444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States chartered air freight transport market represents a dynamic and rapidly evolving sector within the broader aviation and logistics industry. This specialized segment focuses on providing customized air cargo services through dedicated aircraft charters, offering flexibility and tailored solutions that traditional scheduled cargo services cannot match. Market dynamics indicate robust growth driven by increasing demand for time-sensitive deliveries, specialized cargo handling requirements, and the need for direct point-to-point transportation solutions.

Industry transformation has accelerated significantly in recent years, with companies increasingly recognizing the strategic advantages of chartered air freight services. The market encompasses various aircraft types, from small cargo planes handling regional deliveries to large freighter aircraft managing international shipments. Growth projections suggest the sector will continue expanding at a compound annual growth rate of 8.2% through the forecast period, reflecting strong underlying demand fundamentals.

Technological advancements have revolutionized operational efficiency within the chartered air freight sector. Modern fleet management systems, real-time tracking capabilities, and advanced logistics planning software have enhanced service reliability while reducing operational costs. The integration of digital platforms has streamlined booking processes and improved customer experience, making chartered air freight services more accessible to a broader range of businesses.

The United States chartered air freight transport market refers to the specialized aviation sector that provides dedicated cargo aircraft services on a charter basis, offering customized transportation solutions for businesses requiring flexible, time-sensitive, or specialized freight delivery services across domestic and international routes.

Charter operations distinguish themselves from scheduled cargo services by offering complete aircraft dedication to specific customer requirements. This includes accommodating unique cargo specifications, flexible scheduling, direct routing capabilities, and specialized handling procedures. Service providers in this market operate various aircraft types, ranging from small turboprop planes for regional deliveries to large cargo jets capable of intercontinental transportation.

Market participants include dedicated charter operators, freight forwarders offering charter services, and integrated logistics providers expanding their service portfolios. The sector serves diverse industries including automotive, aerospace, pharmaceuticals, perishables, and high-value goods requiring secure transportation. Operational flexibility remains the primary value proposition, enabling customers to optimize supply chain efficiency and respond rapidly to market demands.

Strategic positioning within the United States chartered air freight transport market reveals a sector experiencing unprecedented growth momentum. The convergence of e-commerce expansion, supply chain complexity, and demand for expedited delivery services has created favorable market conditions. Industry analysis indicates that approximately 73% of charter operators have reported increased demand over the past two years, reflecting strong market fundamentals.

Competitive landscape features a mix of established aviation companies and emerging specialized operators, each targeting specific market segments. The sector benefits from regulatory stability and supportive infrastructure development, with major airports expanding cargo handling capabilities. Technology integration has become a key differentiator, with leading operators investing heavily in digital platforms and automated systems.

Market segmentation reveals diverse applications across multiple industries, with automotive and aerospace sectors representing significant demand drivers. The pharmaceutical industry’s growing reliance on temperature-controlled transportation has created new opportunities for specialized charter services. Regional distribution shows concentration in major metropolitan areas and industrial centers, with emerging growth in secondary markets.

Fundamental market dynamics reveal several critical insights shaping the chartered air freight transport landscape. The sector demonstrates remarkable resilience and adaptability, responding effectively to changing customer requirements and market conditions. Operational efficiency improvements have enabled providers to offer competitive pricing while maintaining service quality standards.

Primary growth drivers propelling the United States chartered air freight transport market include the accelerating pace of global commerce and increasing demand for flexible logistics solutions. E-commerce expansion has fundamentally altered shipping requirements, creating opportunities for charter services to bridge gaps in traditional cargo networks. The rise of just-in-time manufacturing and lean inventory management practices has increased demand for reliable, time-definite transportation services.

Supply chain complexity continues to drive charter service adoption as companies seek to maintain operational flexibility while managing cost pressures. The automotive industry’s shift toward electric vehicles has created new transportation requirements for specialized components and batteries, requiring customized handling and routing solutions. Pharmaceutical sector growth has generated substantial demand for temperature-controlled charter services, particularly for biologics and vaccines requiring strict cold chain maintenance.

