444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States aviation market represents one of the most sophisticated and expansive aerospace ecosystems globally, encompassing commercial aviation, general aviation, military aircraft, and supporting infrastructure. Market dynamics indicate robust growth driven by increasing passenger demand, technological innovations, and modernization initiatives across both civilian and defense sectors. The market demonstrates remarkable resilience with projected growth rates of 4.2% CAGR through the forecast period, supported by recovering air travel demand and substantial investments in next-generation aircraft technologies.

Commercial aviation dominates the landscape, featuring major airlines, regional carriers, and cargo operators that collectively handle millions of passengers and freight shipments annually. The sector benefits from strategic geographic positioning, advanced airport infrastructure, and a regulatory framework that promotes both safety and innovation. General aviation maintains significant presence with business jets, private aircraft, and specialized aviation services contributing substantially to overall market vitality.

Technological advancement serves as a primary catalyst, with manufacturers investing heavily in fuel-efficient engines, composite materials, and digital aviation systems. The integration of artificial intelligence, predictive maintenance technologies, and sustainable aviation fuels represents key growth vectors. Infrastructure modernization continues through airport expansion projects, air traffic control system upgrades, and the development of urban air mobility solutions.

The United States aviation market refers to the comprehensive ecosystem encompassing aircraft manufacturing, airline operations, airport services, maintenance and repair organizations, and supporting technologies within the American aerospace sector. This market includes commercial passenger and cargo transportation, general aviation activities, military aircraft operations, and the extensive supply chain supporting these diverse aviation segments.

Market participants range from major aircraft manufacturers and airlines to specialized component suppliers, maintenance providers, and technology companies. The sector encompasses both domestic operations and international activities of US-based companies, creating a complex network of interconnected businesses that support national transportation needs, economic growth, and defense capabilities.

Aviation infrastructure forms the foundation, including airports, air traffic control systems, maintenance facilities, and training centers. The market also encompasses emerging segments such as unmanned aerial systems, urban air mobility, and space-related aviation activities, reflecting the industry’s evolution toward next-generation transportation solutions.

Strategic positioning of the United States aviation market reflects decades of innovation leadership, regulatory excellence, and infrastructure development that established America as the global aviation hub. The market demonstrates exceptional diversity across commercial, general, and military aviation segments, with each contributing unique value propositions and growth opportunities. Recovery momentum following recent industry challenges has accelerated, with passenger traffic approaching pre-pandemic levels and cargo operations exceeding historical benchmarks.

Investment flows continue into advanced manufacturing capabilities, sustainable technologies, and digital transformation initiatives. Major airlines are modernizing fleets with fuel-efficient aircraft, while manufacturers develop next-generation propulsion systems and autonomous flight technologies. Regulatory support through favorable policies, safety standards, and innovation frameworks creates an enabling environment for continued market expansion.

Competitive advantages include world-class manufacturing capabilities, extensive research and development infrastructure, and deep talent pools across engineering, operations, and management disciplines. The market benefits from strong domestic demand, robust export opportunities, and strategic partnerships with international aviation stakeholders. Future growth projections indicate sustained expansion driven by demographic trends, economic development, and technological breakthroughs that will reshape aviation operations.

Market intelligence reveals several critical trends shaping the United States aviation landscape. Passenger demand recovery has exceeded initial projections, with domestic travel reaching 95% of pre-pandemic levels and international routes showing strong rebound momentum. Airlines are strategically adjusting capacity, route networks, and service offerings to capitalize on evolving travel patterns and customer preferences.

Economic expansion serves as the fundamental driver, with GDP growth, business investment, and consumer spending directly correlating with aviation demand. Population demographics favor continued market growth, as younger generations demonstrate strong propensity for air travel and business mobility requirements increase across industries. The rise of remote work has paradoxically increased leisure travel demand while maintaining business aviation needs for face-to-face meetings and corporate activities.

Technological innovation accelerates market development through improved aircraft performance, operational efficiency, and passenger experience enhancements. Advanced materials, engine technologies, and digital systems reduce operating costs while increasing reliability and safety margins. Regulatory modernization supports innovation adoption through updated certification processes, performance-based navigation systems, and streamlined approval procedures for new technologies.

