444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States autonomous car market represents a transformative sector within the automotive industry, characterized by rapid technological advancement and significant investment in self-driving vehicle technologies. Autonomous vehicles are revolutionizing transportation paradigms across America, with major automotive manufacturers, technology companies, and startups competing to develop and deploy fully autonomous driving systems. The market encompasses various levels of automation, from advanced driver assistance systems to fully autonomous vehicles capable of operating without human intervention.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 22.3% driven by technological breakthroughs in artificial intelligence, machine learning, and sensor technologies. Consumer acceptance is gradually increasing as safety features and convenience benefits become more apparent, while regulatory frameworks continue evolving to accommodate autonomous vehicle deployment.

Key market participants include established automotive giants like General Motors, Ford Motor Company, and Tesla, alongside technology leaders such as Waymo, Uber, and Amazon. The market landscape features intense competition in developing Level 4 and Level 5 autonomous capabilities, with significant investments in research and development, strategic partnerships, and pilot programs across multiple states.

The United States autonomous car market refers to the comprehensive ecosystem of self-driving vehicles, supporting technologies, infrastructure, and services designed to enable vehicles to navigate and operate independently without direct human control. This market encompasses the development, manufacturing, and deployment of autonomous vehicles across various automation levels, from basic driver assistance features to fully autonomous systems capable of handling all driving tasks in any environment.

Autonomous vehicles utilize sophisticated combinations of sensors, cameras, radar, lidar, artificial intelligence, and machine learning algorithms to perceive their environment, make driving decisions, and execute safe navigation. The market includes hardware components, software platforms, data processing systems, mapping technologies, and the necessary infrastructure to support autonomous vehicle operations throughout the United States.

The United States autonomous car market stands at the forefront of automotive innovation, representing a paradigm shift toward intelligent, connected, and autonomous mobility solutions. Market growth is accelerated by increasing consumer demand for enhanced safety features, convenience, and mobility accessibility, particularly among aging populations and individuals with disabilities.

Technology advancement continues driving market expansion, with artificial intelligence and machine learning capabilities improving vehicle perception, decision-making, and safety performance. Regulatory support from federal and state governments is facilitating testing and deployment through updated safety standards and autonomous vehicle legislation.

Investment levels remain robust, with venture capital funding and corporate investments reaching significant heights as companies race to achieve commercial viability. Partnership formation between traditional automakers and technology companies is accelerating development timelines and market entry strategies.

Consumer adoption rates show 68% of Americans expressing interest in autonomous vehicle features, particularly advanced safety systems and traffic management capabilities. The market benefits from increasing urbanization, traffic congestion concerns, and environmental sustainability priorities driving demand for efficient transportation solutions.

Strategic market insights reveal several critical trends shaping the United States autonomous car market landscape:

Primary market drivers propelling the United States autonomous car market include technological advancement, safety improvements, and changing consumer preferences. Artificial intelligence and machine learning breakthroughs are enabling vehicles to process complex driving scenarios with increasing accuracy and reliability.

Safety considerations represent a fundamental driver, with autonomous vehicles offering potential solutions to reduce traffic accidents caused by human error, which account for approximately 94% of serious traffic crashes. Advanced driver assistance systems are already demonstrating significant safety improvements in collision avoidance and emergency response scenarios.

Demographic trends are creating demand for autonomous vehicles, particularly among aging populations seeking maintained mobility and independence. Urbanization patterns and increasing traffic congestion are driving interest in efficient, automated transportation solutions that can optimize traffic flow and reduce commute times.

Environmental concerns are accelerating autonomous vehicle adoption, as many autonomous platforms are being developed with electric powertrains, contributing to reduced emissions and improved air quality. Economic benefits include potential cost savings from reduced accidents, improved fuel efficiency, and optimized vehicle utilization through shared autonomous services.

Significant market restraints continue challenging autonomous vehicle adoption and deployment across the United States. Regulatory uncertainty remains a primary concern, as federal and state governments work to establish comprehensive safety standards and liability frameworks for autonomous vehicle operations.

Technical limitations persist in handling complex driving scenarios, particularly in adverse weather conditions, construction zones, and unpredictable traffic situations. Sensor reliability and system redundancy requirements increase vehicle costs and complexity, potentially limiting mass market adoption.