Infrastructure development across secondary airports has expanded charter service accessibility, enabling operators to serve previously underserved markets. The integration of advanced cargo handling equipment and improved ground support services has enhanced operational efficiency. Regulatory streamlining has reduced administrative barriers while maintaining safety standards, facilitating market entry for new operators and service expansion for existing providers.

Operational challenges within the chartered air freight transport market include high capital requirements for aircraft acquisition and maintenance. Cost pressures from fuel price volatility and regulatory compliance expenses can impact profitability, particularly for smaller operators. The specialized nature of charter services requires significant investment in training, equipment, and infrastructure, creating barriers to entry for potential market participants.

Regulatory complexity surrounding international operations can limit service expansion opportunities and increase administrative costs. Security requirements and customs procedures add operational complexity, particularly for time-sensitive shipments requiring expedited processing. Capacity constraints during peak demand periods can limit service availability and impact customer satisfaction levels.

Market fragmentation presents challenges for customers seeking comprehensive service coverage across multiple regions. The lack of standardized pricing models and service specifications can create confusion and complicate procurement decisions. Environmental concerns regarding aviation emissions are increasing pressure for sustainable operations, requiring investment in cleaner technologies and carbon offset programs.

Emerging opportunities within the United States chartered air freight transport market include the growing demand for specialized cargo handling services. Pharmaceutical logistics represents a particularly promising segment, with increasing requirements for temperature-controlled transportation and secure handling protocols. The expansion of biotechnology and medical device manufacturing creates additional opportunities for specialized charter services.

Technology integration offers significant potential for service enhancement and operational efficiency improvements. The development of autonomous cargo aircraft and drone delivery systems could revolutionize last-mile delivery capabilities. Sustainability initiatives present opportunities for operators investing in fuel-efficient aircraft and carbon-neutral operations to differentiate their services and attract environmentally conscious customers.

International expansion opportunities exist as global trade continues to grow and supply chains become increasingly complex. The development of trade corridors and free trade agreements creates new routing opportunities for charter operators. Partnership opportunities with logistics providers, freight forwarders, and technology companies can enhance service capabilities and market reach while sharing investment costs and risks.

Competitive dynamics within the chartered air freight transport market reflect a balance between established operators and emerging specialized providers. Market consolidation trends indicate that larger operators are acquiring smaller regional providers to expand geographic coverage and service capabilities. This consolidation enables economies of scale while maintaining the flexibility and personalized service that characterizes the charter market.

Pricing strategies vary significantly across market segments, with premium services commanding higher rates while standardized offerings compete primarily on cost. The introduction of dynamic pricing models based on demand patterns and capacity utilization has improved revenue optimization for operators. Service differentiation through specialized capabilities, geographic coverage, and technology integration has become increasingly important for maintaining competitive advantage.

Customer relationships remain critical to success in the charter market, with long-term contracts providing revenue stability while spot market opportunities offer growth potential. According to MarkWide Research analysis, approximately 62% of charter revenue comes from repeat customers, highlighting the importance of service quality and reliability in maintaining market position.

Comprehensive analysis of the United States chartered air freight transport market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, operators, customers, and regulatory officials to gather firsthand insights into market trends and dynamics. Survey data from charter operators provides quantitative insights into operational metrics, capacity utilization, and growth projections.

Secondary research encompasses analysis of industry reports, regulatory filings, financial statements, and trade publications to validate primary findings and identify additional market trends. Data triangulation techniques ensure consistency across multiple information sources while identifying potential discrepancies requiring further investigation.

Market modeling incorporates economic indicators, industry growth drivers, and historical performance data to develop accurate forecasts and trend analysis. Statistical analysis of operational data provides insights into capacity utilization, route performance, and seasonal demand patterns. Expert validation through industry advisory panels ensures research findings reflect current market realities and emerging trends.

Geographic distribution of the United States chartered air freight transport market reveals significant concentration in major metropolitan areas and industrial centers. Northeast corridor markets, including New York, Boston, and Philadelphia, represent approximately 28% of total market activity, driven by high-value cargo requirements and international gateway functions.