Infrastructure development creates capacity for market expansion, with airport improvements, air traffic control upgrades, and maintenance facility expansion supporting increased flight operations. International trade growth drives cargo aviation demand, while tourism recovery and business globalization sustain passenger traffic. The emergence of new market segments, including urban air mobility and advanced air mobility, presents additional growth vectors beyond traditional aviation operations.

Regulatory complexity presents ongoing challenges, with certification processes, safety requirements, and environmental regulations creating barriers to rapid innovation deployment. Infrastructure constraints at major airports limit capacity expansion, while air traffic control system limitations affect operational efficiency during peak periods. The lengthy development cycles for new aircraft and technologies require substantial capital investments with extended payback periods.

Workforce shortages across multiple disciplines, including pilots, mechanics, and air traffic controllers, constrain market growth potential. Environmental pressures increase operational costs through carbon pricing, noise restrictions, and sustainability mandates that require significant technology investments. Economic volatility affects both passenger demand and airline profitability, creating cyclical challenges for market participants.

Supply chain vulnerabilities have been exposed through recent disruptions, highlighting dependencies on global suppliers and specialized components. Cybersecurity threats require continuous investment in protective systems and protocols, while aging infrastructure in some regions needs substantial modernization investment. Competition from alternative transportation modes, including high-speed rail and improved ground transportation, affects certain market segments.

Sustainable aviation represents the most significant opportunity, with development of electric aircraft, hydrogen propulsion, and sustainable aviation fuels creating new market segments. Urban air mobility presents transformative potential for metropolitan transportation, with electric vertical takeoff and landing aircraft addressing traffic congestion and time-sensitive transportation needs. Advanced air mobility applications extend beyond passenger transport to cargo delivery, emergency services, and specialized operations.

Digital transformation opportunities span predictive maintenance, autonomous flight systems, and artificial intelligence applications that improve safety, efficiency, and cost-effectiveness. International expansion through strategic partnerships, joint ventures, and export opportunities leverages American aviation expertise in growing global markets. The development of supersonic passenger aircraft and space tourism creates premium market segments with substantial growth potential.

Infrastructure modernization projects offer opportunities for technology providers, construction companies, and service organizations. Workforce development initiatives create opportunities for training organizations, educational institutions, and technology companies providing simulation and learning systems. The integration of aviation with other transportation modes through multimodal hubs and seamless connectivity solutions represents additional market expansion opportunities.

Competitive intensity varies across market segments, with commercial aviation dominated by established players while emerging segments like urban air mobility attract new entrants and venture capital investment. Innovation cycles are accelerating, driven by competitive pressures, regulatory changes, and customer demands for improved performance and sustainability. The market demonstrates strong network effects, where infrastructure investments, route development, and technology adoption create reinforcing advantages for leading participants.

Supply chain dynamics reflect global integration, with American companies both sourcing internationally and exporting products worldwide. Regulatory influence shapes market structure through safety standards, environmental requirements, and certification processes that affect competitive positioning. According to MarkWide Research analysis, market consolidation trends continue in certain segments while new market creation occurs in emerging aviation applications.

Customer behavior evolution affects demand patterns, with increased emphasis on sustainability, convenience, and value-added services. Technology adoption rates vary by segment, with commercial aviation leading in advanced systems while general aviation shows growing interest in modern avionics and connectivity solutions. Market cycles demonstrate resilience, with recovery patterns following disruptions becoming more predictable and manageable through improved risk management and operational flexibility.

Comprehensive analysis employs multiple research approaches to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, regulatory officials, technology providers, and end-users across all major aviation segments. Survey methodologies capture quantitative data on market trends, investment priorities, and future planning initiatives from representative samples of market participants.

Secondary research encompasses analysis of public filings, industry reports, regulatory documents, and academic studies to validate primary findings and identify emerging trends. Data triangulation methods ensure consistency across multiple information sources while identifying potential discrepancies or unique insights. Market modeling techniques incorporate historical performance data, current market conditions, and forward-looking indicators to develop reliable projections.

