong consumer demand, evolving taste preferences, and successful product diversification strategies implemented by leading manufacturers.

Key growth drivers include increasing disposable income, growing appreciation for premium and artisanal products, and rising demand for healthier dessert alternatives that maintain indulgent characteristics. The market benefits from 72% of consumers actively seeking dessert options that balance taste satisfaction with nutritional considerations, creating opportunities for functional ingredient integration and reformulation initiatives.

Competitive dynamics showcase intense rivalry among established players while creating entry opportunities for innovative startups and regional producers. Market leaders maintain competitive advantages through brand recognition, distribution networks, and research capabilities, while emerging companies compete through product differentiation, niche targeting, and direct-to-consumer strategies.

Future prospects indicate continued market expansion driven by demographic trends, urbanization patterns, and evolving consumer lifestyles that prioritize convenience without compromising quality or taste experience. The market is positioned for sustained growth through strategic innovation, market penetration, and category expansion initiatives.

Consumer preference analysis reveals several critical insights that shape market development and strategic decision-making across the dairy desserts industry:

Economic prosperity serves as a fundamental driver for the United States dairy desserts market, with increased disposable income enabling consumers to explore premium products and indulgent experiences. Rising household incomes create opportunities for market expansion through premiumization strategies and product portfolio diversification that caters to affluent consumer segments seeking high-quality dessert experiences.

Demographic trends significantly influence market growth, particularly the expanding millennial and Generation Z populations who demonstrate strong preferences for innovative flavors, Instagram-worthy presentations, and products that align with their values regarding health, sustainability, and social responsibility. These demographic groups drive demand for artisanal products, unique flavor combinations, and brands that demonstrate authentic storytelling and community engagement.

Technological advancement in manufacturing processes enables producers to create innovative textures, extend shelf life, and develop new product formats that meet evolving consumer expectations. Advanced freezing technologies, improved packaging solutions, and enhanced quality control systems support product innovation while maintaining cost efficiency and operational scalability.

Health consciousness paradoxically drives market growth as consumers seek dessert options that provide indulgence while incorporating beneficial ingredients such as probiotics, protein, and natural sweeteners. This trend creates opportunities for product reformulation and the development of functional desserts that satisfy both taste preferences and nutritional goals.

Health concerns regarding sugar content, caloric density, and artificial ingredients create challenges for traditional dairy dessert formulations, requiring manufacturers to invest in reformulation efforts and alternative ingredient sourcing. Consumer awareness of nutrition labels and ingredient lists influences purchasing decisions, potentially limiting market growth for products perceived as unhealthy or overly processed.

Seasonal demand fluctuations create operational challenges for manufacturers and retailers, with significant variations in consumption patterns throughout the year affecting production planning, inventory management, and revenue predictability. Cold weather periods typically see reduced demand for frozen desserts, requiring companies to develop strategies for maintaining consistent sales performance across all seasons.

Raw material price volatility affects production costs and profit margins, particularly for dairy ingredients, premium components, and specialty additives used in product formulation. Fluctuating commodity prices create challenges for pricing strategies and long-term contract negotiations with retail partners, potentially impacting market accessibility for price-sensitive consumer segments.

Regulatory compliance requirements related to food safety, labeling accuracy, and nutritional claims create operational complexity and compliance costs that particularly affect smaller manufacturers and new market entrants. Evolving regulations regarding ingredient disclosure, allergen labeling, and health claims require ongoing investment in regulatory expertise and quality assurance systems.

Plant-based alternatives represent a significant growth opportunity as consumer interest in dairy-free options continues expanding beyond traditional lactose-intolerant demographics. The development of plant-based dairy desserts using innovative ingredients such as oat milk, coconut cream, and cashew bases creates new market segments while addressing environmental sustainability concerns and dietary restrictions.

