444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States customer technical support services industry represents a critical component of the modern business ecosystem, encompassing a comprehensive range of support solutions designed to enhance customer satisfaction and operational efficiency. This dynamic sector has experienced remarkable transformation driven by technological advancement, evolving customer expectations, and the increasing complexity of digital products and services across multiple industries.

Market dynamics indicate substantial growth momentum, with the industry expanding at a robust CAGR of 8.2% as organizations prioritize customer experience excellence. The integration of artificial intelligence, machine learning, and omnichannel support platforms has revolutionized traditional support methodologies, creating new opportunities for service providers and enhanced value propositions for clients.

Digital transformation initiatives across enterprises have fundamentally altered the landscape, with approximately 73% of organizations now implementing cloud-based support solutions to improve scalability and cost-effectiveness. The sector encompasses various service delivery models, including in-house support teams, outsourced solutions, and hybrid approaches that combine human expertise with automated technologies.

Industry participants range from specialized technical support providers to comprehensive business process outsourcing companies, each offering distinct capabilities and expertise. The competitive environment continues to evolve as organizations seek partners capable of delivering seamless, efficient, and personalized customer experiences across multiple touchpoints and communication channels.

The United States customer technical support services industry market refers to the comprehensive ecosystem of organizations, technologies, and processes dedicated to providing technical assistance, troubleshooting, and customer service solutions to businesses and end-users across various sectors. This industry encompasses help desk operations, remote technical assistance, software support, hardware troubleshooting, and customer relationship management services.

Technical support services include multiple service categories such as tier-one basic support, advanced technical troubleshooting, software implementation assistance, and ongoing maintenance support. The industry serves diverse client segments including technology companies, healthcare organizations, financial services firms, retail businesses, and government agencies requiring specialized technical expertise.

Service delivery models within this industry range from traditional call center operations to sophisticated digital support platforms incorporating chatbots, knowledge management systems, and remote diagnostic tools. The sector has evolved to include proactive support services, predictive maintenance, and customer success management as integral components of comprehensive support offerings.

Strategic market analysis reveals that the United States customer technical support services industry is experiencing unprecedented growth driven by digital transformation initiatives and increasing customer experience expectations. Organizations across all sectors are recognizing the critical importance of superior technical support as a competitive differentiator and customer retention strategy.

Key growth drivers include the proliferation of complex software applications, increasing adoption of cloud-based solutions, and the growing demand for 24/7 support availability. Approximately 68% of enterprises now consider technical support quality as a primary factor in vendor selection decisions, highlighting the strategic importance of this industry segment.

Technology integration has become a defining characteristic of modern support services, with artificial intelligence and automation technologies enabling more efficient issue resolution and improved customer satisfaction scores. The industry is witnessing significant investment in omnichannel support platforms that provide consistent experiences across phone, email, chat, and social media channels.

Market consolidation trends are evident as larger service providers acquire specialized firms to expand their capabilities and geographic reach. This consolidation is creating opportunities for enhanced service offerings and improved economies of scale, benefiting both service providers and their clients.

Industry transformation is being driven by several critical factors that are reshaping the competitive landscape and service delivery methodologies. The following insights represent the most significant developments impacting market dynamics:

Digital transformation initiatives across enterprises represent the primary catalyst driving growth in the customer technical support services industry. Organizations are implementing increasingly complex technology solutions that require specialized support expertise, creating substantial demand for professional technical assistance services.

Customer experience expectations have evolved significantly, with consumers and business users demanding immediate, accurate, and personalized support interactions. This shift has compelled organizations to invest in advanced support capabilities and partner with specialized service providers to meet these heightened expectations.

Technology complexity continues to increase as organizations adopt cloud computing, artificial intelligence, Internet of Things devices, and other advanced technologies. The technical expertise required to support these solutions often exceeds internal capabilities, driving outsourcing demand and creating opportunities for specialized support providers.