Expert validation processes involve review by industry specialists, regulatory experts, and academic researchers to ensure analytical accuracy and practical relevance. Continuous monitoring systems track market developments, regulatory changes, and technology advancements to maintain current and actionable intelligence. The methodology emphasizes both quantitative metrics and qualitative insights to provide comprehensive understanding of market dynamics and future opportunities.

Geographic distribution across the United States reveals distinct regional characteristics and growth patterns. West Coast markets demonstrate strong technology integration, with California leading in advanced manufacturing and innovation initiatives. The region benefits from proximity to Asia-Pacific markets and hosts major aircraft manufacturers, technology companies, and research institutions. Market share in the western region represents approximately 28% of total aviation activity.

East Coast operations center on major metropolitan areas and international gateway airports, with strong passenger traffic and cargo operations. The region features extensive airline headquarters, financial services supporting aviation, and mature infrastructure supporting high-density operations. Southeast markets show rapid growth driven by population expansion, business development, and favorable regulatory environments that attract aviation companies and maintenance operations.

Central regions provide strategic advantages through geographic positioning, lower operating costs, and access to transportation networks. Texas aviation markets demonstrate exceptional growth across commercial, general, and military segments, with major manufacturing facilities and airline operations. Midwest markets maintain strong positions in cargo operations, general aviation, and agricultural aviation services, while benefiting from central location advantages for distribution and logistics operations.

Market leadership spans multiple categories, with different companies dominating specific segments of the aviation ecosystem. Aircraft manufacturing features both established industry giants and innovative newcomers developing next-generation technologies.

Competitive strategies emphasize innovation, operational excellence, and customer service differentiation. Market positioning varies from cost leadership to premium service providers, with successful companies developing clear value propositions for target customer segments.

Market segmentation reveals diverse opportunities across multiple dimensions. By Aircraft Type: Commercial aviation includes narrow-body, wide-body, and regional aircraft serving passenger and cargo markets. General aviation encompasses business jets, turboprops, piston aircraft, and helicopters serving corporate, personal, and specialized mission requirements.

By Application:

By Technology: Traditional turbine engines, emerging electric propulsion, hybrid systems, and hydrogen fuel cells represent different technological approaches. By Service Category: Manufacturing, maintenance and repair, training, financing, and support services create comprehensive market ecosystem supporting aviation operations.

Commercial Aviation demonstrates steady recovery with airlines focusing on fleet optimization, route network adjustments, and operational efficiency improvements. Passenger preferences increasingly favor airlines offering enhanced safety protocols, flexible booking options, and premium service amenities. Load factors have improved to 82% average across major carriers, indicating strong demand recovery and effective capacity management.

General Aviation shows robust growth driven by business aviation demand, with companies investing in private aircraft for executive transportation and operational flexibility. Fractional ownership and charter services expand market accessibility, while technological advances improve aircraft performance and reduce operating costs. The segment benefits from airport infrastructure that supports diverse aircraft types and mission requirements.

Cargo Aviation maintains exceptional performance driven by e-commerce growth and supply chain optimization needs. Express delivery services continue expanding capacity and route networks to meet increasing demand for rapid shipment services. Specialized cargo operations, including temperature-controlled and oversized freight, create premium market segments with higher margins and growth potential.

Economic benefits extend throughout the aviation ecosystem, creating employment opportunities, tax revenues, and economic multiplier effects. Airlines benefit from improved aircraft efficiency, reduced fuel consumption, and enhanced passenger experience capabilities that support premium pricing and customer loyalty. Advanced technologies enable predictive maintenance, optimized flight operations, and reduced environmental impact.

Manufacturers gain from strong domestic demand, export opportunities, and technology leadership positions that support premium pricing and market share expansion. Service providers benefit from increasing maintenance requirements, training needs, and specialized support services as aircraft become more sophisticated and operators demand higher reliability standards.