West Coast operations centered around Los Angeles, San Francisco, and Seattle account for substantial market share, benefiting from Pacific trade routes and technology industry demand. The region’s concentration of aerospace and electronics manufacturing creates consistent demand for specialized charter services. Texas markets including Houston, Dallas, and Austin represent rapidly growing segments, supported by energy sector activities and manufacturing expansion.

Midwest industrial centers such as Chicago, Detroit, and Cleveland maintain strong charter service demand driven by automotive and manufacturing industries. The region’s central location provides strategic advantages for domestic distribution networks. Southeast markets are experiencing accelerated growth, with Atlanta serving as a major hub and Florida markets benefiting from international trade and aerospace activities. Regional airports are increasingly important as charter operators seek to serve secondary markets and avoid congestion at major hubs.

Market leadership within the United States chartered air freight transport sector is distributed among several categories of operators, each serving distinct market segments and customer requirements. Established aviation companies leverage extensive fleet resources and operational expertise to serve large corporate accounts and complex logistics requirements.

Competitive strategies focus on service differentiation through specialized capabilities, geographic coverage, and technology integration. Fleet modernization initiatives enable operators to improve fuel efficiency while reducing environmental impact. Strategic partnerships and acquisitions continue to reshape the competitive landscape as operators seek to expand service capabilities and market reach.

Market segmentation within the United States chartered air freight transport sector reveals diverse applications and customer requirements driving demand across multiple dimensions. Aircraft type segmentation includes small cargo aircraft for regional operations, medium-sized freighters for domestic routes, and large cargo jets for international and heavy freight applications.

By Service Type:

By Industry Vertical:

Automotive sector demand represents a significant portion of chartered air freight activity, driven by just-in-time manufacturing requirements and global supply chain complexity. Production disruptions and component shortages have increased reliance on charter services to maintain assembly line operations. The transition to electric vehicles has created new transportation requirements for batteries and specialized components requiring careful handling and routing.

Pharmaceutical logistics continues to expand as a specialized market segment, with increasing demand for temperature-controlled charter services. Biologics transportation requires strict cold chain maintenance and security protocols, creating opportunities for operators with specialized capabilities. The COVID-19 pandemic highlighted the critical importance of reliable pharmaceutical logistics, driving investment in specialized equipment and procedures.

Aerospace industry requirements focus on high-value components and time-critical maintenance parts requiring secure handling and rapid delivery. Aircraft on ground situations create urgent charter requirements where service speed and reliability are paramount. The commercial aviation recovery has increased demand for maintenance parts and components, supporting charter service growth in this segment.

Operational advantages for charter service customers include enhanced supply chain flexibility and reduced inventory carrying costs. Time-sensitive deliveries enable companies to respond rapidly to market demands and production requirements while minimizing disruption risks. The ability to access remote locations and secondary airports provides geographic reach unavailable through scheduled cargo services.

Cost optimization opportunities arise from reduced handling and transit times, minimizing cargo exposure to damage or loss. Specialized handling capabilities ensure proper care for high-value or sensitive cargo, reducing insurance costs and liability exposure. Direct routing eliminates intermediate handling points, improving cargo security and reducing transit times.

Strategic benefits include improved customer service capabilities and competitive differentiation through reliable logistics support. Risk mitigation through diversified transportation options reduces dependence on single carriers or routes. The flexibility to adjust capacity and routing based on demand patterns enables optimized logistics planning and cost management.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a fundamental trend reshaping the chartered air freight transport market. Online booking platforms are streamlining customer access while providing real-time pricing and availability information. Advanced analytics and artificial intelligence are optimizing route planning and capacity utilization, improving operational efficiency and cost management.

Sustainability initiatives are gaining prominence as environmental concerns influence customer decisions and regulatory requirements. Fuel-efficient aircraft adoption is accelerating, with operators investing in modern fleets to reduce emissions and operating costs. Carbon offset programs and sustainable aviation fuel initiatives are becoming standard offerings for environmentally conscious customers.

