444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United States Bone Density (DEXA) market refers to the market for dual-energy X-ray absorptiometry (DEXA) systems used to measure bone density. These systems are primarily utilized in the diagnosis and monitoring of osteoporosis and other bone-related conditions. The market for DEXA systems in the United States has experienced significant growth in recent years due to the rising prevalence of osteoporosis and increased awareness about the importance of early detection and treatment.

Meaning

DEXA, short for dual-energy X-ray absorptiometry, is a diagnostic technique used to measure bone mineral density (BMD). It is a non-invasive and painless procedure that involves the use of low-dose X-rays to evaluate the strength and health of bones. DEXA scans are commonly performed on the hip and spine, which are the most common sites for osteoporotic fractures.

Executive Summary

The United States Bone Density (DEXA) market is experiencing steady growth, driven by factors such as the aging population, increasing incidence of osteoporosis, and advancements in DEXA technology. The market is highly competitive, with several key players vying for market share. The demand for DEXA systems is expected to increase further as awareness about the importance of bone health continues to grow. However, the market also faces challenges, such as high costs associated with DEXA systems and reimbursement issues.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United States Bone Density (DEXA) market is characterized by intense competition among key market players. The market is driven by the increasing prevalence of osteoporosis, technological advancements, and the growing aging population. However, challenges such as the high cost of DEXA systems and reimbursement issues can impede market growth. Despite these challenges, the market presents opportunities for expansion through the expansion of healthcare infrastructure, technological advancements, and a focus on preventive healthcare.

Regional Analysis

The United States Bone Density (DEXA) market can be analyzed on a regional basis to understand variations in market dynamics. The market is typically segmented into different regions, such as the Northeast, Midwest, South, and West. Each region may have its unique factors influencing market growth, such as demographic trends, healthcare infrastructure, and regional policies. In general, regions with a higher population density and a greater proportion of aging individuals may exhibit higher demand for DEXA systems.

Competitive Landscape

Leading Companies in the United States Bone Density (DEXA) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

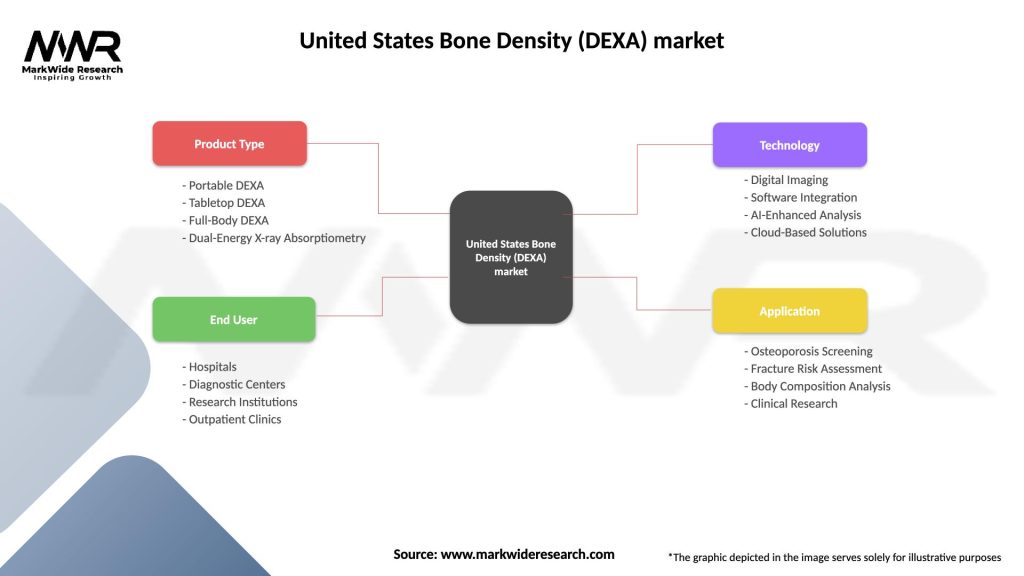

Segmentation

The United States Bone Density (DEXA) market can be segmented based on end-users, applications, and types of DEXA systems.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the United States Bone Density (DEXA) market. The pandemic led to disruptions in healthcare services, including the postponement of non-essential procedures and screenings. This temporary halt in routine bone density testing and elective surgeries had a negative effect on the demand for DEXA systems.