Passengers enjoy improved safety, comfort, and connectivity through modern aircraft and enhanced airport facilities. Communities benefit from economic development, job creation, and improved transportation connectivity that supports business growth and tourism development. Government stakeholders realize tax revenues, economic development, and national security benefits from a strong domestic aviation industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend, with industry-wide commitment to achieving net-zero carbon emissions by 2050. Sustainable aviation fuels adoption accelerates through government incentives, airline commitments, and fuel producer investments. Electric and hydrogen-powered aircraft development progresses from concept to certification, with regional and urban air mobility applications leading adoption.

Digital integration transforms aviation operations through artificial intelligence, machine learning, and advanced analytics. Predictive maintenance systems reduce aircraft downtime while improving safety and cost-effectiveness. Autonomous flight technologies advance from cargo applications toward passenger operations, with regulatory frameworks evolving to support safe implementation.

Urban air mobility emerges as a transformative trend, with electric vertical takeoff and landing aircraft preparing for commercial operations. Advanced air mobility applications extend beyond passenger transport to cargo delivery, emergency services, and specialized missions. MWR data indicates growing investment in vertiport infrastructure and air traffic management systems supporting urban aviation operations.

Regulatory advancement includes Federal Aviation Administration initiatives to modernize certification processes, implement performance-based navigation systems, and develop frameworks for emerging aviation technologies. Infrastructure investment through federal programs supports airport modernization, air traffic control upgrades, and research facility development that enhance industry capabilities.

Technology breakthroughs in electric propulsion, autonomous flight systems, and advanced materials accelerate development timelines for next-generation aircraft. Industry partnerships between manufacturers, airlines, and technology companies create collaborative innovation ecosystems addressing complex technical challenges and market requirements.

Market consolidation continues through strategic acquisitions, joint ventures, and partnership agreements that strengthen competitive positions and expand market reach. International cooperation advances through bilateral agreements, technology sharing arrangements, and collaborative research programs that support global aviation development and standardization efforts.

Strategic priorities should focus on sustainability leadership, technology innovation, and workforce development to maintain competitive advantages. Investment recommendations emphasize sustainable aviation technologies, digital transformation capabilities, and infrastructure modernization that support long-term market growth. Companies should develop clear sustainability strategies addressing environmental concerns while maintaining operational efficiency.

Market positioning strategies should leverage American technology leadership, regulatory expertise, and market scale advantages. Partnership development with international stakeholders creates opportunities for market expansion and technology sharing. Workforce investment through training programs, educational partnerships, and retention initiatives addresses critical skill shortages constraining market growth.

Risk management approaches should address cybersecurity threats, supply chain vulnerabilities, and regulatory changes that could affect operations. Innovation investment in emerging technologies, including urban air mobility and sustainable propulsion, positions companies for future market opportunities. Customer focus on safety, reliability, and environmental responsibility aligns with evolving market expectations and regulatory requirements.

Growth projections indicate sustained market expansion driven by passenger demand recovery, cargo growth, and emerging aviation segments. Technology evolution will accelerate through electric aircraft commercialization, autonomous flight system deployment, and sustainable fuel adoption reaching 15% of total fuel consumption by 2030. Urban air mobility operations are expected to commence commercial service within the next five years.

Market transformation will occur through digitalization, sustainability initiatives, and new mobility solutions that reshape traditional aviation operations. Infrastructure development will support increased capacity, improved efficiency, and new aviation applications through modernized airports, advanced air traffic management, and vertiport networks for urban aviation.

Competitive dynamics will evolve as new entrants challenge established players in emerging market segments while traditional companies adapt business models for changing customer requirements. MarkWide Research projects continued American leadership in aviation innovation, with strong export potential and domestic market growth supporting industry expansion through the forecast period.

Market assessment reveals the United States aviation market maintains exceptional strength across commercial, general, and military aviation segments, with robust recovery momentum and strong future growth prospects. Technology leadership positions American companies advantageously for emerging opportunities in sustainable aviation, urban air mobility, and digital transformation initiatives that will reshape industry operations.

Strategic advantages including advanced infrastructure, regulatory excellence, and innovation capabilities provide sustainable competitive positioning in global aviation markets. Growth drivers encompass passenger demand recovery, cargo expansion, and new market segments that create diverse opportunities for industry participants. The market demonstrates resilience through economic cycles while adapting to evolving customer expectations and environmental requirements.