Cost optimization pressures are encouraging organizations to evaluate outsourcing options for non-core functions like technical support. Professional service providers can often deliver superior support quality at lower costs through economies of scale, specialized expertise, and advanced technology platforms.

Regulatory compliance requirements in industries such as healthcare, financial services, and government are creating demand for specialized support services with deep regulatory knowledge and compliance expertise. These requirements often necessitate partnerships with experienced service providers.

Security concerns represent a significant challenge for the customer technical support services industry, as organizations must balance the benefits of outsourced support with the risks of providing external parties access to sensitive systems and data. These concerns can limit adoption of outsourced support services, particularly in highly regulated industries.

Quality control challenges arise when organizations struggle to maintain consistent service quality across different support channels and service providers. Ensuring uniform expertise levels and service standards can be difficult, particularly when managing multiple vendor relationships or hybrid support models.

Cultural and communication barriers can impact service quality when support services are delivered by offshore providers or teams with limited understanding of local business practices and customer expectations. These challenges can result in customer dissatisfaction and reduced effectiveness of support interactions.

Technology integration complexity presents obstacles when organizations attempt to integrate external support services with existing systems and processes. Compatibility issues, data synchronization challenges, and workflow disruptions can complicate implementation and reduce the effectiveness of support services.

Talent shortage in specialized technical areas creates capacity constraints and increases costs for support service providers. The competition for skilled technical professionals can limit the ability of service providers to scale operations and maintain service quality standards.

Artificial intelligence integration presents substantial opportunities for service providers to enhance efficiency, improve accuracy, and reduce costs while delivering superior customer experiences. AI-powered chatbots, predictive analytics, and automated issue resolution capabilities are creating new service delivery models and competitive advantages.

Vertical specialization opportunities exist for service providers to develop deep expertise in specific industries such as healthcare, financial services, or manufacturing. Specialized knowledge of industry-specific applications, regulations, and business processes can command premium pricing and create competitive differentiation.

Emerging technology support represents a growing opportunity as organizations adopt new technologies like blockchain, augmented reality, and edge computing. Service providers that develop expertise in supporting these emerging technologies can capture early market share and establish leadership positions.

Small and medium enterprise market expansion offers significant growth potential as smaller organizations increasingly recognize the value of professional technical support services. Cloud-based service delivery models make professional support more accessible and affordable for smaller businesses.

Proactive support services development enables service providers to move beyond reactive problem-solving to predictive maintenance and issue prevention. These higher-value services can improve customer outcomes while generating recurring revenue streams and stronger client relationships.

Competitive intensity within the customer technical support services industry continues to increase as traditional service providers compete with technology companies, consulting firms, and specialized support organizations. This competition is driving innovation, improving service quality, and creating downward pressure on pricing.

Technology evolution is fundamentally altering service delivery capabilities and customer expectations. The integration of artificial intelligence, machine learning, and automation technologies is enabling more efficient operations while creating new opportunities for service differentiation and value creation.

Customer behavior changes are influencing service delivery preferences, with increasing demand for self-service options, mobile-friendly interfaces, and instant response capabilities. Service providers must adapt their offerings to accommodate these evolving preferences while maintaining service quality standards.

Regulatory environment changes, particularly related to data privacy and security, are impacting service delivery models and operational requirements. Compliance with regulations such as GDPR, HIPAA, and industry-specific requirements is becoming increasingly important for service providers.

Economic factors including labor costs, technology investments, and client budget constraints are influencing market dynamics and pricing strategies. Service providers must balance cost optimization with service quality maintenance to remain competitive in the evolving market environment.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary research methodologies to ensure accuracy and completeness of market insights. The research framework incorporated quantitative and qualitative analysis techniques to provide a holistic view of industry dynamics.

Primary research activities included structured interviews with industry executives, service providers, and client organizations to gather firsthand insights about market trends, challenges, and opportunities. Survey data was collected from a representative sample of market participants to validate quantitative findings and identify emerging patterns.