E-commerce expansion offers substantial opportunities for direct-to-consumer sales, subscription services, and specialized product offerings that may not be viable through traditional retail channels. Online platforms enable smaller producers to reach national audiences while providing established brands with additional revenue streams and enhanced customer relationship management capabilities.

Functional ingredients integration creates opportunities for product differentiation through the incorporation of probiotics, protein, vitamins, and adaptogens that provide health benefits beyond basic nutrition. MarkWide Research analysis indicates growing consumer acceptance of functional desserts that deliver both indulgence and wellness benefits, creating premium pricing opportunities for innovative formulations.

International flavor exploration presents opportunities for market expansion through the introduction of global dessert traditions adapted for American tastes. Asian-inspired flavors, European artisanal techniques, and Latin American ingredients create differentiation opportunities while appealing to increasingly diverse consumer populations and adventurous taste preferences.

Supply chain evolution demonstrates increasing sophistication in cold chain logistics, inventory management, and distribution efficiency that enables broader market reach and improved product quality maintenance. Advanced refrigeration technologies, optimized delivery routes, and strategic warehouse positioning enhance product availability while reducing operational costs and environmental impact.

Consumer engagement strategies increasingly focus on experiential marketing, social media presence, and community building that creates emotional connections between brands and consumers. Successful companies leverage digital platforms, influencer partnerships, and experiential retail concepts to build brand loyalty and drive repeat purchases in an increasingly competitive marketplace.

Innovation cycles accelerate as companies invest in research and development capabilities, consumer testing programs, and rapid product launch processes that enable quick response to emerging trends and consumer preferences. The market demonstrates 43% faster product development cycles compared to five years ago, enabling companies to capitalize on trending flavors and consumer insights more effectively.

Competitive intensity drives continuous improvement in product quality, pricing strategies, and customer service while creating pressure for operational efficiency and strategic differentiation. Market dynamics favor companies that successfully balance innovation with operational excellence while maintaining strong relationships with retail partners and end consumers.

Primary research methodologies employed in analyzing the United States dairy desserts market include comprehensive consumer surveys, in-depth interviews with industry executives, and focus group discussions with target demographic segments. These research approaches provide qualitative insights into consumer preferences, purchasing behaviors, and emerging trends that quantitative data alone cannot capture effectively.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial statements to establish market baselines and identify growth patterns. This research foundation enables comprehensive understanding of market structure, competitive positioning, and historical performance trends that inform future projections and strategic recommendations.

Market modeling utilizes advanced statistical techniques, trend analysis, and predictive algorithms to forecast market development scenarios and assess potential impact of various market drivers and restraints. These analytical approaches enable stakeholders to make informed decisions based on data-driven insights rather than intuitive assumptions about market behavior.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert consultations, and real-world market observations that confirm analytical findings and strengthen confidence in research conclusions and recommendations provided to market participants and investors.

Northeast region demonstrates the highest consumption rates and premium product penetration, driven by urban population density, higher disposable incomes, and sophisticated consumer preferences that favor artisanal and specialty dairy desserts. Major metropolitan areas including New York, Boston, and Philadelphia serve as trend-setting markets where new products and concepts often achieve initial success before expanding nationally.

West Coast markets show strong growth in health-conscious and innovative product categories, with California leading adoption of plant-based alternatives and functional ingredient integration. The region’s diverse population and health-focused lifestyle trends create demand for products that balance indulgence with nutritional benefits, driving innovation in product formulation and positioning strategies.

Southern states maintain strong traditional preferences while gradually adopting premium and innovative products, with 38% market share in traditional ice cream categories and growing interest in artisanal offerings. The region’s warm climate supports year-round consumption patterns that provide stability for manufacturers and retailers serving these markets.

Midwest region represents a balanced market with steady growth across all product categories, strong retail infrastructure, and consumer preferences that blend traditional favorites with selective adoption of innovative products. The region’s agricultural heritage creates opportunities for locally-sourced ingredients and farm-to-table positioning strategies that resonate with regional consumer values.