Service specialization continues to drive market differentiation, with operators developing expertise in specific industry verticals or cargo types. Temperature-controlled logistics capabilities are expanding to serve pharmaceutical and perishables markets. The integration of ground handling and logistics services is creating comprehensive supply chain solutions extending beyond basic transportation.

Fleet modernization initiatives across the chartered air freight transport industry reflect operators’ commitment to efficiency and environmental responsibility. Aircraft acquisitions focus on fuel-efficient models offering improved payload capacity and range capabilities. The retirement of older aircraft is accelerating as operators seek to reduce maintenance costs and improve operational reliability.

Technology partnerships between charter operators and software providers are enhancing operational capabilities and customer experience. Blockchain integration for cargo tracking and documentation is improving transparency and security throughout the supply chain. The development of predictive maintenance systems is reducing aircraft downtime while optimizing maintenance scheduling and costs.

Market consolidation continues as larger operators acquire regional providers to expand geographic coverage and service capabilities. Strategic alliances between charter operators and logistics providers are creating integrated service offerings. According to MWR findings, approximately 35% of charter operators have entered new partnerships or alliances within the past year, indicating active industry collaboration.

Strategic recommendations for charter operators include continued investment in technology infrastructure and fleet modernization to maintain competitive advantage. Service diversification through specialized capabilities and industry expertise can create sustainable differentiation and pricing power. The development of comprehensive logistics solutions extending beyond transportation can enhance customer value and retention.

Market expansion opportunities exist in underserved regional markets and emerging industry verticals requiring specialized transportation services. Partnership strategies with logistics providers and technology companies can accelerate capability development while sharing investment costs and risks. The focus on sustainability initiatives will become increasingly important for long-term market positioning and customer attraction.

Operational excellence through continuous improvement in safety, reliability, and efficiency remains fundamental to success in the charter market. Customer relationship management systems and service quality metrics should be prioritized to maintain competitive positioning. Investment in employee training and development ensures service quality standards while supporting operational safety and regulatory compliance requirements.

Growth projections for the United States chartered air freight transport market indicate continued expansion driven by evolving customer requirements and supply chain complexity. MarkWide Research analysis suggests the sector will maintain robust growth momentum, with demand increasing across multiple industry verticals and geographic regions. The integration of advanced technologies and sustainable practices will shape competitive dynamics and operational capabilities.

Market evolution will likely feature increased consolidation as operators seek scale advantages and comprehensive service capabilities. Technology adoption will accelerate, with artificial intelligence and automation improving operational efficiency while reducing costs. The development of autonomous cargo aircraft may revolutionize certain market segments, particularly for standardized routes and cargo types.

Industry transformation toward sustainability will intensify, with environmental considerations becoming integral to customer selection criteria and regulatory requirements. Service innovation will focus on specialized capabilities and integrated logistics solutions addressing complex supply chain challenges. The market is expected to achieve a compound annual growth rate of 8.7% over the next five years, reflecting strong underlying demand fundamentals and expanding application opportunities.

Market assessment of the United States chartered air freight transport sector reveals a dynamic industry positioned for sustained growth and evolution. Fundamental drivers including supply chain complexity, time-sensitive delivery requirements, and specialized cargo handling needs continue to support market expansion across diverse industry verticals and geographic regions.

Competitive dynamics reflect a balance between established operators leveraging scale advantages and specialized providers focusing on niche market segments. Technology integration and sustainability initiatives are reshaping operational capabilities while creating new opportunities for differentiation and growth. The sector’s ability to adapt to changing customer requirements and market conditions demonstrates resilience and long-term viability.

Future success will depend on continued investment in fleet modernization, technology advancement, and service specialization. Strategic partnerships and market consolidation will likely accelerate as operators seek comprehensive capabilities and geographic coverage. The chartered air freight transport market represents a critical component of the broader logistics ecosystem, providing essential flexibility and specialized services supporting economic growth and global commerce.

What is Chartered Air Freight Transport?