Secondary research sources encompassed industry publications, company financial reports, regulatory filings, and trade association data to provide comprehensive market context and historical perspective. Academic research and technology trend analysis supplemented the commercial data sources.

Data validation processes were implemented to ensure accuracy and reliability of research findings through cross-referencing multiple sources, expert review, and statistical analysis. The research methodology adhered to established market research standards and best practices.

Market segmentation analysis utilized advanced analytical techniques to identify distinct market segments, competitive dynamics, and growth opportunities within the broader customer technical support services industry.

Geographic distribution of the United States customer technical support services industry reveals significant regional variations in market concentration, service capabilities, and growth patterns. The analysis encompasses major metropolitan areas, emerging markets, and rural regions to provide comprehensive geographic insights.

West Coast markets including California, Washington, and Oregon represent approximately 35% of industry activity, driven by the concentration of technology companies and innovation-focused organizations. These regions demonstrate strong demand for advanced technical support services and emerging technology expertise.

East Coast concentration in states such as New York, Massachusetts, and Virginia accounts for roughly 28% of market activity, supported by financial services, healthcare, and government sectors requiring specialized technical support capabilities. The region shows particular strength in compliance-focused and highly regulated industry support services.

Midwest and South regions collectively represent 37% of market activity, with growing demand driven by manufacturing, healthcare, and emerging technology adoption. These regions are experiencing rapid growth in cloud-based support services and digital transformation initiatives.

Rural and secondary markets are showing increased adoption of technical support services as broadband infrastructure improvements enable better connectivity and access to cloud-based support platforms. This trend is creating new opportunities for service providers to expand their geographic reach.

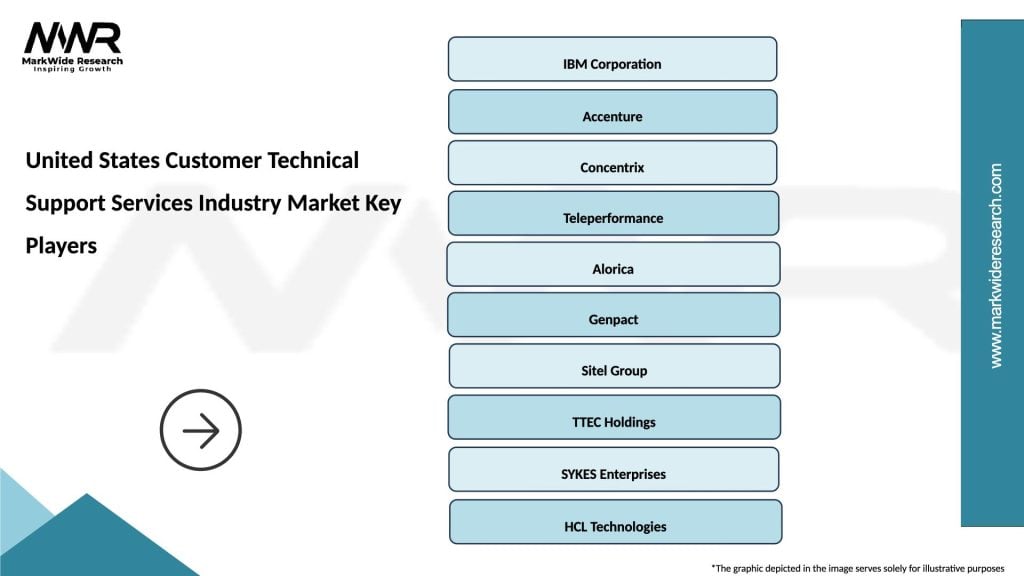

Market leadership in the United States customer technical support services industry is characterized by a diverse ecosystem of established providers, emerging specialists, and technology-enabled disruptors. The competitive environment continues to evolve as organizations seek differentiated capabilities and superior value propositions.