Consumer skepticism regarding autonomous vehicle safety and reliability continues influencing adoption rates, with many potential users preferring human control over critical driving decisions. Cybersecurity concerns about potential hacking and system vulnerabilities create additional barriers to consumer acceptance.

Infrastructure requirements for supporting autonomous vehicles, including updated road signage, communication systems, and mapping data, represent significant investment needs. Insurance and liability questions surrounding autonomous vehicle accidents and system failures create uncertainty for manufacturers, operators, and consumers.

Substantial market opportunities exist within the United States autonomous car market, particularly in commercial applications and specialized use cases. Fleet management and logistics companies represent early adoption opportunities, where autonomous vehicles can provide immediate operational benefits and cost savings.

Ride-sharing services offer significant deployment opportunities, with companies like Uber and Lyft investing heavily in autonomous vehicle technologies to reduce operational costs and improve service efficiency. Last-mile delivery applications present growing opportunities as e-commerce continues expanding and demand for automated delivery solutions increases.

Rural transportation represents an underserved market opportunity, where autonomous vehicles could provide essential mobility services in areas with limited public transportation options. Specialized applications including medical transport, elderly care, and disability services offer targeted market segments with specific autonomous vehicle requirements.

Technology partnerships between automotive manufacturers and technology companies create opportunities for accelerated development and market entry. Government contracts for autonomous vehicle testing and deployment in public transportation systems represent additional growth opportunities.

Market dynamics within the United States autonomous car sector reflect complex interactions between technological advancement, regulatory development, and consumer adoption patterns. Competitive intensity continues increasing as traditional automakers compete with technology companies and startups for market leadership and technological superiority.

Investment patterns show sustained venture capital and corporate funding flowing into autonomous vehicle development, with particular focus on artificial intelligence, sensor technologies, and software platforms. Strategic partnerships are becoming increasingly common as companies seek to combine automotive expertise with technology capabilities.

Regulatory evolution is creating dynamic market conditions, with federal agencies and state governments developing new frameworks for autonomous vehicle testing, certification, and deployment. MarkWide Research analysis indicates that regulatory clarity is essential for accelerating market growth and commercial deployment.

Consumer behavior is gradually shifting toward acceptance of autonomous features, with younger demographics showing higher adoption rates and willingness to use autonomous vehicle services. Technology maturation is reducing costs and improving performance, making autonomous vehicles more commercially viable and accessible to broader market segments.

Comprehensive research methodology employed for analyzing the United States autonomous car market incorporates multiple data sources and analytical approaches to ensure accurate market assessment. Primary research includes interviews with industry executives, technology developers, regulatory officials, and potential consumers to gather firsthand insights into market trends and challenges.

Secondary research encompasses analysis of industry reports, government publications, patent filings, and academic research to understand technological developments and market dynamics. Market surveys and consumer studies provide insights into adoption patterns, preferences, and barriers to autonomous vehicle acceptance.

Data triangulation methods ensure research accuracy by comparing information from multiple sources and validating findings through cross-reference analysis. Expert consultations with automotive engineers, AI specialists, and policy experts provide technical validation and market perspective.

Quantitative analysis includes statistical modeling of market trends, growth projections, and scenario planning to assess various market development paths. Qualitative assessment examines regulatory impacts, competitive dynamics, and technological barriers affecting market evolution.

Regional market analysis reveals significant variations in autonomous vehicle development and deployment across different United States regions. California leads in autonomous vehicle testing and development, accounting for approximately 60% of autonomous vehicle testing miles nationwide, with companies like Waymo, Cruise, and Tesla conducting extensive operations.

The Northeast corridor, including states like New York, Massachusetts, and Pennsylvania, represents 25% of market activity with focus on urban autonomous applications and public transportation integration. Major metropolitan areas in this region are implementing smart city initiatives supporting autonomous vehicle infrastructure.

The Midwest region, particularly Michigan and Ohio, leverages traditional automotive manufacturing expertise to develop autonomous vehicle technologies and testing facilities. Detroit remains a critical hub for automotive innovation and autonomous vehicle research and development.

