444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United States Completion Equipment and Services Market refers to the sector that encompasses various equipment, technologies, and services utilized in the completion phase of oil and gas wells. Completion is a critical stage in the exploration and production process, where the well is prepared for production or injection. The market for completion equipment and services in the United States is witnessing significant growth due to the increasing demand for energy and the exploration of unconventional resources such as shale gas and tight oil.

Meaning

Completion equipment and services are essential in optimizing the productivity and efficiency of oil and gas wells. They include a wide range of tools, machinery, and techniques used to ensure the successful completion of a well and its subsequent production or injection. These equipment and services play a crucial role in enhancing well performance, maximizing hydrocarbon recovery, and minimizing operational risks.

Executive Summary

The United States Completion Equipment and Services Market has been experiencing robust growth in recent years. The market is driven by factors such as the increasing number of drilling activities, advancements in completion technologies, and the need for efficient well completion to extract maximum value from oil and gas reservoirs. The market offers numerous opportunities for equipment manufacturers, service providers, and other stakeholders to expand their business and gain a competitive edge.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The United States Completion Equipment and Services Market is driven by several factors, including:

Market Restraints

Despite the positive growth trajectory, the United States Completion Equipment and Services Market faces certain challenges, including:

Market Opportunities

The United States Completion Equipment and Services Market presents several opportunities for industry participants and stakeholders, including:

Market Dynamics

The United States Completion Equipment and Services Market operates in a dynamic environment influenced by various factors, including technological advancements, regulatory changes, market competition, and economic conditions. Understanding these dynamics is crucial for industry participants to adapt, innovate, and capitalize on emerging opportunities.

Regional Analysis

The United States Completion Equipment and Services Market exhibits regional variations based on factors such as drilling activities, resource availability, and regulatory environment. The key regions contributing to market growth include:

Competitive Landscape

Leading Companies in the United States Completion Equipment and Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

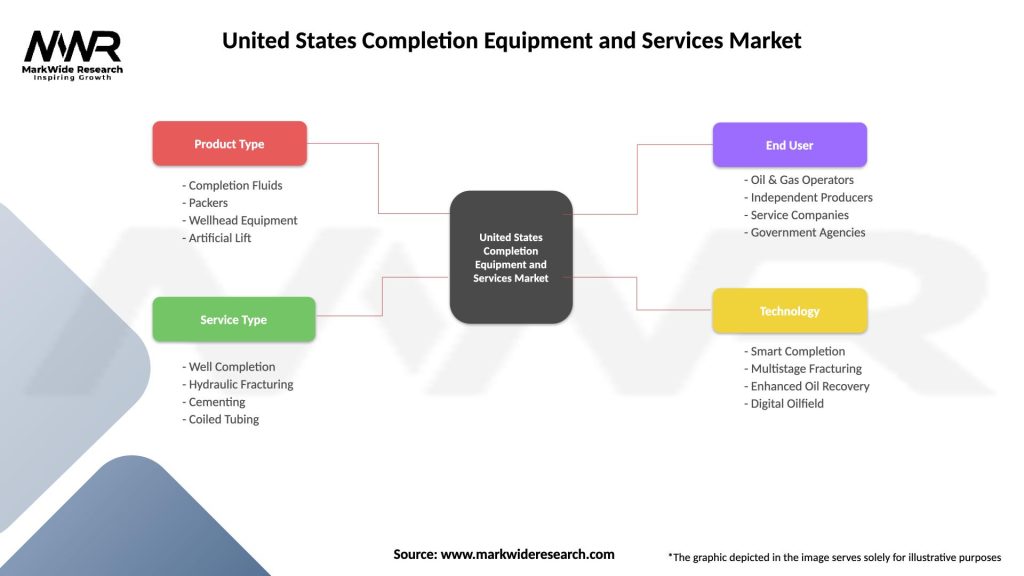

The United States Completion Equipment and Services Market can be segmented based on various factors, including equipment type, service type, application, and end-user. The key segments in the market include:

Segmentation allows market players to understand specific customer needs and tailor their offerings accordingly, leading to improved customer satisfaction and market share.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The United States Completion Equipment and Services Market offer several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the United States Completion Equipment and Services Market provides insights into the market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding the market’s SWOT analysis helps companies devise effective strategies, mitigate weaknesses, and capitalize on opportunities.

