444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United States Baby Food and Infant Formula Market is witnessing steady growth, driven by changing consumer preferences, a growing number of working parents, and an increasing awareness of the nutritional benefits of baby food and infant formula products. The demand for baby food, particularly infant formula, has been rising as parents seek convenient and nutritionally balanced alternatives to breast milk. In recent years, the market has been further boosted by advancements in baby food formulations that offer enhanced nutritional value, organic ingredients, and allergy-free options. The growing trend of health-conscious consumerism, coupled with an expanding e-commerce sector, is shaping the future of this market. However, challenges related to product recalls, regulatory constraints, and price competition remain in the landscape.

Meaning

Baby food and infant formula products are specially formulated foods designed to meet the nutritional needs of infants and toddlers who are unable to consume solid foods. These products are typically used as alternatives or supplements to breast milk, especially for parents who are unable to breastfeed or choose not to. The key categories in this market include:

Executive Summary

The United States Baby Food and Infant Formula Market is expected to experience consistent growth over the forecast period, driven by the increasing preference for baby food and infant formula, innovations in product offerings, and the increasing number of dual-income households. Valued at approximately USD XX billion in 2023, the market is projected to grow at a compound annual growth rate (CAGR) of XX% from 2024 to 2030. The market is characterized by product diversification, with key players focusing on offering organic, allergen-free, and nutrition-optimized formulas. Despite the opportunities, the market faces challenges, including regulatory hurdles, rising raw material costs, and competition from alternative feeding solutions like homemade baby food and breast milk banks.

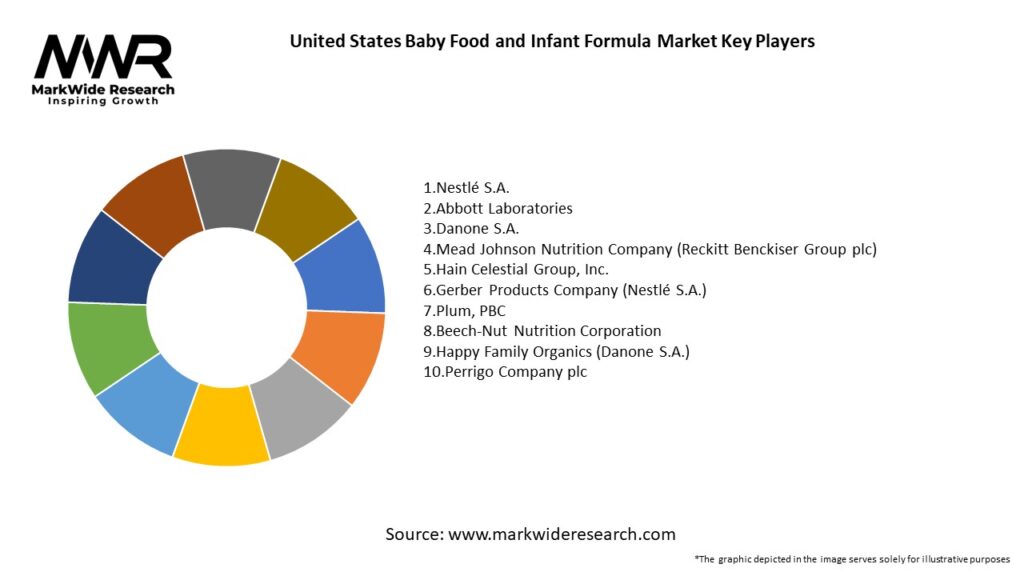

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The United States Baby Food and Infant Formula Market is influenced by several key factors:

