444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States car rental market represents a dynamic and evolving sector within the broader transportation industry, characterized by significant technological advancement and changing consumer preferences. This market encompasses traditional vehicle rental services, emerging mobility solutions, and innovative fleet management technologies that serve diverse customer segments across business and leisure travel. Market dynamics indicate robust growth potential driven by increasing domestic tourism, business travel recovery, and the rising adoption of shared mobility concepts.

Industry transformation has accelerated significantly in recent years, with companies investing heavily in digital platforms, contactless rental processes, and sustainable vehicle fleets. The market demonstrates resilience through strategic adaptation to evolving consumer demands, including enhanced safety protocols, flexible rental terms, and integrated technology solutions. Growth projections suggest the market will expand at a compound annual growth rate of 8.2% through the forecast period, reflecting strong underlying demand fundamentals and operational improvements.

Regional distribution shows concentrated activity in major metropolitan areas, airports, and tourist destinations, with approximately 45% of rental activity occurring in the top ten urban markets. The market structure includes established national chains, regional operators, and emerging peer-to-peer platforms that collectively serve millions of customers annually through diverse service models and pricing strategies.

The United States car rental market refers to the comprehensive ecosystem of companies and services that provide temporary vehicle access to consumers and businesses for various transportation needs. This market encompasses traditional short-term vehicle rentals, long-term leasing arrangements, corporate fleet services, and innovative mobility-as-a-service platforms that facilitate convenient transportation solutions across diverse customer segments.

Market participants include established rental companies operating extensive fleets, technology-enabled platforms connecting vehicle owners with renters, and specialized service providers focusing on specific market niches such as luxury vehicles, commercial trucks, or environmentally sustainable transportation options. The market serves both domestic and international travelers, business customers requiring temporary transportation, and individuals seeking alternatives to vehicle ownership.

Service delivery occurs through multiple channels including airport locations, neighborhood branches, hotel partnerships, and digital platforms that enable remote vehicle access and return. Modern car rental services integrate advanced booking systems, mobile applications, and contactless technologies to enhance customer experience while optimizing fleet utilization and operational efficiency.

Market performance demonstrates strong recovery momentum following pandemic-related disruptions, with rental volumes approaching pre-2020 levels and revenue streams diversifying through innovative service offerings. The industry has successfully adapted to changing travel patterns, implementing enhanced health and safety protocols while expanding digital capabilities to meet evolving customer expectations for seamless, contactless rental experiences.

Competitive dynamics reflect ongoing consolidation among traditional players alongside the emergence of technology-driven disruptors that challenge conventional business models. Major rental companies are investing significantly in fleet electrification, with electric vehicle adoption expected to reach 25% of total fleet composition by 2028, driven by environmental regulations and consumer preferences for sustainable transportation options.

Strategic initiatives focus on operational excellence, customer experience enhancement, and technology integration to capture market share in an increasingly competitive landscape. Companies are expanding beyond traditional rental services to offer comprehensive mobility solutions, including subscription models, ride-sharing integration, and corporate transportation management services that address diverse customer needs and preferences.

Consumer behavior analysis reveals significant shifts in rental patterns, with increased demand for contactless services, flexible booking options, and premium vehicle categories. The market benefits from strong leisure travel recovery, with vacation rental bookings increasing by 15% annually, while business travel segments show gradual improvement as corporate policies adapt to hybrid work arrangements and evolving travel requirements.

Tourism recovery serves as a primary growth catalyst, with domestic travel rebounding strongly as consumers prioritize experiential spending and explore destinations previously inaccessible during pandemic restrictions. The resurgence of leisure travel, combined with pent-up demand for vacation experiences, creates sustained demand for rental vehicles across popular tourist destinations and seasonal markets throughout the United States.

Business travel evolution contributes to market expansion as companies adapt to hybrid work models that require flexible transportation solutions for occasional office visits, client meetings, and project-based travel. Corporate customers increasingly value rental services that offer streamlined booking processes, comprehensive expense management tools, and reliable vehicle availability to support evolving business operations and employee mobility needs.

