444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States cardiometabolic fixed-dose combinations market represents a critical segment of the pharmaceutical industry, addressing the growing prevalence of cardiovascular and metabolic disorders through innovative therapeutic approaches. Fixed-dose combinations (FDCs) have emerged as a cornerstone of modern cardiometabolic treatment, offering enhanced patient compliance and improved clinical outcomes by combining multiple active pharmaceutical ingredients into single dosage forms.

Market dynamics indicate robust growth driven by increasing prevalence of diabetes, hypertension, and cardiovascular diseases across the United States. The market encompasses various therapeutic combinations including antidiabetic agents, antihypertensive medications, and lipid-lowering therapies formulated into convenient single-pill solutions. Current adoption rates show approximately 68% of cardiometabolic patients benefit from combination therapy approaches, with fixed-dose formulations accounting for a significant portion of prescribed treatments.

Healthcare providers increasingly recognize the value proposition of cardiometabolic FDCs, particularly in managing complex patient populations with multiple comorbidities. The market demonstrates strong momentum with projected growth rates of 8.2% CAGR through the forecast period, driven by aging demographics, lifestyle-related disease prevalence, and continuous pharmaceutical innovation in combination therapy development.

The cardiometabolic fixed-dose combinations market refers to the pharmaceutical sector focused on developing, manufacturing, and commercializing single-pill formulations that combine multiple therapeutic agents targeting cardiovascular and metabolic conditions simultaneously. These innovative pharmaceutical products integrate complementary mechanisms of action to address the interconnected nature of cardiometabolic disorders.

Cardiometabolic conditions encompass a spectrum of related health issues including type 2 diabetes, hypertension, dyslipidemia, and cardiovascular disease, which frequently coexist and share common pathophysiological pathways. Fixed-dose combinations represent a strategic therapeutic approach that simplifies treatment regimens while potentially enhancing efficacy through synergistic drug interactions and improved patient adherence to prescribed therapies.

Market participants include pharmaceutical manufacturers, biotechnology companies, generic drug producers, and specialty pharmaceutical firms developing novel combination formulations. The market serves healthcare providers, patients, insurance companies, and healthcare systems seeking cost-effective solutions for managing complex cardiometabolic patient populations with streamlined treatment approaches.

Strategic market analysis reveals the United States cardiometabolic fixed-dose combinations market as a rapidly expanding segment characterized by significant innovation and growing clinical adoption. Key market drivers include rising prevalence of metabolic syndrome affecting approximately 35% of US adults, increasing healthcare focus on preventive medicine, and pharmaceutical industry emphasis on patient-centric treatment solutions.

Competitive landscape features established pharmaceutical giants alongside emerging specialty companies developing next-generation combination therapies. Market segmentation spans multiple therapeutic categories including diabetes-hypertension combinations, lipid-cardiovascular formulations, and comprehensive metabolic syndrome treatments. Regulatory environment remains supportive with FDA initiatives encouraging combination product development through streamlined approval pathways.

Growth trajectory demonstrates sustained momentum driven by clinical evidence supporting combination therapy benefits, healthcare cost containment pressures, and patient preference for simplified medication regimens. Market penetration rates show approximately 42% of eligible patients currently utilizing fixed-dose combination therapies, indicating substantial expansion opportunities in underserved patient segments and emerging therapeutic areas.

Primary market insights reveal several critical factors shaping the cardiometabolic fixed-dose combinations landscape:

Market intelligence indicates growing physician confidence in prescribing fixed-dose combinations, with specialty care adoption rates reaching 76% among endocrinologists and 71% among cardiologists for appropriate patient populations.

Fundamental market drivers propelling growth in the cardiometabolic fixed-dose combinations sector encompass demographic, clinical, and economic factors creating sustained demand for innovative combination therapies.

Demographic trends represent the primary growth catalyst, with aging baby boomer populations experiencing increased incidence of cardiometabolic disorders. Obesity prevalence continues rising, affecting approximately 36% of US adults and directly correlating with diabetes and cardiovascular disease development. Lifestyle factors including sedentary behavior, dietary patterns, and stress contribute to expanding patient populations requiring comprehensive cardiometabolic management.

Clinical evidence supporting combination therapy benefits drives physician adoption and patient acceptance. Healthcare quality initiatives emphasize achieving multiple therapeutic targets simultaneously, making fixed-dose combinations attractive for meeting clinical guidelines and quality metrics. Patient convenience remains a significant driver, with simplified dosing regimens improving treatment satisfaction and long-term adherence rates.