Chartered Air Freight Transport refers to the service of transporting goods via aircraft that are specifically hired for a particular shipment, rather than using scheduled airline services. This method is often utilized for time-sensitive deliveries, large cargo, or specialized freight needs.

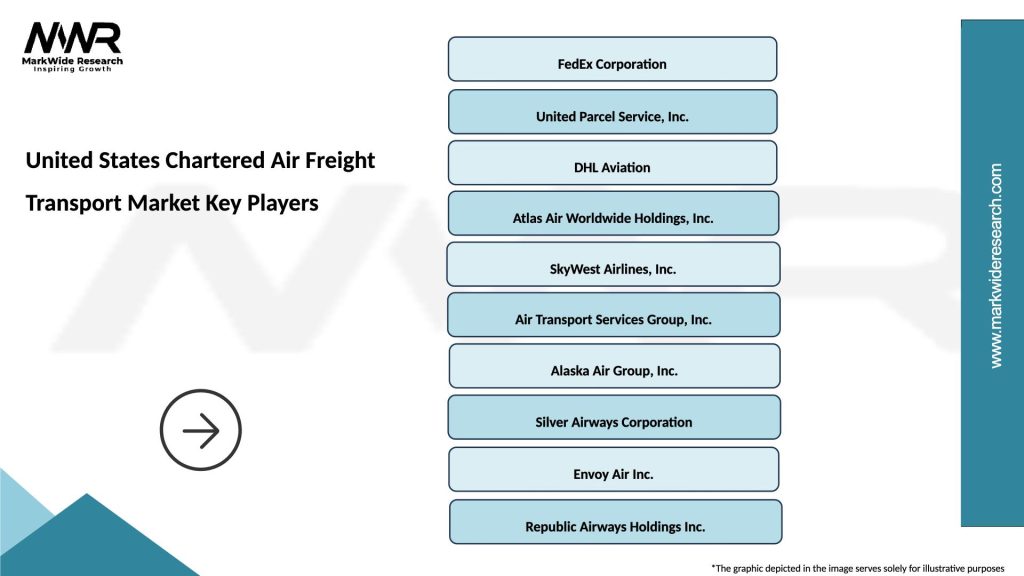

What are the key players in the United States Chartered Air Freight Transport Market?

Key players in the United States Chartered Air Freight Transport Market include companies like Atlas Air, Air Transport Services Group, and Western Global Airlines, among others. These companies provide various air freight solutions tailored to meet diverse customer needs.

What are the growth factors driving the United States Chartered Air Freight Transport Market?

The growth of the United States Chartered Air Freight Transport Market is driven by increasing demand for expedited shipping, the rise of e-commerce, and the need for specialized transport solutions for industries such as pharmaceuticals and automotive.

What challenges does the United States Chartered Air Freight Transport Market face?

Challenges in the United States Chartered Air Freight Transport Market include regulatory compliance, fluctuating fuel prices, and competition from other logistics modes such as trucking and rail transport. These factors can impact operational efficiency and cost management.

What opportunities exist in the United States Chartered Air Freight Transport Market?

Opportunities in the United States Chartered Air Freight Transport Market include the expansion of e-commerce logistics, advancements in aircraft technology, and the potential for increased demand in sectors like healthcare and perishables that require rapid delivery.

What trends are shaping the United States Chartered Air Freight Transport Market?

Trends in the United States Chartered Air Freight Transport Market include the growing use of digital platforms for booking and tracking shipments, an emphasis on sustainability practices, and the integration of advanced technologies such as AI and automation to enhance operational efficiency.

United States Chartered Air Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Service Type | Express Delivery, Standard Delivery, Same-Day Delivery, Scheduled Services |

| End User | E-commerce, Pharmaceuticals, Automotive Parts, Electronics |

| Vehicle Type | Freight Aircraft, Cargo Jets, Helicopters, Charter Planes |

| Delivery Mode | Door-to-Door, Airport-to-Airport, Hub-and-Spoke, Direct Flight |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Chartered Air Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at