Urbanization trends and changing vehicle ownership patterns drive demand for temporary transportation solutions, particularly among younger demographics who prefer access-based mobility over traditional ownership models. The growing popularity of car-sharing concepts and subscription services reflects shifting consumer attitudes toward transportation, creating opportunities for rental companies to expand service offerings and capture new customer segments.

Technology advancement enables enhanced customer experiences through mobile applications, contactless rental processes, and integrated payment systems that simplify vehicle access and return procedures. Digital innovation reduces operational costs while improving service quality, allowing companies to offer competitive pricing and convenient solutions that meet modern consumer expectations for seamless, technology-enabled transactions.

Fleet acquisition costs present ongoing challenges as vehicle prices remain elevated due to supply chain disruptions and semiconductor shortages that limit new car production. Rental companies face increased capital requirements to maintain adequate fleet sizes while managing higher depreciation rates and extended delivery timelines that impact operational planning and customer service capabilities.

Insurance expenses continue rising due to increased accident frequencies, higher repair costs, and expanded liability coverage requirements that affect overall profitability. Companies must balance comprehensive coverage needs with cost management objectives while navigating complex regulatory environments and evolving safety standards that influence insurance premium calculations and risk assessment procedures.

Labor shortages impact service quality and operational efficiency as the industry struggles to attract and retain qualified staff for customer service, vehicle maintenance, and administrative functions. Workforce challenges affect location operating hours, service responsiveness, and fleet management capabilities, potentially limiting growth opportunities and customer satisfaction levels across various market segments.

Regulatory compliance requirements impose additional operational burdens through environmental standards, safety regulations, and consumer protection laws that necessitate ongoing investments in training, systems, and processes. Companies must navigate complex regulatory landscapes while maintaining competitive pricing and service levels, creating ongoing tension between compliance costs and market competitiveness.

Electric vehicle integration presents significant growth potential as rental companies can capitalize on increasing consumer interest in sustainable transportation while benefiting from lower operating costs and government incentives. The transition to electric fleets offers opportunities to attract environmentally conscious customers, reduce fuel expenses, and position companies as industry leaders in sustainable mobility solutions.

Subscription services represent emerging revenue streams that cater to customers seeking flexible, long-term vehicle access without traditional ownership commitments. These services appeal to urban professionals, frequent travelers, and individuals experiencing life transitions who value convenience and predictable monthly costs over conventional rental or purchase arrangements.

Corporate partnerships offer expansion opportunities through strategic alliances with airlines, hotels, ride-sharing platforms, and travel management companies that can provide integrated transportation solutions. Collaborative relationships enable cross-selling opportunities, customer acquisition cost reduction, and enhanced service offerings that create competitive advantages in increasingly crowded markets.

Technology monetization creates new revenue opportunities through data analytics, targeted advertising, and value-added services that leverage customer information and vehicle connectivity. Companies can develop additional income streams while improving customer experiences through personalized recommendations, predictive maintenance, and integrated mobility solutions that extend beyond traditional rental services.

Supply and demand fluctuations create ongoing challenges as rental companies must balance fleet capacity with seasonal demand variations, economic cycles, and unpredictable events that affect travel patterns. Effective demand forecasting and dynamic pricing strategies become critical for maintaining profitability while ensuring adequate vehicle availability during peak periods and optimal utilization during slower seasons.

Competitive intensity drives continuous innovation and service enhancement as traditional rental companies compete with emerging mobility platforms, peer-to-peer services, and technology-enabled alternatives. Market participants must differentiate through superior customer experiences, competitive pricing, and unique value propositions while defending market share against both established competitors and disruptive new entrants.

Customer expectations continue evolving toward greater convenience, transparency, and personalization, requiring companies to invest in technology platforms, staff training, and service processes that meet rising standards. The shift toward digital-first interactions and contactless services accelerates operational transformation while creating opportunities for companies that successfully adapt to changing preferences.

