444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States bio-fungicide market represents a rapidly expanding segment within the broader agricultural biologicals industry, driven by increasing demand for sustainable crop protection solutions. Bio-fungicides have emerged as critical alternatives to synthetic chemical fungicides, offering environmentally friendly approaches to managing fungal diseases in agricultural crops. The market demonstrates robust growth potential, with adoption rates increasing by 12.5% annually as farmers seek effective disease management solutions that align with sustainable farming practices.

Market dynamics indicate strong momentum across diverse agricultural sectors, from specialty crops to row crops, as growers recognize the long-term benefits of biological disease control. The integration of bio-fungicide technologies into conventional farming systems has accelerated, particularly in regions with intensive agricultural production. Regulatory support for biological products continues to strengthen, creating favorable conditions for market expansion and innovation in microbial-based crop protection solutions.

Agricultural sustainability trends have positioned bio-fungicides as essential components of integrated pest management strategies, with adoption rates reaching 35% penetration in key crop segments. The market benefits from increasing consumer demand for residue-free produce and growing awareness of environmental stewardship among agricultural producers.

The United States bio-fungicide market refers to the commercial sector encompassing biological products designed to prevent, control, or suppress fungal diseases in agricultural crops through natural mechanisms. These products utilize living microorganisms, natural compounds, or plant extracts to provide disease protection while maintaining environmental compatibility and supporting sustainable agricultural practices.

Bio-fungicides represent a diverse category of crop protection products that harness biological processes to combat fungal pathogens. Unlike synthetic chemical alternatives, these solutions work through multiple modes of action, including competitive exclusion, antibiotic production, parasitism, and induced plant resistance. The market encompasses various product formulations, application methods, and target crop segments, creating a comprehensive ecosystem of biological disease management solutions.

Market participants include biotechnology companies, agricultural input manufacturers, research institutions, and distribution networks that collectively support the development, production, and commercialization of bio-fungicide products across the United States agricultural landscape.

Strategic market analysis reveals the United States bio-fungicide sector as a high-growth segment within agricultural biologicals, characterized by increasing farmer adoption and expanding product portfolios. The market demonstrates strong fundamentals driven by regulatory support, environmental concerns, and proven efficacy in disease management applications. Growth trajectories indicate sustained expansion across multiple crop categories, with specialty crops leading adoption rates.

Key market drivers include rising demand for sustainable agriculture solutions, increasing resistance to synthetic fungicides, and growing consumer preference for residue-free produce. The sector benefits from continuous innovation in microbial discovery, formulation technologies, and application methods. Market penetration has reached significant levels in high-value crop segments, with expansion opportunities emerging in traditional row crop applications.

Competitive dynamics feature established agricultural companies alongside specialized biotechnology firms, creating a diverse ecosystem of solution providers. The market structure supports both large-scale commercial operations and niche product development, fostering innovation and market segmentation based on crop-specific needs and application requirements.

Market intelligence reveals several critical insights shaping the United States bio-fungicide landscape:

Primary growth drivers propelling the United States bio-fungicide market include escalating demand for sustainable agricultural practices and increasing regulatory pressure on synthetic chemical inputs. Environmental stewardship has become a central concern for agricultural producers, driving adoption of biological alternatives that support ecosystem health while maintaining crop productivity. The growing prevalence of fungicide resistance in target pathogens has created urgent needs for alternative control mechanisms.

Consumer market trends significantly influence bio-fungicide adoption, as food retailers and processors increasingly demand produce with minimal chemical residues. Organic agriculture expansion continues to drive demand for approved biological inputs, while conventional farmers seek tools to reduce synthetic chemical usage. The integration of bio-fungicides into sustainable farming certification programs has created additional market pull.

Economic incentives support market growth through premium pricing for sustainably produced crops and reduced input costs associated with biological products. Technological advances in microbial production, formulation stability, and application methods have improved product performance and commercial viability, encouraging broader adoption across diverse agricultural systems.