Market leadership is characterized by a combination of large multinational corporations and successful regional players that compete through different strategies and market positioning approaches:

Competitive strategies vary significantly across market participants, with large companies leveraging scale advantages, distribution networks, and marketing resources while smaller players compete through product differentiation, local market focus, and direct consumer relationships that create competitive advantages in specific market segments.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Premium ice cream represents the fastest-growing category segment, with 28% annual growth driven by consumer willingness to pay higher prices for superior ingredients, unique flavors, and artisanal production methods. This category benefits from social media marketing, experiential retail concepts, and limited-edition product launches that create excitement and drive trial among target consumers.

Frozen yogurt maintains steady market position through health positioning and customization options that appeal to health-conscious consumers seeking indulgent experiences with perceived nutritional benefits. The category demonstrates resilience through product innovation, flavor variety, and strategic partnerships with health and wellness brands that enhance credibility and market appeal.

Plant-based alternatives emerge as a high-growth category addressing dietary restrictions, environmental concerns, and health preferences while maintaining taste satisfaction and textural appeal. Innovation in this category focuses on ingredient technology, flavor development, and production processes that create products comparable to traditional dairy desserts in taste and consumer satisfaction.

Functional desserts represent an emerging category that incorporates beneficial ingredients such as probiotics, protein, and vitamins while maintaining indulgent characteristics that satisfy consumer dessert expectations. This category creates premium pricing opportunities while addressing consumer desire for products that provide both pleasure and health benefits.

Manufacturers benefit from strong consumer demand, diverse product development opportunities, and multiple distribution channels that provide revenue stability and growth potential. The market offers opportunities for both large-scale production efficiency and niche product development that can command premium pricing and build strong brand loyalty among target consumer segments.

Retailers gain from high product turnover rates, strong consumer traffic generation, and attractive profit margins that make dairy desserts valuable category contributors to overall store performance. The category provides opportunities for private label development, seasonal promotions, and cross-merchandising strategies that enhance overall retail profitability and customer satisfaction.

Consumers enjoy extensive product variety, continuous innovation, and competitive pricing that provide excellent value and satisfaction across diverse taste preferences and dietary requirements. Market competition drives quality improvements, flavor innovation, and convenience enhancements that continuously improve the consumer experience and product accessibility.

Investors find attractive opportunities in a market characterized by steady growth, innovation potential, and diverse investment options ranging from established companies with stable returns to emerging brands with high growth potential. The market provides portfolio diversification opportunities across different risk profiles and growth strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization movement continues driving market evolution as consumers increasingly seek high-quality ingredients, artisanal production methods, and unique flavor experiences that justify higher price points. This trend creates opportunities for manufacturers to develop super-premium product lines that command significant price premiums while building strong brand differentiation and consumer loyalty.

Health-conscious formulation becomes increasingly important as consumers seek dessert options that provide indulgence while incorporating beneficial ingredients and reducing negative nutritional components. MWR data indicates 56% of consumers actively seek desserts with added protein, probiotics, or reduced sugar content, driving innovation in ingredient technology and product reformulation strategies.

Sustainability focus influences consumer purchasing decisions and brand preferences, creating opportunities for companies that demonstrate environmental responsibility through sustainable sourcing, eco-friendly packaging, and carbon footprint reduction initiatives. This trend particularly resonates with younger consumer demographics who prioritize environmental considerations in their purchasing decisions.

Experiential retail concepts gain popularity as companies create immersive brand experiences through flagship stores, pop-up locations, and interactive marketing campaigns that build emotional connections with consumers. These strategies enhance brand awareness, generate social media content, and create memorable experiences that drive customer loyalty and word-of-mouth marketing.

Technology integration accelerates across manufacturing processes, with advanced freezing techniques, automated production systems, and quality control technologies enabling improved product consistency, extended shelf life, and cost efficiency. These technological advances support market growth through enhanced product quality and operational scalability that benefits both manufacturers and consumers.