Market Key Trends

The United States Completion Equipment and Services Market is influenced by several key trends:

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the United States Completion Equipment and Services Market. The oil and gas industry experienced a downturn due to reduced demand, travel restrictions, and lockdown measures imposed to contain the virus spread. This resulted in a decline in drilling activities, project delays, and cancellations, affecting the market’s growth.

However, the market showed resilience and adapted to the challenging circumstances. Operators and service providers implemented strict health and safety measures, digitalized operations, and focused on cost optimization. As the global economy recovers and oil and gas demand rebounds, the market is expected to regain momentum.

Key Industry Developments

The United States Completion Equipment and Services Market has witnessed several key developments in recent years:

Analyst Suggestions

Industry analysts suggest the following strategies for companies operating in the United States Completion Equipment and Services Market:

Future Outlook

The United States Completion Equipment and Services Market is expected to witness steady growth in the coming years. Factors such as increasing energy demand, the exploration of unconventional resources, technological advancements, and environmental considerations will drive market growth.

The transition towards renewable energy sources, digitalization, and automation will present new opportunities and challenges. Companies that adapt to these changes, embrace sustainability, and invest in innovation will be well-positioned to thrive in the evolving market landscape.

Conclusion

The United States Completion Equipment and Services Market is experiencing robust growth, driven by increasing drilling activities, technological advancements, and the need for efficient completion solutions. While the market faces challenges such as volatile oil prices and environmental concerns, it offers opportunities for revenue generation, technological innovation, and market diversification.

Collaborations, digital transformation, and a focus on sustainability are essential for industry participants and stakeholders to succeed in the competitive landscape. The future outlook for the market remains positive, with emerging trends, advancements in technology, and the recovery of the oil and gas industry set to drive further growth.

What is Completion Equipment and Services?

Completion Equipment and Services refer to the tools and processes used to prepare a well for production after drilling. This includes equipment such as packers, tubing, and wellhead systems, as well as services like well testing and stimulation.

What are the key players in the United States Completion Equipment and Services Market?

Key players in the United States Completion Equipment and Services Market include Halliburton, Schlumberger, Baker Hughes, and Weatherford, among others. These companies provide a range of services and equipment essential for well completion.

What are the main drivers of the United States Completion Equipment and Services Market?

The main drivers of the United States Completion Equipment and Services Market include the increasing demand for oil and gas, advancements in drilling technologies, and the need for efficient resource extraction. Additionally, the rise in unconventional oil and gas production is contributing to market growth.

What challenges does the United States Completion Equipment and Services Market face?

The United States Completion Equipment and Services Market faces challenges such as fluctuating oil prices, regulatory hurdles, and the environmental impact of drilling activities. These factors can affect investment and operational decisions in the sector.

What opportunities exist in the United States Completion Equipment and Services Market?

Opportunities in the United States Completion Equipment and Services Market include the growing focus on sustainable practices, the adoption of digital technologies, and the expansion of offshore drilling activities. These trends can lead to innovative solutions and increased efficiency.

What trends are shaping the United States Completion Equipment and Services Market?

Trends shaping the United States Completion Equipment and Services Market include the integration of automation and data analytics in operations, the shift towards environmentally friendly completion methods, and the increasing use of advanced materials in equipment design. These trends are driving innovation and efficiency in the industry.

United States Completion Equipment and Services Market

| Segmentation Details | Description |

|---|---|

| Product Type | Completion Fluids, Packers, Wellhead Equipment, Artificial Lift |

| Service Type | Well Completion, Hydraulic Fracturing, Cementing, Coiled Tubing |

| End User | Oil & Gas Operators, Independent Producers, Service Companies, Government Agencies |

| Technology | Smart Completion, Multistage Fracturing, Enhanced Oil Recovery, Digital Oilfield |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Completion Equipment and Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at