444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States cafes and bars market represents a dynamic and evolving segment of the hospitality industry, encompassing traditional coffee shops, specialty cafes, cocktail bars, sports bars, and hybrid establishments that combine dining with beverage service. This market has demonstrated remarkable resilience and adaptability, particularly following the challenges of recent years, with establishments increasingly focusing on experiential offerings and community engagement.

Market dynamics indicate that the sector is experiencing robust growth, driven by changing consumer preferences toward premium beverages, artisanal experiences, and social dining. The integration of technology, sustainable practices, and innovative service models has transformed how cafes and bars operate, creating new opportunities for differentiation and customer engagement. Growth rates in the specialty coffee segment alone have reached approximately 8.2% annually, while craft cocktail establishments continue to expand their market presence.

Consumer behavior patterns show a significant shift toward quality over quantity, with patrons willing to pay premium prices for unique experiences, locally sourced ingredients, and personalized service. The rise of remote work culture has particularly benefited cafe establishments, as they serve as alternative workspaces and social hubs. Digital integration has become essential, with mobile ordering and contactless payment systems now standard across 73% of establishments in major metropolitan areas.

The United States cafes and bars market refers to the comprehensive ecosystem of establishments primarily focused on serving beverages, including coffee, tea, alcoholic drinks, and complementary food items, within a social or casual dining environment. This market encompasses various business models from independent neighborhood cafes to large chain operations, craft breweries to upscale cocktail lounges, each serving distinct customer segments and occasions.

Market segmentation includes traditional coffee shops that focus on espresso-based beverages and light fare, specialty cafes offering artisanal products and unique experiences, bars ranging from casual neighborhood establishments to sophisticated cocktail venues, and hybrid concepts that blur the lines between cafe and bar service. The definition extends to include establishments that derive their primary revenue from beverage sales while potentially offering food service as a secondary component.

Strategic positioning within the United States cafes and bars market reveals a sector characterized by innovation, premiumization, and community focus. The market has evolved beyond simple beverage service to encompass lifestyle brands, social gathering spaces, and experiential destinations that cater to diverse consumer needs and preferences.

Key performance indicators demonstrate strong market fundamentals, with specialty coffee consumption growing at 6.5% annually and craft cocktail culture expanding rapidly across secondary markets. The integration of food service has become increasingly important, with 68% of successful establishments now offering substantial food menus to drive average transaction values and extend customer dwell time.

Operational excellence has emerged as a critical differentiator, with successful establishments investing heavily in staff training, equipment quality, and customer experience design. The adoption of sustainable practices has become both a competitive necessity and consumer expectation, influencing everything from sourcing decisions to packaging choices.

Consumer preferences have shifted dramatically toward premium, authentic experiences that reflect local culture and artisanal craftsmanship. The following insights highlight the most significant market developments:

Primary growth drivers propelling the United States cafes and bars market include evolving lifestyle patterns, increased disposable income allocation toward experiential spending, and the continued premiumization of beverage consumption. The remote work revolution has fundamentally altered how consumers utilize cafe spaces, creating sustained demand for comfortable, well-equipped environments that serve as alternative offices.

Cultural shifts toward artisanal and craft products have elevated consumer expectations regarding beverage quality and preparation methods. This trend has particularly benefited specialty coffee roasters, craft cocktail establishments, and venues that emphasize the skill and artistry involved in beverage creation. Social media influence has amplified the importance of visual appeal and shareability, driving establishments to invest in Instagram-worthy presentations and unique offerings.

Demographic changes also contribute significantly to market growth, with millennials and Generation Z consumers demonstrating strong preferences for authentic, locally-sourced, and socially responsible brands. These consumer segments prioritize experiences over material possessions, making cafes and bars natural beneficiaries of this spending pattern. Urban densification in major metropolitan areas has created concentrated customer bases that support diverse establishment types within close proximity.

Operational challenges present significant constraints for cafes and bars market participants, particularly regarding labor costs, supply chain volatility, and regulatory compliance. The hospitality industry faces ongoing staffing difficulties, with turnover rates in food service establishments averaging 82% annually, creating continuous training costs and service consistency challenges.

Economic pressures including rising commercial real estate costs, particularly in prime urban locations, squeeze profit margins and limit expansion opportunities for independent operators. Commodity price fluctuations for coffee, alcohol, and other key ingredients create unpredictable cost structures that challenge pricing strategies and profitability maintenance.

Regulatory complexity varies significantly across jurisdictions, with alcohol licensing, health department requirements, and zoning restrictions creating barriers to entry and operational flexibility. The increasing focus on responsible service and liability concerns adds compliance costs and operational constraints that particularly impact smaller establishments with limited administrative resources.