Market challenges facing the United States bio-fungicide sector include product consistency concerns and variable field performance under diverse environmental conditions. Shelf life limitations of biological products create supply chain complexities and inventory management challenges for distributors and end users. The need for specialized storage and handling requirements can increase operational costs and limit distribution efficiency.

Economic barriers include higher per-unit costs compared to synthetic alternatives and the need for more frequent applications in some cases. Knowledge gaps among agricultural advisors and farmers regarding optimal application timing and methods can limit product effectiveness and adoption rates. The complexity of biological mode of action requires enhanced technical support and education programs.

Regulatory complexities surrounding biological product registration and labeling requirements can create market entry barriers for new products. Competition from established synthetic fungicides with proven track records and lower costs continues to challenge market penetration in price-sensitive crop segments.

Emerging opportunities in the United States bio-fungicide market include expanding applications in row crop agriculture, where adoption rates remain relatively low compared to specialty crops. Technology integration with precision agriculture systems offers potential for optimized application timing and dosing, improving product efficacy and economic returns. The development of combination products incorporating multiple biological modes of action presents opportunities for enhanced disease control.

Market expansion opportunities exist in underserved crop segments and geographic regions where biological adoption has been limited. Export market development for bio-fungicide products manufactured in the United States could leverage domestic innovation and production capabilities. The growing interest in regenerative agriculture practices creates new market channels for biological inputs that support soil health and ecosystem services.

Partnership opportunities between biotechnology companies and traditional agricultural input manufacturers can accelerate market development and distribution reach. Digital agriculture integration offers potential for data-driven application recommendations and performance monitoring, enhancing product value propositions and farmer confidence in biological solutions.

Market forces shaping the United States bio-fungicide sector reflect complex interactions between regulatory policies, technological innovation, and agricultural market demands. Supply chain dynamics continue evolving as manufacturers invest in production capacity and distribution networks to support growing demand. The market demonstrates increasing sophistication in product positioning and application strategies.

Competitive pressures drive continuous innovation in product development and market positioning, with companies investing heavily in research and development to maintain competitive advantages. Market consolidation trends include strategic acquisitions and partnerships that combine complementary technologies and market access capabilities. The sector benefits from increasing investment in biological research and development infrastructure.

Price dynamics reflect improving economies of scale in production and growing market acceptance of premium pricing for biological solutions. Market maturation in established segments creates opportunities for product differentiation and specialized applications, while emerging segments offer growth potential for innovative solutions and market entry strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the United States bio-fungicide market. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, agricultural advisors, and end users across diverse crop production systems. Survey methodologies capture quantitative data on adoption rates, usage patterns, and market preferences.

Secondary research incorporates analysis of industry publications, regulatory databases, patent filings, and academic research to understand technological trends and market developments. Market modeling techniques utilize historical data and trend analysis to project future market scenarios and growth trajectories. Data validation processes ensure accuracy and reliability of market insights and projections.

Expert consultation with industry specialists, research scientists, and market analysts provides additional perspective on market dynamics and future trends. Field research includes on-farm visits and product performance evaluations to understand real-world application challenges and opportunities in diverse agricultural environments.

Geographic market distribution across the United States reveals distinct regional patterns in bio-fungicide adoption and growth potential. California leads market development with 42% market share, driven by extensive specialty crop production and strong organic agriculture presence. The state’s diverse agricultural systems and progressive regulatory environment support innovation and adoption of biological solutions.

Florida represents a significant market segment focused on citrus and vegetable production, where bio-fungicides address specific disease challenges and export market requirements. Pacific Northwest regions demonstrate strong adoption in tree fruit and berry production, leveraging biological solutions for premium market positioning and sustainable production practices.

Midwest agricultural regions show emerging growth potential as row crop producers explore biological alternatives for disease management in corn and soybean production systems. Southeastern states benefit from year-round growing seasons and diverse crop production that supports biological product applications. Northeast markets focus on high-value specialty crops and organic production systems that drive demand for biological inputs.