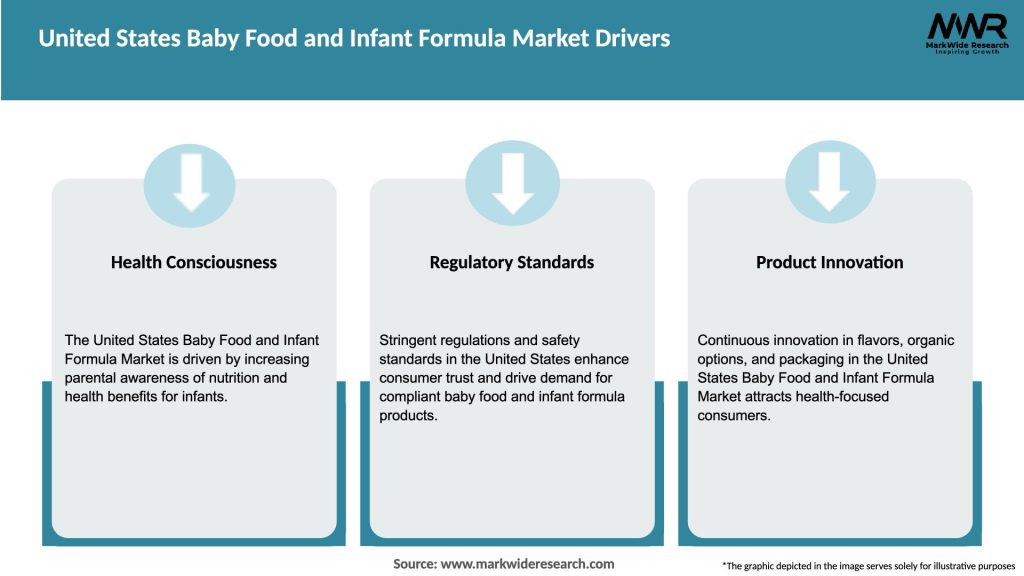

Market Drivers

Several factors are driving the growth of the United States Baby Food and Infant Formula Market:

Market Restraints

Despite its positive growth prospects, the United States Baby Food and Infant Formula Market faces certain challenges:

Market Opportunities

The United States Baby Food and Infant Formula Market offers numerous opportunities for growth:

Market Dynamics

The dynamics of the United States Baby Food and Infant Formula Market are shaped by a combination of supply-side and demand-side factors:

Regional Analysis

The United States Baby Food and Infant Formula Market is primarily driven by the demand from urban areas, with a focus on convenience and nutritional value. Major trends across regions include:

Competitive Landscape

Leading Companies in the United States Baby Food and Infant Formula Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The United States Baby Food and Infant Formula Market can be segmented based on product type, distribution channel, and age group:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The United States Baby Food and Infant Formula Market offers several benefits for manufacturers and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the United States Baby Food and Infant Formula Market include:

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the United States Baby Food and Infant Formula Market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The United States Baby Food and Infant Formula Market is expected to continue its steady growth, driven by innovation, changing consumer preferences, and the rising demand for organic and functional products. Companies that focus on meeting regulatory standards, offering high-quality products, and embracing e-commerce channels will be well-positioned to succeed in this competitive market.

Conclusion

The United States Baby Food and Infant Formula Market is evolving rapidly, driven by consumer demand for healthier, more convenient, and nutritionally balanced products. As the market continues to grow, manufacturers and retailers need to adapt to changing consumer preferences and regulatory requirements to maintain their market position. By focusing on innovation, sustainability, and quality, stakeholders can capitalize on the significant opportunities presented by this dynamic market.

What is the United States Baby Food and Infant Formula?

The United States Baby Food and Infant Formula refers to the range of products designed for infants and young children, including pureed foods, cereals, and liquid formulas that provide essential nutrients for growth and development.

Who are the key players in the United States Baby Food and Infant Formula Market?

Key players in the United States Baby Food and Infant Formula Market include Gerber Products Company, Mead Johnson Nutrition, Nestlé, and Hain Celestial Group, among others.

What are the main drivers of growth in the United States Baby Food and Infant Formula Market?

The main drivers of growth in the United States Baby Food and Infant Formula Market include increasing awareness of infant nutrition, rising disposable incomes, and a growing trend towards organic and natural baby food products.

What challenges does the United States Baby Food and Infant Formula Market face?

Challenges in the United States Baby Food and Infant Formula Market include stringent regulations regarding product safety, competition from homemade baby food options, and concerns over ingredient sourcing and quality.

What opportunities exist in the United States Baby Food and Infant Formula Market?

Opportunities in the United States Baby Food and Infant Formula Market include the expansion of online retail channels, the introduction of innovative product formulations, and the increasing demand for specialized formulas catering to specific dietary needs.

What trends are shaping the United States Baby Food and Infant Formula Market?

Trends shaping the United States Baby Food and Infant Formula Market include a shift towards plant-based ingredients, the rise of subscription services for baby food delivery, and a focus on sustainability in packaging and sourcing.

United States Baby Food and Infant Formula Market:

| Segment | Description |

|---|---|

| Product Type | Baby Food: Prepared Baby Food, Dried Baby Food, Other Baby Food. Infant Formula: Milk-based, Soy-based, Organic, Others |

| Age Group | Infants (0-6 Months), Babies (6-12 Months), Toddlers (12-24 Months) |

| Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Pharmacies, Others |

| Region | United States |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Baby Food and Infant Formula Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at