Strategic partnerships between dairy dessert manufacturers and complementary brands create cross-promotional opportunities, ingredient innovation, and market expansion possibilities. Collaborations with candy companies, bakeries, and beverage brands result in unique flavor combinations and co-branded products that generate consumer excitement and drive trial purchases.

Acquisition activity continues as large companies seek to expand product portfolios, enter new market segments, and acquire innovative brands with strong consumer following. These transactions enable market consolidation while providing growth capital for emerging brands and creating synergies that benefit overall market development and consumer choice.

Regulatory developments influence product formulation, labeling requirements, and marketing claims, requiring companies to adapt strategies and invest in compliance capabilities. Recent developments in nutrition labeling, allergen disclosure, and health claim substantiation create both challenges and opportunities for market participants seeking competitive advantages through regulatory compliance excellence.

Innovation investment should focus on developing products that successfully balance indulgence with health benefits, addressing consumer desire for desserts that provide both satisfaction and nutritional value. Companies should prioritize research into functional ingredients, alternative sweeteners, and protein enhancement technologies that maintain taste appeal while delivering health benefits that resonate with target consumer segments.

Distribution diversification represents a critical success factor, with companies needing to develop multi-channel strategies that include traditional retail, e-commerce, foodservice, and direct-to-consumer options. MarkWide Research analysis suggests companies with diversified distribution strategies achieve 23% higher revenue growth compared to single-channel focused competitors.

Brand positioning should emphasize authentic storytelling, quality ingredients, and consumer value creation rather than competing solely on price or promotional activities. Successful brands develop emotional connections with consumers through consistent messaging, community engagement, and product experiences that create lasting loyalty and word-of-mouth marketing benefits.

Sustainability initiatives should be integrated into core business strategies rather than treated as secondary considerations, as environmental responsibility increasingly influences consumer purchasing decisions and brand preferences. Companies should invest in sustainable packaging, responsible sourcing, and carbon footprint reduction programs that create competitive advantages while supporting long-term market sustainability.

Market trajectory indicates continued growth driven by demographic trends, income growth, and evolving consumer preferences that favor premium products and innovative flavor experiences. The market is expected to maintain steady expansion through successful product innovation, distribution expansion, and strategic brand positioning that addresses changing consumer needs and preferences.

Technology advancement will continue enabling product innovation, operational efficiency, and consumer engagement through digital platforms, advanced manufacturing processes, and data-driven marketing strategies. Companies that successfully leverage technology for product development, customer insights, and operational optimization will achieve competitive advantages in an increasingly sophisticated marketplace.

Consumer evolution toward health-conscious indulgence creates opportunities for products that deliver both pleasure and wellness benefits, with projected 34% growth in functional dessert categories over the next five years. This trend supports premium pricing strategies while expanding market reach to health-conscious consumer segments previously underserved by traditional dessert offerings.

Market maturation will likely result in increased consolidation, with successful companies expanding through acquisition, strategic partnerships, and geographic expansion while maintaining focus on innovation and consumer satisfaction. The market structure will evolve to support both large-scale efficiency and niche specialization that serves diverse consumer preferences and market segments effectively.

The United States dairy desserts market represents a dynamic and resilient industry positioned for continued growth through innovation, premiumization, and strategic adaptation to evolving consumer preferences. Market success factors include product quality, brand differentiation, distribution excellence, and responsiveness to health and sustainability trends that increasingly influence consumer purchasing decisions.

Strategic opportunities exist across multiple dimensions including plant-based alternatives, functional ingredient integration, e-commerce expansion, and international flavor exploration that can drive market growth while serving diverse consumer needs. Companies that successfully balance traditional appeal with innovative approaches will achieve sustainable competitive advantages in this evolving marketplace.

Future success will depend on companies’ ability to navigate changing consumer preferences, regulatory requirements, and competitive pressures while maintaining operational efficiency and product quality standards. The market outlook remains positive for participants who invest in innovation, build strong consumer relationships, and adapt strategies to address emerging trends and opportunities in the dynamic dairy desserts landscape.