Economic sensitivity influences market performance through consumer discretionary spending patterns, business travel budgets, and tourism activity levels that directly impact rental demand. Companies must maintain operational flexibility to respond to economic fluctuations while building resilient business models that can withstand periodic downturns and capitalize on recovery periods.

Data collection encompasses comprehensive primary and secondary research methodologies that combine industry interviews, customer surveys, and market analysis to provide accurate insights into market trends, competitive dynamics, and growth opportunities. MarkWide Research employs rigorous analytical frameworks that integrate quantitative data with qualitative insights to deliver actionable intelligence for market participants and stakeholders.

Primary research includes structured interviews with industry executives, rental company managers, and key stakeholders across the value chain to gather firsthand insights into operational challenges, strategic priorities, and market outlook. Survey methodologies capture customer preferences, usage patterns, and satisfaction levels to understand demand drivers and service requirements that influence market development.

Secondary research analyzes industry reports, financial statements, regulatory filings, and market databases to establish baseline market metrics, competitive positioning, and historical performance trends. This approach ensures comprehensive coverage of market dynamics while validating primary research findings through multiple data sources and analytical perspectives.

Analytical frameworks apply statistical modeling, trend analysis, and forecasting techniques to project market growth, identify emerging opportunities, and assess competitive scenarios. The methodology incorporates scenario planning and sensitivity analysis to account for various market conditions and provide robust insights that support strategic decision-making processes.

Western United States dominates market activity with approximately 35% of national rental volume, driven by major metropolitan areas, extensive tourism infrastructure, and strong business travel demand. California leads regional performance through diverse market segments including entertainment industry support, technology sector business travel, and robust leisure tourism that sustains year-round rental demand across multiple vehicle categories.

Eastern seaboard markets contribute significant revenue through dense urban populations, established business centers, and international gateway airports that generate consistent rental activity. The region benefits from strong corporate travel demand, tourism attractions, and transportation infrastructure that supports both short-term leisure rentals and extended business travel requirements throughout major metropolitan areas.

Southern states demonstrate growing market importance through expanding tourism destinations, business relocations, and infrastructure development that increases rental demand. Florida leads regional growth through cruise ship partnerships, theme park tourism, and seasonal visitor patterns that create substantial rental volume during peak travel periods while maintaining steady baseline demand throughout the year.

Midwest and Mountain regions show steady market development through outdoor recreation tourism, business travel, and seasonal demand patterns that support rental operations across diverse geographic areas. These markets benefit from lower operational costs, reduced competition intensity, and specialized demand segments including recreational vehicle rentals and seasonal tourism that complement traditional business and leisure travel segments.

Market leadership remains concentrated among established national chains that leverage extensive location networks, brand recognition, and operational scale to maintain competitive advantages. These companies continue investing in technology platforms, fleet modernization, and customer experience enhancements to defend market positions while exploring new service offerings and market expansion opportunities.

Competitive strategies emphasize customer experience differentiation, operational efficiency improvements, and technology adoption to capture market share in an increasingly dynamic environment. Companies pursue various approaches including premium service positioning, cost leadership strategies, and niche market specialization to establish sustainable competitive advantages while responding to evolving customer needs and market conditions.

By Vehicle Type: The market encompasses diverse vehicle categories serving different customer needs and preferences, from economy cars for budget-conscious travelers to luxury vehicles for premium experiences. Economy and compact vehicles represent the largest segment due to cost-effectiveness and fuel efficiency, while SUV and truck categories show strong growth driven by family travel and recreational activities.

By Customer Type: Market segmentation includes leisure travelers seeking vacation transportation, business customers requiring reliable mobility solutions, and local residents needing temporary vehicle access. Leisure segment generates the highest volume during peak travel seasons, while business customers provide consistent year-round demand with higher average transaction values and loyalty program participation.

By Rental Duration: Services range from hourly car-sharing arrangements to extended monthly rentals that serve different usage patterns and customer requirements. Short-term rentals dominate transaction volume, while long-term arrangements contribute significantly to revenue stability and customer lifetime value through extended engagement periods.