Regional growth rates vary significantly, with western states maintaining 15% annual growth while emerging markets in traditional agricultural regions show 22% growth potential as awareness and adoption increase.

Market leadership in the United States bio-fungicide sector includes established agricultural companies and specialized biotechnology firms that have developed comprehensive product portfolios and distribution networks. The competitive environment supports both large-scale commercial operations and innovative startup companies focused on novel biological solutions.

Competitive strategies include product innovation, strategic partnerships, acquisition activities, and market expansion initiatives that strengthen market position and customer relationships.

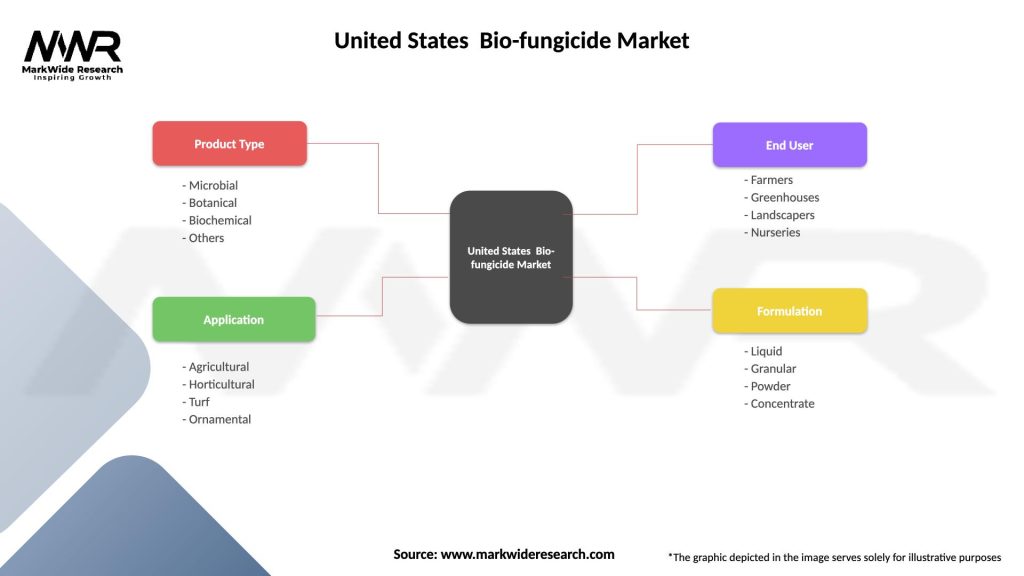

Market segmentation analysis reveals diverse categories within the United States bio-fungicide market, each with distinct characteristics and growth patterns:

By Product Type:

By Application Method:

By Crop Type:

Microbial bio-fungicides dominate market share with 68% penetration across crop categories, leveraging proven efficacy and established production technologies. Bacillus species represent the most widely adopted microbial solutions, offering broad-spectrum disease control and compatibility with existing farming practices. Trichoderma-based products show strong performance in soil-borne disease management applications.

Botanical bio-fungicides demonstrate growing market acceptance, particularly in organic production systems where synthetic alternatives are prohibited. Essential oil-based formulations offer unique modes of action and reduced resistance development potential. Plant extract technologies continue advancing through improved extraction and formulation methods.

Biochemical solutions represent emerging market opportunities with focus on plant immunity activation and systemic acquired resistance. Induced resistance products offer preventive disease management approaches that complement traditional control strategies. Elicitor compounds show promise for integration into comprehensive disease management programs.

Application-specific insights reveal foliar applications maintaining 55% market share due to immediate disease control benefits and established application infrastructure. Soil treatment applications show 28% growth annually as growers recognize long-term disease prevention benefits.