Southern states including Texas, Florida, and Arizona are emerging as important testing grounds due to favorable weather conditions and supportive regulatory environments. Arizona has become particularly attractive for autonomous vehicle companies seeking year-round testing capabilities.

Western states beyond California, including Nevada and Washington, are developing autonomous vehicle programs and attracting technology companies seeking diverse testing environments and regulatory frameworks.

The competitive landscape of the United States autonomous car market features diverse participants ranging from established automotive manufacturers to innovative technology startups. Market leaders are distinguished by their technological capabilities, testing progress, and commercial deployment strategies.

Competitive strategies include technology partnerships, acquisition of startups, investment in research and development, and establishment of testing facilities across multiple states.

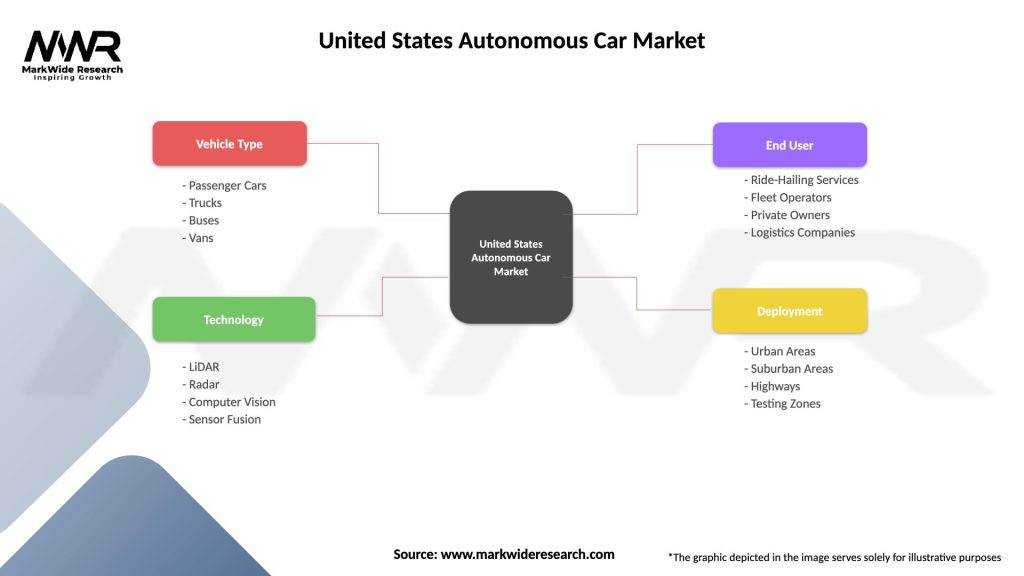

Market segmentation of the United States autonomous car market reveals distinct categories based on automation levels, applications, and vehicle types. By Automation Level: the market includes Level 1 through Level 5 autonomous systems, with Level 2 and Level 3 systems currently dominating commercial deployments.

By Vehicle Type:

By Application:

By Technology:

Category-wise analysis provides detailed insights into specific segments within the United States autonomous car market. Level 2 autonomous systems currently represent the largest deployment category, with features like adaptive cruise control, lane keeping assistance, and automatic emergency braking becoming standard in many new vehicles.

Passenger car applications focus on convenience, safety, and comfort features that enhance the driving experience while maintaining human oversight. Premium vehicle segments are leading adoption of advanced autonomous features, with luxury brands offering comprehensive driver assistance packages.

Commercial vehicle applications emphasize operational efficiency, cost reduction, and safety improvements in freight and delivery operations. Long-haul trucking represents a significant opportunity for autonomous technology deployment, with potential for reduced driver fatigue and improved logistics efficiency.

Urban mobility applications are developing rapidly, with autonomous ride-sharing services beginning commercial operations in select cities. Last-mile delivery applications are expanding as e-commerce growth drives demand for automated delivery solutions.

Sensor technology categories show varying adoption patterns, with camera-based systems leading in cost-effectiveness while lidar systems provide superior environmental perception capabilities. Sensor fusion approaches combining multiple technologies are becoming standard for higher automation levels.

Industry participants and stakeholders in the United States autonomous car market realize numerous benefits from market participation and technology adoption. Automotive manufacturers benefit from differentiated product offerings, enhanced safety features, and potential new revenue streams from autonomous vehicle services and software updates.