Economic pressures within healthcare systems favor cost-effective treatment approaches that reduce overall care expenses while maintaining or improving clinical outcomes. Insurance coverage increasingly supports combination therapies that demonstrate value-based care principles and population health management benefits.

Market constraints affecting cardiometabolic fixed-dose combinations development and adoption include regulatory complexities, clinical challenges, and economic barriers that may limit market expansion potential.

Regulatory hurdles present significant challenges for combination product development, requiring extensive clinical trials demonstrating safety and efficacy of combined formulations. FDA approval processes for fixed-dose combinations often involve complex bioequivalence studies and drug-drug interaction assessments that extend development timelines and increase costs. Manufacturing complexities associated with combining multiple active ingredients while maintaining stability and bioavailability create technical challenges for pharmaceutical companies.

Clinical limitations include potential for increased adverse effects when combining medications, challenges in dose optimization for individual patients, and difficulties in adjusting individual component doses within fixed combinations. Physician prescribing patterns may resist change from established separate medication approaches, particularly among healthcare providers comfortable with traditional treatment protocols.

Economic barriers encompass high development costs, patent protection challenges, and pricing pressures from healthcare payers seeking cost containment. Generic competition intensifies following patent expirations, potentially limiting return on investment for innovative combination products and reducing incentives for continued research and development activities.

Emerging opportunities within the cardiometabolic fixed-dose combinations market present substantial potential for growth and innovation across multiple therapeutic areas and patient populations.

Unmet medical needs in cardiometabolic care create opportunities for novel combination formulations addressing specific patient populations. Pediatric and adolescent markets represent underserved segments with growing prevalence of early-onset diabetes and metabolic disorders requiring age-appropriate combination therapies. Geriatric populations present opportunities for specialized formulations addressing polypharmacy concerns and age-related physiological changes affecting drug metabolism.

Technology integration offers opportunities for smart combination products incorporating digital health features, adherence monitoring, and personalized dosing adjustments. Precision medicine approaches enable development of biomarker-guided combination selections optimizing individual patient responses and minimizing adverse effects.

Global expansion opportunities exist for successful US combination products seeking international market penetration, particularly in emerging markets with growing cardiometabolic disease prevalence. Partnership opportunities between pharmaceutical companies, technology firms, and healthcare providers create potential for innovative combination therapy delivery models and patient support programs.

Complex market dynamics shape the cardiometabolic fixed-dose combinations landscape through interconnected forces influencing supply, demand, competition, and innovation patterns.

Supply-side dynamics reflect pharmaceutical industry consolidation, manufacturing capacity constraints, and regulatory compliance requirements affecting product availability and pricing. Research and development investments in combination therapy platforms demonstrate industry commitment to innovation, with approximately 15% of pharmaceutical R&D budgets allocated to combination product development across major companies.

Demand-side factors include growing patient populations, evolving clinical guidelines, and healthcare provider preferences for simplified treatment regimens. Payer dynamics increasingly emphasize value-based care models that reward combination therapies demonstrating improved outcomes and reduced total cost of care. Patient advocacy for convenient treatment options drives market demand for user-friendly combination formulations.

Competitive dynamics feature intense rivalry between branded and generic manufacturers, with market share distribution showing approximately 58% branded products and 42% generic alternatives. Innovation cycles accelerate as companies seek competitive advantages through novel combination approaches, delivery mechanisms, and patient support services.

Comprehensive research methodology employed for analyzing the United States cardiometabolic fixed-dose combinations market incorporates multiple data sources, analytical techniques, and validation processes ensuring accurate and reliable market intelligence.

Primary research activities include structured interviews with key stakeholders across the pharmaceutical value chain, including pharmaceutical executives, clinical researchers, healthcare providers, and patient advocacy representatives. Survey methodologies capture quantitative insights regarding prescribing patterns, patient preferences, and market trends from representative samples of healthcare professionals and patients.

Secondary research encompasses analysis of published clinical studies, regulatory filings, company financial reports, and industry publications providing comprehensive market context. Database analysis utilizes prescription data, claims information, and epidemiological studies to quantify market size, growth patterns, and competitive positioning.

Analytical frameworks employ statistical modeling, trend analysis, and forecasting methodologies to project market evolution and identify growth opportunities. Validation processes include expert panel reviews, cross-referencing multiple data sources, and sensitivity analysis ensuring research findings accuracy and reliability for strategic decision-making purposes.