However, as the situation improved and healthcare services resumed, the market witnessed a gradual recovery. The increasing emphasis on preventive healthcare, coupled with the rescheduling of postponed bone density tests, contributed to the recovery of the market.

Additionally, the pandemic highlighted the importance of maintaining good bone health and the need for early detection of conditions such as osteoporosis. This increased awareness may further drive the demand for DEXA systems in the post-pandemic period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The United States Bone Density (DEXA) market is expected to continue its growth trajectory in the coming years. Factors such as the increasing prevalence of osteoporosis, technological advancements in DEXA systems, and the growing emphasis on preventive healthcare are expected to drive market expansion. However, challenges such as the high cost of DEXA systems and reimbursement issues need to be addressed to ensure sustained market growth. Industry participants who can effectively navigate these challenges while capitalizing on market opportunities are likely to thrive in the future.

Conclusion

The United States Bone Density (DEXA) market is witnessing steady growth driven by factors such as the rising incidence of osteoporosis, technological advancements, and the growing aging population. However, challenges such as the high cost of DEXA systems and reimbursement issues need to be addressed. The market offers opportunities for expansion through the expansion of healthcare infrastructure, technological advancements, and a focus on preventive healthcare. Industry participants should focus on market expansion, cost optimization, R&D investments, and collaborations to stay competitive and tap into the potential of the growing market. With a strong emphasis on bone health and an aging population, the future outlook for the United States Bone Density (DEXA) market remains promising.

What is Bone Density (DEXA)?

Bone Density (DEXA) refers to a medical imaging technique used to measure bone mineral density, which helps in diagnosing conditions like osteoporosis. It provides critical information about bone health and is commonly used in clinical settings.

What are the key players in the United States Bone Density (DEXA) market?

Key players in the United States Bone Density (DEXA) market include Hologic, Inc., GE Healthcare, and Siemens Healthineers, among others. These companies are known for their advanced imaging technologies and diagnostic solutions.

What are the growth factors driving the United States Bone Density (DEXA) market?

The growth of the United States Bone Density (DEXA) market is driven by an increasing aging population, rising awareness about osteoporosis, and advancements in imaging technology. Additionally, the growing prevalence of bone-related disorders is contributing to market expansion.

What challenges does the United States Bone Density (DEXA) market face?

The United States Bone Density (DEXA) market faces challenges such as high costs associated with DEXA scans and limited access in rural areas. Furthermore, there is a need for more widespread education on the importance of bone health.

What opportunities exist in the United States Bone Density (DEXA) market?

Opportunities in the United States Bone Density (DEXA) market include the development of portable DEXA devices and the integration of artificial intelligence in imaging analysis. These innovations can enhance accessibility and improve diagnostic accuracy.

What trends are shaping the United States Bone Density (DEXA) market?

Trends in the United States Bone Density (DEXA) market include the increasing adoption of telemedicine for remote consultations and the growing emphasis on preventive healthcare. Additionally, there is a rising interest in personalized medicine approaches for bone health management.

United States Bone Density (DEXA) market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable DEXA, Tabletop DEXA, Full-Body DEXA, Dual-Energy X-ray Absorptiometry |

| End User | Hospitals, Diagnostic Centers, Research Institutions, Outpatient Clinics |

| Technology | Digital Imaging, Software Integration, AI-Enhanced Analysis, Cloud-Based Solutions |

| Application | Osteoporosis Screening, Fracture Risk Assessment, Body Composition Analysis, Clinical Research |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Bone Density (DEXA) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at