Technology companies gain access to large-scale deployment opportunities, data collection capabilities, and partnerships with established automotive brands. Software and AI developers benefit from growing demand for autonomous vehicle algorithms, machine learning systems, and data processing platforms.

Fleet operators realize operational benefits including reduced labor costs, improved vehicle utilization, enhanced safety records, and optimized route planning. Insurance companies benefit from potentially reduced accident rates and new insurance product opportunities for autonomous vehicle coverage.

Consumers benefit from enhanced safety features, improved mobility access, reduced transportation costs, and increased convenience in daily transportation needs. Government agencies benefit from potential reductions in traffic accidents, improved traffic flow, and reduced infrastructure maintenance costs.

Infrastructure providers benefit from opportunities to develop smart road systems, communication networks, and charging infrastructure supporting autonomous vehicle operations. Service providers benefit from new business models in maintenance, software updates, and autonomous vehicle support services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the United States autonomous car market include accelerating technology convergence, increasing industry collaboration, and evolving consumer acceptance patterns. Artificial intelligence advancement is enabling more sophisticated decision-making capabilities and improved safety performance in autonomous systems.

Electric vehicle integration is becoming standard in autonomous vehicle development, with most new autonomous platforms incorporating electric powertrains for environmental benefits and operational efficiency. 5G connectivity is enabling real-time communication between vehicles and infrastructure, supporting advanced autonomous features and traffic management systems.

Subscription-based services are emerging as alternative business models, allowing consumers to access autonomous vehicle features through monthly payments rather than upfront purchases. Data monetization strategies are developing as autonomous vehicles generate valuable information about traffic patterns, consumer behavior, and infrastructure usage.

Regulatory harmonization efforts are progressing at federal and state levels to create consistent standards for autonomous vehicle testing and deployment. MWR research indicates that regulatory clarity will be crucial for accelerating market growth and commercial viability.

Urban planning integration is incorporating autonomous vehicles into smart city initiatives, with infrastructure development supporting vehicle-to-infrastructure communication and optimized traffic management.

Recent industry developments demonstrate accelerating progress in autonomous vehicle technology and market deployment. Waymo has expanded its commercial ride-hailing service to additional cities, demonstrating the viability of autonomous transportation services for everyday consumers.

Tesla continues advancing its Full Self-Driving capabilities through over-the-air software updates, with beta testing programs involving thousands of consumer vehicles. General Motors has announced plans for commercial deployment of its Cruise autonomous vehicles in multiple metropolitan areas.

Ford Motor Company has established partnerships with delivery companies to test autonomous vehicle applications in last-mile logistics and package delivery services. Amazon has begun testing its Zoox autonomous vehicles for ride-hailing applications in select markets.

Federal regulatory developments include updated safety guidelines for autonomous vehicle testing and proposed standards for vehicle-to-infrastructure communication systems. State-level initiatives continue expanding, with additional states authorizing autonomous vehicle testing and commercial operations.

Technology partnerships are forming between automotive manufacturers and semiconductor companies to develop specialized chips and computing platforms for autonomous vehicle applications. Investment activity remains robust, with continued venture capital funding and corporate acquisitions in the autonomous vehicle sector.

Industry analysts recommend several strategic approaches for companies participating in the United States autonomous car market. Technology focus should prioritize safety-critical systems, sensor reliability, and edge case handling to build consumer confidence and regulatory approval.

Partnership strategies are essential for combining automotive expertise with technology capabilities, enabling faster development timelines and reduced costs. Pilot program expansion in controlled environments can demonstrate technology capabilities while gathering valuable real-world data.

Regulatory engagement is crucial for influencing policy development and ensuring compliance with evolving safety standards and testing requirements. Consumer education initiatives can address safety concerns and build acceptance for autonomous vehicle technologies.

Market entry strategies should focus on commercial applications and fleet services where operational benefits are most apparent and consumer acceptance barriers are lower. Data strategy development is important for leveraging information generated by autonomous vehicles for additional revenue opportunities.

MarkWide Research suggests that companies should invest in cybersecurity capabilities and develop robust software update mechanisms to address security concerns and maintain system performance over vehicle lifecycles.