Expansion opportunities within the United States cafes and bars market are abundant, particularly in underserved suburban and secondary markets where consumer sophistication continues to grow. The development of mixed-use commercial spaces and lifestyle centers creates ideal environments for cafe and bar concepts that complement retail and residential developments.

Technology integration offers substantial opportunities for operational efficiency and customer engagement enhancement. Advanced point-of-sale systems, inventory management software, and customer relationship management platforms enable smaller establishments to compete more effectively with larger chains while maintaining their unique character and personal service approach.

Franchise and licensing models present scalable growth opportunities for successful independent concepts, allowing rapid market penetration while maintaining quality standards and brand consistency. The development of proprietary products, signature beverages, and branded merchandise creates additional revenue streams and brand extension possibilities.

Competitive dynamics within the cafes and bars market reflect a complex interplay between large chains, regional operators, and independent establishments, each serving distinct market segments and customer needs. MarkWide Research analysis indicates that successful market participants increasingly focus on differentiation through unique value propositions rather than direct price competition.

Supply chain relationships have become increasingly strategic, with successful establishments developing direct relationships with coffee roasters, craft brewers, and artisanal suppliers to ensure product quality and supply security. These partnerships often extend beyond simple vendor relationships to collaborative product development and exclusive offerings that enhance competitive positioning.

Customer loyalty dynamics have evolved beyond traditional punch cards to sophisticated digital programs that track preferences, reward frequent visits, and enable personalized marketing communications. The most successful establishments create community-focused loyalty programs that extend beyond transactional relationships to foster genuine customer engagement and advocacy.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and actionable insights into the United States cafes and bars market. Primary research included extensive surveys of establishment owners, managers, and customers across diverse geographic markets and establishment types to capture authentic market perspectives and emerging trends.

Secondary research incorporated industry publications, trade association reports, government statistics, and academic studies to provide comprehensive market context and validate primary research findings. Financial analysis of publicly traded companies and private establishment performance data contributed to understanding profitability patterns and operational benchmarks.

Field research involved direct observation and analysis of successful establishments across various market segments, documenting best practices in operations, customer service, and market positioning. This qualitative research component provided crucial insights into the experiential aspects of cafe and bar operations that quantitative data alone cannot capture.

Geographic distribution of cafes and bars market activity shows significant concentration in major metropolitan areas, with coastal markets accounting for approximately 45% of premium establishment locations. The Northeast corridor from Boston to Washington D.C. represents the most mature market for specialty coffee and craft cocktail establishments, with high consumer sophistication and willingness to pay premium prices.

West Coast markets demonstrate the strongest growth in innovative concepts and sustainable practices, with California leading in organic and plant-based beverage offerings. The Pacific Northwest continues to influence national coffee culture trends, while Southern California drives cocktail innovation and health-conscious beverage development.

Midwest expansion represents significant growth opportunities, particularly in secondary cities where consumer preferences are evolving toward premium experiences previously concentrated in coastal markets. The Southeast region shows rapid adoption of craft beverage culture, with growth rates in specialty establishments reaching 12% annually in major metropolitan areas.

Mountain West states benefit from population growth and outdoor lifestyle culture that supports cafe and bar establishments focused on community gathering and social interaction. These markets show particular strength in establishments that combine beverage service with outdoor recreation themes and local cultural elements.

Market leadership in the United States cafes and bars sector encompasses diverse establishment types and business models, from international chains to local independent operators. The competitive environment rewards differentiation, operational excellence, and authentic brand positioning rather than simple scale advantages.

Competitive strategies increasingly focus on experience differentiation, with successful establishments creating unique atmospheres, signature beverages, and community engagement programs that build customer loyalty beyond simple convenience or price considerations.

Market segmentation within the United States cafes and bars industry reflects diverse consumer needs, occasions, and preferences that drive establishment specialization and positioning strategies.

By Establishment Type:

By Service Model:

Coffee category performance demonstrates continued strength in premium and specialty segments, with consumers increasingly willing to pay higher prices for quality, sustainability, and unique experiences. Cold brew and nitro coffee have emerged as significant growth drivers, appealing to younger demographics and expanding consumption occasions beyond traditional hot coffee service.

Alcoholic beverage categories show distinct performance patterns, with craft beer maintaining steady growth while spirits-based cocktails experience rapid expansion. Low-alcohol and non-alcoholic alternatives represent emerging opportunities, driven by health-conscious consumers and changing social attitudes toward alcohol consumption.

Food service integration has become increasingly important across all establishment types, with successful venues developing food offerings that complement their beverage focus while driving higher average transaction values. Breakfast and light lunch items perform particularly well in cafe environments, while bars benefit from elevated bar snacks and small plates that encourage longer visits and increased beverage consumption.