Regional market analysis reveals significant variations in cardiometabolic fixed-dose combinations adoption, utilization patterns, and growth potential across different United States geographic regions.

Northeast region demonstrates the highest market penetration rates, with approximately 47% of eligible patients utilizing combination therapies, driven by advanced healthcare infrastructure, specialist availability, and higher insurance coverage rates. Academic medical centers in this region lead clinical research and early adoption of innovative combination products, creating favorable market conditions for new product launches.

Southeast region shows rapid growth potential due to high prevalence of cardiometabolic disorders, with diabetes rates exceeding 12% in several states. Market expansion opportunities exist through improved access to specialty care and patient education programs addressing combination therapy benefits. Healthcare disparities present challenges requiring targeted interventions to ensure equitable access to advanced combination treatments.

Western region exhibits strong adoption of technology-integrated combination products and personalized medicine approaches. California and Washington lead in digital health integration with combination therapies, while rural areas present opportunities for telemedicine-supported combination therapy management programs.

Midwest region demonstrates steady growth with combination therapy adoption rates of approximately 38%, supported by strong primary care networks and integrated healthcare systems facilitating coordinated cardiometabolic care approaches.

Competitive landscape in the United States cardiometabolic fixed-dose combinations market features diverse participants ranging from multinational pharmaceutical corporations to specialized biotechnology companies developing innovative combination therapies.

Strategic initiatives among market leaders include research collaborations, licensing agreements, and acquisition activities aimed at strengthening combination product pipelines and market positioning. Competitive differentiation focuses on clinical efficacy, safety profiles, patient convenience, and comprehensive support services.

Market segmentation analysis reveals distinct categories within the cardiometabolic fixed-dose combinations market, each characterized by unique therapeutic approaches, patient populations, and growth dynamics.

By Therapeutic Class:

By Drug Class:

By Patient Population:

Detailed category analysis provides comprehensive insights into specific segments within the cardiometabolic fixed-dose combinations market, revealing unique characteristics and growth opportunities.

Diabetes-Hypertension Combinations represent the most established category, with market penetration rates of approximately 52% among eligible patients. Clinical advantages include simplified dosing regimens, improved adherence, and synergistic cardiovascular protection. Leading products combine metformin or SGLT2 inhibitors with ACE inhibitors or angiotensin receptor blockers, demonstrating consistent efficacy and safety profiles across diverse patient populations.

Cardiovascular-Metabolic Combinations emerge as high-growth categories addressing comprehensive risk factor management. Innovation focus centers on combining novel diabetes medications with established cardiovascular therapies, creating differentiated products with enhanced clinical value propositions. Market adoption accelerates as clinical evidence demonstrates superior outcomes compared to separate medication approaches.

Triple Combination Products represent the most advanced category, integrating three complementary mechanisms of action within single formulations. Development challenges include complex formulation requirements, extensive clinical testing, and regulatory approval complexities. Market potential remains substantial for products successfully navigating development hurdles and demonstrating clear clinical advantages over existing combination alternatives.

Comprehensive benefits derived from cardiometabolic fixed-dose combinations extend across multiple stakeholder groups, creating value propositions that drive market adoption and growth.

For Pharmaceutical Companies:

For Healthcare Providers:

For Patients:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the cardiometabolic fixed-dose combinations market reflect evolving healthcare needs, technological advances, and changing patient expectations.

Personalized Combination Therapy emerges as a dominant trend, with pharmaceutical companies developing biomarker-guided combination selections optimizing individual patient responses. Pharmacogenomic testing integration enables precise combination therapy selection based on genetic profiles, improving efficacy while minimizing adverse effects. Clinical adoption of personalized approaches shows approximately 28% growth annually among specialty care providers.

Digital Health Integration transforms combination product delivery through smart packaging, adherence monitoring, and patient engagement platforms. Connected devices provide real-time medication adherence data, enabling healthcare providers to optimize treatment regimens and intervene when necessary. Mobile health applications support patient education, medication reminders, and clinical outcome tracking.

Outcome-Based Contracting gains momentum as pharmaceutical companies and payers negotiate value-based agreements tied to clinical outcomes and cost savings. Risk-sharing arrangements align manufacturer incentives with patient outcomes, encouraging development of highly effective combination products. Real-world evidence generation supports outcome-based contracting through comprehensive data collection and analysis.

Preventive Medicine Focus drives development of combination products targeting pre-diabetic and pre-hypertensive populations, emphasizing disease prevention rather than treatment alone.