What is Dairy Desserts?

Dairy Desserts refer to sweet dishes made primarily from dairy products such as milk, cream, and cheese. These desserts include a variety of items like puddings, ice creams, and cheesecakes, which are popular in many culinary traditions.

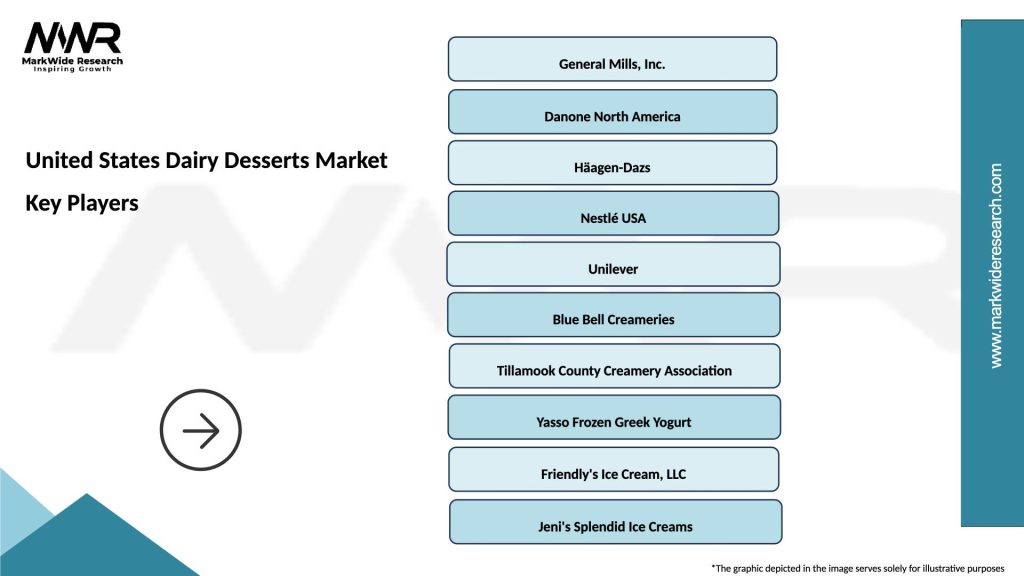

What are the key players in the United States Dairy Desserts Market?

Key players in the United States Dairy Desserts Market include companies like Kraft Heinz, General Mills, and Nestlé, which offer a range of dairy-based dessert products. These companies compete on product innovation and quality, among others.

What are the growth factors driving the United States Dairy Desserts Market?

The United States Dairy Desserts Market is driven by increasing consumer demand for indulgent treats, the popularity of premium and artisanal products, and the rising trend of health-conscious desserts made with natural ingredients.

What challenges does the United States Dairy Desserts Market face?

Challenges in the United States Dairy Desserts Market include fluctuating milk prices, health concerns related to sugar content, and competition from non-dairy alternatives that appeal to lactose-intolerant consumers.

What opportunities exist in the United States Dairy Desserts Market?

Opportunities in the United States Dairy Desserts Market include the growing trend of plant-based dairy alternatives, the potential for innovative flavor combinations, and the expansion of online retail channels for dessert products.

What trends are shaping the United States Dairy Desserts Market?

Trends in the United States Dairy Desserts Market include the rise of low-calorie and low-sugar options, the incorporation of superfoods into dessert recipes, and an increasing focus on sustainable sourcing of dairy ingredients.

United States Dairy Desserts Market

| Segmentation Details | Description |

|---|---|

| Product Type | Ice Cream, Pudding, Yogurt, Cheesecake |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Shops |

| Customer Type | Households, Restaurants, Cafés, Bakeries |

| Flavor Profile | Chocolate, Vanilla, Strawberry, Caramel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Dairy Desserts Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at