Major industry participants include both traditional business process outsourcing companies and specialized technical support providers:

Competitive differentiation strategies include specialization in specific industries, investment in advanced technologies, geographic expansion, and development of proprietary support platforms. Service providers are increasingly focusing on outcome-based pricing models and performance guarantees to differentiate their offerings.

Market consolidation trends are evident as larger providers acquire specialized firms to expand capabilities and market reach. This consolidation is creating opportunities for enhanced service integration and improved economies of scale.

Service type segmentation reveals distinct categories within the customer technical support services industry, each addressing specific client needs and market requirements. The primary segmentation includes help desk services, technical troubleshooting, software support, and specialized consulting services.

By Service Delivery Model:

By Industry Vertical:

By Organization Size:

Help desk services represent the foundational category of customer technical support, encompassing first-level support, ticket management, and basic troubleshooting capabilities. This category has experienced significant transformation through automation and AI integration, with 45% of routine inquiries now handled through automated systems.

Advanced technical support includes complex problem resolution, system integration assistance, and specialized expertise for sophisticated technology environments. This high-value category commands premium pricing and requires highly skilled technical professionals with deep product knowledge and troubleshooting capabilities.

Proactive support services are emerging as a high-growth category, incorporating predictive analytics, monitoring services, and preventive maintenance capabilities. Organizations are increasingly recognizing the value of preventing issues rather than simply responding to problems after they occur.

Customer success management represents an evolving category that extends beyond traditional technical support to include onboarding assistance, adoption optimization, and strategic consulting services. This category focuses on maximizing customer value realization and long-term satisfaction.

Specialized industry support categories are developing to address unique requirements in sectors such as healthcare, financial services, and manufacturing. These specialized services require deep industry knowledge and compliance expertise, enabling premium pricing and stronger client relationships.

Service providers benefit from the growing demand for technical support services through expanded market opportunities, recurring revenue streams, and the ability to leverage technology investments across multiple clients. The industry offers opportunities for specialization, geographic expansion, and premium service development.

Client organizations gain access to specialized expertise, cost-effective support solutions, and scalable service capabilities that would be difficult to develop internally. Outsourced technical support enables organizations to focus on core business activities while ensuring high-quality customer support.

End customers benefit from improved support quality, faster issue resolution, and enhanced service availability through professional support services. The integration of advanced technologies and specialized expertise results in better customer experiences and higher satisfaction levels.

Technology vendors can extend their market reach and improve customer satisfaction by partnering with professional support service providers. These partnerships enable vendors to offer comprehensive support capabilities without significant internal investment in support infrastructure.

Economic stakeholders benefit from job creation, skill development, and technology advancement driven by the growing technical support services industry. The sector contributes to economic growth through innovation, efficiency improvements, and enhanced competitiveness of supported organizations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence adoption is transforming the customer technical support services landscape, with intelligent chatbots, predictive analytics, and automated issue resolution becoming standard capabilities. MarkWide Research analysis indicates that AI-powered support tools are improving first-call resolution rates by approximately 35% while reducing operational costs.

Omnichannel support integration is becoming essential as customers expect consistent experiences across phone, email, chat, social media, and mobile applications. Organizations are investing in unified platforms that provide seamless transitions between communication channels and maintain context throughout customer interactions.

Proactive support evolution is shifting the industry focus from reactive problem-solving to predictive issue prevention and customer success management. This trend is driven by advanced monitoring capabilities and data analytics that enable identification of potential problems before they impact customers.

Remote support expansion has accelerated significantly, with organizations recognizing the efficiency and cost benefits of technology-enabled remote assistance. Virtual reality and augmented reality technologies are emerging as powerful tools for remote technical support and training applications.

Outcome-based pricing models are gaining popularity as clients seek performance guarantees and measurable results from their support service investments. These models align service provider incentives with client success metrics and customer satisfaction objectives.