By Distribution Channel: Rental bookings occur through multiple channels including direct company websites, mobile applications, travel booking platforms, and physical locations. Digital channels continue gaining market share as customers prefer convenient online booking and contactless service options that streamline the rental process and reduce transaction friction.

Economy Vehicle Segment: This category maintains strong demand through price-sensitive customers and corporate travel policies that emphasize cost control. Fuel efficiency and affordable daily rates drive selection decisions, while companies focus on fleet optimization and operational efficiency to maintain profitability in this high-volume, low-margin segment that serves diverse customer needs.

Premium and Luxury Categories: These segments demonstrate resilience through customers willing to pay higher rates for enhanced comfort, advanced features, and brand prestige. Revenue per rental significantly exceeds economy categories, while customer satisfaction levels remain high due to superior vehicle quality and often enhanced service experiences that justify premium pricing strategies.

SUV and Truck Segments: Growing popularity reflects changing travel patterns, family vacation preferences, and recreational activity participation that requires larger vehicles. These categories generate higher revenue per rental while serving customers who prioritize space, capability, and versatility over fuel economy considerations, creating profitable opportunities for rental companies.

Electric and Hybrid Vehicles: Emerging as important differentiators, these categories attract environmentally conscious customers while offering operational cost advantages through reduced fuel expenses. Early adoption positions companies as sustainability leaders while building experience with electric vehicle operations and charging infrastructure requirements that will become increasingly important.

Rental Companies benefit from diversified revenue streams, scalable business models, and opportunities to leverage technology for operational efficiency improvements. The market offers potential for geographic expansion, service line diversification, and strategic partnerships that enhance competitive positioning while building sustainable customer relationships through loyalty programs and superior service delivery.

Customers gain access to flexible transportation solutions that eliminate vehicle ownership costs, maintenance responsibilities, and depreciation concerns while providing access to newer vehicles with advanced safety and technology features. Rental services offer convenience, choice, and cost-effectiveness for various travel needs without long-term commitments or significant capital investments.

Automotive Manufacturers benefit from large-volume fleet sales that provide predictable revenue streams and opportunities to showcase new models to potential retail customers. Rental partnerships enable manufacturers to gather real-world usage data, demonstrate vehicle reliability, and create brand awareness among diverse customer segments who may become future purchasers.

Tourism Industry stakeholders gain enhanced destination accessibility through reliable transportation options that support visitor mobility and extend stay durations. Car rental availability increases tourism appeal, enables exploration of regional attractions, and contributes to overall visitor satisfaction levels that encourage repeat visits and positive destination recommendations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless Service Adoption accelerates as customers prefer minimal physical interaction during rental transactions, driving investment in mobile applications, keyless vehicle access, and automated check-in processes. This trend enhances operational efficiency while meeting evolving customer expectations for safe, convenient service delivery that reduces transaction time and improves overall satisfaction levels.

Sustainability Integration becomes increasingly important as rental companies expand electric and hybrid vehicle offerings while implementing environmental initiatives that appeal to conscious consumers. Green fleet expansion supports corporate sustainability goals while potentially reducing operational costs through lower fuel expenses and government incentives for electric vehicle adoption.

Subscription Service Growth reflects changing consumer preferences toward access-based mobility models that provide vehicle availability without traditional ownership commitments. These services appeal to urban professionals, frequent travelers, and individuals seeking predictable transportation costs while offering rental companies opportunities for customer retention and revenue stability.

Technology Platform Enhancement continues through artificial intelligence integration, predictive analytics, and personalized customer experiences that improve service quality while optimizing fleet utilization. Advanced technology enables dynamic pricing, demand forecasting, and maintenance scheduling that enhance operational efficiency while supporting superior customer service delivery.

Fleet Electrification Initiatives gain momentum as major rental companies announce significant investments in electric vehicle fleets, charging infrastructure, and sustainability programs. These developments position companies as environmental leaders while preparing for regulatory changes and evolving customer preferences that favor sustainable transportation options over traditional gasoline-powered vehicles.