Agricultural producers benefit from bio-fungicide adoption through reduced chemical residue concerns, improved crop quality, and access to premium markets that value sustainable production practices. Economic advantages include potential cost savings through reduced synthetic chemical inputs and premium pricing for sustainably produced crops. Operational benefits encompass reduced pre-harvest intervals and simplified worker safety protocols.

Input manufacturers gain competitive advantages through product differentiation and access to growing sustainable agriculture markets. Innovation opportunities include development of specialized formulations and application technologies that address specific crop and disease challenges. Market expansion potential exists through geographic diversification and new crop segment penetration.

Retailers and distributors benefit from higher margin biological products and growing customer demand for sustainable solutions. Service opportunities include technical support and education programs that enhance customer relationships and product adoption. Market positioning advantages emerge through association with sustainable agriculture trends and environmental stewardship.

End consumers benefit from reduced chemical residues in food products and support for environmental conservation through sustainable agricultural practices. Food processors gain access to raw materials that meet increasingly stringent quality and sustainability requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological advancement trends include development of improved formulation technologies that enhance product stability and field performance. Microencapsulation techniques extend product shelf life and provide controlled release mechanisms for sustained disease control. Combination products incorporating multiple biological modes of action offer enhanced efficacy and broader disease spectrum control.

Application technology trends focus on precision delivery systems that optimize biological product performance and reduce application costs. Digital agriculture integration enables data-driven application timing and environmental monitoring for improved product efficacy. Drone application technologies expand access to biological treatments in challenging terrain and large-scale operations.

Market consolidation trends include strategic acquisitions and partnerships that combine complementary technologies and distribution capabilities. Vertical integration strategies encompass research, production, and distribution activities to capture value across the supply chain. Specialization trends create niche market opportunities for crop-specific and disease-specific biological solutions.

Sustainability integration trends align bio-fungicide adoption with broader environmental stewardship goals and carbon footprint reduction initiatives. Certification program integration supports market access for sustainably produced agricultural products.

Recent industry developments highlight significant progress in bio-fungicide technology and market expansion. Product launches include next-generation microbial formulations with improved stability and broader disease control spectrum. Regulatory approvals for new biological active ingredients expand available product options and application opportunities.

Strategic partnerships between biotechnology companies and established agricultural input manufacturers accelerate product development and market access. Acquisition activities consolidate market leadership and combine complementary technologies for enhanced product portfolios. Research collaborations with academic institutions advance fundamental understanding of biological disease control mechanisms.

Infrastructure investments include expansion of biological product manufacturing facilities and specialized distribution networks. Technology platform developments create opportunities for rapid product development and customized solutions for specific market needs. Market expansion initiatives target underserved crop segments and geographic regions with growth potential.

According to MarkWide Research analysis, industry developments demonstrate accelerating innovation and market maturation that support sustained growth in biological crop protection solutions.

Strategic recommendations for market participants include investment in product development capabilities that address specific crop and disease challenges. Market positioning strategies should emphasize unique value propositions and differentiated product benefits compared to synthetic alternatives. Distribution network expansion remains critical for reaching underserved markets and crop segments with growth potential.

Innovation priorities should focus on improving product consistency, extending shelf life, and developing combination products that offer enhanced disease control efficacy. Technical support programs are essential for educating agricultural advisors and farmers about optimal application practices and integration strategies. Partnership development can accelerate market access and technology advancement through collaborative approaches.

Market development strategies should target row crop segments where biological adoption remains limited but growth potential is significant. Geographic expansion opportunities exist in regions with developing sustainable agriculture markets and supportive regulatory environments. Digital agriculture integration offers potential for enhanced product value propositions and customer relationships.

MWR analysis suggests that companies focusing on specialized applications and superior product performance will achieve competitive advantages in the evolving bio-fungicide market landscape.

Market projections indicate continued robust growth for the United States bio-fungicide market, driven by increasing adoption across diverse crop segments and geographic regions. Growth acceleration is expected in row crop applications, where biological solutions are beginning to demonstrate commercial viability and farmer acceptance. Technology advancement will continue improving product performance and expanding application opportunities.