Strategic partnerships between technology vendors and support service providers are creating comprehensive solution offerings that combine product expertise with professional service capabilities. These partnerships enable enhanced customer experiences and expanded market reach for both parties.

Technology platform investments by major service providers are resulting in proprietary support platforms with advanced capabilities for automation, analytics, and customer experience management. These investments are creating competitive differentiation and operational efficiency improvements.

Acquisition activity within the industry continues as larger providers seek to expand their capabilities, geographic reach, and client base through strategic acquisitions of specialized firms. This consolidation is creating opportunities for enhanced service integration and economies of scale.

Regulatory compliance enhancements are driving investments in security, data protection, and industry-specific compliance capabilities. Service providers are developing specialized offerings to address requirements in highly regulated industries such as healthcare and financial services.

Workforce development initiatives are addressing talent shortage challenges through training programs, certification development, and partnerships with educational institutions. These initiatives are essential for maintaining service quality and supporting industry growth.

Technology investment prioritization should focus on artificial intelligence, automation, and analytics capabilities that can deliver measurable improvements in efficiency and customer satisfaction. Service providers should evaluate emerging technologies for their potential to create competitive advantages and operational benefits.

Vertical specialization strategies can create opportunities for premium pricing and stronger client relationships by developing deep expertise in specific industries. Organizations should consider focusing on sectors with complex requirements and high barriers to entry for competitors.

Partnership development with technology vendors, consulting firms, and complementary service providers can expand market reach and enhance service capabilities. Strategic alliances can provide access to new markets and technologies while sharing investment risks and costs.

Talent management strategies must address recruitment, retention, and development challenges in a competitive labor market. Organizations should invest in training programs, competitive compensation packages, and career development opportunities to attract and retain skilled professionals.

Customer experience optimization should be a primary focus area, with investments in omnichannel platforms, self-service capabilities, and proactive support services. Organizations that excel in customer experience delivery will achieve competitive advantages and stronger client relationships.

Industry growth prospects remain strong as digital transformation initiatives continue to drive demand for specialized technical support services. MWR projections indicate sustained growth momentum with expanding opportunities in emerging technology support and vertical specialization.

Technology evolution will continue to reshape service delivery capabilities, with artificial intelligence, machine learning, and automation technologies becoming increasingly sophisticated and capable. These advances will enable new service models and improved operational efficiency while maintaining high service quality standards.

Market consolidation is expected to continue as larger providers seek to expand their capabilities and market reach through strategic acquisitions. This trend will create opportunities for enhanced service integration, improved economies of scale, and more comprehensive solution offerings.

Customer expectations will continue to evolve, with increasing demand for immediate response, personalized service, and proactive support capabilities. Service providers must adapt their offerings to meet these evolving expectations while maintaining cost-effectiveness and operational efficiency.

Regulatory environment changes, particularly related to data privacy and security, will continue to influence service delivery models and operational requirements. Organizations must stay current with regulatory developments and invest in compliance capabilities to maintain market access and client trust.

The United States customer technical support services industry represents a dynamic and rapidly evolving market characterized by strong growth prospects, technological innovation, and increasing strategic importance to organizations across all sectors. The industry has demonstrated remarkable resilience and adaptability in responding to changing customer needs and technological advances.

Key success factors for industry participants include technology investment, talent development, customer experience optimization, and strategic positioning in high-growth market segments. Organizations that excel in these areas will be well-positioned to capitalize on emerging opportunities and achieve sustainable competitive advantages.

Future market dynamics will be shaped by continued digital transformation, evolving customer expectations, and technological advancement. The integration of artificial intelligence, automation, and advanced analytics will create new possibilities for service delivery while maintaining the human expertise that remains essential for complex technical support requirements.

Strategic recommendations for industry stakeholders emphasize the importance of proactive adaptation to market changes, investment in emerging technologies, and focus on customer experience excellence. Organizations that successfully navigate these dynamics will contribute to the continued growth and evolution of this essential industry sector.