Digital Platform Investments continue expanding through mobile application enhancements, artificial intelligence integration, and contactless service capabilities that streamline customer interactions. Companies prioritize technology development to improve operational efficiency, reduce service delivery costs, and meet rising customer expectations for seamless, self-service rental experiences.

Strategic Partnership Formation increases as rental companies collaborate with airlines, hotels, ride-sharing platforms, and travel management companies to create integrated mobility solutions. These partnerships enable customer acquisition cost reduction, service expansion, and competitive differentiation through comprehensive transportation offerings that address diverse customer needs.

Market Consolidation Activity continues through mergers, acquisitions, and strategic alliances that reshape competitive dynamics while creating operational synergies. Industry consolidation enables companies to achieve greater scale, expand geographic coverage, and invest in technology platforms while potentially reducing competitive intensity in certain market segments.

Technology Investment Prioritization should focus on customer-facing applications, operational automation, and data analytics capabilities that enhance service quality while reducing costs. MWR analysis indicates that companies investing in comprehensive digital transformation achieve higher customer satisfaction scores and improved operational efficiency compared to competitors maintaining traditional service models.

Fleet Diversification Strategies should balance traditional vehicle categories with emerging alternatives including electric vehicles, luxury options, and specialized equipment that serve niche market segments. Companies should develop flexible fleet management approaches that respond to changing demand patterns while maintaining optimal utilization rates across diverse vehicle categories and market conditions.

Customer Experience Enhancement requires continuous improvement in service delivery processes, staff training programs, and technology integration that exceeds evolving customer expectations. Successful companies prioritize seamless booking experiences, transparent pricing, and responsive customer support that builds loyalty and encourages repeat business in increasingly competitive markets.

Sustainability Leadership becomes essential for long-term competitiveness as environmental regulations tighten and customer preferences shift toward sustainable transportation options. Companies should develop comprehensive sustainability strategies that include electric vehicle adoption, carbon footprint reduction, and environmental reporting that demonstrates commitment to responsible business practices.

Market expansion prospects remain positive through 2030, driven by continued travel recovery, evolving mobility preferences, and technology adoption that enhances service delivery capabilities. MarkWide Research projects sustained growth momentum as companies successfully adapt to changing market conditions while capturing opportunities in emerging service categories and customer segments that value flexible transportation solutions.

Technology transformation will accelerate through artificial intelligence integration, autonomous vehicle preparation, and enhanced connectivity features that revolutionize customer experiences while optimizing operational performance. Companies investing in advanced technology platforms position themselves for competitive advantages as the industry evolves toward more sophisticated, data-driven service delivery models.

Sustainability initiatives will become increasingly important as electric vehicle adoption reaches mainstream acceptance levels and environmental regulations influence fleet composition decisions. The transition to sustainable transportation options creates opportunities for early adopters while potentially challenging companies that delay electric vehicle integration and environmental program development.

Service model evolution will continue toward integrated mobility solutions that combine traditional rentals with subscription services, ride-sharing integration, and comprehensive transportation management. Companies that successfully develop diverse service portfolios while maintaining operational excellence will capture greater market share and build stronger customer relationships in an increasingly dynamic competitive environment.

The United States car rental market demonstrates remarkable resilience and adaptation capability as it navigates evolving customer preferences, technological advancement, and competitive pressures that reshape industry dynamics. Market participants that prioritize customer experience enhancement, technology integration, and operational efficiency improvements position themselves for sustained success in an increasingly sophisticated marketplace that rewards innovation and service excellence.

Growth opportunities remain substantial through electric vehicle adoption, subscription service development, and strategic partnership formation that expand service capabilities while addressing diverse customer needs. Companies that successfully balance traditional rental services with emerging mobility solutions will capture greater market share while building sustainable competitive advantages in a rapidly evolving transportation landscape.