Establishment owners benefit from multiple revenue streams, community connection opportunities, and relatively low barriers to entry compared to full-service restaurants. The ability to create unique brand identities and develop loyal customer bases provides sustainable competitive advantages and premium pricing opportunities.

Suppliers and vendors gain access to diverse customer bases through cafe and bar partnerships, with opportunities for product development collaboration and brand exposure. The growing emphasis on local sourcing creates particular opportunities for regional suppliers to develop long-term, mutually beneficial relationships with establishment operators.

Real estate developers benefit from cafes and bars as anchor tenants that drive foot traffic and create vibrant commercial environments. These establishments often serve as community gathering spaces that enhance the overall appeal and value of mixed-use developments and retail centers.

Local communities gain social gathering spaces, employment opportunities, and economic activity that supports broader commercial districts. Well-operated cafes and bars contribute to neighborhood character and property values while providing venues for community events and social interaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has evolved from a competitive differentiator to a baseline customer expectation, with establishments implementing comprehensive environmental programs covering sourcing, packaging, waste reduction, and energy efficiency. Circular economy principles are increasingly adopted, with 78% of premium establishments now implementing some form of waste reduction or recycling program.

Health and wellness focus drives menu innovation toward functional beverages, plant-based alternatives, and reduced-sugar options that appeal to health-conscious consumers without compromising taste or experience quality. The integration of adaptogenic ingredients, probiotics, and other wellness-focused components represents a significant growth opportunity.

Technology convergence encompasses mobile ordering, contactless payment, social media integration, and data analytics that enable personalized customer experiences and operational optimization. Artificial intelligence applications in inventory management, demand forecasting, and customer service are becoming more accessible to smaller establishments.

Experience personalization reflects growing consumer expectations for customized service, unique offerings, and memorable interactions that justify premium pricing and encourage repeat visits. Successful establishments create distinctive atmospheres and signature experiences that cannot be easily replicated by competitors.

Consolidation activities within the industry include strategic acquisitions of successful independent concepts by larger operators seeking to expand their portfolio diversity and market reach. These transactions often preserve the unique character of acquired brands while providing resources for expansion and operational improvement.

Technology partnerships between establishment operators and software providers have accelerated the development of industry-specific solutions for point-of-sale, inventory management, and customer engagement. These collaborations result in more effective and affordable technology solutions tailored to cafe and bar operational needs.

Regulatory developments at state and local levels continue to evolve, particularly regarding alcohol service, food safety, and labor practices. MWR analysis indicates that successful operators increasingly invest in compliance systems and legal consultation to navigate this complex regulatory environment effectively.

Supply chain innovations include direct trade relationships, cooperative purchasing programs, and sustainable sourcing initiatives that provide cost advantages while supporting quality and ethical sourcing objectives. These developments particularly benefit smaller establishments that previously lacked the purchasing power to access premium suppliers directly.

Strategic positioning recommendations emphasize the importance of authentic brand development that reflects local community characteristics and operator expertise rather than attempting to replicate successful concepts from other markets. Establishments should focus on creating unique value propositions that justify premium pricing and encourage customer loyalty.

Operational excellence requires continuous investment in staff training, equipment maintenance, and customer experience refinement. Successful operators implement systematic approaches to quality control, service standards, and operational efficiency that create sustainable competitive advantages.

Financial management strategies should emphasize cash flow optimization, cost control, and strategic reinvestment in growth opportunities. MarkWide Research recommends that operators maintain adequate working capital reserves to weather seasonal fluctuations and unexpected challenges while positioning for expansion opportunities.

Technology adoption should be approached strategically, with investments prioritized based on direct customer benefit and operational efficiency gains rather than technology trends alone. Integration with existing systems and staff training requirements must be carefully considered to ensure successful implementation.

Market evolution over the next five years will likely emphasize sustainability, technology integration, and experience personalization as key differentiators. Establishments that successfully combine these elements while maintaining authentic local connections and operational excellence will capture disproportionate market share and profitability.

Growth projections indicate continued expansion in specialty segments, with craft cocktail establishments and premium coffee concepts expected to maintain growth rates above 9% annually in major metropolitan markets. Secondary markets represent the strongest expansion opportunities, with consumer sophistication and willingness to pay premium prices continuing to develop.

Innovation opportunities will emerge from the intersection of health and wellness trends, sustainability requirements, and technology capabilities. Establishments that pioneer new approaches to these challenges while maintaining focus on fundamental hospitality principles will establish market leadership positions.

Competitive dynamics will likely favor establishments that can demonstrate clear value propositions, operational consistency, and community engagement over those competing primarily on price or convenience. The most successful operators will build brands that transcend simple beverage service to become integral parts of their communities’ social and cultural fabric.