Recent industry developments demonstrate significant innovation and strategic activity within the cardiometabolic fixed-dose combinations market, reflecting continued investment and growth potential.

Regulatory Milestones include FDA approval of several novel combination products addressing unmet medical needs in cardiometabolic care. Breakthrough therapy designations expedite development of promising combination formulations demonstrating substantial clinical advantages over existing treatments. Guidance document updates provide clearer regulatory pathways for combination product development and approval.

Strategic Partnerships between pharmaceutical companies accelerate combination product development through complementary expertise and resource sharing. Licensing agreements enable access to novel compounds for combination formulation, while co-development partnerships reduce individual company risks and costs. Academic collaborations advance scientific understanding of combination therapy mechanisms and optimization strategies.

Technology Innovations include advanced drug delivery systems, extended-release formulations, and bioavailability enhancement techniques improving combination product performance. Manufacturing advances enable more complex combination formulations while maintaining cost-effectiveness and quality standards. Digital integration capabilities transform combination products into comprehensive therapy management solutions.

Market Access Initiatives focus on demonstrating value propositions to healthcare payers through real-world evidence generation and health economic studies. Patient assistance programs improve access to innovative combination products for underserved populations.

Strategic recommendations for market participants in the cardiometabolic fixed-dose combinations sector emphasize innovation, market access, and patient-centric approaches for sustainable competitive advantage.

For Pharmaceutical Companies: MarkWide Research analysis suggests prioritizing combination products addressing unmet medical needs in specific patient populations, particularly elderly patients with multiple comorbidities. Investment focus should emphasize digital health integration capabilities and real-world evidence generation supporting value-based care initiatives. Partnership strategies with technology companies and healthcare providers can accelerate market penetration and enhance product value propositions.

For Healthcare Providers: Clinical integration of combination therapies requires comprehensive staff education and patient counseling programs ensuring optimal utilization and outcomes. Quality improvement initiatives should incorporate combination therapy metrics and patient adherence monitoring. Technology adoption for adherence tracking and patient engagement enhances combination therapy effectiveness and patient satisfaction.

For Payers: Value-based contracting approaches with combination product manufacturers can align costs with clinical outcomes and population health improvements. Coverage policies should recognize combination therapy benefits in reducing total cost of care through improved adherence and outcomes. Prior authorization processes should facilitate appropriate combination product access while maintaining cost control objectives.

For Investors: Investment opportunities exist in companies developing innovative combination platforms, digital health integration capabilities, and personalized medicine approaches within cardiometabolic care.

Future market trajectory for United States cardiometabolic fixed-dose combinations indicates sustained growth driven by demographic trends, clinical innovation, and evolving healthcare delivery models.

Growth projections suggest continued market expansion with compound annual growth rates of approximately 8.5% through the next decade, supported by aging populations, increasing disease prevalence, and pharmaceutical industry innovation investments. Market maturation will likely feature increased competition, pricing pressures, and emphasis on differentiated value propositions beyond basic combination formulations.

Innovation trajectories point toward more sophisticated combination products incorporating multiple therapeutic mechanisms, extended-release technologies, and digital health integration capabilities. Personalized medicine approaches will likely become standard practice, with biomarker-guided combination selection achieving mainstream adoption rates exceeding 45% by 2030. Artificial intelligence and machine learning applications will optimize combination therapy selection and dosing for individual patients.

Regulatory evolution may streamline combination product approval processes while maintaining safety standards, potentially reducing development timelines and costs. International harmonization of regulatory requirements could facilitate global market expansion for successful US combination products. Real-world evidence requirements will likely increase, emphasizing post-market surveillance and outcomes measurement.

Market consolidation trends may accelerate as companies seek scale advantages and comprehensive combination product portfolios. MWR projects continued strategic activity including mergers, acquisitions, and partnerships shaping competitive dynamics and market structure evolution.

The United States cardiometabolic fixed-dose combinations market represents a dynamic and rapidly evolving pharmaceutical sector characterized by significant growth potential, continuous innovation, and expanding clinical adoption. Market fundamentals remain strong, supported by increasing disease prevalence, aging demographics, and healthcare system emphasis on cost-effective treatment approaches that improve patient outcomes and adherence.

Strategic opportunities abound for pharmaceutical companies, healthcare providers, and other stakeholders willing to invest in innovative combination therapy development, digital health integration, and patient-centric care models. Competitive dynamics will likely intensify as market participants seek differentiation through novel combination approaches, superior clinical evidence, and comprehensive patient support services.