Future success depends on strategic investments in technology platforms, fleet modernization, and sustainability initiatives that meet rising customer expectations while supporting operational efficiency improvements. The market outlook remains positive for companies that embrace change, prioritize customer satisfaction, and develop comprehensive strategies that address both current market demands and emerging opportunities in the dynamic United States car rental market.

What is Car Rental?

Car rental refers to the service of renting automobiles for a short period, typically ranging from a few hours to a few weeks. This service is commonly used by travelers, businesses, and individuals who need temporary transportation solutions.

What are the key players in the United States Car Rental Market?

Key players in the United States Car Rental Market include companies like Enterprise Holdings, Hertz Global Holdings, and Avis Budget Group, among others. These companies dominate the market by offering a wide range of vehicles and services to meet diverse customer needs.

What are the main drivers of growth in the United States Car Rental Market?

The main drivers of growth in the United States Car Rental Market include increasing travel and tourism activities, a rise in business travel, and the growing popularity of ride-sharing services. Additionally, the expansion of online booking platforms has made car rental services more accessible.

What challenges does the United States Car Rental Market face?

The United States Car Rental Market faces challenges such as fluctuating fuel prices, vehicle maintenance costs, and competition from alternative transportation options like ride-sharing. These factors can impact profitability and operational efficiency for rental companies.

What opportunities exist in the United States Car Rental Market?

Opportunities in the United States Car Rental Market include the potential for growth in electric vehicle rentals, partnerships with travel agencies, and the integration of technology for enhanced customer experiences. These trends can help companies differentiate themselves in a competitive landscape.

What trends are shaping the United States Car Rental Market?

Trends shaping the United States Car Rental Market include the increasing adoption of technology for online reservations, the rise of eco-friendly vehicle options, and the growing demand for flexible rental terms. These trends reflect changing consumer preferences and environmental considerations.

United States Car Rental Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Minivan, Pickup |

| Customer Type | Leisure, Business, Government, Corporate |

| Booking Channel | Online, Travel Agency, Direct, Mobile App |

| Rental Duration | Short-term, Long-term, Weekend, Monthly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

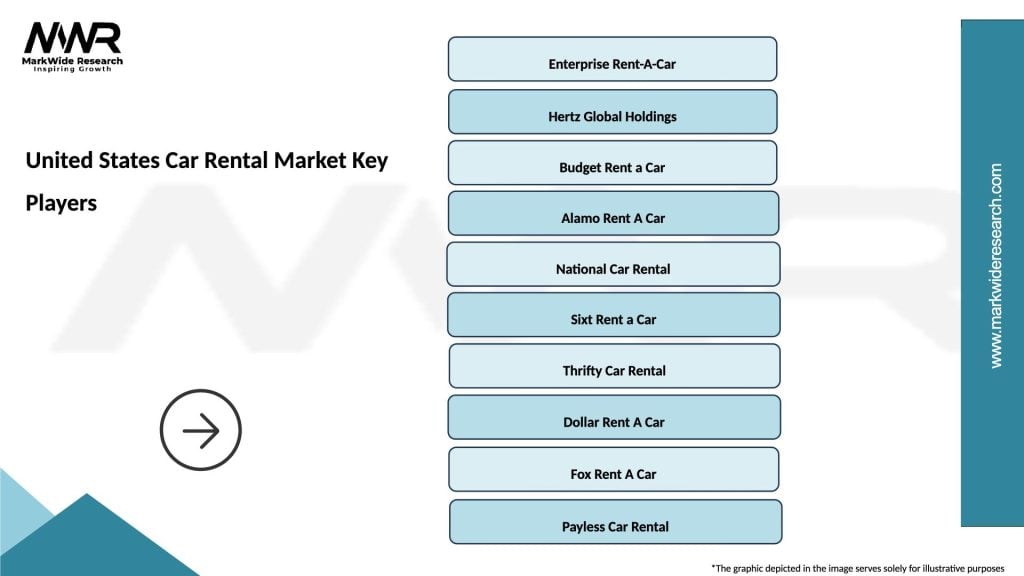

Leading companies in the United States Car Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at