What is Customer Technical Support Services?

Customer Technical Support Services refer to the assistance provided to customers in resolving technical issues related to products or services. This includes troubleshooting, guidance on product usage, and addressing customer inquiries to enhance user experience.

What are the key players in the United States Customer Technical Support Services Industry Market?

Key players in the United States Customer Technical Support Services Industry Market include companies like Concentrix, Teleperformance, and Sitel Group, which provide a range of support solutions across various sectors, including technology and telecommunications, among others.

What are the growth factors driving the United States Customer Technical Support Services Industry Market?

The growth of the United States Customer Technical Support Services Industry Market is driven by the increasing demand for customer satisfaction, the rise of digital transformation, and the need for efficient problem resolution in sectors such as IT and consumer electronics.

What challenges does the United States Customer Technical Support Services Industry Market face?

Challenges in the United States Customer Technical Support Services Industry Market include high operational costs, the need for continuous staff training, and the increasing complexity of products that require more specialized support.

What opportunities exist in the United States Customer Technical Support Services Industry Market?

Opportunities in the United States Customer Technical Support Services Industry Market include the expansion of AI-driven support solutions, the growth of remote support services, and the increasing importance of omnichannel support strategies to enhance customer engagement.

What trends are shaping the United States Customer Technical Support Services Industry Market?

Trends shaping the United States Customer Technical Support Services Industry Market include the integration of artificial intelligence for automated responses, the shift towards remote support solutions, and the emphasis on personalized customer experiences to improve service quality.

United States Customer Technical Support Services Industry Market

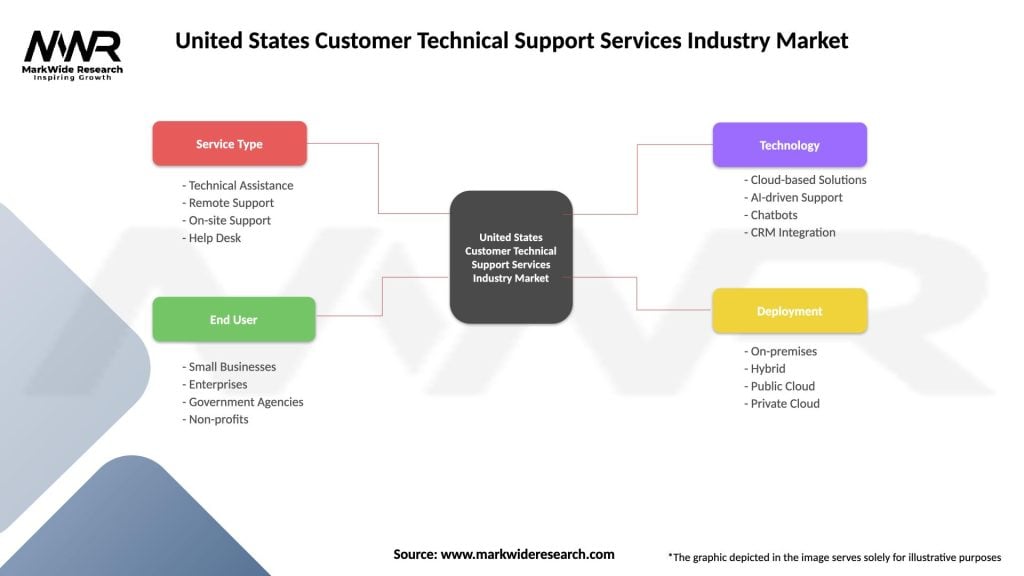

| Segmentation Details | Description |

|---|---|

| Service Type | Technical Assistance, Remote Support, On-site Support, Help Desk |

| End User | Small Businesses, Enterprises, Government Agencies, Non-profits |

| Technology | Cloud-based Solutions, AI-driven Support, Chatbots, CRM Integration |

| Deployment | On-premises, Hybrid, Public Cloud, Private Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Customer Technical Support Services Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at