Future success in this market will depend on companies’ ability to navigate regulatory complexities, demonstrate clear clinical and economic value, and adapt to evolving healthcare delivery models emphasizing outcomes-based care. Patient-centric innovation focusing on convenience, efficacy, and safety will drive market leadership, while technology integration and personalized medicine approaches will define next-generation combination products. The market’s trajectory suggests continued expansion and evolution, creating substantial opportunities for stakeholders committed to advancing cardiometabolic care through innovative fixed-dose combination solutions.

What is Cardiometabolic Fixed-dose Combinations?

Cardiometabolic Fixed-dose Combinations refer to pharmaceutical formulations that combine multiple active ingredients to manage cardiometabolic conditions, such as hypertension, diabetes, and dyslipidemia, in a single dosage form.

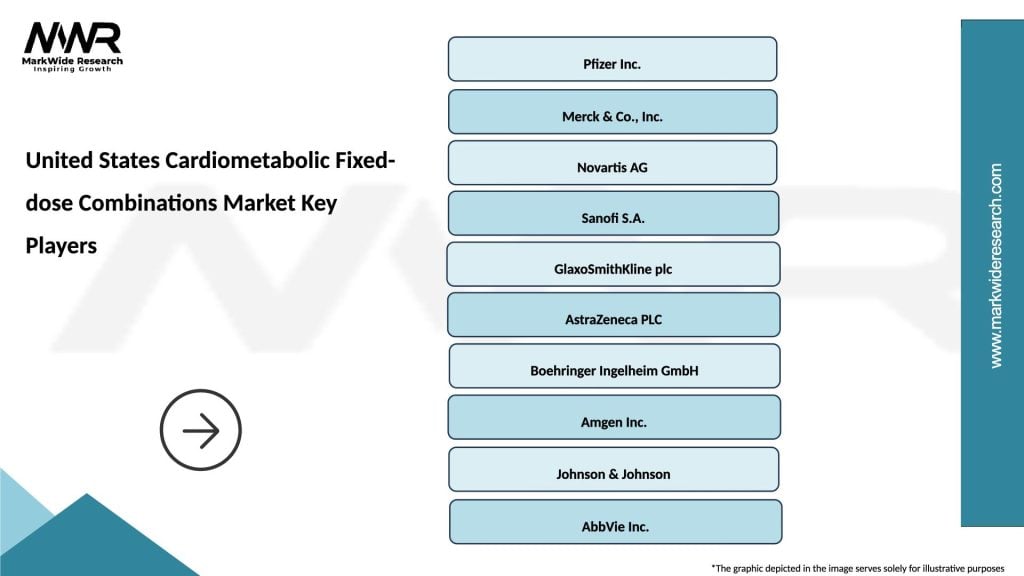

What are the key players in the United States Cardiometabolic Fixed-dose Combinations Market?

Key players in the United States Cardiometabolic Fixed-dose Combinations Market include Pfizer, Merck & Co., Novartis, and Sanofi, among others.

What are the growth factors driving the United States Cardiometabolic Fixed-dose Combinations Market?

The growth of the United States Cardiometabolic Fixed-dose Combinations Market is driven by the increasing prevalence of cardiometabolic diseases, rising healthcare costs, and the demand for more effective treatment regimens that improve patient adherence.

What challenges does the United States Cardiometabolic Fixed-dose Combinations Market face?

Challenges in the United States Cardiometabolic Fixed-dose Combinations Market include regulatory hurdles, the complexity of drug development, and potential side effects associated with combination therapies.

What opportunities exist in the United States Cardiometabolic Fixed-dose Combinations Market?

Opportunities in the United States Cardiometabolic Fixed-dose Combinations Market include the development of novel combinations targeting specific patient populations and advancements in personalized medicine that enhance treatment efficacy.

What trends are shaping the United States Cardiometabolic Fixed-dose Combinations Market?

Trends in the United States Cardiometabolic Fixed-dose Combinations Market include the increasing focus on preventive care, the integration of digital health technologies, and the growing emphasis on patient-centered treatment approaches.

United States Cardiometabolic Fixed-dose Combinations Market

| Segmentation Details | Description |

|---|---|

| Product Type | Antihypertensives, Antidiabetics, Lipid Regulators, Others |

| Delivery Mode | Oral, Injectable, Transdermal, Inhalation |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Therapy Area | Diabetes, Hypertension, Dyslipidemia, Obesity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Cardiometabolic Fixed-dose Combinations Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at