The United States cafes and bars market represents a dynamic and resilient sector that continues to evolve in response to changing consumer preferences, technological advancement, and cultural shifts. Success in this market requires a sophisticated understanding of local community needs, operational excellence, and strategic positioning that differentiates establishments from increasingly competitive alternatives.

Market fundamentals remain strong, supported by demographic trends, lifestyle changes, and continued consumer willingness to invest in experiential purchases. The integration of sustainability practices, technology solutions, and community engagement strategies has become essential for long-term success, while maintaining focus on fundamental hospitality principles and product quality.

Future opportunities will reward establishments that can successfully balance innovation with authenticity, efficiency with personalization, and growth with community connection. The most successful operators will continue to evolve their concepts while preserving the essential characteristics that create customer loyalty and sustainable competitive advantages in this vibrant and essential market segment.

What is Cafes & Bars?

Cafes & Bars refer to establishments that serve beverages, snacks, and meals, often providing a social atmosphere for customers. They can range from casual coffee shops to upscale bars, catering to various consumer preferences and occasions.

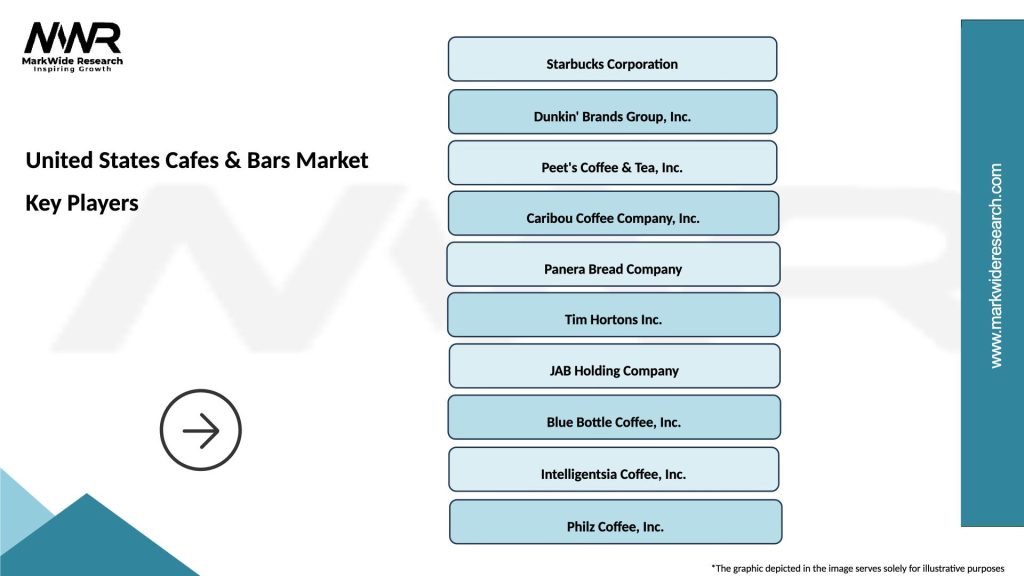

What are the key players in the United States Cafes & Bars Market?

Key players in the United States Cafes & Bars Market include Starbucks, Dunkin’, and Peet’s Coffee, which dominate the cafe segment, while companies like TGI Fridays and Buffalo Wild Wings are significant in the bar sector, among others.

What are the growth factors driving the United States Cafes & Bars Market?

The growth of the United States Cafes & Bars Market is driven by increasing consumer demand for specialty coffee, the rise of social dining experiences, and the trend towards premium alcoholic beverages. Additionally, the expansion of urban areas contributes to the market’s growth.

What challenges does the United States Cafes & Bars Market face?

The United States Cafes & Bars Market faces challenges such as intense competition, fluctuating commodity prices, and changing consumer preferences towards healthier options. These factors can impact profitability and operational strategies.

What opportunities exist in the United States Cafes & Bars Market?

Opportunities in the United States Cafes & Bars Market include the growing trend of online ordering and delivery services, the potential for expanding into underserved areas, and the increasing popularity of craft beverages. These trends can enhance customer engagement and revenue streams.

What trends are shaping the United States Cafes & Bars Market?

Trends shaping the United States Cafes & Bars Market include the rise of plant-based menu options, the integration of technology for customer convenience, and a focus on sustainability practices. These trends reflect changing consumer values and preferences.

United States Cafes & Bars Market

| Segmentation Details | Description |

|---|---|

| Product Type | Coffee, Tea, Alcoholic Beverages, Snacks |

| Customer Type | Students, Professionals, Tourists, Locals |

| Service Type | Dine-in, Takeaway, Delivery, Catering |

| Price Tier | Budget, Mid-range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Cafes & Bars Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at