Future success will depend on continued investment in technology innovation, workforce development, and sustainability initiatives that address market challenges while capitalizing on emerging opportunities. The United States aviation market remains well-positioned for sustained growth and continued global leadership through strategic focus on innovation, operational excellence, and customer value creation across all aviation segments.

What is Aviation?

Aviation refers to the design, development, production, and operation of aircraft. It encompasses various segments including commercial, military, and general aviation, playing a crucial role in transportation and logistics.

What are the key players in the United States Aviation Market?

Key players in the United States Aviation Market include Boeing, Lockheed Martin, and Delta Air Lines, among others. These companies are involved in manufacturing aircraft, providing airline services, and developing aviation technologies.

What are the growth factors driving the United States Aviation Market?

The growth of the United States Aviation Market is driven by increasing air travel demand, advancements in aviation technology, and the expansion of cargo services. Additionally, the rise of low-cost carriers has made air travel more accessible.

What challenges does the United States Aviation Market face?

The United States Aviation Market faces challenges such as regulatory compliance, environmental concerns, and fluctuating fuel prices. These factors can impact operational costs and sustainability efforts within the industry.

What opportunities exist in the United States Aviation Market?

Opportunities in the United States Aviation Market include the development of sustainable aviation fuels, the integration of unmanned aerial vehicles, and advancements in air traffic management systems. These innovations can enhance efficiency and reduce environmental impact.

What trends are shaping the United States Aviation Market?

Trends in the United States Aviation Market include the increasing use of digital technologies for operations, a focus on sustainability, and the growth of urban air mobility solutions. These trends are transforming how aviation services are delivered and experienced.

United States Aviation Market

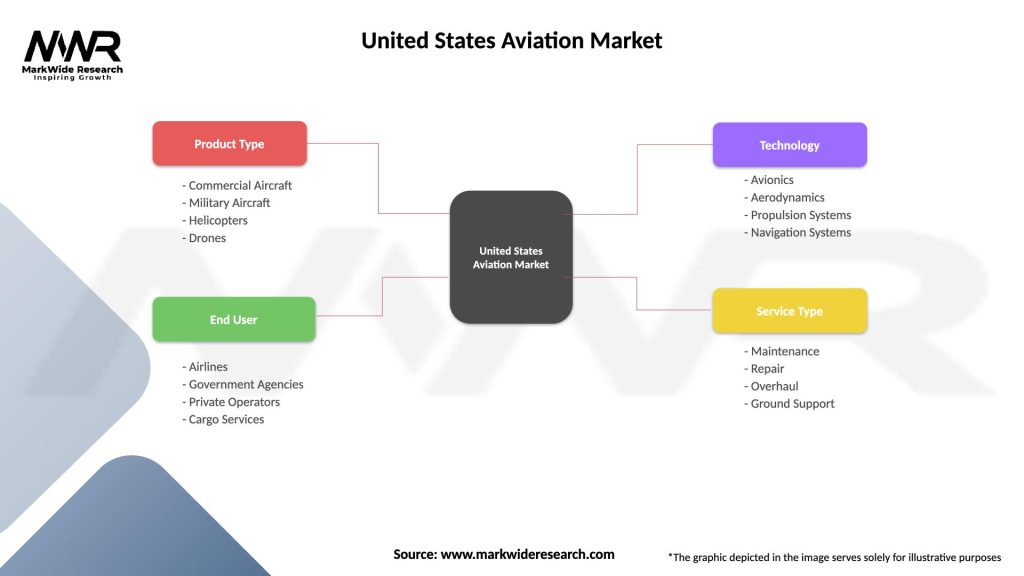

| Segmentation Details | Description |

|---|---|

| Product Type | Commercial Aircraft, Military Aircraft, Helicopters, Drones |

| End User | Airlines, Government Agencies, Private Operators, Cargo Services |

| Technology | Avionics, Aerodynamics, Propulsion Systems, Navigation Systems |

| Service Type | Maintenance, Repair, Overhaul, Ground Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Aviation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at