The future outlook for the United States autonomous car market indicates continued strong growth and technological advancement over the next decade. Technology maturation is expected to accelerate, with Level 4 autonomous systems becoming commercially viable in specific applications and geographic areas.

Market expansion is projected to continue at a compound annual growth rate exceeding 20% as technology costs decrease and consumer acceptance increases. Commercial deployment is expected to lead consumer adoption, with fleet services and ride-sharing applications providing early market validation.

Regulatory frameworks are anticipated to become more comprehensive and standardized, providing clearer guidelines for autonomous vehicle development and deployment. Infrastructure development will accelerate to support autonomous vehicle operations, including smart traffic systems and vehicle-to-infrastructure communication networks.

Consumer adoption is expected to increase gradually, with younger demographics leading acceptance and usage of autonomous vehicle services. Geographic expansion will extend beyond current testing areas to include smaller cities and rural areas as technology capabilities improve.

Industry consolidation may occur as successful companies acquire smaller competitors and struggling startups, leading to a more concentrated market structure with established leaders in different technology and application segments.

The United States autonomous car market represents one of the most significant technological and economic transformations in modern transportation history. Market dynamics indicate strong growth potential driven by technological advancement, safety improvements, and evolving consumer preferences toward automated mobility solutions.

Key success factors include continued investment in research and development, strategic partnerships between automotive and technology companies, supportive regulatory frameworks, and gradual consumer acceptance of autonomous vehicle capabilities. Commercial applications are leading market development, providing immediate operational benefits and serving as stepping stones toward broader consumer adoption.

Challenges remain in technical complexity, regulatory uncertainty, and consumer acceptance, but ongoing progress in artificial intelligence, sensor technologies, and safety validation is addressing these concerns. Market opportunities are substantial across multiple segments, from personal transportation to commercial logistics and specialized mobility services.

The competitive landscape features intense innovation and investment, with established automotive manufacturers competing alongside technology companies and startups to achieve market leadership. Future growth depends on successful technology deployment, regulatory clarity, and demonstrated safety and reliability in real-world applications, positioning the United States as a global leader in autonomous vehicle development and adoption.

What is Autonomous Car?

Autonomous cars, also known as self-driving cars, are vehicles equipped with technology that allows them to navigate and operate without human intervention. They utilize a combination of sensors, cameras, and artificial intelligence to perceive their surroundings and make driving decisions.

What are the key players in the United States Autonomous Car Market?

Key players in the United States Autonomous Car Market include companies like Waymo, Tesla, and General Motors, which are actively developing and testing autonomous vehicle technologies. These companies are focusing on various aspects such as software development, vehicle design, and regulatory compliance, among others.

What are the growth factors driving the United States Autonomous Car Market?

The growth of the United States Autonomous Car Market is driven by factors such as advancements in artificial intelligence, increasing demand for safer transportation solutions, and the potential for reduced traffic congestion. Additionally, government support and investment in infrastructure are also contributing to market expansion.

What challenges does the United States Autonomous Car Market face?

The United States Autonomous Car Market faces challenges including regulatory hurdles, public acceptance, and technological limitations. Issues such as cybersecurity threats and the need for extensive testing before widespread adoption also pose significant challenges.

What opportunities exist in the United States Autonomous Car Market?

Opportunities in the United States Autonomous Car Market include the potential for new business models such as ride-sharing and mobility-as-a-service. Additionally, partnerships between technology companies and automotive manufacturers can lead to innovative solutions and enhanced vehicle capabilities.

What trends are shaping the United States Autonomous Car Market?

Trends shaping the United States Autonomous Car Market include the integration of advanced driver-assistance systems (ADAS), increased investment in electric and autonomous vehicle technologies, and a growing focus on sustainability. Furthermore, developments in vehicle-to-everything (V2X) communication are also influencing market dynamics.

United States Autonomous Car Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Passenger Cars, Trucks, Buses, Vans |

| Technology | LiDAR, Radar, Computer Vision, Sensor Fusion |

| End User | Ride-Hailing Services, Fleet Operators, Private Owners, Logistics Companies |

| Deployment | Urban Areas, Suburban Areas, Highways, Testing Zones |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Autonomous Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at