Innovation trends suggest development of more sophisticated biological solutions that combine multiple modes of action and provide enhanced disease control efficacy. Market maturation in established segments will drive product differentiation and specialized applications for specific crop and disease challenges. Integration with precision agriculture technologies will optimize biological product performance and economic returns.

Regulatory environment evolution is expected to continue supporting biological product development while maintaining appropriate safety and efficacy standards. Market expansion into international markets offers significant growth potential for United States-based bio-fungicide manufacturers and technology developers. Sustainability trends will continue driving demand for biological alternatives to synthetic chemical inputs.

Long-term market outlook projects sustained growth with annual expansion rates of 14-16% as biological solutions become increasingly integrated into mainstream agricultural production systems. MarkWide Research forecasts continued innovation and market development that will establish bio-fungicides as essential components of modern crop protection strategies.

The United States bio-fungicide market represents a dynamic and rapidly evolving sector within agricultural biologicals, characterized by strong growth fundamentals and expanding adoption across diverse crop production systems. Market drivers including environmental sustainability demands, regulatory support, and proven product efficacy create favorable conditions for continued expansion and innovation in biological disease management solutions.

Strategic opportunities exist for market participants to capitalize on growing demand through product innovation, market expansion, and strategic partnerships that enhance competitive positioning. Technology advancement continues improving product performance and commercial viability, while expanding application opportunities create new market segments and growth potential.

Future market development will be shaped by continued innovation in biological technologies, expanding adoption in traditional agricultural segments, and integration with digital agriculture platforms that optimize product performance. The sector’s commitment to sustainable agriculture solutions positions bio-fungicides as essential components of modern crop protection strategies that balance productivity, profitability, and environmental stewardship objectives.

What is Bio-fungicide?

Bio-fungicide refers to a type of pesticide derived from natural materials, used to control fungal diseases in plants. These products are increasingly popular in agriculture due to their effectiveness and lower environmental impact compared to synthetic fungicides.

What are the key players in the United States Bio-fungicide Market?

Key players in the United States Bio-fungicide Market include companies like Bayer AG, BASF SE, and Marrone Bio Innovations, which are known for their innovative bio-fungicide solutions. These companies focus on developing sustainable agricultural practices and effective disease management strategies, among others.

What are the growth factors driving the United States Bio-fungicide Market?

The United States Bio-fungicide Market is driven by increasing consumer demand for organic produce, the need for sustainable farming practices, and the rising awareness of the environmental impact of chemical pesticides. Additionally, regulatory support for bio-based products is fostering market growth.

What challenges does the United States Bio-fungicide Market face?

Challenges in the United States Bio-fungicide Market include the limited shelf life of bio-fungicides, potential variability in efficacy, and competition from synthetic fungicides. These factors can hinder adoption among traditional farmers who may prioritize immediate results.

What opportunities exist in the United States Bio-fungicide Market?

The United States Bio-fungicide Market presents opportunities for innovation in product development, particularly in enhancing the efficacy and stability of bio-fungicides. Additionally, the growing trend towards integrated pest management systems offers a platform for bio-fungicides to be utilized more widely.

What trends are shaping the United States Bio-fungicide Market?

Trends in the United States Bio-fungicide Market include the increasing adoption of precision agriculture technologies, the rise of biocontrol agents, and a shift towards more sustainable agricultural practices. These trends are influencing how farmers approach pest management and crop protection.

United States Bio-fungicide Market

| Segmentation Details | Description |

|---|---|

| Product Type | Microbial, Botanical, Biochemical, Others |

| Application | Agricultural, Horticultural, Turf, Ornamental |

| End User | Farmers, Greenhouses, Landscapers, Nurseries |

| Formulation | Liquid, Granular, Powder, Concentrate |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Bio-fungicide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at